So, you're thinking about buying a second home. It's an exciting thought—a mountain cabin, a beachside getaway, or just a place in a city you love to visit. But before you start browsing listings, the first real hurdle is figuring out the down payment.

For a second home, lenders want to see more cash upfront than they do for your primary residence. We're generally talking a down payment in the ballpark of 10% to 25% of the purchase price. This guide will walk you through exactly why that is, how to qualify for the best terms, and the smart strategies you can use to fund your purchase.

In This Guide

- 1 How Much Down Payment Do You Really Need?

- 2 Why Lenders See Your Second Home Differently

- 3 Second Home vs. Investment Property Decoded

- 4 Unlocking the Best Financing for Your Purchase

- 5 Creative Ways to Fund Your Down Payment

- 6 Your Second Home Buyer Readiness Checklist

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. Can I really buy a second home with only 10% down?

- 7.2 2. How much cash do I truly need in reserves?

- 7.3 3. Will I have to pay PMI on a second home?

- 7.4 4. Can I use potential rental income to help me qualify for a second home loan?

- 7.5 5. Are the down payment rules different for a condo versus a house?

- 7.6 6. Can my parents gift me the entire down payment?

- 7.7 7. Do I get a better deal if I use my current mortgage lender?

- 7.8 8. How soon after buying my first home can I buy a second?

- 7.9 9. Are interest rates higher for second homes?

- 7.10 10. Does the location of the second home affect the down payment?

How Much Down Payment Do You Really Need?

From a lender's point of view, a second home is simply riskier. It makes sense when you think about it: if you hit a financial rough patch, which mortgage are you going to pay first? The one for the roof over your head, of course. The vacation home loan would likely be the first one to be missed.

This is exactly why they require a higher down payment. By asking you to put more "skin in the game," lenders reduce their own risk and get a clear signal that you're financially solid enough to take on a second mortgage.

Key Factors That Determine Your Down Payment

That 10% to 25% range is a pretty wide target. Where you land on that spectrum depends on a few key things about your financial profile and the property itself.

- Your Credit Score: This is your financial report card. A stellar score, especially 720 or higher, shows you’re a reliable borrower and can often unlock a lower down payment requirement.

- Debt-to-Income (DTI) Ratio: Lenders will look closely at how much of your monthly income is already spoken for by other debts. A low DTI reassures them you aren't overextended and can comfortably handle another mortgage payment.

- Cash Reserves: This is huge. Lenders need to see you have enough liquid cash to cover not just the down payment, but also a buffer for emergencies. Be prepared to show 6 to 12 months of mortgage payments for both properties sitting in the bank.

- Property Type and Location: A turnkey condo in a hot rental market is viewed differently than a rustic cabin in a remote, less-proven area. The property's stability and appeal can influence the lender's terms.

To put this in perspective, data from the Consumer Financial Protection Bureau shows the average down payment on a vacation home is around 17%. Compare that to just 13% for a primary home. With median vacation home prices hovering around $475,000, that 17% translates to a hefty $80,750 you'll need in cash.

Second Home Down Payment at a Glance

This table gives you a quick snapshot of typical down payment requirements, helping you immediately benchmark where you might stand.

| Borrower Profile | Typical Down Payment | Key Influencing Factors |

|---|---|---|

| Excellent (Credit >740, Low DTI, High Reserves) | 10% – 15% | Strong financials make you a low-risk borrower. |

| Good (Credit 680-739, Moderate DTI) | 15% – 20% | Solid but not perfect; lender wants more commitment. |

| Fair (Credit <680, Higher DTI) | 20% – 25% | Higher risk profile requires a larger upfront investment. |

| Jumbo Loan (Loan exceeds conforming limits) | 20% – 30%+ | Larger loan amounts inherently carry more risk for the lender. |

Ultimately, a strong financial profile is your best negotiating tool for securing favorable terms.

A larger down payment isn’t just about meeting the lender’s minimums. It’s a strategic move. Putting more money down can unlock a lower interest rate, shrink your monthly payments, and give you instant equity in your new property. It pays off for the entire life of the loan.

Think of the down payment not as a barrier, but as the foundation for a smart, long-term investment. If you're looking to plan your finances, you can use our guide on how to calculate payments for an investment property loan to get a clearer picture. In the sections ahead, we’ll dive into financing strategies, ways to save up, and the important differences between buying a second home for pleasure versus pure investment.

