Jumping into investing can feel exciting, but the smartest first move isn't picking stocks—it's shoring up your own financial defenses. Before you even think about putting money into the market, you need to tackle high-interest debt and build a solid emergency fund. Think of it as preparing your launchpad.

In This Guide

First, Build Your Financial Launchpad

You wouldn't build a house on a shaky foundation, right? The same logic applies to your financial future. Without a solid base, any market turbulence or unexpected life event could topple your entire plan. Your foundation has two main pillars: getting rid of expensive debt and creating a cash buffer for emergencies.

Get Rid of High-Interest Debt

High-interest debt, especially from credit cards, is a wealth-destroying machine. It’s a guaranteed loss that will almost always outpace your investment gains. For instance, a credit card with a 20% APR is an anchor dragging down your finances. Paying it off is like getting a guaranteed 20% return on your money. You simply won't find a safer or better return than that anywhere in the investment world.

Real-Life Example: The Debt vs. Investment Dilemma

Let's look at a quick, real-world scenario. Sarah has $5,000 in credit card debt at 22% APR and she also has $5,000 ready to invest. Here are her two choices:

| Option | Action | Year 1 Financial Impact |

|---|---|---|

| Invest First | Invests the $5,000 and earns a solid 10% market return. | Gain: +$500 from investing. Loss: -$1,100 in credit card interest. Net Result: -$600 |

| Pay Off Debt First | Uses the $5,000 to clear her credit card debt completely. | Gain: $1,100 in interest payments avoided. Loss: $0. Net Result: +$1,100 |

By paying off the debt first, Sarah is instantly $1,700 better off compared to investing while carrying that debt. It's a critical first step on your path to financial freedom.

Set Up Your Emergency Fund

Your emergency fund is your financial shock absorber. It’s cash you've set aside specifically for life’s curveballs—the sudden car repair, an unexpected medical bill, or a job loss. Without this fund, a minor crisis could force you to sell your investments at the worst possible moment, like during a market downturn, just to raise cash.

Your emergency fund isn't an investment; it's insurance. It protects your actual investments from life's unpredictability, allowing them to grow untouched for the long term.

The goal is to save 3 to 6 months' worth of essential living expenses. To figure out your target number, just add up your bare-bones monthly costs:

- Housing (rent or mortgage)

- Utilities

- Groceries

- Transportation costs

- Insurance payments

Park this cash in a high-yield savings account. It needs to be liquid and easy to access, but keeping it separate from your everyday checking account prevents you from accidentally spending it. This isn't about putting off investing; it's about making sure your journey is secure and sustainable from the very beginning.

What's the Money For? Get Clear On Your Goals

Jumping into investing without a clear goal is like starting a road trip with no destination in mind. You'll burn a lot of gas, but you’ll never actually get anywhere. Before you put a single dollar to work, you need to know exactly what you're working toward. This isn't about some vague dream of "getting rich"; it's about setting real, tangible targets.

Think of it this way: your financial goals are the foundation of your entire investment plan. Are you trying to pull together a down payment for a house in the next five years? Or are you socking away money for a retirement that's still three decades down the road? The answer completely changes how you should approach investing.

Your Timeline Drives Your Strategy

The amount of time you have to let your money grow—what investors call your time horizon—is the single most important factor. If you have a lot of time, you can afford to take on more risk for the potential of higher returns. If you need the money soon, your priority has to be protecting what you've got.

Real-Life Example: Different Timelines, Different Plans

-

Meet Maria: She’s 28 and wants to buy her first home in five years. She needs to save $40,000 for the down payment. Because her timeline is short, a big stock market drop right before she needs to buy would be a disaster. She needs a more conservative strategy, focusing on capital preservation.

-

Meet David: He’s 35 and wants to retire at 65. He has a 30-year time horizon. David can absolutely afford to ride out the market’s inevitable ups and downs, giving his investments decades to compound and grow. He can take a more aggressive, growth-focused approach.

This difference is everything. Maria's focus is on safety. David's focus is on long-term growth. While your personal definition of success is important—you can read more about how to define wealth beyond money and possessions in our guide—for investing, hard numbers and dates are what matter.

