By John Smith, Real Estate Investing Expert and Author

At its heart, a wholesale real estate contract is a legal document that lets an investor lock in the right to buy a property, usually one that's priced below market value. But here’s the twist: instead of actually buying it, the investor (the "wholesaler") turns around and sells that contract to another buyer, pocketing a profit in the process. It's a popular way to get into real estate because you don't need a mountain of cash to get started.

In This Guide

- 1 The Wholesaler as a Real Estate Matchmaker

- 2 Essential Clauses Every Wholesaler Must Master

- 3 Walking Through a Wholesale Deal From Start to Finish

- 4 Navigating Wholesaling Laws and Staying Compliant

- 5 Choosing Your Exit Strategy: Assignment vs. Double Close

- 6 Your Top Wholesale Real Estate Questions, Answered

- 6.1 1. How Much Money Do I Really Need to Start Wholesaling?

- 6.2 2. What's the 70% Rule, and Why Should I Care?

- 6.3 3. Can I Wholesale a Property Listed on the MLS?

- 6.4 4. How Do I Build a Solid Cash Buyers List?

- 6.5 5. What Happens If I Can't Find a Buyer for My Contract?

- 6.6 6. How Do I Find an Investor-Friendly Title Company or Attorney?

- 6.7 7. How Will My Assignment Fee Be Taxed?

- 6.8 8. What Are the Biggest Mistakes New Wholesalers Make?

- 6.9 9. How Do I Nail Down the After Repair Value (ARV)?

- 6.10 10. Should I Get a Real Estate License to Wholesale?

- 7 About the Author

The Wholesaler as a Real Estate Matchmaker

The best way to think about a real estate wholesaler is as a professional matchmaker for properties. Your job is to find a motivated seller—someone who needs to sell fast—and connect them with a cash buyer who's ready to pull the trigger, typically another investor looking for their next project. The wholesaler doesn't make money from flipping the house; they earn a fee for finding and teeing up the deal.

| Feature | Wholesaling | Traditional Flipping |

|---|---|---|

| Capital Required | Low (earnest deposit) | High (purchase + rehab costs) |

| Holding Period | Short (contract assignment) | Longer (rehab and sale) |

| Risk Level | Low (inspection contingency) | Higher (market and rehab risk) |

| Profit Source | Assignment fee | Appreciation and rehab margin |

| Licensing | No license needed | No license needed (unless brokered) |

The Key Players in a Wholesale Transaction

Every wholesale deal boils down to three key people, and understanding what drives each one is crucial to making it all work.

- The Motivated Seller: This isn't just any homeowner. It's someone who needs to sell quickly due to a specific situation—maybe they're facing financial trouble, inherited a property they can't manage, or have to relocate for a job. They’re often willing to trade a bit of equity for a fast, simple, all-cash sale.

- The Wholesaler (You): You're the deal-finder, the person in the middle. Your skill is in sniffing out these motivated sellers, negotiating a price that works for everyone, and locking it down with a wholesale contract. It’s all about finding hidden gems and building a solid list of buyers.

- The End Buyer: This is almost always a cash buyer—think house flippers or landlords looking to add another rental to their portfolio. They want properties with instant equity and are happy to pay you an “assignment fee” for bringing them a great deal on a silver platter.

The whole thing only works when you create a win-win-win situation. The seller gets their quick, painless sale. The end buyer gets a solid investment. And you, the wholesaler, get paid for making the connection happen.

The Core Concept: You aren't selling the property; you're selling the right to purchase the property. This distinction is the foundation of legal and ethical wholesaling.

For those still weighing their options, our guide on is real estate a good investment can offer some valuable perspective. Wholesaling lets you learn the market and generate income without the heavy risks that come with actually owning the property.

Essential Clauses Every Wholesaler Must Master

Your wholesale real estate contract is the single most important tool in your arsenal. It's the engine that drives the entire deal. A weak or poorly written agreement can cause a fantastic opportunity to fall apart, leaving you with nothing but wasted time and a frustrated seller. To really succeed in this business, you have to understand the legal anatomy of a contract that protects you and keeps the deal moving forward smoothly.

