Buying a rental property isn't just about getting a second set of keys; it's like starting a small business. You're the CEO, the property is your product, and your tenants are the customers driving your revenue. Thinking this way is the first step—it changes your perspective from just owning a house to actively building a wealth-generating machine.

In This Guide

- 1 The Three Engines Of Rental Property Wealth

- 2 How To Confidently Analyze A Rental Deal

- 3 Financing Your First Investment Property

- 4 Navigating The Legal And Tax Landscape

- 5 Mastering Your Property Management Strategy

- 6 Steering Clear of Common (and Costly) Investing Pitfalls

- 7 Frequently Asked Questions About Rental Property Investing

- 7.1 1. How much money do I actually need to start rental property investing?

- 7.2 2. Is rental income considered passive income?

- 7.3 3. What is the "1% Rule" and is it still relevant?

- 7.4 4. Should I form an LLC for my first rental property?

- 7.5 5. What is "house hacking"?

- 7.6 6. What's more important: cash flow or appreciation?

- 7.7 7. How do I find good tenants?

- 7.8 8. Should I self-manage or hire a property manager?

- 7.9 9. What are the biggest tax benefits of owning rental properties?

- 7.10 10. How do I know if I'm analyzing a good deal?

The Three Engines Of Rental Property Wealth

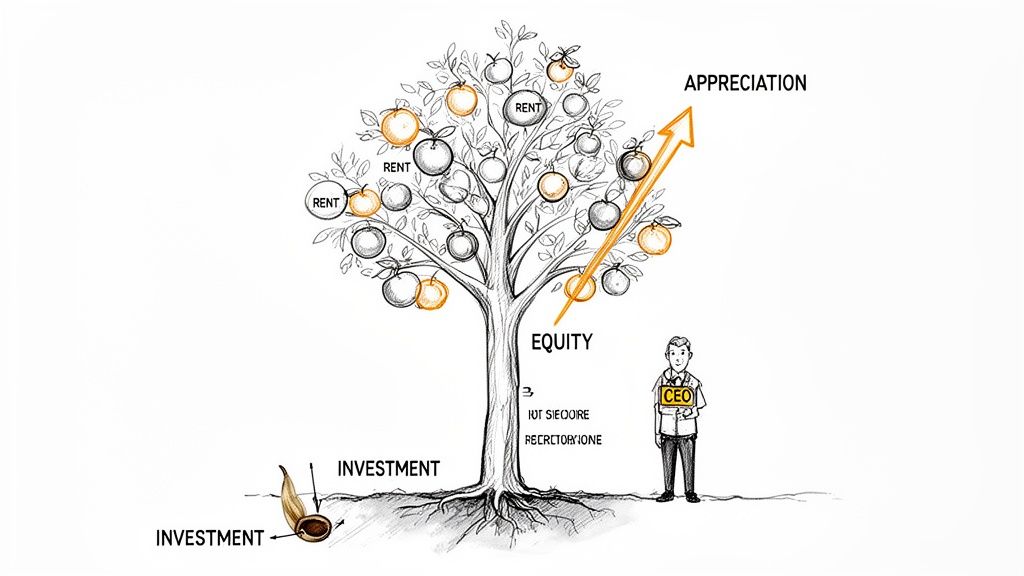

From my own experience, I like to think of a rental property as planting a fruit tree. You put in some initial effort and money to get it in the ground, and then you tend to it. Before long, that tree starts producing fruit every season (your rent checks) while also growing bigger and more valuable over the years (appreciation). It's a simple idea, but it perfectly captures how rental properties work for you on multiple levels.

This isn't some niche hobby, either. We're talking about a massive global market. Projections show the real estate rental market hitting an incredible USD 2.91 trillion in 2025 and climbing to USD 3.87 trillion by 2029. That's fueled by a steady 7.4% compound annual growth rate (CAGR), largely because rising home prices are keeping more people in the rental market for longer.

How You Actually Make Money

So, how does this all translate into actual profit in your pocket? It comes down to three key profit centers working in your favor, often all at the same time.

Your investment's success hinges on:

- Monthly Cash Flow: This is the purest form of profit. After you collect rent and pay all the bills—mortgage, taxes, insurance, repairs, and management fees—the money left over is your cash flow. This is the income that keeps the whole operation running and puts money in your bank account month after month.

