Let's get right to it. Passive income is money you earn that doesn’t require your active, day-to-day involvement. Think of it like a musician who writes a hit song. They do the intense, creative work once, but they continue to earn royalties every time that song is played on the radio, streamed online, or used in a movie—for years to come.

This powerful concept is what disconnects your time from your earnings, and it’s the cornerstone of achieving true financial independence. It’s not about getting rich quick; it’s about strategically building assets that generate income for you.

In This Guide

- 1 What Is Passive Income and Why Should You Care?

- 2 Exploring the World of Passive Income Streams

- 3 A Practical Guide to Popular Passive Income Strategies

- 4 How to Build Your First Passive income Stream

- 5 Common Myths and Costly Mistakes to Avoid

- 6 Ready to Start Your Journey?

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. What is the most realistic passive income for beginners?

- 7.2 2. Can you really make money while you sleep?

- 7.3 3. How much passive income is considered good?

- 7.4 4. What are the tax implications of passive income?

- 7.5 5. Is it possible to lose money with passive income?

- 7.6 6. What is the difference between passive income and a side hustle?

- 7.7 7. How long does it take to build a meaningful passive income stream?

- 7.8 8. Are REITs a good passive income source?

- 7.9 9. Can I generate passive income from my savings account?

- 7.10 10. Which is better: investing for growth or for passive income?

What Is Passive Income and Why Should You Care?

Let's be clear: passive income isn't magic money. It’s the result of upfront work—investing time, money, or a specific skill—to create a system or asset that generates cash flow with minimal ongoing effort. This marks a fundamental shift from the traditional 9-to-5 model, where you are paid only for the hours you work.

Grasping this distinction is the first step toward reducing financial anxiety and creating more freedom in your life. The goal is to make your assets work for you, not the other way around.

The concept is gaining serious traction globally. As a testament to its legitimacy, a growing number of countries are catching on. As of 2024, 44 countries offer special visa programs specifically for retirees and individuals with passive income streams, aiming to attract those who are financially self-sufficient. This trend highlights a worldwide acknowledgment that passive income is a key component of long-term financial security.

Active vs. Passive Income: The Fundamental Split

The core difference between active and passive income comes down to the relationship between your time and your money. With active income, the money stops when you stop working. With passive income, the income stream can continue to flow whether you’re at your desk, on vacation, or asleep.

The secret to building lasting wealth isn't just about earning more. It’s about structuring your finances so your income is no longer directly tied to your daily effort.

Developing passive streams creates a financial safety net. This buffer can support you through unexpected job loss, economic downturns, or major life events, providing a level of security a single paycheck cannot match.

Active Income vs. Passive Income: A Head-to-Head Comparison

To make the distinction clear, let's compare the two income models side-by-side. This table breaks down exactly how different these two approaches to earning truly are.

| Characteristic | Active Income | Passive Income |

|---|---|---|

| Effort Required | Constant and direct; you trade hours for dollars. | Heavy effort is front-loaded; ongoing work is minimal. |

| Scalability | Limited by the number of hours you can work. | Highly scalable; can grow without demanding more of your time. |

| Income Potential | Typically capped by a salary or hourly wage. | Potential for uncapped, compounding growth. |

| Dependency | Income stream stops the moment you stop working. | Continues to generate income regardless of your daily activities. |

Ultimately, building passive income is more than a financial strategy—it's a lifestyle choice. It’s about creating the freedom and flexibility to focus on what truly matters to you.

