Hunting for investment properties isn't about luck—it's about strategy. The real secret is to build a clear investment blueprint that nails down your budget, financial goals, and ideal property type before you even glance at a listing. Think of it as your personal filter; it saves you from wasting time and keeps you focused on opportunities that actually make sense for you.

In This Guide

- 1 Build Your Investment Blueprint Before You Search

- 2 Sourcing Deals Beyond the Multiple Listing Service

- 3 Finding Markets and Neighborhoods with Real Potential

- 4 How to Confidently Analyze the Numbers on Any Property

- 5 Mastering Due Diligence to Protect Your Investment

- 6 Frequently Asked Questions About Finding Investment Properties

- 6.1 1. What's the fastest way to find my first investment property?

- 6.2 2. How much money do I really need to get started?

- 6.3 3. Should I prioritize cash flow or appreciation?

- 6.4 4. What are the biggest red flags to watch for when looking at a property?

- 6.5 5. What's the difference between on-market and off-market deals?

- 6.6 6. Is it better to buy a turnkey property or a fixer-upper?

- 6.7 7. How do I find a good real estate agent for investing?

- 6.8 8. What is the "1% Rule" and is it still relevant?

- 6.9 9. Can I find investment properties in a competitive market?

- 6.10 10. How many properties should I analyze before making an offer?

Build Your Investment Blueprint Before You Search

The smartest investors I know can tell you exactly what a "good" deal looks like for them long before they start scrolling through listings. Diving into the market without a plan is like trying to drive across the country without a map. Sure, you'll end up somewhere, but probably not where you wanted to be.

Crafting your personal investment blueprint is the single most important step. It's what stops you from making costly mistakes or getting stuck in "analysis paralysis."

This isn't about generic advice. It's about getting specific with your own situation. It all starts with your core financial goals. Are you looking for immediate monthly cash flow to pad your income? Or are you playing the long game, banking on appreciation where the property’s value skyrockets over time? Your answer here completely changes where you look and what you buy.

Defining Your Financial Goals

Let's say you're all about cash flow. You might zero in on a duplex near a college town where steady rental demand practically guarantees a consistent income stream.

On the other hand, if appreciation is your goal, you'd likely be hunting for a single-family home in an up-and-coming suburb. Maybe it has excellent schools and a new tech campus planned nearby—all signs of future value growth. Neither approach is right or wrong, but they lead you down two totally different paths.

Key Takeaway: Your investment strategy is your most powerful filter. It lets you immediately ignore 90% of the properties out there and focus your energy on the few that perfectly match what you’re trying to achieve.

Choosing Your Property Niche

Next up, you need to match the property type to your lifestyle and budget. Are you ready to handle the demands of a multi-unit property, or is a simpler, turnkey single-family home a better fit for your first go?

Here's a comparison of common property types to help you decide:

| Property Type | Pros | Cons | Ideal For |

|---|---|---|---|

| Single-Family Homes | Easier financing, high tenant demand, simpler management. | One income stream per property, higher vacancy impact. | Beginners, investors focused on appreciation. |

| Duplexes/Multi-Family | Multiple income streams, economies of scale, can live in one unit. | More management work, higher purchase price, complex financing. | Cash flow investors, house-hackers. |

| Small Commercial | Longer lease terms, tenants often pay for maintenance (NNN leases). | Sensitive to economic downturns, requires specialized knowledge. | Experienced investors seeking stable, long-term income. |

Finally, you have to lock down your budget. And I don't just mean the down payment. You need to account for closing costs, a buffer for renovations, and a healthy cash reserve for those inevitable vacancies or surprise repairs. Figuring out how to finance an investment property is something you absolutely must do before starting your search.

Your blueprint should also keep an eye on the bigger picture. Research from sources like the Urban Land Institute and PwC shows a cautiously optimistic global market. They suggest investors pay attention to where real estate and new infrastructure meet, like data centers or renewable energy projects. This kind of awareness helps ensure your local game plan aligns with broader economic trends. You can read more on the global real estate outlook for 2025 to get a better sense of how these macro-level shifts might impact your choices.

Sourcing Deals Beyond the Multiple Listing Service

Anyone can scroll through the Multiple Listing Service (MLS), and that's exactly the problem. When a property hits the open market, you're immediately competing against every other buyer out there, which almost always means paying a premium.

The real money is made by finding deals before they become public knowledge. This is where seasoned investors separate themselves from the pack. It's not about luck; it's about building a system to generate a consistent flow of off-market opportunities. You have to get to motivated sellers first.

