Dividend stocks — they’re the secret sauce for investors hungry for steady cash flow and growing your wealth over the long haul. Here at Top Wealth Guide, we’ve watched these stocks do wonders, delivering stability and a financial safety net (think cash cushion) for our clients.

So, let’s dive in… Today, we’re scouting out the crème de la crème of dividend stocks — those that have been tried, tested, and true in throwing value back to shareholders. Plus, we’ll dissect the critical factors you should absolutely keep in mind when picking dividend-paying studs for your investment arsenal.

In This Guide

What Are Dividend Stocks?

Definition and Importance

Dividend stocks… what are we really dealing with here? They’re a piece of the corporate pie given back to you – the investor – regularly. This slice of pie can be a game-changer in the world of wealth building and crafting that sweet flow of passive income.

The Mechanics of Dividends

Okay, so here’s the 411: Companies that make dough have two major roads they can stroll down – plow it back into growing the business or hand it out to shareholders. Dividends, they’re mostly dropping into your account quarterly, but you have the oddball ones going monthly or annually. Realty Income, now that’s a head-turner with its monthly dividends (a big magnet for anyone who’s into frequent paydays).

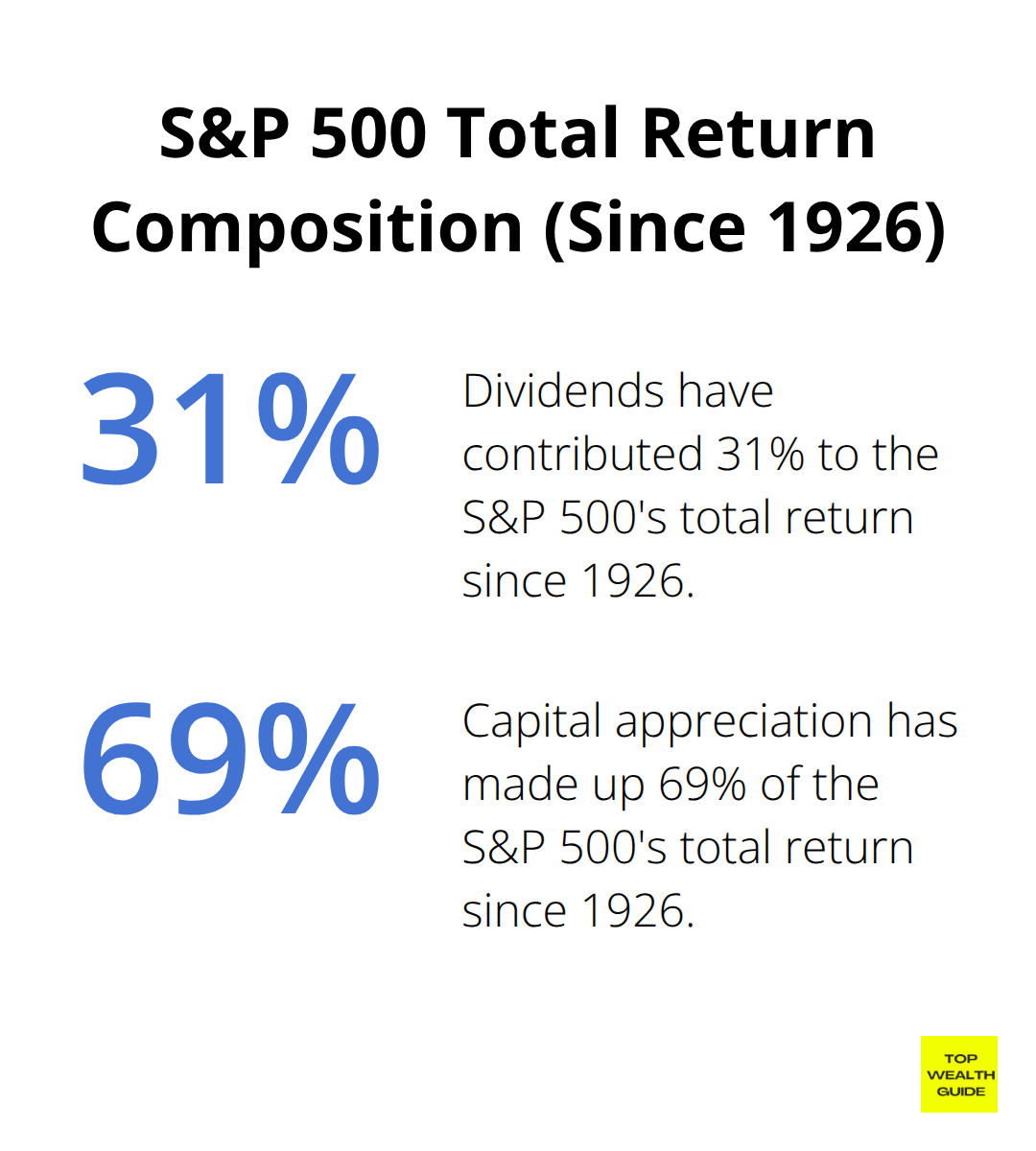

Dividends… they’re a big chunk of the total returns pie. Since the roaring ’20s – 1926, to be exact – these beauties have made up roughly 31% of the total return for the S&P 500, leaving capital appreciation to handle 69%. Look at it: that speaks volumes about the magic of dividend reinvestment – it’s like clockwork, compounding like crazy over time.