Exploring the World of Passive Income Streams

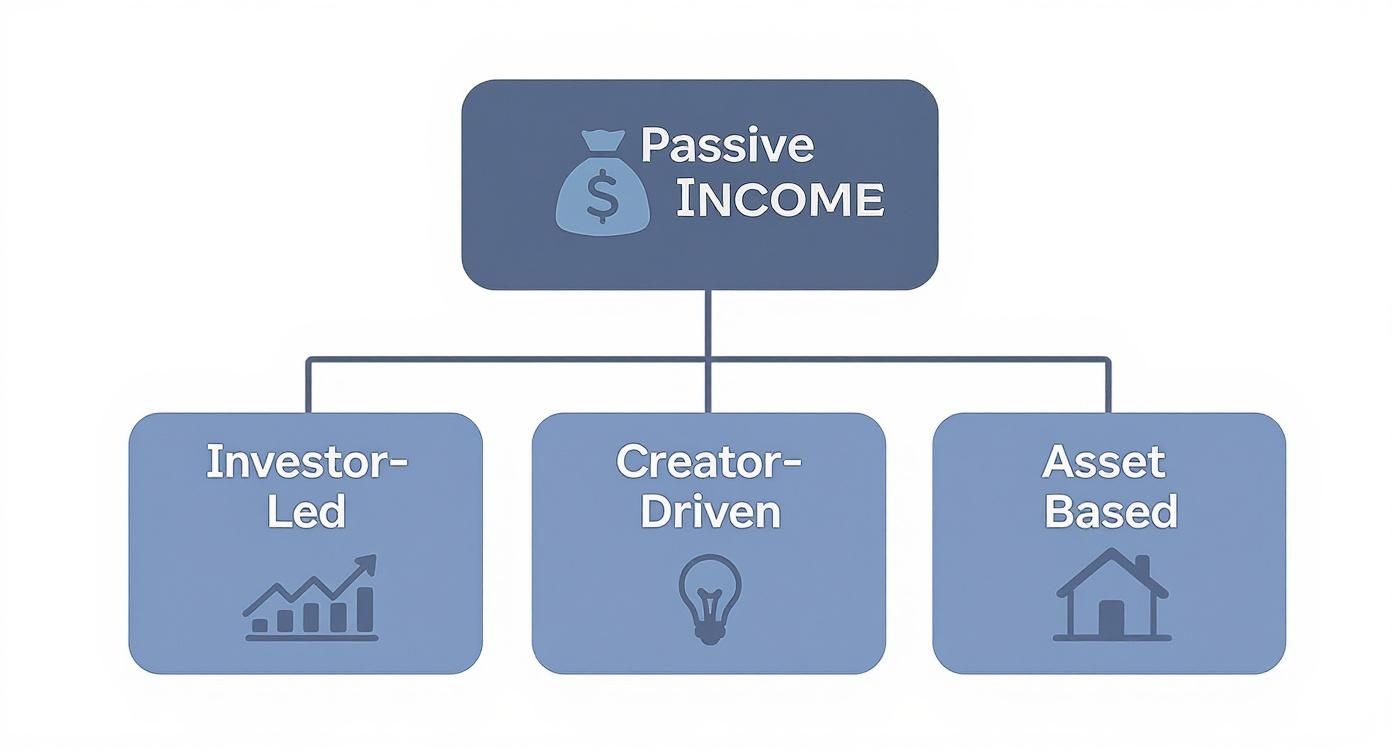

Now that we understand the concept, let's explore the different ways to create passive income. It's not a one-size-fits-all approach. These strategies generally fall into three main categories, each requiring a different primary resource: your money, your creativity, or assets you already own.

Figuring out which category best suits your current situation is the first step. It depends entirely on your skills, financial standing, and long-term goals.

Investor-Led Strategies

This is the most traditional path to passive income. It involves putting your capital to work in assets designed to generate regular cash flow. If you have savings you're ready to invest, this is an excellent place to start.

- Dividend Stocks: When you own shares in established companies, they distribute a portion of their profits to you as dividends. It’s like receiving a regular paycheck for being a part-owner. A real-life example is investing in a blue-chip company like Procter & Gamble, which has paid dividends for over a century.

- Real Estate Investment Trusts (REITs): Want to own a piece of commercial real estate without the hassle of being a landlord? REITs allow you to buy shares in a company that owns and manages a portfolio of properties, and you collect a share of the rental income.

- Bonds: When you buy a bond, you are essentially lending money to a government or a corporation. In return, they pay you periodic interest over a set term. Government bonds, in particular, are considered one of the safer investment vehicles.

These strategies are powerful because once established, they require minimal day-to-day management. However, they require upfront capital and an understanding that all investments carry some level of risk.

Creator-Driven Ventures

If you're short on cash but rich in knowledge, skill, or creativity, this is your domain. The goal is to create an asset once that can be sold or monetized repeatedly. The primary investment here isn't money; it's your time and expertise.

