Before you even think about putting a dollar into the market, you need to get crystal clear on two things: what you’re saving for and how much risk you can stomach. This is the foundation. Without it, you’re not building a strategy; you’re just reacting to market noise. Think of it as purpose before portfolio.

In This Guide

- 1 Setting Your Financial North Star

- 2 Letting Time Do the Heavy Lifting

- 3 Choosing Your Investment Toolkit

- 4 Building a Portfolio That Can Weather Any Storm

- 5 Staying Disciplined When Markets Get Emotional

- 6 Your Top Investing Questions, Answered

- 7 FAQ: Your Quick Guide to Wise Investing

- 7.1 1. How much money do I actually need to start investing?

- 7.2 2. Is it better to invest a lump sum or use dollar-cost averaging (DCA)?

- 7.3 3. What’s the real difference between an ETF and a mutual fund?

- 7.4 4. How often should I check on my portfolio?

- 7.5 5. Is it too late for me to start investing?

- 7.6 6. Should I pay off all my debt before I invest?

- 7.7 7. What are the most common rookie investing mistakes?

- 7.8 8. Do I need a financial advisor to invest wisely?

- 7.9 9. What should I do when the stock market crashes?

- 7.10 10. How much do fees really impact my returns?

Setting Your Financial North Star

The first question I always ask people is, “What are you investing for?” It’s the most important one. Answering it is what separates aimless saving from building a life you truly want. Vague ambitions like “get rich” aren’t goals—they’re dreams without a deadline. You need a destination before you can draw the map.

Investing is incredibly personal. Your goals will determine your timeline, how much risk you should be taking on, and which investments are right for you. Chasing hot stocks without a plan is a surefire way to make panicked, emotional decisions that hurt you in the long run.

From Vague Ideas to Concrete Goals

Let’s make this real. Take Alex, a 28-year-old software developer who wants to be “financially free.” That’s a great starting point, but it’s not an actionable plan.

To turn that dream into a reality, Alex needs to get specific. He breaks it down into tangible, time-bound objectives:

- Short-Term (1-3 years): Save $15,000 for a wedding and honeymoon.

- Mid-Term (5-7 years): Build a $60,000 down payment for a first home.

- Long-Term (30+ years): Grow a retirement nest egg to $1.5 million.

Suddenly, Alex has a roadmap. Each goal demands a completely different approach. The wedding fund needs to be safe and liquid, probably in a high-yield savings account. The retirement money, on the other hand, can be invested more aggressively for growth since it has decades to ride out market waves.

What Is Your “Sleep at Night” Factor?

This leads us right into risk tolerance—what I like to call the “sleep at night” factor. It’s your gut-level reaction to seeing your portfolio drop.

Could you handle watching your investments fall by 20% in a bad year, knowing that it’s part of the process for higher long-term gains? Or would that kind of volatility make you want to cash out and hide your money under the mattress? Be honest. There’s no right answer.

Your risk tolerance is a mix of two things: your financial capacity to handle a loss (your timeline, job security, etc.) and your emotional willingness to see it happen. Getting this right is non-negotiable for long-term success.

A little self-assessment goes a long way. Think about how you’d genuinely feel in a few different market scenarios. This personal insight is what makes an investment plan truly yours—one that fits your personality, not just a generic financial model. It also helps to consider how to define wealth beyond money and possessions, which can bring a lot of clarity to what you’re really working toward.

Letting Time Do the Heavy Lifting

If there’s one “secret weapon” in an investor’s toolkit, it’s not some genius stock pick or flawless market timing. It’s something far more powerful and accessible to every single one of us: compounding.

Simply put, compounding is when your investment returns start generating their own returns. It creates a snowball effect that can transform small, steady contributions into a serious nest egg over the years. Your money quite literally starts working for you, 24/7.

Why Starting Early Is a Game Changer

Let’s look at a classic tale of two investors—we’ll call them Maya and Ben. Both are shooting for an average 8% annual return on their investments, but their timelines are completely different. This simple scenario drives home why learning how to start investing money is less about how much you start with and more about when you start.

| Investor Profile | Maya (The Early Starter) | Ben (The Late Starter) |

|---|---|---|

| Starting Age | 25 | 45 |

| Monthly Investment | $300 | $600 |

| Total Invested | $144,000 | $144,000 |

| Portfolio Value at 65 | ~$1,050,000 | ~$355,000 |

Take a look at those numbers. Even though Ben invested double the monthly amount to contribute the exact same total, Maya’s portfolio is nearly three times larger by retirement.