Think of these clauses as the gears in a machine. If one is missing or faulty, the whole operation grinds to a halt. Mastering them isn't just a good idea—it's non-negotiable for building a lasting wholesaling business.

The Heart of the Deal: The Right to Assign Clause

This is it. The most critical piece of any wholesale contract. The Right to Assign clause is what officially gives you, the wholesaler, the legal authority to transfer your rights and obligations in the contract to someone else—your end buyer. Without this clause, you're just a regular buyer, and your wholesaling business is dead in the water.

A simple but solid assignment clause might read something like this:

“Buyer shall have the right to assign this agreement to a third party without the seller's consent. All rights and obligations of the original buyer shall be transferred to the new assignee, who will be bound by the terms and conditions herein.”

That language is your permission slip to sell the contract. You might see some investors just add "and/or assigns" after their name on the buyer line, but a dedicated, standalone clause is much stronger. It leaves zero room for confusion or arguments down the road.

Your Safety Net: The Inspection Contingency

The inspection contingency, often called a "due diligence period," is your escape hatch. This clause gives you a set amount of time (usually 10-15 business days) to do two crucial things: inspect the property and, more importantly, find your cash buyer.

During this window, you can back out of the deal for almost any reason without losing your earnest money deposit. If you can't find a buyer willing to pay your price, you simply terminate the contract based on your "inspection findings." This clause almost single-handedly eliminates your financial risk.

- Here’s how it plays out: You get a property under contract for $100,000. After marketing it for a week, you realize you miscalculated the repair costs. Your best cash buyer offers are only coming in at $105,000, which doesn't leave enough meat on the bone for your assignment fee.

- The solution? You exercise your inspection contingency, let the seller know you're terminating the agreement, and get your earnest money back. No harm, no foul.

Securing the Deal: Earnest Money and Closing Date

Two other clauses work together to give the agreement teeth and a clear timeline.

- Earnest Money Deposit (EMD): This is your good-faith deposit to show the seller you're serious. While you can technically get away with as little as $100, putting down a bit more ($500-$1,000) makes your offer look much stronger and more competitive. Your contract needs to spell out the EMD amount and state clearly that it’s refundable if you cancel during the contingency period.

- Closing Date: This sets a firm deadline, typically 30 to 45 days out, for the entire transaction to be finished. This timeframe gives you enough runway to find a buyer and for them to get their funds in order. A clear closing date creates a sense of urgency and keeps everyone on the same page.

Comparing Key Contract Provisions

Understanding how these clauses work in harmony is vital. A weak clause can easily undermine a strong one, so you need to make sure they're all crafted to support each other.

| Clause | Primary Function | Why It's Critical for Wholesalers |

|---|---|---|

| Right to Assign | Grants permission to sell the contract. | Core mechanism that makes wholesaling possible. |

| Inspection Contingency | Provides a risk-free period to find a buyer. | Acts as an "escape clause" to protect earnest money. |

| Clear Closing Date | Establishes a firm deadline for the deal. | Creates urgency and clarity for all parties. |

| Earnest Money Terms | Shows the seller your commitment. | Specifies refundability during the contingency period. |

For investors looking ahead, it's also smart to understand how to finance an investment property, as your end buyers might need that guidance. By making sure your agreements are airtight, you build a foundation for consistent, protected, and profitable deals.

Walking Through a Wholesale Deal From Start to Finish

Knowing the theory behind wholesale real estate contracts is one thing. Watching a deal come together from start to finish? That's where it all really clicks. The entire process, when done right, follows a clear, repeatable roadmap. Let's walk through the five key stages of a successful wholesale transaction, from the initial property hunt all the way to cashing that check.

