Real estate portfolio management is the strategic discipline of overseeing your investment properties to maximize returns and minimize risk. It's about moving beyond simply owning properties and becoming the CEO of your real estate business, setting clear goals, acquiring the right assets, and actively managing them to achieve your long-term financial targets.

In This Guide

- 1 Building Your Strategic Investment Blueprint

- 2 Making Smart Acquisitions and Getting Creative with Financing

- 3 Fortifying Your Portfolio Against Market Shocks

- 4 Mastering Active Asset Management to Boost Returns

- 5 Navigating Tax, Legal, and Profitable Exit Strategies

- 6 Frequently Asked Questions About Real Estate Portfolio Management

- 6.1 1. How many properties make a "portfolio"?

- 6.2 2. Should I pay off my mortgages or stay leveraged?

- 6.3 3. What are the biggest mistakes new portfolio managers make?

- 6.4 4. How do I know when it’s time to sell a property?

- 6.5 5. What exactly is the BRRRR Method?

- 6.6 6. How much cash should I keep in reserves?

- 6.7 7. Can I manage a portfolio with a full-time job?

- 6.8 8. What's the difference between asset management and property management?

- 6.9 9. How does inflation affect my real estate investments?

- 6.10 10. What technology should I use to manage my portfolio?

Building Your Strategic Investment Blueprint

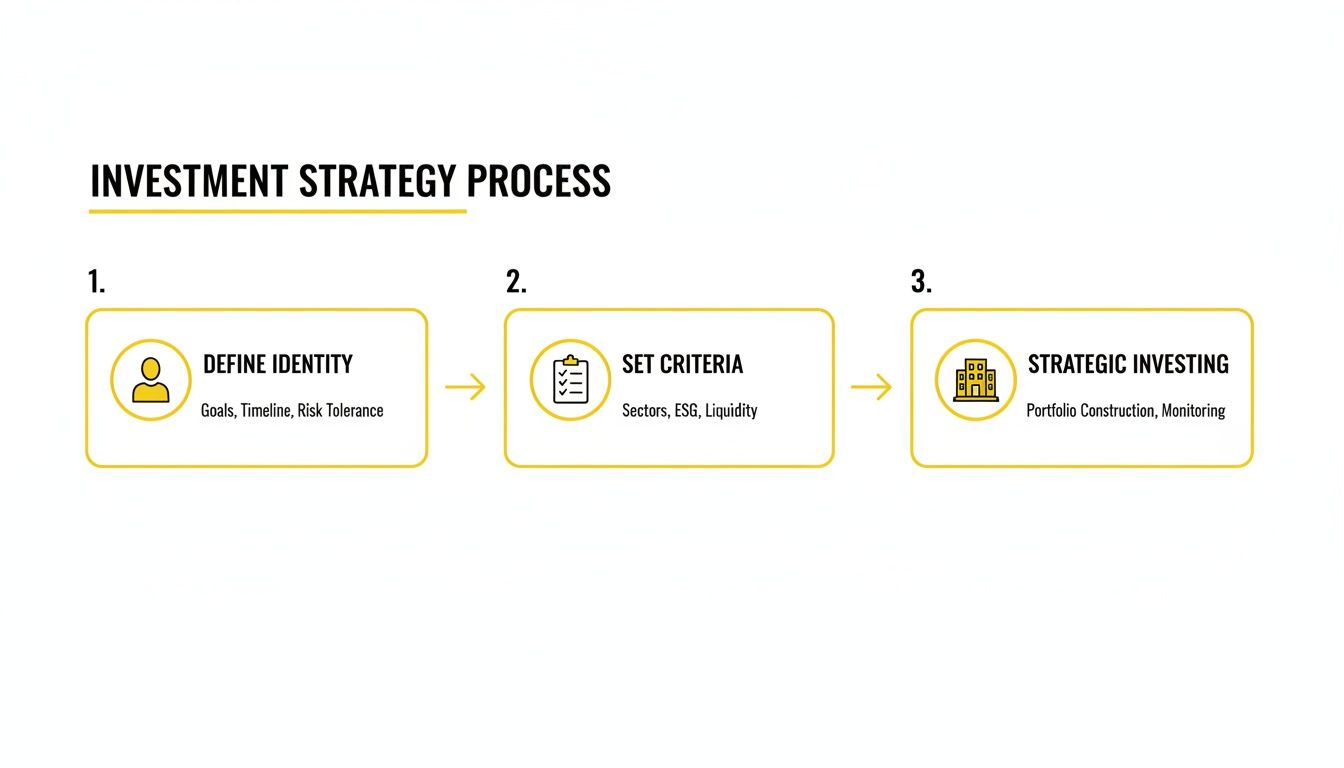

Before you even begin scrolling through property listings, a solid plan is non-negotiable. A strategic blueprint is the bedrock of any successful real estate portfolio. This isn't about vague aspirations like "I want to get rich"; it's about defining your specific identity as an investor. Are you pursuing high-growth potential in emerging markets, or do you require steady, predictable cash flow to fund your retirement?

The answer to that question dictates every subsequent decision. For instance, a young professional with a long time horizon might comfortably use higher leverage to acquire multiple properties, focusing on long-term appreciation over immediate cash flow. Conversely, an investor nearing retirement will almost certainly prioritize owning properties outright that generate reliable, debt-free income each month.

Define Your Investor Identity

Your strategy must be tailored to you—your financial situation, risk tolerance, and long-term vision. The market is increasingly rewarding investors who focus on specific asset performance rather than making broad bets on an entire sector. This makes sense, as performance can vary dramatically within the same market. For example, recent data showed that UK real estate returned a solid 8.1% over 12 months, but this was driven almost entirely by income, not capital appreciation, highlighting a significant shift in where profits are generated.

To clarify your approach, consider these two common investor archetypes:

- The Growth Investor: This individual targets markets with robust job and population growth. They are comfortable with higher leverage and seek properties they can improve—a classic "value-add" play—to force appreciation over a 5 to 10-year horizon.

