So, you've just signed the papers for your new home. It’s an exciting time, but it also comes with a hefty financial responsibility: the mortgage. That’s where mortgage protection insurance, or MPI, comes into the picture.

At its core, MPI is a type of life insurance with a very specific, singular mission: to pay off your outstanding mortgage balance if you pass away. The whole point is to ensure your family can stay in their home, free and clear, without the stress of monthly mortgage payments hanging over their heads.

It's easy to get this confused with Private Mortgage Insurance (PMI), but they are worlds apart. PMI protects your lender if you default on the loan. MPI is all about protecting your family.

In This Guide

- 1 Understanding Mortgage Protection Insurance

- 2 How Mortgage Protection Insurance Actually Works

- 3 MPI vs. Term Life Insurance Head-to-Head

- 4 The Pros and Cons of Mortgage Protection Insurance

- 5 When Does Mortgage Protection Insurance Make Sense?

- 6 Frequently Asked Questions About MPI

- 6.1 1. Is Mortgage Protection Insurance Tax-Deductible?

- 6.2 2. What Happens If I Refinance My Mortgage?

- 6.3 3. Is MPI the Same as Private Mortgage Insurance (PMI)?

- 6.4 4. Can I Cancel My MPI Policy?

- 6.5 5. Does My Lender Require MPI?

- 6.6 6. How Much Does MPI Typically Cost?

- 6.7 7. Are the Premiums Guaranteed to Stay the Same?

- 6.8 8. What Do Disability Riders Cover?

- 6.9 9. Who Should Be My Beneficiary?

- 6.10 10. Can I Get MPI with a Pre-existing Condition?

Understanding Mortgage Protection Insurance

Think of it like this: MPI is a financial safety net stretched right under your home loan. Its one and only job is to catch that specific debt so it doesn't land on your loved ones. If you were to pass away while the policy is active, the insurance company sends the payout directly to your mortgage lender to wipe the slate clean.

This laser-focus is what makes MPI different from other financial tools. A healthy emergency fund is absolutely essential, but it’s built for short-term crises like a job loss or an unexpected medical emergency. MPI, on the other hand, is built to tackle the single largest debt most people will ever have. You can see how these tools fit together in our guide on why an emergency savings account isn't big enough.

Key Characteristics of MPI

Mortgage protection insurance has a few unique features that really define how it works:

- Decreasing Benefit: The policy’s value is directly tied to what you owe on your mortgage. As you pay down your loan each year, the potential insurance payout gets smaller to match.

- Direct Payout to Lender: Your family never sees a check. The benefit goes straight to the bank or lender that holds your mortgage. This guarantees the money is used exactly as intended—to pay off the house.

- Optional Coverage: Let's be clear: no lender can force you to buy MPI. It’s a completely optional product that homeowners choose for added peace of mind.

Mortgage protection insurance is an optional term insurance policy, where you pay fixed premiums for a set period of time—generally the same term as your home loan.

The market for this kind of specific protection has been growing, hitting around USD 9.8 billion in 2024. This boom shows just how many homeowners are looking for straightforward ways to protect their biggest asset from life's unpredictability. It’s a niche product, but it offers a simple, powerful promise.

How Mortgage Protection Insurance Actually Works

Think of mortgage protection insurance (MPI) as a very specific tool designed for one job and one job only: paying off your mortgage if you die. It’s not as complicated as it sounds. Let’s break down how a policy works, from the day you sign the dotted line to the moment it might actually be needed.

The whole thing is tied directly to your home loan. When you take out an MPI policy, the coverage amount is set to match whatever you owe on your mortgage. So, if you just took out a $300,000 loan, your MPI policy starts with a $300,000 death benefit. This is the key difference that separates it from other kinds of life insurance.

From that point on, the policy's value follows your loan balance downward. As you chip away at your mortgage principal with each monthly payment, the MPI policy's potential payout shrinks right along with it. This is what's known as a decreasing benefit.

