Building wealth is less about finding a single secret and more about applying a consistent, multi-faceted approach. While the journey to financial independence is unique for everyone, the underlying principles remain remarkably consistent. This guide moves beyond generic advice to provide a detailed blueprint of 10 powerful and proven strategies for building wealth, designed to create a robust financial foundation.

This article, written by financial strategist and author Jane Sterling, serves as a comprehensive roadmap, not just a list of ideas. We will explore a curated collection of actionable tactics covering everything from disciplined saving and diversified investing to advanced risk management and tax optimization. You will learn how to build a portfolio that includes stocks, real estate, and even alternative assets, all while strategically managing debt and creating new income streams.

We break down each strategy with specific implementation details, real-life examples, and clear comparison tables to help you make informed decisions. The goal is to provide you with a clear structure for turning these concepts into a personalized financial plan. Whether you are just beginning to invest or are looking to refine your existing approach, this roundup will equip you with the essential tools and fresh perspectives needed to accelerate your progress. Consider this your definitive guide to constructing a secure and prosperous financial future, one strategic step at a time.

In This Guide

- 1 1. Master the Diversified Investment Portfolio

- 2 2. Maximize Retirement Accounts

- 3 3. Real Estate Investment

- 4 4. Debt Elimination and Credit Optimization

- 5 5. Income Diversification and Side Hustles

- 6 6. Consistent Saving and Budgeting

- 7 7. Stock Market and Index Fund Investing

- 8 8. Invest in Your Human Capital Through Education and Skill Development

- 9 9. Entrepreneurship and Business Ownership

- 10 10. Harness the Power of Long-Term Compound Growth

- 11 Wealth-Building Strategies: A Comparative Overview

- 12 Turning Strategy into Action: Your Personalized Wealth Plan

- 13 Frequently Asked Questions (FAQ) about Building Wealth

1. Master the Diversified Investment Portfolio

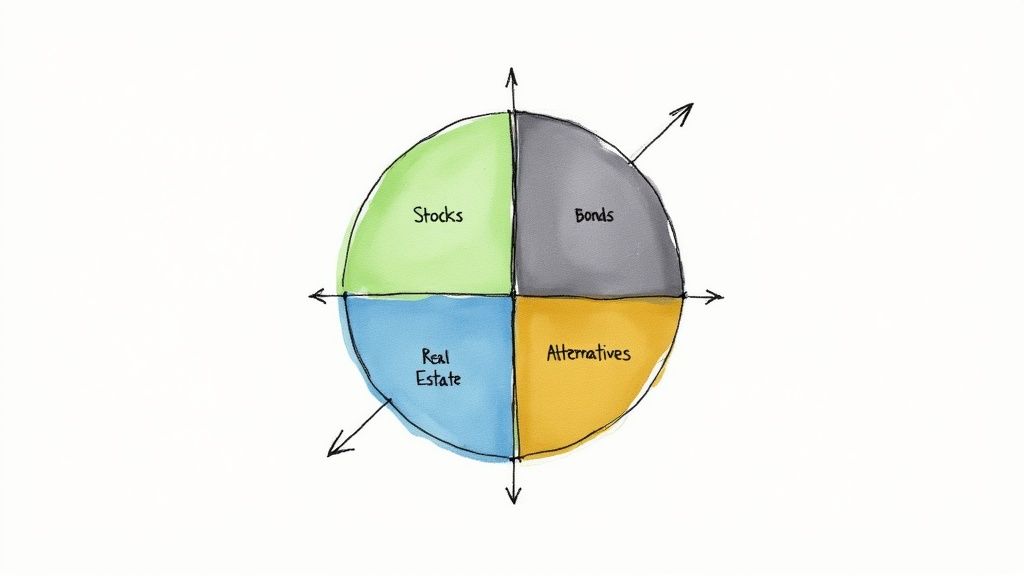

The foundational principle of strategic wealth accumulation is not about picking a single winning stock; it's about building a resilient and balanced collection of assets. This is the core of a diversified investment portfolio, one of the most reliable strategies for building wealth over the long term. This approach, rooted in Harry Markowitz's Nobel Prize-winning Modern Portfolio Theory, involves spreading your capital across various asset classes like stocks, bonds, real estate, and alternatives to mitigate risk.

