Thinking about investing in cryptocurrency? You're in the right place. At its core, crypto investing involves buying digital assets like Bitcoin or Ethereum with the expectation that their value will increase over time. But it’s more helpful to see it as an investment in a new, groundbreaking technology rather than just a digital stock. This guide is your complete roadmap for navigating this exciting—and admittedly volatile—world with confidence.

In This Guide

- 1 Your Crypto Investing Journey Starts Here

- 2 Understanding Core Cryptocurrency Concepts

- 3 Choosing Your Cryptocurrency Investment Platform

- 4 Developing Your First Crypto Investment Strategy

- 5 Managing Risks and Securing Your Digital Assets

- 6 Let's Talk About Crypto Taxes and Regulations

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How much money do I need to start investing in crypto?

- 7.2 2. What cryptocurrency should I buy first?

- 7.3 3. Is it too late to invest in Bitcoin?

- 7.4 4. How do I cash out my cryptocurrency back into dollars?

- 7.5 5. How do I research a new crypto project?

- 7.6 6. Is my cryptocurrency insured like money in a bank?

- 7.7 7. What are "gas fees"?

- 7.8 8. What's the difference between investing and trading?

- 7.9 9. Can I lose more money than I invest?

- 7.10 10. What is a stablecoin and why would I use one?

Your Crypto Investing Journey Starts Here

Welcome. This guide is designed to take you from a curious beginner to a confident crypto investor. The world of digital assets can feel like a maze of complex jargon and wild price swings, but our goal is to cut straight through that noise. We'll give you a clear, practical path to follow.

We'll start with the absolute basics and then move, step-by-step, through picking the right platforms, crafting a smart strategy, and managing the inevitable risks. Forget the dry, textbook definitions. We'll use simple analogies and real-life examples to explain the why behind the how, making sure everything clicks.

Why Is Everyone Talking About Crypto Now?

The buzz around digital assets isn't just hype; there's a real shift happening. Global adoption is picking up steam, and it’s changing how people think about money and digital ownership.

- Going Mainstream: Big-name companies and even traditional financial institutions are starting to get on board. This brings a level of legitimacy and stability that just wasn't there a few years ago.

- More Than Just Money: The technology behind crypto, especially blockchain, is finding incredible new uses. We're seeing it pop up in everything from supply chain management to digital art, hinting at huge long-term potential.

- A New Flavor for Your Portfolio: For many investors, crypto is a great way to diversify. It moves differently than traditional assets like stocks and bonds, which can help balance your overall portfolio. You can get a refresher on these core principles in our complete guide on how to start investing money.

The numbers back this up. Cryptocurrency ownership has surged, with a significant portion of the population in major markets now holding some. This growth is a clear signal that investor confidence is on the rise. You can dig deeper into these trends by checking out the latest data on global crypto adoption.

What You Will Learn in This Guide

We've structured this guide to build your knowledge from the ground up. We’ll cover all the core pillars of crypto investing so you have the confidence and the tools to make smart decisions for yourself.

This is about more than just buying a few coins. It's about understanding a whole new financial ecosystem. We're focused on helping you become a strategic, informed participant—not a gambler chasing quick wins. By the end, you'll have a solid framework to make your first investment.

Our focus is on practical, actionable steps. Whether you’re looking to make your first $50 investment or planning to allocate a larger sum, the fundamental principles are the same. Let's get started.

Understanding Core Cryptocurrency Concepts

Before you even think about putting money into crypto, you need to get the lay of the land. Let's skip the dense, technical stuff for now. Instead, I'll walk you through the big ideas using simple analogies. Think of it like learning the rules of the road before you get behind the wheel.

At the very heart of almost every crypto is the blockchain. The easiest way to picture it is as a digital ledger—like a shared notebook that’s copied and spread across thousands of computers. Every transaction is a new line item in this notebook. And here's the kicker: once a line is written, it can’t be erased or changed. It's there for good.

This brings us to another huge concept: decentralization. No single person, company, or government owns this shared notebook. It’s collectively maintained by everyone on the network, which makes it incredibly transparent and nearly impossible for one entity to control or censor. If you want to go a bit deeper, we've broken it all down in our guide explaining what cryptocurrency is and how it works.

Coins vs. Tokens: What Is the Difference?

