A DSCR loan is a unique type of mortgage designed specifically for real estate investors. The approval isn't based on your personal salary or tax returns; instead, it hinges almost entirely on the investment property's ability to generate enough rental income to cover its own mortgage payments.

Essentially, if the property's cash flow can handle its debt obligations, you're likely on your way to getting approved. This makes it an incredibly powerful tool for investors who want to buy properties based on the strength of the deal itself, not the numbers on their W-2.

In This Guide

- 1 The Investor's Alternative to Traditional Mortgages

- 2 Mastering the DSCR Formula for Your Next Deal

- 3 Why So Many Savvy Investors Are Choosing DSCR Loans

- 4 How to Qualify for a DSCR Loan

- 5 Evaluating the Pros and Cons of DSCR Loans

- 6 Is a DSCR Loan Right for Your Investment Strategy?

- 7 Frequently Asked Questions About DSCR Loans

- 7.1 1. What’s the minimum DSCR lenders will accept?

- 7.2 2. How do lenders figure out the "real" market rent?

- 7.3 3. Can I use a DSCR loan for an Airbnb or VRBO?

- 7.4 4. Do these loans have prepayment penalties?

- 7.5 5. What if the property is empty when I buy it?

- 7.6 6. How much does my personal credit score really matter?

- 7.7 7. Can I refinance my current mortgage into a DSCR loan?

- 7.8 8. Are DSCR loans only for houses and small multi-family properties?

- 7.9 9. Is it really possible to get a DSCR loan with no money down?

- 7.10 10. Do I need to be an experienced landlord?

The Investor's Alternative to Traditional Mortgages

Think about it like this: if you were buying a small local business, a traditional bank would want to see all your personal financial documents. A smarter commercial lender, however, would care more about one thing: does the business make enough profit to pay back the loan?

That’s exactly how DSCR loans work for real estate. They treat your rental property as a standalone business venture.

Instead of digging through your personal debt-to-income (DTI) ratio, lenders focus on a single, powerful metric: the Debt Service Coverage Ratio (DSCR). This ratio is the heart of the whole process, measuring the property’s rental income against its total mortgage payment.

Why This Shift in Focus Matters

This approach is a total game-changer for so many investors. It's especially valuable for those who are self-employed, have multiple streams of income, or are trying to scale a rental portfolio quickly.

With conventional mortgages, you can hit a wall pretty fast. After buying just a few properties, your personal DTI can get too high to qualify for another loan, even if all your rentals are cash-flowing beautifully.

A DSCR loan breaks this cycle. It assesses each property on its own financial footing, allowing you to add cash-flowing assets to your portfolio without being limited by your personal income.

A Clear Comparison

To really grasp the difference, it helps to see these two loan types side-by-side. One is designed for buying a home to live in; the other is a business tool for building wealth.

Here’s a simple breakdown of how they compare.

DSCR Loan vs Conventional Mortgage at a Glance

| Feature | DSCR Loan | Conventional Mortgage |

|---|---|---|

| Primary Qualification Metric | Property's Cash Flow (DSCR) | Borrower's Personal Income (DTI) |

| Borrower Type | Real Estate Investors (often in an LLC) | Homebuyers and Primary Occupants |

| Typical Property Use | Investment & Rental Properties | Primary Residence |

| Income Verification | Not Typically Required | W-2s, Tax Returns, Pay Stubs |

| Portfolio Scaling | Easier to acquire multiple properties | Limited by personal DTI ratio |

This distinction is what separates hobbyists from serious investors.

Understanding this financing option opens up new paths for growth—a cornerstone of any solid real estate investment guide. It completely reframes the question from, "Can I afford this?" to the much more important question, "Can the property afford this?" That's the mindset of a true investor.

Mastering the DSCR Formula for Your Next Deal

At the core of every DSCR loan is a surprisingly simple calculation. This little formula is the lender's go-to tool for sizing up an investment property. It tells them, in black and white, whether the property can pay for itself. Getting a handle on this math is your first step toward vetting deals like a pro.

The formula itself is pretty straightforward: DSCR = Net Operating Income (NOI) / Total Debt Service.

Think of it as a financial stress test for the property. It answers the one question every lender has: for every dollar the property owes in mortgage payments each year, how many dollars of income does it actually bring in? If the answer is more than one, you're in business.