Short-Term Sprints vs. Long-Term Marathons

To really nail this down, it helps to sort your goals into buckets. This simple exercise will give you a clear map and point you toward the right kinds of investments later on.

| Goal Timeline | Time Horizon | Example Goals | Appropriate Investment Approach |

|---|---|---|---|

| Short-Term | 1-5 Years | House down payment, new car, wedding fund | Conservative: Your goal is to keep your money safe. Think high-yield savings accounts, CDs, or short-term bond funds. |

| Mid-Term | 5-10 Years | College fund for a pre-teen, home renovation | Balanced: A mix of stocks and bonds to provide some growth while managing risk. A 60/40 stock/bond portfolio is classic. |

| Long-Term | 10+ Years | Retirement, college fund for a young child | Growth-Oriented: Your goal is to maximize growth. Think a diversified mix of stocks, primarily through ETFs and index funds. |

Setting clear, time-bound goals is what separates simple saving from strategic wealth-building. It transforms a wish into a concrete plan that guides every single investment decision you make from here on out.

Understanding Your Risk Appetite and Compounding

Okay, you’ve got your financial goals mapped out. Now we need to tackle two concepts that are absolutely fundamental to investing: risk tolerance and compounding. Think of them as the engine and the steering wheel for your entire investment journey. They dictate how you’ll navigate the inevitable market swings and, ultimately, how much your money can grow.

First up is understanding your personal comfort with risk. This isn't just some abstract financial term; it’s about your gut reaction. What would you do if your portfolio’s value suddenly dropped by 20%? Seriously, think about it. Would you panic and sell everything, or would you see it as a chance to buy more at a discount? There’s no right answer here, only what’s right for you.

Gauging Your Comfort with Market Swings

Your risk tolerance is a blend of your financial reality, your timeline, and your personality. It makes sense that someone saving for retirement in 30 years can handle a lot more market volatility than someone who needs a down payment for a house in the next three years.

A quick self-check can help you figure out where you stand:

- Age: The younger you are, the more time you have on your side to recover from any market downturns. This generally means you can afford to take on more risk.

- Time Horizon: As we talked about earlier, a long runway gives you the freedom to build a more aggressive, growth-focused portfolio.

- Financial Stability: Do you have a steady job and a healthy emergency fund? Having that safety net makes it much easier to stay calm when the market gets choppy.

Knowing your risk tolerance isn't just a box-ticking exercise. It's what stops you from making panicked, emotional decisions down the road. It helps you build a portfolio you can actually stick with long-term, which is the real secret to success.

The True Magic of Investing: Compounding

If risk is about managing the bumps in the road, compounding is about what makes the journey worthwhile. You’ve probably heard it called the eighth wonder of the world, and for good reason. Compounding is simply your earnings generating their own earnings. It’s a snowball effect—your money grows, and then the growth itself starts to grow, accelerating over time.

The key ingredient? Time. Nothing is more powerful. The earlier you start investing, the more dramatic the compounding effect becomes.

Real-Life Example: The Power of an Early Start

Let's compare two investors, both earning an average 8% annual return:

- Early Ava: Starts investing $200/month at age 25. By age 65, she will have invested a total of $96,000, and her portfolio could be worth approximately $700,000.

- Later Leo: Waits ten years and starts investing the same $200/month at age 35. By age 65, he will have invested a total of $72,000, but his portfolio will only be worth about $320,000.

Leo invested just $24,000 less than Ava, but ended up with less than half the money. That decade of lost compounding time is priceless.

Choosing the Right Investment Accounts for You

Okay, you’ve set some goals and figured out your comfort level with risk. So, where does your money actually go? Think of choosing an investment account like picking the right tool for a job. Each one has its own purpose, rules, and—most importantly—tax benefits. Getting this part right is a critical first step when you start investing money.

The whole world of investment accounts can feel a little overwhelming, but it really just boils down to two main buckets: retirement accounts and standard (taxable) brokerage accounts.