The logic is simple yet powerful: different asset classes react differently to the same economic events. When one segment of your portfolio is underperforming, another may be thriving, creating a balancing effect that smooths out returns and reduces overall volatility. This strategy protects your capital from the catastrophic failure of a single investment, ensuring a more stable and predictable path toward your financial objectives.

How to Implement Portfolio Diversification

Getting started with diversification is more accessible than ever, thanks to financial innovations championed by figures like Vanguard founder Jack Bogle.

- Start with Low-Cost Index Funds: For beginners, index funds or Exchange-Traded Funds (ETFs) offer instant diversification. A single S&P 500 index fund, for instance, gives you a small stake in 500 of the largest U.S. companies.

- Determine Your Asset Allocation: Your ideal mix of assets depends heavily on your age, financial goals, and risk tolerance. A common starting point is the classic "60/40 portfolio" (60% stocks for growth, 40% bonds for stability). Younger investors might adopt a more aggressive 80/20 split, while those nearing retirement may prefer a conservative 40/60 allocation.

- Rebalance Periodically: Your portfolio's allocation will naturally drift over time as different assets grow at different rates. It is crucial to rebalance, typically annually or semi-annually, by selling some of your outperforming assets and buying more of your underperforming ones to return to your target allocation.

Real-Life Example: Maria, a 30-year-old software engineer, adopts an 80/20 allocation. She invests 80% of her portfolio in a mix of U.S. and international stock index funds and 20% in a total bond market fund. When stocks had a strong year and grew to 85% of her portfolio, she sold 5% of her stock funds and bought more bond funds to rebalance back to her 80/20 target. This disciplined approach locks in some gains and prevents her from becoming over-exposed to stock market risk.

For a deeper dive into crafting your ideal asset mix, you can learn more about how to optimize your portfolio with smart asset allocation. Ultimately, mastering diversification is a non-negotiable step in building sustainable, long-term wealth.

2. Maximize Retirement Accounts

One of the most potent strategies for building wealth is systematically leveraging tax-advantaged retirement accounts. Vehicles like a 401(k), Traditional IRA, or Roth IRA are not merely savings accounts; they are powerful wealth-building engines supercharged with significant tax benefits. This strategy accelerates your financial growth by reducing your current taxable income or allowing for tax-free withdrawals in retirement, letting your investments compound more efficiently over time.

The core advantage lies in tax deferral or tax-free growth. Contributions to a traditional 401(k) or IRA lower your immediate tax bill, allowing you to invest more capital upfront. This "pre-tax" money grows untouched by yearly capital gains taxes, a phenomenon known as "tax-sheltered growth," which dramatically enhances long-term returns. For high-income earners or the self-employed, specialized accounts like a Solo 401(k) offer even greater contribution limits, making this a cornerstone strategy for nearly every financial plan.

Retirement Account Comparison Table

| Feature | 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|

| Contribution Source | Employee & Employer | Individual | Individual |

| 2024 Contribution Limit | $23,000 (+$7,500 catch-up if 50+) | $7,000 (+$1,000 catch-up if 50+) | $7,000 (+$1,000 catch-up if 50+) |

| Tax Treatment | Pre-tax contributions, tax-deferred growth | Pre-tax contributions, tax-deferred growth | Post-tax contributions, tax-free growth & withdrawals |

| Key Advantage | Employer match, high contribution limits | Tax deduction on contributions | Tax-free withdrawals in retirement |

How to Implement Retirement Account Maximization

Harnessing the full potential of these accounts requires a deliberate and consistent approach. The key is to take advantage of every benefit offered, from employer contributions to tax optimization.

- Capture the Full Employer Match: The first priority should always be contributing enough to your 401(k) to receive the maximum employer match. This is an instant, guaranteed return on your investment. For example, if your employer matches 50% up to 6% of your salary, contributing that 6% immediately yields a 50% return on your money.

- Aim for Maximum Annual Contributions: After securing the match, work toward contributing the annual maximum allowed by the IRS. For 2024, this is $23,000 for a 401(k) for those under 50. Consistently maxing out these accounts is one of the most reliable strategies for building wealth.

- Choose the Right Account Type: Decide between Traditional (pre-tax) and Roth (post-tax) accounts based on your expected future income. If you anticipate being in a higher tax bracket during retirement, a Roth account's tax-free withdrawals can be incredibly valuable. Conversely, if you expect lower income, a Traditional account's upfront tax deduction may be more beneficial.