- Equity Buildup: Here’s the beautiful part. Every time your tenant pays rent, a chunk of that money goes directly to paying down your mortgage. You're essentially getting a forced savings account paid for by someone else, increasing your ownership stake (your equity) without lifting a finger.

- Long-Term Appreciation: Real estate has historically gone up in value over the long haul. Thanks to things like inflation, population growth, and neighborhood improvements, the property you buy today is likely to be worth a lot more down the road. This is where you can see massive returns when you decide to sell.

Understanding how to manage these three wealth drivers is what separates successful investors from the rest. You're not just buying a property; you're putting a financial engine to work. To see how this fits into the bigger picture, check out our complete real estate investment guide.

Getting these core concepts down is your first real step. It shifts you from thinking like a homeowner to thinking like a savvy investor who can spot opportunities and make smart, calculated decisions to grow your wealth.

How To Confidently Analyze A Rental Deal

The difference between a rental property that builds wealth and one that drains your bank account rarely comes down to curb appeal. It's almost always in the numbers. Smart investors learn to take emotion out of the equation and let the cold, hard data tell the story.

This is the battle-tested framework you need to analyze any potential rental property. We'll walk through the essential metrics, so you can stop guessing and start making decisions with confidence.

Starting With The Property's Own Profit: Net Operating Income

Before you can figure out what a property will put in your pocket, you have to understand its own financial health. That starts with calculating the Net Operating Income (NOI).

Think of NOI as the property's profit before you even consider a mortgage. It’s the total income left over after you pay all the bills required to keep the place running. It’s a pure measure of the asset's performance.

Here’s the simple breakdown:

- Gross Potential Rent: First, figure out the maximum rent you could possibly collect if the property was 100% occupied for the entire year.

- Subtract Vacancy: Let's be real—no property stays full 100% of the time. You need to account for empty months. A conservative buffer is 5% to 8% of the gross rent.

- Subtract Operating Expenses: Now, subtract all the costs of ownership. This includes property taxes, insurance, routine maintenance, property management fees, and any utilities you cover. Do NOT include your mortgage payment here; that comes later.

What's left is your NOI. This number is the foundation for everything else.

Finding The Real Money: Your Cash Flow

While NOI is critical for analysis, it isn't the money that actually hits your bank account. For that, we need to calculate Cash Flow.

This is the moment of truth. It's your NOI minus your total mortgage payment (both principal and interest).

Cash Flow = Net Operating Income (NOI) – Total Mortgage Payment

Positive cash flow is the name of the game. It’s the monthly profit you walk away with after the property has paid for itself and all its expenses. Even a modest $100 to $200 per month in positive cash flow can become a powerful income stream as you add more properties to your portfolio.

Expert Insight: Never, ever forget to budget for Capital Expenditures (CapEx). These are the big-ticket items that don't happen often but can wipe you out—think a new roof, HVAC system, or water heater. A good rule of thumb is to set aside 5% to 10% of the gross rent every single month. This builds a war chest so a major repair is just an expense, not a financial emergency.

Using Cap Rate To Compare Apples To Apples

So you've found a duplex in one part of town and a single-family home in another. How do you decide which is the better deal financially? This is where the Capitalization Rate (Cap Rate) comes in.

Cap Rate is a fantastic tool because it lets you compare properties on an even playing field, completely ignoring the financing. It simply measures the property's return on its price.

The formula couldn't be easier:

Cap Rate = Net Operating Income (NOI) / Property Purchase Price

Generally, a higher cap rate suggests a higher potential return (and often, higher risk). A lower cap rate usually points to a safer, more stable investment with a lower return. By running the cap rate on different deals, you can quickly see which property is working more efficiently for its price tag.

The Most Important Number: Your Cash-on-Cash Return

At the end of the day, there's one number that matters more than any other to you as the investor: Cash-on-Cash (CoC) Return.

This metric tells you exactly how hard your money is working. It measures the annual cash flow you receive against the total amount of cash you personally invested to get the deal done. This isn't just the down payment; it includes closing costs and any money you spent on immediate repairs or renovations.

