Property investment — sounds fancy, right? Sure, it can fill your pockets with Benjamins, but let’s not kid ourselves… you’ve got to grasp the dollars and cents first. Step one? (drum roll) The right loan. Yeah, it’s the MVP of your money-making journey with Top Wealth Guide.

Try our Investment Property Calculator to calculator for investment property. Think of it as your crystal ball in this game. It’s not just about crunching numbers — it’s your backstage pass to seeing how different loans might shake up your returns. So, before you throw your cash into the property ring, give it a whirl and see what might really bring home the bacon.

In This Guide

What Are Investment Property Loans?

So, think you want to dip your toes into the world of real estate investing? Well, you’re gonna need some cash-and it’s not gonna come from the magic money tree in your backyard. Enter: investment property loans. These financial beasts are crafted for folks looking to scoop up properties for rental moolah or flipping for a sweet profit. But, heads up, they’re a whole other ballgame compared to your run-of-the-mill home loans. Knowing these beasts down to their bones? Essential… unless you fancy losing a chunk of change.

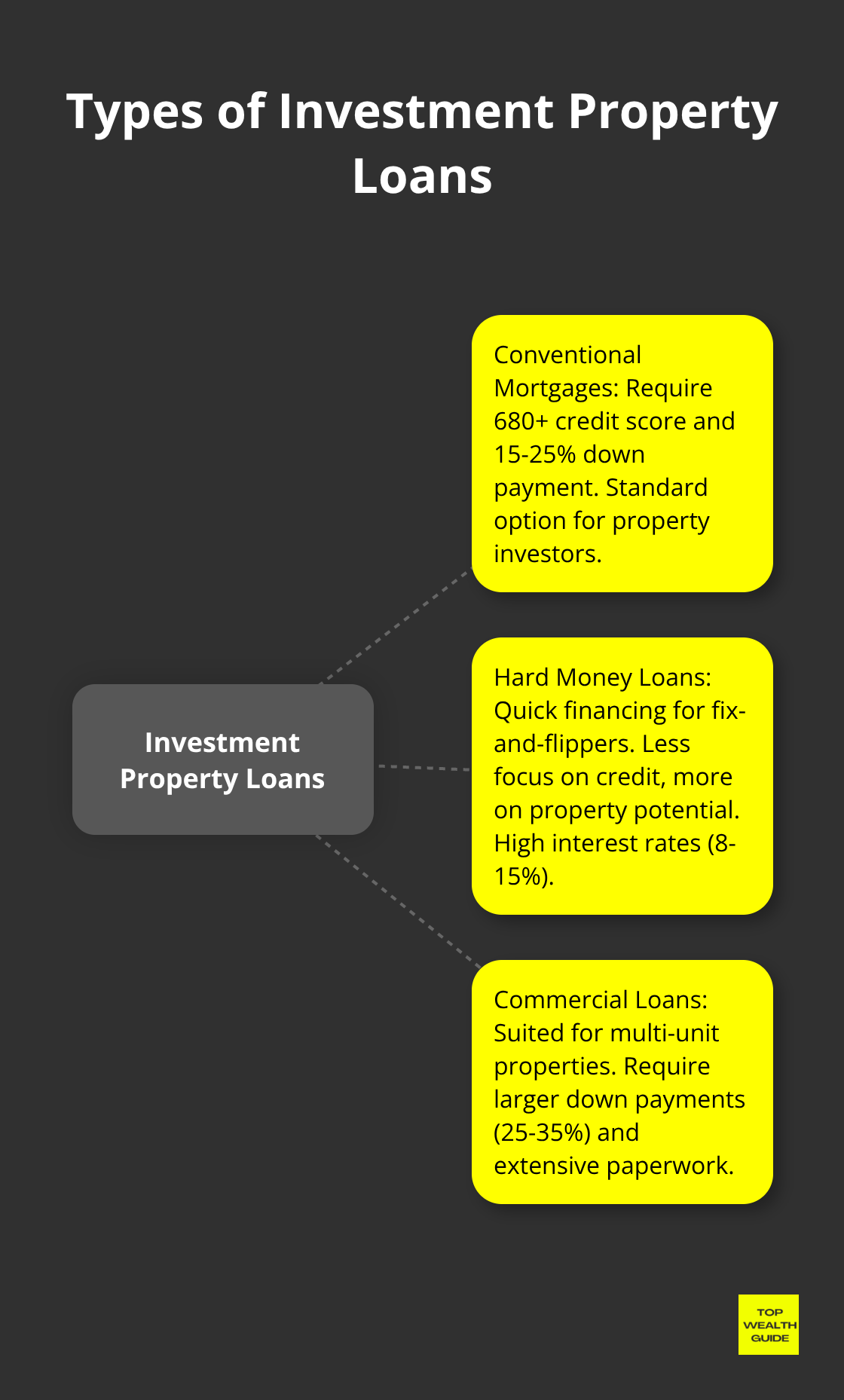

Types of Investment Property Loans

Picture this: you’re at an all-you-can-eat buffet, but instead of food, it’s loans. Feast your eyes, but choose wisely. Conventional mortgages? They’re the bread and butter but come with extra crunch-like needing a 680+ credit score and a chunky down payment of 15-25%.

Then there are hard money loans-the bad boys of the loan world. Perfect for those fix-and-flippers who need quick cash. They care less about your squeaky-clean credit and more about the property’s promise. Quick but pricey, these loans come with a side of high interest (we’re talking 8-15%).

Got your sights set on an empire of apartment units? Commercial loans may be your ticket. Be ready with a heftier down payment (think 25-35%), and roll up your sleeves for some serious paperwork.

Factors Affecting Loan Terms and Rates

What’s in your wallet? Seriously, your credit score is the golden ticket. Nailing a score above 740? You’re sailing into the best rates. But below 620? Let’s just say… it’s gonna be rough out there.