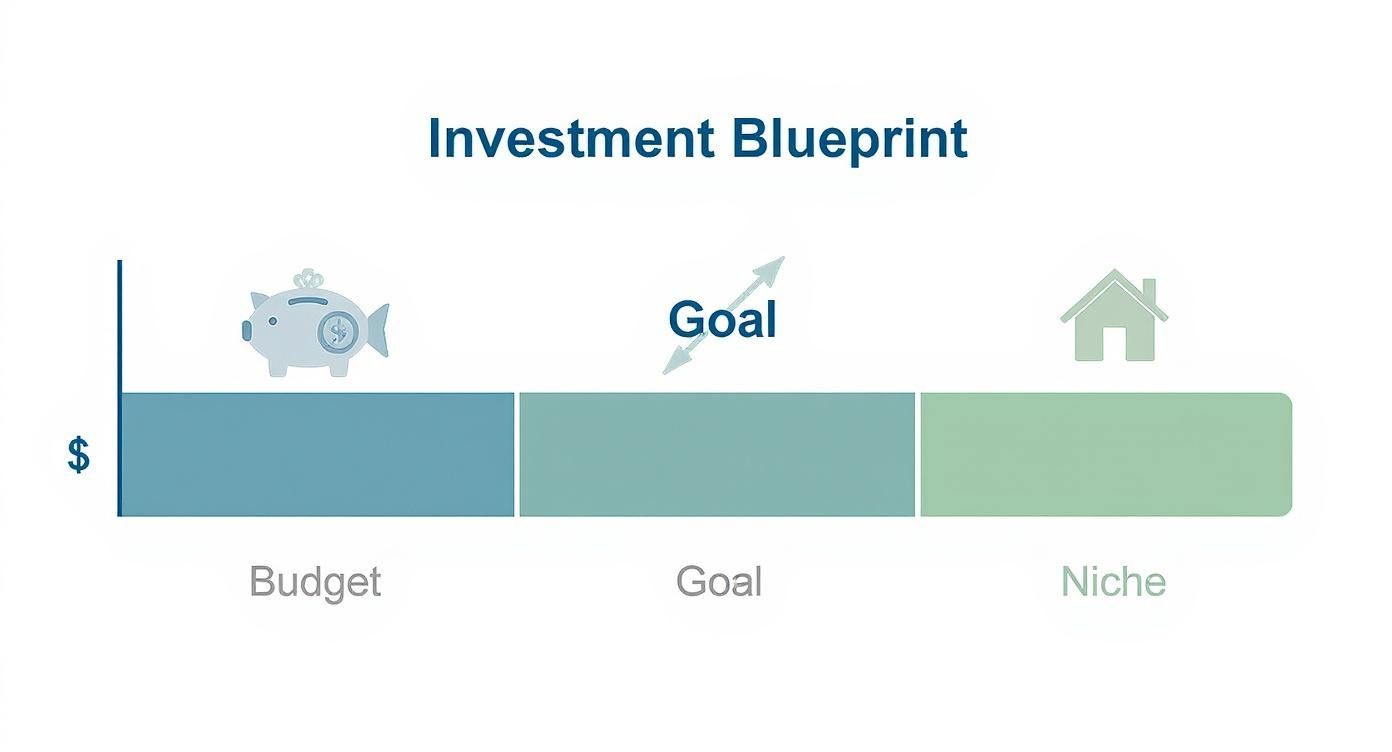

Before you even think about looking for properties, your own plan needs to be rock-solid. This infographic breaks down the essentials.

As you can see, knowing your budget, your ultimate goal, and your specific niche are the absolute cornerstones of a successful search. With these defined, you can zero in on the right kind of off-market deals instead of just chasing everything that pops up.

Cultivating Your Professional Network

Your network is, without a doubt, your single greatest asset for finding hidden gems. The right people hear about potential sales and distressed situations long before they hit the MLS.

- Wholesalers: These are the ground-pounders of the industry. They specialize in finding undervalued properties, getting them under contract, and then assigning that contract to an investor (like you) for a finder's fee.

- Attorneys: I've found that divorce and estate attorneys are fantastic sources. Their clients often need to liquidate a property quickly and without the hassle of a public listing.

- Contractors: Think about it—plumbers, roofers, and electricians are the first ones to see a property that's falling apart from deferred maintenance. They know which owners are overwhelmed.

Building these relationships doesn't happen overnight. A great way to get on their radar is to offer a simple finder's fee for any lead that turns into a closed deal. It incentivizes them to call you first.

Direct Outreach and Guerilla Marketing

If you're willing to roll up your sleeves, you can create your own luck. These classic "guerilla" tactics have stuck around for one simple reason: they work.

