Before you even think about making an offer—before you start imagining paint colors or picking out new appliances—you need to run the numbers. A rental property cash flow calculator is your best friend here. It's the cold, hard, unbiased financial check that separates a great deal from a money pit that just looks good on the surface.

This isn't just about subtracting the mortgage from the rent. True cash flow analysis is the foundation of any smart real estate investment, saving you from deals that will bleed you dry over time.

In This Guide

- 1 Why Cash Flow Analysis is Everything in Your Investment Strategy

- 2 Assembling the Numbers for a Bulletproof Calculation

- 3 Calculating Net Operating Income: Your Core Profitability Metric

- 4 Finding Your True Profit and Cash-on-Cash Return

- 5 Avoiding the Common Oversights That Sink Investments

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. What's a good cash flow per month for a rental property?

- 6.2 2. How do I accurately estimate future repair costs?

- 6.3 3. Should I include property management fees even if I plan to self-manage?

- 6.4 4. What is the difference between cash flow and profit?

- 6.5 5. Can a property with negative cash flow be a good investment?

- 6.6 6. How does vacancy rate impact my cash flow calculation?

- 6.7 7. What are Capital Expenditures (CapEx) and how should I budget for them?

- 6.8 8. Where can I find reliable data for my expense estimates?

- 6.9 9. What is the 50% Rule and is it reliable?

- 6.10 10. Should I use an online calculator or build my own spreadsheet?

Why Cash Flow Analysis is Everything in Your Investment Strategy

It’s easy for new investors to get caught up in the hype of appreciation. They buy a property hoping it will be worth more in a few years. That's speculation, not investing. While appreciation is great when it happens, banking on it is a massive gamble.

A strategy built on positive cash flow, on the other hand, is about creating a reliable income stream you can count on every single month.

Think of it as a financial safety net. If the market goes sideways or even dips, a property that cash-flows can still cover its own mortgage, taxes, insurance, and repairs. You won't have to pull money out of your own pocket to keep it afloat.

The Power of Objective Data

Running a detailed cash flow analysis forces you to take off the rose-colored glasses. It makes you look at every single expense, not just the big ones you remember off the top of your head. This data-driven approach is powerful for a few key reasons:

- You can compare deals accurately. Suddenly, you can look at two completely different properties and see, in black and white, which one will actually make you more money.

- You can negotiate from a position of strength. When you know your numbers inside and out, you can make an offer with confidence, knowing exactly what price makes the deal work for you.

- You can avoid a world of financial pain. A solid analysis will flag properties with razor-thin margins or hidden costs that could easily turn your investment into a nightmare.

Appreciation vs. Cash Flow: A Clear Distinction

Relying on appreciation is like hoping to win big at the casino. Positive cash flow is like owning the casino—you get paid consistently. It's a real, tangible return you see in your bank account right away. Here’s how the two strategies compare:

| Feature | Cash Flow Investing | Appreciation Investing |

|---|---|---|

| Primary Goal | Generate consistent, predictable monthly income. | Increase the property's market value over time. |

| Risk Level | Lower; income provides a buffer against market downturns. | Higher; relies on market forces outside your control. |

| Return Timeline | Immediate; returns are realized monthly. | Delayed; returns are realized only upon sale or refinance. |

| Investor Focus | Operations, expense management, tenant quality. | Market trends, neighborhood development, economic forecasts. |

Appreciation is the bonus, not the foundation. A successful real estate investor builds their portfolio on a bedrock of properties that generate monthly income. This approach ensures long-term stability and sustainable growth.

Focusing on cash flow is the most dependable path for building wealth through real estate. It gives you the stability to hold onto your assets for the long haul, weathering any market storms that come your way.

Ultimately, a property that pays you every month is a true asset. One that costs you money is a liability, no matter what it might be worth someday. A rental property cash flow calculator is simply the tool that helps you tell the difference.

Assembling the Numbers for a Bulletproof Calculation

Any cash flow analysis is only as good as the numbers you feed into it. It’s the classic "garbage in, garbage out" scenario. To get a truly bulletproof calculation, you have to put on your detective hat and track down every key financial figure. This isn't just about glancing at the seller's pro-forma; it's about building your own financial case based on hard, verifiable facts.

First up, you need to pin down the property's real income potential. That starts with the Gross Potential Rent (GPR)—the absolute maximum rent you could collect if the property was 100% occupied all year. Don't just take the current leases at face value. Do your own homework. Check out what comparable properties in the immediate area are renting for. Are the current rents at, above, or below the going market rate?