Stage 1: Finding Motivated Sellers

Your work begins long before any contract is signed. The lifeblood of a wholesaling business is a steady flow of leads from motivated sellers. These are homeowners who need to sell fast and are open to trading some of their equity for a quick, no-fuss cash closing. You won't find these deals on the MLS; the real gold is found off-market.

So, how do you find these hidden gems?

- Driving for Dollars: You literally drive through neighborhoods you're interested in, looking for signs of a property in distress—think overgrown lawns, boarded-up windows, or mail piling up. These are often clues to a vacant property and a potentially motivated owner.

- Direct Mail Campaigns: Sending targeted postcards or letters to specific lists of people, like out-of-state owners or homeowners facing foreclosure, can bring leads right to your doorstep.

- Digging into Public Records: You can sift through public records for things like notices of default, tax delinquencies, or probate filings. These documents often point to sellers in tough spots who need a solution fast.

Real-Life Example: In Phoenix in early 2023, I spotted a vacant bungalow while driving for dollars. The owner, relocating for a tech job in Seattle, agreed to a $95,000 contract after I sent a direct-mail letter. With estimated $20,000 in repairs and an ARV of $200,000, I assigned the contract for $110,000, securing a $15,000 fee in just 30 days.

For a deeper dive into sourcing deals, our guide on how to find investment properties lays out even more strategies to keep your pipeline full.

Stage 2: Calculating Your Maximum Allowable Offer

Once you've got a promising lead, you can't just throw out a number. Your offer has to be rooted in solid math to make sure the deal works for you and your future cash buyer. The industry-standard formula for this is the Maximum Allowable Offer (MAO), and it's designed to protect everyone's profit.

Here's the formula:

(After Repair Value) x 70% – (Estimated Repair Costs) = MAO

Let's break that down:

- After Repair Value (ARV): Your best estimate of what the house will be worth once it's all fixed up, based on what similar renovated homes (comps) have sold for.

- The 70% Rule: Most fix-and-flip investors won't pay more than 70% of a property's ARV. That 30% buffer covers holding costs, closing fees, and profit.

- Repair Costs: Your educated guess on how much money it will take to get the property up to its full ARV.

Real-World ARV Example:

Imagine you find a distressed property with an ARV of $250,000. You estimate $40,000 in repairs.

MAO = ($250,000 x 0.70) – $40,000 = $175,000 – $40,000 = $135,000

You must secure the contract at $135,000 or less to preserve a profit.

Stage 3: Negotiating and Securing the Contract

With your MAO in hand, it's time to talk to the seller. This is as much about building a connection as it is about numbers. Your goal is to present a fair, all-cash offer that solves their problem. Once you agree on a price, you'll use your wholesale purchase agreement to get it locked in. As we've covered, your assignability clause and inspection contingency are non-negotiable.

This infographic gives a simple, clear visual of the process once the contract is signed.

As you can see, once you assign the contract, the deal flows through due diligence (the buyer's inspection) and moves logically toward closing. Each step is a critical milestone.

Stage 4: Marketing to Your Buyers List

The second that contract is signed, the clock starts ticking on your inspection period. It's time to market the deal—not the property itself—to your network of cash buyers. An up-to-date, pre-vetted buyers list is truly your greatest asset in this business.

When you present the deal, be clear and concise. Include:

- The property address and basic specs (beds, baths, square footage).

- Your contract price and the assignment fee you're asking for.

- The estimated ARV and your repair budget.

- Plenty of photos and clear instructions for showings.

Your objective here is to find a buyer who immediately sees the value and is ready to move.

Stage 5: Assigning the Contract and Closing

Once you've found your buyer, you'll have them sign an Assignment Agreement. This is a simple legal document that officially transfers all your rights and obligations in the original contract over to them. In return, they agree to pay your assignment fee.

From there, you send both the original purchase contract and the new assignment agreement to an investor-friendly title company. They handle the rest. Your buyer wires the total funds, and you get paid your fee at closing. It’s that straightforward.

