At its core, real estate investing is a time-tested way to build real, long-term wealth. You’re not just buying a property; you’re acquiring an asset—a financial engine designed to generate income, grow in value, and even provide unique tax perks along the way. Think of this guide as your first step, written by someone who has navigated this path, to help you understand the fundamentals and make informed decisions.

In This Guide

- 1 Why Real Estate Investing Is Still A Powerful Wealth Builder

- 2 Choosing Your Investment Path

- 3 Mastering The Key Financial Metrics

- 4 How To Fund Your First Investment Property

- 5 A Step-By-Step Guide To Your First Purchase

- 6 Avoiding Common Beginner Mistakes and Managing Risk

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How much money do I actually need to start?

- 7.2 2. Should I form an LLC before buying my first property?

- 7.3 3. What credit score do I need to get an investment loan?

- 7.4 4. How do I find a good deal in a competitive market?

- 7.5 5. Should I manage the property myself or hire a property manager?

- 7.6 6. What are the biggest hidden costs of owning a rental?

- 7.7 7. Is house flipping as easy as it looks on TV?

- 7.8 8. What's more important: cash flow or appreciation?

- 7.9 9. How do I analyze a rental property deal quickly?

- 7.10 10. Can I invest in real estate if I live in an expensive area?

Why Real Estate Investing Is Still A Powerful Wealth Builder

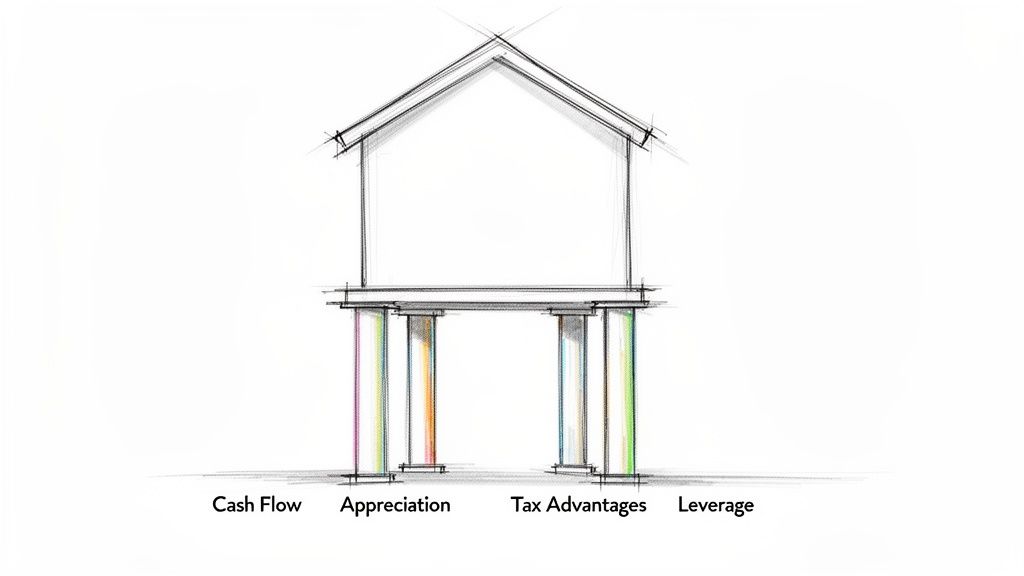

Before we jump into the "how" of buying your first property, it’s essential to get a firm grip on the "why." Real estate isn't just about owning a house; it’s a strategic vehicle for financial growth. Think of it like a sturdy structure built on four powerful pillars that all work together to boost your net worth.

Even with today's high interest rates and tight inventory, the fundamental principles that make real estate such a potent investment haven't changed. Let’s break down exactly how it works.

The Four Pillars of Real Estate Returns

Unlike stocks or bonds, which usually grow in just one way, real estate can generate wealth from multiple angles at the same time. Getting to know these four pillars is the first real step on your journey as an investor.

- Cash Flow: This is the money left in your pocket after you’ve collected rent and paid all the bills—mortgage, taxes, insurance, and maintenance. Positive cash flow is like getting a monthly paycheck directly from your property.

- Appreciation: This is the slow-and-steady increase in your property's value over time. It's driven by things like inflation, growing demand in your area, and any improvements you make. Appreciation is where serious, long-term equity is built.