Characteristics of Dividend-Paying Companies

What kind of companies are cutting dividend checks? We’re talking the mature, stable businesses of the corporate world – think of them as the elder statesmen with cash to spare. They’re earning more than they need just to get by or to grow, so they share the wealth through regular dividend payouts.

Advantages of Dividend Investing

- Passive Income Streams: This is gold for anyone eyeballing retirement or simply kicking back with a steady income flow.

- Market Downturn Protection: When the market’s playing yo-yo, those dividend payments act like a buffer, softening the blow from those nosediving stock prices.

- Lower Volatility: Compared to their wild, non-dividend-flinging cousins, these stocks? They’re like the calm in the storm.

- Inflation Hedge: Many players in the dividend game are upping their dividend ante over time – a neat trick to keep inflation in check.

Performance of Dividend Aristocrats

Zoom in on the S&P 500 Dividend Aristocrats – they’re the elite club that’s been bumping up dividends for at least a quarter-century. They’ve strut their stuff on the performance front over long stretches.

Looking ahead, putting the puzzle pieces together for selecting top stocks – that’s the blueprint for an income-generating portfolio that’s as solid as a rock.

How to Pick Winning Dividend Stocks

Yield and Payout Ratio: The Dynamic Duo

Dividend yield – it’s the bread and butter of divvy investing, folks! It’s that delicious slice of company profits that gets doled out to shareholders, calculated by the sweet, simple math of annual dividends per share divided by the current market price. But watch it – yields north of 4% or 5% are like a neon sign screaming “Look closer!”