The Payout Mechanism: A Direct Line to the Lender

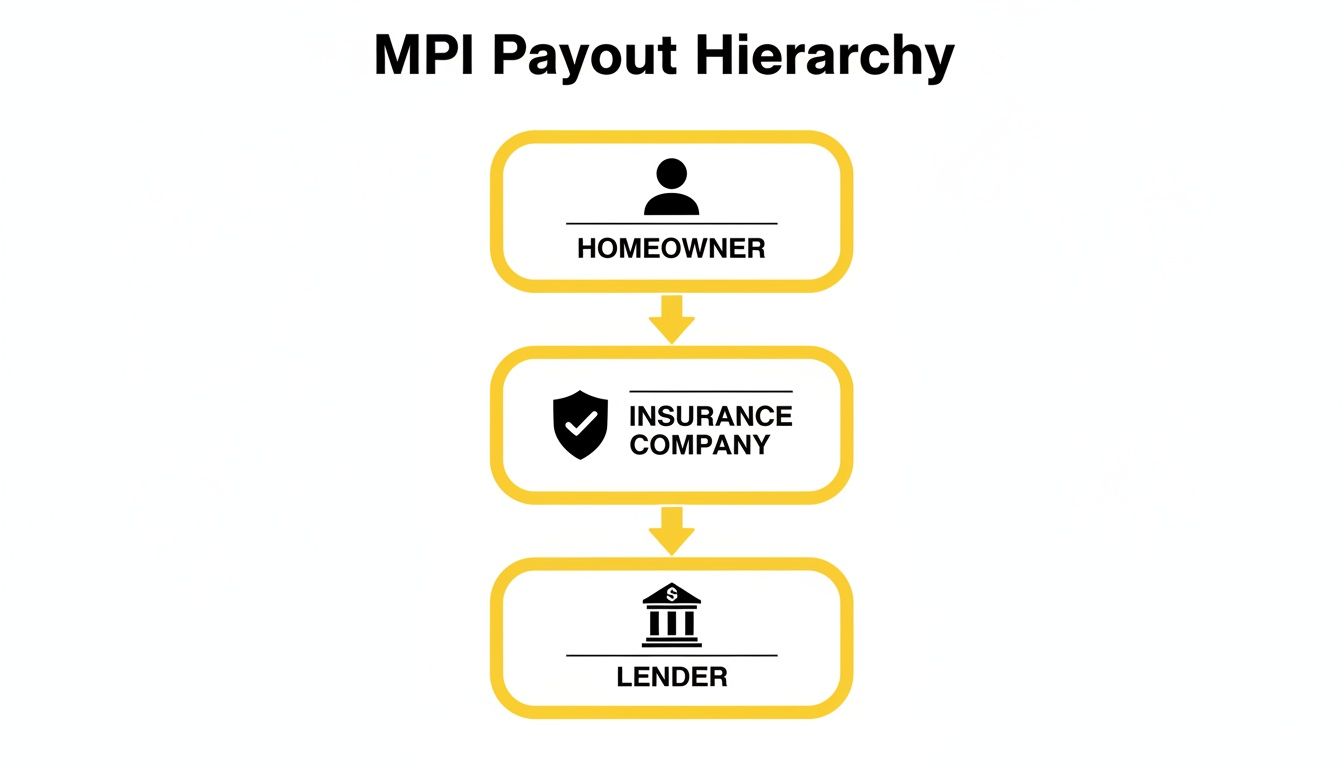

Here’s the most critical piece of the puzzle: who gets the money. With traditional life insurance, you name a person—your spouse, your kids—as the beneficiary. With MPI, the beneficiary is always your mortgage lender. No exceptions.

This means if you pass away, the insurance company sends a check for the remaining mortgage balance straight to the bank. Your family never sees the money and has zero say in how it's used. The policy's sole mission is to wipe out that one specific debt so your family owns the home free and clear.

The defining feature of MPI is its payout structure. The benefit bypasses your heirs and goes straight to the financial institution holding your mortgage, guaranteeing the loan is satisfied.

That direct-to-lender payment offers a unique kind of peace of mind. You know for certain the money can't be spent on anything else; the house is secured, period. This not only saves your family from the threat of foreclosure but also instantly solidifies the home as a fully owned asset. To get a better grasp on why this matters so much for your family's net worth, it's worth understanding what equity is in real estate and how a paid-off home supercharges it.

Real-Life Example: The Chen Family

Let's walk through a real-life scenario to see this in action.

- The Homeowners: Meet the Chens. They just bought their first home with a $400,000, 30-year mortgage. With two young children, they wanted to ensure their family could always keep the house.

