When you hear investors talk about "leverage" in real estate, they're talking about a powerful concept: using borrowed money to buy a much bigger asset than you could afford with your own cash. Think of it as using a mortgage to purchase a property instead of waiting until you've saved up the entire purchase price.

It’s this very strategy that allows investors to supercharge their returns and scale their portfolios much faster than they could otherwise.

In This Guide

- 1 Understanding The Core Idea of Real-Estate Leverage

- 2 How Leverage Actually Works in a Real Estate Deal

- 3 Calculating Your Returns: Where Leverage Really Shines

- 4 Understanding the Benefits and Risks of Leverage

- 5 Smart Ways to Use Leverage and Build Your Portfolio

- 6 Frequently Asked Questions About Real Estate Leverage

- 6.1 1. What is a good leverage ratio for real estate?

- 6.2 2. Can you lose more than your initial investment with leverage?

- 6.3 3. How does leverage affect real estate taxes?

- 6.4 4. When should I consider an all-cash real estate purchase?

- 6.5 5. What is the difference between positive and negative leverage?

- 6.6 6. How do rising interest rates impact a leveraged property?

- 6.7 7. What is the Debt Service Coverage Ratio (DSCR)?

- 6.8 8. What happens if my leveraged property's value drops?

- 6.9 9. Is my primary home mortgage a form of leverage?

- 6.10 10. How much cash reserves should I keep for a leveraged property?

- 7 Wrapping It Up: The Real Power of Real Estate Leverage

Understanding The Core Idea of Real-Estate Leverage

Imagine you need to move a huge boulder in your yard. Trying to push it with your bare hands is nearly impossible. But what if you grab a long, sturdy lever? Suddenly, with just a little bit of your own effort, you can move something enormous.

That's exactly how leverage works in real estate. Your down payment is the small effort you apply, and the mortgage is the lever that gives you control over a much larger, more valuable asset—the property. It's the financial tool that separates saving from investing, allowing you to get into the market and start building wealth without needing to be a millionaire first.

The Key Players In a Leveraged Deal

Every leveraged deal comes down to three core pieces. Once you understand how they fit together, you've grasped the fundamentals.

- Your Capital (Down Payment): This is your skin in the game—the cash you put into the deal. Think of it as the initial force you apply to the lever.

- Borrowed Capital (The Loan): This is the money you get from a lender, famously known as "Other People's Money" (OPM). This is the lever itself, amplifying your financial strength.

- The Asset (The Property): This is the high-value property you now control. Here’s the magic: even though you only paid a fraction of its price, you benefit from 100% of its appreciation.

To make this crystal clear, here’s a quick breakdown of these concepts.

Leverage at a Glance Key Concepts

| Concept | What It Means in Plain English | Simple Example |

|---|---|---|

| Down Payment | Your own money used to secure the loan. | You put $50,000 down on a property. |

| Borrowed Capital | The mortgage you get from the bank. | The bank lends you the remaining $200,000. |

| The Asset | The total value of the property you now control. | You control a $250,000 house. |

This table shows how a small personal investment gives you control over a much larger asset, which is the heart of the strategy.

Leverage acts as a financial multiplier. During the 2007-2008 financial crisis, for example, research showed that even a moderate increase in leverage had a staggering 13.69% impact on total returns for public real estate companies, dramatically amplifying both gains and losses.

A simple way to think about it: With leverage, your return isn't just based on your down payment. It's calculated on the entire value of the property. This is how a relatively small investment can produce such impressive profits.

This dynamic between what you've invested and what the property is worth is everything. As the property appreciates or you pay down the loan, the gap between what it's worth and what you owe gets bigger. That gap is your equity.

How Leverage Actually Works in a Real Estate Deal

It’s one thing to talk about leverage as a concept, but seeing it play out in a real deal is where it all clicks. At its core, using leverage is like forming a partnership with a lender. You bring the down payment and the strategy, and they provide the bulk of the capital to bring the deal to life.

It all starts when you go to get a mortgage. Lenders aren’t just giving away money; they're making their own calculated investment. To protect themselves, they use a few key numbers to size up the risk of a deal. Getting familiar with these metrics is non-negotiable—they don't just decide if you get the loan, they influence the terms you get.