To help determine which accounts best fit your financial goals, you can learn more about how a retirement accounts comparison can maximize your tax benefits. Properly utilizing these tools is a fundamental step toward securing a prosperous financial future.

3. Real Estate Investment

Beyond stocks and bonds, real estate represents a tangible and powerful asset class for wealth creation. Popularized by figures like Robert Kiyosaki and Barbara Corcoran, real estate investment is a cornerstone strategy for building wealth by acquiring property that can generate income, appreciate in value, or both. This approach offers unique advantages, including the ability to use leverage through mortgages, significant tax benefits like depreciation, and a natural hedge against inflation as property values and rents tend to rise over time.

The core principle is to control an appreciating asset that can also produce steady cash flow. Whether it's a long-term rental providing monthly income or a strategic property purchase in a growing neighborhood, real estate allows you to build equity as you pay down your mortgage and the property's value increases. This dual benefit of cash flow and appreciation makes it one of the most reliable strategies for building wealth for those willing to learn the market.

How to Implement Real Estate Investment

Getting started in real estate doesn't always require a massive down payment. There are multiple entry points depending on your capital, risk tolerance, and desired level of involvement.

- Start with Your Primary Residence: Often called "house hacking," you can purchase a multi-unit property, live in one unit, and rent out the others. The rental income can offset or even cover your entire mortgage payment, allowing you to live for free while building equity in a valuable asset.

- Focus on Cash-Flowing Rentals: The most common strategy is buying residential properties to rent out. The primary goal is to ensure the monthly rent covers all expenses (mortgage, taxes, insurance, maintenance) with a surplus left over. This positive cash flow provides passive income while the property appreciates.

- Explore Real Estate Investment Trusts (REITs): For those who want exposure to real estate without the responsibilities of being a landlord, REITs are an excellent option. These are companies that own or finance income-producing real estate, and you can buy shares in them just like a stock, offering diversification and liquidity.

Real-Life Example: David and Sarah buy a duplex for $400,000 using an FHA loan with a low down payment. They live in one unit and rent the other for $1,800/month. Their total mortgage payment is $2,400. The rental income covers 75% of their housing cost, allowing them to save aggressively. Over five years, the property appreciates to $500,000, and they've built over $130,000 in equity while having their tenant pay down most of their mortgage.

To get a comprehensive overview of your options, you can explore this complete Real Estate Investment guide. Ultimately, real estate provides a proven pathway to financial independence through the acquisition of real, tangible assets.

4. Debt Elimination and Credit Optimization

One of the most potent yet often overlooked strategies for building wealth is aggressively managing the liability side of your personal balance sheet. This involves a dual-pronged approach of systematically eliminating high-interest debt and optimizing your credit score. This financial maneuver is critical because high-interest debt, like credit card balances or personal loans, acts as a significant drag on your wealth-building capacity, siphoning off cash that could otherwise be invested and compounded.

The principle is straightforward: every dollar you pay in interest is a dollar that isn't working for you. By strategically paying down these obligations, you not only save money but also free up significant cash flow. This newly available capital can then be redirected toward your investment portfolio, effectively accelerating your path to financial independence. A strong credit profile further enhances this by granting you access to lower interest rates on future loans, from mortgages to auto financing, saving you thousands over your lifetime.

Debt Paydown Method Comparison

| Method | Approach | Psychological Impact | Mathematical Efficiency |

|---|---|---|---|

| Debt Snowball | Pay off smallest balances first, regardless of interest rate. | High (quick wins build motivation). | Lower (you may pay more interest over time). |

| Debt Avalanche | Pay off highest-interest balances first. | Lower (may take longer to see first debt disappear). | Highest (saves the most money on interest). |

How to Implement Debt and Credit Strategies

Executing this strategy requires a disciplined plan, popularized by financial experts like Dave Ramsey and Suze Orman.

- Choose Your Takedown Method: Two primary methods exist. The Debt Snowball (popularized by Ramsey) involves paying off your smallest debts first for psychological wins, building momentum. The Debt Avalanche method focuses on tackling the debt with the highest interest rate first, which is the most efficient from a mathematical standpoint.

- Optimize Your Credit Utilization: A key factor in your credit score is your credit utilization ratio, which is the amount of credit you're using divided by your total available credit. Consistently keeping this ratio below 30% is crucial for maintaining a healthy score.

- Leverage Favorable Terms: Don't hesitate to take action. Explore options like 0% balance transfer credit cards to pause interest accrual or refinance high-interest student loans to a lower rate. You can even call your credit card providers and negotiate for a lower annual percentage rate (APR).

