This guide is your first step toward a powerful realization: building wealth through property isn't some secret club for the ultra-rich. It's a real, achievable goal. Think of your first property as a financial engine with two cylinders firing at once—it can put cash in your pocket every month while its value grows quietly in the background.

In This Guide

- 1 Why Real Estate Is Such a Powerful Wealth-Building Tool

- 2 How to Read and Understand the Real Estate Market

- 3 Finding the Right Real Estate Investment Strategy

- 4 How to Secure Financing for Your Investment Property

- 5 Managing Your Risks and Maximizing Your Returns

- 6 Your Action Plan for Buying Your First Property

- 7 Frequently Asked Questions (FAQ)

Why Real Estate Is Such a Powerful Wealth-Building Tool

There’s a common myth that you need a huge pile of cash to even think about investing in real estate. That’s just not true. For generations, property has been one of the most reliable and understandable paths to financial freedom. Unlike stocks and bonds, which can feel like numbers on a screen, real estate is tangible. It's a physical asset you can see, touch, and improve, giving you a greater sense of control and security.

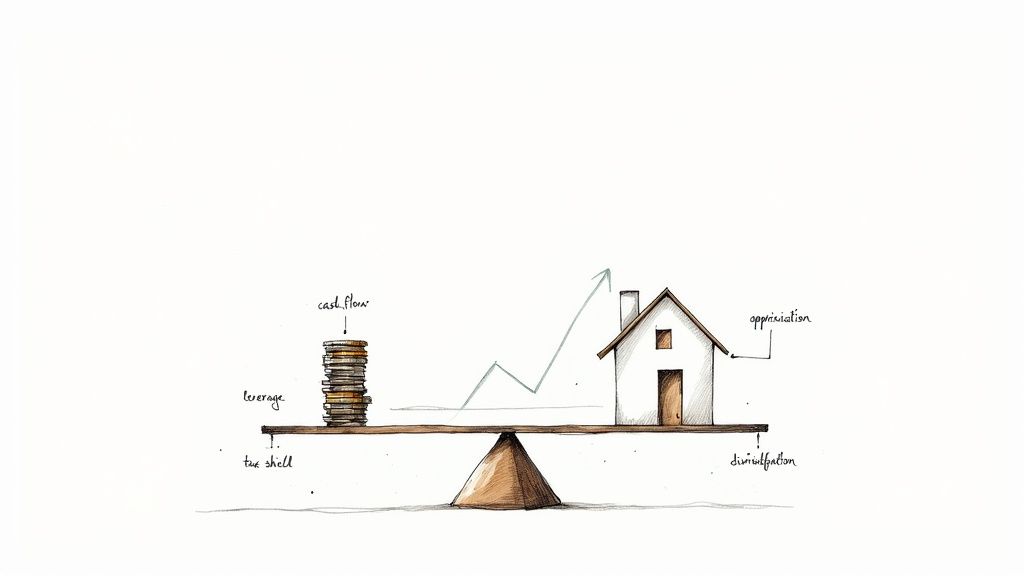

At its heart, real estate builds wealth in two simple ways. First, you get cash flow from rental income—that's the money left in your bank account after the mortgage and all other bills are paid. It's a predictable income stream. Second, real estate has a long history of appreciating, meaning its value goes up over time. This builds your equity without you lifting a finger.

The Core Benefits for Smart Investors

Beyond those two fundamentals, real estate offers some pretty unique perks that make it a cornerstone for savvy investors. These advantages work together to really accelerate your financial goals.

Here’s a look at what makes it so attractive:

- Leverage: This is the real magic. You can use a relatively small amount of your own money—the down payment—to buy and control a much larger asset. Putting just a 20% down payment on a $300,000 property means you get the financial benefit of owning a $300,000 asset.

- Tax Advantages: The government loves property owners. You get to deduct things like mortgage interest, property taxes, and a whole host of operating expenses. The best part? Depreciation. It lets you write off a portion of the property's value for "wear and tear," often creating a paper loss that reduces your tax bill, even while the property's actual value is climbing.

- An Inflation Hedge: When the cost of everything else goes up (inflation), so do rents and property values. Your rental income and the asset's worth grow right alongside the cost of living, protecting your money's buying power over the long haul.

