So, what exactly is a brokerage account? In simple terms, think of it as your personal gateway to the world of investing. It’s a specialized account that allows you to buy, sell, and hold financial assets like stocks, bonds, and funds.

This isn't your everyday checking account, which is designed for paying bills and daily spending. A brokerage account is a dedicated space where you hold your investments—the assets you purchase with the goal of building wealth over time.

You don't need a finance degree to get started, either. Modern brokerage platforms are designed for everyday people, providing a straightforward way to put your money to work. The core purpose is to give you a direct connection to the financial markets, allowing you to become a part-owner of public companies and participate in the global economy.

In This Guide

- 1 How Your Brokerage Account Actually Works

- 2 Choosing The Right Type Of Brokerage Account

- 3 Untangling Brokerage Fees and Taxes

- 4 How to Open Your First Brokerage Account

- 5 Brokerage Accounts vs. Other Investment Accounts

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. How much money do I need to open a brokerage account?

- 6.2 2. Is my money insured in a brokerage account?

- 6.3 3. Can I have more than one brokerage account?

- 6.4 4. What's the difference between a brokerage account and a 401(k)?

- 6.5 5. How quickly can I get my money out?

- 6.6 6. Can I lose money in a brokerage account?

- 6.7 7. Do I have to pay taxes on my investments every year?

- 6.8 8. What is a "ticker symbol"?

- 6.9 9. What is the difference between a cash account and a margin account?

- 6.10 10. Can I open a brokerage account for my child?

Your Gateway to the Financial Markets

At its core, a brokerage account connects you to the market through a licensed company called a broker-dealer. You can’t just call up the New York Stock Exchange and ask to buy a share of stock yourself. You need a broker to facilitate the transaction for you.

This connection lets you:

- Buy Shares: Purchase small pieces of ownership in public companies like Apple (AAPL) or Amazon (AMZN).

- Invest in Funds: Easily diversify by buying into collections of stocks or bonds, like Exchange-Traded Funds (ETFs) or mutual funds.

- Hold Your Investments: Keep all your assets organized and secure in one place.

- Sell Your Assets: Convert your investments back into cash whenever you decide the time is right.

For a deeper dive into the different kinds of accounts available, check out our guide on what is an investment account.

Brokerage Account at a Glance

To make it even clearer, here’s a quick summary of what a brokerage account is all about.

| Key Feature | Description | Real-Life Example |

|---|---|---|

| Purpose | To buy, sell, and hold financial assets like stocks, bonds, ETFs, and mutual funds. | You want to own a piece of your favorite tech company, so you buy its stock through your brokerage account. |

| Who It's For | Anyone looking to invest and grow their money for goals outside of retirement. | A recent graduate wants to start a "house fund" by investing in a mix of stocks and bonds. |

| Key Function | Acts as an intermediary, connecting individual investors to the financial markets. | The brokerage firm executes your order to buy 10 shares of an S&P 500 ETF on the stock exchange. |

| Flexibility | Funds can be withdrawn at any time without age-based penalties (taxes may apply). | You sell some investments to cover an unexpected home repair, and the cash is in your bank in a few days. |

| Accessibility | Modern online brokers have made it easy for beginners to open an account and start. | You download a brokerage app, sign up in 10 minutes, and fund your account with an initial $50. |

This table shows just how straightforward the concept is once you break it down.

Surprisingly, recent data shows that only 48% of individuals have a personal brokerage account. This means there's a huge opportunity for more people to get started.

And it's never been easier. Many platforms now offer zero-commission trading, opening the doors for newcomers to invest in things like domestic equity funds, where index products make up a massive 62.8% of the $21.27 trillion in assets. You can dig into more global financial trends on bis.org.

How Your Brokerage Account Actually Works

So, you've opened an account and put some money in it. What happens next? How does that cash actually turn into an investment? Let's pull back the curtain and walk through the entire process, because it’s a lot more straightforward than it sounds.

Think of your brokerage account as your mission control for investing. The first step is always funding the mission—you need fuel. This is as simple as linking your bank account and transferring some cash over, just like you would with an app like Venmo or PayPal. Once that money lands, it sits in your account as a cash balance, ready to be deployed.

The Life of an Investment, From Start to Finish

Let's say you've moved $100 into your brokerage account. You have a company in mind that you believe in, and you want to own a small piece of it. Here’s how that $100 becomes a real-life investment.

Placing Your Order: You log into your broker's app or website, find the company you want to invest in (using its stock ticker symbol), and tell the system you want to buy $100 worth of its shares. This is called "placing an order."

