Patient investors… they’re the unsung heroes playing the long game. You know, the ones who skip the casino and go for the blue chips. Quality stocks held for decades? It’s like hitting the jackpot, but with patience as your dealer. Who’s the poster child for this? Warren Buffett. Yep, Berkshire Hathaway flexes those 20% annual returns over half a century by sticking with firms that boast rock-solid fundamentals and not jumping on every shiny new object.

So, what do we do with this insight? At Top Wealth Guide, we’ve cracked the code — and we’ve got the top 10 best stocks you should be scooping up now if long-term growth is your game. We’re talking revenue consistency, competitive edge that slices through the market butter, and management teams that aren’t just steering the ship — they’re cruising the yacht.

In This Guide

What Makes a Stock Worth Holding for Decades

Alright, let’s keep it real. The stock game isn’t just about flashy earnings and slick marketing-it’s about the long haul. We’re talking stocks with staying power-that means three things you can’t skimp on. First, revenue growth can’t be a one-hit wonder. You’ve got to see it year after year, stretching over at least five years, not some lucky quarter.

Think Microsoft-14% annual revenue growth from 2015 to 2024. Amazon’s been hitting double digits for more than ten years. You’ve gotta spot firms posting revenue jumps in, say, 8 out of 10 recent years. Anything less? Well, instability’s a sneaky thief of your returns.

Revenue Consistency Beats Growth Spurts

The scoreboard doesn’t lie, folks. Case in point-Coke, generating revenue growth for 128 years till 2020, minting millionaires as it went. Now stack that up against those flashy tech startups-300% growth one year, only to nosedive 50% the next. It’s that good ol’ steady 8-12% annual revenue haul-that’s your ticket to massive wealth city over 20-30 years. It’s all about those quarterly reports from the past decade. Got a company with more than two years of revenue slumps? Move on. Boring outperforms exciting when you’re out to build generational wealth. Just ask Johnson & Johnson or Procter & Gamble.

Competitive Moats That Actually Matter

Real edge comes from profit margins, not empty promises. Why does Apple rock 25% net profit margins? Premium prices, baby-iOS locks you in. Walmart’s sitting at 2.4%, but scale and unbeatable supply chain magic keep it at the front of the pack. Seek out companies with Return on Equity-Berkshire Hathaway? They go for economic moats so wide competitors pack it in. We’re talking patent portfolios, brand clout, network effects, or those regulatory boosts creating fortresses around long-term profits.

Management Teams That Execute Vision

It’s the leadership, stupid. Strong leaders flip strategy into solid results-year in, year out. Tim Cook morphed Apple from a computer firm into a $3 trillion ecosystem beast. And Satya Nadella? Cloud focus-boom, Microsoft’s value shoots up 500% since 2014. Check those management records before laying down your cash. CEO leadership fuels confidence, resilience, and smart growth moves amid chaos. Steer clear of firms with revolving-door leadership or execs who promise the moon and deliver a flashlight. Top teams? They make smart capital calls, grow market share with precision, and keep the lines open with shareholders about both wins and stumbles.

So these bedrock traits sharpen your eye for stocks worth decades of patience, but keeping a pulse on market volatility and dodging common financial mistakes takes your gains even higher.

Which Stocks Should You Hold for 20 Years

NVIDIA… they’re not just about cool graphics cards anymore. They’ve morphed into this AI infrastructure behemoth. Think: from gamer gear to the brains behind the next-gen tech revolution. Crushing it in the AI chip market, their data center haul soared 112% – landing at $30.8 billion in Q3 2025 (mic drop). Then, there’s Microsoft. A cloud juggernaut – Azure’s flex grew 29% year-over-year in Q4 2024, and Office 365? Crushing with 345 million users. Apple’s still the impenetrable fortress we love – $383 billion in revenue, and yep, 2 billion active devices that glue us all to their universe. These guys? They don’t just grow – they redefine everything and make patient investors grin like Cheshire cats.