- Portfolio Diversification: The stock market zigs, but real estate often zags. Because property values don't always follow the same trends as stocks and bonds, adding real estate to your portfolio brings a welcome dose of stability.

Consider this guide your roadmap. We’ll walk through everything from analyzing the market and picking a strategy to getting your financing in order and finally closing that first deal. For an even deeper dive, our article on building wealth with real estate breaks down the core principles even further. By the time you're done here, you’ll have the clarity and confidence to make your move.

How to Read and Understand the Real Estate Market

Investing in real estate without understanding the market is like setting sail without a compass. Sure, you might get lucky, but you're far more likely to drift off course. To really succeed, you have to learn to read the economic landscape like a pro, making moves based on solid data instead of just a gut feeling or the latest media hype.

Think of the market as a living ecosystem where a few key forces are always at play. Once you understand these forces, you can start to see shifts in property values and rental demand coming before everyone else does. That insight is your most powerful tool.

Core Economic Drivers to Watch

National headlines paint a broad picture, but the real money is made by zooming in on local trends. Three big drivers really dictate the health of almost any real estate market.

-

Job Growth: This is the big one. When a major company sets up a new headquarters or a whole new industry springs up, it creates a wave of jobs. More jobs mean more people moving in, and every single one of them needs a place to live. That surge in demand is what pushes both property values and rental rates skyward.

-

Population Shifts: Always keep an eye on who is moving where. Are young professionals flooding into the city for tech jobs? Are retirees cashing out and heading for sunnier climates? These demographic currents tell you what kind of housing will be in high demand, whether it's trendy downtown condos or single-story homes in quiet suburbs.

-

Interest Rates: The cost of borrowing money is a massive lever on the market. When interest rates are low, mortgages are cheap. This encourages more people to buy, which naturally drives prices up. When rates climb, the opposite happens—buying gets more expensive, which can cool down a hot market and often increases the demand for rentals.

By tracking just these three factors, you can spot emerging hotspots before they hit the mainstream.

Looking Beyond the Headlines for Local Clues

While economic data is your foundation, you also need to get your boots on the ground to spot the real signals of future growth. A new tech campus breaking ground, a major downtown revitalization project, or a planned light-rail extension are all flashing green lights that an area is on the rise. These local developments can completely transform a neighborhood in just a few years, creating huge returns for investors who got in early.

The most successful real estate investors are masters of local knowledge. They don't just read reports; they drive through neighborhoods, attend city planning meetings, and talk to local business owners to understand the true direction of the market.

It's also smart to watch the bigger, long-term trends. For instance, the constant need for logistics centers and new housing keeps those sectors incredibly resilient. Sustainability is also becoming a huge factor; properties with features like onsite power generation might become gold mines as our energy grids face more and more strain.

Real estate markets don't move in a straight line; they move in predictable cycles. Knowing which phase of the cycle you're in is absolutely critical for smart timing. Each phase offers its own unique set of risks and opportunities.

| Market Cycle | Investor Action and Opportunity | Real-World Example |

|---|---|---|

| Recovery | Vacancies are high and rents are low. Opportunity: This is the time to buy properties at a deep discount from distressed sellers, right before prices start to climb back up. | Think back to the post-2008 financial crisis. Investors swooped into cities like Phoenix and Las Vegas, buying foreclosed homes for pennies on the dollar. |

| Expansion | Job and population growth kick in, causing vacancies to drop and rents to rise. Opportunity: Focus on new development or value-add projects to meet the booming demand. | This was Austin, TX in the mid-2010s. The tech scene exploded, and new apartment buildings couldn't go up fast enough to house everyone moving in. |

| Hyper-Supply | Construction finally outpaces demand, and vacancies start to creep up. Opportunity: A great time to sell any overvalued assets and start building a cash reserve for the next downturn. | Around 2017-2018, the luxury condo markets in cities like Miami and NYC got flooded with too many new units, causing prices and rents to flatline. |

| Recession | The economy shrinks, vacancies shoot up, and rents begin to fall. Opportunity: Hold on tight to your stable, cash-flowing properties and get ready to buy again during the next recovery. | At the start of the COVID-19 pandemic, office and retail spaces emptied out overnight, forcing landlords to offer huge concessions to attract tenants. |

Finding the Right Real Estate Investment Strategy

Picking a real estate investment strategy is a lot like choosing the right tool for a job. You wouldn't use a sledgehammer to hang a picture frame, right? The same logic applies here. The best strategy for you depends entirely on your financial goals, your timeline, and frankly, how much risk you can stomach without losing sleep.