- The Income Investor: For this investor, consistent cash flow is paramount. They prioritize predictability, often targeting turnkey multi-family buildings in stable, well-established neighborhoods. They typically use less debt to ensure their net operating income is as high and reliable as possible.

This thought process demonstrates why defining your identity is the critical first step before establishing acquisition rules or purchasing any assets.

This image underscores a core principle: intelligent investing is a disciplined process, not a series of impulsive, hopeful acquisitions.

Establish Non-Negotiable Acquisition Criteria

Once you know who you are as an investor, it's time to codify your buying rules. These are your non-negotiable acquisition criteria—the objective standards that prevent emotional decisions and ensure every property you acquire aligns perfectly with your strategic blueprint.

A disciplined investor with clear criteria will always outperform a brilliant one who buys on impulse. Your blueprint is your defense against costly mistakes and market noise.

Your criteria must be specific and measurable. For example:

- Property Type: Will you focus exclusively on single-family homes, small multi-family buildings (2-4 units), or venture into commercial retail?

- Location: Will you only invest in Class B neighborhoods, areas with a specific school rating, or properties within a certain proximity to major employers?

- Financial Performance: What are your minimum thresholds? Perhaps an 8% cash-on-cash return or a Debt Service Coverage Ratio (DSCR) of at least 1.25x.

Completing this foundational work transforms your mindset from merely buying properties to strategically building a powerful, goal-oriented portfolio. A clear plan is essential to optimize your portfolio with smart asset allocation. It's how you guarantee that every closed deal is a deliberate step toward your ultimate financial freedom.

Making Smart Acquisitions and Getting Creative with Financing

With your investment blueprint in place, it's time to execute. Smart acquisition is where theory meets reality, and often, it means looking where others aren't. While the Multiple Listing Service (MLS) is a starting point, the true gems—the deals that build significant wealth—are frequently found off-market.

This is how you sidestep bidding wars. Effective portfolio management requires building a consistent deal pipeline, which means being proactive. I've sourced some of my best investments by cultivating relationships with local contractors, wholesalers, and property managers—the people who hear about distressed owners or quiet sales long before the general public.

How to Uncover Off-Market Opportunities

Securing a deal before it becomes public knowledge provides a massive competitive advantage. You're no longer competing solely on price. Instead, you can structure an offer that solves a specific problem for the seller, making your proposal more compelling even if it isn't the highest bid.

Here are a few proven methods for finding off-market deals:

- Direct Mail Campaigns: Send personalized letters to owners in your target neighborhoods. Focus on specific profiles, such as absentee owners or those who have held their property for decades. It's an old-school tactic that still delivers results.