Why Lenders See Your Second Home Differently

To get the best loan for a second home, you have to start thinking like a lender. From their side of the desk, a vacation property or weekend getaway is a completely different animal than your primary residence. It all comes down to risk.

There's a simple, human truth that every underwriter knows: when times get tough, people will do almost anything to protect the roof over their family's head. But that lake house or ski condo? That can quickly feel like an expensive luxury when money gets tight. This one fact changes everything about how they look at your application.

Because of this higher risk, lenders need to see that you're not just stable today, but that you have the financial muscle to handle a rough patch down the road. A bigger down payment is their number one tool for managing that risk, as it proves you have serious skin in the game from day one.

The Three Pillars of Underwriting Approval

When a lender reviews your file for a second home, they're laser-focused on three core areas of your financial life. Think of these as the legs of a stool—if one is weak, the whole thing gets wobbly.

- Credit Score: A strong credit history is your ticket to entry. Lenders want to see a proven track record of responsibility, which is why they typically look for a score of 720 or higher for the best rates and terms. If you're not quite there, check out our guide on achieving an 800+ credit score for tips.

- Debt-to-Income (DTI) Ratio: This is the big one. Your DTI ratio shows how much of your monthly income is already spoken for by other debts. When you add a second mortgage, lenders want to see that total figure stay below 43%. It's their way of making sure you aren't stretched too thin.

- Cash Reserves: This is your emergency fund, and it’s non-negotiable. Lenders need proof that after you’ve paid your down payment and closing costs, you still have enough cash on hand to cover 6 to 12 months of mortgage payments (principal, interest, taxes, and insurance) for both homes.

Real-Life Example: The Millers vs. The Carters

Let's look at a real-world scenario. Imagine two families, the Millers and the Carters. Both earn a healthy $250,000 a year and want to buy the same $500,000 vacation home. To a lender, their financial pictures couldn't be more different.

| Metric | The Millers (Low-Risk Profile) | The Carters (Higher-Risk Profile) |

|---|---|---|

| Credit Score | 780 (Excellent) | 690 (Good) |

| DTI Ratio | 32% (including new mortgage) | 45% (including new mortgage) |

| Cash Reserves | 18 months of payments ($108,000) | 4 months of payments ($24,000) |

| Lender's Offer | 10% Down ($50,000) at 6.5% interest | 25% Down ($125,000) at 7.0% interest |

The Millers are an underwriter's dream. With their fantastic credit, low DTI, and deep cash reserves, they'll easily get approved for a 10% down payment and the best interest rate available. They look like a safe bet.

The Carters, however, set off a few alarm bells. Their credit is okay but not great, their DTI is pushing the limits, and their cash reserves are thin. To compensate for this higher risk, the lender will demand a significantly larger 25% down payment and assign them a higher interest rate.

This shows exactly why getting your financial house in order is so critical. It doesn't just impact whether you get the loan—it directly affects how much cash you'll need at closing and how much you'll pay over the life of the loan.