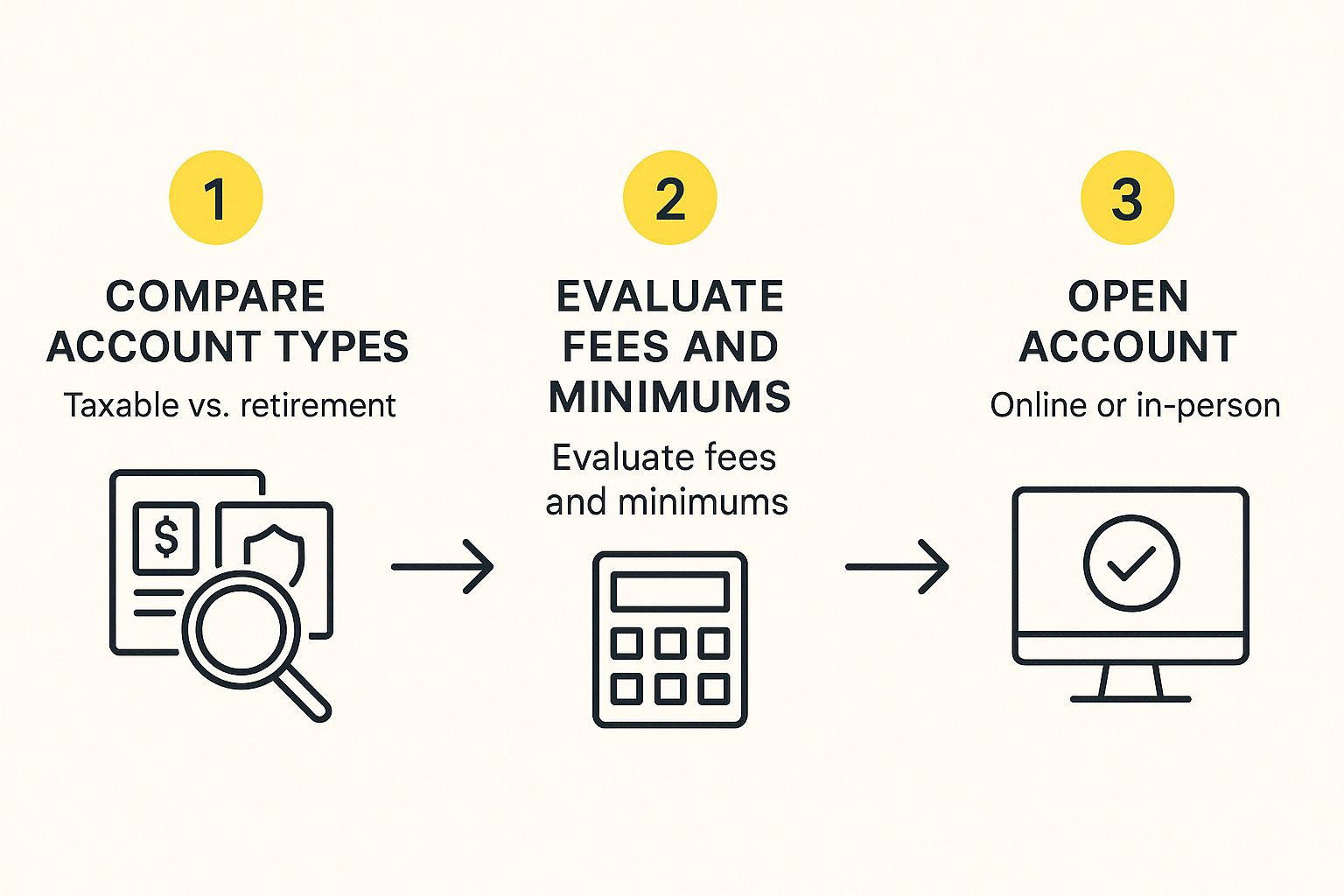

This infographic lays out the simple path to getting your account up and running.

As you can see, it's a pretty straightforward process. You'll compare your options, double-check for low fees, and then walk through the online setup. Taking a moment to do this deliberately ensures you’re making a smart choice that actually fits your financial plan.