Order Execution: The moment you hit "buy," your broker gets to work. It zaps your order to a stock exchange, where it's instantly matched with someone who's looking to sell their shares at the current market price. This whole matchmaking dance often happens in less than a second.

Settlement: The trade is now official, but there’s a little bit of back-office work that needs to happen. The exchange takes a day or two to verify all the details, transfer the ownership of the shares to you, and move your cash to the seller. This is called "settlement."

Ownership: After settlement, it’s a done deal. The shares are officially yours and will show up in your account’s portfolio. Congratulations—you're now a part-owner of that company! From here on out, the value of your investment will go up and down with the market.

This whole process is what makes a brokerage account so powerful. It acts as your trusted go-between, turning your instructions into actual ownership of stocks, bonds, or funds. It's a well-oiled machine designed to handle millions of these transactions every single day.

From Order to Ownership: A Simple Breakdown

To make it even clearer, let's break down what happens with that first $100.

| Step | Your Action | What Your Broker Does | The Outcome |

|---|---|---|---|

| Funding | Transfer $100 from your bank to your brokerage account. | Securely receives and holds your cash. | Your account shows a $100 cash balance. |

| Placing an Order | You instruct your broker to buy $100 of a specific stock. | Transmits your order to the stock exchange for execution. | Your order is in the market, waiting to be matched. |

| Owning a Stock | You wait for the transaction to complete. | Executes the trade and handles the settlement process. | The shares appear in your portfolio. You're an investor! |

As you can see, your broker handles all the complicated moving parts. Your job is to make the decisions—what to invest in and when. If you're ready to dive deeper into the specifics of stock picking, our guide on how to invest in stocks is a great next step. This whole system is what allows anyone, not just financial pros, to turn their savings into wealth-building assets.

Choosing The Right Type Of Brokerage Account

Just like a mechanic has a whole toolbox for different jobs, investors have different types of brokerage accounts for different financial goals. Picking the right one is your first big decision, and it’s what sets the stage for your entire investment strategy. For most people dipping their toes in the water, the choice is pretty straightforward, but knowing all the options will help you make smarter moves as your portfolio grows.