With income established, it's time to dig into the fixed operational costs. These are the expenses that hit your account every month, whether you have a tenant or not. They're non-negotiable.

- Property Taxes: You can usually find the property's tax history right on the county assessor's or tax collector's website. A word of caution, though: a recent sale can trigger a tax reassessment, which could mean a much bigger bill for you than the previous owner paid.

- Homeowners Insurance: Never, ever rely on the seller's current policy. Pick up the phone, call an insurance agent, and get a fresh quote for a landlord policy. These often cost more than a standard homeowner's policy, and you need to know your actual number.

- HOA Fees: If the property is in a homeowners association, get the current fee schedule. While you're at it, ask if they have any special assessments planned. A surprise five-figure bill for a new roof can wreck your numbers.

Uncovering the Variable Expenses

Variable expenses are the real wild cards. This is where a lot of investors get tripped up because these costs fluctuate with occupancy, the seasons, and just plain bad luck. Getting these wrong can quickly turn a deal that looks great on paper into a money pit.

One of the most critical—and most frequently underestimated—expenses is Property Management. I always tell people to budget for this, even if you plan to manage the property yourself. Pencil in a fee of 8-10% of gross monthly rent. Why? It keeps your analysis conservative and forces you to account for the value of your own time. And if you ever decide to hand the keys to a pro, the cost is already baked into your numbers from day one.

Insider Tip: Before you get too deep, call at least two local property management companies. Ask them what they'd expect the real-world expenses to be for a property of that size and age, in that specific neighborhood. They're on the front lines and see the true costs of maintenance, turnovers, and repairs every single day. Their insight is gold.

Estimating Maintenance and Capital Expenditures

Let's get one thing straight: Maintenance and Capital Expenditures (CapEx) are not the same thing, and you have to budget for both. Maintenance is the routine stuff—fixing a leaky faucet, touching up paint. CapEx is for the big-ticket items—a new roof, a new HVAC system.

Here’s a simple way to think about the difference:

| Expense Category | Description | Examples | Common Budgeting Method |

|---|---|---|---|

| Routine Maintenance | Ongoing, predictable repairs and upkeep. | Painting, faucet repair, landscaping | 1% of property value/year |

| Capital Expenditures | Large, infrequent system replacements. | New roof, HVAC unit, water heater, windows | 1-3% of property value/year |

Failing to budget for CapEx is probably the single biggest mistake I see new investors make. Those huge expenses aren't a matter of if they happen, but when. A solid cash flow analysis demands that you set aside a monthly reserve for both maintenance and these inevitable capital projects.

Gathering all these numbers is easily the most time-consuming part of analyzing a deal, but it's also the most important. The more accurate your inputs are, the more you can trust the results. This detailed legwork is the foundation you'll build on as you learn how to calculate rental yields and other key metrics for your potential investment.

Calculating Net Operating Income: Your Core Profitability Metric

Before you ever get to your personal profit, you have to understand the property's standalone financial health. This is where Net Operating Income (NOI) comes into play. It’s the gold standard for measuring a rental property’s raw profitability, completely separate from your loan.

NOI gives you a pure, unfiltered look at a property's ability to make money. Think of it as the annual profit a property generates before you factor in your mortgage payments or income taxes. This is exactly why lenders and appraisers lean on this number so heavily—it lets them make a true apples-to-apples comparison between different investment opportunities.

The formula itself is pretty simple:

Gross Operating Income (GOI) – Operating Expenses = Net Operating Income (NOI)

Getting this calculation right is the first major step toward analyzing deals like a pro. It tells the story of the property's financial performance, independent of the buyer's unique financing situation.

Breaking Down the NOI Formula With a Real-World Example

Let's walk through how this works with a hypothetical duplex. Imagine each unit rents for $1,500 per month.

First, we need to figure out the Gross Operating Income (GOI). This isn't just the maximum possible rent; it's the rent you can realistically expect to collect after accounting for time when a unit is empty. A 5% vacancy rate is a common and prudent place to start.

- Gross Potential Rent: $3,000/month ($1,500 x 2 units) = $36,000/year

- Less Vacancy (5%): $36,000 x 0.05 = –$1,800/year

- Gross Operating Income (GOI): $36,000 – $1,800 = $34,200/year

With our income projected, the next step is to tally up all the operating expenses. These are all the necessary costs to keep the property running smoothly, excluding your mortgage and income taxes.