Second Home vs. Investment Property Decoded

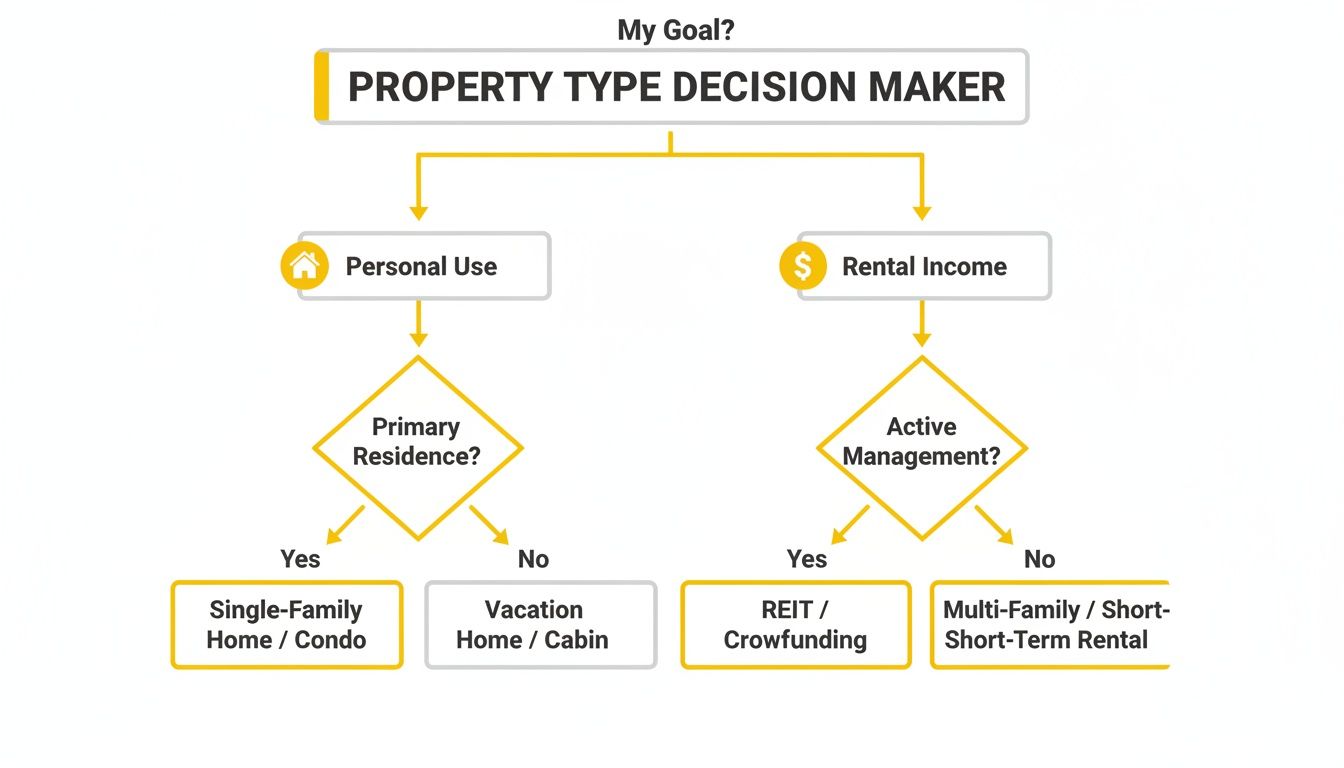

When you're getting a mortgage, the difference between a "second home" and an "investment property" isn't just semantics—it's one of the most important distinctions you'll make. Lenders see these as two completely separate risk categories, and that perception dramatically changes your down payment, interest rate, and how you qualify.

So, what's the line in the sand? It’s all about your intent. A second home is a place you plan to use for personal enjoyment, like a vacation cabin or a city crash pad. An investment property, on the other hand, is bought primarily to generate rental income. Your stated plan for the property determines which loan you get, and you can bet the lender will verify it.

How Lenders Figure Out Your Real Plan

You can't just tell a lender it's a second home to snag better financing terms if your true goal is to rent it out year-round. They have a few ways of sniffing out the property’s real purpose.

- Location, Location, Location: A cottage a few hours from your main house? That feels like a second home. A condo 2,000 miles away? Lenders will be skeptical unless you have a good reason for being there personally.

- Your Financials: If your loan application leans heavily on future rental income to make the numbers work, it's an investment property. No two ways about it.

- The Fine Print: Second home loans come with strings attached, specifically occupancy rules. You’ll likely have to promise to live there for a certain number of days each year.

Trying to game the system by misrepresenting your intent is a really bad idea. It's considered mortgage fraud, which comes with some pretty severe penalties. Always be upfront with your lender from day one. To learn more, check out our guide on how to finance an investment property.

Comparing the Financial Impact

How your property gets classified hits you directly in the wallet. Because lenders see a second home as less risky than a pure rental, they offer much more attractive terms.

Why the better deal on a second home? Lenders figure if you're personally using the property, you're more invested in its upkeep. They believe you'll prioritize that mortgage payment, even if money gets tight, compared to a landlord who only sees the property as a line item on a spreadsheet.

To make it crystal clear, let's look at a side-by-side comparison of what you can expect financially.