You'll hear the terms "coin" and "token" thrown around a lot, often interchangeably, but they are not the same thing. Knowing the difference is crucial because they serve completely different functions.

| Aspect | Coins (e.g., Bitcoin, Litecoin) | Tokens (e.g., UNI, LINK on Ethereum) |

|---|---|---|

| Foundation | Operate on their own independent blockchain. | Built on top of an existing blockchain (like Ethereum). |

| Primary Purpose | To act as money: a store of value and medium of exchange. | To provide utility within a specific application or ecosystem. |

| Analogy | Like the native currency of a country (e.g., USD, EUR). | Like an arcade token or a concert ticket for a specific venue. |

| Examples | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC). | Uniswap (UNI), Chainlink (LINK), Shiba Inu (SHIB). |

This is the first step on your crypto journey—getting these core concepts down. Once you do, you're ready to think about where to buy and how to build a strategy.

As you can see, a solid foundation of knowledge is what all your future decisions will be built on.

Wallets and Keys: Your Digital Bank Account

To actually hold and use crypto, you’ll need a crypto wallet. This isn’t something you carry in your pocket; it’s a program or device that stores your digital assets and lets you send and receive them. It’s your personal portal to the crypto economy.

Every wallet boils down to two critical pieces of information:

- Public Key: This works like your bank account number. You can share it with anyone without worry so they can send you funds.

- Private Key: This is the master key to your funds. It's a long, secret code that proves you own your crypto and gives you the ability to spend it. If you lose your private key, your crypto is gone forever. No exceptions.

A good way to think about it is this: your public key is your home address, which you can give out freely. Your private key is the actual key to your front door. You'd never share that with anyone, right? Same principle applies here.

The excitement around these ideas isn't just hype. The global cryptocurrency market has grown substantially, with projections indicating continued expansion. That kind of growth shows that more and more people are buying into the potential here.

Now that you've got these fundamentals down, you’re in a much better position to start navigating this market with confidence.

Choosing Your Cryptocurrency Investment Platform

Alright, you've got the basics down. Now it's time for the fun part: actually getting into the market. The platform you choose is your gateway to the world of crypto, and it's a decision that will absolutely shape your entire investing experience.

Think of it like choosing a bank. You could go with a big, traditional institution that offers lots of hand-holding, or you could opt for a more independent, self-directed online service. Both get you where you need to go, but they're built for different people with different needs.

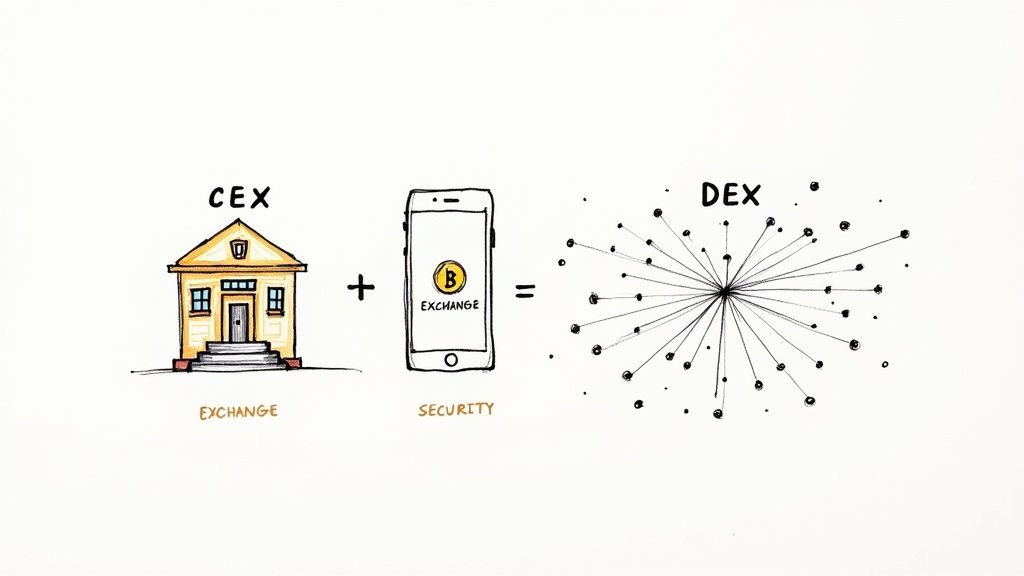

In crypto, your main choices are centralized exchanges (CEX) and decentralized exchanges (DEX). Getting a handle on how they differ is the first real step to picking the right one for you.