Driving for Dollars is an old-school classic. You literally drive through your target neighborhoods and look for signs of a neglected property—overgrown grass, boarded windows, a pile of newspapers on the porch. Once you spot one, you can use public records to find the owner's info and reach out. It's surprisingly effective.

Another powerhouse method is a Direct Mail Campaign. This involves sending letters or postcards to a highly targeted list of owners, like out-of-state landlords or people facing foreclosure. You'd be amazed how well a simple, personal-looking letter can perform compared to glossy ads.

Real-Life Example: An investor I know in Austin, TX, sent 500 simple postcards to absentee owners in a target zip code. She received seven calls, and one turned into an off-market duplex purchase for $425,000, roughly 20% below its estimated market value of $530,000. This single campaign saved her over $100,000 at closing.

For a more tech-savvy approach, you can check out some of the best real estate investment apps that can help you identify and track potential properties right from your smartphone.

The smartest investors don't rely on a single source. By diversifying your strategy, you create multiple pipelines for deals, ensuring you always have opportunities to analyze. Combining a passive awareness of what's on the market with an active hunt for what's not is the true key to consistently finding great investments.

Finding Markets and Neighborhoods with Real Potential

You've heard it a million times: "location, location, location." It might sound like a tired cliché, but it’s the absolute bedrock of a successful real estate investment. I'd rather have an average house in a fantastic, up-and-coming neighborhood than a palace in an area that's on the decline. The real skill is learning to see beyond a coat of fresh paint and dig into the data that signals genuine potential.

The smartest investors I know all use a top-down approach. They start by analyzing the big picture at the city or metro level, and only then do they drill down into specific neighborhoods. This method helps you avoid getting distracted by a "good deal" in a bad market, letting you invest with the confidence that the location itself is poised for growth.

Reading the Macro Tea Leaves

Before you ever look at a single property listing, you have to get a feel for the health of the entire market. These high-level indicators paint a clear picture of a city's trajectory.

Here's what I always look for:

- A Healthy Job Market: Are companies moving in? A city that's consistently adding jobs, especially in high-paying sectors like tech or healthcare, is a magnet for new residents who will need a place to live. That's your future tenant pool.

- Population Growth: Is the city growing or shrinking? This is a simple but powerful metric. You can get hard numbers directly from the U.S. Census Bureau to see which cities are attracting people.

- Public and Private Investment: Keep an eye on the local news. Are they building a new light rail? Revitalizing the riverfront? Is a major corporation building a new headquarters? These kinds of projects are massive signals that a city is investing in itself, making it a better place to live and work.

Expert Insight: One of my favorite, often-overlooked strategies is to follow the "path of progress." Find the trendiest, most expensive neighborhoods in a city and then start looking at the areas right next door. That's almost always where the next wave of investment and appreciation is headed.

Diving Deep into Neighborhood Data

Once you’ve zeroed in on a promising city, the real detective work starts at the neighborhood level. This is where you can get a huge edge over other investors by meticulously comparing the micro-data.

Let’s walk through a real-world scenario. Imagine you're comparing two different neighborhoods in the same city.

| Metric | Neighborhood A ("Stable Core") | Neighborhood B ("Up-and-Coming") | Analysis |

|---|---|---|---|

| Average Rent | $2,200/month | $1,750/month | Neighborhood A brings in more cash flow today. |

| Vacancy Rate | 3% | 8% | A is clearly more stable with tighter demand right now. |

| Year-Over-Year Growth | 1.5% | 7% | This is a huge flag. B is growing much faster. |

| Future Development | None planned | New tech campus (2,000 jobs) | This is the game-changer for B's future. |

At first glance, Neighborhood A looks safer with its higher rent and low vacancy. But its growth is stagnant. Neighborhood B, while having some weaker stats today, is on an explosive upward trend, supercharged by the new tech campus. The smart money is on Neighborhood B for long-term appreciation and the ability to significantly raise rents in the near future. This is the kind of analysis that separates good investments from great ones.

This data-first mindset is exactly how sophisticated investors operate globally. A 2025 Deloitte report found that nearly 75% of global investors are planning to increase their real estate portfolios, specifically as a way to buffer against inflation. They aren't just buying anywhere; they are carefully picking local markets with solid fundamentals to find those pockets of growth potential.

How to Confidently Analyze the Numbers on Any Property

Finding a property that looks good on the surface is just the beginning. The real work—and where the pros separate themselves from the amateurs—happens when you dig into the numbers. You have to take emotion out of the equation. Success in real estate investing is all about making decisions based on cold, hard data.

