Using a HELOC for an investment property is a powerful strategy many seasoned real estate investors use to leverage their primary home's equity. This equity can then fund new property purchases or finance significant renovations. It functions like a flexible, revolving credit line, making it an ideal tool for capitalizing on market opportunities as they arise.

This guide provides an in-depth look at how to use a HELOC for real estate investing, backed by real-life examples and expert analysis. We'll cover qualification requirements, the pros and cons, a step-by-step process, and crucial risk management strategies to help you make an informed decision.

In This Guide

- 1 Your Home Equity: A Powerful Tool for Real Estate Investing

- 2 Qualifying for an Investment Property HELOC

- 3 Weighing the Pros and Cons of a HELOC Strategy

- 4 How to Buy an Investment Property with a HELOC: Step by Step

- 5 Getting a Handle on the Financial Risks and Tax Rules

- 6 What Are the Alternatives to a HELOC?

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. Can I buy an investment property entirely with a HELOC?

- 7.2 2. Is the interest on an investment property HELOC tax-deductible?

- 7.3 3. What is the biggest risk of a variable interest rate?

- 7.4 4. Do I need a separate HELOC for each new property?

- 7.5 5. How quickly can I access funds from a HELOC?

- 7.6 6. How does opening a HELOC affect my credit score?

- 7.7 7. Can I get a HELOC on an investment property I already own?

- 7.8 8. What is the difference between the "draw period" and "repayment period"?

- 7.9 9. Are the closing costs for a HELOC significant?

- 7.10 10. What is the single most important risk to consider?

Your Home Equity: A Powerful Tool for Real Estate Investing

It’s easy to think of your home's equity as a static number on paper—money locked away until you sell. But with a Home Equity Line of Credit (HELOC), that value becomes a dynamic financial instrument. A HELOC provides a reusable line of credit secured by your property, which can be a secret weapon for an ambitious investor.

What makes this financial product so appealing is the ability to access a substantial amount of cash without selling your home or disturbing a low-interest primary mortgage. For a foundational understanding, our guide on what equity is in real estate breaks down the core concepts.

The Two Phases of a HELOC

Understanding a HELOC is simpler when you see it in two distinct stages: the draw period and the repayment period. Each phase serves a different function in your investment strategy.

- The Draw Period: This is the active borrowing phase, typically lasting 10 years. During this decade, you can withdraw funds up to your credit limit, repay them, and withdraw again as needed. Payments are often interest-only, a significant advantage that keeps monthly costs low while you are acquiring or renovating a property.

- The Repayment Period: Once the draw period ends, the HELOC enters the repayment phase, which usually lasts for 15-20 years. You can no longer borrow money. Your monthly payments will now include both principal and interest, amortized over the remaining term of the loan.

This two-part structure offers incredible flexibility precisely when you need it for expenses like down payments, closing costs, or unforeseen repairs.

A Resurgence in Home Equity Lending

Using a HELOC for investing is not a new concept, but it has experienced a significant resurgence. Since 2022, homeowners have increasingly tapped into their accumulated wealth. By early 2024, the national HELOC debt had climbed to $359.9 billion, a 9.7% increase from the previous year.

With U.S. homeowners now holding a staggering $11.5 trillion in 'tappable' equity, it’s clear this is more than a fleeting trend. As Experian's home equity line of credit study highlights, borrowers are becoming more strategic.

By leveraging the value locked in your primary residence, you can acquire the capital needed to build a robust real estate portfolio and accelerate your wealth-building goals.