This entire process thrives in a shifting market. For instance, recent global real estate trends have shown commercial sales in the Americas rising by 12%, while markets in Europe and Asia-Pacific saw sharp drops. According to Deloitte's analysis of commercial real estate, this kind of volatility creates more motivated sellers—the perfect environment for wholesalers to connect them with cash-rich investors looking for their next project.

https://www.youtube.com/embed/CVoLbkZkiKM

Let's tackle the big question that looms over every new wholesaler: is this even legal? The short answer is yes, absolutely. But the long answer is where you need to pay close attention. The entire legality of wholesaling comes down to one core concept: you are selling your equitable interest in a property, not the property itself.

When you and a seller sign a purchase agreement, you're not just getting a piece of paper. You're gaining what the law calls equitable interest—the right to buy that property according to the terms you've both agreed on. Assigning this right to another buyer for a fee is a perfectly legitimate transaction.

The Fine Line Between Wholesaler and Unlicensed Agent

To keep your business above board, you have to know exactly where that line is drawn. State laws are put in place to protect consumers from people acting as agents without the proper training and licensing. Stepping over that line can bring on some serious penalties, from hefty fines to court dates.

It all boils down to how you market your deal and communicate with people. You can never, ever position yourself as the property owner or an agent working for them. You are simply a principal party in a contract, and you have the right to sell that contract.

Crucial Distinction: Your product is the contract, not the house. Frame all your marketing efforts around finding a buyer for your purchase agreement. This single shift in perspective is the foundation of compliant wholesaling.

Real-Life Scenario: A Florida wholesaler once omitted a standalone Right to Assign clause and struggled when the seller refused assignment. He restructured contracts with clear assignment language thereafter, avoiding legal delays and protecting his business.

Best Practices for Legal and Ethical Wholesaling

Staying on the right side of the law isn't just about dodging trouble; it's about building a solid, reputable business that people want to work with. Honesty and transparency are your best friends here.

- Be Upfront with Sellers: Don't be mysterious. Clearly explain who you are and what you plan to do. Let the seller know you're an investor and you intend to assign the contract to a partner or another buyer.

- Market the Contract, Not the Property: When you're talking to your cash buyers, make it crystal clear that you're selling them your rights to the purchase agreement. Avoid using websites or language that make it look like you're listing the property itself.

- Never "Represent" Others: Watch your words. Avoid any language that even hints you're acting on behalf of the seller. You're acting for yourself as a principal in the deal.

State-Specific Regulations and the Double Close Alternative

It's critical to remember that real estate law is local. The rules for wholesaling can vary significantly from one state to the next. Some states, like Ohio, have tightened their regulations, now requiring wholesalers to give sellers a specific written disclosure. This form makes it clear the wholesaler isn't their agent and plans to sell the contract for a profit.

So, what do you do in states with tougher rules, or when a contract itself forbids assignment (which is common with bank-owned REO properties)? You pivot to the double close.

A double close, or simultaneous close, is exactly what it sounds like—two separate closings that happen back-to-back, often on the same day:

- Transaction A: You buy the property from the original seller. For a brief moment, you are the official owner.

- Transaction B: You immediately turn around and sell that same property to your end buyer.

Sure, this route means paying two sets of closing costs, but it completely removes any legal gray areas about brokering. It's the cleanest, safest way to pull off a wholesale-style deal in a restrictive market. Just as you need to know your exit strategies, it’s also smart to understand financial details like property investment tax deductions that will affect your final profit.

By being transparent, understanding the legal lines you can't cross, and having strategies like the double close in your back pocket, you can build a successful and compliant wholesaling business anywhere.

