When you own property, there are a whole host of expenses that come with it. But what many people don't realize is that the IRS allows you to subtract many of those costs from your income, which lowers your tax bill. These are real estate tax deductions.

For investors, this is a game-changer. Nearly every penny spent maintaining and managing a rental property can chip away at your taxable income. Even if you're a regular homeowner, deductions like mortgage interest can put a significant amount of money back in your pocket. Learning how these rules work isn't just about saving a few bucks—it's about making your real estate work smarter for you.

In This Guide

- 1 Why Tax Deductions Are a Cornerstone of Smart Investing

- 2 Maximizing Returns on Your Rental and Investment Properties

- 3 Unlocking the Power of Depreciation and Cost Segregation

- 4 Claiming Deductions on Your Primary Residence and Home Office

- 5 Essential Recordkeeping to Bulletproof Your Deductions

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. Can I deduct mortgage points on my taxes?

- 6.2 2. What is the difference between active and passive real estate income?

- 6.3 3. Can I deduct expenses for a property that was vacant?

- 6.4 4. How does the capital gains exclusion work when I sell my home?

- 6.5 5. What is a 1031 exchange and how does it relate to taxes?

- 6.6 6. Can I deduct the cost of my real estate education or seminars?

- 6.7 7. Are closing costs on a rental property deductible?

- 6.8 8. What are the travel expenses I can deduct for my rental properties?

- 6.9 9. Is an HOA fee a deductible expense on a rental property?

- 6.10 10. How do I calculate my property's basis for depreciation?

Why Tax Deductions Are a Cornerstone of Smart Investing

It helps to think of your real estate investments as a business. And just like any business, there's money coming in (income) and money going out (expenses). The real magic of real estate investing is how it lets you turn so many of those expenses into direct tax savings.

That's the simple idea behind tax deductions. They aren't shady loopholes; they are fully sanctioned by the IRS to encourage people to own and invest in property. By understanding them, you can legally reduce your taxable income, meaning you owe less to the government and keep more of what you earn.

The Foundation of Wealth Creation

For investors, this is where the real power lies. All those necessary costs—property taxes, insurance, repairs—are no longer just drains on your wallet. They become tools to boost your cash flow.

For every dollar you can legally deduct, your taxable income shrinks. That saved cash can be a powerful engine for growth, giving you more capital to buy another property, pay down your mortgage faster, or make valuable upgrades. This cycle is a fundamental part of building wealth through real estate and can seriously speed up your journey to financial freedom.

Tax deductions are not just about saving money at the end of the year; they are an active part of your investment strategy that improves your property's performance from day one.

A Roadmap for Every Owner

Whether you're a first-time homeowner figuring out the mortgage interest deduction or a seasoned investor managing a portfolio, this guide is your roadmap. We’ll break down the key deductions available for every situation:

- Primary Residences: Unlock the tax savings hidden in your own home.

- Rental Properties: Turn your operating costs into powerful tax benefits.

- Home Offices: Learn how to claim valuable deductions if you work from home.

We’ll start with the basics and move into more advanced strategies, like depreciation, giving you the clarity you need to make smart financial moves. When you get a handle on these rules, tax season starts to look less like a headache and more like an opportunity to strengthen your financial position.

Maximizing Returns on Your Rental and Investment Properties

Think of your rental property less like a passive asset and more like an active business. Every single dollar you spend to keep it running—from the mortgage payment to a can of paint—is a potential tax deduction. Mastering these write-offs is one of the most powerful things you can do to lower your tax bill and seriously boost your net returns.

While most investors know about deducting mortgage interest and property taxes, those are just the tip of the iceberg. The real magic happens when you start meticulously tracking all the other operating expenses that chip away at your taxable income.

A Checklist of Essential Operating Expenses

These are the everyday costs of doing business as a landlord. The great part is that each one is fully deductible in the year you pay for it.

- Insurance Premiums: This isn’t just your standard landlord policy. It includes flood, fire, and any liability insurance you carry.