The magic of a creator-driven asset is that you do the hard work once, and it can pay you for years. A well-crafted online course or a popular ebook can generate income long after you've moved on to the next project.

Here are a few powerful ways to turn your expertise into a passive income stream:

- Royalties: An author earns a royalty for every book sold, years after it was written. The same applies to a musician for every song streamed or a photographer for every image licensed from a stock photo site.

- Digital Products: Consider creating an online course teaching a skill you've mastered, like graphic design or coding. Once the course is created and launched, it can be sold to an unlimited number of students with no additional effort.

- Affiliate Marketing: If you have a blog, YouTube channel, or social media presence, you can earn commissions by recommending products you trust. For example, a tech reviewer who creates an in-depth video review of a new laptop can earn a percentage of the sale every time a viewer makes a purchase through their unique affiliate link.

These ventures require you to turn what you know into a valuable product. For more on this, our guide on how to create multiple income streams offers a deeper dive.

Asset-Based Rentals

This category is a hybrid, leveraging assets you already own to generate income. While it may require some management, many processes can now be streamlined or outsourced.

| Asset Type | Real-Life Rental Example | Management Effort |

|---|---|---|

| Physical Property | Renting out a spare room on Airbnb or a garage space in a busy urban area. | Moderate (cleaning, guest communication) |

| Equipment | Leasing out professional camera gear on platforms like Fat Llama, or your car on Turo when you're not using it. | Low to Moderate (maintenance, bookings) |

| Financial Capital | Using a peer-to-peer (P2P) lending platform to lend money to individuals or small businesses and earn interest. | Low (the platform handles screening and payments) |

Each of these paths offers a legitimate route to financial freedom. The key is to honestly assess your resources—your money, skills, and time—and choose the strategy that aligns best with your life.

A Practical Guide to Popular Passive Income Strategies

Understanding the theory is one thing, but choosing the right strategy requires a practical look at the details. You need to consider the upfront investment, time commitment, potential return, and risk level of each option.

We're witnessing a massive shift in how people earn money. The global gig and passive income economy is booming, valued at approximately $556.7 billion in 2024 and projected to reach $2.15 trillion by 2033. Popular strategies like affiliate marketing, now an $18.5 billion industry, are a significant part of this growth.

To help you navigate your options, the flowchart below organizes the main types of passive income, showing how different strategies fit into the broader landscape.

As you can see, strategies fall into three primary categories: investor-led, creator-driven, and asset-based.

Investor-Led Strategies Breakdown

Investor-led strategies are ideal if you have capital to put to work. Here, your money does the heavy lifting to generate steady cash flow.

- Dividend Stock Investing: A timeless strategy. You buy shares in stable companies and receive a portion of their profits. For more details, explore our guide to the best dividend stocks for passive income.

- Real Estate Investment Trusts (REITs): REITs offer a way to invest in a diversified portfolio of properties without the responsibilities of being a landlord. You buy shares just like any other stock.

- Bonds: Buying a bond means you're lending money to an entity (like a government or corporation) that pays you interest in return.

While these methods require less ongoing management, they are not completely hands-off. They are subject to market fluctuations, and thorough upfront research is essential to manage risk.

Creator-Driven Ventures Explained

Creator-driven income is built on "sweat equity"—your time, skills, and creativity. The primary investment is your effort in creating something valuable.

- Affiliate Marketing: You create content (blog, YouTube channel) and earn a commission for recommending products. A niche blogger might only make $20-$50 per month initially, but this can scale significantly as their audience grows.

- Creating Digital Products: The model is "build it once, sell it forever." This could be an online course, an ebook, or design templates. The hard work is concentrated in the creation and marketing phases.

- Royalties: This is income from licensing your intellectual property, like a book, song, or photograph. Each time it's used or sold, you receive a payment.

The real power of a creator-driven asset lies in its scalability. A single online course can be sold to ten students or ten thousand without any significant increase in your ongoing effort.

These strategies often have low startup costs but demand a significant commitment of time and expertise.