Decoding the Loan-to-Value Ratio

First up is the Loan-to-Value (LTV) ratio. This is the lender's go-to metric for quickly assessing risk. It’s a simple percentage that shows how much of the property's value they're being asked to finance.

A lower LTV means you’ve put more of your own cash into the deal—you have more "skin in the game." This creates a buffer for the lender. If the market dips and the property's value drops, your equity takes the first hit, making it much less likely the bank will lose money.

LTV Formula: Loan Amount / Property Value = LTV Ratio

Let's say you're buying a $400,000 property and putting $80,000 down. You'd be borrowing $320,000. In this case, your LTV would be 80% ($320,000 / $400,000). For most conventional investment property loans, lenders are happiest when they see an LTV of 80% or lower.

Today, borrowing strategies are absolutely central to real estate investing. We’ve seen private real estate fundraising skyrocket to $23.3 billion recently, a figure over 60% higher than the previous year, with much of that growth coming from debt-focused funds. Non-traditional lenders are also jumping in, with private credit funds now making up 24% of all U.S. commercial real estate lending—a huge leap from the 14% ten-year average.

Assessing Cash Flow with the DSCR

While LTV shows how much equity you have, the Debt Service Coverage Ratio (DSCR) tells the lender if the property can actually pay its own mortgage. It's a direct comparison of the property's income to its debt payments. Think of it as the ultimate stress test for an investment's financial health.

A DSCR of 1.0 is the break-even point—the income is just enough to cover the mortgage. Lenders hate this. They want to see a comfortable cushion.

Here’s the simple breakdown:

- Calculate Net Operating Income (NOI): This is your total rental income minus all your operating expenses (property taxes, insurance, repairs, etc.), but before you've paid the mortgage.

- Calculate Annual Debt Service: This is the total of your mortgage payments (principal and interest) for one year.

- Divide NOI by Debt Service: That’s your DSCR.

DSCR in a Real-Life Example

Let's run the numbers on a hypothetical rental property to see this in action.

| Metric | Calculation | Result |

|---|---|---|

| Gross Rental Income | $2,500/month x 12 | $30,000 |

| Operating Expenses | (Taxes, Insurance, etc.) | -$8,000 |

| Net Operating Income (NOI) | $30,000 – $8,000 | $22,000 |

| Annual Debt Service | $1,350/month x 12 | $16,200 |

| DSCR | $22,000 / $16,200 | 1.36 |

Here, the DSCR is 1.36. This tells a lender that the property generates 36% more income than it needs to cover the mortgage. Since most lenders look for a DSCR of 1.25 or higher, this property looks like a solid, cash-flowing asset—making it an easy "yes" for financing.

By getting comfortable with LTV and DSCR, you can start looking at deals through the same lens as a lender. If you want to dive deeper, you can also explore our guide on how to finance an investment property to learn more about your options.

Calculating Your Returns: Where Leverage Really Shines

This is where the magic happens. Theory is great, but let's put some real numbers on the page to see how using other people's money can supercharge your returns.

We're going to walk through a side-by-side comparison. Imagine two investors, Alex and Brenda, buying the exact same property. Alex pays all cash, while Brenda uses a standard mortgage. By the end, you'll see exactly how a smaller upfront investment can generate a much bigger return on your dollar.

Case Study: The $500,000 Rental Property

Let's set the stage with a realistic single-family rental property. Nothing flashy, just a solid investment in a decent market.

- Purchase Price: $500,000

- Annual Gross Rental Income: $36,000 (or $3,000 per month)

- Annual Operating Expenses: $10,800 (a standard 30% of gross income to cover taxes, insurance, repairs, etc.)

- Net Operating Income (NOI): $25,200 ($36,000 – $10,800)

- Property Appreciation: Let’s assume a conservative 4% a year.

With these numbers in place, let's see how our two investors make out.

Scenario 1: Alex Buys with All Cash

Alex is a cautious investor. He prefers owning his assets free and clear to maximize monthly income and eliminate any risk of foreclosure. Simple and safe.

- Total Cash Invested: $500,000

- Annual Cash Flow: With no mortgage payment, Alex’s cash flow is simply his NOI, which comes out to $25,200.

To measure his performance, we'll use a core real estate metric: the Cash-on-Cash Return. It tells you what percentage of your invested cash you get back each year in profit.