How is that possible? Ben’s own contributions made up 40% of his final portfolio value. For Maya, her contributions were only about 14% of the total. The rest was pure, unadulterated growth. That 20-year head start she had gave her money decades to work its magic.

Supercharging Growth with Reinvestment

That compounding snowball gets even bigger and faster when you reinvest any dividends or capital gains your investments spin off. Instead of pocketing the cash, you put it right back to work buying more shares. Those new shares then start generating their own returns. It’s a beautiful, self-fueling cycle.

The lesson here is crystal clear: Time in the market is vastly more important than timing the market. The longer your money is invested, the more opportunity it has to grow and smooth out the inevitable bumps along the way.

History backs this up. The U.S. stock market has delivered an average annualized return of roughly 10% over the long haul. At that rate, your initial investment can multiply over 17 times every 20 years. It’s an incredible force, and all it asks of you is patience and consistency.

Choosing Your Investment Toolkit

Alright, you’ve mapped out your financial goals. Now comes the fun part: picking the tools to actually build your portfolio. The secret isn’t finding one magic “best” investment. It’s about assembling a mix that’s perfectly suited to you.

Getting a handle on the main asset classes is your first real step toward investing with confidence. Think of these as the fundamental building blocks of your entire financial future.

The Main Players: Stocks and Bonds

For most people, stocks and bonds are the bedrock of a portfolio.

Stocks (also called equities) are exactly what they sound like—a share of ownership in a company. When you buy a stock, you become a part-owner of that business. The big draw is their potential for high long-term growth, but they also come with the most risk and price swings.

Bonds, on the other hand, are much simpler. You’re essentially loaning money to a government or a corporation. In return for your loan, they promise to pay you back with interest. Bonds are generally safer than stocks and can provide a steady income stream, which is a huge help when the stock market decides to have a bad day (or month).

I see so many new investors think it’s an “either/or” game. That’s a huge mistake. The real magic happens when you blend stocks and bonds strategically. It’s like having an engine for growth and a reliable set of brakes for safety.

Diversification Made Easy: ETFs and Mutual Funds

Let’s be honest: researching and buying individual stocks and bonds takes a ton of time and effort. This is exactly why Exchange-Traded Funds (ETFs) and mutual funds were created. Both are essentially baskets holding dozens, sometimes hundreds, of different investments, all managed by a professional.

Their superpower is instant diversification. Instead of putting all your eggs in one company’s basket, you’re spreading your investment across an entire market or industry. For the vast majority of people, these funds are the most efficient way to build a solid portfolio.

Of course, if you’re interested in exploring some of the newer, more volatile asset classes, you can learn more by checking out our beginner’s guide to investing in cryptocurrency.

Comparing Common Investment Asset Classes

To help you visualize how these pieces fit together, I’ve put together a quick comparison of the most common asset classes. This table breaks down their typical roles, risks, and what kind of investor they’re best suited for.

| Asset Class | Description | Typical Risk Level | Potential Return | Best For |

|---|---|---|---|---|

| Stocks | Ownership in a company, aimed at long-term growth. | High | High | Long-term investors who can handle market ups and downs. |

| Bonds | A loan to a government or corporation that pays interest. | Low | Low to Moderate | Investors who want to preserve capital and generate income. |

| ETFs | A basket of assets that trades like a single stock. | Varies (Low to High) | Varies (Low to High) | DIY investors seeking low costs and trading flexibility. |

| Mutual Funds | A professionally managed portfolio of stocks and bonds. | Varies (Low to High) | Varies (Low to High) | Investors who prefer a hands-off, “set it and forget it” approach. |

This table should give you a clearer picture of the different tools available. As you can see, each one has a specific job to do within a well-balanced portfolio.