Comparison of Popular Passive Income Streams

So, which path is right for you? This table compares popular strategies side-by-side, outlining the crucial factors: what it takes to start, the time it demands, potential earnings, and the risks involved. Use it as a quick reference to plan your first move.

| Income Stream | Initial Investment | Time Commitment | Potential Return | Risk Level |

|---|---|---|---|---|

| Dividend Stocks | Medium to High Capital | Low (Ongoing Research) | Low to Medium (2-5% Yield) | Medium |

| Rental Properties | Very High Capital | Medium (Management) | Medium to High | Medium |

| Affiliate Marketing | Low (Website/Content) | High (Upfront Content) | Varies (Low to High) | Low to Medium |

| Digital Products | Low to Medium (Tools) | Very High (Creation) | Medium to High | Low to Medium |

| P2P Lending | Low to High Capital | Low (Platform-Managed) | Medium (5-10%+) | High |

The best passive income strategy is the one that aligns with your budget, skills, and interests. Whether you invest your money in dividend stocks or your time in building a niche blog, the key is to start with a clear understanding of what each path requires.

How to Build Your First Passive income Stream

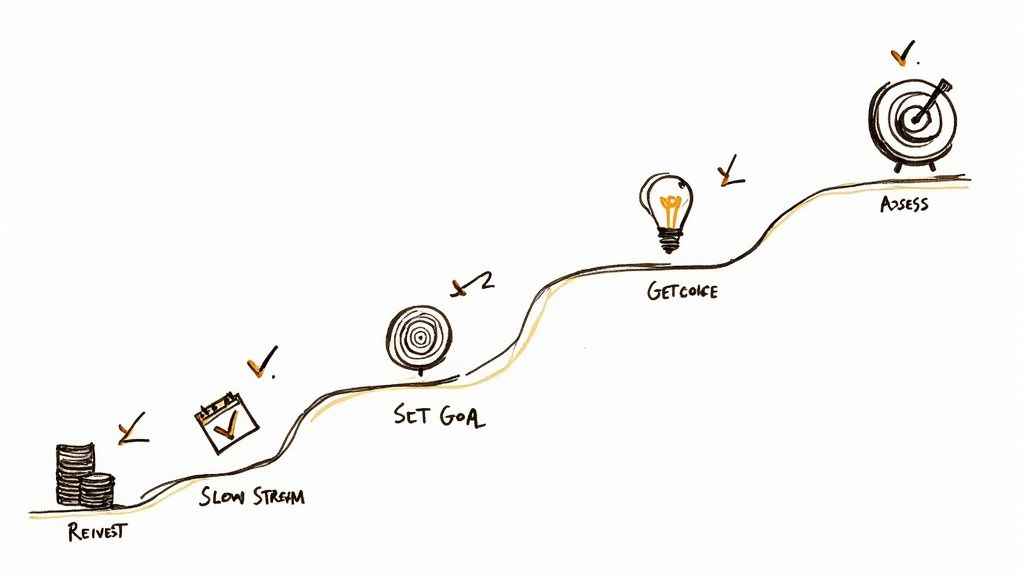

Knowing what passive income is and actually building it are two different things. That gap can feel intimidating, but it doesn't have to be. The key is to break the process down into simple, manageable steps that take you from theory to action without the overwhelm.

Think of it less like climbing a mountain and more like laying one brick at a time. Every step, no matter how small, helps build the foundation for a more secure financial future.

Step 1: Take an Honest Inventory

First, you need a clear picture of your starting point. This means being brutally honest about the three core resources at your disposal:

- Your Capital: How much money can you realistically invest right now? It could be $5,000 or $50. Both are valid starting points.

- Your Skills: What are you genuinely good at? Are you a great writer, a skilled photographer, or an expert in a niche hobby? These are valuable assets.

- Your Time: How many hours per week can you realistically commit? Be honest to avoid burnout.

This isn't about judging your situation; it's about strategy. Knowing your resources helps you choose a path that plays to your strengths and fits your life.

Step 2: Define Your Target

A vague goal like "I want to make passive income" is nearly impossible to act on. You need to get specific. A clear, motivating target turns a fuzzy wish into a concrete objective.

For example, a strong goal is: "Generate an extra $200 per month within six months to cover my car payment." It's measurable, has a deadline, and is tied to a real-life benefit.

The purpose of a goal is to focus your efforts. A specific target acts as your North Star, guiding your decisions and keeping you motivated when the initial excitement fades.