Real-Life Example: NOI Calculation for a Duplex Property

Let's apply this to a real-world scenario for a duplex in a typical suburban neighborhood.

| Income/Expense Item | Monthly Amount | Annual Amount | Notes |

|---|---|---|---|

| Gross Operating Income | $2,850 | $34,200 | After a 5% vacancy allowance. |

| Property Taxes | $250 | $3,000 | Based on county records for similar properties. |

| Insurance | $100 | $1,200 | Quote received for a landlord policy. |

| Maintenance & Repairs | $150 | $1,800 | Budgeting ~0.5% of property value annually. |

| Capital Expenditures (CapEx) | $150 | $1,800 | Saving for future roof, HVAC, etc. |

| Property Management (10%) | $285 | $3,420 | Standard rate, included even if self-managing. |

| Total Operating Expenses | $935 | $11,220 |

Now, we just plug the numbers into our formula:

$34,200 (GOI) – $11,220 (Operating Expenses) = $22,980 (Annual NOI)

That $22,980 is the magic number. It's the core annual profit the duplex generates all by itself. This is the figure you'll use to calculate your actual cash flow and other crucial returns. A solid NOI calculation is also essential for getting the most out of any quality real estate investment calculator you might use.

Why a Solid NOI Is So Important Today

Getting your NOI projections right is more critical than ever in the current market. With challenges in homeownership affordability and major demographic shifts, the residential rental sector has become a powerhouse for investors.

This trend creates a promising environment, often allowing for stronger rent growth and lower vacancy rates in our projections. In fact, some recent analyses suggest that for new developments to be profitable, U.S. NOI would need to climb by about 15%—a huge jump from just a few quarters ago. This signals a strengthening market for rental income and highlights just how vital this metric is.