Qualifying for an Investment Property HELOC

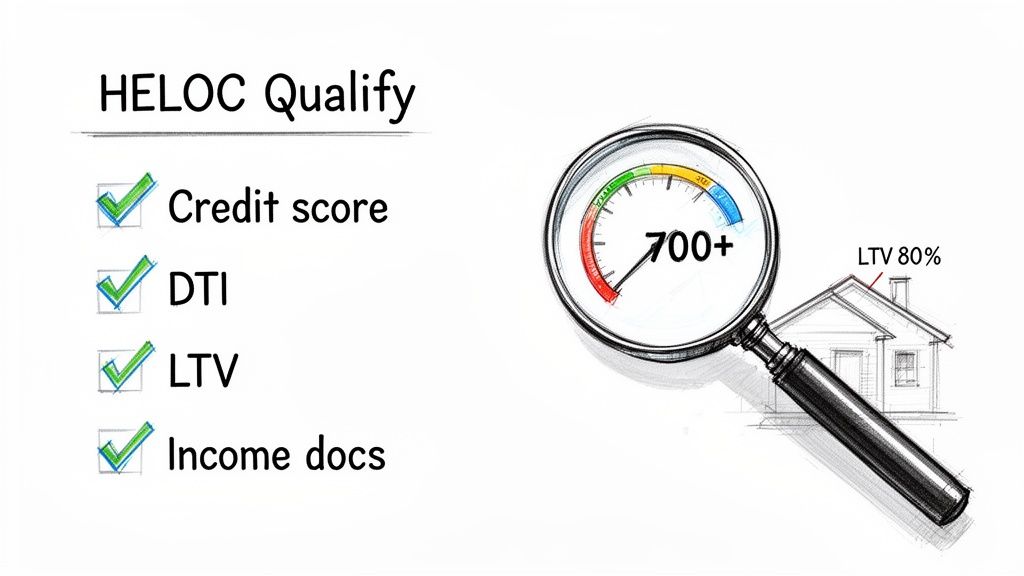

Securing a HELOC to purchase an investment property is fundamentally different from obtaining a loan for a primary residence. Lenders view it as a higher-risk endeavor, meaning your financial profile will be scrutinized meticulously. The underwriting standards are more stringent because the lender must be confident you can manage multiple mortgage payments, even if the new investment experiences a vacancy.

Because the lender assumes greater risk, you will face stricter criteria. They need assurance that you can handle the financial burden of an investment property, which is essentially a business venture.

The Financial Hurdles You Must Clear

To gain approval, you must present a rock-solid financial profile. Lenders will focus on four key areas to assess your ability to repay the loan and manage the risks associated with rental property ownership.

Your application's success hinges on these core metrics:

- Loan-to-Value (LTV) Ratio: Lenders almost universally cap the combined LTV at 75% to 80% for an investment-related HELOC. This means your current mortgage balance plus the new HELOC cannot exceed 80% of your primary home's appraised value. You need at least 20% to 25% equity to be considered.

- Credit Score: A strong credit score is non-negotiable. While a conventional loan might be possible with a lower score, for a HELOC on an investment property, most lenders require a FICO score of 720 or higher. This demonstrates a history of responsible debt management.

- Debt-to-Income (DTI) Ratio: Your DTI ratio measures the percentage of your gross monthly income that goes toward debt payments. Lenders typically look for a DTI of 43% or lower, proving you have sufficient financial capacity to take on an additional payment.

- Cash Reserves: Lenders need to see a financial safety net. Be prepared to show proof of at least six months' worth of mortgage payments—for both your primary residence and the new property—in a savings or investment account. This provides assurance that an unexpected vacancy or costly repair won't lead to default.

Expert Insight: Lenders are not just evaluating numbers; they are assessing you as a potential business owner. A well-organized application supported by a clear investment strategy can significantly enhance your credibility and improve your chances of approval.

Required Documentation Checklist

Organizing your paperwork before applying will streamline the entire process. It signals to the lender that you are prepared and serious, which can expedite your application.

Here is a summary of the documents you will almost certainly need to provide:

| Document Category | Specific Items Needed |

|---|---|

| Proof of Income | Your last 30-60 days of pay stubs, W-2s from the past two years, and your last two years of federal tax returns. |

| Asset Verification | Bank statements from the last 2-3 months, plus statements for any brokerage and retirement accounts. |

| Property Details | The most recent mortgage statement for your primary residence, your homeowners insurance declaration page, and your latest property tax bill. |

| Debt Information | Current statements for any auto loans, student loans, or other outstanding lines of credit. |

Understanding these requirements is crucial. To see how a HELOC fits into the broader financing landscape, review our detailed guide on how to finance an investment property. Ultimately, approaching a lender with a strong financial profile and a professional plan is the most effective way to secure the funding needed to expand your real estate portfolio.