- The Policy: They opt for a 30-year MPI policy, wanting a straightforward guarantee that the mortgage would be paid if one of them passed away unexpectedly.

- The Unforeseen Event: Five years later, Mr. Chen tragically passes away. By then, they’ve paid their mortgage down to $370,000.

- The Payout: The MPI policy is activated. The insurance company pays the $370,000 balance directly to their lender, and the loan is completely cleared.

- The Outcome: Mrs. Chen and her children now own their home outright. She doesn't have to worry about making a huge monthly mortgage payment while grieving and can focus on her family's future, secure in their home.

This scenario perfectly illustrates the problem MPI is built to solve. It zeroes out the biggest debt a family usually has, providing immediate stability when it’s needed most.

Adding Layers of Protection with Riders

Many MPI policies aren't just for a death benefit. You can often add optional features, called riders, to build a bigger safety net for other life events that could derail your ability to pay the mortgage.

Some of the most common riders include:

- Disability Rider: If you become disabled and can't work, this can cover your mortgage payments for a specific period.

- Job Loss Rider: A few policies offer a rider that will step in and make your payments for a few months if you're laid off.

- Critical Illness Rider: This pays a benefit if you're diagnosed with a serious illness covered by the policy, like a heart attack or cancer.

Adding riders gives you more flexibility with an otherwise rigid policy. They do cost more, but they can protect you from a wider range of financial shocks, making your mortgage one less thing to stress about during a crisis.

MPI vs. Term Life Insurance Head-to-Head

When it comes to protecting your family and your home, the two biggest players you'll hear about are mortgage protection insurance (MPI) and traditional term life insurance. They might sound similar, but how they work—and who they truly serve—couldn't be more different.

Think of term life insurance as a flexible financial safety net. If you pass away, it pays a tax-free, lump-sum check directly to the people you choose, like your spouse or kids. They get to decide the best way to use that money, whether that’s paying off the mortgage, covering bills, saving for college, or just having some breathing room.

MPI, on the other hand, is built for one job and one job only: paying off your mortgage. The insurance payout goes straight to your lender, not your family. This choice between flexibility and a single-purpose tool is the most important one you'll make in this process, as it dictates your family’s financial freedom during an incredibly tough time.

Who Gets The Money? Beneficiary and Benefit Flexibility

The biggest fork in the road between MPI and term life is who gets paid. With an MPI policy, the beneficiary is set in stone—it's always the bank that holds your mortgage. This guarantees the loan gets paid off, but it completely removes your family from the decision-making process.

A term life policy puts your loved ones in the driver's seat. They receive the money and can look at their entire financial picture. Maybe paying off a mortgage with a 2.5% interest rate isn't the smartest move when they have high-interest credit card debt or need cash for daily expenses. That kind of flexibility is priceless.

The core difference is simple: MPI pays off a debt, while term life insurance provides for your people. This single distinction shapes every other aspect of the comparison.

This diagram makes it crystal clear how an MPI payout works. The money flows from you to the insurer and directly to the lender, completely bypassing your family.

As you can see, the policy is designed to do one thing: clear that specific debt with your lender.

Does The Payout Change? Coverage Amount and Policy Value

Another critical difference is how the policy's value holds up over time. With mortgage protection insurance, you're buying a decreasing benefit. As you faithfully make your mortgage payments each month, the potential insurance payout shrinks right alongside your loan balance. The kicker? Your monthly premium usually stays the same. You end up paying the same price for less and less coverage over the years.

Term life insurance is the complete opposite. It provides a level death benefit. If you buy a $500,000 policy for a 20-year term, that $500,000 benefit is guaranteed for the entire two decades. Your family gets the full amount whether you pass away in year two or year nineteen, making it a much more predictable and powerful financial tool.

If you want to dig deeper into the nuts and bolts of life insurance policies, our guide comparing whole life vs. term life insurance is a great place to start.

Getting Approved: Underwriting and Cost Comparison

The path to getting approved for each policy is also quite different. Term life insurance typically involves a full underwriting process, which means a medical exam and a thorough look at your health history. It might sound like a hassle, but for healthy folks, this process leads to significantly cheaper premiums for a whole lot more coverage.

MPI is often sold on its convenience. The underwriting is simplified, and you can frequently get a policy with no medical exam at all. This is its main selling point, especially for people with pre-existing health issues who might struggle to get approved for traditional life insurance. The trade-off for this easy approval is cost—MPI premiums are almost always higher than term life for the same starting coverage, particularly for healthy applicants.