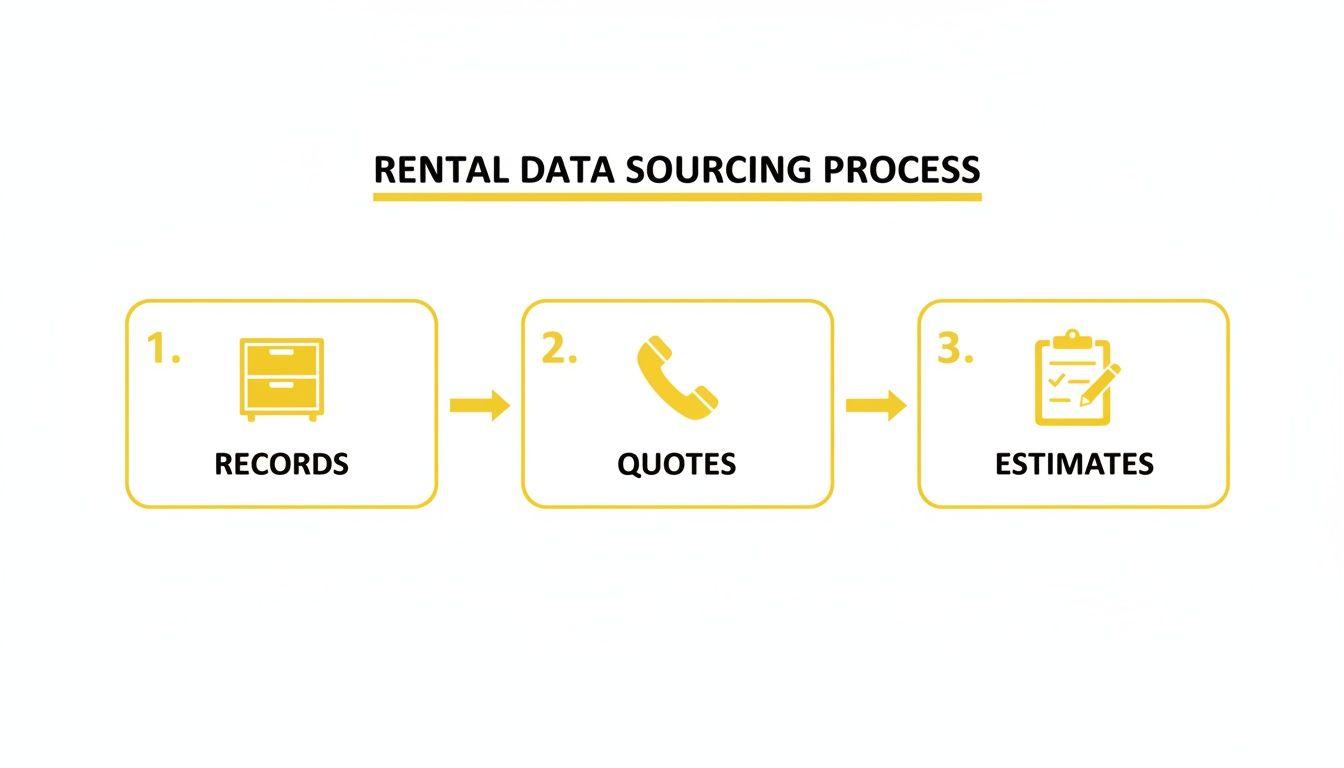

To get your numbers right, you need a solid process for gathering data.

As you can see, it all starts with hard data from official records, then moves to getting real-world quotes and reliable estimates. This is how you build an expense forecast you can actually trust.

Finding Your True Profit and Cash-on-Cash Return

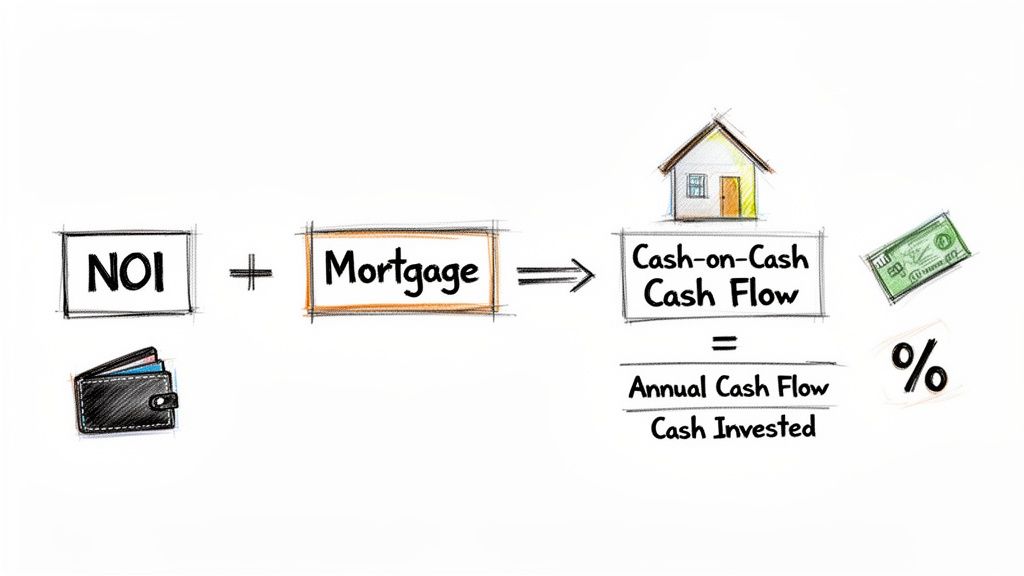

Once you’ve nailed down your Net Operating Income (NOI), you know how profitable the property is on its own. But that's only half the story. The next step is connecting that number to your personal bottom line to see what cash actually hits your bank account.

To get to your pre-tax cash flow, you simply subtract your total mortgage payment from your NOI. It's crucial to use the full payment here—principal and interest included. This final figure is the profit you pocket before dealing with taxes.

Let's stick with our duplex example, which we calculated to have an annual NOI of $22,980.

Calculating Annual Pre-Tax Cash Flow

Imagine you landed a $300,000 mortgage for this property. With a 30-year term and a 6.5% fixed interest rate, your monthly payment for principal and interest comes out to about $1,896.

Here’s how the math shakes out for the year:

- Annual NOI: $22,980

- Annual Mortgage Payments: $1,896 (monthly) x 12 = $22,752

- Annual Pre-Tax Cash Flow: $22,980 (NOI) – $22,752 (Mortgage) = $228

So, you’re left with $228 for the year, or a meager $19 a month. While that might not sound like much, it’s a positive number. At the very least, it confirms the property is paying for itself and not bleeding you dry.

The Most Powerful Investor Metric: Cash-on-Cash Return

Now for the metric that every serious investor lives by: the Cash-on-Cash (CoC) Return. This simple percentage cuts through the noise and tells you exactly how hard your invested cash is working for you. It pits your annual pre-tax cash flow against the total cash you pulled out of your pocket to buy the place.