Second Home vs. Investment Property: Key Financial Differences

This table breaks down the crucial financing differences, showing how the property's classification impacts your costs and requirements.

| Financing Aspect | Second Home (Personal Use) | Investment Property (Rental Income) |

|---|---|---|

| Typical Down Payment | 10% – 25% | 20% – 30%+ |

| Interest Rates | Generally 0.25% – 0.50% higher than a primary home | Often 0.50% – 1.00% or more higher than a primary home |

| Credit Score Required | Typically 720+ for best terms | Often 740+ is the minimum for competitive rates |

| Cash Reserves | 6-12 months of PITI for both homes | 12+ months of PITI for both homes may be required |

| Use of Rental Income | Cannot be used to help qualify for the loan | Projected rental income can be used to qualify (usually 75% of expected rent) |

As you can see, the path to financing an investment property requires a larger down payment, a stronger credit profile, and more cash in the bank. The trade-off, of course, is that you can use the potential rent to help you secure the loan—a key advantage for real estate investors.

Unlocking the Best Financing for Your Purchase

When you start digging into mortgages for a second home, it can feel like you're learning a new language. But it’s simpler than it looks. Let's break down the most common paths to financing that dream getaway or investment property.

Most buyers kick things off with a conventional loan. This is your bread-and-butter mortgage, the kind that follows the rules set by government-sponsored enterprises like Fannie Mae and Freddie Mac. They're popular because they offer stable, predictable terms and pretty competitive rates.

The one catch with conventional loans is something called conforming loan limits. Think of it as a cap on how much you can borrow. These limits change each year to keep up with home prices and vary by county. For most of the U.S. in 2024, that magic number is $766,550. In pricier markets, that limit can be a lot higher.

When Your Dream Home Exceeds the Limits

So, what happens if the property you’ve fallen in love with costs more than that limit? That's when you step into the world of jumbo loans. These are exactly what they sound like—bigger loans for high-value properties that don't conform to the standard limits.

Because the lender is taking on more risk, they're going to put your finances under a much stronger microscope. If you're going for a jumbo loan, you should be ready for a higher bar:

- A Bigger Down Payment: A conventional loan might let you get away with 10-15% down on a second home. For a jumbo, expect to bring 20-30% or even more to the table.

- A Stellar Credit Score: Lenders are looking for top-tier borrowers. You’ll almost certainly need a FICO score of 740 or higher just to get in the door.

- Serious Cash Reserves: They’ll want to see that you have enough liquid cash to cover emergencies. This often means proving you have 12 months or more of mortgage payments (for both homes!) sitting in the bank.

Tapping Into Your Existing Home Equity

For many homeowners, the best source for a down payment isn't in a savings account—it's locked up in the walls of their primary residence. If you've been paying down your mortgage and your home's value has gone up, you have some powerful options.

A Home Equity Line of Credit (HELOC) is a hugely popular tool. It works like a credit card that’s secured by your home. You get approved for a certain limit and can draw money as you need it for the down payment and closing costs. The best part? You only pay interest on what you actually use.

Another smart move can be a cash-out refinance. With this strategy, you replace your current mortgage with a new, larger one and pocket the difference in cash. This is an especially great option if you can also snag a lower interest rate on your primary mortgage at the same time.

Comparing Financing Options: Conventional vs. Jumbo vs. HELOC

Choosing the right loan depends on your specific financial situation and the property's price point. This table offers a clear comparison to help guide your decision.

| Loan Type | Best For… | Key Requirement | Main Downside |

| :— | :— | :— |

| Conventional Loan | Properties under the conforming loan limit (e.g., $766,550). | Good credit (680+), stable DTI, and 10%+ down payment. | PMI is required for down payments under 20%. |

| Jumbo Loan | High-value properties exceeding conforming limits. | Excellent credit (740+), low DTI, and a 20%+ down payment. | Stricter underwriting and higher cash reserve requirements. |

| HELOC / Equity Loan | Homeowners with significant equity in their primary residence. | Strong credit and sufficient home equity to cover the new down payment. | Variable interest rates and using your primary home as collateral. |

We’ve seen how economic shifts can really impact the market. When mortgage rates shot up from lows near 3% to over 7%, buyers had to come up with larger down payments just to keep their monthly costs from ballooning. It's why the median down payment for vacation homes has often hovered around 17%—lenders get a bit more cautious in a shaky market. For more on real estate trends, you can always check out the latest from the National Association of REALTORS®.