Cash-on-Cash Return = Annual Cash Flow / Total Cash Invested

Real-Life Example: An investor, Sarah, buys a duplex for $300,000. Her total cash invested (down payment + closing costs) is $65,000. After all expenses and mortgage payments, her annual cash flow is $6,500. Her Cash-on-Cash return is 10% ($6,500 / $65,000). This tells her she's earning a 10% return on her actual cash investment each year, which is a great indicator of a strong deal.

Key Metrics For Evaluating A Rental Property

This table breaks down the essential formulas and what they tell you about a potential investment property, helping you quickly assess its financial viability.

| Metric | Formula | What It Measures |

|---|---|---|

| Net Operating Income (NOI) | Gross Income – Operating Expenses | The property's profitability before financing. |

| Cash Flow | NOI – Mortgage Payment | The actual profit you receive each month. |

| Cap Rate | NOI / Purchase Price | The property's return rate; used to compare deals. |

| Cash-on-Cash Return | Annual Cash Flow / Total Cash Invested | How hard your personal investment capital is working. |

Each of these metrics gives you a different piece of the puzzle. Together, they create a clear picture of whether a deal is worth pursuing.

The Quick Filter: The 1% Rule

When you're sifting through dozens of online listings, you need a way to quickly weed out the duds. That's where the 1% Rule comes in handy.

It’s a simple rule of thumb that says the gross monthly rent should be at least 1% of the property's purchase price.

For a $200,000 property, you'd want to see it renting for at least $2,000 per month. If it's renting for much less, the odds of it generating positive cash flow are slim, and you can probably move on without wasting more time. It's not a substitute for a full analysis, but it's an incredibly effective first-pass filter.

Mastering these core metrics will give you a repeatable process to evaluate any deal with confidence. To run these numbers quickly, feel free to use our free real estate investment calculator to plug in the figures and see the results instantly. This approach is what separates amateurs who hope for a good investment from professionals who know they've found one.

Financing Your First Investment Property

Figuring out how to pay for your first rental property often feels like the single biggest hurdle. It’s easy to assume you need a mountain of cash sitting in the bank, but that’s rarely the case. In reality, there are plenty of roads to take, from standard bank loans to more creative routes designed for investors.

The key is knowing which path is right for you. The best financing choice not only gets you the keys to the property but also fits your personal finances and sets you up for long-term success.

The Traditional Path: Conventional Investment Loans

The most well-trodden path is a conventional investment property loan. Think of it as a standard mortgage, but for a property you won’t be living in. Because lenders see these loans as a bit riskier than a loan for your own home, they tighten up the requirements.

Here’s what you should expect to bring to the table:

- A Higher Down Payment: For a typical single-family rental, lenders will want 20% to 25% down. There's no private mortgage insurance (PMI) on these types of loans, so a larger down payment is non-negotiable.

- Strong Financials: You'll need to show a healthy credit score (usually 680 or higher), a low debt-to-income (DTI) ratio, and proof of cash reserves to cover several months of mortgage payments.

While the bar is set a little higher, a conventional loan is a stable, straightforward way to fund your investment.

Creative Financing for Savvy Investors

What if you don’t have 25% to put down? Don't worry, you’re not out of the game. Some of the most effective strategies for new investors involve creative and more accessible financing methods that can significantly lower your upfront costs.

This is a great time to understand how the money flows in a rental deal.

As the chart shows, you start with your total rent collected (Gross Income), subtract all your operating expenses to find the Net Operating Income (NOI), and then subtract your loan payment (debt service) to see what’s left in your pocket—the Cash Flow.

With that in mind, let's look at a few popular financing strategies.

Comparison of Investment Property Financing Options

This table compares different financing methods to help you identify the best fit for your investment strategy and financial situation.

| Financing Method | Typical Down Payment | Best For… | Key Benefit |

|---|---|---|---|

| FHA Loan (House Hacking) | As low as 3.5% | First-time investors buying a 2-4 unit property to live in. | Slashes your personal living costs while you build equity. |

| VA Loan (House Hacking) | 0% | Eligible veterans and service members buying a multi-unit property. | No down payment required, making it incredibly accessible. |

| Seller Financing | Negotiable | Buyers who can't qualify for a traditional loan or want flexible terms. | Opens the door to off-market deals with custom rates and terms. |

| Hard Money Loan | 10-25% | Short-term "fix and flip" projects or buying properties quickly. | Extremely fast funding—you can often close in days, not weeks. |

Each of these tools has a specific job. House hacking with an FHA or VA loan is a fantastic way for beginners to jump in with very little cash. Seller financing and hard money loans, on the other hand, are more like specialized instruments used by experienced investors to solve particular problems or seize unique opportunities.