There’s no magic bullet—no single "best" way to invest. Instead, the goal is to find the approach that fits you perfectly.

Think of it like a roadmap. Different market conditions suggest different routes. A booming local economy might be a green light for one strategy, while a slower market could favor another.

As you can see, a market with strong job growth and an increasing population is fertile ground for strategies that bank on appreciation, like flipping. On the other hand, a stable, predictable market is often ideal for generating steady, long-term rental income.

Matching a Strategy to Your Investor Profile

Let's make this real. Most successful investors fall into a few common profiles. See if you recognize yourself in any of these.

Real-Life Example: The "Steady-Income Sarah" Profile

Sarah is a 45-year-old marketing manager playing the long game. She wants to build a reliable income stream that will help fund her retirement. She's not looking to get rich overnight; she values consistency and predictable growth above all else.

- Best Strategy: Long-Term Rentals. For Sarah, buying residential properties like single-family homes or duplexes is a perfect fit. She purchases a three-bedroom home in a good school district near her city, hires a property manager, and rents it out to a family. The monthly rent covers her mortgage, taxes, insurance, and management fees, leaving her with a few hundred dollars in positive cash flow each month. Even better, her tenants are effectively paying down her mortgage, building her equity while the property (hopefully) appreciates in value. It’s the classic "slow and steady wins the race" approach.

Real-Life Example: The "Quick-Flip Frank" Profile

Frank is a 32-year-old contractor who is hands-on. He has a great eye for spotting a diamond in the rough and isn't afraid of a little (or a lot of) sawdust. He wants to generate big chunks of cash relatively quickly so he can roll that capital into the next, bigger project.

- Best Strategy: House Flipping. This is Frank’s domain. He finds a dated but structurally sound house in an up-and-coming neighborhood, purchases it with a short-term hard money loan, and spends three months renovating the kitchen and bathrooms himself. He then lists the modernized home and sells it for a $60,000 profit after all costs. The timeline is short—six to twelve months. It’s an active, demanding strategy that requires sharp market knowledge, but the payoff can be substantial.

Exploring Lower-Capital and Passive Options

What if you don't have a huge down payment or the desire to deal with leaky faucets? Good news. There are other ways to get into the game that don't require you to be a landlord or a general contractor.

-

Real Estate Investment Trusts (REITs): Think of this as the most hands-off way to own real estate. A REIT is a company that owns and operates a portfolio of properties—malls, apartment buildings, office towers. You buy shares in the REIT just like a stock and collect dividends from the rental income. It's liquid, diversified, and completely passive, though you miss out on the tax advantages of direct ownership.

-

Wholesaling: This one is for the hustlers. If you have more time and drive than cash, wholesaling could be your ticket in. A wholesaler finds an undervalued property, puts it under contract with the seller, and then sells that contract to another investor for a fee. You never actually own the property; you're the matchmaker connecting a seller in a tough spot with a buyer looking for a deal.

The most important thing you can do is take an honest look in the mirror. How much cash do you have to invest? How much free time can you truly commit? What’s your gut-level tolerance for risk? The right strategy should feel like a natural fit for your life, not something you have to force.

A Head-to-Head Strategy Comparison

To make the choice a little clearer, let's put these four popular strategies side-by-side. This table breaks down the key differences in what each one demands and the kind of returns you can expect.

Comparing Real Estate Investment Strategies

| Strategy | Initial Capital | Risk Level | Potential Return Type | Time Commitment |

|---|---|---|---|---|

| Long-Term Rentals | Moderate to High | Low to Medium | Consistent Cash Flow, Appreciation | Low (with manager) |

| House Flipping | Moderate to High | High | Large, Lump-Sum Profit | High (Active) |

| REITs | Very Low | Low | Dividend Income, Share Growth | Very Low (Passive) |

| Wholesaling | Very Low | Medium | Assignment Fees | Medium to High |

Each of these paths can lead to building significant wealth through real estate. The trick is simply to choose the one that makes the most sense for your finances and your life.