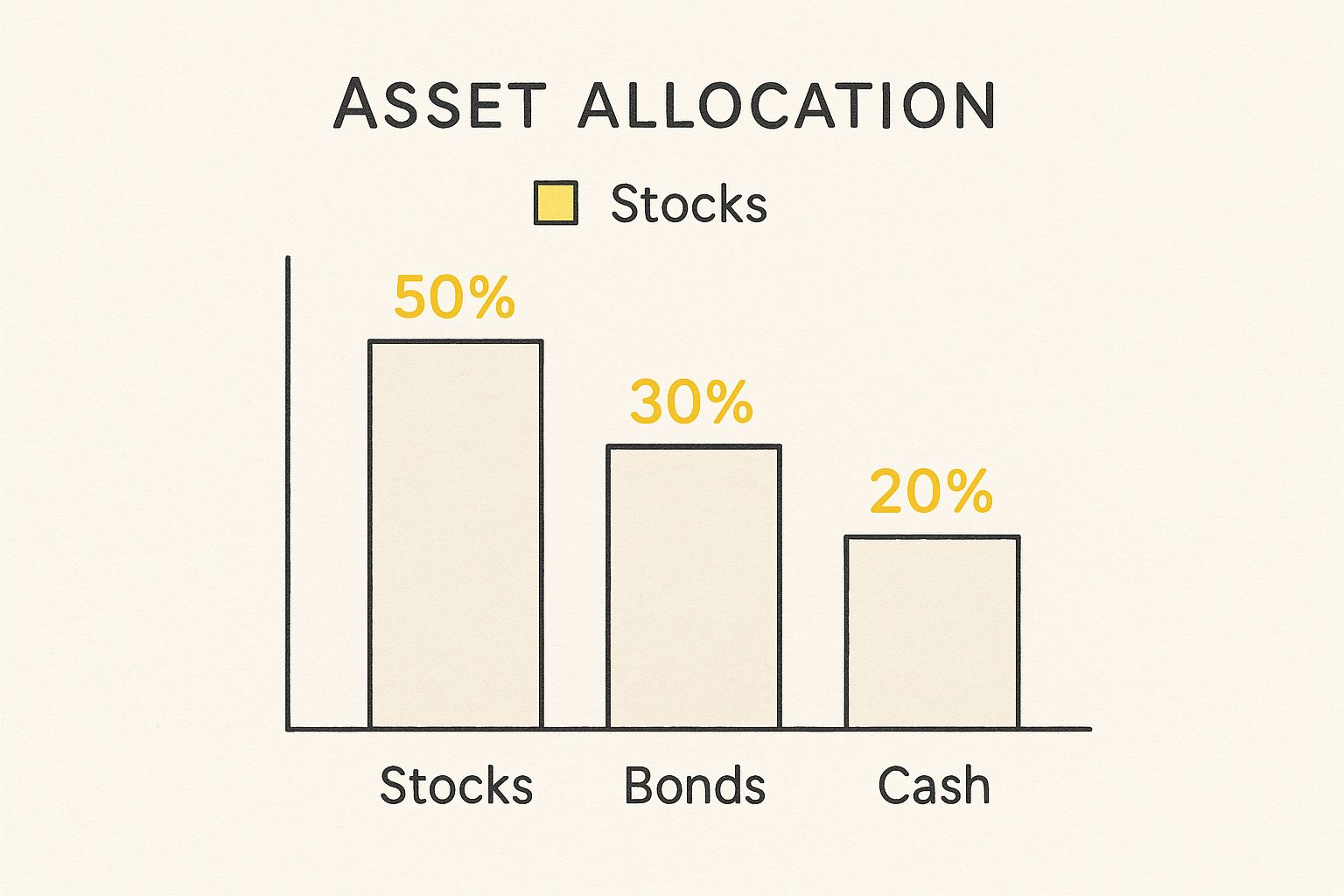

This kind of visual breakdown is a great starting point. Notice how stocks typically make up the bulk of a growth-focused portfolio, while bonds and cash act as a defensive buffer to smooth out the ride.

Building a Portfolio That Can Weather Any Storm

You’ve heard it a million times: “don’t put all your eggs in one basket.” It sounds simple, almost cliché, but it’s genuinely the most powerful principle for protecting your hard-earned money. This idea, which we call diversification in the finance world, is your absolute best defense against the market’s inherent unpredictability.

But let’s be clear. This isn’t just about owning a handful of different stocks. Real diversification means spreading your investments across various asset classes—things that tend to react differently to the same economic news. When one part of your portfolio is having a tough time, another part is hopefully holding steady or even rising, which helps smooth out the entire journey.

What a Balanced Portfolio Actually Looks Like

Okay, enough with the theory. What does a properly diversified portfolio look like in the real world? Let’s imagine an investor with a moderate appetite for risk and a long time horizon.

A tried-and-true starting point often looks something like this:

- 60% Global Stocks: This is your growth engine. Going global means you aren’t just betting on the U.S. economy. You’d likely have a blend of large American companies, stocks from other developed countries, and maybe a small allocation to emerging markets for extra growth potential.

- 30% Bonds: These are the shock absorbers for your portfolio. When the stock market gets choppy, bonds are typically the asset that provides stability and a steady stream of income.

- 10% Alternatives: This is where you can add things like real estate (through REITs) or even commodities. These assets often march to the beat of their own drum, giving you another layer of protection that isn’t directly tied to the performance of stocks or bonds.