- Tax Advantages: The government offers some pretty incredible tax breaks to property owners. You can deduct expenses like mortgage interest and property taxes. The real game-changer, though, is depreciation—a non-cash deduction that can significantly lower your taxable income.

- Leverage: This is the magic of using other people's money (a mortgage) to control a large asset. You might only put down 20% of your own cash, but you control 100% of the property and get to keep all the benefits from cash flow and appreciation. It’s a powerful way to amplify your returns.

Let's be honest: the current market has its hurdles. Stepping into real estate as a beginner today means you’re up against a landscape dominated by repeat buyers and all-cash offers. A recent report found that first-time buyers now make up just 21% of the market—the lowest share since tracking began back in 1981.

This is mostly due to tight inventory and affordability issues, which makes the game tougher, but definitely not impossible for newcomers. You can discover more insights into these market extremes from the National Association of Realtors.

Despite these conditions, the opportunities are still out there for those who know what to look for. By understanding the core pillars, you can learn to spot deals that make sense, even in a competitive market. It helps to remember why real estate is still a good investment and keep the long-term benefits in focus.

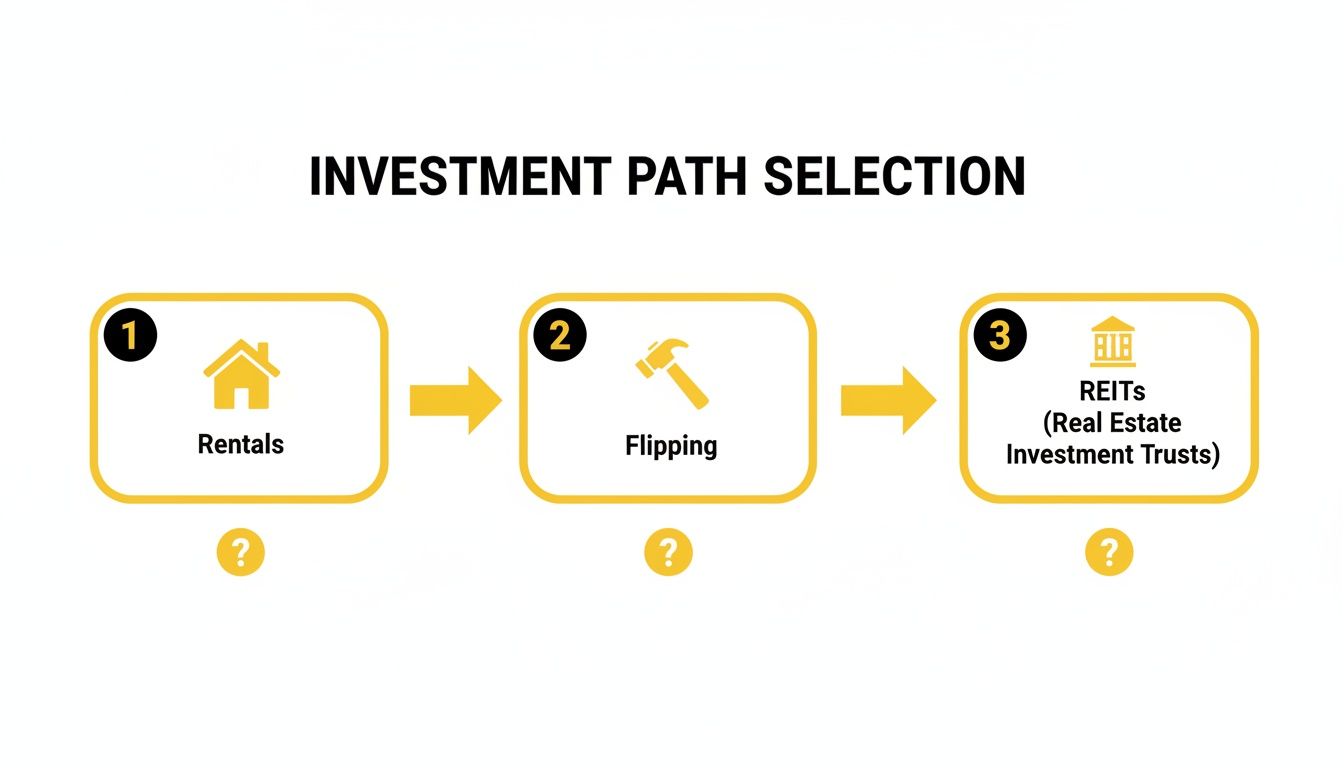

Choosing Your Investment Path

There isn't just one way to make money in real estate. Your first big decision is figuring out which path fits your budget, your goals, and—most importantly—how much of your personal time you're willing to put in.