Once you get the hang of a few key calculations, you’ll be able to quickly size up any property and know whether it’s a deal worth chasing.

Before you even think about building a complicated spreadsheet, you can use a couple of simple rules of thumb. I use these all the time to do a quick "back-of-the-napkin" check. They’re not the final word, but they’re fantastic for weeding out the duds from the get-go.

Quick Filters: The 1% and 50% Rules

Two of the most popular quick-check rules in an investor's toolkit are the 1% Rule and the 50% Rule. Think of them as your first line of defense against bad deals.

- The 1% Rule: This one's simple. Does the property's gross monthly rent equal at least 1% of the purchase price? So, for a $200,000 property, you’re looking for a minimum of $2,000 in monthly rent.

- The 50% Rule: This rule helps you quickly estimate your expenses. It assumes that roughly 50% of your gross rental income will go toward operating expenses—and this doesn't include your mortgage payment. We're talking about everything else: taxes, insurance, repairs, vacancy, you name it.

If a potential deal passes both of these tests, it’s probably worth spending more time on. If it fails miserably on one or both, you can confidently move on without wasting another minute.

Core Metrics for Deeper Analysis

Once a property has cleared the initial hurdles, it's time to roll up your sleeves and calculate the numbers that truly matter. This is where you move beyond gut feelings and into sound business analysis.

The first big number you need to find is the Net Operating Income (NOI). This is simply the property’s total income minus all of its operating expenses. Once you have the NOI, you can figure out the two returns that tell you the real story.

| Metric | Calculation | What It Tells You | Example |

|---|---|---|---|

| Cap Rate | NOI / Purchase Price | The property's raw, unleveraged return. Perfect for comparing properties apples-to-apples. | $12,000 NOI / $200,000 Price = 6% Cap Rate |

| Cash-on-Cash Return | Annual Cash Flow / Total Cash Invested | Your personal ROI. Measures the return on the actual money you pulled out of your pocket. | $4,000 Cash Flow / $40,000 Invested = 10% Return |

Let’s put that into perspective with a real-life scenario. Say you invest $40,000 of your own cash (down payment, closing costs) to buy that $200,000 property. After all expenses and mortgage payments are made, it leaves you with $4,000 in your pocket at the end of the year. Your Cash-on-Cash Return is a respectable 10%. This is the metric that tells you how hard your invested dollars are actually working for you.

Investor Tip: Don't get caught off guard by the "hidden" costs that sink rookie investors. Always factor in budgets for vacancy (5-10% of gross rent is a safe bet), capital expenditures (that new roof won't pay for itself), and property management fees—even if you plan to manage it yourself at first.

Building Your Deal Analysis Spreadsheet

Ultimately, you want a repeatable system. Building your own deal analysis spreadsheet is the best way to develop that muscle. It lets you plug in the numbers for any property and see the projected returns almost instantly.

To get started, you can use a dedicated tool. We've put together a powerful real estate investment calculator that runs all these numbers for you, ensuring you don't miss a thing. This data-driven approach is non-negotiable for anyone serious about finding investment properties that build lasting wealth.

Mastering Due Diligence to Protect Your Investment

Getting an offer accepted feels incredible, but don’t pop the champagne just yet. This is where the real work begins. The due diligence period is your one and only chance to peek behind the curtain and make sure you’re not buying a money pit.

I've seen it time and time again: new investors get excited and rush this step. It's easily the single biggest mistake you can make, and it can be a financially devastating one.

Think of this phase as protecting your hard-earned capital. Your mission is to verify every single assumption you made about the deal, so you can either move forward with confidence or walk away knowing you dodged a bullet.

Your Inspection Checklist

First things first: hire a professional property inspector. This is non-negotiable. While they handle the technical deep dive, you need to be there, walking the property with an investor's critical eye.

Pay close attention to the big-ticket items:

- Foundation & Roof: Look for any hairline cracks in the foundation or subtle water stains on the ceilings. These are often the most expensive and disruptive repairs imaginable.

- HVAC & Electrical: Find the manufacturing date on the furnace and AC unit. Check out the electrical panel. If they look ancient, you’re looking at a major capital expense just waiting to happen.

- Plumbing: Open every cabinet under every sink and look for signs of past or present leaks. Turn on the faucets to check for weak water pressure—a sign of much deeper, more complex issues.

Key Takeaway: Due diligence isn't just about finding deal-breakers. It's a fact-finding mission that gives you leverage. You can use what you find to renegotiate the price or have the seller cover the cost of repairs.

