Think of an umbrella insurance policy as a fail-safe for your financial life. It's an extra layer of liability coverage that kicks in when the claims on your regular home or auto insurance policies have been maxed out. In our increasingly litigious society, it's the financial backstop that protects your assets and future income from a lawsuit that could otherwise wipe you out.

In This Guide

- 1 Why You Need a Financial Safety Net

- 2 How Umbrella Insurance Works with Your Existing Policies

- 3 Who Needs an Umbrella Insurance Policy?

- 4 Real-Life Scenarios Where Umbrella Insurance Saves the Day

- 5 Umbrella Insurance Policy Coverage and Exclusions

- 6 How to Buy an Umbrella Insurance Policy

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. What does a $1 million umbrella policy typically cost?

- 7.2 2. Is an umbrella insurance policy only for the wealthy?

- 7.3 3. Can I buy an umbrella policy without having auto or home insurance?

- 7.4 4. Does an umbrella policy cover incidents that happen abroad?

- 7.5 5. Will my personal umbrella policy cover my business?

- 7.6 6. What is a Self-Insured Retention (SIR)?

- 7.7 7. How much coverage do I really need?

- 7.8 8. Will my premium increase if I file a claim?

- 7.9 9. Does an umbrella policy cover rental properties?

- 7.10 10. What's the difference between umbrella and excess liability insurance?

Why You Need a Financial Safety Net

Your standard insurance policies, like auto and home, are your first line of defense. They handle the common, everyday risks. But what about the catastrophic, once-in-a-lifetime event? That’s where an umbrella insurance policy comes in, acting as a massive shield when the smaller shields are overwhelmed.

Without that extra protection, a single, unexpected accident can turn into a financial nightmare. Let's say you're found at fault in a serious car crash. The other party's medical bills, lost wages, and legal fees could easily soar past the $300,000 or $500,000 liability limit on a typical auto policy.

Understanding Primary Liability Limits

Once a claim blows past the limits of your primary insurance, you are on the hook for every dollar that remains. This is where the real danger to your financial health lies. A court judgment against you could mean liquidating everything you own to cover the difference.

What's at risk?

- Your Home: A lien could be placed against your property.

- Your Investments: You might be forced to sell off stocks, bonds, and mutual funds.

- Your Savings: Your emergency fund and other cash reserves could be completely drained.

- Your Future Earnings: A court can even garnish a portion of your future paychecks until the debt is settled.

This isn’t just a concern for the super-rich. If you own a home, have a retirement account, or earn a good salary, you have assets that need protecting. An umbrella policy creates a critical buffer between a lawsuit and your financial security. For a deeper dive into safeguarding your assets, especially when the economy is shaky, check out these essential wealth protection strategies during economic downturns.

An umbrella policy isn't a luxury; it's a strategic defense for your net worth. It provides peace of mind by ensuring one accident doesn't undo years of hard work and careful financial planning.

For what is often a surprisingly low annual premium—sometimes just a few hundred dollars—you can get $1 million or more in extra liability coverage. This simple addition to your insurance portfolio is one of the most cost-effective ways to protect everything you've worked so hard for. It bridges the gap between what your primary policies cover and the potentially devastating costs of a major liability claim, ensuring one bad day doesn't define your financial future.

How Umbrella Insurance Works with Your Existing Policies

An umbrella policy isn't a standalone product—it's designed to sit on top of your existing insurance, giving you a powerful extra layer of protection. Think of your auto and homeowners policies as your first line of defense. Each one has its own primary liability coverage, which is the maximum amount it will pay if you're responsible for an accident or injury.

But what happens when a serious lawsuit results in damages that blow past those limits? That’s where you’d normally be on the hook personally, putting your savings, home, and even future earnings at risk. This is the exact moment an umbrella policy kicks in. It provides excess liability coverage, covering the remaining costs up to its own, much higher limit—which usually starts at $1 million.