Decoding the Most Common Account Types

For most people just starting out, a handful of accounts will cover nearly every situation. The easiest place to begin is often an employer-sponsored plan like a 401(k). If your company offers a match, that’s your first move. It’s essentially a 100% return on your contribution—you can't beat that.

If you don't have a plan at work or you've maxed out your match, an Individual Retirement Account (IRA) is your next best bet. The two main flavors are the Roth IRA and the Traditional IRA.

Your choice of investment account directly impacts your long-term growth. Tax-advantaged accounts like 401(k)s and IRAs are powerful tools because they allow your money to compound without being taxed every year, dramatically boosting your returns over time.

Comparison Of Common Investment Accounts

This table breaks down the key features of the accounts you're most likely to encounter.

| Account Type | Tax Advantage | Contribution Source | Best For |

|---|---|---|---|

| 401(k) | Pre-tax contributions lower your current taxable income. | Automatically deducted from your paycheck. | Employees whose company offers a matching contribution. |

| Roth IRA | Post-tax contributions mean qualified withdrawals in retirement are 100% tax-free. | You contribute your own post-tax money directly. | Younger investors who expect to be in a higher tax bracket in the future. |

| Traditional IRA | Contributions may be tax-deductible, lowering your taxable income now. | You contribute your own money directly. | Individuals who want a tax break today or aren't eligible for a Roth IRA. |

| Brokerage Account | No special tax advantages; you pay taxes on gains and dividends. | You contribute your own post-tax money directly. | Saving for non-retirement goals or investing beyond retirement account limits. |

Selecting Your Brokerage Platform

Once you know which type of account you need, you have to choose a brokerage—the company that will actually hold your investments. When you’re comparing platforms, there are a few things that are non-negotiable for new investors.

- Low Fees: Only consider brokerages that offer $0 commissions on stock and ETF trades. You should also look for accounts with no annual maintenance fees.

- No Minimum Deposit: Many great platforms today let you open an account with $0. This lets you get started with whatever amount you're comfortable with.

- Ease of Use: As a beginner, you don't want to fight with a confusing website or app. Look for a platform that feels intuitive and makes it simple to manage your portfolio.

Ultimately, the best account is the one you actually open and fund. The goal here isn't to find the one perfect, magical option—it's to make a solid choice, get started, and let your money begin its journey.

Build Your First Diversified Portfolio

Alright, this is where the rubber meets the road. Your account is funded, and now it's time to actually build the engine that will drive your financial growth—your investment portfolio.

The guiding principle is one you've probably heard before: don't put all your eggs in one basket. Spreading your money across different assets is the single most effective way to manage risk without giving up on potential returns.

Your Core Building Blocks

Most beginners can build a powerful portfolio using just a few fundamental asset types. Think of these as your essential ingredients.

| Investment Type | What It Is | Primary Role in a Portfolio |

|---|---|---|

| Stocks | A small piece of ownership in a public company like Apple or Microsoft. | Growth. This is where your highest long-term returns will likely come from, but they also bring the most volatility. |

| Bonds | Essentially a loan you give to a government or a corporation for a set period, and they pay you interest. | Stability. Bonds act as a shock absorber, generally being less risky than stocks and providing a predictable income stream. |

| Mutual Funds & ETFs | A basket that holds hundreds or even thousands of different stocks or bonds in a single, convenient package. | Instant Diversification. This is, by far, the easiest and most effective way for a new investor to spread their risk. |

Trying to pick individual stocks right out of the gate is a recipe for anxiety and, often, disappointment. This is exactly why mutual funds and Exchange-Traded Funds (ETFs) are a game-changer for new investors.

The Magic of Low-Cost Index Funds and ETFs

Instead of trying to buy one company, what if you could buy a tiny sliver of the entire stock market with a single click? That's what an index fund or ETF lets you do. A classic example is an S&P 500 index fund, which instantly makes you an owner in the 500 largest companies in the United States.

Just like that, you've got a stake in giants like Google, Johnson & Johnson, and Visa.

Starting with low-cost index funds or ETFs is the cornerstone of modern portfolio theory because it minimizes fees, provides instant diversification, and captures the market's overall growth.