Healthcare Giants Built for Decades

Johnson & Johnson… the granddaddy of dividends – 128 years of payouts for investors. Pfizer – a cool $100 billion in revenue in 2022 thanks to game-changing drugs and a reach that spans 175 places on the globe. UnitedHealth Group’s been on a decade-long bender – 14% annual growth, totaling $372 billion in 2023, just riding that relentless healthcare cost wave. Eli Lilly’s hopping aboard too, with its diabetes and obesity wonders – Mounjaro snapped up $5.2 billion in 2023. Healthcare stocks? They surf through recessions like it’s a summer breeze (because, folks, we need meds no matter what – an aging populace ensures that demand for pharma brilliance stays hotter than ever).

Consumer Staples That Never Fail

Coca-Cola – 63 years of dividend boosts; you drop a grand in 1962? That’s $680,000 today… Ka-ching! Procter & Gamble’s the puppet master of your cupboards – 5 billion consumers get tagged by Tide, Crest, Pampers every day. Walmart’s $611 billion revenue in 2024? Proof of retail supremacy with 10,500 stores serving 230 million folks weekly. These consumer titans flourish when the economy tanks and shoppers flock to value brands. Dividend powerhouses like PepsiCo, Colgate-Palmolive, and Kimberly-Clark crank out steady 3-5% yields… because, come on, must-have products fuel cash flow even through market squalls.