Centralized Exchanges (CEX)

Centralized exchanges—think big names like Coinbase or Binance—work a lot like the stockbrokers you're already familiar with. They're companies that act as a trusted middleman, connecting buyers and sellers and making sure everything runs smoothly. For most people just starting out, a CEX is the perfect on-ramp.

They're designed to be incredibly user-friendly. You can usually fund your account with a debit card or a simple bank transfer, and the interfaces are clean and intuitive. But this convenience comes with a trade-off. Because the CEX manages your funds for you, you're not technically in control of your crypto's private keys.

You’ll hear this a lot in crypto: "Not your keys, not your coins." When you use a CEX, you're trusting that company to keep your assets safe, just like you trust a bank to hold your cash.

For anyone dipping their toes in for the first time, a solid CEX is often the best bet. If you're looking for a place to start, our breakdown of the best cryptocurrency exchanges for beginners can point you in the right direction.

Decentralized Exchanges (DEX)

On the other side of the coin, you have decentralized exchanges, or DEXs. These platforms capture the original, peer-to-peer spirit of crypto. A DEX like Uniswap is simply a marketplace where you can trade directly with another person, with no company in the middle.

With a DEX, there's no one holding your funds but you. You maintain 100% control over your private keys from start to finish. This gives you much greater security from platform-specific hacks and eliminates any chance of censorship.

The catch? DEXs have a much steeper learning curve. You'll need to set up and manage your own crypto wallet, and you become solely responsible for keeping it secure. It's empowering, but the buck stops with you.

CEX vs. DEX: A Direct Comparison

To help you decide, let's put them side-by-side. Your personal preference for ease of use, total control, or the types of coins you want to buy will steer you toward one or the other.

| Feature | Centralized Exchanges (CEX) | Decentralized Exchanges (DEX) |

|---|---|---|

| Ease of Use | Very beginner-friendly with simple interfaces and customer support. | Requires more technical knowledge; you are your own support. |

| Security | You trust the exchange's security measures to protect your funds. | You have full control, but are solely responsible for your own security. |

| Fees | Generally higher, with trading fees and withdrawal charges. | Typically lower, consisting mainly of network "gas" fees. |

| Asset Control | The exchange holds your private keys; "not your keys, not your coins." | You retain full custody of your private keys and assets at all times. |

| Anonymity | Requires identity verification (KYC) to comply with regulations. | No KYC needed; trading is pseudonymous via your wallet address. |

| Asset Variety | Lists popular, vetted cryptocurrencies. | Often lists a wider, more diverse range of new and niche tokens. |

Ultimately, there's no single "best" choice—it all comes down to what you're comfortable with and what you want to achieve. In fact, many seasoned investors use both types of platforms. They might use a CEX to easily convert their cash into crypto, then move it to a DEX to trade a wider range of tokens while keeping full control.

Developing Your First Crypto Investment Strategy

Okay, you've picked your crypto exchange. Now the real work begins. We're shifting from the where to the how—and a solid strategy is what separates calculated investing from just gambling. Think of it as your roadmap, the thing that keeps you grounded when the market gets wild and your emotions start screaming at you to buy or sell.

This isn't about day trading or trying to predict the future with complicated charts. For anyone just starting out, the best strategies are the simplest ones. They give you a solid foundation to build your portfolio, manage your expectations, and actually move toward your financial goals.

Let's dive into two of the most common and effective approaches for beginners.

Thinking Long-Term with HODLing

You'll hear the term HODLing thrown around a lot in crypto circles. It actually started as a hilarious typo in an old Bitcoin forum but has since been adopted to mean "Hold On for Dear Life." The philosophy is incredibly simple: buy a cryptocurrency you genuinely believe in and hold it for the long haul, tuning out the noise of short-term price swings.

The core belief behind HODLing is that while crypto is famously volatile day-to-day, the best projects will grow in value substantially over many years. This takes patience and real conviction.

Real-Life Example: An early Bitcoin investor who bought $1,000 worth in 2013 and HODLed through multiple market crashes would have seen that investment grow to hundreds of thousands of dollars, far outperforming someone who panic-sold during the first major dip.

This strategy is a natural fit for assets like Bitcoin, which many investors treat as a long-term store of value—a sort of digital gold.

Smoothing Out the Bumps with Dollar-Cost Averaging

Another fantastic strategy, especially for beginners, is Dollar-Cost Averaging (DCA). Instead of dumping a large chunk of money in all at once and praying you picked the right time, you invest a smaller, fixed amount on a regular schedule.