Knowing exactly what you're aiming for makes the journey more manageable and allows you to track your progress and celebrate small wins.

Step 3: Choose One Stream and Go Deep

This is where most beginners falter. They get excited and try to do everything at once—starting a blog, buying dividend stocks, and dabbling in P2P lending. Resist this urge.

Instead, use your inventory from Step 1 to pick one single income stream that aligns with your resources.

| If You Have More… | Consider These Streams… |

|---|---|

| Capital | Dividend Stocks, REITs, High-Yield Savings Accounts |

| Time & Skills | Affiliate Marketing, Digital Products, YouTube Channel |

| Assets & Capital | Rental Properties, Peer-to-Peer Lending |

For example, if you have capital saved up, dividend stocks could be a great fit. With ongoing economic uncertainty, many investors are shifting toward stable assets. Investing €20,000 in a diversified portfolio of dividend stocks with an average yield of 4% could generate €800 annually—a perfect example of building consistent cash flow. You can read more about why investors are shifting their strategies on QCCapitalGroup.com.

If you have little money but strong writing skills, an affiliate blog on a topic you love is a fantastic choice. If real estate interests you, dive into our guide on how to buy your first rental property.

The point is to focus your energy on mastering one thing before you consider diversifying.

Step 4: Reinvest to Ignite Compounding

Once your first stream starts generating income—even if it's just a few dollars—the most powerful move you can make is to reinvest it. This is where the magic of compounding happens.

Don't spend that first $10 dividend payment. Use it to buy more shares of the stock. That slightly larger position will then generate a slightly larger dividend next time, which you can reinvest again. It’s a snowball effect that can dramatically accelerate your wealth over time.

By systematically putting your earnings back to work, you force your money to make more money. This is how you turn a small stream into a powerful river of passive income.

Common Myths and Costly Mistakes to Avoid

The idea of passive income is exciting, but it's often glamorized online. This leads many newcomers to fall for common myths or make expensive mistakes that can derail their progress. Knowing what not to do is just as important as knowing what to do.

One of the most persistent myths is that passive income is "easy money." The reality is quite different. While the goal is to earn money with less daily effort, nearly every legitimate stream requires a significant upfront investment of time, money, or both. You are essentially front-loading the hard work.

Myth 1: The "Set It and Forget It" Fantasy

It's tempting to believe you can build an asset, launch it, and walk away as the cash rolls in. This rarely happens. Even the most "passive" income sources require periodic check-ins, maintenance, and optimization to remain profitable.

A successful passive income stream isn't abandoned; it's managed efficiently. Neglecting your assets, whether it's an outdated blog post or an underperforming stock, is a direct path to diminishing returns.

Think about it: a blog with affiliate links needs fresh content and SEO updates to stay relevant. A dividend portfolio needs to be rebalanced periodically to align with your goals. Ignoring these tasks can turn a thriving asset into a forgotten liability.

Mistake 1: Diving in Without a Plan

Excitement is a great motivator but a terrible substitute for due diligence. Jumping into rental properties or P2P lending without understanding the market, risks, and legal requirements is a recipe for disaster.

This type of impulsive decision-making is one of the most common financial mistakes that can cost you dearly over time. You must do your homework. Learn the fundamentals of any strategy you're considering and understand the worst-case scenarios, not just the best-case ones.

Myth 2: You Need a Ton of Money to Start

This myth stops too many people in their tracks. While strategies like buying rental properties require significant capital, many powerful income streams can be built with very little.

- Blogging: You can start a blog for less than the cost of a few coffees a month. Real-Life Example: A home cook started a food blog as a hobby. By consistently creating valuable recipes and tutorials, she grew her audience and now earns over $2,100 per month from affiliate links and sponsored posts.

- Digital Products: Creating an ebook costs you your time and knowledge, not a large sum of money.

- Micro-investing: Modern apps allow you to start buying dividend stocks or REITs with as little as $5.

Mistake 2: Spreading Yourself Too Thin

When starting out, the urge to chase every shiny new opportunity is strong. However, trying to do everything at once is a classic beginner's mistake. Spreading your focus too thin prevents you from building real expertise or momentum in any single area.