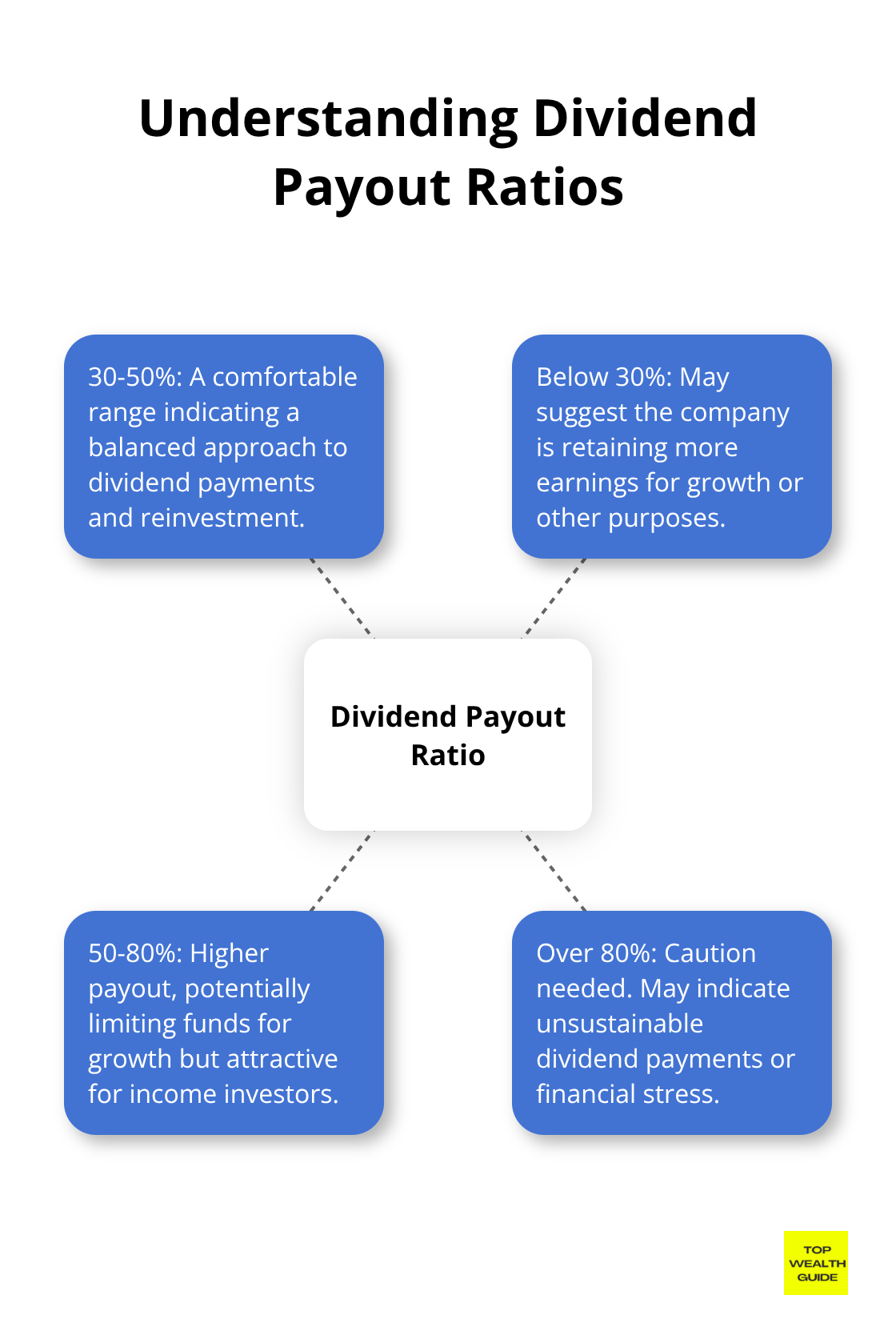

The payout ratio – this little gem works hand-in-glove with yield. It shows what portion of the profits is sent straight into investors’ pockets as dividends. A snug and comfy ratio would sit between 30% and 50%. But if you see it tiptoeing over 80% – yikes – hit the brakes and dig deeper.

Consistency: The Hallmark of Quality

Consistency – the true test of a company’s mettle. Diving into dividends isn’t just about who’s paying, but who’s upping the ante year after year. Enter Dividend Aristocrats – the creme de la creme, the S&P 500 hitters with 25 years of consecutive dividend boosts.