The right choice ultimately comes down to your capital, credit, and overall investment strategy. By exploring all your options, you can find a way to finance your first rental that perfectly matches your situation. To get into the nitty-gritty, you can learn more about how to finance an investment property in our dedicated guide.

Finding a great deal is just the start. Many new investors get so caught up in the hunt for the perfect property that they overlook the backend of the business—the legal and tax stuff. But this is where savvy investors really protect themselves and amplify their returns.

Treating your rentals like a true business from day one is non-negotiable. That means setting up the right legal structures and getting smart about the tax code. It's the difference between a thriving portfolio and a ticking time bomb.

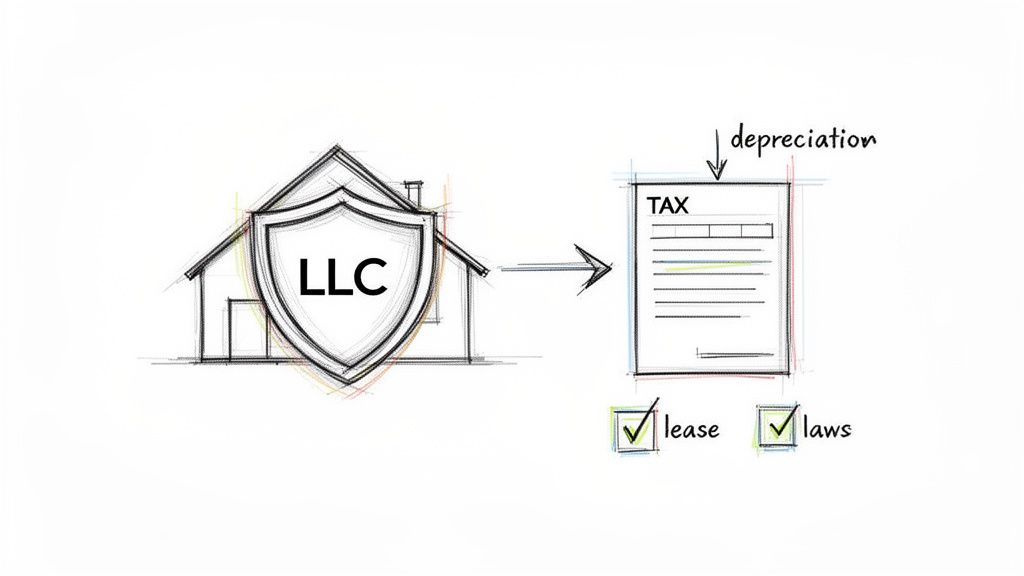

Creating A Legal Firewall With An LLC

One of the first moves many seasoned investors make is forming a Limited Liability Company (LLC). Think of it as a legal shield. It creates a formal separation between your business assets (the rental property) and your personal assets (your home, car, and savings).

Why does this matter? Imagine a tenant slips, falls, and decides to sue. If your property is held within an LLC, they sue the company, not you personally. Without that barrier, your entire personal net worth could be on the line. It's a foundational step in risk management.

The Foundation Of Your Business: A Bulletproof Lease

Your lease agreement isn't just a formality; it's the rulebook for your entire investment. A generic template you find online is an invitation for trouble. A rock-solid lease needs to be specific to your property and compliant with all state and local laws, which can vary wildly.

A good lease leaves no room for interpretation. It must clearly cover:

- Clear Rent Terms: The exact amount due, the specific due date, how you'll accept payment, and precisely how late fees are calculated.

- Tenant Responsibilities: Who handles lawn care? Which utilities are they responsible for? Spell it all out to avoid future arguments.

- Rules and Policies: Don't be vague. Set clear policies on pets, overnight guests, smoking, and quiet hours.

- Landlord's Right of Entry: Define exactly how much notice you'll provide before entering for inspections or maintenance, as required by law.

Beyond the lease, you absolutely must know the local landlord-tenant laws and the federal Fair Housing Act. Ignorance isn't an excuse, and violations come with hefty penalties.