Cash-on-Cash Return Formula: Annual Cash Flow / Total Cash Invested = Return

For Alex, that’s $25,200 / $500,000, giving him a 5.04% Cash-on-Cash Return. It's a respectable, steady return. But let's see what Brenda can do with leverage.

Scenario 2: Brenda Buys with a Mortgage

Brenda decides to amplify her returns using a loan. She gets a typical mortgage for an investment property.

- Down Payment (20%): $100,000

- Loan Amount (80%): $400,000

- Total Cash Invested: $100,000 (we'll ignore closing costs to keep it simple)

- Mortgage Terms: A 30-year fixed loan at a 6% interest rate.

- Annual Mortgage Payment: $28,780 (covering both principal and interest).

Now, let's look at Brenda's cash flow. It's her NOI minus that mortgage payment: $25,200 – $28,780, which equals -$3,580 per year.

Hold on—she's losing money every month! On the surface, this looks like a terrible investment compared to Alex, who's pocketing over $2,000 a month. But this is where most people get it wrong. They're only looking at cash flow and ignoring the two other powerful wealth-building engines: appreciation and loan paydown.

You can run these kinds of scenarios with your own numbers using a good real estate investment calculator.

A Five-Year Comparison: The Final Verdict

To see who truly comes out ahead, we have to look beyond a single year. Let's fast-forward five years. The property has appreciated by 4% annually and is now worth around $608,326.

This table breaks down the entire picture, showing how each investor's position has evolved.

Leveraged vs All-Cash Investment: A Five-Year Projection

| Metric | Leveraged Purchase (Brenda) | All-Cash Purchase (Alex) |

|---|---|---|

| Initial Cash Invested | $100,000 | $500,000 |

| Total Appreciation Gain | $108,326 | $108,326 |

| Loan Principal Paid Down | $23,887 (Equity Gained) | $0 |

| Cumulative Cash Flow Loss | -$17,900 (Cash out of pocket) | $126,000 (Cash profit) |

| Total Equity Gain | $114,313 ($108,326 + $23,887 – $17,900) | $234,326 ($108,326 + $126,000) |

| Total Return on Investment (ROI) | 114.31% ($114,313 / $100,000) | 46.87% ($234,326 / $500,000) |

The results are pretty eye-opening.

Even with negative cash flow, Brenda's total return on investment is more than double Alex's. She turned her $100,000 into a $114,313 gain, achieving a 114.31% ROI. Alex needed five times the cash ($500,000) to make his $234,326 gain, resulting in a 46.87% ROI.

Brenda's money worked dramatically harder because she controlled a $500,000 appreciating asset with just a fraction of the capital. This, right here, is the true power of leverage in real estate.

Understanding the Benefits and Risks of Leverage

Leverage in real estate is a true double-edged sword. Used wisely, it can supercharge your wealth-building journey in a way that paying all-cash never could. But get it wrong, and it can amplify your losses just as quickly. Before you even think about signing on the dotted line for a loan, you need a crystal-clear understanding of both sides of this powerful tool.

The core appeal of leverage is its ability to expand your financial footprint. Think about it: instead of sinking $500,000 into a single property, you could use that same cash as a down payment on four or five different properties. This doesn't just spread your risk around; it dramatically increases your potential to build a powerful, diversified income stream.

The Upside: Amplifying Returns and Building Wealth

The number one reason investors use leverage is the incredible boost it gives to their returns. When a property you own goes up in value, you get to keep 100% of that appreciation—even if you only put down 20% of the purchase price. A small bump in the market can suddenly turn into a massive return on the actual cash you invested.

But the benefits don't stop at appreciation. Leverage offers some serious perks for growing your portfolio and your bottom line.

- Faster Portfolio Growth: Using other people's money lets you buy more properties, more quickly. This is how you scale a real estate business and ramp up your rental income at a speed that would be impossible if you were saving up for each purchase in full.

- Significant Tax Benefits: The tax code is surprisingly friendly to real estate investors who use debt. You can usually deduct the mortgage interest you pay every year, which directly lowers your taxable income. On top of that, you can depreciate the entire value of the building (not just your down payment), creating a powerful "paper loss" that can shelter your cash flow from taxes.

- Increased Cash Flow Potential: This might sound strange since you have a mortgage to pay, but owning several leveraged properties can often generate a higher total cash flow than owning one property free and clear.