Calculating Net Operating Income (NOI)

First up, you need to find the Net Operating Income (NOI). This number is all about the property's pure earning power—what it makes after paying its day-to-day bills but before you factor in the mortgage. It’s the cleanest measure of an asset's profitability.

To get your NOI, you just take your total potential rent and subtract all the legitimate operating expenses.

- Gross Rental Income: This is what you'd collect in a perfect world, with the property rented out 100% of the time for the entire year.

- Operating Expenses: These are the necessary costs to keep the lights on and the property running smoothly. Think property taxes, landlord's insurance, property management fees (even if you self-manage, you have to account for it), a budget for maintenance, and a provision for vacancies.

Be brutally honest with your expense estimates. If you lowball your costs, you'll get an inflated NOI and a fake DSCR that an underwriter will tear apart in minutes. For a deeper dive, check out our guide on how to properly calculate rental property cash flow.

Understanding Total Debt Service

The other half of the equation is the Total Debt Service. Don't let the fancy name fool you; this is just the total of all your mortgage payments for one year.

For most investment properties, this means the full PITI payment:

- Principal: The part that actually pays down your loan.

- Interest: The bank's profit for lending you the money.

- Taxes: Your annual property taxes, broken down monthly.

- Insurance: Your annual landlord/hazard insurance policy, also broken down monthly.

When you see "Total Debt Service," just think "annual PITI." It’s that simple.

DSCR Calculation In Action: A Real-Life Example

Let's run the numbers on a real-world example. Imagine an investor, Sarah, is looking at a duplex.

Duplex Investment Example

- Gross Monthly Rent (Both Units): $4,000

- Annual Gross Income: $4,000 x 12 = $48,000

- Annual Operating Expenses (taxes, insurance, 5% vacancy, 8% maintenance): $14,400

- Proposed Annual Mortgage Payment (PITI): $27,000

- First, get the NOI: $48,000 (Gross Income) – $14,400 (Expenses) = $33,600

- Now, calculate the DSCR: $33,600 (NOI) / $27,000 (Debt Service) = 1.24

The DSCR here is 1.24. This tells the lender that for every $1.00 this property owes in mortgage payments, it generates $1.24 in income. That 24% cushion is exactly what they want to see, putting Sarah in a strong position for loan approval.

This process is all about the property's ability to perform, not your personal finances.

As you can see, the property's numbers are front and center. That's the whole game with a DSCR loan.

So, What's a Good DSCR?

Most lenders are looking for a DSCR of at least 1.20 to 1.25. Anything below 1.0 is an absolute non-starter—it means the property is losing money every month before you even think about profits.

A stronger DSCR doesn't just get you a "yes." It often unlocks better loan terms, like lower interest rates and fees, because it proves your deal is a safer bet for the lender.

Why So Many Savvy Investors Are Choosing DSCR Loans

There's a major shift happening in how real estate investors get their funding. More and more, experienced investors are moving past the strict, box-checking world of conventional mortgages and embracing the freedom of DSCR loans. This isn't just a fleeting trend; it’s a smart, strategic move for anyone serious about speed, growth, and protecting their assets.

The core appeal of a DSCR loan is simple: it treats your investment property like a business. It's a loan that understands a rental property is a cash-flowing asset, and this simple change in perspective unlocks some powerful advantages for building a portfolio.

Grow Your Portfolio Without Hitting a Wall

The biggest game-changer is the ability to scale your portfolio without being limited by your personal income. With conventional loans, every property you buy piles onto your personal debt-to-income (DTI) ratio. Sooner or later, you'll hit a ceiling where lenders say "no," even if all your properties are generating fantastic cash flow.

DSCR loans completely sidestep that problem. Since the loan is based on the property’s ability to pay for itself, you can keep acquiring profitable properties one after another. Each deal stands on its own, allowing you to expand your portfolio as quickly as you can find great deals.

The Need for Speed in a Hot Market

In any competitive real estate market, speed is your secret weapon. The underwriting process for a DSCR loan is often much faster and simpler than for a conventional one. The lender really only cares about two things: the property's appraisal (including its market rent value) and your credit score.

Because lenders don't need to dig through your W-2s, pay stubs, and complicated tax returns, the whole approval and closing timeline can be cut down significantly. This speed lets you make aggressive offers and close quickly, often beating out other buyers who are still waiting for their bank to give them the green light.