Weighing the Pros and Cons of a HELOC Strategy

Using a HELOC for an investment property can be a game-changing move for building wealth, but it is a high-stakes strategy. While it offers unparalleled flexibility and rapid access to capital, it also introduces significant risks that demand meticulous management. A clear-eyed assessment of both sides is essential before proceeding.

The primary allure of a HELOC is its flexibility. Once established, it provides a line of credit ready for immediate use. This is a massive advantage when an attractive deal appears, allowing you to act swiftly without undergoing a new loan application process each time.

The Clear Advantages of This Approach

The structure of a HELOC is almost perfectly suited for real estate investors, particularly for short-term projects like fix-and-flips or the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy.

- Access to On-Demand Capital: Instead of receiving a lump sum, you draw funds as needed. This means you only pay interest on the money you are actively using, which is ideal for funding renovations in stages or covering unexpected repairs.

- Interest-Only Payments: During the initial draw period (typically 10 years), most HELOCs require you to cover only the interest. This keeps monthly payments extremely low while you are stabilizing the property or finding a tenant.

- Lower Closing Costs: Compared to a new mortgage or a cash-out refinance, HELOCs generally have much lower upfront fees. Some lenders even offer promotions with no closing costs, making it a more cost-effective way to access your home equity.

The Significant Risks to Consider

Despite its benefits, leveraging your home to fund an investment is a momentous decision. The very features that make a HELOC attractive can become its greatest weaknesses if not managed carefully.

The most prominent risk is the variable interest rate. A HELOC’s rate is not fixed; it is tied to a benchmark like the Prime Rate. If market rates rise, so will your payment, which can severely impact the cash flow from your investment property. This uncertainty can turn a profitable venture into a financial liability. Before pursuing this strategy, it is critical to learn how to calculate rental yields to stress-test your projections against potential rate increases.

Real-Life Example: The Disciplined vs. The Overleveraged Investor

Sarah, a disciplined investor, uses her HELOC to fund the down payment and renovation of a distressed single-family home. Her plan is to complete the rehab in four months and then refinance the property with a long-term, fixed-rate mortgage to pay off the HELOC. She sticks to her budget and timeline, successfully executing the BRRRR method. The variable rate poses minimal risk due to her short-term use.

In contrast, Tom uses his HELOC for the down payment on a turnkey rental property. He relies on the low interest-only payments, but two years later, market rates spike. His monthly HELOC payment triples, erasing his rental cash flow and putting him in a negative position. He is forced to sell the property in an unfavorable market to close the HELOC and protect his primary home.

This brings us to the most critical risk: your primary residence is the collateral. If the investment fails and you cannot make the HELOC payments, the lender can foreclose on your home. This is the ultimate risk and should be the paramount consideration in your decision-making process.

HELOC for Investment Property: A Comparative Look

A side-by-side comparison can help clarify whether this strategy aligns with your financial situation and risk tolerance.

| Advantages (Pros) | Disadvantages (Cons) |

|---|---|

| Revolving Credit: Borrow, repay, and borrow again without reapplying, offering unmatched flexibility. | Variable Interest Rates: Your monthly payments can rise unexpectedly, eroding your investment's profitability. |

| Interest-Only Payments: Keeps monthly expenses low during the crucial initial phase of stabilizing an investment. | Your Home is at Risk: Defaulting on the HELOC could lead to the foreclosure of your primary residence. |

| Lower Upfront Costs: Closing costs are typically much lower than for other types of real estate loans. | Temptation to Over-leverage: Easy access to cash can lead some investors to take on more debt than they can safely manage. |

The bottom line: a HELOC is a powerful tool in the right hands—for a disciplined investor with a solid plan, a financial safety net, and a clear exit strategy. However, for anyone unprepared for interest rate fluctuations or the possibility of a deal underperforming, it can be a perilous path.