For example, you could decide to buy $50 worth of Ethereum every single Friday, no matter what the price is.

- When the price is high, your $50 buys a little less ETH.

- When the price is low, that same $50 buys you a lot more.

Over months and years, this simple trick averages out your buy-in price, drastically reducing the risk of you accidentally investing your entire sum at the top of a market bubble. DCA is a disciplined, low-stress way to build your position over time.

Building Your Starter Portfolio

A smart first portfolio isn’t about betting it all on one horse. A good starting point is to build a portfolio with a strong, stable foundation while leaving a little room for some higher-growth (and higher-risk) bets.

Here’s a popular way to think about allocating your funds:

| Asset Category | Allocation Example | Rationale | Examples |

|---|---|---|---|

| Blue-Chip Cryptos | 70-80% | This is your foundation. These have the longest track records, largest market caps, and are considered the "safest" bets. | Bitcoin (BTC), Ethereum (ETH) |

| Promising Altcoins | 10-20% | Established projects with strong potential for higher growth, but they come with more risk than blue-chips. | Cardano (ADA), Solana (SOL), Polygon (MATIC) |

| Speculative Plays | 0-10% | The "moonshot" portion. Reserved for newer, high-risk, high-reward projects. Only use money you are 100% willing to lose. | New DeFi or gaming tokens |

This balanced structure gives you a solid core with a bit of exposure to potential breakout stars. If you want to dive deeper into more advanced portfolio ideas, check out our guide on different cryptocurrency investing strategies.

It’s crucial to keep perspective. While the top cryptocurrencies have a combined market value of over two trillion U.S. dollars, the market is still driven heavily by speculation on future value. Your strategy should reflect that reality by focusing on long-term appreciation.

Managing Risks and Securing Your Digital Assets

In the world of crypto, picking winning coins is only half the battle. Just as critical is knowing how to protect what you own. This means mastering two completely different but equally important skills: navigating the market's wild price swings and locking down your digital assets against threats.

Let's break down how to build a solid playbook for both.

First up is market risk. The crypto market is famously volatile, with prices that can rocket up or plummet without warning. It's incredibly easy to make emotional, fear-based decisions when you see your portfolio drop 20% in a single afternoon.

The key is to set up your mental framework before you put any money on the line. This all starts with the golden rule of this space: only invest what you are genuinely prepared to lose. This isn't just some catchy phrase; it’s the bedrock of a healthy mindset that lets you ride out the storms without panicking.

Understanding Your Role as Head of Security

Once you have a handle on managing market risk, your focus has to shift to personal security. With traditional banking, institutions have layers of insurance and protection for your money. In crypto, you are your own bank—and that means you're also your own head of security.

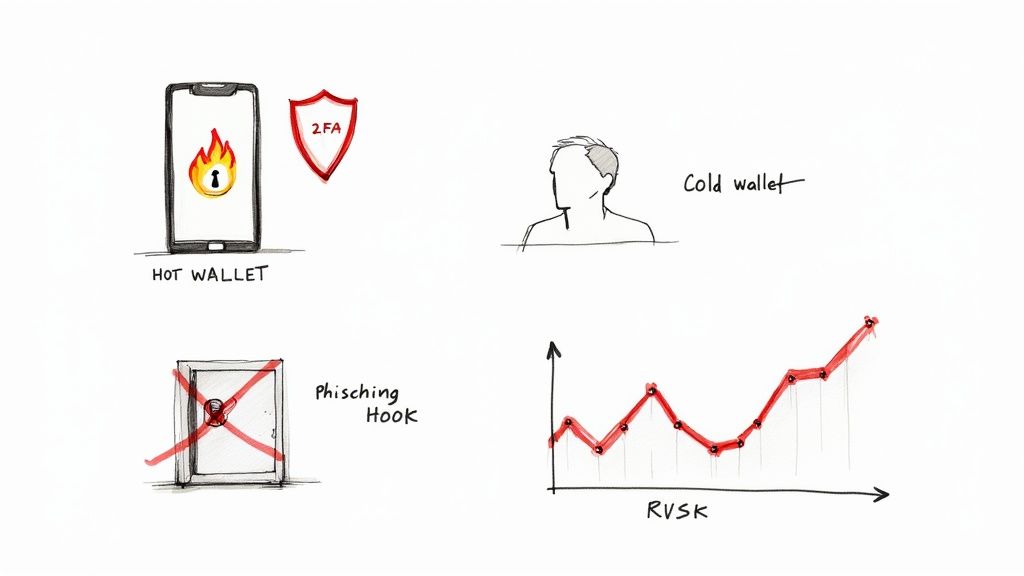

This responsibility begins with knowing where and how you store your coins. The main tools for the job are crypto wallets, which come in two primary flavors: hot and cold.