Essentially, your umbrella policy stays dormant, waiting in the wings until your primary policy has paid out every last dollar it's supposed to.

The Claim Process Step-by-Step

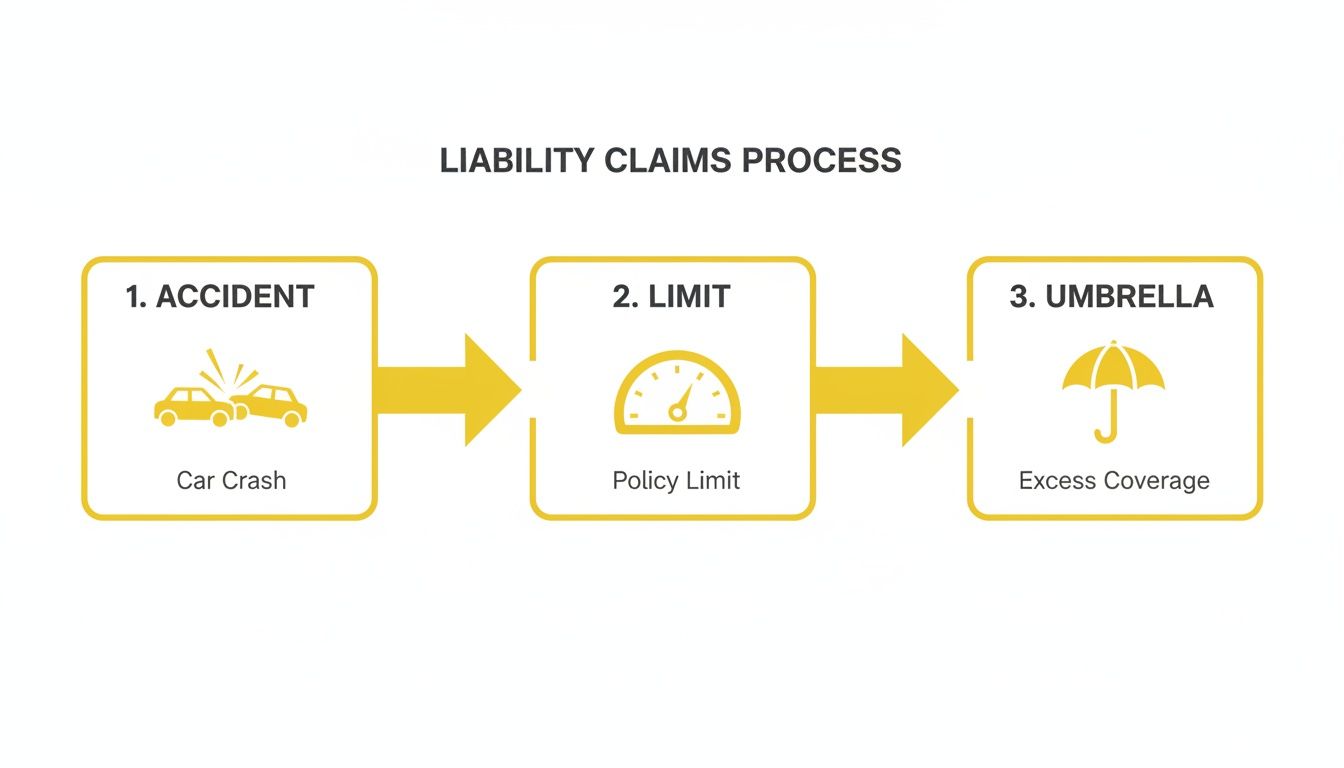

Let's walk through a real-world example to see how this plays out. Imagine you cause a multi-car pile-up and are found at fault.

The total bill for medical costs, lost wages, and property damage comes to a staggering $800,000. Your auto insurance is solid, but it has a bodily injury liability limit of $300,000.

Here’s how the two policies work together to protect you:

- Primary Policy Pays First: Your car insurance company steps up and pays out its full $300,000 policy limit. That's as far as its obligation goes.