This isn't just about convenience; it's a real competitive edge that can mean the difference between landing a fantastic deal and watching someone else get it.

Protect Your Personal Wealth with an LLC

Another huge plus for smart investors is the ability to buy properties using a business entity, like an LLC. Most conventional lenders insist you purchase the property in your personal name, which leaves your personal assets vulnerable if a tenant sues or something goes wrong.

DSCR lenders, on the other hand, are perfectly fine with lending to an LLC. This creates a critical firewall between your investment business and your personal life, protecting your home, savings, and other assets. It's a fundamental part of smart, long-term risk management.

The numbers show just how popular these loans have become. Back in May 2025, DSCR loan activity hit a new peak, with one platform alone generating 2,757 DSCR loan documents. That's a massive number, even beating out the historical highs for short-term bridge loans. This surge marked a 31% increase from the previous year, proving that DSCR loans are quickly moving from a niche product to a go-to tool for serious investors. You can dig into more of this data by checking out the market trends on LightningDocs.ai.

When you combine property-based qualifying, faster closings, and the protection of an LLC, it's clear why DSCR loans offer a powerful blueprint for investors looking to build and protect their wealth more effectively.

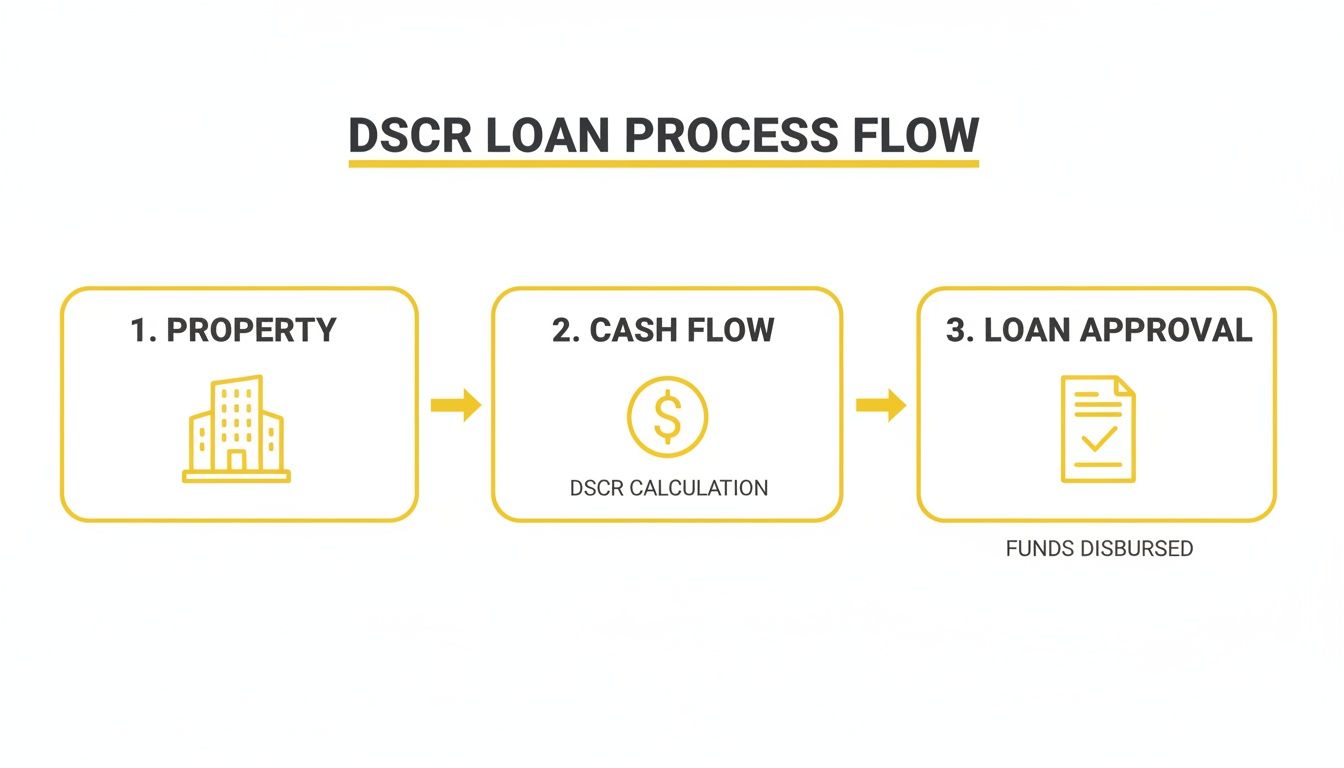

How to Qualify for a DSCR Loan

While the DSCR formula is the main event, lenders look at more than just the property's cash flow before they'll sign off on a loan. They need the full picture—of you as an investor and the property as a viable business—to feel confident in the deal. Knowing what they’re looking for ahead of time is the best way to ensure your application sails smoothly through underwriting.

Think of it like bringing on a financial partner. Your lender wants to see that you have the stability and resources to handle the unexpected, like a sudden vacancy or a costly repair. This is where a few key personal and property-level factors come into play.

Credit Score and Financial Health

Even though DSCR loans are famous for not requiring W-2s or tax returns, your personal credit history absolutely matters. Lenders see your credit score as a barometer of your financial discipline. A strong score tells them you manage your debts responsibly, which lowers their risk.

Most lenders set the bar at a minimum credit score of 680. To get the best rates and terms, however, you'll want to be in the 720 or higher club. A score below the minimum doesn't automatically kill the deal, but it often means you'll face a higher interest rate or be asked to bring more cash to the table.

Down Payment and Cash Reserves

Get ready to put more skin in the game than you would for a primary residence. Since the property itself is the main collateral, lenders need to see a significant commitment from you upfront.

For most DSCR loans, you should plan for a down payment of at least 20% to 25% of the purchase price. If you have less experience as an investor or your credit is on the lower end of the spectrum, some lenders might even ask for 30%.