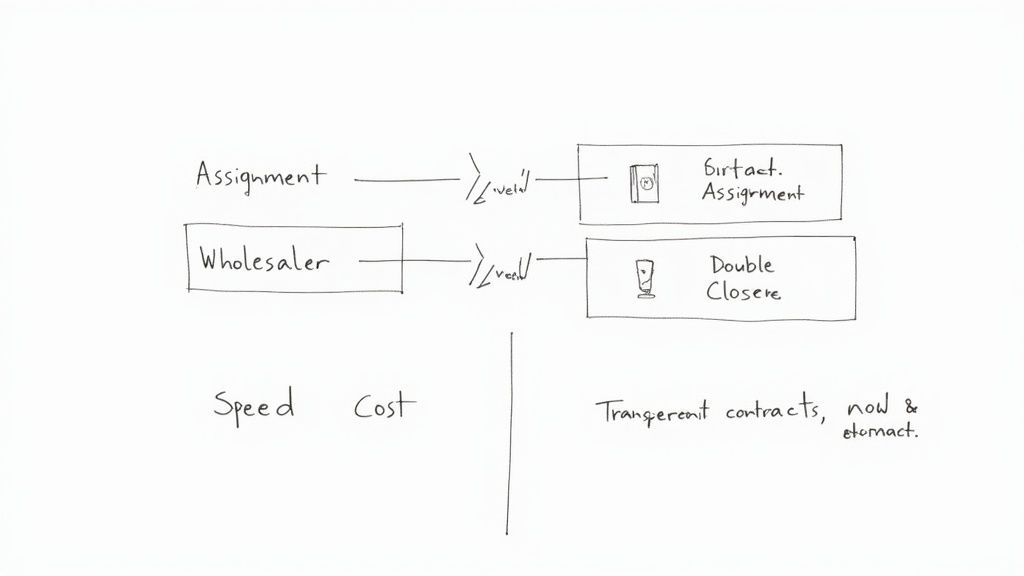

Choosing Your Exit Strategy: Assignment vs. Double Close

Alright, you've got a property locked up with a wholesale contract. This is where the real strategy comes into play. How you hand off that deal to your cash buyer and collect your check—your exit strategy—is a crucial decision that shapes your profit, timeline, and even your legal footing.

You're essentially standing at a crossroads with two main paths: the contract assignment and the double close.

The contract assignment is the most direct route. Think of it like selling your ticket to a sold-out concert. You aren't selling the venue; you're just selling your right to get in. You simply transfer your rights in the purchase agreement to another buyer for a fee. It's quick, cheap, and a favorite for many wholesalers for its beautiful simplicity.

A double close, also called a simultaneous close, is a bit more involved. It consists of two distinct closings that happen back-to-back. First, you officially buy the property from the seller. Then, sometimes just minutes later, you turn around and sell it to your end buyer. You technically own the property for a brief moment, which creates a clean, legal firewall between the two deals.

When to Choose an Assignment

An assignment is your best bet for a clean, simple deal where speed is key. If you have a cooperative seller and your profit margin is solid but not astronomical, assigning the contract is incredibly efficient. It keeps your costs down and gets you paid fast.

But there's a catch: transparency. In an assignment, everyone sees everyone else's cards. The end buyer knows what you paid, and the seller sees your assignment fee on the final paperwork. If you've negotiated a killer deal with a huge profit spread—say, $20,000+—this can sometimes create last-minute drama. A seller seeing that number might get cold feet or feel like they've been taken advantage of, putting your entire deal at risk.

When a Double Close is a Must

The double close is your go-to move for more sensitive or complex scenarios. Its main advantage is privacy. Because there are two separate transactions, your profit is completely shielded. The seller never knows what the end buyer paid, and the end buyer never knows your original purchase price. This is absolutely critical for protecting those larger wholesale fees.

Beyond privacy, a double close is often the only option in certain situations:

- Tougher State Laws: Some states have cracked down on wholesaling, and a double close is the most compliant and legally sound way to operate.

- Contracts That Forbid Assignment: Deals involving bank-owned properties (REOs) or those on a standard real estate agent's contract often include a clause that flat-out prohibits assignments.

- Buyer Is Getting a Loan: If your end buyer is using a mortgage or other traditional financing, their lender will almost always demand a double close to ensure a clean chain of title.