A systematic approach to debt is fundamental to creating a strong financial foundation. By mastering your debts and credit, you unlock the resources needed to build lasting wealth.

5. Income Diversification and Side Hustles

One of the most powerful strategies for building wealth is to stop relying on a single paycheck. Creating multiple income streams, a concept championed by entrepreneurs like Tim Ferriss and Pat Flynn, moves you beyond trading time for money. It involves establishing various revenue sources that supplement your primary employment, accelerating wealth accumulation and creating a financial safety net. This strategy fundamentally reduces your dependence on one employer and empowers you to take control of your financial destiny.

The logic is compelling: if your main source of income is disrupted, other streams can provide stability. Moreover, this additional cash flow can be directly channeled into investments, savings, or debt repayment, drastically shortening your timeline to financial independence. By monetizing skills, passions, or assets, you transform your earning potential from a linear path into an exponential one, building a more resilient and dynamic financial foundation.

How to Implement Income Diversification

Building additional income streams is more about strategic action than simply working more hours. It involves leveraging what you already know or own and finding a market for it.

- Leverage Existing Skills: Start by identifying skills from your day job or hobbies that others would pay for. If you're a skilled writer, programmer, or designer, freelancing platforms like Upwork or Fiverr can provide an immediate starting point. If you have deep expertise in a specific field, consider offering consulting services.

- Explore Passive and Scalable Models: Focus on business models with passive income potential. This could include creating a digital product like an ebook or online course once and selling it repeatedly. E-commerce models like dropshipping or building a niche blog that earns affiliate revenue are also powerful, scalable options.

- Start Small and Reinvest: You don't need a massive upfront investment. Begin with a small, manageable side hustle, track your earnings and expenses meticulously, and reinvest the initial profits back into the venture to fuel its growth. This disciplined approach minimizes risk and allows you to scale sustainably.

Real-Life Example: Emily, a graphic designer, starts a side hustle creating and selling custom templates on Etsy. Initially, it earns $200/month. She reinvests that money into online ads and creating more templates. Within two years, her Etsy shop generates $2,500/month in semi-passive income, which she uses to max out her Roth IRA and invest in a taxable brokerage account, dramatically accelerating her wealth-building journey.

For those ready to move beyond a single salary, you can learn more about how to create multiple income streams and build financial resilience. By diversifying your income, you are actively engineering a faster and more secure path to wealth.

6. Consistent Saving and Budgeting

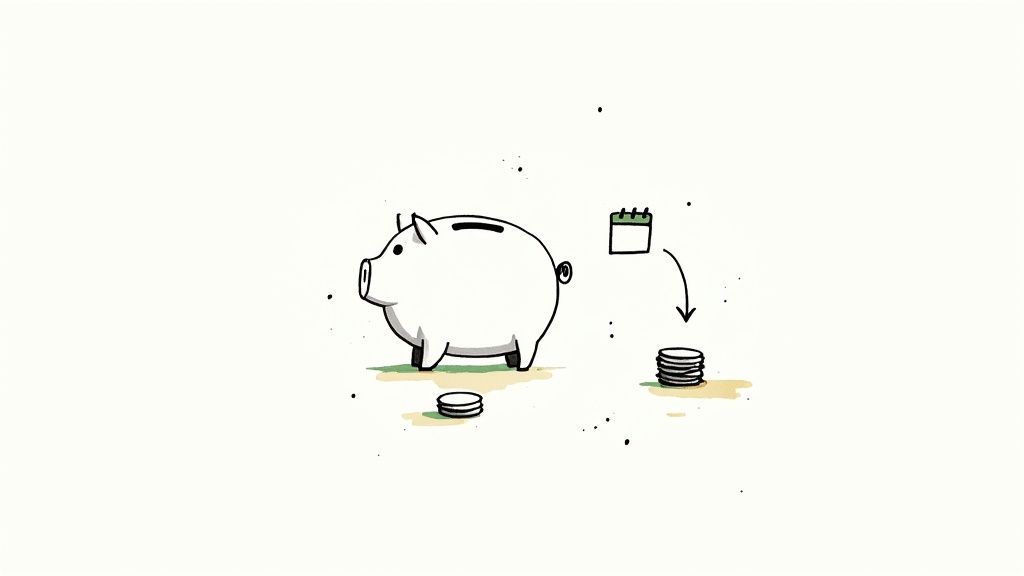

Before any investment can be made or any asset can be purchased, the capital must first be created. This is why consistent saving and disciplined budgeting form the bedrock of all strategies for building wealth. This foundational practice is about consciously directing your income, ensuring a significant portion is set aside for growth rather than consumption. It creates the fuel for your entire wealth-building engine and instills the financial discipline necessary for long-term success.