If you're ready to dig deeper, you can explore the pros and cons of these approaches in our detailed guide on the best real estate investment strategies.

How to Secure Financing for Your Investment Property

Getting the money together isn't just one part of the process—it's the fuel for the entire engine. A lot of new investors hit a wall here, thinking they absolutely need a massive 20% down payment to even get in the game. But that's a common misconception, and thankfully, it's not the whole story.

Financing an investment property is really about matching the right financial tool to the right deal. Once you know where to look, you’ll find a whole world of options, from the loans your parents might have gotten to the clever strategies seasoned pros use every day.

The Traditional Routes: Starting with the Banks

For most people dipping their toes into real estate investing, the first stop is a traditional lender. Banks and credit unions offer the stability and competitive rates you'd expect, but they play by a strict set of rules.

They're going to zero in on a couple of key numbers:

- Loan-to-Value (LTV) Ratio: This is just a simple comparison of the loan amount to the property's official appraised value. For investment properties, lenders want to see an LTV of 80% or lower. In plain English, that means you need to bring at least a 20% down payment to the table.

- Debt-to-Income (DTI) Ratio: This calculation takes all your monthly debt payments and stacks them up against your total monthly income before taxes. Lenders typically look for a DTI below 43%, which gives them confidence you can actually afford another mortgage payment without being stretched too thin.

Conventional mortgages are the most beaten path, but don't overlook government-backed loans. FHA or VA loans can sometimes be a great fit, especially if you're "house hacking"—living in one unit of a duplex or triplex while renting out the others.

Creative Financing: Thinking Beyond the Bank

So, what happens if that 20% down payment feels more like a mountain than a hurdle? This is where the real magic happens and where smart investors separate themselves from the crowd. Thinking outside the traditional bank box can get you into a property much faster.

This flexibility is more important than ever. While global real estate deals started to pick up in 2024, raising money became tougher, with fundraising hitting its lowest point since 2012. You can dig deeper into these global private market trends from McKinsey's report.

Here’s a quick look at how some popular creative financing strategies stack up:

| Financing Method | Best For… | Key Advantage | Main Drawback |

|---|---|---|---|

| Seller Financing | Buyers with less cash on hand or a less-than-perfect credit score. | You negotiate flexible terms directly with the owner, not a bank. | The seller might ask for a higher price or interest rate for the convenience. |

| Hard Money Loans | House flippers and rehabbers who need cash in a hurry. | Funding is incredibly fast—often in days, not weeks or months. | The tradeoff is very high interest rates and short repayment deadlines. |

| Partnerships | Investors looking to pool resources for a larger, more expensive deal. | You get access to more capital and can share both the work and the risk. | A rock-solid legal agreement is a must, and you'll be splitting the profits. |

| HELOC | Homeowners who have built up significant equity in their primary residence. | It's a flexible line of credit, almost like a credit card for your house. | You're putting your own home on the line as collateral, which adds risk. |

If you want to dive deeper into how these work, our guide on how to finance an investment property breaks it all down.

A Real-World Example of Creative Financing

Let's see what this looks like in the real world. Imagine an investor named Alex who finds a perfect duplex listed for $400,000. The problem? He only has $40,000 (10%) saved up. A conventional loan is out of the question.

Instead of walking away, Alex pieced together a solution:

- He Negotiated Seller Financing: The seller owned the property free and clear and was motivated. Alex convinced them to finance 10% of the price ($40,000) as a second, smaller mortgage.

- He Secured a Conventional Loan: With the seller providing a slice of the financing, Alex now only needed the bank to cover 80% of the property's value ($320,000). This was a standard LTV ratio the bank was perfectly comfortable with.

- He Used His Personal Savings: Alex then used his own $40,000 to cover the remaining 10% of the purchase price plus closing costs.

By stacking these strategies, Alex was able to buy a cash-flowing asset with half the down payment a bank would normally demand. It just goes to show that financing isn't always an impossible wall—sometimes, it’s just a puzzle waiting to be solved.

Managing Your Risks and Maximizing Your Returns

Here’s a little secret: the best real estate investors aren't just good at finding deals. They're masters of managing risk. It's easy to get swept up in the excitement of a promising property, but true skill lies in protecting your capital and methodically growing your returns.