The downside? Cost. A double close means two sets of closing costs—title fees, recording fees, etc.—which will dip into your bottom line. It's essential to run the numbers beforehand. Using a good real estate investment calculator can help you figure out if the extra protection of a double close is worth the added expense.

Contract Assignment vs. Double Closing At a Glance

| Feature | Contract Assignment | Double Closing (or Simultaneous Closing) |

|---|---|---|

| Speed | Faster. Everything happens in one transaction. | Slower. Coordinate two separate closings. |

| Cost | Very low cost. Only one closing. | Higher cost. Two sets of closing costs. |

| Transparency | Fully transparent. Profit is visible to all. | Completely private. Profit shielded. |

| Legal Complexity | Simpler, but can be gray in some states. | More steps, but clean, legally solid. |

| Best For | Smaller margins, all-cash buyers, friendly sellers. | Large margins, buyer financing, REOs, restrictive states. |

Ultimately, understanding both strategies gives you the flexibility to structure your deals for maximum profit and minimum risk. As you gain more experience, you'll develop an instinct for which exit strategy best fits each unique opportunity.

Your Top Wholesale Real Estate Questions, Answered

Jumping into the world of wholesaling can feel like learning a new language. You're bound to have questions, and that's a good thing—it means you're taking it seriously. I've been there. Let's walk through some of the most common questions I hear from new wholesalers to clear things up and get you moving forward with confidence.

1. How Much Money Do I Really Need to Start Wholesaling?

People love to say wholesaling requires "no money," but that's not the whole story. While it has a famously low barrier to entry, it’s not completely free.

Your first potential cost is the Earnest Money Deposit (EMD). This is your "skin in the game," showing the seller you’re serious. It can be as low as $100, but for a more desirable property, you might see it climb to $5,000 or more.

You'll also need a small budget for marketing to find motivated sellers. Think of it as fuel for your business—whether it’s for direct mail, bandit signs, or a subscription to a tool that helps you find off-market deals. And finally, I always tell beginners to set aside a few hundred dollars to have a lawyer review their first couple of contracts. It's a small price to pay for peace of mind.

2. What's the 70% Rule, and Why Should I Care?

The 70% Rule is the back-of-the-napkin math that fix-and-flip investors live by. As a wholesaler, you need to master this because your end buyers are using it to evaluate every deal you bring them.

Here's the formula: (After Repair Value) x 70% – (Repair Costs) = Maximum Allowable Offer (MAO).

Your entire job boils down to getting a property under contract for a price well below this MAO. That gap between your contract price and the flipper's maximum offer is where your assignment fee lives. Nail this calculation, and you’ll create deals that your cash buyers can't say no to.

3. Can I Wholesale a Property Listed on the MLS?

The short answer is yes, technically. But the real answer is that it's incredibly tough, and I wouldn't recommend it when you're starting out.

Properties on the Multiple Listing Service (MLS) are out there for the whole world to see, which means they’re usually priced at or very close to their full retail value. You also have to deal with real estate agents and their commissions, which slices away at your already slim potential profit. The real money in wholesaling is made "off-market," by finding homeowners who need to sell now and aren't already working with an agent.

4. How Do I Build a Solid Cash Buyers List?

Your cash buyers list is your golden ticket in this business. Forget everything else—without buyers, you just have a contract, not a deal. Building a quality list is an ongoing hustle, not a one-time task.

- Hit Up Local REIA Meetings: Real Estate Investor Association meetings are the best place to shake hands with active, local cash buyers.

- Be a Fly on the Wall at Auctions: Head down to the local courthouse or foreclosure auctions. The people bidding and winning are the ones with cash ready to deploy.

- Dig into Public Records: You can look up recent all-cash sales in your area. Find out who bought them and reach out directly.

- Go Digital: Join local real estate investor groups on Facebook or get active on forums like BiggerPockets.

A quick tip: Always vet your buyers. Ask them what their buying criteria are (e.g., "3-bed, 2-bath, under $150k") and, most importantly, ask for proof of funds. This separates the real players from the pretenders.