- Professional Fees: Did you hire a property manager, an accountant, or a lawyer? Their fees are a business expense.

- Marketing and Advertising: Any money you spent to find tenants—whether it was for online listings, social media ads, or a simple "For Rent" sign—can be written off.

- Utilities: If you cover the cost of water, gas, electricity, or trash collection for your tenants, those are direct deductions.

- HOA and Condo Fees: Those monthly or annual fees you pay to a homeowners' association are 100% deductible for a rental property.

And don't forget the small stuff! Costs like tenant screening services, bank fees for your rental account, or even mileage for driving to your property for maintenance all add up. Every legitimate expense is a win for your bottom line.

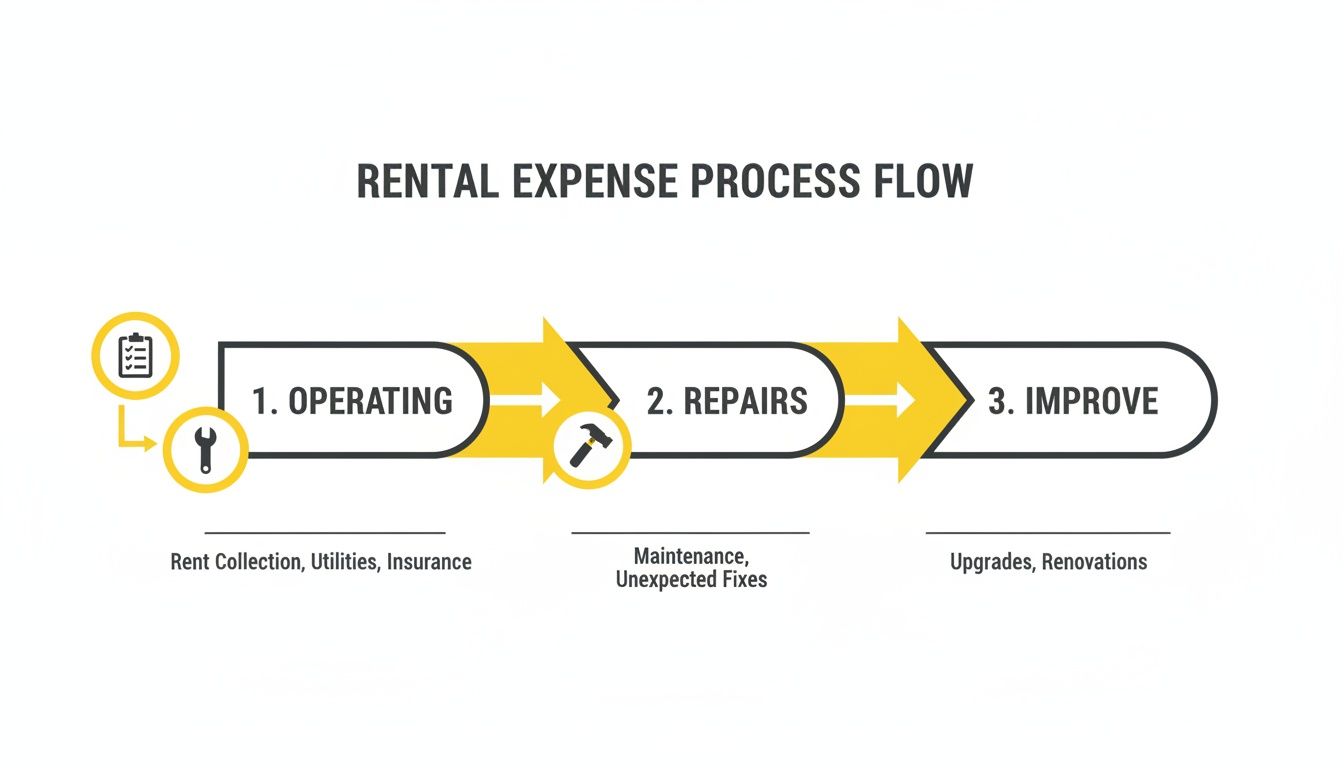

Repairs vs Improvements: The Critical Distinction

This is where a lot of new investors get tripped up, and getting it right is crucial because the IRS treats them very differently.