On top of the down payment, you’ll need to show you have cash reserves. These are liquid funds—money in the bank—set aside to cover the total mortgage payment (PITI) for several months. This proves you can weather a storm. Lenders typically want to see enough reserves to cover three to six months of PITI.

The Property Appraisal and Rental Analysis

The appraisal is a make-or-break moment in the DSCR loan process. It’s not just about confirming the property's market value; it includes a critical second piece: a rental income analysis.

The appraiser doesn't just take your word for it. They'll pull rental comps from the surrounding area to determine a fair market rent for the property. This independent analysis ensures the income figure used in your DSCR calculation is grounded in reality, not just wishful thinking.

If the appraiser's rent estimate comes in lower than what you projected, it will directly lower your DSCR. This can sometimes be the difference between approval and denial, which is why it's so important to base your own numbers on solid, verifiable market data from the start.

Necessary Documentation for Underwriting

Having your paperwork in order from day one can drastically speed up the closing timeline. Here’s a quick rundown of what you’ll typically need to have ready:

- Purchase Agreement: The fully signed contract for the property.

- Property Details: Basic information like the address and the number of units.

- Lease Agreements: For occupied properties, you'll need to provide copies of all current leases.

- LLC Documents: If you’re buying in an entity, have your Articles of Organization and Operating Agreement handy.

- Bank Statements: To verify the source of your down payment and your required cash reserves.

The popularity of DSCR loans has skyrocketed, especially as traditional banks have tightened their lending standards. In early 2025, the market saw a massive surge, with January alone accounting for over 4,272 transactions valued at more than $2 billion. That’s a stunning 123% jump from the previous year. This growth is fueled by investors who need to close fast (DSCR loans often close in 10-21 days, versus 45+ for banks). As you get ready to apply, brushing up on how to finance an investment property will put you in a great position for success.

Evaluating the Pros and Cons of DSCR Loans

Just like any specialized tool in an expert's toolbox, a DSCR loan comes with its own unique set of strengths and weaknesses. Figuring out if it’s the right fit for your investment strategy really comes down to understanding this balance.

For a lot of real estate investors, the upside is a powerful path to growth that traditional financing just can't offer. But, as with most things in life, these perks come with a few trade-offs. Let's weigh both sides of the coin so you can make a smart, informed decision that truly lines up with your goals.

The Clear Advantages for Investors

The biggest draws of DSCR loans are all about speed, scalability, and protecting your assets. These loans were built for investors who operate like business owners, where the property's performance is what really matters—not your personal paycheck.