How to Buy an Investment Property with a HELOC: Step by Step

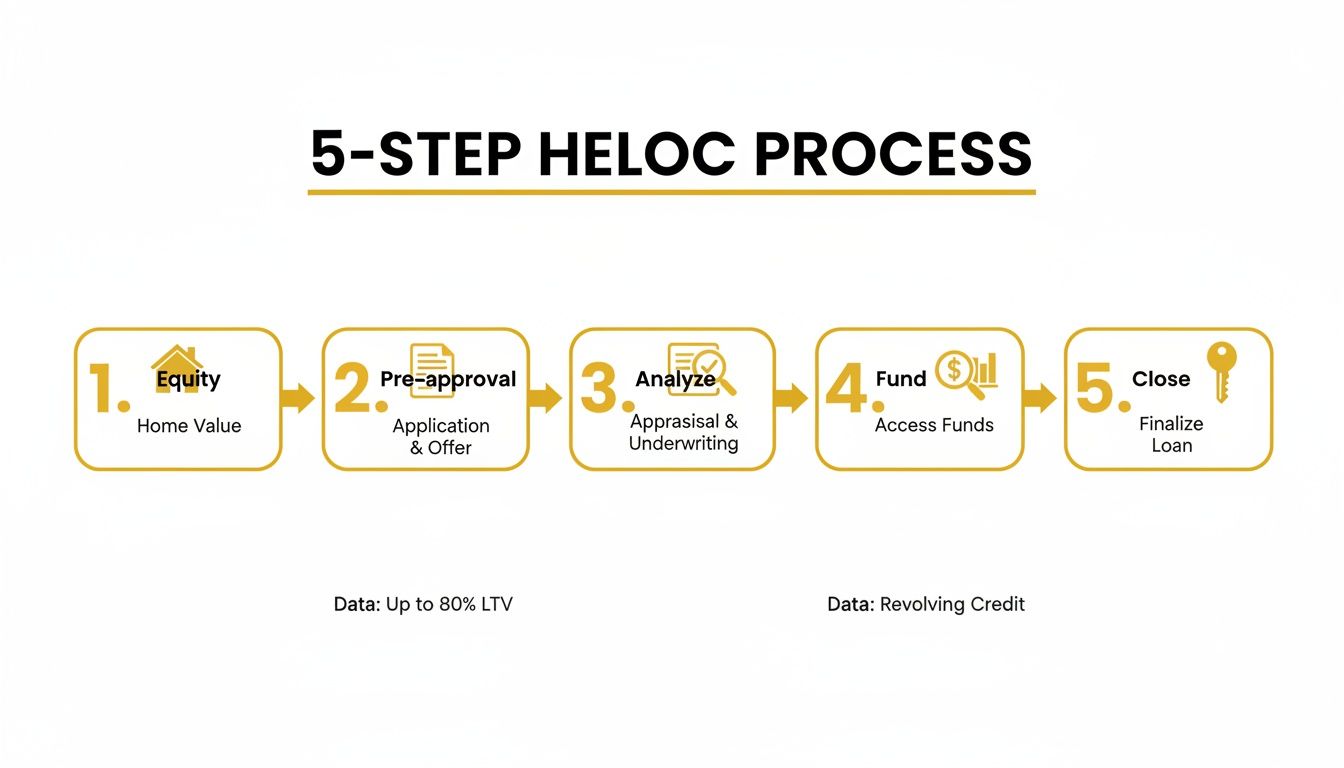

Let's transition from theory to practice with a clear, actionable playbook for using a HELOC for an investment property. We'll walk through the entire process in five manageable steps, transforming a complex financial maneuver into a straightforward plan.

To illustrate this, let's follow a fictional investor, Maria. She owns a primary home valued at $500,000 with a remaining mortgage balance of $280,000, leaving her with $220,000 in home equity. Maria's goal is to purchase her first rental property using a HELOC.

Step 1: Calculate Your Usable Equity

First, you must determine exactly how much you can borrow. Lenders will not let you access 100% of your equity. They typically allow you to borrow up to 80% of your home's value, minus your outstanding mortgage balance. This is known as the combined loan-to-value (CLTV) calculation.

Let's calculate Maria's potential HELOC amount:

- Home Value: $500,000

- Maximum LTV (80%): $500,000 x 0.80 = $400,000

- Current Mortgage Balance: $280,000

- Potential HELOC Amount: $400,000 – $280,000 = $120,000

Maria now knows she has access to a $120,000 line of credit. This is the capital she can deploy for her investment.