Think of each strategy as a completely different type of business. Some require you to be a hands-on manager, while others are almost entirely passive. Let's walk through the four most common ways beginners get their start.

The Landlord: Long-Term Rentals

This is the classic, time-tested approach. You buy a property—maybe a condo, a duplex, or a single-family home—and lease it out to tenants who pay you rent every month.

The name of the game here is cash flow. That’s the money left in your pocket after you’ve paid the mortgage, taxes, insurance, and all the other bills. It’s like running a small, steady business where your main product is a place to live. While it does take work (or the cost of hiring a property manager), you get a reliable income stream and the property’s value grows over time.

The Project Manager: House Flipping

House flipping is all about short-term, active work for a potentially big payoff. The idea is simple: buy a property that needs work, fix it up to boost its value, and sell it for a profit. This usually happens over a few months, not years.

This isn't a "set it and forget it" investment; it’s more like running a high-stakes project. You need a good eye for what buyers want, a solid grip on renovation costs, and the ability to manage contractors and tight deadlines. The chance for a quick, lump-sum profit is huge, but so is the risk if your budget spirals or the project takes too long.

What if you want to invest in real estate without ever having to deal with tenants or toilets? That’s where Real Estate Investment Trusts (REITs) come in. REITs are companies that own and operate massive portfolios of income-producing properties, like shopping malls, apartment complexes, or office towers.

Buying a REIT is a lot like buying a stock. You purchase shares on the stock market, and in return, you get a slice of the income from the company's properties, paid out as dividends. It’s a truly hands-off way to get into real estate, offering instant diversification and the ability to sell your shares anytime. To see how this works in more detail, check out our in-depth guide on how Real Estate Investment Trusts work.

The Matchmaker: Real Estate Wholesaling

Wholesaling is a popular entry point for people with more hustle than cash. A wholesaler finds a great deal on a property—often one that’s distressed or undervalued—and puts it under contract with the seller. But instead of buying it, they find another investor (usually a flipper) and assign the contract to them for a fee.

The wholesaler’s profit is that assignment fee. You’re essentially acting as a deal-finder or a matchmaker, connecting a motivated seller with a ready buyer, all without ever taking ownership of the property yourself. It’s fast-paced and relies heavily on your networking and negotiation skills.

Comparison of Real Estate Investment Strategies for Beginners

So, which path is right for you? It really boils down to what you have to work with—your money, your time, and your skills. To make it easier, here’s a quick comparison of the four strategies we just covered.

| Strategy | Initial Capital | Time Commitment | Risk Level | Key Skill | Example Persona |

|---|---|---|---|---|---|

| Long-Term Rentals | Medium to High | Medium | Medium | Patience & Management | The Planner: Someone building a steady, long-term retirement income stream. |

| House Flipping | High | High | High | Project Management | The Creator: Someone who loves design, renovation, and a quick, tangible result. |

| REITs | Low | Low | Low | Asset Allocation | The Diversifier: An investor wanting real estate exposure without the hands-on work. |

| Wholesaling | Very Low | High | Medium | Networking & Sales | The Hustler: A person with great people skills but limited starting cash. |

Each of these avenues can lead to building real wealth, but they demand different things from you. The best first step you can take is to be honest with yourself about your financial situation, your stomach for risk, and just how hands-on you want to be. That self-assessment will point you in the right direction.

Mastering The Key Financial Metrics

At the end of the day, successful real estate investing isn't about gut feelings or following the latest hot trend—it's a numbers game. To really win, you have to speak the language of finance. Let's demystify the core metrics that seasoned investors live and die by, turning these formulas into practical tools you can start using immediately.