Here's where they shine:

- No Personal Income Verification: Lenders are laser-focused on the property's ability to generate cash. They aren't digging through your W-2s or tax returns, which is a massive win for self-employed investors or anyone with a non-traditional income stream.

- Unlimited Property Financing: With conventional loans, your personal debt-to-income ratio eventually puts a cap on how many properties you can own. DSCR loans don't have that problem. Since each deal stands on its own merit, there’s no hard limit to the size of your portfolio.

- Faster Closing Times: When you cut out all the paperwork related to personal finances, the underwriting process gets a whole lot faster. This can give you a serious leg up when you're competing for a hot property.

- Ability to Purchase in an LLC: DSCR lenders are completely comfortable lending to a Limited Liability Company (LLC). This is huge for savvy investors who want to keep their personal assets separate and protected from business liabilities.

These benefits have really caught on. Throughout 2025, for example, DSCR loan originations jumped by nearly 35% year over year. Investors flocked to them to get around those pesky DTI limits and use rising rental income to their advantage.

Potential Drawbacks to Consider

Now for the other side of the scale. The flexibility and speed of DSCR loans don't come for free. These trade-offs are real financial considerations that you absolutely must bake into your analysis of any potential deal.

A good evaluation means looking past the shiny benefits and getting real about the long-term financial impact. You can use a structured approach like our real estate due diligence checklist to make sure you don't miss anything.

The core trade-off with a DSCR loan is exchanging easier qualification standards for higher costs. This can impact your overall cash flow and return on investment if not planned for properly.

Let's break down the most common disadvantages investors run into.

Weighing the Decision: DSCR Loan Pros and Cons

To make it simple, I've put together a quick side-by-side comparison. Think of this as your cheat sheet for deciding if a DSCR loan makes sense for your next deal.

| Pros of DSCR Loans | Cons of DSCR Loans |

|---|---|

| Qualify with Property Income | Higher Interest Rates & Fees |

| No Limit on Number of Properties | Larger Down Payment (20-30%) |

| Faster and Simpler Closing Process | Not for Primary Residences |

| Buy in an LLC for Asset Protection | Prepayment Penalties Possible |

So, what's the verdict? A DSCR loan is a strategic weapon. For investors dead-set on scaling a portfolio of cash-flowing rentals quickly, the pros often crush the cons.

However, if you have a straightforward financial situation or are just buying one or two rentals, a conventional loan might still be the more cost-effective way to go.

Is a DSCR Loan Right for Your Investment Strategy?

Choosing the right financing is all about matching the tool to the job. The entire idea behind a DSCR loan is beautifully simple: it’s built for investment properties that can pay their own way. If the rent coming in can comfortably handle the mortgage payment and other bills, this loan type can be a game-changer.

This naturally leads to the question of who this is really for. Are you trying to build a rental portfolio where the property's performance—not your personal W-2 income—is what fuels your growth? If that sounds like you, then you're exactly who these loans were designed for. DSCR loans are for investors who treat their properties like a business, focusing on the numbers and the potential for long-term cash flow.

Real-Life Scenarios: When to Choose a DSCR Loan

Let's look at a couple of real investor profiles to see where this financing shines.

| Investor Profile | Why a DSCR Loan is a Great Fit |

|---|---|

| The Self-Employed Investor (Alex) | Alex runs a successful e-commerce business but has complex tax returns that don't show a high, stable W-2 income. A conventional lender struggles to approve him. With a DSCR loan, his personal income is irrelevant; he can buy a high-cash-flowing rental based purely on the property's performance. |

| The Portfolio Builder (Maria) | Maria already owns four rental properties financed conventionally. Her personal DTI is now maxed out, blocking her from buying more. By using DSCR loans for her next acquisitions, she can continue to scale her portfolio without limit, as each new property qualifies on its own merit. |

| The Fast-Moving Flipper (David) | David finds an under-market-value property that needs a quick close. The seller wants a deal in 15 days, a timeline impossible for a traditional bank. A DSCR lender's streamlined process allows David to secure financing rapidly, beat the competition, and land the deal. |

Making Your Final Decision

So, how do you know for sure? To make a confident call, think of this as your final gut-check before you dive in. Getting these three things right is key to making sure a DSCR loan actually fits your game plan.