Step 2: Get Pre-Approved for the HELOC

With her borrowing power established, Maria's next step is to get pre-approved. This is a critical move that empowers her to make serious offers on properties. She gathers her financial documents (pay stubs, tax returns, bank statements) and applies with a lender.

The lender reviews her excellent credit score and low debt-to-income ratio, pre-approving her for the full $120,000 HELOC. She now has the official green light to begin her property search.

This diagram breaks down the key stages of the process, from calculating your equity to closing the deal.

Visualizing the steps can make what feels like an intimidating financial journey seem much more manageable.

Step 3: Find and Analyze a Potential Property

Now for the exciting part: property hunting. Maria searches for a property that aligns with her budget and investment criteria. She identifies a promising duplex listed for $300,000 that requires minor cosmetic updates. Before making an offer, she must perform a thorough financial analysis to ensure its profitability.

A crucial piece of this is due diligence. For a comprehensive guide on what to examine, our real estate due diligence checklist is an invaluable resource, covering everything from property inspections to financial verification.

Here’s a snapshot of Maria’s cash flow analysis:

| Income & Expenses | Monthly Amount |

|---|---|

| Gross Monthly Rent | $2,800 |

| Mortgage Payment (P&I) | -$1,500 |

| Property Taxes | -$250 |

| Homeowners Insurance | -$100 |

| Vacancy (5% Buffer) | -$140 |

| Repairs & Maintenance (8%) | -$224 |

| Total Monthly Expenses | -$2,214 |

| Net Monthly Cash Flow | $586 |

The analysis looks strong. The property is projected to generate a positive cash flow of $586 per month, totaling $7,032 annually.

Step 4: Fund the Down Payment with Your HELOC

Maria submits an offer on the duplex, and it is accepted. To secure a conventional investment property mortgage, she needs a 20% down payment, which amounts to $60,000 ($300,000 x 0.20).

This is where the HELOC becomes the key to the entire transaction. She draws $60,000 from her $120,000 HELOC to cover the down payment and closing costs. The best part? She still has $60,000 remaining in her credit line for future renovations or even another investment.

Key Takeaway: By using her HELOC, Maria acquired an income-producing asset without depleting her personal savings. Her cash reserves remain intact for emergencies.

Step 5: Close the Deal and Manage Your New Asset

On closing day, the $60,000 from Maria’s HELOC is wired to finalize the purchase. She is now an investment property owner. Her new monthly financial obligations include two separate loan payments: one for the new investment property mortgage, and one for the interest on the $60,000 she drew from her HELOC.

Assuming her HELOC has a 7% interest rate, her interest-only payment on the drawn amount would be approximately $350 per month ($60,000 x 0.07 / 12). Since her rental property generates positive cash flow, this payment is easily covered, validating her strategy. By following these steps, Maria successfully converted dormant home equity into a new stream of income.

Getting a Handle on the Financial Risks and Tax Rules

Tapping into your home's equity is a powerful financial move, but success hinges on mastering the numbers. If you're serious about using a HELOC for an investment property, you must fully understand the financial exposure and the specific tax rules involved. Overlooking these details can lead to significant financial setbacks.

One of the first questions every investor asks is whether the interest on their HELOC is tax-deductible. The answer is nuanced: Yes, it can be, but only under specific circumstances.

When you use HELOC funds to buy, build, or substantially improve an investment property, the interest paid is generally considered a business expense. This allows you to deduct it against your rental income, reducing your overall tax liability.

However, if you draw from that same HELOC for personal use—such as buying a car or consolidating credit card debt—that portion of the interest is not deductible. This is why maintaining meticulous, separate records is absolutely critical. You must be able to prove to the IRS precisely how every dollar was allocated. For a deeper dive, our article on property investment tax deductions provides a detailed breakdown.

Taming the Unpredictable Nature of a HELOC

By far, the most significant financial risk of a HELOC is its variable interest rate. Your monthly payment is not fixed; it fluctuates with market rates. An unexpected rate hike can transform a profitable rental into a money-losing asset almost overnight.

This is precisely why "stress-testing" your investment is non-negotiable. Before applying for a HELOC, you must model several worst-case scenarios to determine if the investment can withstand financial pressure.