In simple terms, a repair keeps the property in good working order, while an improvement makes it better, adapts it for a new use, or restores it. This difference dictates whether you can deduct the cost this year or have to spread it out over many years.

Real-Life Example:

Let's say a tenant calls about a leaky faucet under the kitchen sink. You hire a plumber for $250 to fix it. That's a repair, and you can deduct the entire $250 on this year's taxes. Simple.

But what if you decide to rip out all the old, corroded plumbing in the entire house and replace it for $15,000? That's a capital improvement. The IRS says this adds significant value, so you can't deduct the cost all at once. Instead, you have to depreciate it, writing off a piece of the cost each year for 27.5 years.

Repairs vs Improvements: A Quick Comparison

This table should help you quickly see the difference between a repair you can write off immediately and an improvement you have to depreciate over time. It's a fundamental concept for managing your taxes and cash flow.

| Category | Repairs (Deductible Now) | Improvements (Depreciated Over Time) |

|---|---|---|

| Plumbing | Fixing a leak or unclogging a drain | Replacing the entire plumbing system |

| Exterior | Replacing a few broken roof shingles | Installing a brand new roof |

| Interior | Repainting a room between tenants | Adding a new bedroom or bathroom |

| Appliances | Repairing a broken dishwasher | Buying and installing a new HVAC system |

| Electrical | Replacing a faulty light switch | Rewiring the entire house |

Making this distinction correctly is absolutely key to smart tax planning. When you're ready to take on those bigger projects, you can learn more by checking out our guide on how to finance investment property.

The Qualified Business Income Deduction

On top of all the direct expense deductions, the Tax Cuts and Jobs Act (TCJA) of 2017 gave real estate investors a huge gift: the 20% Qualified Business Income (QBI) deduction.

For many investors who operate as a sole proprietor or through an LLC, this allows you to deduct up to 20% of your net rental income straight off your taxable income. If you have $100,000 in net rental income, this could mean $20,000 is simply not taxed at the federal level, potentially saving you thousands. This is a game-changer, especially since the vast majority—around 95% of U.S. businesses—are pass-through entities that can qualify. You can get more details on the ongoing tax debate around this at the Bipartisan Policy Center.

By systematically tracking every expense and understanding these key rules, you can transform your rental from a simple asset into a highly efficient, tax-optimized machine.

Unlocking the Power of Depreciation and Cost Segregation

What if I told you there’s a way to get a hefty tax break every single year for a property that's likely appreciating in value? This isn't some shady loophole; it's the magic of depreciation, one of the single most powerful real estate tax deductions on the books for investors. It's often called a "phantom" deduction because you claim it without actually spending any cash that year.

The IRS gets it—buildings, unlike land, wear out over time. To account for this gradual wear and tear, they let you deduct a piece of your property's cost each year. The crucial part to remember is that you can only depreciate the building itself. The land it sits on is assumed to last forever, so it’s not part of the calculation.

Calculating Standard Depreciation

Getting to your annual depreciation number is actually pretty straightforward. For residential rental properties, the IRS has set the timeline at 27.5 years. If you own a commercial property, that period extends to 39 years.

Let's break it down with a simple, real-world example:

- Find Your Cost Basis: You buy a rental duplex for $350,000. After factoring in some closing costs, your total basis comes to $355,000.

- Isolate the Land Value: A property appraiser values the lot at $80,000. This means your depreciable basis for the building is $355,000 – $80,000 = $275,000.

- Calculate the Annual Deduction: Now, just divide the building's basis by the IRS-mandated recovery period.

- $275,000 / 27.5 years = $10,000 per year.

That's it. You now have a $10,000 deduction you can take against your rental income every year for nearly three decades, directly lowering your tax bill without having to spend a single extra penny. For a deeper look at the mechanics, you can explore our other articles on real estate depreciation.