- Umbrella Policy Covers the Gap: With the primary policy maxed out, there's still a $500,000 shortfall. This is where your umbrella policy activates, covering that entire remaining amount.

- Your Assets Are Protected: Because the full $800,000 judgment is covered, your personal assets are safe. Without that umbrella policy, you’d be facing a half-million-dollar bill. Getting the right primary coverage is the first step, and you can get a better sense of your options by reviewing car insurance quotes online.

This flowchart breaks down the process visually, showing how a claim flows from the accident, through your primary policy, and finally to your umbrella coverage for the excess amount.

It’s a great illustration of how the umbrella acts as a crucial safety net after your first line of defense is exhausted.

What About Claims Your Primary Policy Won't Cover?

Here’s another key benefit: an umbrella policy often provides broader protection, covering certain claims that your standard home or auto policies simply won't touch. These can include lawsuits stemming from things like:

- Libel (written defamation)

- Slander (spoken defamation)

- False arrest or imprisonment

- Malicious prosecution

For these types of claims, there's no primary policy to pay first. In these cases, the umbrella policy has its own version of a deductible called a Self-Insured Retention (SIR). The SIR is the amount you have to pay out-of-pocket before the umbrella coverage begins, typically ranging from $250 to $10,000.

As more people build wealth and diversify their assets, their exposure to major liability claims grows right along with it. This is why having comprehensive protection is no longer a luxury, but a necessity.

Who Needs an Umbrella Insurance Policy?

Let's clear up a common myth: an umbrella insurance policy isn't just for millionaires. The truth is, if you have assets you want to protect or a solid future earning potential, you should be thinking about this coverage. Your need for an umbrella policy has less to do with your current bank balance and more to do with your everyday exposure to risk.

Think about it. The more you do—drive a car, own a home, raise kids, even post on social media—the more chances there are for a costly accident. A lawsuit can pop up from anywhere, and it can easily blow past the liability limits on your standard home or auto insurance. The first step is to get honest about your personal risk factors.

High-Risk Profiles That Benefit Most

For some people, an umbrella policy shifts from a "nice-to-have" to a "must-have." If you fit into any of these categories, your risk of a major liability claim is significantly higher.

-

Homeowners and Landlords: Owning property is one of the biggest liability magnets out there. A guest slips and falls, a delivery driver trips on a cracked step, or a tenant's friend gets hurt on your rental property. For landlords, the risk is even greater—one serious injury claim could put your entire portfolio in jeopardy. That's why solid liability coverage is so crucial. For those who rent out properties, understanding your primary coverage is key; our comprehensive renters insurance guide can provide foundational knowledge.

-

Parents of Teen Drivers: We all know the feeling of handing the car keys to a new driver. It's a rite of passage, but it also sends your risk profile through the roof. Young drivers are just statistically more likely to be in a serious accident. As the policyholder, you're on the hook for any damages they cause that go beyond your auto policy's limits.

-

Owners of "Attractive Nuisances": This is an old-school insurance term, but it’s still incredibly relevant. If you have a swimming pool, hot tub, or trampoline, you have an "attractive nuisance." These things can draw children onto your property, even uninvited ones, creating a huge potential for injury. A lawsuit from a swimming pool accident can easily climb into the seven figures.

Modern Risks and High Net Worth Individuals

Your risk doesn't stop with physical property. Our modern lives have created entirely new ways to get sued, and your net worth can make you a bigger target.

An umbrella policy isn't just about protecting what you have today. It's about protecting your entire financial future. One major lawsuit can wipe out your savings and garnish your wages for years.

Take social media. A bad online review or an angry post that damages someone's reputation could spark a defamation lawsuit. That’s a claim your standard homeowner’s policy probably won't touch, but an umbrella policy often will.