Success in this game isn't about dodging every single risk—that’s just not possible. It's about seeing them coming and having a solid plan to deal with them when they arrive.

This section is your playbook for turning common investor anxieties into manageable challenges. We’ll look at the big four—vacancies, surprise repairs, problem tenants, and market downturns—and I'll show you how to handle each one. Then, we’ll switch gears to the fun part: making money. You'll learn to speak the language of professional investors by mastering the key metrics that really separate a great deal from a dud.

Proactively Managing Common Investor Risks

The line between a profitable rental and a financial nightmare is often just a matter of preparation. Here’s how you build a solid defense against the problems that trip up most new investors.

-

The Vacancy Threat: An empty property is a leaky bucket. It's not just that you're missing out on income; you're actively paying for a property that isn't paying you back. The best defense is a good offense. Start marketing your rental a good 30-60 days before the current lease is up. Make sure your rent is competitive for the neighborhood. And most importantly, always bake vacancy into your budget by setting aside 5-10% of the gross monthly rent.

-

Surprise Repairs: Nothing will kill your profits faster than a dead furnace in January or a roof that suddenly decides to leak. This is exactly why a Capital Expenditure (CapEx) fund isn't optional; it's essential. Smart investors squirrel away 5-10% of their monthly rent into a separate savings account just for these big, inevitable expenses.

-

Problem Tenants: I've seen a single bad tenant cause thousands in damages, not to mention the legal headaches and lost rent. Your most powerful tool here is a rigorous, multi-step tenant screening process. This isn't something to rush. It has to include a full credit check, a criminal background check, verifying their employment and income (I always look for income that's at least 3x the rent), and—the step people always forget—actually calling their previous landlords.

Speaking the Language of Returns

With your risks under control, you can focus on the numbers that drive your profit. To make smart decisions with your head instead of your gut, you need to get comfortable with a few key performance indicators (KPIs). These simple metrics cut through the hype and tell you exactly how hard your money is really working for you.

Net Operating Income (NOI) is the single most important measure of a property's raw profitability. Think of it as the income left over after you've paid all the bills to keep the property running—but before you've paid the mortgage. Get this one right, and you're already thinking like a pro.

Let's break down the essential formulas you'll use on every single deal.

- Net Operating Income (NOI): This is your property's total income minus its operating expenses.

NOI = Gross Rental Income - Operating Expenses. - Capitalization Rate (Cap Rate): This is a quick way to compare different properties, regardless of how you finance them. It shows the property's return as if you'd paid all cash.

Cap Rate = NOI / Property Purchase Price. - Cash-on-Cash Return (CoC): For most investors, this is the bottom line. It tells you the annual return you're making on the actual cash you pulled out of your pocket to buy the property.

CoC Return = Annual Cash Flow / Total Cash Invested.

Running the Numbers: A Sample Deal Analysis

Formulas on a page are one thing, but seeing them in action is where the magic happens. Let's walk through a quick analysis of a hypothetical single-family rental to see how these numbers tell a story.

Here's a breakdown of the kind of spreadsheet I'd create for a potential deal.

Sample Rental Property Deal Analysis

| Metric | Calculation | Example Value |

|---|---|---|

| Purchase Price | N/A | $250,000 |

| Down Payment (20%) | $250,000 * 0.20 | $50,000 |

| Closing Costs | ~3% of Purchase Price | $7,500 |

| Total Cash Invested | $50,000 + $7,500 | $57,500 |

| Gross Annual Rent | $2,000/month * 12 | $24,000 |

| Annual Operating Expenses | Taxes, Insurance, Vacancy, Maintenance | ($8,400) |

| Net Operating Income (NOI) | $24,000 – $8,400 | $15,600 |

| Annual Mortgage Payments | Principal & Interest on $200k loan | ($13,728) |

| Annual Pre-Tax Cash Flow | $15,600 – $13,728 | $1,872 |

| Cap Rate | $15,600 / $250,000 | 6.24% |

| Cash-on-Cash Return | $1,872 / $57,500 | 3.25% |

Looking at these numbers, the 6.24% Cap Rate seems decent for some markets. But the 3.25% Cash-on-Cash return? That's pretty low. This simple analysis instantly tells me I'd need to either negotiate a lower purchase price, find a way to increase the rent, or trim my expenses to make this a deal worth pursuing.