This infographic helps visualize where depreciation fits in. While you deduct operating costs and repairs right away, improvements are written off over time through depreciation—a key difference for smart tax planning.

As you can see, understanding this flow is vital. Mixing up a repair (immediately deductible) with an improvement (depreciated) is a common and costly mistake.

Supercharging Your Deductions with Cost Segregation

For investors who are ready to level up, especially those with larger residential or commercial properties, there's an even more potent strategy: cost segregation.

Instead of treating the entire building as a single monolith depreciating over 27.5 or 39 years, this approach intelligently breaks the property down into its individual components, many of which have much shorter lifespans in the eyes of the IRS.

A cost segregation study is a detailed analysis, usually done by engineers, that identifies and reclassifies a property’s components to accelerate depreciation. It doesn't create new deductions—it just pulls them forward into the early years of ownership when you need the cash flow most.

Think of your property not as one big asset, but a bundle of smaller ones. A cost segregation study might identify that the carpet, appliances, and light fixtures can be depreciated over 5 years, while things like fences and landscaping can be written off over 15 years.

The table below shows just how dramatic the difference can be.

| Component | Regular Depreciation (27.5 Years) | Cost Segregation Depreciation | Impact |

|---|---|---|---|

| Carpeting ($10,000) | $364 / year | $2,000 / year (5 Years) | Massive upfront deduction |

| Appliances ($8,000) | $291 / year | $1,600 / year (5 Years) | Accelerated savings |

| Landscaping ($15,000) | $545 / year | $1,000 / year (15 Years) | Faster cost recovery |

| Building Structure | Remainder over 27.5 years | Remainder over 27.5 years | No change to structure |

By front-loading these deductions, you create massive tax savings in the first few years of owning the property. This strategy frees up a ton of cash that can be reinvested to pay down your mortgage, fund more improvements, or even help you acquire your next property years sooner than you thought possible.

Claiming Deductions on Your Primary Residence and Home Office

You don't have to be a landlord with a sprawling portfolio to tap into some seriously valuable real estate tax deductions. In fact, your own home can be a goldmine of tax savings, especially if you carve out a space to run your business.

For most homeowners, the two heavy hitters are mortgage interest and property taxes. When you know how to claim them correctly, these deductions can make a real dent in what you owe Uncle Sam. Let’s break down how they work under the current rules.

Mortgage Interest and Property Tax Deductions

The Mortgage Interest Deduction is a long-standing benefit for homeowners. It allows you to write off the interest you pay on the loan you used to buy, build, or make major improvements to your home. Right now, you can deduct the interest on up to $750,000 of mortgage debt ($375,000 if you’re married filing separately). For many families, this deduction alone shaves thousands of dollars off their annual tax bill.

Next up is the State and Local Tax (SALT) deduction, which is where you can write off the property taxes you pay. But this is where things get tricky. The Tax Cuts and Jobs Act (TCJA) threw a wrench in the works by capping the total SALT deduction at just $10,000 per household, per year. This cap lumps together your property taxes with your state and local income or sales taxes.

Real-Life Example:

Imagine your annual property tax bill is $12,000 and your state income tax is $8,000. Your total SALT is $20,000, but you can only deduct $10,000 of that on your federal return. The introduction of the cap led to a staggering 30% drop in the number of taxpayers who itemize their deductions. You can dig deeper into how these tax law shifts affect real estate investors over at Cohen & Company.

The Valuable Home Office Deduction

With so many people working remotely or starting their own ventures, the Home Office Deduction has become one of the most important write-offs out there. This powerful tax break lets you deduct a portion of your home's expenses, but only if you use part of your home exclusively and regularly for your business.

The IRS has two strict tests you have to pass to qualify:

- Regular and Exclusive Use: The space must be used only for your business, and on an ongoing basis. A laptop at the kitchen table doesn't count. It needs to be a dedicated room or a separately identifiable area.

- Principal Place of Business: Your home office has to be the main hub for your business operations, even if you do some work on the road or at client sites.