And finally, the more you have, the more you have to lose. If you have a high net worth—meaning your assets like home equity, investments, and savings are substantial—you’re a much more appealing target for a lawsuit. For anyone serious about protecting their wealth, an umbrella policy is non-negotiable.

To see where you stand, run through this quick checklist. The more boxes you tick, the stronger your need for umbrella insurance becomes.

| Risk Factor Checklist | Do You Have This Risk? |

|---|---|

| Do you own a home or other real estate? | ☐ Yes / ☐ No |

| Do you own rental properties? | ☐ Yes / ☐ No |

| Do you have a swimming pool, hot tub, or trampoline? | ☐ Yes / ☐ No |

| Do you have a teen driver on your auto policy? | ☐ Yes / ☐ No |

| Do you have a high net worth (over $500k)? | ☐ Yes / ☐ No |

| Do you have a dog (especially a large breed)? | ☐ Yes / ☐ No |

| Are you an active social media user or blogger? | ☐ Yes / ☐ No |

| Do you host frequent parties or gatherings at home? | ☐ Yes / ☐ No |

If you answered "yes" to even a couple of these, your liability risk is probably higher than what your standard policies can handle. An umbrella policy is that essential extra layer of security that lets you sleep at night, knowing your financial foundation is safe.

Real-Life Scenarios Where Umbrella Insurance Saves the Day

Definitions and policy details are one thing, but seeing how umbrella insurance actually performs in a crisis is what really hits home. Let's step away from the technical jargon and look at a few real-world situations where this extra coverage was the only thing that stood between a family's financial security and complete ruin.

These stories show just how fast an everyday mishap can spiral out of control, blowing past the limits of a standard insurance policy and putting a lifetime of savings on the line.

Real-Life Example 1: The Devastating Car Accident

The Scenario: A driver glances at their phone for just a second, causing a multi-car accident that leaves another person with permanent injuries.

The Lawsuit: The court awards a $1.2 million judgment to cover medical bills, lost lifetime income, and pain and suffering.

The Outcome:

- Without an Umbrella Policy: The driver's auto insurance pays its $500,000 limit. The driver is now personally responsible for the remaining $700,000, potentially facing bankruptcy, wage garnishment, and the forced sale of their home.

- With an Umbrella Policy: After the auto policy pays its limit, the $1 million umbrella policy kicks in and covers the entire $700,000 shortfall. The driver's personal assets and financial future remain secure.

Real-Life Example 2: The Rental Property Slip-and-Fall

The Scenario: A landlord owns a small rental property. On an icy morning, a delivery person slips on the front walk, suffering a severe back injury requiring multiple surgeries.

The Lawsuit: The court finds the landlord negligent and awards an $800,000 settlement.

The Outcome:

- Without an Umbrella Policy: The landlord's insurance policy covers the first $300,000. The landlord must personally come up with the remaining $500,000, likely by selling the rental property or liquidating personal investments.

- With an Umbrella Policy: The landlord policy pays its limit, and the umbrella policy covers the $500,000 gap. The investment property and personal finances are protected. It's a critical safeguard, much like specialized policies such as mortgage protection insurance are designed to protect specific, high-value assets.

Real-Life Example 3: The Social Media Defamation Claim

The Scenario: In a heated online discussion, a person posts an angry, false comment about a local business owner, causing significant damage to their reputation and sales.

The Lawsuit: The business owner sues for libel and wins a $150,000 judgment. Legal defense costs add another $30,000.

The Outcome:

- Without an Umbrella Policy: A standard homeowner's policy typically excludes this type of personal injury claim. The individual would be responsible for the entire $180,000.

- With an Umbrella Policy: This type of claim is often covered. After the individual pays a small deductible (the Self-Insured Retention or SIR), typically around $1,000, the umbrella policy covers the rest of the $179,000 judgment and legal fees.