- Driving for Dollars: This is as simple as it sounds. Drive through your target areas looking for properties that appear neglected or distressed. Then, use public records to identify the owner and initiate contact.

- Networking: Attend local real estate investor meetups. Build relationships with the attorneys, accountants, and contractors who are deeply connected to the local market. They are an incredible source of leads.

The Power of Creative Financing

Finding the deal is only half the battle; funding it is the other. Many believe a conventional bank loan with 20% down is the only path, but that's just one tool in the kit. When traditional lending tightens, creative financing can transform an impossible deal into a portfolio home run, turning a financing roadblock into a strategic advantage.

Real-Life Example: Imagine you find an ideal duplex for $400,000, but lack the $80,000 for a conventional down payment. The seller is an older landlord, tired of managing tenants and seeking a reliable income stream. This is a perfect scenario for creative financing.

Creative financing is about solving the seller's problem. When you can offer a solution that provides them with steady income, a quick closing, or freedom from a burdensome property, the down payment often becomes a secondary concern.

Here’s a comparison of how a seller-financed deal could stack up against a traditional mortgage in this case:

| Financing Metric | Traditional Bank Loan | Seller Financing Deal |

|---|---|---|

| Purchase Price | $400,000 | $400,000 |

| Down Payment | $80,000 (20%) | $40,000 (10%) |

| Loan Amount | $320,000 | $360,000 |

| Interest Rate | 6.5% | 7.0% |

| Monthly P&I | ~$2,023 | ~$2,395 |

| Key Advantage | Lower interest rate | Half the cash required to close |

While the monthly payment is slightly higher, the seller-financed route requires only $40,000 of your cash upfront. This frees up the other $40,000 for renovations, reserves, or a down payment on another property, effectively accelerating your portfolio's growth.

Other Creative Financing Tools in Your Arsenal

Seller financing is powerful, but it's not the only option. Here are other strategies to help you scale:

- Hard Money Loans: These are short-term, asset-based loans ideal for fix-and-flip projects where speed is critical. Lenders prioritize the property's after-repair value (ARV) over your personal income.

- Joint Ventures (JVs): Lacking capital? Partner with someone who has it. You bring the deal-finding and project management skills; they provide the funding. A well-structured JV allows you to participate in much larger deals than you could alone.

- The BRRRR Method: This is a powerhouse strategy: Buy a distressed property, Renovate it, Rent it to a tenant, Refinance with a cash-out loan, and Repeat. This allows you to pull your initial capital back out for the next deal. Our complete guide explains exactly how the BRRRR method explained can supercharge your portfolio growth.

Mastering these acquisition and financing techniques separates amateurs from serious investors. It’s how you build your portfolio faster and more strategically, securing your financial future one deal at a time.

Fortifying Your Portfolio Against Market Shocks

Simply accumulating properties doesn't create a resilient portfolio. True strength lies in the strategic mix of those assets. Effective real estate portfolio management is about building a financial fortress capable of withstanding economic turbulence. This requires moving beyond concentrating on single-family homes in one neighborhood.

Think of your portfolio as a well-balanced sports team. You need steady, consistent players (cash-flowing assets) and high-growth stars (appreciation plays) to win. This is precisely where diversifying across asset classes becomes crucial.

Mixing Asset Classes for Stability and Growth

Combining different property types is one of the most effective ways to balance risk. For example, a stable multi-family property in a solid, working-class neighborhood can provide predictable cash flow—the defensive anchor of your portfolio. In contrast, a small commercial space in an up-and-coming area offers greater upside potential, acting as your offensive powerhouse.

This strategy works because different property types often react differently to economic shifts. A downturn affecting commercial retail might have minimal impact on residential rental demand, keeping your overall income stable.

A portfolio of ten identical single-family rentals in one city isn't diversified; it's concentrated risk. True diversification means owning assets that don't all rise and fall with the same economic tide.

Geographic Diversification: The Ultimate Defense

Spreading investments across different cities or states is equally critical. It's your best defense against localized economic downturns. If a major employer leaves town, the local housing market could be devastated. However, if you also own assets in a different economic region, the blow to your overall portfolio is significantly softened.

Despite some market volatility, the long-term global outlook remains positive. According to research from Nuveen, private real estate values have been rising for five consecutive quarters through Q2 2025. With global transaction volumes reaching $739 billion and positive returns across 21 countries, the data clearly supports the value of a geographically diverse strategy.