While MPI protects the homeowner, its cousin, private mortgage insurance (PMI), is all about protecting the lender. Mortgage-related insurance is a huge part of the U.S. housing market. In fact, research from the Urban Institute shows that between 1957 and 2023, the PMI industry helped over 38 million people buy a home. This kind of insurance helps stabilize the entire system by reducing risk for lenders.

Comparison Table: MPI vs. Term Life Insurance

To help you visualize the trade-offs, here’s a direct comparison of the key features of MPI and Term Life Insurance. Reviewing this can help you pinpoint which policy truly aligns with your family’s needs.

| Feature | Mortgage Protection Insurance (MPI) | Term Life Insurance |

|---|---|---|

| Primary Beneficiary | The mortgage lender | Your chosen beneficiaries (spouse, children, etc.) |

| Benefit Flexibility | None. Payout is restricted to paying off the mortgage. | Complete flexibility. Beneficiaries can use funds for any purpose. |

| Coverage Amount | Decreases as you pay down your mortgage. | Stays level for the entire term of the policy. |

| Underwriting | Simplified, often with no medical exam required. | More comprehensive, usually requires a medical exam. |

| Typical Cost | Generally more expensive for the amount of coverage provided. | More affordable, especially for healthy individuals. |

| Main Advantage | High accessibility, even with health issues. | Greater value, flexibility, and control for your family. |

So, what's the bottom line? The right choice really comes down to your personal situation and priorities. If your only goal is to make absolutely sure the mortgage is paid and you have health conditions that make other insurance a non-starter, MPI could be a reasonable solution.

For most people, however, the superior flexibility, better value, and complete control offered by term life insurance make it a far better way to protect your family’s total financial future.

The Pros and Cons of Mortgage Protection Insurance

Like any financial product, mortgage protection insurance (MPI) comes with a unique set of trade-offs. It makes a very simple promise: if you die, your mortgage gets paid off. But that simplicity often comes with hidden costs and a serious lack of flexibility. You really need to weigh the good against the bad before deciding if it’s the right move for your family.

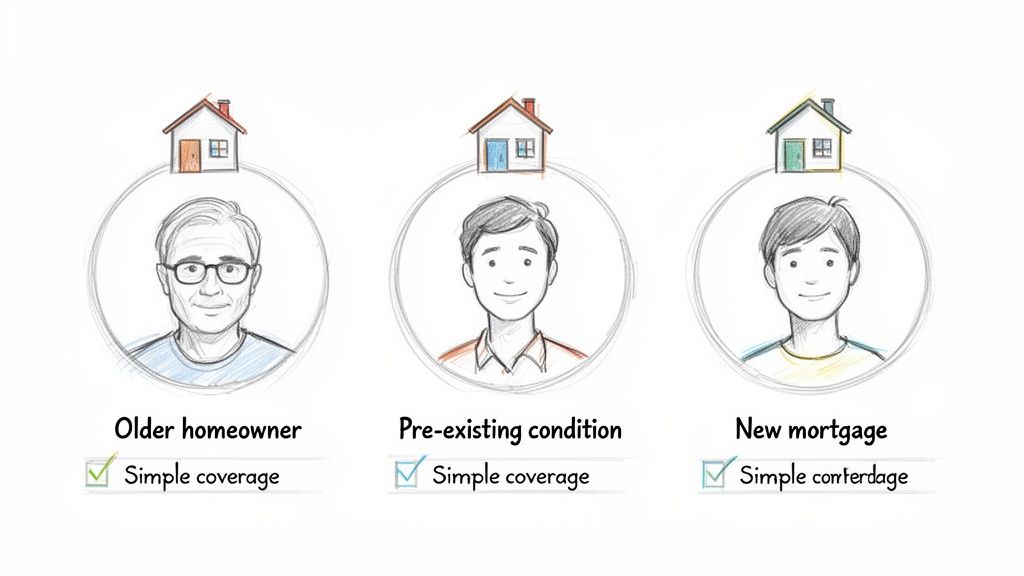

The biggest selling point for MPI is how easy it is to get. The application is usually a breeze, and many policies don't even require a medical exam. This makes it a potential lifeline for anyone with pre-existing health conditions who might get turned down for traditional life insurance.