If you clear those hurdles, you have two different ways to calculate the deduction. Which one you pick really boils down to how much record-keeping you're willing to do versus how big of a write-off you want.

There's a persistent myth that taking the home office deduction is like waving a red flag at the IRS, inviting an audit. Don't believe it. As long as you meet the requirements and have your paperwork in order, it's a perfectly legitimate and valuable business expense.

Choosing Your Calculation Method

The two approaches for calculating your home office deduction offer a classic trade-off: simplicity versus a potentially bigger payoff.

The simplified method is exactly what it sounds like—incredibly straightforward. You just measure the square footage of your office (up to a 300-square-foot maximum) and multiply it by a flat rate set by the IRS, which is currently $5 per square foot. So, a 200-square-foot office gives you a neat $1,000 deduction. No need to track a single utility bill.

On the other hand, the actual expense method demands more effort but can lead to a much larger deduction. Here, you figure out the percentage of your home that your office occupies (for example, a 200-square-foot office in a 2,000-square-foot home is 10%). You then get to deduct that same percentage of your actual home expenses, including things like mortgage interest, property taxes, insurance, utilities, and even some repairs.

Home Office Deduction Methods: Simplified vs Actual Expense

The choice between the simplified and actual expense methods can significantly impact your tax return. The simplified method offers convenience, while the actual expense method can provide a much larger deduction if you're diligent with your record-keeping. This comparison should clarify which one is a better fit for your situation.

| Feature | Simplified Method | Actual Expense Method |

|---|---|---|

| Calculation | Square footage (max 300) x $5 | Business use percentage x actual home costs |

| Recordkeeping | Minimal; just need the office size | Meticulous; must track all home expenses |

| Maximum Deduction | Capped at $1,500 per year | No specific cap; limited by business income |

| Depreciation | No home depreciation is claimed | Allows for depreciation deduction on the office portion of your home |

| Best For | Freelancers or small business owners wanting maximum simplicity. | Homeowners with significant expenses who are organized record-keepers. |

Ultimately, the best way to know for sure is to run the numbers both ways. It might take a little extra time, but it’s the only way to guarantee you’re getting the biggest tax benefit you’re entitled to.

Essential Recordkeeping to Bulletproof Your Deductions

When it comes to taxes, a deduction is only as good as the proof you have to back it up. The IRS doesn't take your word for it; they want to see receipts. That’s why meticulous documentation isn't just good practice—it's your best defense in an audit and the only way to claim every real estate tax deduction you rightfully deserve.

Let’s be honest, nobody enjoys scrambling for crumpled receipts in a shoebox come April. The key is to build a simple, organized system you can maintain all year. For any serious property owner, that means going digital and tracking every single transaction as it happens.

Building Your Digital Documentation System

Thanks to modern tools, this is easier than ever. The goal is to create one central place for all your property’s financial data. This becomes invaluable for everything from calculating annual depreciation to running the numbers for a real estate due diligence checklist on your next potential buy.

Your digital system should track:

- Income: A clean record of all rent payments, including who paid and when.

- Expenses: Every dollar you spend, sorted into the right categories (like repairs, utilities, or insurance).

- Mileage: A log of any property-related travel with dates, purpose, and mileage. Apps like MileIQ or Stride can handle this for you automatically.

- Asset Information: The property's purchase price, closing costs, and receipts for any capital improvements. You'll need this for depreciation.

Think of your recordkeeping system as your property's financial diary. It should tell a clear, chronological story of all money coming in and going out, supported by digital proof for every entry.

Essential Documents You Must Keep

Your spreadsheet or software is the summary; the original documents are the proof. Get in the habit of scanning and saving everything to a cloud folder. It's instant, searchable, and safe from being lost or damaged.