The Downside: The Real Risks of Borrowing

Just as leverage can magnify your wins, it can do the exact same thing to your losses. The biggest risk is that even a small dip in property value can hammer your equity. If that $500,000 property you bought with a $400,000 loan drops in value by just 20% to $400,000, your entire $100,000 in equity is gone. Poof.

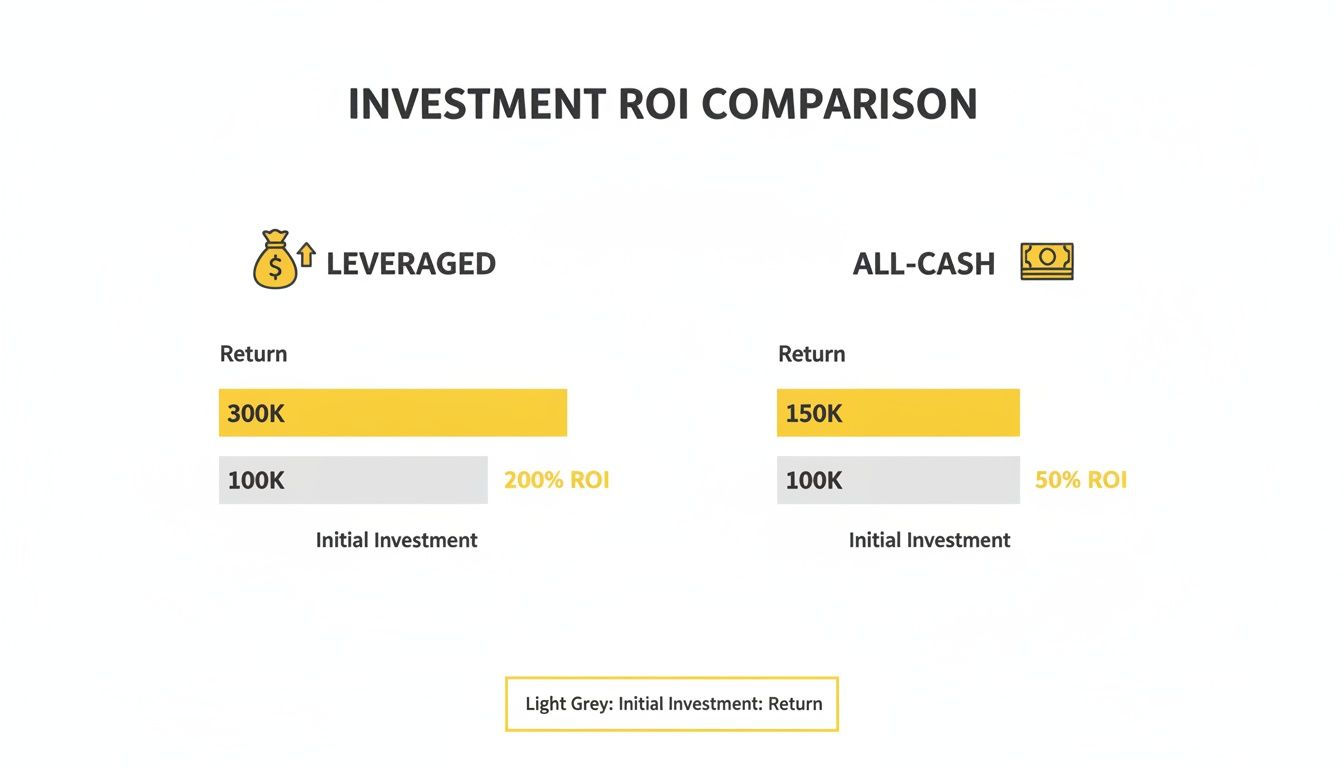

This infographic shows a direct comparison between a leveraged purchase and an all-cash one, making the power of amplified returns easy to see.

As the visual makes plain, a much smaller initial investment in a leveraged deal can produce wildly higher percentage returns compared to the all-cash scenario.

But market drops aren't the only danger. There are a few other risks you need to keep a close eye on.

Risk vs. Reward: The fundamental trade-off of leverage is accepting higher risk for the potential of higher returns. A responsible investor never focuses solely on the upside but prepares diligently for the downside.