The principle is straightforward: spend less than you earn and strategically allocate the difference. By creating a deliberate plan for your money, you gain control over your financial destiny, transforming your income from a simple means of survival into a powerful tool for accumulation. This proactive approach, championed by financial experts like Dave Ramsey and Suze Orman, prevents financial leakage and maximizes the capital available for investment, ensuring a steady and predictable path toward your goals.

Budgeting Method Comparison

| Method | How It Works | Best For |

|---|---|---|

| 50/30/20 Rule | 50% of after-tax income on needs, 30% on wants, 20% on savings/debt. | Beginners who want a simple, flexible framework. |

| Zero-Based Budgeting | Every dollar of income is assigned a "job" (spending, saving, debt). | Detail-oriented people who want maximum control over their cash flow. |

| Pay Yourself First | Savings are treated as the first and most important bill. | People who struggle with saving and want to build the habit automatically. |

How to Implement Saving and Budgeting

Establishing this habit is less about restriction and more about intentionality. Modern tools and timeless methods make it easier than ever to get started.

- Pay Yourself First: The most effective strategy is to automate your savings. Set up an automatic transfer from your checking account to your savings or investment account for the day you get paid. This removes temptation and treats saving as a non-negotiable expense.

- Choose a Budgeting Method: Find a system that works for you. The 50/30/20 rule allocates 50% of your income to needs, 30% to wants, and 20% to savings. Alternatively, zero-based budgeting, popularized by platforms like YNAB (You Need A Budget), requires you to assign every dollar a job, ensuring no money is wasted.

- Track and Review Relentlessly: Use apps like Mint or EveryDollar to track your spending against your budget. A monthly review is crucial to identify overspending, find new savings opportunities, and adjust your plan as your income or goals change.

Aim to save at least 15-20% of your gross income. By mastering your cash flow, you build the essential foundation required to effectively execute every other wealth-building strategy on this list.

7. Stock Market and Index Fund Investing

One of the most powerful and historically proven strategies for building wealth is participating in the growth of the global economy through the stock market. Investing in stocks means owning a piece of a publicly-traded company, allowing you to benefit from its profits, growth, and innovation. This approach, championed by legendary investors like Warren Buffett and Vanguard founder Jack Bogle, provides a direct path to harnessing the power of compound growth over time.

The core principle is that by owning productive assets like businesses, your capital grows as these companies generate value. While individual stocks offer high growth potential, they also carry significant risk. For this reason, many successful investors turn to index funds, which hold a diversified basket of stocks tracking a major market index like the S&P 500. This instantly spreads your investment across hundreds of companies, reducing individual stock risk while capturing the market's overall upward trend.

How to Implement Stock and Index Fund Investing

Getting started in the stock market is more accessible today than ever before, with numerous low-cost brokerage platforms available. The key is to adopt a disciplined, long-term mindset.

- Start with Low-Cost Index Funds: For most investors, a broad-market index fund or ETF is the ideal starting point. Funds like the Vanguard 500 Index Fund (VOO) or the iShares Core S&P 500 ETF (IVV) provide instant diversification at an extremely low cost, making them a cornerstone for many wealth-building plans.

- Use Dollar-Cost Averaging: Instead of trying to "time the market," which is notoriously difficult, commit to investing a fixed amount of money at regular intervals (e.g., monthly). This strategy, known as dollar-cost averaging, ensures you buy more shares when prices are low and fewer when they are high, smoothing out your average cost over time.

- Reinvest All Dividends: Many stocks and funds pay out dividends, which are a share of the company's profits. Automatically reinvesting these payments allows you to buy more shares, which in turn generate their own dividends, creating a powerful compounding effect that can significantly accelerate your portfolio's growth.

Real-Life Example: At age 25, Michael begins investing $500 per month into an S&P 500 index fund. He never tries to time the market, simply investing the same amount every month and reinvesting all dividends. By age 65, despite several market crashes and recessions, his consistent investment, powered by compound growth, has grown to over $1.7 million, assuming an average 8% annual return.