- Rate Shock Scenario: How does your cash flow look if interest rates increase by 3%, 5%, or even 7%? Does the property still break even, or does it start generating a loss?

- Vacancy Scenario: How would you cover expenses if the property remained vacant for three consecutive months? You would be responsible for the HELOC payment and the investment property's mortgage, with all funds coming from your personal savings.

Investor Reality Check: If a 3% rate increase or a 90-day vacancy would create a financial crisis, you are not prepared for this level of risk. The goal is to build wealth, not to gamble with your financial security.

Your #1 Job: Protect Your Primary Residence

Never forget that your HELOC is secured by your personal home. If the investment underperforms and you are unable to make the payments, the lender has the right to foreclose. Protecting your home must be your top priority.

The best defense is a proactive one. This means building a robust financial safety net before drawing any funds from your HELOC. Your risk management plan should include these key elements:

| Risk Management Strategy | Actionable Step |

|---|---|

| Build an Emergency Fund | Maintain at least six months of total housing expenses (primary mortgage + HELOC + investment mortgage) in a separate, liquid account. |

| Define a Clear Exit Plan | Know your exit strategy before you invest. Will you sell if cash flow turns negative? Do you have a plan to refinance into a fixed-rate loan? |

| Maintain Meticulous Books | Use a separate bank account for your investment property. Diligently track every expense. This is vital for tax purposes and for calculating your true ROI. |

On a positive note, borrowing costs have recently become more favorable for investors. The monthly payment on a $50,000 HELOC draw, for instance, dropped from $412 to $311 between early 2024 and the end of Q1 2025. According to ICE Mortgage Technology's analysis on record levels of home equity, this decrease is attributed to introductory rates falling by 2.5 percentage points. Some forecasts even suggest rates could reach the mid-6% range by 2026.

While lower rates are appealing, they do not eliminate the inherent risks. A disciplined approach, supported by solid financial planning and a thorough understanding of the tax implications, is the only way to make a HELOC a successful tool in your investment arsenal.

What Are the Alternatives to a HELOC?

A HELOC is an incredibly flexible tool, but it is not the only method for financing a real estate investment. A savvy investor understands the importance of having a diverse financial toolbox and knowing which instrument is best suited for each situation.

Sometimes, the stability of a fixed-rate loan is paramount. Other times, the speed of a private loan is the only way to secure a deal. The optimal choice depends on your specific project, your timeline, and your personal risk tolerance.

Let's explore three popular financing alternatives and their ideal applications.

Cash-Out Refinance

A cash-out refinance involves replacing your current mortgage with a new, larger one and receiving the difference in cash. This allows you to access a significant portion of your home's equity in a single lump sum.

The new loan is typically a 30-year fixed-rate mortgage, providing predictable monthly payments. This makes it an excellent choice for large, one-time capital needs, such as a down payment on a new property or a full-scale renovation project. The primary benefit is the stability of a fixed interest rate, which protects you from market volatility.

The trade-off is that you will incur closing costs again, and you may have to relinquish a very low interest rate from your previous mortgage. This is a significant consideration that requires careful analysis.

Traditional Investment Property Mortgage

This is the most conventional and straightforward financing method. You apply for a separate mortgage directly on the investment property you intend to purchase. This loan is independent and does not use your primary residence as collateral.

This approach is ideal for investors who have sufficient cash for a down payment—typically 20-25% for an investment property—and prefer to keep their personal and investment finances separate. It is a clean transaction that does not endanger your home, providing significant peace of mind.

The main obstacle, however, is the substantial down payment required, which can be a barrier for new investors.

Private Money Loans

Private money loans are provided by individuals or small investment groups rather than large banks. They specialize in short-term real estate financing and are known for their speed.

These are typically interest-only loans favored by fix-and-flip investors who need to close deals quickly. A private lender can often provide funds within a week or two, whereas a traditional bank might take over a month.

This option is tailored for experienced flippers with a proven track record and a clear plan to sell the property promptly. However, this speed comes at a premium. Interest rates are significantly higher than bank loans, and you will usually pay upfront "points" (fees calculated as a percentage of the loan). It is a high-cost tool designed for short-term, high-profit projects.