Real Estate Diversification Strategies Compared

This table illustrates how different diversification approaches compare in terms of risk, return potential, and management intensity.

| Diversification Strategy | Description | Risk Profile | Potential Return | Management Intensity |

|---|---|---|---|---|

| Asset Class Mix | Owning various property types (e.g., residential, commercial, industrial) in a single region. | Moderate | Moderate to High | High |

| Geographic Spread | Owning the same property type (e.g., single-family homes) across multiple cities or states. | Moderate | Moderate | High |

| Combined Approach | Owning different property types in various geographic markets. | Low to Moderate | High | Very High |

As shown, a combined approach offers the best risk mitigation but requires the most hands-on management.

Essential Risk Mitigation Tools

Diversification is your first line of defense, but it must be supported by legal and financial armor. For any serious investor, these are non-negotiable:

- Limited Liability Companies (LLCs): This is foundational. Holding each property in a separate LLC contains liability. If a lawsuit arises from an incident at Property A, your personal assets and Property B are shielded because the legal action is confined to that single LLC.

- Umbrella Insurance Policies: This is an extra layer of liability coverage that activates when your standard property insurance is exhausted. A $1-2 million umbrella policy is surprisingly affordable and can protect your entire net worth from a catastrophic event.

- Capital Expenditure (CapEx) Fund: Never be caught off guard by major repairs. A new roof or HVAC failure can wipe out your cash flow for years. You must maintain a dedicated CapEx fund, setting aside 5-10% of your gross rents each month. This ensures you can handle major expenses without derailing your financial plan.

By combining smart diversification with robust risk mitigation, you transition from being a mere property owner to the architect of a resilient, wealth-building machine.

Mastering Active Asset Management to Boost Returns

Acquiring a property is just the beginning; active asset management is how you win the game. This involves shifting from a passive landlord who collects rent to a strategic operator running a business. To succeed, you must look beyond basic income and focus on the key performance indicators (KPIs) that truly drive wealth.

Effective portfolio management hinges on meticulous financial tracking. This isn't just about verifying profitability; it's about identifying hidden opportunities to optimize the performance of every asset.

Know Your Numbers: The KPIs That Matter

Focusing on the right metrics provides a clear picture of your portfolio's health. You cannot improve what you do not measure.

Here is a breakdown of the essential KPIs that reveal the true operational efficiency of your investments and highlight where to focus your efforts.

Essential KPIs for Your Real Estate Portfolio

| Metric (KPI) | Formula | What It Measures | Good Benchmark |

|---|---|---|---|

| Net Operating Income (NOI) | Gross Rental Income – Operating Expenses | The pure profitability of an asset before debt and taxes. It's the cleanest measure of a property's performance. | Should consistently increase year-over-year. |

| Cash-on-Cash Return | Annual Pre-Tax Cash Flow / Total Cash Invested | The return on the actual cash you have in the deal. This is your personal ROI. | 8-12% or higher is a solid target for stabilized properties. |

| Return on Equity (ROE) | (Annual Cash Flow + Principal Paid Down) / Total Equity | The total return generated on the equity you've built. It accounts for both cash flow and mortgage paydown. | Should be higher than your Cash-on-Cash Return. A rising ROE is an excellent sign. |

| Occupancy Rate | (Number of Occupied Units / Total Number of Units) x 100 | The percentage of your units generating income. A direct lever on your gross potential rent. | 95% or higher is a strong benchmark for residential real estate. |

Closely monitoring these numbers enables data-driven decisions, allowing you to identify which properties are star performers and which are underperforming.

Boosting Revenue with Smart Value-Add Strategies

Once you are tracking performance, you can actively work to increase your NOI. This is where you get creative and implement new income streams beyond monthly rent.

These "value-add" improvements don't have to be expensive renovations. Often, the best returns come from small, strategic changes.

- Implement a Utility Bill-Back System (RUBS): Instead of absorbing the cost of water or trash, use a Ratio Utility Billing System to fairly allocate these costs among tenants. This creates a new revenue stream and encourages conservation.

- Add Fee-Based Amenities: Consider installing coin-operated laundry, offering reserved parking for a monthly fee, or providing rentable on-site storage units. Each adds a scalable, high-margin income source.