8. Invest in Your Human Capital Through Education and Skill Development

Beyond stocks and real estate, one of the most powerful and often overlooked strategies for building wealth is investing in your own human capital. This means actively pursuing education, certifications, and new skills to dramatically increase your earning potential. Unlike market assets that can fluctuate, the knowledge and abilities you acquire become a permanent part of your personal wealth-building engine.

The principle is straightforward: the more value you can provide in the marketplace, the higher your income will be. This increased income serves as the primary fuel for all other wealth-building activities, from investing more aggressively to paying down debt faster. By treating your career as an asset to be managed and grown, you create a sustainable advantage that compounds over your entire professional life, making this a foundational element of any comprehensive financial plan.

How to Implement This Strategy

Investing in yourself doesn't always require a four-year degree or massive student loan debt. Modern platforms and professional development opportunities have made this more accessible than ever.

- Calculate the ROI: Before enrolling in an expensive program, analyze its potential return on investment. Consider the cost, the time commitment, and the projected salary increase in your desired field. A $10,000 certification that leads to a $15,000 annual raise pays for itself in under a year.

- Leverage Employer Benefits: Many companies offer tuition reimbursement or professional development funds. This is a powerful, often underutilized resource that allows you to gain valuable qualifications at little to no personal cost.

- Focus on High-Demand Skills: Research fields with high growth and compensation, such as technology (AI, cybersecurity), healthcare, or specialized trades. Platforms like Coursera, Udemy, and LinkedIn Learning offer targeted courses to build these in-demand competencies.

- Never Stop Learning: Wealth creation is a long-term game, and career relevance is key. Continuously update your skills to adapt to industry changes, ensuring your earning power remains strong and grows throughout your career.

9. Entrepreneurship and Business Ownership

While investing in existing assets is a proven path, one of the most powerful strategies for building wealth involves creating your own. Entrepreneurship and business ownership offer a direct route to generating substantial capital through profits, asset appreciation, and potential exit valuations. Unlike traditional employment, which typically caps income, owning a business provides unlimited earning potential and allows you to build an asset that can grow exponentially.

The core principle is simple: instead of exchanging time for money, you create systems that generate value for customers, which in turn generates revenue and profit for you. Successful entrepreneurs like Steve Jobs and Elon Musk have demonstrated how a visionary business idea can transform into a wealth-generating engine. This approach allows you to control your financial destiny, moving from a passive participant in the economy to an active creator of value and wealth.

How to Implement Entrepreneurship

Embarking on the entrepreneurial journey requires a blend of strategic planning, risk management, and relentless execution. The modern business landscape, influenced by thinkers like Tim Ferriss and Paul Graham, offers numerous accessible starting points.

- Start Lean and Validate: Begin with a business model that requires minimal upfront investment, such as a service-based agency, consulting, or an e-commerce store using dropshipping. Before pouring significant capital into an idea, validate it by securing your first few paying customers to confirm market demand.

- Focus on Solving Problems: The most successful businesses are built on solving a specific, painful problem for a defined audience. Whether it's a SaaS product that streamlines a workflow or a coaching service that helps clients achieve a goal, your focus should be on delivering tangible value.

- Build Scalable Systems: From day one, document your processes and build systems that allow the business to operate without your constant involvement. This is the key to scaling your operations and transitioning from a self-employed individual to a true business owner.

- Reinvest for Growth: In the early stages, it is crucial to maintain financial discipline. Keep business and personal finances separate, and prioritize reinvesting profits back into the business for marketing, product development, and talent acquisition to fuel accelerated growth.

Ultimately, entrepreneurship is a high-risk, high-reward strategy. While not for everyone, it offers one of the most direct and potent methods for achieving significant financial independence.

10. Harness the Power of Long-Term Compound Growth

Perhaps the most powerful force in finance, as Albert Einstein reportedly called it, is the principle of compound growth. This is not a complex trading tactic but a fundamental wealth-building strategy that leverages time and reinvested earnings to generate exponential growth. It’s the process where your investment returns begin to earn their own returns, creating a snowball effect that can turn modest, consistent savings into a substantial fortune over decades.