Creative Ways to Fund Your Down Payment

Let's be honest: coming up with a five- or six-figure down payment is usually the biggest hurdle to buying a second home. While using your primary home's equity is a fantastic option, it's not the only trick up your sleeve. There are several other smart ways to pull together the cash you need.

Often, the best strategy isn't to rely on a single source. A little from here, a little from there can help you hit your target without completely draining one account. Let's walk through some of the most common and effective ways to fund your dream.

Using Gift Funds From Family

Getting a financial boost from family is a popular route for a reason. Most lenders are perfectly fine with this, but they have one non-negotiable rule: it must be a true gift, not a loan in disguise that adds to your debt.

To prove it, you'll need a formal gift letter signed by the person giving you the money. This document must spell out in no uncertain terms that the funds are a gift with no expectation of repayment. Lenders will also want to see bank statements from both of you to trace the money from their account to yours.

Important Takeaway: Gift funds can be a game-changer, but they come with a paper trail. Get a head start on collecting the necessary documents to prevent any last-minute hiccups with your loan approval.

Tapping Into Your Retirement Accounts

Dipping into your 401(k) or IRA is a definite possibility, but you need to tread carefully. With a 401(k), you can typically borrow against your savings—usually up to 50% of your vested balance or $50,000, whichever is less. The big plus here is that you're paying the interest back to your own retirement account.

But the risks are real. If you leave your job for any reason, the full loan amount could become due almost immediately. If you can't pay it back, it’s treated as a taxable distribution, and you'll get hit with a 10% early withdrawal penalty if you're under 59½. Unlike with a primary home, you can't claim a penalty-free hardship withdrawal for a second property.

Selling Appreciated Stocks or Assets

If you've been investing and have a brokerage account with stocks or other assets that have grown in value, selling them is a direct path to cash. It’s a clean way to raise funds without taking on any new debt.

The main thing to account for is capital gains tax. You'll owe taxes on the profit you made when you sell. Before you do anything, it’s a good idea to chat with a financial advisor. They can help you figure out the tax impact and decide which assets make the most sense to sell.

Comparing Your Funding Options

Every strategy comes with its own set of pros and cons. Seeing them laid out side-by-side can make it much clearer which mix is right for your financial picture.

| Funding Method | Best For… | Watch Out For… |

|---|---|---|

| Gift Funds | Buyers with family support who need to close a small gap. | Strict documentation rules and potential lender limits on amounts. |

| 401(k) Loan | People with stable jobs who need fast access to cash. | Stiff tax penalties and immediate repayment if your job ends. |

| Selling Stocks | Investors with solid gains who want to avoid new monthly payments. | Capital gains taxes and the risk of selling at a bad time. |

| HELOC | Homeowners with plenty of equity who value flexibility. | Variable interest rates and putting your primary home on the line. |

In the end, there's no single "best" way. A blended approach is often the most practical. You might use gift funds to get over the 20% down payment line, then sell some stocks to handle the closing costs. You can learn more about how a HELOC for an investment property can fit into this puzzle in our detailed guide.

Your Second Home Buyer Readiness Checklist

Turning the dream of a second home into a reality is all about turning knowledge into action. Think of this checklist as your roadmap—it pulls together all the key lessons from this guide to make sure you're truly prepared for the journey ahead.

1. Finalize Your Property’s Purpose

Before you do anything else, you need to be absolutely clear on one thing: is this a genuine second home for your own enjoyment, or is it an investment property you plan to rent out? Your answer to this question changes everything about the financing process, from the down payment required to the interest rate you'll get. Lenders will dig into your intent, so it’s best to be upfront from day one.

2. Polish Your Credit Score

Your credit score is your single most powerful negotiating tool. To get the best loan terms and lowest down payment options, you should be aiming for a score of 720 or higher. A great score tells lenders you're a low-risk borrower, which is hugely important when you're taking on a second mortgage.

3. Calculate and Lower Your DTI

Lenders are laser-focused on your debt-to-income (DTI) ratio. Figure out your current DTI, then add the estimated monthly payment for the new property. The magic number most lenders want to see is 43% or less. If you're pushing that limit, concentrate on paying down other debts—like high-interest credit cards or car loans—before you even think about applying.