Real-World Example: An investor in Seattle once entered a tenant's unit for a minor repair without giving the legally required notice. It seemed like a small oversight, but the tenant knew their rights and filed a complaint. The result? A $2,500 fine and a serious blow to the landlord's reputation. A completely avoidable mistake.

The Powerful Tax Advantages Of Rental Properties

Here’s where real estate investing really starts to shine. The U.S. tax code is incredibly friendly to property owners, offering a suite of benefits that can dramatically lower your tax bill.

Nearly every dollar you spend running your rental is a potential tax deduction. We’re talking about the big stuff and the small stuff:

- Mortgage interest

- Property taxes and insurance

- All maintenance and repair costs

- Fees paid to a property manager

- Expenses for advertising a vacancy

But the real game-changer is depreciation. This is a fantastic "on-paper" deduction that lets you write off the value of the building itself (not the land) over 27.5 years. It’s a phantom expense—it reduces your taxable income, but no cash actually leaves your pocket. It's one of the most powerful wealth-building tools in real estate. To get the full picture, check out our guide on powerful property investment tax deductions.

Mastering Your Property Management Strategy

You can find the perfect property with incredible numbers, but without a solid management plan, it can quickly turn into a nightmare. How you handle the day-to-day operations—from marketing your unit to fixing a leaky faucet—is what truly determines your cash flow, tenant happiness, and long-term success.

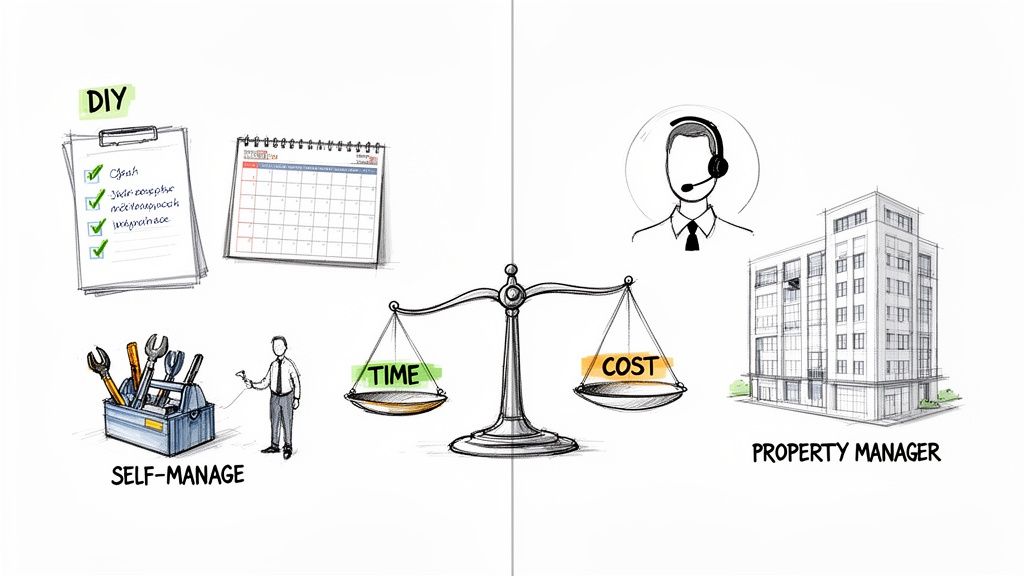

Sooner or later, every investor hits this fork in the road: do I manage it myself, or do I hire a professional? This isn’t just a financial decision; it’s a lifestyle choice.

The Two Paths Of Property Management

The right path for you really boils down to how much time, energy, and hands-on control you want over your investment. Each approach has some pretty clear pros and cons.

-

Self-Management (The DIY Approach): Going this route means you are the CEO, the marketing department, and the maintenance crew all in one. You find tenants, you collect the rent, and yes, you get those late-night emergency calls. The huge upside is saving on management fees, which boosts your bottom line. But the trade-off is your time and your sanity.

-

Hiring a Professional Manager: This is the hands-off approach. You pay a company a fee, typically 8-12% of the monthly rent, and they take care of everything. This frees you up to find your next deal or just enjoy your life, but it does take a bite out of your net income.