5. What Happens If I Can't Find a Buyer for My Contract?

This is the fear that keeps new wholesalers up at night. The good news is, there's a safety net, and it's built right into your contract. It's called an "inspection contingency" or "due diligence" clause.

This clause gives you a set period—maybe 10 to 21 days—to "inspect" the property. But what you're really doing is marketing the deal to your buyers. This clause gives you the legal right to back out of the contract for any reason (or no reason at all) during that window. If you can't find a buyer in time, you simply terminate the agreement and get your earnest money back. This escape hatch is non-negotiable; without it, you could lose your EMD or even get sued.

6. How Do I Find an Investor-Friendly Title Company or Attorney?

This is a step most beginners overlook, and it can absolutely kill a deal. Your average neighborhood title company might get confused by an assignment contract or a double closing. You need a closing agent who speaks the language of real estate investing.

The best way to find one is through referrals. Ask for recommendations at your local REIA meeting or from other investors you connect with. When you call a potential title company, ask them straight up: "Do you have experience with wholesale assignment of contract deals?" A great, investor-savvy closing agent is a critical part of your team and will make your life a thousand times easier.

7. How Will My Assignment Fee Be Taxed?

Uncle Sam will want his cut. Your assignment fee is almost always taxed as ordinary income, not a capital gain, because you never actually owned the property. It's treated like income you earned for providing a service.

If you're wholesaling consistently, the IRS will see you as self-employed. That means you'll be on the hook for self-employment taxes (Social Security and Medicare) on top of your income tax. My best advice? Find a CPA who works with real estate investors and talk about setting up an LLC or another business entity. It can save you a lot of headaches and money down the road.

8. What Are the Biggest Mistakes New Wholesalers Make?

I see new wholesalers make the same few mistakes over and over. If you can avoid these, you'll be way ahead of the curve.

- Fuzzy Math: Getting the After Repair Value (ARV) wrong or drastically underestimating repair costs. This creates a "deal" with no profit for anyone.

- Putting the Cart Before the Horse: Getting a property under contract before you've even started building a buyers list. Always be building your list.

- Using Weak Contracts: Grabbing a generic contract off the internet that doesn't have the key clauses you need, like the right to assign or a strong exit clause.

- Inconsistent Marketing: You have to consistently market for motivated sellers. A few bandit signs one weekend won't cut it; it needs to be a constant effort.

- Ignoring Local Laws: Wholesaling regulations can vary by state. Not knowing the rules in your backyard is a recipe for disaster.

9. How Do I Nail Down the After Repair Value (ARV)?

An accurate ARV is the foundation of every successful wholesale deal. The most reliable way to find it is by running "comps"—looking at what similar, recently sold homes have gone for in that immediate neighborhood.

The key is to compare apples to apples. You're looking for homes with a similar square footage, age, and style that have been fully renovated. Your best friend here can be a real estate agent who can pull fresh, accurate comps from the MLS. You can also use services like PropStream or DealMachine. And remember, base your ARV on what has actually sold, not what people are asking for.

10. Should I Get a Real Estate License to Wholesale?

This is a great question, and there's no single right answer—it's a strategic choice.

Getting your license gives you direct MLS access, which is huge for running comps. It also adds a layer of credibility with sellers and allows you to earn a commission if a deal falls through for wholesaling but could work as a traditional listing.

On the flip side, being licensed costs money, requires ongoing education, and puts you under the microscope of your state's real estate commission, which adds rules and regulations to how you operate. You don't need a license to start, but many successful wholesalers eventually get one to open up more doors.

About the Author

John Smith is a real estate investor with over 10 years of experience in wholesaling, fix-and-flips, and rental properties. He has closed over 200 wholesale deals nationwide and regularly shares his insights on Top Wealth Guide.

Ready to take your wealth-building journey to the next level? At Top Wealth Guide, we provide the strategies and insights you need to succeed in real estate, stocks, and more. Explore our resources and start making smarter investment decisions today.