- Hot Wallets: These are software-based wallets connected to the internet, like mobile apps or browser extensions. They’re convenient for quick trades but are more exposed to online threats.

- Cold Wallets: These are physical hardware devices that keep your crypto completely offline. They provide the highest level of security for long-term holding.

Think of it like this: a hot wallet is your checking account, perfect for spending and small, frequent transfers. A cold wallet is your safe deposit box, where you lock away your most valuable assets for maximum protection. For a more detailed look at these fundamentals, our guide on cryptocurrency for beginners is a great starting point.

Hot Wallets vs. Cold Wallets: A Security Breakdown

Which wallet is right for you? It really just depends on your goals. Someone actively day-trading has very different needs than a long-term "HODLer." This table lays out the key trade-offs between convenience and security.

| Feature | Hot Wallet (Software) | Cold Wallet (Hardware) |

|---|---|---|

| Primary Use Case | Frequent trading, daily use | Long-term holding, high security |

| Internet Connection | Always connected | Completely offline |

| Security Level | Good, but vulnerable to online attacks | Excellent, immune to online hacks |

| Convenience | High, easily accessible | Lower, requires physical device access |

| Cost | Usually free | Typically $60 – $200 |

| Best For | Small amounts, active traders | Large amounts, long-term investors |

Your Essential Security Checklist

Beyond just picking a wallet, practicing smart digital hygiene is absolutely non-negotiable. Scammers are always cooking up new ways to target crypto investors, but a few core habits can stop the vast majority of attacks in their tracks.

In cryptocurrency, the weakest link in the security chain is almost always human error. Your private keys are the literal keys to your kingdom; guard them with your life and never share them with anyone, for any reason.

Follow these steps to build a rock-solid security routine:

- Enable Two-Factor Authentication (2FA): Always use an authenticator app (like Google Authenticator) for your exchange and email accounts instead of SMS. This one step adds a critical barrier against intruders.

- Beware of Phishing Scams: Be hyper-vigilant about suspicious emails, direct messages, or websites that promise free crypto or urgent account action. Scammers create convincing fake login pages to steal your credentials.

- Secure Your Private Keys Offline: Never, ever store your private keys or seed phrase on a computer, in an email, or on a cloud service. Write them down on paper and keep them in multiple secure, physical locations.

Let's Talk About Crypto Taxes and Regulations

Look, nobody enjoys thinking about taxes, but it's an absolutely essential part of investing in crypto responsibly. While this is not financial advice, and you should consult a qualified professional, getting a handle on the basics now will save you a world of pain later.

In most places, including the U.S., tax authorities see cryptocurrency as property. Think of it less like cash and more like a stock or a piece of real estate. This little detail changes everything about how it's taxed. It means you owe taxes on your profits whenever you sell, trade, or spend your coins—not just when you cash out into dollars.

So, What Triggers a Tax Bill?

A "taxable event" is basically any move you make that locks in a profit or a loss. You might be surprised by how many everyday crypto activities actually count. Getting familiar with these is the first step to staying on the right side of the tax man.

Here are the most common transactions that will have tax implications:

- Selling crypto for cash: This is the obvious one. Selling your Bitcoin for U.S. Dollars, for instance.

- Trading one crypto for another: This catches a lot of people off guard. Swapping your Ethereum for Solana is a taxable event because you're technically "selling" your ETH.

- Using crypto to buy things: That coffee you bought with crypto? That's a sale in the eyes of the IRS. The same goes for buying a new laptop or anything else.

- Earning crypto income: Getting rewards from staking, mining, or even some airdrops is usually treated as regular income, taxed at your normal rate.

The good news? Just buying and holding crypto isn't a taxable event. You don't owe anything until you actually sell, swap, or spend it. This is why keeping clean records of every single transaction is non-negotiable.

Figuring Out Your Gains and Losses

Your tax is calculated on the difference between what you paid for your crypto (your "cost basis") and what you got for it when you sold it.