To manage effectively, you also have to know what today's renters want. Recent studies show that over 40% of renters are actively looking for pet-friendly places, and another 40% say affordability is their top priority. We're also seeing a 20% surge in demand for energy-efficient units. Knowing these trends can give you a serious edge in keeping your property filled and your rent competitive.

Comparing Your Management Options

To figure this out, you have to honestly weigh the trade-offs between cost, time, and stress. What works perfectly for a duplex you own down the street is probably the wrong move for a property you own two states away.

I've put together this table to give you a clear, side-by-side look at the two options. It should help you see which approach lines up best with your goals.

Self-Management vs. Professional Property Manager

A side-by-side comparison to help you decide the best management approach for your rental property investment based on key factors.

| Factor | Self-Management | Hiring a Professional |

|---|---|---|

| Cost | No management fees, which means more cash in your pocket. | Fees typically range from 8-12% of monthly rent, plus potential leasing fees. |

| Time Commitment | High. You're on the hook for marketing, showings, maintenance calls, and tenant relations. | Low. The manager handles all the day-to-day tasks, giving you your time back. |

| Control | Total control. You pick the tenants, set the rent, and approve every repair. | Less direct control. You have to trust the manager's judgment and systems. |

| Stress & Hassle | High. You're the one who has to deal with every tenant issue, emergency, and potential eviction. | Low. The manager acts as a professional buffer, handling the tough conversations and legal headaches. |

| Expertise | Your success hinges on your own knowledge of landlord-tenant laws, marketing, and maintenance. | You get instant access to their professional expertise, vendor networks, and legal know-how. |

So, which one is right for you? It's not always a clear-cut answer, but the table above should point you in the right direction.

Making The Right Choice For Your Portfolio

Deciding on your management strategy is a huge step. If you live close to your property, have a flexible schedule, and genuinely enjoy the hands-on work, self-managing can be incredibly rewarding and more profitable.

On the other hand, if your time is more valuable spent elsewhere, you live far from your rental, or you just want to focus on acquiring more properties instead of operating them, a professional manager is worth their weight in gold. A great manager can often improve your returns through better tenant screening and more efficient operations, sometimes enough to completely offset their own fees.

For more ideas on boosting your property's performance, you can explore our other guide to maximize rental property income with proven methods.

Steering Clear of Common (and Costly) Investing Pitfalls

In real estate, the cheapest education you can get is learning from someone else's mistakes. The rewards of owning rental properties are huge, but the path is littered with traps that can easily trip up a new investor. If you know where others have gone wrong, you can see these problems coming and protect your hard-earned money.

Building a solid rental portfolio isn't about finding a "perfect" property. It's about consistently avoiding a few critical, unforced errors. Most investors who fail don't get taken out by a bad market; they stumble over preventable miscalculations and emotional decisions.

Underestimating the True Cost of Ownership

The single most common mistake I see is underestimating what it really costs to own a rental property. It’s so easy to get fixated on the mortgage payment and completely forget about all the other expenses that will quietly drain your bank account.

Think about this classic scenario: an investor finds a house that looks great on paper. They run the numbers on the mortgage and it cash flows. But they don't budget for the big-ticket items—the capital expenditures (CapEx) like a new roof or an HVAC system. A few years down the road, the furnace gives out in January. Suddenly, they're hit with an unexpected $5,000 bill that not only eats every dime of profit they've made but also puts them in the red.

Here’s how you stay ahead of that:

- The 50% Rule: A good, conservative rule of thumb is to assume that 50% of your rental income will be spent on things other than your mortgage. This bucket covers taxes, insurance, routine maintenance, future CapEx, and property management fees.

- Build a Rainy Day Fund: You absolutely must have a separate reserve account for each property. Aim to keep 3-6 months' worth of total expenses (mortgage included) in there. This is your safety net for when a tenant leaves unexpectedly or a pipe bursts.

Rushing the Tenant Screening Process

Another devastating mistake is cutting corners on tenant screening. When you have an empty unit, the pressure is on to get it filled fast. It’s tempting to take the first person who shows up with a deposit check in hand, but that’s a shortcut that often leads to a world of pain.

One bad tenant can cost you thousands in lost rent, legal fees for eviction, and repairs for the damage they leave behind. They can turn a profitable asset into a money pit overnight. Your screening process is your best defense.