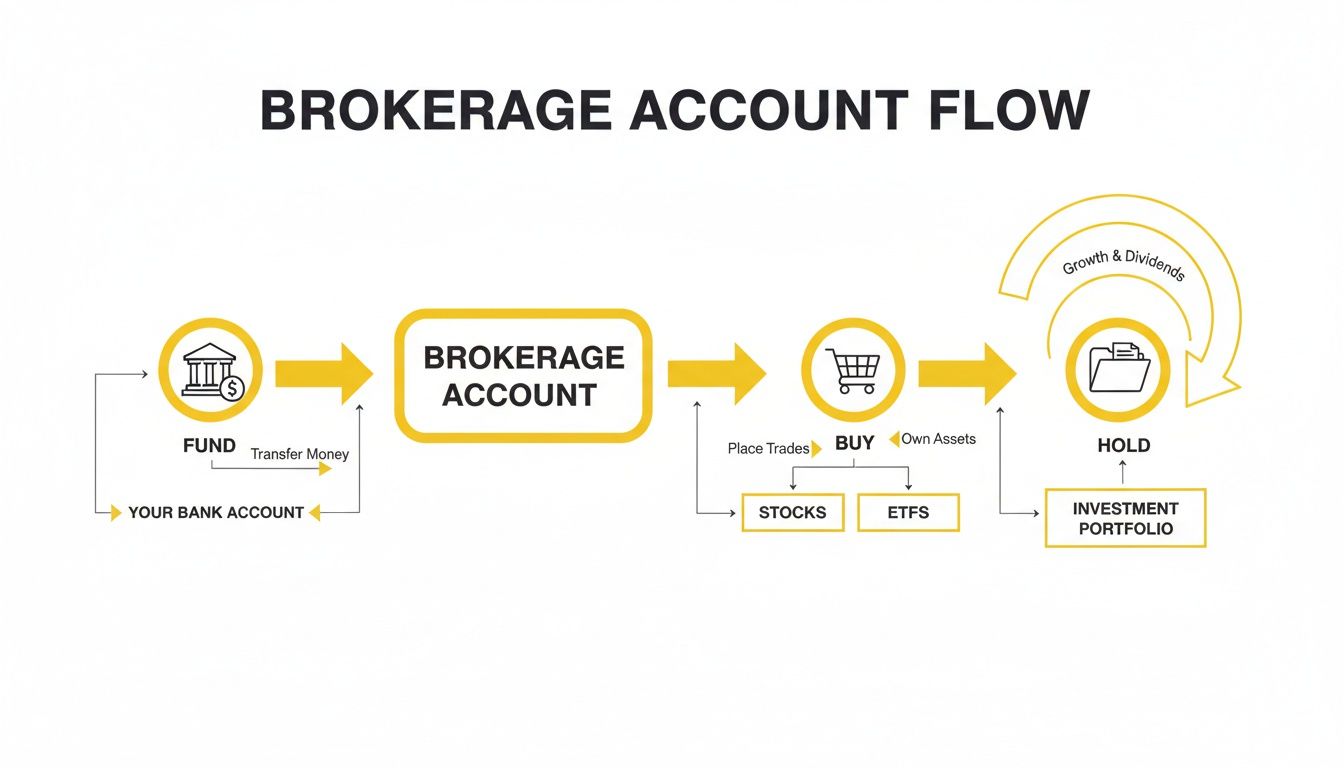

No matter which account you pick, the basic mechanics are the same: you put money in, you use that money to buy investments like stocks or ETFs, and then you hold those assets in your account.

This simple chart shows you that journey from start to finish.

The real differences between account types aren't in this core process but in the rules, risks, and ultimate purpose of each one.

The Standard Cash Account

The most common and direct path to investing is the cash account. It’s as simple as it sounds: you can only trade with the money you’ve actually deposited.

If you have $1,000 in your account, you can buy up to $1,000 worth of investments. That’s it. This built-in limit is its greatest strength, as it prevents you from getting into debt or making risky bets with money you don't have. It's the perfect starting point.

The Advanced Margin Account

A margin account is a whole different ballgame. Here, your broker essentially offers you a line of credit to buy more investments than your cash balance allows. Think of it as getting a loan to boost your buying power.

While using margin can seriously amplify your gains if the market goes your way, it also magnifies your potential losses. If your investments drop, you could end up owing more than you initially put in. Because of this, margin accounts are best suited for experienced investors who are comfortable with, and fully understand, the high stakes involved.

Specialized Account Types

Beyond these two, you’ll find specialized accounts designed for specific life goals.

A custodial account (like an UGMA or UTMA) is a fantastic tool for parents or guardians who want to save and invest for a child. The adult manages the funds, but the assets legally belong to the minor. Once the child comes of age, they get full control of the account.

Choosing the right account sets the foundation for your entire investment strategy. It determines your risk exposure, flexibility, and even your tax situation, so it's vital to match the account type to your long-term financial objectives.

The world of brokerage accounts is massive. In 2024, there are 634,508 registered professionals helping people navigate their options. Investors come in all shapes and sizes, too—47% are individual retail investors like you and me, while 32% are large institutions. You can dig deeper into global financial investment trends on unctad.org to see the bigger picture.

To help you sort through the main options, here’s a quick side-by-side look. Understanding these key differences is a critical part of figuring out which investment accounts you should prioritize in 2025.

Cash vs Margin vs Custodial Accounts

This table breaks down the most common brokerage account types to help you decide which one aligns with your current needs and future goals.

| Account Type | Best For | Key Feature | Main Risk |

|---|---|---|---|

| Cash Account | Beginners and risk-averse investors. | You can only invest the cash you have on hand. | Limited to no risk of debt. |

| Margin Account | Experienced, risk-tolerant investors. | Allows you to borrow money to invest more. | Potential for losses exceeding your initial investment. |

| Custodial Account | Parents or guardians investing for a minor. | Assets are legally owned by the child. | Limited control once the child reaches legal age. |

Ultimately, the best account is the one that fits your comfort level with risk and helps you move toward your specific financial targets. For most, starting with a cash account is the smartest and safest bet.

Untangling Brokerage Fees and Taxes

Investing isn't free, but the costs associated with a brokerage account are pretty straightforward once you know what to look for. Getting a handle on the common fees and tax implications is the key to making sure more of your money stays in your pocket, working for you.

Let's break down what you can expect.

The big headline for years has been the move to $0 commissions for trading stocks and ETFs, which has been a game-changer for everyday investors. But "commission-free" doesn't always mean "cost-free."

- Account Maintenance Fees: Some brokers, often the more traditional full-service firms, might charge a yearly or quarterly fee just to keep your account open. Thankfully, this is getting rarer.