The smarter approach is to pick one strategy that fits your resources and skills, and then commit to it. Build that one stream until it's stable and generating consistent income. Only then should you consider adding a second one. By avoiding these myths and mistakes, you'll build your financial future on a much stronger foundation.

Ready to Start Your Journey?

Building real, sustainable passive income isn't a get-rich-quick scheme. It’s more like planting a tree than winning the lottery. Every successful investor started exactly where you are now: at the beginning. The goal is to patiently build systems that work for you, eventually freeing you up to focus on what you truly love.

We’ve covered a lot—from what passive income is (and isn't) to the practical details of different strategies. But if you remember just one thing from this guide, let it be this: consistency beats intensity, every time. A few hours of frantic effort once a year won't get you as far as small, steady actions taken week after week.

So, what's next? It's simple. Pick one idea from this guide that genuinely excites you. Then, take the smallest possible step to bring it to life. Today.

Maybe that’s opening a brokerage account to buy your first index fund share. Or maybe it’s outlining a blog post on a topic you’re passionate about. That first small action is the most powerful one you'll ever take.

Financial freedom isn't about one giant leap. It’s built one step, one smart decision, and one invested dollar at a time. Your journey starts now.

Frequently Asked Questions (FAQ)

1. What is the most realistic passive income for beginners?

For beginners with limited capital, affiliate marketing or creating a digital product (like an ebook) are highly realistic. They rely on your time and skill ("sweat equity") rather than a large financial investment. If you have some capital, investing in a low-cost S&P 500 index fund that pays dividends is a straightforward and time-tested starting point.

2. Can you really make money while you sleep?

Yes, but that's the result, not the process. The "money while you sleep" phase comes after significant upfront work. For example, an author puts in months or years writing a book. Once it's published, they can earn royalties from sales that happen at any time of day, anywhere in the world, with no further effort on that specific book.

3. How much passive income is considered good?

This is entirely personal and depends on your goals. A "good" amount could be an extra $100 a month to cover a utility bill, or it could be $5,000 a month to achieve full financial independence. A great starting goal is to generate enough passive income to cover one of your smaller monthly expenses, then build from there.

4. What are the tax implications of passive income?

Passive income is taxed, but the rules vary significantly by type and location. For instance, income from rental properties, stock dividends (qualified vs. non-qualified), and royalties are all treated differently by the IRS. It's crucial to consult with a tax professional to understand your obligations and potential deductions.

5. Is it possible to lose money with passive income?

Absolutely. All investments carry risk. You could lose money if a stock you own plummets, a rental property remains vacant for too long, or a digital product fails to sell. This is why diversification and thorough research are essential to mitigate risk.

6. What is the difference between passive income and a side hustle?

The key difference is active involvement. A side hustle, like driving for Uber or freelance writing, is active income—you only get paid for the hours you work. Passive income, once established, requires minimal ongoing effort. A side hustle can, however, be used to generate the initial capital needed to fund a passive income stream.

7. How long does it take to build a meaningful passive income stream?

Be prepared for a long-term commitment. While you might see your first few dollars within months, building a stream that generates a substantial, life-changing income often takes several years of consistent effort and reinvestment. Patience and persistence are non-negotiable.

8. Are REITs a good passive income source?

Yes, for many investors, REITs (Real Estate Investment Trusts) are an excellent source of passive income. They allow you to invest in a diversified portfolio of real estate without the high cost and hassle of direct property ownership. They are also legally required to pay out at least 90% of their taxable income to shareholders as dividends.

9. Can I generate passive income from my savings account?

Yes, a high-yield savings account (HYSA) is one of the simplest forms of passive income. While the returns are typically lower than other investment types, it's virtually risk-free (up to FDIC insurance limits) and requires zero effort beyond opening the account.

10. Which is better: investing for growth or for passive income?

It depends on your financial goals and timeline. Younger investors often focus on growth stocks to build their net worth over the long term. As investors approach retirement, they typically shift their focus toward income-generating assets (like dividend stocks and bonds) to create a steady cash flow to live on. A balanced portfolio often includes a mix of both.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build and manage wealth effectively. Explore our articles, tools, and guides to start your journey today.

Learn more and subscribe at https://topwealthguide.com.