- Analyze Cash Flow Like a Pro: This isn't the time for guesswork. You need to dig into the property's real income potential. Use verified market rents and factor in realistic expenses to come up with a DSCR you can count on, not just hope for.

- Look at Your Long-Term Goals: Are you trying to buy one property, or are you aiming to pick up several over the next few years? The biggest advantage of DSCR financing is its scalability, letting you sidestep the personal debt-to-income limits that hold so many investors back.

- Compare Lender Terms Carefully: No two DSCR loans are created equal. You have to shop around. Get quotes from different lenders and line them up side-by-side to compare interest rates, fees, required down payments, and any prepayment penalties.

Using the right financial tools is how you build real, lasting wealth in real estate. For the right investor with the right property, a DSCR loan isn't just another mortgage—it’s the strategic key that can unlock serious portfolio growth.

Frequently Asked Questions About DSCR Loans

When you're diving into the world of real estate investing, DSCR loans can feel like a game-changer. But with any powerful tool, a lot of questions pop up. Let's walk through some of the most common ones we hear from investors, so you can move forward with confidence.

1. What’s the minimum DSCR lenders will accept?

Think of it like a safety buffer. Most lenders want to see that a property's income can cover its mortgage payment with room to spare. The industry benchmark for a minimum DSCR is typically 1.20 to 1.25. In plain English, this means the property needs to generate at least 20-25% more income than what's needed for the debt payments. Anything below a 1.0 is almost always a hard no.

2. How do lenders figure out the "real" market rent?

Lenders won't just take your word for what a property could rent for. They need an unbiased, professional opinion. This comes from an independent appraiser who conducts a Fair Market Rent analysis as part of the overall property appraisal. The appraiser pulls data on recently rented, similar properties in the immediate vicinity to determine a realistic rent figure for the DSCR calculation.

3. Can I use a DSCR loan for an Airbnb or VRBO?

Yes, many lenders now offer programs specifically for short-term rentals (STRs). Instead of looking at a long-term lease, the lender will use data from platforms like AirDNA or Mashvisor to project the property's potential annual income. Because STR income can be more volatile, expect lenders to require a higher DSCR (sometimes 1.35+) and more cash reserves.

4. Do these loans have prepayment penalties?

Yes, this is a big one to watch out for. Prepayment penalties are very common with DSCR loans. It's a fee the lender charges if you pay off the loan early, usually within the first three to five years. This can affect your exit strategy, making it costly to sell or refinance. Always clarify the penalty structure before committing.

5. What if the property is empty when I buy it?

No problem—you can absolutely get a DSCR loan on a vacant property. Since there’s no current lease, the lender will rely completely on the appraiser's market rent analysis to calculate the projected DSCR. Be prepared for stricter requirements, such as a larger down payment (25-30%) and more substantial cash reserves.

6. How much does my personal credit score really matter?

It matters a lot. Even though the loan hinges on the property's cash flow, your credit score is the lender's window into your financial responsibility. Most lenders set a floor with a minimum credit score of 680. However, to unlock the best interest rates and terms, you should aim for 720 or higher.

7. Can I refinance my current mortgage into a DSCR loan?

Absolutely. This is a very popular strategy. Refinancing an existing property with a DSCR loan can be a great way to pull cash out for your next deal or to get a mortgage off your personal credit report, freeing up your DTI ratio. The process is nearly identical to a purchase. You can use an investment property loan calculator to estimate your new payments.

8. Are DSCR loans only for houses and small multi-family properties?

For the most part, yes. The sweet spot for DSCR loans is residential investment property with one-to-four units (single-family homes, duplexes, triplexes, and quads). While some lenders offer similar financing for small commercial properties, it is a more niche product with different underwriting rules.

9. Is it really possible to get a DSCR loan with no money down?

In a word: no. A down payment is non-negotiable with DSCR loans. Because the lender isn't looking at your personal income, your equity in the property is their primary security. The industry standard minimum down payment is 20%, but it is very common for lenders to require 25% or more.

10. Do I need to be an experienced landlord?

Not necessarily. While a track record is always helpful, it’s not a deal-breaker. Lenders are often willing to work with first-time investors, especially those with a strong personal financial profile (good credit, solid assets, and cash reserves). A seasoned investor may get slightly better terms, but the door is open for newcomers.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.