We’re going to break down the big three: Capitalization Rate (Cap Rate), Cash-on-Cash Return, and Return on Investment (ROI). These aren't just industry jargon; they're the vital signs of a property's financial health. They'll tell you whether you're looking at a golden opportunity or a potential money pit. Once you get these down, you can analyze any deal with confidence.

The image above shows a few different ways to get into the game. Each path, whether it's long-term rentals, quick flips, or passive REITs, has its own unique financial DNA.

First Things First: Net Operating Income (NOI)

Before you can calculate anything meaningful, you have to get a handle on Net Operating Income (NOI). Think of NOI as the raw profit a property generates before you factor in your mortgage or income taxes. It’s the purest measure of a building’s ability to make money on its own.

The formula couldn't be simpler:

Gross Rental Income – Operating Expenses = Net Operating Income (NOI)

So, what are operating expenses? Everything it takes to keep the lights on and the property running smoothly: property taxes, insurance, routine maintenance, property management fees, and maybe some utilities. What it does not include is your loan payment—that comes later.

The Three Metrics That Matter Most

Once you've figured out your NOI, you're ready to unlock the three most critical numbers for evaluating any potential deal. Each one tells a slightly different, but equally important, part of the story.

-

Capitalization (Cap) Rate: This is your "apples-to-apples" comparison tool. The cap rate shows the potential return on a property if you were to buy it with all cash. It’s the perfect way to quickly compare different properties in the same market, taking financing completely out of the equation.

- The Math: (NOI / Property Price) x 100

- In Action: A property with $12,000 in NOI selling for $300,000 has a Cap Rate of 4%.

-

Cash-on-Cash (CoC) Return: For a new investor, this might be the most important number of all. It answers one simple question: "How hard is my actual cash working for me?" It measures the annual cash flow you pocket against the real money you pulled out of your bank account for the down payment and closing costs.

- The Math: (Annual Cash Flow / Total Cash Invested) x 100

- In Action: If you have $3,600 in positive cash flow for the year and you invested $60,000 out of pocket, your CoC Return is a solid 6%.

-

Return on Investment (ROI): This is the big picture. ROI looks beyond just cash flow to include the wealth you're building through property appreciation and paying down your loan (building equity). It gives you a much more complete view of your total return over a year.

- The Math: (Annual Cash Flow + Equity Gained) / Total Cash Invested x 100

- In Action: With that same $3,600 in cash flow, let's say you also gained $5,000 in equity. Your ROI on that $60,000 investment jumps to 14.3%.

Key Takeaway: The Cap Rate helps you size up different deals on an even playing field, but your Cash-on-Cash Return tells you the real story of how your own money is performing.

Strong rental demand is a beginner's best friend. With millennials and Gen Z facing housing affordability issues that can consume nearly 35% of their income for a median home, the rental market is booming. In fact, rental prices are sitting 29.4% above where they were before the pandemic, and single-family rents just saw a 2.6% jump.

Those are market dynamics that heavily favor landlords, creating a fantastic opportunity to find properties with great cash flow potential. These metrics are what separate amateur speculators from strategic investors who build real, lasting wealth. To sharpen your skills even more, you should check out our guide to learn more about how to calculate rental yields.

How To Fund Your First Investment Property

Figuring out how to pay for your first property can feel like hitting a brick wall. But here’s the thing: you have way more options than you probably think. The real key is to stop thinking you need a massive 20% down payment and start exploring all the different ways you can secure a deal.

For most people, this process starts with getting their own finances in order. That means polishing up your credit score, socking away cash for a down payment, and getting pre-approved for a loan. Taking these steps shows sellers you're serious and builds the financial foundation you'll need.

Conventional Loans And Their Alternatives

The path most traveled is the conventional investment property loan. This is your standard bank loan, and they typically want you to put down 20-25%. Why so much? Because lenders see investment properties as a bit riskier than the home you live in, so they tighten the requirements. It’s a solid option if you have the cash, but it’s far from the only game in town.

Thankfully, there are some government-backed loans that can be a real game-changer for new investors.

- FHA Loans: Backed by the Federal Housing Administration, these are fantastic. You can buy a property with up to four units and put down as little as 3.5%. The only catch? You have to live in one of the units for at least a year.