The logic behind this strategy is deceptively simple: stay invested and let time do the heavy lifting. Unlike short-term trading which relies on market timing, this approach, championed by legendary investors like Warren Buffett, focuses on "time in the market." By allowing your earnings to be reinvested, your principal grows, and each subsequent percentage gain is calculated on a larger base. This patient approach is one of the most reliable and proven strategies for building wealth, transforming consistent contributions into significant long-term capital.

How to Implement a Compound Growth Strategy

Applying this principle doesn't require sophisticated financial knowledge, but it does demand discipline and a long-term perspective.

- Start as Early as Possible: Time is your greatest asset. Investing just $200 per month from age 25 could result in over $550,000 by age 65, assuming a 7% average annual return. Waiting until 35 to start the same plan would yield less than half that amount.

- Automate and Be Consistent: Set up automatic, recurring contributions to your investment accounts, such as a 401(k) or Roth IRA. Consistent investing, regardless of market highs or lows (a practice known as dollar-cost averaging), ensures you are always adding to your base.

- Reinvest All Earnings: Always opt to automatically reinvest any dividends or capital gains your investments generate. Taking these distributions out halts the compounding process. This is the key mechanism that fuels exponential growth over time.

- Stay the Course: The most critical component is patience. Resist the urge to panic-sell during market downturns or to chase short-term trends. A long-term, buy-and-hold mindset is essential to let the mathematical magic of compounding work for you.

Wealth-Building Strategies: A Comparative Overview

To help you choose the right strategies for your financial journey, this table provides a high-level comparison based on key factors like risk, complexity, and potential return.

| Strategy | Risk Level | Complexity | Capital Needed | Time Horizon | Potential Return |

|---|---|---|---|---|---|

| Diversified Portfolio | Low-Medium | Medium | Low to High | Long | Moderate-High |

| Maximize Retirement | Low | Low | Low to High | Long | High (tax-adjusted) |

| Real Estate | Medium-High | High | High | Medium-Long | High |

| Debt Elimination | Very Low | Low | Low (Cash Flow) | Short-Medium | N/A (Saves money) |

| Income Diversification | Low-Medium | Medium | Very Low | Short-Long | Moderate-High |

| Saving & Budgeting | None | Low | None | Ongoing | N/A (Enables others) |

| Index Fund Investing | Medium | Low | Low to High | Long | High |

| Education/Skills | Low | Medium | Low to High | Long | High (Income Growth) |

| Entrepreneurship | Very High | Very High | Low to High | Medium-Long | Very High |

| Compound Growth | (Depends on asset) | Low | Low to High | Very Long | Very High |

Turning Strategy into Action: Your Personalized Wealth Plan

Throughout this guide, we've explored ten powerful pillars of financial growth. From the foundational discipline of Consistent Saving and Budgeting to the dynamic potential of Entrepreneurship and Business Ownership, you now possess a comprehensive toolkit of proven strategies for building wealth. We have dissected the mechanics of a Diversified Investment Portfolio, demystified Stock Market and Index Fund Investing, and highlighted the tangible benefits of Real Estate Investment.

The journey, however, doesn't end with knowledge. True financial transformation begins when information is converted into intentional, consistent action. The difference between wishing for financial independence and achieving it lies in the execution of a personalized plan tailored to your unique circumstances, goals, and risk tolerance.

From Blueprint to Reality: Your Immediate Next Steps

Knowing where to start can feel overwhelming. The key is to build momentum with manageable, high-impact actions. Don't try to implement all ten strategies at once. Instead, focus on creating a strong foundation that will support your long-term growth.

Here is a practical, step-by-step approach to translate these concepts into your financial reality:

- Conduct a Financial Audit: Before you can build, you must understand your starting point. Take an honest inventory of your assets, liabilities, income, and expenses. Use a simple spreadsheet or a budgeting app to see exactly where your money is going. This clarity is the bedrock of all successful strategies for building wealth.

- Automate Your Foundation: Remove decision fatigue from the equation. Set up automatic transfers to your savings and investment accounts for the day after you get paid. This "pay yourself first" method ensures your long-term goals are prioritized, making consistent contributions to your Maximized Retirement Accounts and other investment vehicles effortless.

- Initiate Debt Annihilation: High-interest debt is a wealth-destroying anchor. Target your most expensive debt, such as credit card balances, with aggressive repayment. The capital you free up from interest payments can then be redirected toward wealth-building assets, dramatically accelerating your progress.

- Choose Your Core Investment Strategy: Select one or two investment strategies from this guide to master first. For many, starting with low-cost Index Fund Investing within a retirement account like a 401(k) or IRA is a perfect entry point. It provides instant diversification and leverages the power of the market with minimal complexity.