Knowing these risks is the first step to protecting yourself. It's essential to "stress-test" any deal you're considering. What happens if you have a long vacancy? What if the water heater and the roof fail in the same year? For investors tackling fix-and-flips or other specialized projects, it's also worth exploring alternative financing, like the short-term funding offered by hard money loans.

A Balanced View: Weighing Both Sides

To make a smart decision, it helps to see the pros and cons laid out clearly.

| Benefits of Leverage | Risks of Leverage |

|---|---|

| Amplified ROI | Amplified Losses |

| Faster Portfolio Scaling | Negative Cash Flow |

| Significant Tax Advantages | Foreclosure Risk |

| Control of Larger Assets | Increased Personal Liability |

At the end of the day, leverage isn't good or bad. It's simply a tool, and a very powerful one at that. It demands skill, foresight, and a healthy dose of respect for risk. The most successful investors know how to find that sweet spot—using just enough leverage to put their capital to work without stretching themselves too thin.

Smart Ways to Use Leverage and Build Your Portfolio

Knowing what leverage is and isn't is just the first step. The real magic happens when you learn how to use it strategically to build lasting wealth. This means moving past the textbook definitions and into real-world plans that push for growth while keeping risk in check.

At the end of the day, any smart leverage strategy is about finding the right balance. It’s not a game of borrowing as much as the bank will give you; it’s about aligning your debt with your personal investment goals and what you’re comfortable risking.

Keep a Healthy Loan-to-Value Ratio

Think of your Loan-to-Value (LTV) ratio as your first line of defense if the market takes a turn. Sure, a higher LTV lets you get into a deal with less money down, which can look great on paper. But it also leaves you with a paper-thin equity cushion if things go south.

A much safer, more sustainable approach is to aim for an LTV of 75% or less. It means putting more money down upfront, but the benefits are huge:

- You get a safety buffer. If property values dip, you have enough equity to absorb the hit without owing more than the property is worth.

- Your cash flow improves. A smaller loan means a smaller monthly payment, making it far easier to stay profitable each month.

- You'll get better loan terms. Lenders see lower LTVs as less risky, and they’ll often reward you with better interest rates and more favorable terms.

The Importance of Cash Reserves

Leverage magnifies everything, including risk. The absolute best way to protect yourself is to have plenty of cash on hand. Think of cash reserves as your emergency fund for your investments—it's non-negotiable.

This liquidity is what will cover you during a surprise vacancy, a major repair like a new roof, or a wider economic slump. It’s the difference between weathering a storm and being forced to sell at a loss.

A good rule of thumb is to keep at least six months' worth of total expenses for each property. That includes the mortgage, taxes, insurance, and a maintenance budget. This turns a potential disaster into just another problem to solve.

This isn’t just a principle for small-time investors. On a larger scale, leverage is a key tool in the real estate secondary market, which recently saw a record $24.3 billion in transactions in a single year. General partners use debt to optimize portfolios and create liquidity, but the same rules apply. Top wealth strategists always advise investors to keep a close eye on LTV ratios and use debt wisely, especially with high-demand properties.

The BRRRR Method: A Strategy for Compounding Growth

If you're looking for a powerful way to scale a portfolio, look no further than the BRRRR method. It’s a brilliant system designed to let you reuse your initial investment capital over and over, helping you acquire more properties without saving up for a new down payment each time.

BRRRR is an acronym that breaks down the process:

- Buy: Find and purchase an undervalued property that needs some work, often using short-term financing.

- Rehab: Renovate the property to force appreciation, boosting its value and rental appeal.

- Rent: Find a quality tenant to create a steady, predictable stream of rental income.

- Refinance: Get a new, long-term loan based on the property's new, higher value after renovations.

- Repeat: The cash-out refinance allows you to pull your original investment—and sometimes more—back out. You then use that cash to repeat the process on the next property.

This strategy is a masterclass in using leverage to create a snowball effect. To get a complete breakdown of this powerful technique, check out our guide where the BRRRR method is explained in full detail. By adding value and then tapping into that new equity, you can grow your real estate portfolio much faster than you ever could with traditional methods.

Frequently Asked Questions About Real Estate Leverage

1. What is a good leverage ratio for real estate?

A healthy and common benchmark is a Loan-to-Value (LTV) ratio between 75-80%. This means putting 20-25% down. It provides significant leverage to amplify returns while maintaining a solid equity buffer to protect against market downturns. Your personal risk tolerance may lead you to use more or less leverage.