- VA Loans: If you're a veteran or an active-duty service member, this is an incredible benefit you've earned. VA loans let you buy a property—including a multi-unit one you live in—with 0% down.

These programs dramatically lower the financial barrier to entry, making it possible to get your first investment property much sooner than you might expect. We go into even more detail in our dedicated guide where you can learn how to finance an investment property.

The Power Of House Hacking

Those FHA and VA loans lead us directly to one of the smartest strategies out there for new investors: house hacking.

The concept is beautifully simple. You buy a small multi-family property (a duplex, triplex, or fourplex), you move into one unit, and you rent out the rest. Often, the rent you collect from your tenants covers your entire mortgage payment. This means you could potentially live for free or even make a little extra cash right from the start.

Real-Life Example: House Hacking a Duplex

Take Sarah, a 26-year-old marketing professional. She used an FHA loan to buy a $400,000 duplex, putting down just $14,000 (3.5%). Her total monthly mortgage is $2,800. She lives in one half and rents the other for $1,800. This drops her personal housing cost to just $1,000 a month—way less than she was paying for a tiny apartment. With one smart move, Sarah is building equity and learning how to be a landlord with very little financial risk.

Creative Financing Options

Beyond the banks, there are a few other clever ways to fund your deals. One is seller financing, where the owner of the property essentially acts as your bank. You make payments directly to them, which can be a great workaround if you’re having trouble qualifying for a traditional loan. Another popular approach is forming partnerships—teaming up with friends, family, or other investors to pool your cash and your skills.

Real-Life Example: A Partnership Flip

Mark and Jen wanted to flip a house but couldn't afford it alone. Mark had $30,000 in savings and a knack for project management. Jen was a skilled contractor with tools and a crew. They formed a partnership, bought a distressed property for $150,000, used Mark's cash for the down payment and Jen's expertise for the renovation. Six months later, they sold it for $250,000, splitting a $50,000 profit after all costs.

Coming up with a down payment is a major hurdle today, with the median for first-time buyers hitting a multi-decade high of 10%. For investors, that number can be even higher. Most people scrape it together from personal savings (59%), get help from family (22%), or even borrow from their retirement accounts (26%). This tough environment makes strategies like FHA loans and house hacking more important than ever for getting your foot in the door. You can read the full research on home buyer trends on nar.realtor.

A Step-By-Step Guide To Your First Purchase

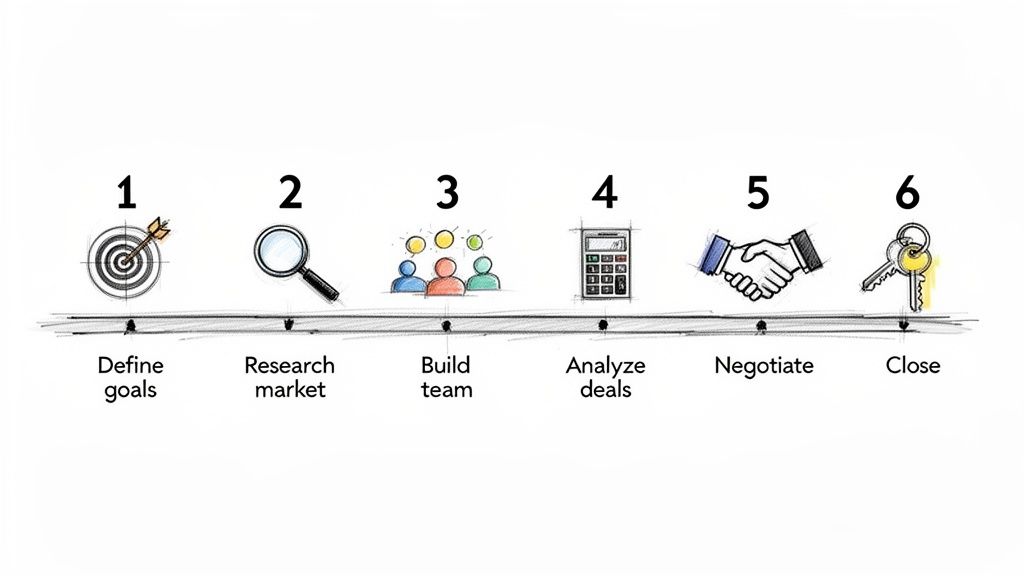

Alright, let's move past the theory and get into how you actually buy your first property. This isn't just a random walk through Zillow; it's a process. I've broken it down into a clear, repeatable system to take the guesswork out of it and give you the confidence to make your move.