This is the power of running the numbers. It takes emotion out of the equation and shows you the cold, hard financial truth of an investment.

Your Action Plan for Buying Your First Property

All the knowledge in the world doesn't mean a thing without action. This is your roadmap to finally break free from "analysis paralysis" and make the leap from aspiring investor to actual property owner.

Think of this not just as a summary, but as your personal launch sequence.

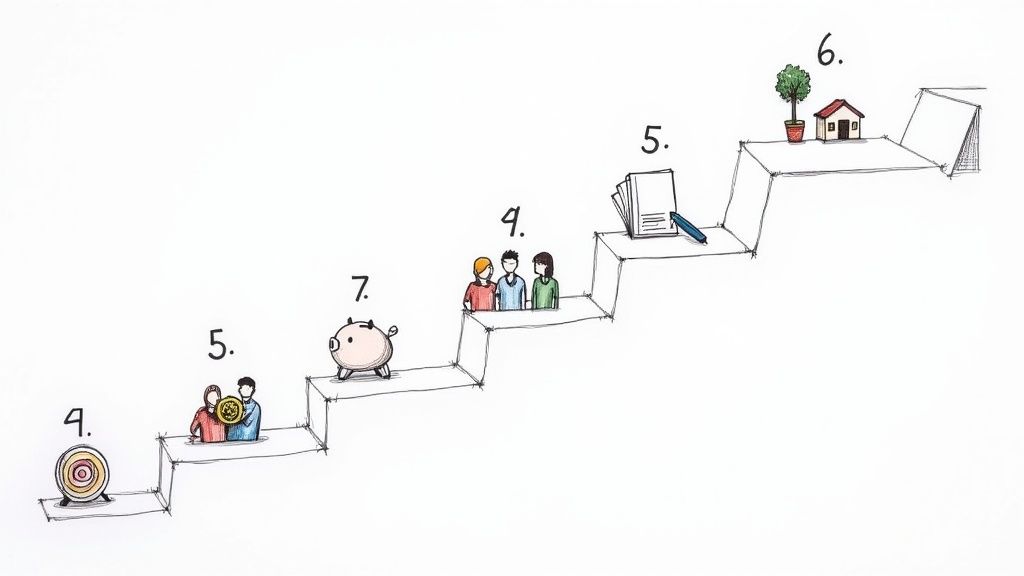

Step 1: Solidify Your Financial Foundation

Before you even glance at a single listing, you need to get your financial house in order. Start by pulling your credit report. Clean up any errors and focus on paying down high-interest debts to improve your debt-to-income (DTI) ratio.

Next, you have to get brutally honest about what you can actually afford. To get a clear picture, use our calculator to see if you can afford an investment property. This simple step provides the clarity you need to make a confident purchase.

Finally, get serious about saving for your down payment and closing costs. Open a dedicated savings account just for this purpose. Watching that balance grow makes the goal feel real and keeps you motivated.

Step 2: Assemble Your Professional Team

Real estate is a team sport—you can't win it alone. Building a solid network of professionals is one of the smartest investments you'll ever make. Your A-team should include:

- A Real Estate Agent: Don't just find any agent; find one who specializes in working with investors. They know how to run the numbers on a deal and often have access to properties before they even hit the market.

- A Mortgage Lender: Get pre-approved before you start your property search. A pre-approval letter shows sellers you're a serious buyer and gives you a concrete budget to stick to.

- A Home Inspector: A meticulous inspector is your best line of defense. They can uncover hidden, costly problems that could completely tank a deal's profitability.

Step 3: Analyze Deals and Make an Offer

With your financing lined up and your team ready, it's time for the hunt. You should be analyzing dozens of potential properties using the metrics we've covered—NOI, Cap Rate, and Cash-on-Cash Return. Remember, don't fall in love with the property; fall in love with the numbers.

When you find a deal that makes sense on paper, work with your agent to craft a competitive offer. Be ready to negotiate, but never compromise on the numbers that made it a smart investment in the first place. This disciplined approach is crucial, especially as the market continues to show its strength.

In fact, global private real estate values have seen a solid recovery, with five straight quarters of positive returns. This resilience, largely driven by stable rental income, shows just how valuable this asset class can be when other markets are shaky.