The CoC Return is the ultimate equalizer. It lets you compare a rental property deal directly against a stock market index fund, a high-yield savings account, or any other investment. It’s a true, apples-to-apples performance measure.

The formula couldn't be simpler:

CoC Return = (Annual Pre-Tax Cash Flow / Total Cash Invested) x 100

Putting It All Together: A Duplex Example

To run this calculation, we first need to figure out your total cash invested. This goes way beyond just the down payment. You have to include all your initial out-of-pocket costs.

- Purchase Price: $375,000

- Down Payment (20%): $75,000

- Closing Costs (3%): $11,250

- Initial Renovation Budget: $10,000

- Total Cash Invested: $75,000 + $11,250 + $10,000 = $96,250

With our total cash investment sorted, we can finally calculate the Cash-on-Cash Return using the cash flow we found earlier:

($228 / $96,250) x 100 = 0.24% CoC Return

That 0.24% return is, frankly, terrible. It’s a massive red flag, signaling a major issue with the deal's pricing or your financing structure. Most seasoned investors I know wouldn't touch a deal with a CoC return under 8-12%. Getting a handle on this metric is a non-negotiable part of your analysis, which you can dive deeper into in our complete guide to using a rental property ROI calculator.

In today’s market, even the big players are shifting focus to immediate liquidity and yield. A recent analysis from Cambridge Associates revealed some 2020-vintage real estate funds had only returned about 24% of capital to investors by early 2025—nearly half of what earlier funds achieved. For individual investors, the lesson is clear: focus on assets with stable, predictable returns instead of just banking on appreciation.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Avoiding the Common Oversights That Sink Investments

A rental property cash flow calculator is an amazing tool, but it has one huge blind spot: it only knows what you tell it. This is where the real work begins. If you forget or—more likely—underestimate a key expense, a deal that looks like a winner on paper can quickly turn into a financial nightmare.

Lots of new investors get tripped up by relying on overly simple shortcuts, like the infamous "50% Rule," which assumes your operating expenses will magically eat up half your gross rent. It’s a handy trick for a five-second first look at a property, but making a final decision based on it? That’s just asking for trouble. Real-world expenses are never that clean.

To build an investment that can actually withstand the realities of being a landlord, you have to get serious about the three silent budget killers: Vacancy, Capital Expenditures (CapEx), and all those other lovely unexpected repairs.

Moving Beyond Generic Vacancy Rates

Vacancy is the ultimate income killer. Every single month a unit sits empty, you’re not just missing out on rent—you’re still paying the mortgage, taxes, and utilities out of your own pocket.

Slapping a generic 5% vacancy rate on your spreadsheet might seem safe, but it could be dangerously optimistic. That 5% might work for a hot downtown apartment with a waiting list, but it’s a fantasy for a C-class property in a small town that just lost its main employer.

To get a number you can actually trust, you have to do some local detective work:

- Walk the neighborhood. Are "For Rent" signs everywhere, or is it a ghost town for vacancies? The answer tells you a lot about demand.

- Think about your property type. Single-family homes tend to have lower turnover, but when they do go vacant, finding a new tenant can take much longer than for a small apartment.

- Talk to a property manager. These are the people on the front lines. A good local manager can tell you the real vacancy rates for your exact type of property in that specific area. Their intel is pure gold.

The Inevitable Cost of Capital Expenditures

Capital Expenditures, or CapEx, are the big-ticket items that every property will need replaced eventually. I’m not talking about fixing a leaky faucet. I’m talking about a new roof, a new HVAC system, or replacing the water heater.

These aren’t if expenses; they are when expenses.

Failing to save for CapEx is probably the single fastest way to go broke as a landlord. When that $10,000 bill for a new roof comes due, you need to have the cash ready. A solid rule of thumb is to set aside 1-3% of the property's value every single year just for these future costs.

A property with a brand-new roof and HVAC system requires a much smaller monthly CapEx reserve than one with 15-year-old systems. Always factor in the age and condition of the major components when setting your budget.

Common Rules of Thumb vs. Detailed Expense Budgeting

So, why go through all this trouble when you could just use a simple rule? Because the difference between a quick guess and a detailed analysis is the difference between hoping for profit and actually planning for it.