4. Build Your Down Payment and Cash Reserves

Start a dedicated savings fund specifically for your down payment for second home. While you can sometimes get away with 10%, the real goal should be 20% to avoid private mortgage insurance (PMI) and lock in a better interest rate. At the same time, you need to build up your cash reserves. Lenders will want to see that you have enough cash on hand to cover 6 to 12 months of mortgage payments for both your primary home and the new one after closing.

5. Get Pre-Approved for a Mortgage

A pre-approval isn't just a piece of paper; it’s your budget set in stone. It tells you exactly how much house you can realistically afford and gives you serious leverage when you make an offer. This step keeps your search grounded in reality so you don't waste time on properties you can't actually buy. You might even find some extra negotiating room in today's market. Recent data shows that national single-family inventory was up 15.68% year-over-year, which can give buyers more power to ask for better terms or even seller concessions. Those concessions could help ease the down payment burden. You can find more insights about current housing trends on AmericaMortgages.com.

6. Account for the Total Cost of Ownership

Your financial planning can't stop with the mortgage payment. You have to budget for the total cost of owning the home, which means factoring in all the extras:

- Property Taxes: These can vary dramatically by location, so do your homework.

- Homeowners Insurance: Expect premiums to be a bit higher for a second home.

- Maintenance and Repairs: A good rule of thumb is to set aside at least 1% of the home's value each year for upkeep.

- HOA Fees: If the property is in a community with a homeowners association, don't forget to add this monthly cost.

Taking a thoughtful approach to these steps will set you up for a smooth and successful purchase. For a much deeper dive into the inspection and validation phase, our real estate due diligence checklist will help you make sure no detail gets missed.

Frequently Asked Questions (FAQ)

1. Can I really buy a second home with only 10% down?

Yes, it's possible, but it's reserved for borrowers with exceptional financial profiles—think credit scores above 740, very low DTI, and substantial cash reserves. However, putting down less than 20% will mean paying Private Mortgage Insurance (PMI) and likely a higher interest rate.

2. How much cash do I truly need in reserves?

Lenders typically require you to have enough liquid cash to cover 6 to 12 months of mortgage payments (PITI) for both your primary residence and the new second home. This must be available after you've paid the down payment and closing costs.

3. Will I have to pay PMI on a second home?

Yes. If you get a conventional loan and put down less than 20%, you will be required to pay PMI. It functions exactly as it does for a primary home mortgage, protecting the lender until your loan-to-value ratio reaches 80%.

4. Can I use potential rental income to help me qualify for a second home loan?

No. For a property to be classified as a "second home," you must qualify for the mortgage based on your existing income and assets alone. If you need to use future rent to qualify, the property must be financed as an "investment property," which has stricter requirements.

5. Are the down payment rules different for a condo versus a house?

The percentage may be the same, but lenders conduct a "condo review" to assess the financial health of the homeowners' association (HOA). If they find issues like low reserve funds or too many renters, they may require a larger down payment to offset the perceived risk.

6. Can my parents gift me the entire down payment?

Generally, no. Most lenders want to see that the borrower has some of their own money invested, typically requiring at least 5% of the down payment to come from your own funds. All gifted money must be accompanied by a formal gift letter confirming it is not a loan.

7. Do I get a better deal if I use my current mortgage lender?

Not necessarily. While it might seem convenient, loyalty doesn't guarantee the best rates or terms. It is always recommended to shop around with multiple lenders to ensure you're getting the most competitive offer.

8. How soon after buying my first home can I buy a second?

There's no official waiting period, but lenders want to see a stable payment history on your primary mortgage. A general rule of thumb is to have at least 12 months of consistent, on-time payments before applying for a second mortgage.

9. Are interest rates higher for second homes?

Yes, you can expect the interest rate on a second home mortgage to be slightly higher, typically by 0.25% to 0.50%, compared to a primary residence mortgage. This is to compensate the lender for the increased risk.

10. Does the location of the second home affect the down payment?

Absolutely. If the property is in a volatile or unproven market, a lender may view it as a riskier asset. To mitigate that risk, they might require a larger down payment to ensure you have more equity in the property from day one.

At Top Wealth Guide, we provide the insights you need to make smart financial decisions. Explore our resources and strategies to build your wealth through real estate and other investments. Discover more at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.