The Mindset of a Wealth Builder

Beyond the tactical moves, cultivating the right mindset is paramount. The path to significant wealth is a marathon, not a sprint. It is defined by patience during market downturns, discipline when faced with temptation, and a relentless commitment to Long-Term Compound Growth.

Key Insight: Your financial future is not a product of one brilliant investment, but the cumulative result of thousands of small, disciplined decisions made consistently over decades.

Embrace the role of a lifelong learner. The financial landscape evolves, and your commitment to Education and Skill Development will be your greatest asset. Continue to read, ask questions, and refine your approach as you gain experience.

The strategies we have outlined, from Income Diversification to credit optimization, are not just financial tactics; they are tools for crafting a life of greater freedom, security, and opportunity. By mastering these approaches, you are not just accumulating capital. You are building a future where your money works for you, giving you the power to pursue your passions, support your loved ones, and make a meaningful impact. The journey requires dedication, but with this roadmap in hand, you are fully equipped to begin building the prosperous future you deserve.

Ready to take your financial planning to the next level with expert-guided tools and personalized insights? The Top Wealth Guide offers a comprehensive suite of resources designed to help you implement these strategies for building wealth with confidence. Visit Top Wealth Guide to discover how our platform can help you create and execute a roadmap for lasting financial success.

Frequently Asked Questions (FAQ) about Building Wealth

1. What is the single most important strategy for building wealth?

While all strategies are important, the most foundational are Consistent Saving & Budgeting and harnessing Long-Term Compound Growth. Without saving, you have no capital to invest, and without compounding, your growth is limited. Starting early with consistent investments in a diversified portfolio is the most proven path.

2. How much money do I need to start investing?

You don't need a lot of money. Thanks to fractional shares and low-cost index funds (ETFs), you can start investing with as little as $5 or $10. The key is not the amount you start with, but the consistency of your contributions over time.

3. Is it better to pay off debt or invest?

This depends on the interest rate of your debt. A common rule of thumb is to compare the debt's interest rate to your expected investment return (historically 7-10% for the stock market). If your debt has a high interest rate (like credit cards at 15-25%), paying it off provides a guaranteed return and should be the priority. If it's low-interest debt (like a mortgage at 3-5%), you may be better off investing.

4. What is the difference between a Roth and a Traditional 401(k)/IRA?

The main difference is when you pay taxes. With Traditional accounts, you contribute pre-tax money, which lowers your taxable income today, and you pay taxes on withdrawals in retirement. With Roth accounts, you contribute post-tax money, and your qualified withdrawals in retirement are completely tax-free.

5. How can I diversify my income if I have a demanding full-time job?

Start small and focus on scalable or low-time-commitment ideas. This could include investing in dividend stocks or REITs for passive income, creating a digital product (like an ebook or template) that you build once and sell many times, or monetizing a hobby you already enjoy.

6. Is real estate a better investment than the stock market?

Neither is universally "better"; they serve different purposes. The stock market offers high liquidity, low transaction costs, and easy diversification through index funds. Real estate offers tangible assets, income through rent, significant tax advantages, and the ability to use leverage (a mortgage) to control a large asset with a small down payment. Many wealthy individuals use both.

7. How often should I check my investments?

For long-term investors, checking too frequently can lead to emotional decisions like panic selling during downturns. A good practice is to review and rebalance your portfolio once or twice a year, or when you have a major life change (new job, marriage). Avoid checking daily.

8. What's the biggest mistake people make when trying to build wealth?

The biggest mistakes are often lifestyle inflation (spending more as you earn more, instead of saving the difference), starting too late (missing out on years of compounding), and making emotional, short-term investment decisions based on market noise or fear.

9. Is it too late for me to start building wealth in my 40s or 50s?

It's never too late to start. While you have less time for compounding to work its magic, you are likely in your peak earning years. This allows you to save and invest more aggressively. Focus on maximizing contributions to retirement accounts (including catch-up contributions if you're over 50) and developing a solid financial plan.

10. What is a "side hustle" and can it really help build wealth?

A side hustle is any type of employment undertaken in addition to one's full-time job. It can be a powerful wealth-building tool because the extra income can be dedicated entirely to saving, investing, or paying off debt, dramatically accelerating your financial goals without impacting your primary budget.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.