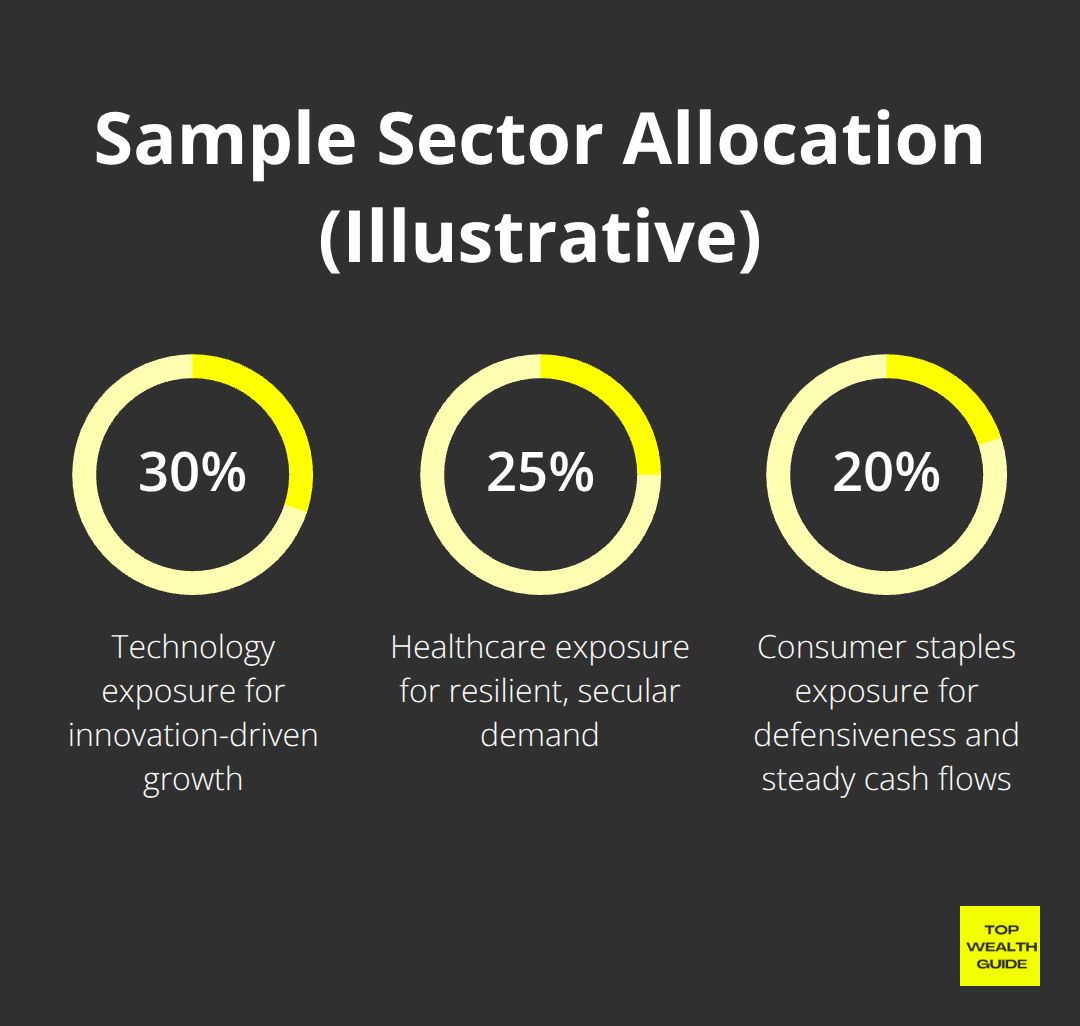

The secret sauce? Portfolio construction – it ain’t just about picking stars and crossing your fingers. Nope. Savvy allocation across these rock-solid sectors demands strategy… maximizing returns while trimming risk like a pro.

How Should You Construct Your Long-Term Portfolio

Let’s talk smart, practical portfolio construction – ever heard of the 70-20-10 rule? It’s got real street cred. Throw a solid 70% into large-cap stocks – think tech giants, healthcare stalwarts, consumer staples – the likes of Microsoft, Johnson & Johnson, Coca-Cola. Then, 20% goes to mid-cap growth stocks in promising sectors, and keep 10% for those wild small-cap value plays – hello, explosive potential. Remember: sector allocation is the real heavyweight. Go for 30% tech, 25% healthcare, 20% consumer staples, 15% financials, and 10% industrials. That way, if one sector goes belly-up, you’re not sunk – others carry the load.

Dollar-Cost Average Instead of Market Timing

Here’s the deal: invest $500 monthly. Steer clear of the whole “drop $6,000 in one splash” philosophy. Dollar-cost averaging is your safety net against poor market timing. Set it up automatically – 1st of each month. No fuss, no drama, no second-guessing market conditions. Picture this: Tesla dollar-cost averagers from 2019 to 2024 enjoyed a sweet 847% return, while the lump-sum folks who “timed the market” got just 623%. Brutal math: miss out on the top 10 trading days over 20 years, and boom – returns slashed by 54% (thanks, JP Morgan). For volatile stocks, weekly investments beat monthly, smoothing out rocky price juxtapositions.