Your screening process has to be rock-solid and non-negotiable. Every single time. It must include a full credit check, criminal background check, eviction history, and direct verification of their income and employment. And whatever you do, never skip calling their previous landlords.

Buying with Your Heart, Not Your Calculator

Finally, letting your emotions drive a purchase is a surefire way to lose money. It's easy to fall in love with a property’s beautiful kitchen or its charming curb appeal, but those things don't pay the rent.

Successful rental property investing is a numbers game, pure and simple.

Every decision you make must be based on cold, hard data: cash flow, cap rate, and cash-on-cash return. High rental yields are what you're after. For example, some international markets are drawing a lot of attention right now; Turkey, for instance, has an average gross rental yield of 7.76%. Compare that to Spain's national average of around 5.43% or Dubai's 6-7%. These figures show why a data-first approach is so crucial for building a strong portfolio. You can find more insights about global property investment trends and see why smart money is flowing into these areas.

If you can successfully sidestep just these three common mistakes, you’ll be on a much more stable and profitable path from day one.

Frequently Asked Questions About Rental Property Investing

1. How much money do I actually need to start rental property investing?

You'll need funds for three key areas: the down payment (typically 20-25% for an investment property), closing costs (2-5% of the purchase price), and cash reserves. It is critical to have 3-6 months of total expenses (including mortgage) set aside as a safety net for vacancies or unexpected repairs.

2. Is rental income considered passive income?

It's more accurately described as semi-passive. While it can become more hands-off over time, especially with a property manager, there is always work involved. In the beginning, you are actively managing an asset, finding tenants, and handling maintenance. True passivity is rare without professional help.

3. What is the "1% Rule" and is it still relevant?

The 1% Rule is a quick screening tool suggesting that a property's gross monthly rent should be at least 1% of its purchase price (e.g., a $200,000 property should rent for at least $2,000/month). It's a useful first filter to weed out deals that are unlikely to cash flow, but it is not a substitute for a full analysis, especially in high-cost-of-living areas.

4. Should I form an LLC for my first rental property?

Forming an LLC can provide significant legal protection by separating your personal assets from your business assets. While it's a smart move for liability protection, some lenders may have stricter financing terms for LLCs. It's wise to consult with a real estate attorney and a mortgage broker to weigh the pros and cons for your specific situation.

5. What is "house hacking"?

House hacking is a strategy where you buy a multi-unit property (2-4 units), live in one unit, and rent out the others. The rental income from your tenants can significantly offset or even cover your entire mortgage payment, allowing you to live for free or very cheaply while building equity in an investment property.

6. What's more important: cash flow or appreciation?

For most new investors, cash flow is king. It pays the bills, covers unexpected expenses, and provides a stable income stream. Appreciation is a powerful wealth-builder, but it's speculative and not guaranteed. A property that has positive cash flow from day one is a much safer and more sustainable investment.

7. How do I find good tenants?

A rigorous and consistent tenant screening process is non-negotiable. This should include a detailed application, credit check, criminal background check, eviction history search, income verification (aim for income of 3x the rent), and calls to previous landlords. Never skip a step.

8. Should I self-manage or hire a property manager?

This depends on your goals, location, and personality. If you live nearby, have the time, and enjoy hands-on work, self-managing can save you money. If you value your time, live far from the property, or want to scale your portfolio, a professional manager (typically charging 8-12% of rent) is an excellent investment.

9. What are the biggest tax benefits of owning rental properties?

The major tax advantages include deducting operating expenses (like mortgage interest, property taxes, insurance, and repairs), and the "phantom" deduction of depreciation, which allows you to write off the value of the building over 27.5 years, often reducing your taxable income significantly.

10. How do I know if I'm analyzing a good deal?

A good deal is based on the numbers, not emotion. It should meet the 1% Rule as a first check. Your detailed analysis should project positive cash flow after all expenses (including vacancy and CapEx reserves), and it should offer a solid Cash-on-Cash Return, ideally 8-12% or higher.

At Top Wealth Guide, we're focused on giving you the practical strategies and clear resources needed to build and manage your wealth. Whether you're buying your first rental or scaling your portfolio, our insights are designed to help you navigate your financial journey. Discover more at Top Wealth Guide.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.