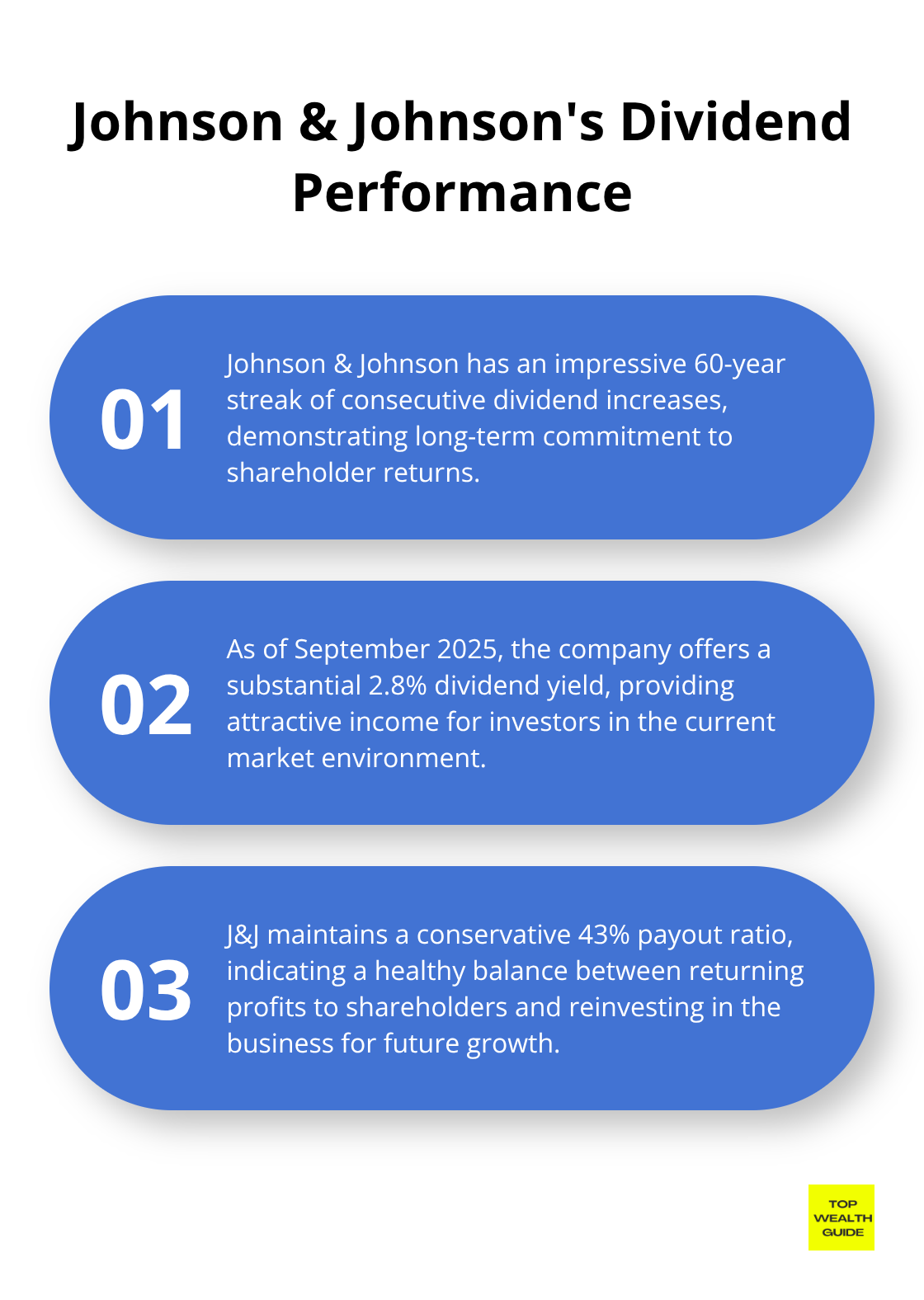

Johnson & Johnson? The crown jewel with a 60-year gig of non-stop dividend love. That’s the kind of reliability that makes investors breathe easy, knowing their income stream is secure.

Financial Health: The Foundation of Sustainability

Time to pop the hood and look at those financial statements if you want to know if the divvies are here to stay. Key metrics on your checklist should be:

- Cash Flow: Ample free cash flow? Jackpot! It signals the ability to keep the dividends coming (and growing).

- Debt Levels: Too much debt and it’s like trying to swim with a lead jacket – not good for those dividend dreams.

- Profit Margins: Nice, fat margins are the cushion that keeps dividend policies from bouncing.

Profitless companies or ones buried under debt? That’s a red alert for divvy lovers. Stick with the big fish in stable ponds (think utilities, consumer staples, healthcare) if you want peace of mind.

Industry Position: The Competitive Edge

A company’s rank in its industry is a biggie – can it hold its ground and keep those dividends rolling? The market kings often have the pricing strategy and big-scale advantages to back consistent dividend checks. Sizing up a company’s competitive moat helps you gauge if dividends are built to last.

Building an invincible dividend portfolio doesn’t wrap up here. Stay tuned for our next dive into spotlighting specific dividend stars currently turning heads in the market. You’ll see how these principles shine in actual investment plays.