Comparison of Document Retention Needs

Here’s a look at the core documents you'll need for different property types. Notice the overlap, but also the unique items for each.

| Document Category | Primary Residence | Rental Property | Home Office |

|---|---|---|---|

| Purchase & Sale | Closing Statements, Deed | Closing Statements, Deed | N/A |

| Ongoing Expenses | Mortgage Interest Statements | All Operating Expense Receipts | Prorated Utility & Insurance Bills |

| Major Costs | Receipts for Improvements | Receipts for Repairs & Improvements | Receipts for Office-Specific Costs |

| Tax Forms | Form 1098 | Schedule E | Form 8829 |

| Travel | N/A | Detailed Mileage Logs | N/A |

Common Recordkeeping Mistakes to Avoid

Even the best-intentioned investors can make simple, costly errors. The absolute worst mistake is commingling funds—mixing your personal and business finances by using a personal bank account for your rental property. It creates an accounting nightmare and is a major red flag for the IRS, potentially leading them to disallow your deductions.

The fix is simple: open a separate bank account and credit card for each rental property, or at least for your real estate business as a whole. This automatically creates a clean, transaction-by-transaction record that makes bookkeeping a breeze and solidifies your claims if you're ever audited.

Another classic slip-up is misclassifying expenses, especially the tricky distinction between a repair and an improvement we talked about earlier. Tagging each expense correctly in your spreadsheet is crucial. A well-organized system doesn't just save you headaches at tax time; it gives you a clear view of your property's financial health, helping you manage it better and boost your returns.

Frequently Asked Questions (FAQ)

1. Can I deduct mortgage points on my taxes?

Yes, but how you deduct them depends on the property. For your primary home, you can often deduct the full amount in the year you pay them. For a rental property or a refinance, you must spread the deduction out (amortize) over the life of the loan.

2. What is the difference between active and passive real estate income?

Passive income applies to most rental activities, and losses can only offset other passive income. Active income status is for "real estate professionals" (over 750 hours/year + over 50% of work time in real estate) and allows rental losses to offset other income, like a W-2 salary.

3. Can I deduct expenses for a property that was vacant?

Absolutely. As long as the property was available for rent and you were actively trying to find a tenant, you can continue to deduct ordinary and necessary expenses like mortgage interest, property taxes, insurance, and depreciation.

4. How does the capital gains exclusion work when I sell my home?

If you've owned and lived in your home as your main residence for at least two of the five years before selling, you can exclude a significant amount of profit from taxes: up to $250,000 for single filers and $500,000 for married couples filing jointly.

5. What is a 1031 exchange and how does it relate to taxes?

A 1031 exchange allows you to sell an investment property and roll all the proceeds into a new "like-kind" property, deferring all capital gains taxes. It's a powerful tool for growing a real estate portfolio without the immediate tax hit.

6. Can I deduct the cost of my real estate education or seminars?

It depends. If you're already a landlord, costs for education to maintain or improve your skills in your existing business are generally deductible. However, costs to enter a new business (like a beginner's bootcamp) are typically not deductible.

7. Are closing costs on a rental property deductible?

Some are, but most are added to your property's cost basis and recovered through depreciation. For example, loan origination fees are amortized over the loan's life, while costs like title insurance are added to your basis. Prepaid property taxes are usually deductible in the year you pay them.

8. What are the travel expenses I can deduct for my rental properties?

If you travel overnight to manage your rentals, you can deduct necessary costs like airfare, lodging, and 50% of meal expenses. You must keep meticulous records proving the primary purpose of the trip was business-related.

9. Is an HOA fee a deductible expense on a rental property?

Yes, for a rental property, HOA fees are 100% deductible as an operating expense on Schedule E. However, for your primary residence, HOA fees are considered a non-deductible personal expense.

10. How do I calculate my property's basis for depreciation?

Your depreciable basis is not just the purchase price. It's calculated as: (Purchase Price) + (Certain Closing Costs like title insurance and legal fees) – (Value of the Land). This final number is what you depreciate over 27.5 years for a residential rental. You can find more strategies in our guide to tax planning moves every investor should make before December.

At Top Wealth Guide, we are dedicated to providing you with the knowledge and tools you need to build and manage your wealth effectively. Explore our resources to master investment strategies across real estate, stocks, and more. Visit us at https://topwealthguide.com to secure your financial future.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.