Beyond the Physical Property

A solid building is only half the battle. Your investigation needs to go much deeper, covering the legal and financial health of the property.

A professional title search is absolutely essential. This is what uncovers hidden claims, old debts (liens), or ownership squabbles that could threaten your right to the property. You also have to dig into local zoning laws. Can you actually add that second unit or run it as a short-term rental? Never assume.

If the property comes with tenants, you need to see the paperwork. Get copies of all lease agreements and, just as importantly, their payment histories. This tells you if you're inheriting responsible tenants or a nightmare eviction scenario. Understanding the real numbers behind your rental property cash flow is the only way to know if you have a good deal.

It's also smart to keep an eye on the bigger picture. We're at an interesting turning point in the global real estate market, with prices stabilizing and inflation cooling. Rental growth has kept valuations strong, and certain niches like warehouses and senior housing are in high demand. If you want to dive deeper, you can discover more insights on the 2025 real estate outlook to stay ahead of the curve.

Frequently Asked Questions About Finding Investment Properties

1. What's the fastest way to find my first investment property?

The fastest method is typically working with an investor-friendly real estate agent who can provide immediate access to MLS listings. However, the best deals with the highest potential profit are often found off-market through more time-intensive methods like networking with wholesalers, direct mail campaigns, or "driving for dollars" in target neighborhoods.

2. How much money do I really need to get started?

While a 20-25% down payment is standard for conventional investment loans, it's not the only option. You can start with less through strategies like FHA loans (3.5% down) on a multi-family property you live in ("house hacking"), seller financing, or partnering with a cash-heavy investor. Remember to also budget for closing costs and have a cash reserve of 3-6 months of expenses.

3. Should I prioritize cash flow or appreciation?

This depends entirely on your financial goals. Cash flow provides immediate monthly income, which is ideal if you need to supplement your salary or build passive income streams quickly. Appreciation is a long-term strategy focused on the property's value increasing over time for a large payout upon sale. The best investments offer a blend of both.

4. What are the biggest red flags to watch for when looking at a property?

Key red flags include foundation issues (cracks), evidence of water damage (stains, musty smells), outdated electrical systems (knob-and-tube wiring), a roof that is near the end of its life, and abnormally low rent for the area, which could signal problem tenants or deferred maintenance.

5. What's the difference between on-market and off-market deals?

On-market deals are publicly listed on the Multiple Listing Service (MLS) and accessible to everyone, leading to high competition. Off-market deals are not publicly advertised and are found through networking, direct marketing, or word-of-mouth. They often present the best opportunities for below-market prices because you face little to no competition.

6. Is it better to buy a turnkey property or a fixer-upper?

Turnkey properties are move-in ready and can generate cash flow from day one, making them ideal for beginners who want a simpler investment. Fixer-uppers (like those used in a BRRRR strategy) require significant renovation but offer the potential to create "forced equity" and achieve a much higher return on investment. This strategy is better suited for investors with construction knowledge or a reliable team of contractors.

7. How do I find a good real estate agent for investing?

Look for an agent who is an investor themselves or has a proven track record of working with investors. They should understand concepts like Cap Rate and Cash-on-Cash Return. Ask for referrals from local real estate investor groups or find agents who specialize in investment properties in your target market.

8. What is the "1% Rule" and is it still relevant?

The 1% Rule is a guideline suggesting that a property's gross monthly rent should be at least 1% of its purchase price (e.g., $2,000/month rent for a $200,000 property). While it's a useful quick screening tool, it's becoming harder to find properties that meet this rule in many high-cost markets. It should be used as a preliminary filter, not a final decision-making metric.

9. Can I find investment properties in a competitive market?

Yes, absolutely. In competitive markets, the key is to focus on off-market strategies where there's less competition. Build strong relationships with wholesalers, attorneys, and contractors. Target specific types of motivated sellers with direct mail, such as absentee owners or those in pre-foreclosure. You have to be more creative and persistent than the average buyer. You can learn more by reading our guide on how to find and buy distressed properties.

10. How many properties should I analyze before making an offer?

There's no magic number, but many experienced investors follow the "100-10-1" rule: analyze 100 properties, make offers on 10, and get 1 accepted. The goal is to become so familiar with your market and your numbers that you can quickly identify a good deal. The more properties you analyze, the more confident and efficient you'll become.

At Top Wealth Guide, our mission is to give you the practical knowledge and tools to invest with confidence. Check out our resources and let's build a strategy to lock in your financial future. https://topwealthguide.com

1 Comment

Pingback: Top 10 Best Cities for Rental Properties in 2025