December is the last call for investors to dive into tax planning—seriously, this is your shot to make big moves that can really boost your financial situation. Think of it as the final round in a game where the stakes are high, and the smart play here can save you thousands on your tax bill.

Our team at Top Wealth Guide has done the homework and identified the top year-end strategies you absolutely should not skip. These aren’t just any strategies—they’re the kind that not only lighten your tax load but also set you up for that sweet, long-term growth.

In This Guide

How Tax-Loss Harvesting Works for Investors

So, tax-loss harvesting-what’s the deal? It’s like turning lemons into lemonade, but for your portfolio. You take those dud investments and voilà, they morph into tax savings. Sell those underachieving stocks to combat capital gains. And the kicker? Offset all the capital gains you want, plus shave off up to $3,000 in losses against your regular income every year. According to Vanguard, over 400 stocks in the S&P 500 dipped-by at least 5%-in 2025. Opportunity knocks! Just circle November 28, 2025, on your calendar to ensure trades settle before December 31.

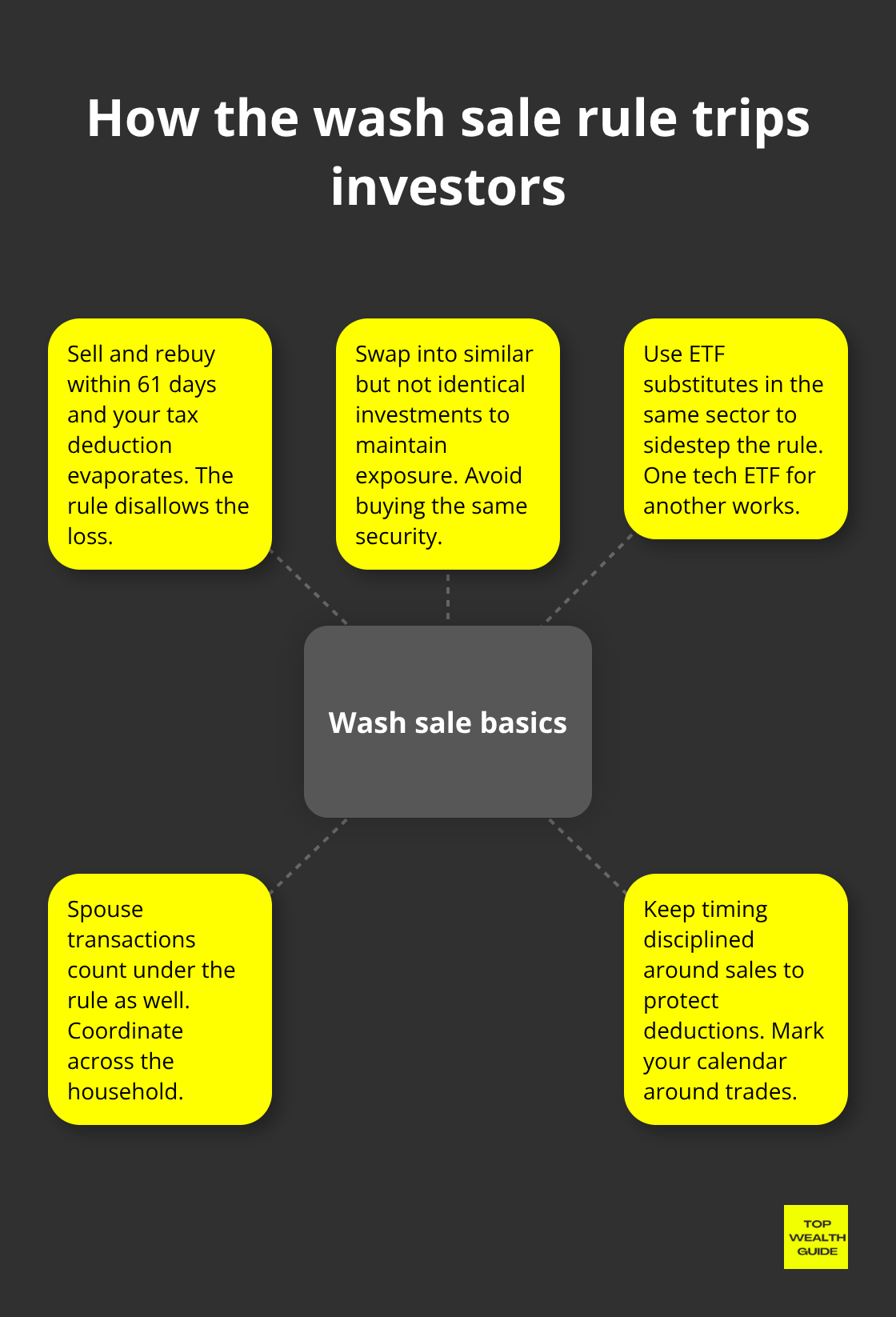

The 30-Day Wash Sale Trap

Ah, the IRS and their wash sale rule-a real party pooper. If you sell a stock and buy it back within 61 days…poof! Tax deduction gone. Imagine selling Apple, then snagging it back 20 days later-no bueno for your tax break. Savvy investors dodge this by playing musical chairs with similar but not identical investments. One tech ETF swapped for another…problem solved. And heads up-if your spouse plays the same game, it counts too.

Family coordination is key, folks!