Here’s a look at how these two approaches stack up.

| Budgeting Method | How It Works | Pros | Cons |

|---|---|---|---|

| Rules of Thumb (e.g., 50% Rule) | Assumes expenses are a fixed percentage of gross rent (e.g., 50%). | Fast and easy for initial screening. | Highly inaccurate; ignores property age, condition, and market specifics. |

| Detailed Line-Item Budgeting | Involves researching and assigning a specific monthly cost to each expense category (taxes, insurance, CapEx, etc.). | Far more accurate and realistic. | Time-consuming and requires significant research. |

This detailed, line-by-line approach is non-negotiable before you sign any closing papers. It forces you to look the true costs of ownership in the eye and build a financial model that can handle a few surprises. Fortunately, as market conditions stabilize, building these projections is becoming more manageable. The global real estate market has seen private values rise for five straight quarters, with transaction volumes hitting $739 billion, a 19% year-over-year increase. As you can discover more insights about these real estate trends on nuveen.com, these clearer market signals mean the numbers you plug into your calculator are more likely to reflect reality.

At the end of the day, conservative, well-researched numbers are your best defense against the unexpected. Your goal isn’t just to survive in this business—it’s to thrive. Proper budgeting is also essential for maximizing your returns, and understanding all the financial levers you can pull is critical. To go deeper, you can explore our guide on leveraging property investment tax deductions to further strengthen your financial position.

Frequently Asked Questions (FAQ)

Here are answers to the top questions investors have when using a rental property cash flow calculator.

1. What's a good cash flow per month for a rental property?

While this varies greatly by market and property price, many investors aim for a minimum of $100-$200 per unit per month. A more experienced investor might target a cash-on-cash return percentage (e.g., 8%+) rather than a fixed dollar amount, as this scales better with the investment size.

2. How do I accurately estimate future repair costs?

The "1% rule" is a common starting point: budget 1% of the property's purchase price annually for maintenance. For a $300,000 home, that's $3,000 per year, or $250 per month. However, for older properties (20+ years) with original systems, it's safer to budget 2-3% to account for more frequent and costly repairs.

3. Should I include property management fees even if I plan to self-manage?

Yes, absolutely. Always budget 8-10% of gross rent for property management. This makes your analysis more conservative and "pays" you for your time. If you later decide to hire a manager, the cost is already accounted for, ensuring the property's finances can support it.

4. What is the difference between cash flow and profit?

Cash flow is the actual money left in your bank account after all expenses and mortgage payments are paid. Profit (or net income) is an accounting term that includes non-cash expenses like depreciation. An investor can have a positive cash flow but show a paper loss for tax purposes due to depreciation, which is a key benefit of real estate investing.

5. Can a property with negative cash flow be a good investment?

It's a high-risk strategy based on speculation. This approach relies entirely on future appreciation to generate a return. It's generally not recommended, especially for new investors. A property should ideally support itself from day one with positive cash flow.

6. How does vacancy rate impact my cash flow calculation?

Vacancy is a direct hit to your income. A 5% vacancy rate on a property renting for $2,000/month means you must reduce your projected annual income by $1,200 ($2,000 x 12 months x 0.05). Always research local vacancy rates for your specific property type; don't just use a generic number.

7. What are Capital Expenditures (CapEx) and how should I budget for them?

CapEx are large, infrequent expenses for replacing major systems like the roof, HVAC, or water heater. They are not routine maintenance. A common method is to set aside 1-3% of the property's value annually into a separate savings account specifically for these future costs. Ignoring CapEx is one of the most common and costly mistakes new investors make.

8. Where can I find reliable data for my expense estimates?

- Property Taxes: County assessor's or tax collector's official website.

- Insurance: Call local insurance agents for quotes on a landlord policy.

- Repairs & Rents: Speak with local property management companies. They have the most accurate, on-the-ground data.

- Utilities: Ask the seller for the last 12 months of utility bills.

9. What is the 50% Rule and is it reliable?

The 50% Rule suggests that all operating expenses (excluding the mortgage) will be about 50% of the gross rental income. It's a very rough tool for quick, initial screening of a property. It should never be used for a final investment decision, as it ignores property-specific details like age, condition, and property taxes, which can vary dramatically.

10. Should I use an online calculator or build my own spreadsheet?

Both. Use a free online rental property cash flow calculator for rapid analysis when you're screening dozens of potential deals. However, building your own spreadsheet is an invaluable learning experience. It forces you to understand every component of the calculation and allows you to customize the analysis to your specific needs and assumptions.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and tools you need to build lasting wealth through smart investing.

Explore our resources and join a community of savvy investors at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.