Financial Impact: With vs. Without an Umbrella Policy

This table clearly illustrates the powerful financial protection an umbrella policy provides.

| Liability Scenario | Total Judgment Cost | Covered by Primary Policy | Your Out-of-Pocket Cost Without Umbrella | Your Out-of-Pocket Cost With Umbrella |

|---|---|---|---|---|

| Severe Auto Accident | $1,200,000 | $500,000 | $700,000 | $0 |

| Rental Property Slip-and-Fall | $800,000 | $300,000 | $500,000 | $0 |

| Social Media Defamation | $180,000 | $0 | $180,000 | $1,000 (SIR) |

As these examples make perfectly clear, an umbrella policy isn't just another bill to pay. It’s an essential line of defense for everything you’ve worked to build.

Umbrella Insurance Policy Coverage and Exclusions

So, you’re considering an umbrella policy. To really get the most out of it, you need to know exactly what it does—and just as importantly, what it doesn't do. Think of it less as a magic wand and more as a powerful, specialized tool for your financial toolkit. Getting clear on the boundaries now can save you a world of headaches later.

At its heart, an umbrella policy is a massive extension of your existing insurance. It’s built to shield you from the kind of catastrophic liability claims that can wipe out your savings, assets, and even future income.

What Your Umbrella Policy Typically Covers

An umbrella policy takes the liability limits on your auto and home insurance and supercharges them. It also steps into the ring to cover some unique risks your primary policies won't even touch. Here are the main areas where it has your back:

| Coverage Area | Description |

|---|---|

| Bodily Injury Liability | Covers medical bills, lost income, and rehabilitation costs for someone you seriously injure, after your primary auto/home policy limits are exhausted. |

| Property Damage Liability | Pays for repairs or replacement of someone else's property (e.g., their car, home) that you damage, for costs exceeding your primary policy limits. |

| Personal Injury Offenses | A key benefit. Covers claims often excluded by standard policies, such as libel (written defamation), slander (spoken defamation), false arrest, or malicious prosecution. |

| Landlord Liability | Extends liability protection to rental properties you own, covering incidents like a tenant's guest getting injured on the property. |

| Legal Defense Costs | Covers attorney fees, court costs, and other legal expenses associated with a covered lawsuit, often paid in addition to your liability limit. |

For more insights into this area, you can explore our other articles on liability protection.

Common Policy Exclusions to Understand

Now for the other side of the coin. Knowing what isn't covered is just as critical to avoid a false sense of security. Generally, an umbrella policy will not pay for:

- Your Own Injuries or Property Damage: This is key. It only covers your liability for harm you cause to other people. Your own health insurance handles your medical bills, and your homeowners or auto policy covers damage to your own property.

- Intentional or Criminal Acts: No insurance policy will cover you for deliberately harming someone or for damages that result from criminal behavior.

- Business-Related Liabilities: Your personal umbrella policy is for you, not your business. Claims related to your professional life or business operations require a separate commercial umbrella policy.

- Contractual Liabilities: It won’t cover liability that you voluntarily take on by signing a contract.

The demand for this kind of protection is skyrocketing. According to some reports, the global umbrella insurance market is expected to grow significantly, reflecting a rise in litigation and large court judgments. You can read more about these market projections and their drivers.

How to Buy an Umbrella Insurance Policy

Getting an umbrella policy is a surprisingly simple process, and it's one of the most powerful steps you can take to protect your financial future. Think of it as adding a critical top layer of security. Before you can add that layer, though, you need to have a solid foundation in place.

Insurers won't sell you an umbrella policy unless you already have primary auto and home (or renters) insurance. They’ll also have minimum liability requirements for those base policies, typically asking for at least $250,000 per person/$500,000 per accident for your auto coverage and $300,000 for your homeowners liability. This setup ensures your main policies handle everyday claims, saving the umbrella for true catastrophes.

Step 1: Calculate Your Ideal Coverage Amount

So, how much umbrella coverage do you actually need? A good rule of thumb is to get enough to cover your entire net worth plus your future income potential. You're trying to protect everything you've worked for, so you need an accurate picture of what that is.