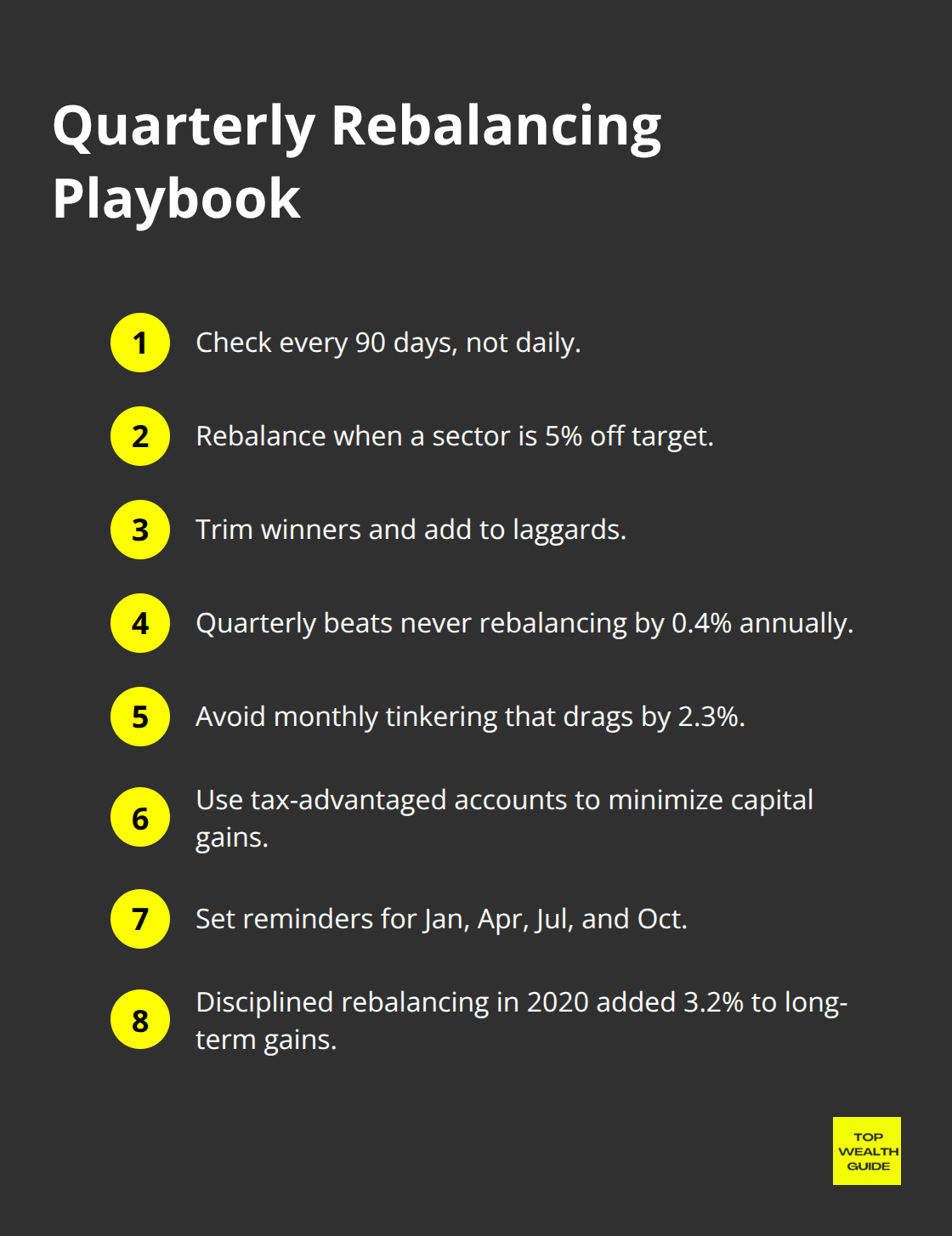

Rebalance Quarterly Without Overtrade

Peek at your portfolio every 90 days, not every morning. Rebalance if any sector wanders 5% away from target. Sell some winners, pick up the laggards.

Morningstar tells us quarterly rebalances outpunch those who never rebalance by 0.4% annually – and dodge that 2.3% drag monthly tinkers cause. Use tax-advantage accounts for rebalancing – buffer those capital gains. Set reminders for January, April, July, October – stick to it, market noise be damned. Charles Schwab figures show disciplined rebalancing during the 2020 chaos boosted long-term gains by 3.2%, as folks snagged premier stocks at generous markdowns.

Diversify Across Market Caps and Geographies

It’s a big world out there – don’t just buddy up with U.S. large-caps. Go global for those juicy growth opportunities. International stocks? Great hedge against dollar flips and light up different economic stages. Pop in 15-20% for developed markets, 5-10% to dip into emerging markets for that diversification mojo. Small-cap stocks? Historically, they’ve outshone large-caps in certain times – like the inflation-heavy ’70s. Blend growth and value stocks across the board. Growth stocks thrive in boom times, value stocks shine in recovery phases. Finally, consider investment apps for easy, efficient execution – and keep track of your assets across varied platforms.

Final Thoughts

You’ve got to love patient investors-they’re the tortoises that always, always beat the hares in this market race. Take a cue from Warren Buffett… his 20% annual returns over 50 years pretty much scream that if you hold quality stocks for, well, decades, you’re going to be swimming in wealth. Companies like NVIDIA, Microsoft, and Johnson & Johnson-yep, they’re handing out rewards to those patient investors who dig consistent growth and market dominance.

Let’s talk strategy. Your stock game should plant its flag on three hills: consistent revenue growth (not just one year, folks, we’re talking multiple), competitive moats that keep the profits flowing, and management teams that know their stuff. The top 10 best stocks to buy now… they’ve got these traits lined up and ready to roll, with steady cash flows that laugh in the face of economic whims. And don’t forget, building your portfolio is just as big a deal as picking those golden stocks (think 70-20-10 allocation rule, dollar-cost averaging monthly, quarterly rebalancing…the works).

Time to kickstart that long-term portfolio. Automatic monthly investments in rock-solid companies with real-deal fundamentals-don’t wait. Stick to your guns even when the market gets all wobbly and please, avoid those panicky decisions that can tank your returns faster than you can say “oops.” At Top Wealth Guide, we’ve got the insights to keep you on your path to investment decisions that match your financial dreams.