Let's walk through a quick, real-world example. Say you bought 0.1 BTC for $5,000. A year goes by, and you decide to trade that 0.1 BTC for some Ethereum. At that exact moment, your 0.1 BTC is worth $7,000.

- Sale Price: $7,000

- Cost Basis: $5,000

- Capital Gain: $2,000

Even though you never touched traditional money, you have a $2,000 capital gain that you need to report on your taxes. The timing of that trade matters, too.

Short-Term vs. Long-Term Gains

How long you held onto an asset completely changes how it's taxed. This is a crucial distinction that can save you a lot of money.

| Gain Type | Holding Period | How It's Taxed |

|---|---|---|

| Short-Term | One year or less | Taxed just like your regular income, at your highest tax bracket. |

| Long-Term | More than one year | Taxed at much lower, more favorable long-term capital gains rates. |

Trying to manually track the dates, costs, and sale prices for every transaction is a recipe for disaster. Thankfully, there are plenty of great crypto tax software tools out there. They can sync with your exchanges and wallets to automatically crunch the numbers and spit out the reports you need for tax time.

Frequently Asked Questions (FAQ)

We've covered a lot of ground, but you probably still have a few questions. That's completely normal. Let's tackle some of the most common ones that new investors have.

1. How much money do I need to start investing in crypto?

You can start with a very small amount. Many exchanges allow you to buy as little as $10 or $20 worth of cryptocurrency. The key is not the amount, but the consistency. Using a strategy like Dollar-Cost Averaging (DCA) with a small, regular investment is a great way to begin.

2. What cryptocurrency should I buy first?

For most beginners, starting with the two largest and most established cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), is a sensible approach. They are considered the "blue chips" of the crypto market, with the most liquidity and a longer track record, making them generally less volatile than smaller altcoins.

3. Is it too late to invest in Bitcoin?

While it's true that the days of buying Bitcoin for a few dollars are long gone, many investors still see long-term potential due to its fixed supply and growing adoption as a store of value. Instead of worrying about timing the market perfectly, focus on a long-term strategy. Investing a small, fixed amount regularly (DCA) can mitigate the risk of buying at a peak.

4. How do I cash out my cryptocurrency back into dollars?

Cashing out is the reverse of buying. On a centralized exchange, you simply sell your cryptocurrency for your local currency (e.g., USD, EUR). The funds will then appear in your account balance, and you can withdraw them to your linked bank account. Remember that this sale is a taxable event.

5. How do I research a new crypto project?

Thorough research is critical. Start with the project's whitepaper to understand its goals and technology. Investigate the development team—look for experience and a public track record. Analyze the "tokenomics" to understand the coin's supply, distribution, and utility. Finally, engage with the community on platforms like Discord or Telegram to gauge active development and user sentiment.

6. Is my cryptocurrency insured like money in a bank?

No. Unlike bank deposits protected by government programs like the FDIC, cryptocurrency holdings are generally not insured. While some exchanges have private insurance against large-scale hacks of their own systems, this does not cover individual account compromises. This is why self-custody with a hardware wallet is recommended for significant amounts.

7. What are "gas fees"?

Gas fees are transaction costs on a blockchain network, most notably Ethereum. Think of them as a toll you pay to use the network's computational power to process and validate your transaction. Fees fluctuate based on network congestion—the busier the network, the higher the gas fees.

8. What's the difference between investing and trading?

Investing in crypto is a long-term strategy. You buy and hold assets ("HODL") for months or years, based on the belief in their fundamental value and future growth. Trading is a short-term approach, involving frequent buying and selling to profit from price volatility. Trading is much riskier and requires significant expertise.

9. Can I lose more money than I invest?

If you are simply buying and holding crypto (spot investing), you cannot lose more than your initial investment. The value can go to zero, but not below. However, if you use advanced financial instruments like leverage or margin trading, you can absolutely lose more than your initial capital. Beginners should stick strictly to spot investing.

10. What is a stablecoin and why would I use one?

A stablecoin is a type of cryptocurrency whose value is pegged to a stable asset, usually the U.S. dollar. This design keeps its price stable, typically at or near $1. Investors use stablecoins like USDC and USDT as a safe haven to hold value on an exchange without being exposed to the volatility of other cryptocurrencies, or to facilitate trading.

Ready to build your financial future with confidence? At Top Wealth Guide, we provide the strategies and insights you need to navigate the world of investing, from crypto and stocks to real estate. Explore our resources and start your journey toward wealth creation today at https://topwealthguide.com.