Strategic Timing for Maximum Impact

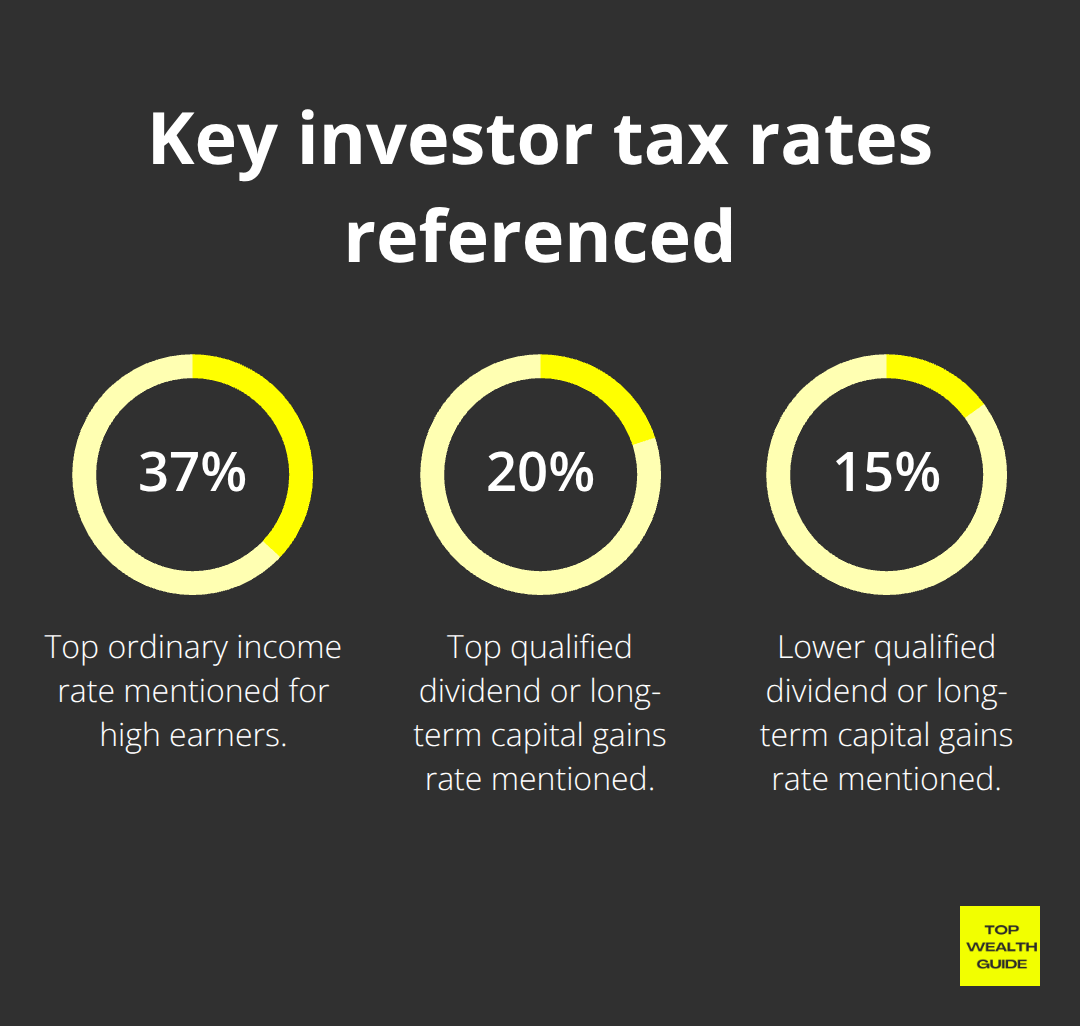

Timing is everything, especially for tax-loss harvesting. You’ve got hefty capital gains? Perfect timing. The folks in the 37% tax bracket really reap the rewards-high tax folks face lofty capital gains rates as high as 23.8%. Using the MinTax cost basis method helps minimize tax when juggling those multiple stock lots. Remember, long-term losses dance with long-term gains, and short-term losses with short-term gains-keeping track is a must. And those extra losses? They carry forward, like luggage, continually cutting future taxes.

Automated vs Manual Harvesting

Enter automated harvesting services-your tax-saving sidekick, slashing labor and boosting savings. These platforms analyze your portfolio and seize opportunities like a hawk. Manual harvesting? Sure, you’re the captain, but it demands constant vigilance and meticulous bookkeeping. Most folks see automated systems scooping up more chances than the sporadic DIY approach. Next up-max out those retirement contributions before the year’s curtain call.