The journey to building wealth through real estate is not a single leap but a series of consistent, informed steps. Your first property is the most important step of all.

Once your offer is accepted, lean on your team to navigate the closing process. Perform your final due diligence, sign the paperwork, and take a deep breath. You're officially a real estate investor.

Frequently Asked Questions (FAQ)

Jumping into real estate investing always comes with a lot of questions. It's only natural. To help you get clear and confident, we’ve put together answers to the ten most common questions we hear from new investors. Think of this as your go-to guide for getting past those first-time jitters.

1. How much money do I really need to start investing in real estate?

While a 20% down payment for a conventional loan is common, it's not the only way. You can start with less through government-backed loans like an FHA loan (as little as 3.5% down) or a VA loan (0% down for eligible veterans). Strategies like house hacking or partnering with other investors can also significantly lower your initial cash outlay.

2. What is the biggest mistake new real estate investors make?

The most common and costly mistake is underestimating expenses and overestimating potential income. New investors often forget to budget for crucial items like vacancy periods (typically 5-10% of gross rent), capital expenditures (large repairs like a new roof or HVAC system), routine maintenance, and property management fees. A failure to accurately account for all costs can quickly turn a promising investment into a financial drain.

3. Is real estate a better investment than stocks?

Neither is inherently "better"; they serve different purposes in a portfolio. Real estate offers unique advantages like leverage, tangible asset ownership, and significant tax benefits (like depreciation). Stocks, on the other hand, offer high liquidity and lower transaction costs. A well-diversified investment plan often includes both asset classes to balance risk and returns.

4. What is a good return on a rental property?

A "good" return can be subjective and market-dependent, but many investors aim for a Cash-on-Cash (CoC) Return of 8-12% or higher. Another helpful guideline is the "1% Rule," which suggests that the gross monthly rent should be at least 1% of the property's purchase price (e.g., a $200,000 property should rent for at least $2,000/month). While not a strict rule, it's a useful initial screening tool.

5. What is "house hacking" and how does it work?

House hacking is a popular strategy where you buy a multi-unit property (like a duplex or triplex), live in one unit, and rent out the others. The rental income from your tenants can help pay down your mortgage, often covering most or all of your housing costs. It's an effective way to start investing with a lower-down-payment owner-occupant loan while building equity.

6. Can I invest in real estate if I have a full-time job?

Absolutely. Many successful real estate investors have full-time careers. Strategies like long-term rentals can be made relatively passive by hiring a professional property manager to handle day-to-day operations. Alternatively, investing in Real Estate Investment Trusts (REITs) allows you to own a piece of a real estate portfolio with no active management required.

7. Should I form an LLC for my rental property?

For your first property, it might not be necessary, but as you scale your portfolio, forming a Limited Liability Company (LLC) is highly recommended. An LLC provides liability protection by separating your personal assets from your business assets. If a lawsuit were to occur related to your property, only the assets within the LLC would be at risk, protecting your personal home and savings.

8. How do I find good investment deals?

Finding good deals requires a proactive approach. Build a relationship with an investor-friendly real estate agent, monitor online listings (MLS), and look for off-market opportunities like For Sale By Owner (FSBO) properties or local auctions. Networking at real estate investor meetups is also a powerful way to hear about deals before they become public knowledge.

9. What is the difference between Cap Rate and Cash-on-Cash Return?

The Capitalization (Cap) Rate measures a property's unleveraged return (NOI / Purchase Price), making it useful for comparing properties as if you paid all cash. The Cash-on-Cash (CoC) Return measures the return on the actual cash you invested (Annual Cash Flow / Total Cash Invested), providing a real-world picture of your personal return after factoring in your loan.

10. What's the difference between a real estate agent and a REALTOR®?

While both are licensed to help clients buy and sell real estate, a REALTOR® is a member of the National Association of REALTORS® (NAR) and is bound by its strict Code of Ethics. This code requires a higher standard of professional conduct and duties to clients. When building your team, looking for an investor-friendly REALTOR® can add an extra layer of professionalism and accountability.

At Top Wealth Guide, our mission is to give you the insights to build a secure financial future. Whether you're making your first move or scaling your portfolio, our resources are here to help you make smart, profitable decisions. Explore more expert strategies on our website.

1 Comment

Pingback: 10 Proven Strategies for Building Wealth in 2025