To get your number, sit down and add up the value of all your assets:

- Home equity

- Savings and checking accounts

- Investment portfolios (stocks, bonds, mutual funds)

- Retirement accounts (401(k)s, IRAs)

- Other valuable property you own

The goal is to have an umbrella policy limit that meets or, even better, exceeds that grand total. These policies are usually sold in $1 million increments, which makes it easy to find the right level of protection and increase it later as your wealth grows.

Step 2: Shop Smart and Compare Your Options

Once you know how much coverage you're aiming for, it's time to find the right policy. Your first stop should always be your current insurance company. Most major carriers like State Farm, Allstate, and Geico offer hefty discounts when you bundle your umbrella policy with your existing home and auto insurance.

But don't just take the first offer. It pays to get quotes from a few other highly-rated insurers to see what’s out there. As you compare your options, remember that price isn't the only thing that matters.

Dig a little deeper and check each insurer's financial strength rating from a firm like A.M. Best. You want a company with a strong rating (A or higher), which signals they have the financial muscle to actually pay out a massive claim if you ever have one. After all, that’s why you're buying the policy in the first place.

Also, look into their reputation for customer service and how they handle claims. By balancing cost with financial stability and service quality, you can choose a policy that gives you genuine peace of mind, knowing your assets are truly safe.

Frequently Asked Questions (FAQ)

1. What does a $1 million umbrella policy typically cost?

For most people, a $1 million umbrella policy costs between $150 and $350 per year. The exact premium depends on your risk profile, including factors like your driving record, the number of properties you own, and whether you have teenage drivers or a swimming pool.

2. Is an umbrella insurance policy only for the wealthy?

No, this is a common misconception. A major lawsuit can target your future earnings through wage garnishment, not just your current assets. An umbrella policy protects your financial future, making it a valuable tool for anyone with a steady income or growing assets.

3. Can I buy an umbrella policy without having auto or home insurance?

No. Insurers require you to have underlying auto and home (or renters) insurance policies with specific minimum liability limits (e.g., $300,000 on home, $250k/$500k on auto) before they will issue an umbrella policy.

4. Does an umbrella policy cover incidents that happen abroad?

Yes, in most cases, umbrella policies provide worldwide coverage. This is a significant benefit, as your standard auto and home policies often have geographical limitations. However, always confirm the specifics of your policy with your agent before traveling.

5. Will my personal umbrella policy cover my business?

No. A personal umbrella policy explicitly excludes liabilities related to business or professional activities. You will need a separate commercial umbrella policy to protect your business assets.

6. What is a Self-Insured Retention (SIR)?

A Self-Insured Retention (SIR) is like a deductible that applies only when your umbrella policy covers a claim not covered by any underlying policy (like a lawsuit for slander). You must pay the SIR amount (typically $250 to $10,000) out-of-pocket before the umbrella coverage begins.

7. How much coverage do I really need?

A good guideline is to secure enough coverage to match your total net worth (assets minus liabilities). You should also factor in your future earning potential. Policies are sold in increments of $1 million, making it easy to scale coverage as your wealth grows.

It is very likely. As with any insurance, filing a large claim will probably result in a higher premium at renewal. In some cases, the insurer might choose not to renew your policy. However, this is a far better outcome than facing a massive judgment without coverage.

9. Does an umbrella policy cover rental properties?

Yes, a personal umbrella policy can typically extend coverage to rental properties you own (usually up to four units), provided that each property is already insured with its own landlord policy. The landlord policy acts as the primary insurance.

10. What's the difference between umbrella and excess liability insurance?

While similar, an umbrella policy is generally broader. It can "drop down" to cover claims not handled by your primary policies (subject to an SIR). An excess liability policy simply provides higher limits for the exact same coverages and exclusions as your underlying policy and does not offer broader protection.

Ready to secure your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build and protect your wealth. Explore our resources and learn how to make smarter investment decisions today.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.