Real-Life Example: An investor I know acquired a 12-unit apartment building where the previous owner paid for all water. By installing simple submeters and billing tenants for their actual usage, he reduced the property's water consumption by 30% and increased the annual NOI by over $7,200. That's pure profit.

Slashing Expenses Without Sacrificing Quality

Controlling costs is just as important as increasing revenue. The key is to eliminate waste, not cut corners. Every dollar saved on expenses flows directly to your bottom line, boosting your NOI and overall cash flow. Learn more in our guide on calculating and improving rental property cash flow.

Focus on strategic cost-saving measures that won't alienate tenants and lead to costly vacancies.

- Review and Appeal Property Taxes: Tax assessments are often generated by algorithms and can be inaccurate. A successful appeal can save you thousands of dollars annually.

- Shop Your Insurance Annually: Rates and coverage options change constantly. Have an independent insurance broker shop your policy to multiple carriers each year to ensure you aren't overpaying.

- Implement Energy-Efficient Upgrades: Small changes add up. Installing LED lighting in common areas, low-flow toilets, and programmable thermostats can create substantial long-term utility savings.

The Big Question: Self-Manage or Hire a Pro?

As your portfolio grows, you will face the decision to self-manage or hire a professional. Self-management provides ultimate control and saves the 8-10% management fee, but it costs your most valuable asset: time.

A great property manager handles the day-to-day headaches—screening tenants, fielding late-night maintenance calls, and collecting rent. This frees you to focus on high-value activities: finding new deals and growing your portfolio. This transition is a pivotal moment for any serious investor, marking the shift from working in your business to working on it.

The true mark of a professional investor isn't just buying the right properties; it's knowing how to protect those assets and, crucially, how to exit intelligently. While acquiring a great deal is exciting, real wealth is built by mastering the backend—legal structures, tax advantages, and exit strategies.

First, you must build a legal fortress around your assets. Holding investment properties in a Limited Liability Company (LLC) is non-negotiable. An LLC acts as a firewall, separating your business liabilities from your personal finances. This means a slip-and-fall lawsuit at one rental property will not threaten your family home or retirement savings.

Unlocking Powerful Tax Strategies

Beyond defense, savvy investors use the tax code offensively. One of the most powerful tools is the 1031 exchange. This allows you to defer capital gains taxes when you sell a property, provided you roll the entire proceeds into another "like-kind" investment property.

Case Study: The 1031 Exchange in Action

An investor, Sarah, bought a duplex ten years ago for $300,000. It’s now worth $600,000. A direct sale would trigger a significant tax bill on her $300,000 profit.Instead, Sarah executes a 1031 exchange. She sells the duplex and uses the full $600,000 to acquire a small apartment building. The result? She pays zero capital gains tax on the sale. She has effectively used the government’s money, tax-free, to trade up into a larger, better-performing asset that increases her monthly cash flow.

This strategy is a cornerstone for rapidly scaling a portfolio, allowing you to keep your capital working for you instead of paying a large portion to the IRS with each upgrade. For more tax-saving ideas, review our guide on common real estate tax deductions.

Mastering the Art of the Exit

Knowing when to sell is as critical as knowing when to buy. A well-planned exit can infuse your portfolio with new capital, accelerate your returns, and allow you to pivot with market shifts.

By 2025, sectors like data centers and AI-related infrastructure are emerging as global hotspots, driven by the energy transition and explosive AI growth. These opportunities are attracting capital and often delivering superior returns. You can explore more of these global real estate trends from PwC to stay ahead of the curve.

When you're ready to exit, several solid options are available.

| Exit Strategy | Description | Best For | Key Benefit |

|---|---|---|---|

| Outright Sale | Selling the property on the open market for a lump-sum profit. | Cashing out on a property that has reached peak value or quickly unlocking maximum capital. | Provides immediate liquidity for your next major investment. |

| Cash-Out Refinance | Refinancing for more than the current loan balance and pocketing the tax-free difference. | Accessing equity without selling a high-performing, cash-flowing asset. | You gain capital for new deals while your original property continues to generate income. |

| Hold for Legacy | Keeping the property long-term to generate steady income for future generations. | Building true generational wealth and creating a stable, passive income stream. | Provides long-term financial security and a valuable inheritance. |

The right exit is a calculated move based on your property’s performance, the market climate, and your portfolio's future direction. A successful exit is the final, and most rewarding, step in a well-executed investment.