This isn’t just a random mix; it’s a structure designed to capture upside while providing a much-needed cushion during downturns. Think back to the 2008 financial crisis—a brutal test for any investor. Global stocks tanked by roughly 40%. Portfolios that were well-diversified with a solid bond allocation, however, often saw much smaller losses, closer to 20%. That’s a huge difference. If you want to dig into the data, the Global Market Outlook from T. Rowe Price offers some great insights into these market dynamics.

The point of diversification isn’t to dodge risk entirely—that’s just not possible. The real goal is to manage it so you can stay in the game long enough to hit your goals without panicking every time the market dips.

The Underrated Discipline of Rebalancing

Putting together a great portfolio is a fantastic start, but it’s not a “set it and forget it” deal. As the markets move, your carefully chosen allocations will start to drift. After a stellar year for stocks, your 60% stock allocation might creep up to 70%. Suddenly, your portfolio is carrying more risk than you originally signed up for.

This is where rebalancing comes into play. It’s the simple, disciplined practice of selling a bit of what has done well and buying more of what has lagged to bring your portfolio back to its original targets. It’s a system that forces you to sell high and buy low without letting emotions get in the way. For anyone looking to make this a core part of their strategy, our guide on effective portfolio rebalancing strategies breaks down exactly how to do it.

Ultimately, rebalancing ensures your portfolio stays aligned with your goals, not just chasing the market’s latest trend.

Staying Disciplined When Markets Get Emotional

Let’s be honest. The biggest threat to your investment portfolio isn’t a recession or a sudden market crash. It’s the person staring back at you in the mirror.

Our brains are hardwired with powerful emotions like fear and greed. These instincts can drive us to do exactly the wrong thing at the wrong time—like panic-selling everything during a temporary dip or blindly chasing a hot stock right at its peak.

The real secret to investing wisely isn’t about outsmarting the market. It’s about being more disciplined than the next person. Your investment plan is what keeps you anchored when the emotional storm hits.

The Power of a System: Dollar-Cost Averaging

So, you have a chunk of money ready to invest. What do you do? Go all-in at once (lump sum investing), or feed it into the market in smaller, regular installments? This second method is called dollar-cost averaging (DCA), and it’s one of the best tools for taking emotion out of the equation.

Let’s see how this plays out. Imagine you have $1,200 to invest over four months.

| Investment Approach | Lump Sum (All at Once) | Dollar-Cost Averaging (Over Time) |

|---|---|---|

| January | Invests $1,200 at $12/share. Buys 100 shares. | Invests $300 at $12/share. Buys 25 shares. |

| February | The market dips. You just hold your 100 shares. | Invests $300 at $10/share. Buys 30 shares. |

| March | The market stays flat. Still holding 100 shares. | Invests $300 at $10/share. Buys 30 shares. |

| April | The market recovers. You still have 100 shares. | Invests $300 at $12/share. Buys 25 shares. |

| Total Invested | $1,200 | $1,200 |

| Total Shares Owned | 100 shares | 110 shares |

| Average Cost per Share | $12.00 | $10.91 |

See what happened? By investing a fixed amount each month, the DCA investor automatically bought more shares when they were cheap. This simple, consistent approach turns market dips into opportunities, completely removing the stress of trying to time the market perfectly.

Taming Your Inner Investor Saboteur

History shows that this kind of systematic investing often leads to better long-term results, especially when the market gets choppy. In fact, studies show that during bear markets, investors using DCA tend to have smaller losses because their strategy forces them to buy more assets as prices fall. If you want to dive deeper, you can discover more about managing market outlooks from J.P. Morgan.

The most successful investors don’t have a crystal ball. They have a system. They automate their contributions and then tune out the daily noise, trusting the process they’ve built.

To sidestep the most common behavioral traps, just focus on these two things:

- Put It on Autopilot: Set up automatic transfers from your checking account to your investment account for every payday. Investing becomes a habit, not a choice you have to wrestle with.

- Stop Watching the Ticker: Constantly checking your portfolio is a fast track to anxiety and bad decisions. If you have a long-term plan, a quarterly check-in is plenty to make sure you’re still on course.

In the end, your mindset is your most valuable asset. By building a disciplined system, you take emotion out of the driver’s seat and let your well-crafted plan do the work for you.

Your Top Investing Questions, Answered

Jumping into the world of investing can feel a little overwhelming at first. There’s a lot of jargon, and it’s completely normal to have a ton of questions. Getting straight, practical answers is the best way to build your confidence and learn how to invest wisely.