Top 5 Dividend Stocks for Steady Income

Johnson & Johnson (JNJ): A Healthcare Titan

Johnson & Johnson, the stalwart of healthcare, with a jaw-dropping 60-year dividend increase streak. Yup, 60. As of September 2025, this titan offers a juicy 2.8% dividend yield with a no-fuss payout ratio of 43%. The secret sauce? A sprawling healthcare empire (pharma, medical devices, consumer health products) that weathers economic storms better than most.

And get this-JNJ’s balance sheet is rock solid, sitting on a $20 billion cash pile-yes, billion with a “b.” This cushions its ability to keep the dividends flowing and growing. Plus, with over $12 billion thrown at R&D each year, they’re locked and loaded for future expansion and dividend longevity.

Procter & Gamble (PG): Consumer Staples Leader

Procter & Gamble, your grandma’s fave for household goods, has been upping its dividend game for 65 years straight. You heard right-65! Offering a decent 2.5% yield and a 61% payout ratio, this dividend is snugly covered by earnings. Think Tide, Pampers, Gillette-routine must-haves generating cash regardless of economic hiccups.

PG just keeps savvy-shifts like core margin expansion and earning per share (EPS) growth when markets are doing cartwheels epitomize its premiumization plan. Plain and simple, it’s a reliable bet for those chasing consistent dividend growth.

Coca-Cola (KO): Refreshing Dividends

Coca-Cola-it’s not just your go-to soda. It’s for income hunters too, with a barrage of 59 consecutive years hiking dividends. Right now, KO offers a thirst-quenching 3.1% yield and a 75% payout ratio. Yeah, that ratio’s kinda chunky, but the brand clout and global reach keep those dividends trucking.

Pivoting to healthier drinks and breaking into emerging markets? Smart. Add aggressive cost-slashing, and you’ve got a formula for keeping that dividend train rolling along.

AT&T (T): High-Yield Telecom Giant

AT&T, don’t call it just another telecom. This outfit’s dishing out a whopping 7.2% dividend yield-leaps above the S&P 500 norm. Some drama though, a recent dividend slash and WarnerMedia spin-off. The silver lining? AT&T’s core telecom biz, bolstered by the 5G wave, is still kicking out growth avenues.

Consider the high 95% payout ratio-it’s a bit dicey for continuity. But with a laser focus on slashing debt and powering digital infrastructure, it’s still a contender for income seekers-just keep an eye on it.

Realty Income (O): Monthly Dividend Machine

Realty Income, aka “The Monthly Dividend Company,” for those who like their payouts as regular as clockwork. This REIT’s jacked up its dividend 115 times since 1994. That’s right, 115. Currently dishing out a sweet 4.5% yield with a steady AFFO payout ratio of 76%.

Realty Income isn’t joking-about 90% of its rent collection is bulletproof against both recessions and the e-commerce tidal wave. Toss in its new European ventures and a focus on top-tier tenants, and it stands as a fortress of dependability for dividend hunters.

Final Thoughts

Dividend investing… what’s the deal? It’s like having your cake and eating it too (because who doesn’t like cake?), offering a surefire way to build wealth and rake in some regular income. The crème de la crème of dividend stocks-top ranked if you will-aren’t just about numbers. They provide a neat package of stability, growth, and cash flow that fortifies any investor’s portfolio. These companies? They’ve got the secret sauce-long-standing dividend increase streaks and rock-solid financials.

But let’s not get tunnel vision here. A mix-and-match approach is key, even when you’re swooning over those dividend darlings. Spreading your bets across sectors and companies ensures you’re not betting the farm on a single stock’s fate. And, do your homework, folks. Dive deep into a company’s financials, industry rank, and that juicy dividend history before you put your money on the line.

Top Wealth Guide – our partner in crime on the road to dividend investing and wealth building. They’ve got the goods, from market analysis to financial planning tools, all designed to arm you for the journey toward that pot of gold. Whether you’re just getting your feet wet or fine-tuning your investment acumen, they’re here to see you through.

1 Comment

Pingback: Investment Timing Guide for Maximum Wealth Growth - Top Wealth Guide - TWG