Frequently Asked Questions About Real Estate Portfolio Management

As you build and scale your real estate portfolio, new questions will inevitably arise. Below are answers to the ten most common questions investors ask, drawn from years of hands-on experience.

1. How many properties make a "portfolio"?

There is no magic number. A portfolio is defined not by the quantity of properties, but by a cohesive strategy that governs them. Most experienced investors agree that having 3-5 properties managed under a single, unified investment thesis constitutes a legitimate portfolio. The focus should always be on asset quality and alignment with your goals.

2. Should I pay off my mortgages or stay leveraged?

This depends on your risk tolerance and financial goals. Paying off mortgages maximizes monthly cash flow and provides significant security, making it popular for those nearing retirement. Conversely, maintaining leverage allows you to control more assets, potentially accelerating wealth creation through appreciation across a larger base. A common hybrid strategy is to keep newer acquisitions leveraged for growth while systematically paying down older, stabilized properties.

3. What are the biggest mistakes new portfolio managers make?

The most common pitfalls include:

- Insufficient Due Diligence: Getting excited and rushing into a deal without thoroughly investigating the property's condition and financials.

- Underestimating CapEx: Failing to budget for large, infrequent expenses like roofs, HVAC systems, and plumbing, which can destroy profitability.

- Poor Tenant Screening: Placing a bad tenant can lead to property damage, lost rent, and expensive legal battles.

- Treating it like a hobby: Not meticulously tracking income, expenses, and KPIs. Real estate investing is a business and must be treated as such.

4. How do I know when it’s time to sell a property?

Continuously evaluate your assets. Key indicators that it may be time to sell include:

- Stagnant Appreciation: The market has peaked or the neighborhood's growth has stalled.

- Opportunity Cost: The equity could be redeployed into a new investment with a significantly higher return.

- Impending Major Expense: A large capital expenditure is required that does not offer a sufficient return on investment.

- Shifting Goals: The property no longer aligns with your evolving investment strategy (e.g., shifting from appreciation to cash flow).

5. What exactly is the BRRRR Method?

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It is an advanced strategy for rapidly scaling a portfolio. The process involves buying an undervalued property, renovating it to force appreciation, placing a tenant, and then performing a cash-out refinance based on the new, higher appraised value. The goal is to pull out your initial capital to "repeat" the process on the next deal.

6. How much cash should I keep in reserves?

A conservative rule of thumb is to hold 3-6 months of total expenses (mortgage, taxes, insurance, maintenance) for each property in a liquid savings account. For larger portfolios, this can be calculated as a percentage of the total portfolio value, typically 5-10%. These reserves are a critical safety net for unexpected vacancies or repairs.

7. Can I manage a portfolio with a full-time job?

Yes, this is how most investors begin. The key is not finding more time, but building efficient systems. This typically involves hiring a reputable property manager for day-to-day operations and using modern software for accounting and rent collection. With a trusted team (contractor, agent, lawyer), the process becomes highly manageable.

8. What's the difference between asset management and property management?

This is a crucial distinction.

- Property Management (Tactical): Focuses on day-to-day operations like collecting rent, handling maintenance, and placing tenants.

- Asset Management (Strategic): Focuses on the big picture, such as deciding when to buy/sell, structuring financing, planning major improvements, and maximizing the portfolio's overall ROI.

Even if you hire a property manager, you are always the asset manager.

9. How does inflation affect my real estate investments?

Real estate is historically an excellent hedge against inflation. As the cost of living rises, you can increase rents, boosting your income. Meanwhile, your largest expense—a fixed-rate mortgage—remains the same, widening your profit margin. Additionally, property values tend to rise with inflation, increasing your net worth.

10. What technology should I use to manage my portfolio?

Leverage modern technology for efficiency. For property management, software like Buildium, AppFolio, or Stessa can automate rent collection, track expenses, and generate financial reports. For analyzing new deals, tools like the calculators on BiggerPockets or a platform like DealCheck are invaluable for making data-driven decisions.

Ready to take your wealth-building journey to the next level? The experts at Top Wealth Guide provide exclusive insights and proven tactics to help you enhance your investment portfolio and secure your financial future. Subscribe to Top Wealth Guide and gain access to the knowledge you need to succeed.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.