This strategy is not only powerful but also incredibly cheap. Index funds are known for their rock-bottom fees (often called "expense ratios"), which means more of your money stays invested and compounds for you, not for a fund manager.

A Simple, Powerful Portfolio to Get You Started

So, what does this actually look like in practice? A fantastic and time-tested starting point is what's known as the "three-fund portfolio." It’s simple, globally diversified, and incredibly effective.

Here’s a common breakdown for a growth-oriented investor:

- 50% U.S. Total Stock Market Index Fund/ETF: This gives you a piece of thousands of American companies, from the biggest names to smaller, up-and-coming players.

- 30% International Total Stock Market Index Fund/ETF: You're not just betting on the U.S. This fund captures growth from established and emerging markets all over the world.

- 20% U.S. Total Bond Market Index Fund/ETF: This is your anchor. It adds a crucial layer of stability to cushion your portfolio when the stock market gets choppy.

Think of this as your starting recipe. As your investments grow and markets shift, you'll want to check in periodically to make sure you're still on track with your target percentages. The most important thing is to start with a sensible plan and stick with it.

Common Questions for New Investors

Starting your investing journey is exciting, but it's totally normal for questions to pop into your head. Let's tackle some of the most common ones.

FAQs on Getting Started

1. How much money do I really need to start investing?

You can start with as little as $1. Most modern brokers have eliminated account minimums, and with fractional shares, you can buy a sliver of a stock or ETF. The key is building the habit of consistent investing, not starting with a huge lump sum.

2. Is investing in the stock market just gambling?

No. Gambling is a short-term, zero-sum game based on random outcomes. Proper investing is long-term ownership of productive assets (businesses) that are expected to grow in value over time. While there's risk, a diversified strategy is a bet on overall economic growth, not a roll of the dice.

3. What is the single best investment for a beginner?

A low-cost, broad-market index fund or ETF (like an S&P 500 index fund) is a fantastic choice. With one purchase, you get instant ownership in hundreds of the biggest U.S. companies, providing massive diversification and minimizing fees.

4. Should I pay off all my debt before I invest?

Prioritize high-interest debt (like credit cards with 15%+ APR) first, as paying it off offers a guaranteed return you can't beat. For low-interest debt (like a mortgage or federal student loans), it often makes sense to invest simultaneously, especially to capture an employer 401(k) match.

FAQs on Investment Types and Strategy

5. What's the difference between a stock and an ETF?

A stock is a slice of ownership in a single company (e.g., Apple). An Exchange-Traded Fund (ETF) is a basket holding hundreds or thousands of different stocks or bonds, all bundled into one investment you can buy. ETFs offer instant diversification.

6. What is 'dollar-cost averaging'?

It’s investing a fixed amount of money on a regular schedule (e.g., $100 every month), regardless of market fluctuations. This simple strategy forces you to buy more shares when prices are low and fewer when prices are high, which can lower your average cost over time and build discipline.

7. How often should I check my investments?

Far less often than you think! For long-term investors, checking daily or weekly invites anxiety and emotional decision-making. A quarterly or semi-annual check-in to ensure your portfolio still aligns with your goals is a much healthier approach.

FAQs on Practical Matters

8. What are dividends?

Dividends are a portion of a company's profits paid out to its shareholders, typically as a cash payment per share. It's a direct return on your investment, and you can often choose to automatically reinvest them to buy more shares, accelerating compounding.

9. Do I need a financial advisor to start?

Not necessarily. With user-friendly brokerage apps and simple, low-cost index funds, most beginners can build a solid portfolio on their own. As your finances become more complex, consulting a certified financial planner can be a very smart move.

10. What happens if my brokerage company goes out of business?

In the U.S., legitimate brokerage accounts are protected by the Securities Investor Protection Corporation (SIPC). SIPC insures your securities and cash up to $500,000 if your brokerage firm fails. This does not protect against market losses, but it does protect your assets from the firm's failure.

Ready to continue your journey toward financial mastery? At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. Explore more articles and tools at topwealthguide.com to secure your financial future.