For someone in that specific situation, this easy approval can bring incredible peace of mind. It’s a dedicated, purpose-built safety net that guarantees the house is secured for the family, no matter what.

The Advantages of MPI

While MPI isn't for everyone, its benefits can be a perfect fit in certain scenarios.

- Easy to Qualify For: As we just covered, you can often get a policy without a single medical question. That's a huge deal if you're managing a chronic illness like diabetes or have a history of heart trouble.

- A Dedicated Payout: The money goes straight from the insurer to your mortgage lender. There’s no ambiguity or chance for the funds to be used for anything else—the mortgage is simply gone.

- Specific Peace of Mind: There's a real comfort in knowing your family's biggest single debt will be wiped clean automatically, taking one massive worry off their plate.

The Significant Downsides

This is where things get tricky. For most homeowners, the drawbacks of MPI are pretty serious and often make it a poor choice. The biggest problem by far is its total lack of flexibility.

The death benefit is locked in—it can only be used to pay your lender. Your family doesn't see a dime of it and has zero say in how it's used. This rigid structure can backfire spectacularly if your family has other, more urgent financial needs after you're gone.

A policy that only pays off a single debt can become a financial trap. It robs your family of the power to use the money where it's needed most.

Let's imagine a real-world situation. David, the main breadwinner in his family, passes away, leaving behind a spouse and two kids. Their MPI policy works as promised and pays off the remaining $250,000 mortgage. But now, the family is staring down a pile of medical bills from his final illness and needs cash just to cover groceries and utilities. That insurance money, which could have been a lifeline, is now trapped as equity in the house, leaving them cash-poor and struggling with daily expenses.

Pros and Cons Comparison Table

To really lay it all out, let's look at the trade-offs side-by-side. This gives you a balanced view of where MPI makes sense and where it falls apart.

| Pros of MPI | Cons of MPI |

|---|---|

| Accessible with no medical exam | Inflexible; benefit only pays the lender |

| Guarantees mortgage payoff | Decreasing benefit; you pay the same for less coverage over time |

| Provides specific peace of mind | Typically more expensive than term life for healthy people |

| Predictable, fixed premiums | Limited use; cannot cover other financial needs |

At the end of the day, term life insurance is a much better deal for most people. It gives your family a level death benefit (it doesn't decrease), it's usually cheaper if you're in decent health, and it provides the financial freedom they'll desperately need. If you're weighing your options, our guide to the best life insurance companies is a great place to start your research. For anyone who can qualify, the control and flexibility of a term life policy make it the superior choice for protecting your family’s complete financial picture.

When Does Mortgage Protection Insurance Make Sense?

Let's be clear: for most homeowners, term life insurance is the smarter, more flexible option. But that doesn't mean mortgage protection insurance (MPI) is a throwaway product. Think of it as a specialized tool. It's not right for every job, but for a few specific situations, it’s the perfect fit.

The real advantage of MPI is its accessibility. Its biggest selling point is that you can often get a policy without a medical exam. For some people, that’s not just a convenience—it's the only way they can get coverage at all.

Who Is MPI Actually For?

So, when does it make sense to choose the less flexible option? MPI is built for homeowners who find other doors closed to them.

Here’s who might find it a lifesaver:

- People with Serious Health Conditions: If a pre-existing condition like heart disease, diabetes, or a past cancer diagnosis makes it tough or impossible to get an affordable term life policy, MPI offers a straightforward alternative to protect your home.

- Older Homeowners: Taking out a mortgage later in life can make term life insurance incredibly expensive. An MPI policy can be a more direct and sometimes cheaper way to ensure the new mortgage is covered without jumping through medical hoops.

- Anyone Who Wants a Sure Thing: Some people just want the peace of mind that comes with knowing the house will be paid off, no questions asked. They don't want to leave it to chance or hope a beneficiary uses a life insurance payout for the mortgage. MPI pays the lender directly, eliminating any doubt.

For these homeowners, MPI isn't just an insurance policy; it’s a targeted solution. It solves one specific problem—paying off the mortgage—when the more common, flexible alternatives just aren't a practical choice.

It seems more people are catching on to this. A 2024 report found that 41% of UK mortgage advisers had more conversations about protection insurance than the year before. Even more telling, the number of clients bringing up the topic themselves jumped from 11% in 2023 to 21% in 2024. You can read more about this trend in the Gen Z and millennial mortgage protection report on mpamag.com.