Step 1: Define Your Goals And Strategy

Before you even think about looking at properties, you need to know why you're doing this. What's the end game? Are you chasing long-term rental income (cash flow), or are you looking for a quick profit from a flip (appreciation)? Maybe a little of both? Your answer shapes everything that comes next. A cash flow investor might want a stable duplex in a quiet neighborhood, while a flipper is on the hunt for a diamond in the rough in an area that's about to pop. Get really specific with your financial targets and your timeline.

Step 2: Research Your Target Market

Location, location, location—it's a cliché for a reason. Not all markets are created equal, and your job is to find one that actually supports your goals. You're looking for places with solid fundamentals that point toward growth. Here’s what to keep an eye on:

- Job Growth: A booming local economy means new people are moving in, and those people need a place to live.

- Population Growth: More people equals more demand for both rentals and homes for sale. Simple as that.

- Low Vacancy Rates: This is a fantastic sign for a landlord. It means demand is high and you won't have trouble finding tenants.

- Landlord-Friendly Laws: It's worth knowing if the local laws favor tenants or landlords. Some states make being a property owner much easier than others.

Step 3: Assemble Your Professional Team

Listen, real estate investing is a team sport. You can't be an expert in everything, and you don't have to be if you surround yourself with the right people. Here's who you need in your corner:

- An Investor-Friendly Real Estate Agent: This is crucial. You need someone who gets the numbers and has worked with investors before, not just first-time homebuyers looking for their dream house.

- A Mortgage Broker or Lender: They are your guide to the money. A good one will help you get pre-approved and find the right loan for an investment property.

- A Real Estate Attorney or Title Company: These are the folks who handle all the legal stuff, making sure the title is clean and the closing process is smooth.

- A Home Inspector: This person is your safety net. Their job is to find every potential problem with a property before you're legally committed to buying it.

Step 4: Analyze Deals And Make Offers

Now that you have a team and a market, it's time for the fun part: finding and analyzing deals. This is where you put all that financial metric knowledge to use. Run the numbers on every property that catches your eye—calculate the Cap Rate, Cash-on-Cash Return, and potential ROI.

A good rule of thumb to remember is the "100-10-1" rule. You might have to analyze 100 properties, make offers on 10 of them, and only get one accepted. This is a numbers game, so don't get discouraged. Persistence pays off.

Once you find a deal that works on paper, team up with your agent to write a smart, competitive offer. Be ready to negotiate. The inspection period is your last chance to uncover issues, so use our real estate due diligence checklist to make sure you cover all your bases.

Step 5: Close The Deal And Take Ownership

After your offer is accepted and you've done all your homework, you head to the closing table. This is where you'll finalize the loan, sign a mountain of paperwork, and officially get the keys. Congratulations—you're officially a real estate investor.

Avoiding Common Beginner Mistakes and Managing Risk

The best investors aren't just brilliant at spotting a good deal—they're masters of defense. This playbook helps you sidestep the common traps that snag so many new investors. It’s easy to get caught up in the excitement of potential profits, but the real pros focus just as much on what could go wrong. Building resilience into your plan is what separates a successful first investment from a painful lesson.

Underestimating Costs and Overleveraging

One of the fastest ways to find yourself in hot water is by lowballing the true cost of owning a property. It's so much more than the mortgage payment. You've got taxes, insurance, and the quiet killer of cash flow: maintenance and big-ticket repairs. At the same time, taking on too much debt—what we call being overleveraged—is like walking a tightrope without a net. A single vacancy or an unexpected repair bill can drain your cash reserves in a hurry if your mortgage payment is too high.

Pro Tip: I always run two budgets for any property. First is the monthly operating budget for all the predictable stuff. The second is a Capital Expenditure (CapEx) fund for the big things that eventually break, like a roof or an HVAC unit. A solid rule of thumb is to sock away 5-10% of your monthly rent just for those future headaches.