- Expense Ratios: This is a big one. If you own mutual funds or ETFs, you're paying an annual fee that's baked right into the fund. It's a small percentage of your investment that covers the fund's management and operating costs.

- Miscellaneous Fees: Always read the fine print for other potential charges, like fees for wire transfers, closing an account, or even getting old-school paper statements mailed to you.

What You Owe the Tax Man

When you sell an investment for more than you paid, you've got a "capital gain," and Uncle Sam will want his cut. How much you owe comes down to one simple thing: how long you owned the investment.

The long-term data from UBS's 2025 Global Investment Returns Yearbook confirms that stocks are fantastic wealth-builders over time, but you have to factor in taxes on those gains. It's just as important as understanding expense ratios for funds. For perspective, actively managed ETFs pulled in a staggering $391 billion in the first nine months of 2025 alone, and every one of those investors will have to navigate capital gains eventually. You can read more about industry trends from FINRA.

The single most important factor determining your tax rate is your holding period. Keeping an investment for more than one year can literally slash your tax bill.

A Real-World Tax Example

Let's say you invest $2,000 into an ETF and it does well. Here’s how a little patience pays off.

| Scenario | Holding Period | Profit | Type of Gain | Tax Rate (Example) | Tax Owed |

|---|---|---|---|---|---|

| Scenario A | 10 months | $500 | Short-Term | 22% (Ordinary Income) | $110 |

| Scenario B | 14 months | $500 | Long-Term | 15% (Preferential Rate) | $75 |

In this simple case, just by waiting an extra four months to cross that one-year mark, you saved $35. It might not sound like a fortune, but those small, smart decisions compound over a lifetime of investing.

For more on this topic, check out our guide on how to minimize capital gains tax. Once you get these cost structures down, you’ll be in a much better position to make decisions that truly support your financial goals.

How to Open Your First Brokerage Account

Ready to move from the sidelines into the market? Opening a brokerage account is your ticket to investing, and honestly, it’s a lot less intimidating than most people think. We'll break it down into a few simple steps.

What's surprising is how fast you can get it done. Most of the time, you can go from choosing a broker to funding your account in under 15 minutes. It's all done online, and brokerage platforms have made the whole process incredibly smooth.

The Four Steps to Your First Investment

Let’s walk through the setup process. Having your information ready beforehand will make it even quicker.

1. Pick Your Brokerage

This is the most critical decision you'll make at this stage. You're choosing your home base for investing, so think about what matters to you. Look at things like trading fees (many offer $0 stock trades now), how easy their app is to use, and what kind of research or educational tools they provide. It’s smart to compare a few of the big online brokers before settling on one.

2. Gather Your Info

You'll need a few key pieces of information to verify your identity, which is a standard requirement to keep your account secure. It’s the same kind of stuff you’d need to open a bank account.

- Your Social Security Number (or ITIN)

- A valid U.S. residential address

- Your date of birth

- Your employment status and a rough idea of your annual income

3. Fill Out the Application

This is a straightforward online form. You’ll plug in the details you just gathered, agree to the platform's terms, and answer a few quick questions about your investing goals. Don't overthink these—they just help the broker understand what you're trying to achieve.

4. Fund the Account

The last piece of the puzzle is to link your bank account and make an initial deposit. You can use a checking or savings account for this. The best part? Most brokers have no minimum deposit, so you can start with whatever amount feels right for you, whether it's $50 or $5,000.

Once your deposit clears, which usually takes a couple of business days, you're officially ready to buy your first investment. To figure out what to do next, check out our guide on how to start investing for beginners.

Brokerage Accounts vs. Other Investment Accounts

A brokerage account is an incredibly flexible tool for building wealth, but it's just one tool in the box. Think of it this way: you wouldn't use a hammer to turn a screw. Knowing when to reach for a brokerage account versus another type of account is what separates a good financial plan from a great one.

The biggest distinction boils down to two things: flexibility and taxes. Brokerage accounts give you the ultimate freedom—you can invest in almost anything and pull your money out whenever you want. The trade-off is that you don't get the special tax breaks that come with accounts designed specifically for long-term goals like retirement.

Retirement Accounts: 401(k)s and IRAs

When it comes to saving for retirement, accounts like a 401(k) or an Individual Retirement Arrangement (IRA) are the heavy lifters. Their superpower is how they handle taxes.