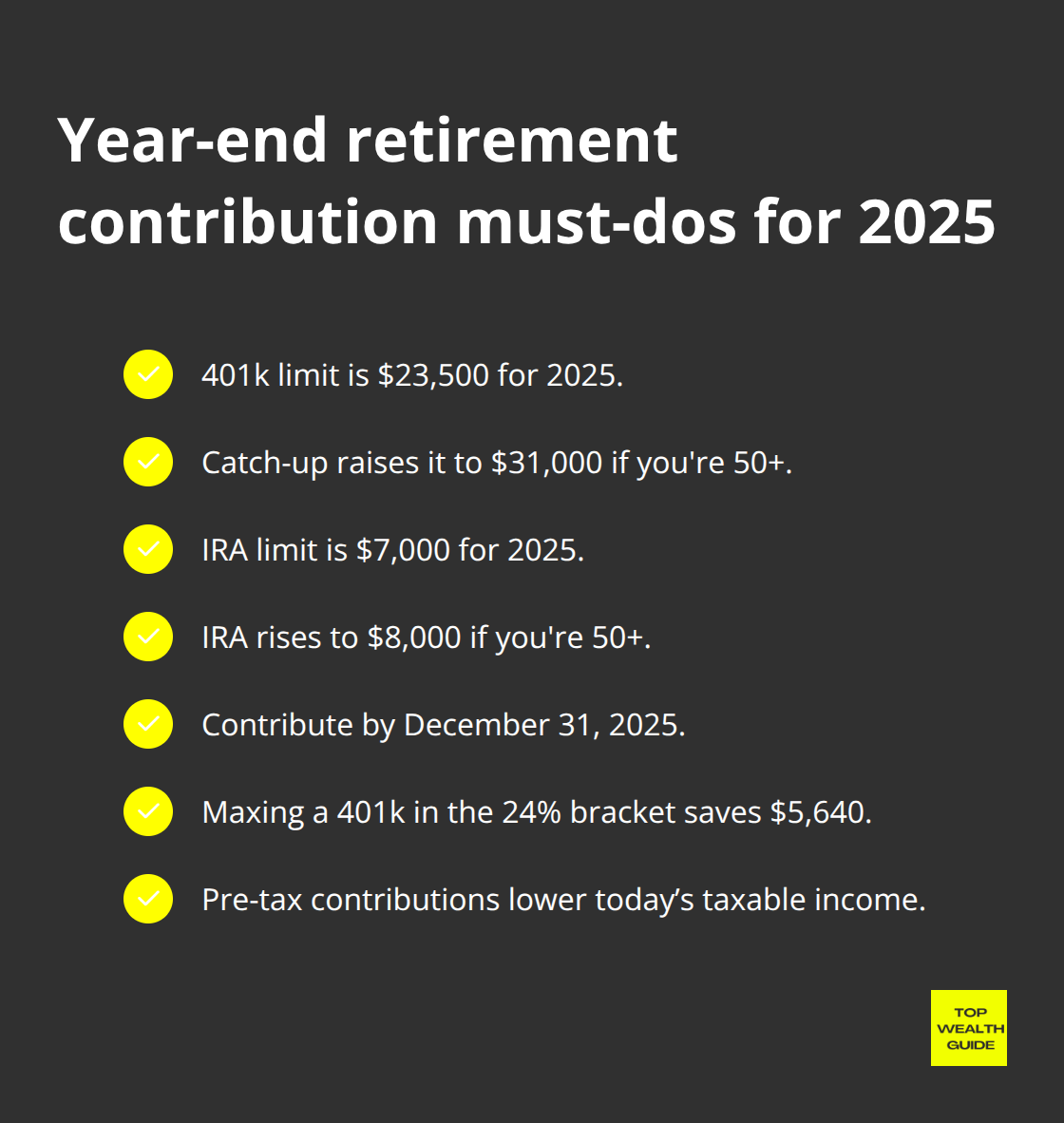

Maximizing 401k and IRA Contributions Before Year-End

December 31 – that’s your last call to supercharge those 2025 retirement contributions. The numbers? They’re big. The 401k contribution limit is $23,500 for 2025. And if you’re 50 or older, you get a boost – up to $31,000 with catch-up contributions. And IRA folks? You’re looking at $7,000, $8,000 if you’re over 50.

These are not your friendly neighborhood suggestions – they’re serious chances to trim that tax bill while growing your nest egg. Imagine this: A worker in the 24% tax bracket maxing out their 401k saves $5,640 in taxes right off the bat. It’s simple math, folks: Toss in your contributions now, dodge the taxman today, pay up later when you’re cruising in that lower tax bracket in retirement.

Roth Conversion Windows Close Fast

Let’s talk Roth IRA conversions. They’re like the Swiss army knife of tax strategies-multifaceted. Convert those traditional IRA funds to a Roth, and sure, you pay taxes now on the converted amount, but poof-no more future required minimum distributions and you get tax-free growth.

The prime time for conversions? When you’re earning less than usual, or if you expect Uncle Sam to up his cut in the future. Take a $50,000 conversion in the 22% bracket-it’s an $11,000 tax hit today but saves you more if tax rates jump. And Secure Act 2.0? Geez, it even allows 529 plan conversions to Roth IRAs, given certain conditions. More ways to grow tax-free, what’s not to love?

RMD Deadlines Hit Hard

Now, RMDs. Required minimum distributions for you folks hitting 73 and up need to be done by December 31, 2025, or else face the IRS wrath-a 25% penalty on whatever you didn’t take out. They’ll knock that down to 10% if you fix it in two years, but c’mon, better to avoid that mess altogether.

Figuring out RMD amounts involves dividing your December 31, 2024, account balance by your life expectancy factor (thanks, IRS Publication 590-B). Just turned 73 in 2024? You’ve got until April 1, 2025, for the first RMD, but be strategic-taking both the 2024 and 2025 RMDs in the same year can bump you into those sticky high tax brackets.