Poor Tenant Screening and Location Analysis

Your tenants are the engine of your rental business, and the property's location is the road it travels on. If you cut corners on either one, you're setting yourself up for a breakdown. A bad tenant can cost you thousands in lost rent, legal battles, and property damage. And buying in an area where jobs are leaving or crime is on the rise? That will slowly poison your property's value and make it a nightmare to find good renters.

Here’s how you can build a solid defense against these common missteps:

- Bulletproof Tenant Screening: Don't just glance at a credit score. Your process needs to be thorough: a full background check, actual income verification (ask for pay stubs!), and—this is crucial—calling their previous landlords.

- Conservative Deal Analysis: When you're running the numbers on a potential deal, be a pessimist. Assume a higher vacancy rate than what's typical for the area and budget more for repairs than you think you'll need. This is how you "stress-test" an investment to see if it can handle a few bumps in the road.

- In-Depth Location Due Diligence: Look beyond the four corners of the property. Dig into local economic trends, check out the school ratings, and see if there are any major development plans for the area. A neighborhood with strong fundamentals acts as a safety net for your entire investment.

By thinking about these risks upfront, you stop being a hopeful speculator and start acting like a strategic investor. The goal isn't just to buy a piece of property; it's to build a resilient business that can weather any storm and set you up for real, long-term success.

Frequently Asked Questions (FAQ)

Diving into real estate investing for the first time can be overwhelming. Here are answers to ten of the most common questions beginners have.

1. How much money do I actually need to start?

While a 20-25% down payment for a conventional loan is common, it's not the only way. Low-down-payment options like an FHA loan (3.5% down) for a multi-family property you live in (house hacking) can significantly lower the entry barrier. For those with very little capital, strategies like wholesaling require more time and networking than cash.

2. Should I form an LLC before buying my first property?

While not mandatory for your first property, it's a wise consideration for liability protection. An LLC separates your personal assets from your business assets. Many beginners buy their first property in their personal name to secure better financing and then transfer it to an LLC later after consulting with a legal professional.

3. What credit score do I need to get an investment loan?

For a conventional investment property loan, lenders typically look for a credit score of 620 or higher, with better interest rates offered to those with scores above 740. Government-backed loans like FHA may have more lenient credit requirements.

4. How do I find a good deal in a competitive market?

Look for off-market deals. Network with real estate agents, wholesalers, contractors, and property managers. These professionals often hear about distressed properties or motivated sellers before they hit the multiple listing service (MLS). Be prepared to analyze many deals to find one that meets your criteria.

5. Should I manage the property myself or hire a property manager?

Self-management saves money (typically 8-12% of monthly rent) and provides invaluable hands-on experience. However, it requires significant time and effort. A property manager handles tenant screening, rent collection, and maintenance calls, freeing you to focus on acquiring more properties.

Vacancy (periods with no rent), capital expenditures (CapEx) for major replacements like a new roof or HVAC system, and unexpected repairs are the biggest budget-killers. Always budget 5-10% of rent for maintenance and another 5-10% for CapEx reserves.

7. Is house flipping as easy as it looks on TV?

No. TV shows often gloss over the risks, budget overruns, and timeline delays. Successful flipping requires accurate cost estimation, reliable contractors, and a deep understanding of the local market to avoid over-improving the property for the neighborhood.

8. What's more important: cash flow or appreciation?

For beginners, cash flow is king. Positive cash flow provides a safety net to cover expenses during vacancies or unexpected repairs. It ensures the property supports itself. Appreciation is a powerful long-term wealth builder but is speculative and not guaranteed. A great investment offers potential for both.

9. How do I analyze a rental property deal quickly?

Use the 1% Rule as an initial screening tool. If a property's monthly rent is at least 1% of the purchase price (e.g., $2,000/month rent for a $200,000 property), it's likely worth a deeper look. If it passes this test, then run a full analysis of your NOI, Cap Rate, and Cash-on-Cash return.

10. Can I invest in real estate if I live in an expensive area?

Absolutely. You don't have to invest where you live. Many investors live in high-cost-of-living areas but invest "long-distance" in more affordable markets with better cash flow potential. This requires building a reliable team (agent, property manager, contractors) on the ground in your target market.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.