Looking at Your Own Situation

The choice really boils down to your personal circumstances and what you value most. If your number one priority is to guarantee the mortgage gets paid off, and you prefer simplicity over flexibility, MPI could be a smart move. It's a single-purpose tool that does its one job very well.

But even if you fit the ideal profile for MPI, don't let it be your only safety net. A solid emergency fund is still critical for covering immediate expenses that insurance won't touch. Our guide on how to build an emergency fund walks you through creating that essential cash buffer. Pairing a targeted policy like MPI with a healthy savings account creates a much stronger financial foundation.

Frequently Asked Questions About MPI

Diving into the world of mortgage protection insurance can definitely bring up some questions. It's a specific kind of coverage, and it's easy to get it mixed up with other types of insurance. To help you get a clear picture, here are straightforward answers to the ten most common things homeowners ask about MPI.

1. Is Mortgage Protection Insurance Tax-Deductible?

In almost all cases, no. The premiums you pay for mortgage protection insurance are not tax-deductible. The IRS views these payments as a personal expense, putting them in the same bucket as your car insurance or a standard life insurance policy. While you get to deduct your mortgage interest, MPI premiums don't qualify.

2. What Happens If I Refinance My Mortgage?

This is a great question. When you refinance, you’re taking out an entirely new loan to pay off your old one. Since your MPI policy was tied specifically to that original mortgage, refinancing will terminate the policy. If you still want that protection for your new loan, you'll have to apply for a brand new MPI policy that matches the balance and term of your refinanced mortgage.

3. Is MPI the Same as Private Mortgage Insurance (PMI)?

This is one of the most common points of confusion. They sound similar, but they protect two completely different parties. Put simply: MPI protects you, while PMI protects your lender. MPI is an optional policy that pays off your mortgage if you die. PMI is insurance your lender requires if you put down less than 20%, and it only protects them if you default.

4. Can I Cancel My MPI Policy?

Absolutely. Because MPI is an elective policy you purchase separately from your loan, you can cancel it whenever you want. All it takes is a call to your insurance provider to end the coverage. Just know that you won't get a refund for any of the premiums you've already paid.

5. Does My Lender Require MPI?

Nope. A lender can't make you buy mortgage protection insurance. MPI is always an optional product, and it's actually illegal for a lender to require it as a condition for approving your mortgage. They might pitch it to you during the closing process, but the final decision is 100% yours.

6. How Much Does MPI Typically Cost?

There's no single price tag. The cost varies based on your age, health, mortgage balance, and loan term. Because the underwriting is lenient, MPI often ends up being more expensive than a term life insurance policy for the same amount of coverage, especially for healthy people. It's crucial to shop around for quotes from multiple insurers.

7. Are the Premiums Guaranteed to Stay the Same?

For the vast majority of MPI policies, yes. The premiums are typically level, meaning they’re designed to stay the same for the entire life of the loan. This makes it easy to budget for. However, you should always double-check the policy documents to confirm the premiums are "guaranteed level."

8. What Do Disability Riders Cover?

A disability rider is a powerful add-on. If you become disabled due to an illness or injury and can't work, this rider will cover your monthly mortgage payments for a set period of time (often up to two years). It’s a safety net that can keep you from falling behind on your mortgage while you focus on your recovery.

9. Who Should Be My Beneficiary?

This is one of the defining features of MPI, and you don't get a choice. With mortgage protection insurance, the beneficiary is always your mortgage lender. The policy is set up to pay the death benefit directly to the bank. This is fundamentally different from traditional life insurance, where your loved ones receive the cash.

10. Can I Get MPI with a Pre-existing Condition?

Yes, and for many people, this is the biggest selling point of mortgage protection insurance. Many MPI policies require no medical exam and use a simplified health questionnaire. This makes them a fantastic option for people with pre-existing conditions who may have been denied traditional life insurance.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

At Top Wealth Guide, our mission is to provide you with the clear, actionable information you need to build a secure financial future. From understanding complex products like mortgage protection insurance to developing long-term investment strategies, we’re here to help you navigate your journey to wealth. Explore our resources and start making more confident financial decisions today.

Discover more at https://topwealthguide.com.