Let’s dive into some of the most common questions I hear from both new and seasoned investors, and get you the clear insights you need to move forward.

Where to Begin and What to Expect

The single biggest hurdle for most people? Just getting started. There’s a persistent myth that you need a huge pile of cash to invest, but that idea is what keeps too many people on the sidelines.

Thankfully, modern investing platforms have torn down those old walls. You can genuinely start with as little as $1 by using features like fractional shares, which let you buy a small slice of a company’s stock. The important thing is to begin, not how much you start with.

Another big piece of the puzzle is setting realistic expectations. To get a handle on what different investments can deliver over the long haul, it’s really helpful to understand the average rate of return investors have seen historically. This gives you a solid benchmark for your own financial goals.

Picking the Right Tools for the Job

Many investors get tripped up comparing different investment vehicles. Two of the most common you’ll see are ETFs and mutual funds—they serve a similar purpose but work in fundamentally different ways.

Both are essentially baskets of diversified assets, but how they trade and what they cost can be quite different. Knowing these distinctions is crucial for picking the right one for your strategy.

| Feature | Exchange-Traded Fund (ETF) | Mutual Fund |

|---|---|---|

| Trading | Trades like a stock on an exchange, with prices changing all day. | Priced only once per day after the market closes. |

| Fees | Typically has lower expense ratios and fewer hidden costs. | Can have higher expense ratios and sometimes sales commissions (“loads”). |

| Best For | Hands-on investors who value flexibility, transparency, and lower costs. | Investors who prefer a set-it-and-forget-it, professionally managed fund. |

I’ve seen a few common mistakes trip up even savvy investors: trying to time the market, letting fear or greed drive their choices, not diversifying properly, and getting eaten alive by high fees. The best defense is a disciplined, long-term plan focused on low-cost, diversified funds.

FAQ: Your Quick Guide to Wise Investing

To wrap things up, here are answers to the 10 most common questions people have when learning how to invest wisely.

1. How much money do I actually need to start investing?

You can genuinely get started with as little as $1. Most modern brokerage apps have no account minimums and offer fractional shares, which let you buy a small piece of a stock or ETF. The key is to just start, no matter how small.

2. Is it better to invest a lump sum or use dollar-cost averaging (DCA)?

Historically, lump-sum investing has produced slightly higher returns because your money is in the market longer. However, DCA is a powerful strategy to reduce risk and take emotion out of the equation, especially in a volatile market. For most people, DCA is the more sustainable, stress-free approach.

3. What’s the real difference between an ETF and a mutual fund?

Think of it this way: ETFs trade like stocks all day long, and their prices fluctuate throughout the day. Mutual funds are priced only once at the end of the trading day. ETFs also tend to have lower fees and better tax efficiency, making them a popular choice for many DIY investors.

4. How often should I check on my portfolio?

For long-term investors, looking too often is a recipe for making emotional, reactive decisions. A quick check-in to rebalance your portfolio once or twice a year is more than enough. Resist the urge to watch the daily market movements.

5. Is it too late for me to start investing?

Absolutely not. While starting early gives your money more time to compound, investing at any age is far better than not investing at all. Your strategy might be different if you’re closer to retirement, but the principle of putting your money to work for you remains the same.

6. Should I pay off all my debt before I invest?

It’s a balancing act. You should always prioritize wiping out high-interest debt (like credit card balances with 20%+ APR). But for low-interest debt (like a mortgage or student loan with a rate below 5-6%), it often makes financial sense to invest at the same time, since the potential returns from the market are historically higher.

7. What are the most common rookie investing mistakes?

The biggest ones are: trying to time the market, making emotional decisions based on fear or greed, not diversifying (putting all your eggs in one basket), and ignoring the impact of high fees on your returns.

8. Do I need a financial advisor to invest wisely?

Not necessarily. Many people can successfully manage their own investments using low-cost index funds, target-date funds, or robo-advisors. A financial advisor becomes most valuable when your financial situation gets more complex (e.g., estate planning, complex taxes, multiple income streams).

9. What should I do when the stock market crashes?

Stick to your long-term plan. A market downturn is a normal part of investing. If your time horizon is long, see it as a buying opportunity to acquire assets at a discount. Avoid panic-selling at all costs, as that locks in your losses.

10. How much do fees really impact my returns?

Massively. Fees compound just like your returns do, but they work against you. A seemingly small 1% fee can reduce your final portfolio value by nearly 30% over several decades. Always prioritize low-cost index funds and ETFs to keep more of your money working for you.