2. Can you lose more than your initial investment with leverage?

Yes, it is possible with a "recourse" loan, which is the standard for most residential mortgages. If you default and the foreclosure sale doesn’t cover the loan balance, the lender can pursue your other personal assets. With a "non-recourse" loan, typically used in large commercial deals, your loss is limited to the property itself.

3. How does leverage affect real estate taxes?

Leverage offers significant tax advantages. You can typically deduct the mortgage interest you pay from your taxable income. More importantly, you can depreciate the entire value of the building (not just your down payment), which can create a "paper loss" that shelters your rental income from taxes.

4. When should I consider an all-cash real estate purchase?

Buying with all cash is ideal for investors prioritizing maximum monthly cash flow and minimal risk. It's a great strategy for retirees seeking stable income or anyone investing in a high-interest-rate environment where borrowing costs might outweigh the benefits of leverage.

5. What is the difference between positive and negative leverage?

Positive leverage occurs when the total return on your property (from appreciation and cash flow) is higher than the interest rate on your loan. Your debt is making you money. Negative leverage is the opposite: the cost of your debt is higher than the property's return, meaning your loan is eroding your profits.

6. How do rising interest rates impact a leveraged property?

For variable-rate loans, rising rates directly increase your monthly payment, which can reduce or eliminate cash flow. For fixed-rate loans, the risk is indirect: higher market-wide rates can cool buyer demand, slowing appreciation and potentially causing property values to fall. This is why locking in a long-term, fixed-rate mortgage is a popular defensive strategy.

7. What is the Debt Service Coverage Ratio (DSCR)?

DSCR is a metric lenders use to determine if a property's income can cover its mortgage payments. It's calculated by dividing the Net Operating Income (NOI) by the total annual mortgage payments (debt service). Lenders typically require a DSCR of 1.25 or higher, meaning the property generates 25% more income than needed to pay its debt.

8. What happens if my leveraged property's value drops?

A drop in value directly erodes your equity and increases your real leverage. For example, if a $500,000 property with a $400,000 loan (80% LTV) drops 10% in value to $450,000, your $100,000 in equity is cut in half to $50,000. A significant drop can leave you "underwater," owing more than the property is worth.

9. Is my primary home mortgage a form of leverage?

Absolutely. A mortgage on your personal residence is one of the most common forms of leverage. By putting down a small percentage of the purchase price, you gain control over 100% of the asset and benefit from all of its appreciation, which dramatically amplifies the return on your down payment.

10. How much cash reserves should I keep for a leveraged property?

A widely accepted rule of thumb is to maintain cash reserves equivalent to at least six months of the property's total expenses. This includes the mortgage payment, property taxes, insurance, and an allowance for maintenance and repairs. These reserves are crucial for covering unexpected vacancies or large capital expenditures without risking default.

Wrapping It Up: The Real Power of Real Estate Leverage

So, what’s the final word on leverage? It’s without a doubt one of the most potent tools you can use to build wealth through real estate. Nothing else lets you scale your portfolio and magnify your returns quite like it. It’s the difference between buying one property and controlling several.

But with great power comes great responsibility. The secret isn't just using leverage, but using it wisely. You're looking for that sweet spot: enough debt to make your money work hard for you, but not so much that a single vacancy or repair bill could sink the ship. It's a balancing act.

By truly getting a handle on concepts like LTV and DSCR, running the numbers for worst-case scenarios, and always keeping a healthy cash reserve, you turn leverage from a potential risk into your single greatest advantage. Understanding what leverage is in real estate goes far beyond just taking out a loan—it's about becoming a master of calculated risk on your journey to financial freedom.

The goal isn’t to sidestep risk altogether. That's impossible. The real aim is to understand it, manage it, and make sure the potential upside is worth the exposure. This is what separates seasoned investors from the rest of the pack.

At the end of the day, your success hinges on the quality of your decisions. A smartly leveraged property in a good market can put you on the fast track to hitting your financial goals. On the flip side, a poorly thought-out deal can be a major setback. Do your homework on every single deal, plan for the unexpected, and you'll be in a prime position to build lasting wealth.

For more expert insights and strategies on building a robust investment portfolio, explore the resources at Top Wealth Guide. Visit us at https://topwealthguide.com to continue your journey toward financial mastery.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.