Qualified Charitable Distributions Offer Smart Workarounds

In a charitable mood? Qualified charitable distributions are your best friend-donate up to $108,000 straight from your IRA to charity, satisfy that RMD, and dodge taxes on the distribution. Couples can double down-$216,000 combined. Real fireworks for high-net-worth retirees.

This move’s a winner if you itemize deductions and already support charities. The donation hits your RMD requirement and slices your taxable income dollar-for-dollar. And hey, asset location strategies can push your tax efficiency even further across different account types. Efficiency and charity? That’s a combo you don’t see every day.

Investment Portfolio Rebalancing for Tax Efficiency

Here’s the deal – smart asset placement across different account types is like having a tax slasher in your back pocket. It means parking your high-tax investments in tax-advantaged accounts while keeping the tax-friendly stuff in taxable ones. Bond interest? Yeah, it gets pummeled at those ordinary income rates up to 37%… perfect candidates for your 401k or a traditional IRA. Stocks? They’re the belle of the ball, with qualified dividends taxed at just 15% to 20% – ideal for taxable accounts.

And real estate investment trusts? Throw these into that Roth IRA for those sweet words: tax-free growth forever.

Municipal Bonds Slash State and Federal Taxes

Municipal bonds – the tax saviors for those raking it in. These bonds pay interest that’s exempt from federal taxes, and if you grab bonds from your home state, you dodge state taxes too. Imagine being a California resident in the 37% federal bracket who picks up California munis… you get a tax-equivalent yield lift. A 4% muni bond shakes out as a 6.35% taxable one for someone at the top. Vanguard’s Tax-Exempt Bond Index Fund? It’s been rolling out solid returns while keeping Uncle Sam’s mitts off the cash. High earners in California, New York, and New Jersey get the biggest bang here.

Asset Location Strategies That Actually Work

Strategic, tax-efficient investors – they know where to place their assets across account types. Those REITs and high-yield bonds? Stuff them into tax-deferred accounts where ordinary income treatment has zero bite. Stock index funds? Toss them into taxable accounts where you can harvest losses and enjoy the lower capital gains rates. And international funds? Great fit for taxable accounts too since you can snag foreign tax credits (miss those in retirement accounts). It’s clear math: A bond fund giving off 5% annually hits with a 1.85% tax if you’re in the 37% bracket… but nada in a 401k.

Charitable Donations with Appreciated Securities

Here’s the no-brainer – donating appreciated securities wins against writing checks every single time. Donating stock held over a year? Full fair market value deduction without capital gains taxes lurking up to 23.8%. Fidelity Charitable has helped folks support over 406,000 nonprofits with $84.5 billion in donor-recommended grants. Donor-advised funds? They let you grab the tax deduction now and roll out grants to charities over time. The annual gift tax exclusion sticks at $19,000 for individuals in 2025, serving up plenty of room for strategic donations that trim down your tax bill while supporting what you love.

Final Thoughts

December tax planning. It’s like setting your GPS for financial success-today and way down the road. Tax-loss harvesting? Yeah, it’s like saving a bundle without breaking a sweat… and catching stuff you might otherwise miss. Hack your 401k to the limit at $23,500, and boom-tax relief with compound interest riding shotgun. Then there’s Roth conversions-your VIP pass to tax-free retirement money, especially sweet when Uncle Sam starts raising the rates.

Now, pay attention-strategic asset placement? That’s the ace up your sleeve. Municipal bonds-they’re like tax invisibility cloaks for high earners, dodging both federal and state taxes. And giving away appreciated securities? Double tax win. Crunching numbers? Picture this-someone in California at 37% bracket transforms a 4% muni bond into 6.35% if it were taxable. Do the math.

These moves? They’re like planting money trees for decades. Early tax planning? It’s the secret handshake that fuels capital growth and speeds up wealth pile-on. Reactive vs. proactive tax moves? That’s where you separate the ‘okay’ investors from the ones who crush it. Here at Top Wealth Guide, we’re your GPS for this journey-giving you real, actionable moves to build your wealth empire using smart, savvy decisions.