Comparing Financing Options for Your Next Investment Property

This table provides a clear comparison to help you determine the right path for your specific investment goals.

| Financing Method | Interest Rate Type | Best For | Key Consideration |

|---|---|---|---|

| HELOC | Variable | Short-term projects, renovations, and having flexible, on-demand capital. | Your primary home is the collateral, and payments can rise with market interest rates. |

| Cash-Out Refinance | Fixed | Large, one-time funding needs and investors who prioritize payment stability. | Replaces your entire mortgage, potentially losing a low rate; closing costs are higher. |

| Investment Mortgage | Fixed | Keeping investment finances separate and avoiding leverage on your primary home. | Requires a significant cash down payment, typically 20% or more. |

| Private Money Loan | Fixed (High) | Rapid property acquisitions, such as fix-and-flips, where speed is critical. | Much higher interest rates and fees; designed exclusively for short-term use. |

Ultimately, whether you choose the revolving flexibility of a HELOC or the steadfast predictability of a fixed-rate loan, the objective remains the same: select the financing that best supports your journey toward building a successful real estate portfolio.

Frequently Asked Questions (FAQ)

Here are answers to the 10 most common questions investors have when considering a HELOC for an investment property.

1. Can I buy an investment property entirely with a HELOC?

Yes. If your available HELOC credit line is large enough to cover the full purchase price of a property, you can use it to make an all-cash offer. This strategy is particularly effective for investors targeting lower-priced properties or those who have built substantial equity in their primary residence.

2. Is the interest on an investment property HELOC tax-deductible?

In most cases, yes. When HELOC funds are used to buy, build, or substantially improve an investment property, the interest paid typically qualifies as a deductible business expense against rental income. However, tax laws are complex and subject to change, so consulting with a tax professional is always recommended.

3. What is the biggest risk of a variable interest rate?

The primary risk is that a rise in market interest rates will increase your monthly HELOC payment. This can shrink or eliminate your property's cash flow, turning a profitable investment into a financial burden. It is crucial to stress-test your numbers to ensure the investment can withstand potential rate hikes.

4. Do I need a separate HELOC for each new property?

No, and that is a key advantage. You establish one HELOC secured by a single property (usually your primary home), and that credit line can be used to fund multiple investments. You can draw from it for down payments or full purchases on several properties, provided you do not exceed your total credit limit.

5. How quickly can I access funds from a HELOC?

Once the HELOC is established, access to the funds is almost instantaneous. Lenders typically provide a debit card or a checkbook linked to the account. This speed allows you to act decisively when a promising investment opportunity arises.

6. How does opening a HELOC affect my credit score?

Applying for a HELOC results in a hard credit inquiry, which may cause a small, temporary dip in your credit score. The new line of credit will also appear on your credit report. If managed responsibly with on-time payments, it can positively contribute to your credit history over time.

7. Can I get a HELOC on an investment property I already own?

It is possible, but lenders are generally more cautious. The terms are often less favorable, with lower loan-to-value (LTV) limits and higher interest rates. Lenders view a HELOC on a non-owner-occupied property as a higher risk compared to one secured by your primary residence.

8. What is the difference between the "draw period" and "repayment period"?

The draw period is the initial phase, often 10 years, during which you can borrow, repay, and re-borrow funds up to your credit limit, similar to a credit card. Payments during this time are often interest-only. The repayment period follows, typically for 15-20 years. Borrowing is frozen, and you begin making payments that cover both principal and interest on your outstanding balance.

9. Are the closing costs for a HELOC significant?

Generally, no. HELOC closing costs are typically much lower than those for a traditional mortgage, often ranging from a few hundred to a couple of thousand dollars. Some lenders even offer "no-closing-cost" HELOCs, though it's wise to verify if this is offset by a higher interest rate.

10. What is the single most important risk to consider?

The most critical risk is that your HELOC is secured by your home. If your investment fails and you default on the HELOC payments, the lender can foreclose on your primary residence. This underscores the absolute necessity of careful financial planning, risk assessment, and maintaining an emergency fund.

At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. To explore more about real estate, stocks, and other investment avenues, visit us at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.