With a traditional 401(k) or IRA, your contributions can often lower your taxable income for the year, and your investments grow without being taxed along the way. You only pay taxes when you take the money out in retirement. A Roth IRA works in reverse: you put in money that's already been taxed, but then your growth and withdrawals in retirement are completely tax-free.

But this tax magic comes with a catch: strict rules. You generally can't touch the money before age 59½ without getting hit with a hefty penalty. This makes them a terrible choice for saving for a house or any other goal that isn't decades away.

Real-Life Scenarios: When to Use Which Account

Let's make this practical. Here are two common goals and the right account for each.

Goal 1: Saving for a House Down Payment in 5 Years. Maria wants to buy her first home. Since she needs the money in the medium-term, a brokerage account is perfect. She can invest her savings for potential growth but, crucially, can withdraw the full amount penalty-free when she finds the right house. Locking her money in a 401(k) would be a disaster.

Goal 2: Planning for Retirement in 30 Years. David is focused on building a nest egg for his golden years. His best strategy is to contribute as much as possible to his company 401(k), especially to get the full employer match. After that, he can open and fund an IRA. Over three decades, the tax advantages of these accounts will create a compounding effect that a standard brokerage account simply can't match.

Here’s a simple breakdown to help you decide which tool fits the job.

| Account Type | Primary Goal | Key Advantage | Main Limitation |

|---|---|---|---|

| Brokerage Account | Flexible, non-retirement goals | Withdraw funds anytime | No special tax benefits |

| 401(k) / IRA | Long-term retirement savings | Significant tax advantages | Penalties for early withdrawal |

| Robo-Advisor Account | Automated, hands-off investing | Simple setup & management | Less control over specific investments |

It's also worth noting that a robo-advisor isn't really a separate type of account, but rather a service that manages your investments for you. You can have a robo-advisor manage your brokerage account or even your IRA. They use algorithms to build and maintain a diversified portfolio, which is a fantastic option for beginners who want a more hands-off approach.

The smartest financial strategies almost always involve using a combination of these accounts, each playing to its strengths to help you reach your different financial goals.

Frequently Asked Questions (FAQ)

1. How much money do I need to open a brokerage account?

Most modern online brokers have no minimum deposit requirements. This means you can get started with as little as $1. Thanks to fractional shares, you can buy a small piece of a company's stock even if you can't afford a full share.

2. Is my money insured in a brokerage account?

Yes, but it's different from bank insurance. In the U.S., accounts are protected by the Securities Investor Protection Corporation (SIPC) for up to $500,000 (including a $250,000 limit for cash) if the brokerage firm fails. This does not protect you against investment losses from market fluctuations.

3. Can I have more than one brokerage account?

Absolutely. There is no limit to the number of brokerage accounts you can own. Some investors use different accounts for different strategies—for example, one for long-term holds and another for more active trading.

4. What's the difference between a brokerage account and a 401(k)?

A brokerage account offers maximum flexibility for investing toward any goal, with no restrictions on when you can withdraw your money. A 401(k) is a retirement-specific account with significant tax advantages but heavy penalties for withdrawing funds before age 59½.

5. How quickly can I get my money out?

When you sell an investment, the transaction takes about two business days to "settle." After that, transferring the cash to your bank account usually takes another 1-3 business days. Plan on a total of 3-5 business days from sale to cash-in-hand.

6. Can I lose money in a brokerage account?

Yes, all investing involves risk. The value of stocks, bonds, and other assets can go down. However, the risk of losing all your money is very low if you build a diversified portfolio (by investing in many different assets) rather than putting all your money into a single stock.

7. Do I have to pay taxes on my investments every year?

You only owe capital gains tax when you sell an investment for a profit. If you simply buy and hold assets, you won't owe taxes on their growth. However, you will likely owe taxes on any dividends or interest paid out by your investments each year.

8. What is a "ticker symbol"?

A ticker symbol is a unique series of letters assigned to a security for trading purposes. For example, the ticker symbol for Apple Inc. is AAPL, and for The Coca-Cola Company, it's KO. You use these symbols to look up and trade investments.

9. What is the difference between a cash account and a margin account?

A cash account requires you to pay for investments in full with the money you have deposited. A margin account allows you to borrow money from the broker to purchase more investments, which amplifies both potential gains and potential losses. Beginners should almost always start with a cash account.

10. Can I open a brokerage account for my child?

Yes, you can open a custodial account (like an UGMA or UTMA). You manage the account on behalf of a minor, and the assets legally belong to them. Once the child reaches the age of majority in their state (usually 18 or 21), they gain full control of the account.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.