The property you pick plays a part-single-family homes? Easier to score a loan for. Those multi-unit buildings or commercial spots? A tad more complicated. And don’t forget where it’s parked-lenders love themselves a hot market with cool growth prospects.

Debt-to-income ratio (DTI) is another biggie. Lenders wanna see that you aren’t drowning in debt. Keep it under 43%, capisce? Means your monthly dues (including our new property pal) shouldn’t gulp down more than 43% of your gross monthly dough.

How They Differ from Primary Residence Mortgages

Look, investment property loans come with a price tag-and it usually involves higher interest rates. Think 0.5% to 1% (or more) above what you’d score for your own sweet digs. Today’s landscape? Imagine facing a climb of 7.5% or higher for these babies.

Same deal with down payments-while your own place might let you slide with 3-5%, investment properties wanna see at least 15-25% on the table.

Then there’s how lenders view rental income-they might be cool with counting a slice for mortgage qualification. Handy for meeting those debt-to-income hurdles.

The Impact of Loan Choice on Your Investment

The loan you opt for can steer the ship of your investment into plentiful or perilous waters. A lower interest rate? More cash filling your pockets every month. A shorter loan term? Building up equity faster than a pack of racehorses. It’s about striking the right balance between the here-and-now payoffs and that sweet long-term sugar.

Picture it: a mere 1% shift in interest on a $200,000 loan? You’re staring at $40,000+ in extra interest over 30 years. That’s why shopping around and playing the field with multiple lenders isn’t just smart-it’s essential.

Now, armed with the nitty-gritty on investment property loans, it’s time to dive into using a loan calculator to crank out some savvy decisions about your real estate investment game plan.

How to Master Investment Property Loan Calculators

So, investment property loan calculators-yeah, those magic machines-are these powerful allies in your financial arsenal. Ready to unleash their potential and maybe, just maybe, rake in some serious bucks from your real estate ventures? Gear up for a ride down Profits Lane.

Essential Inputs for Accurate Calculations

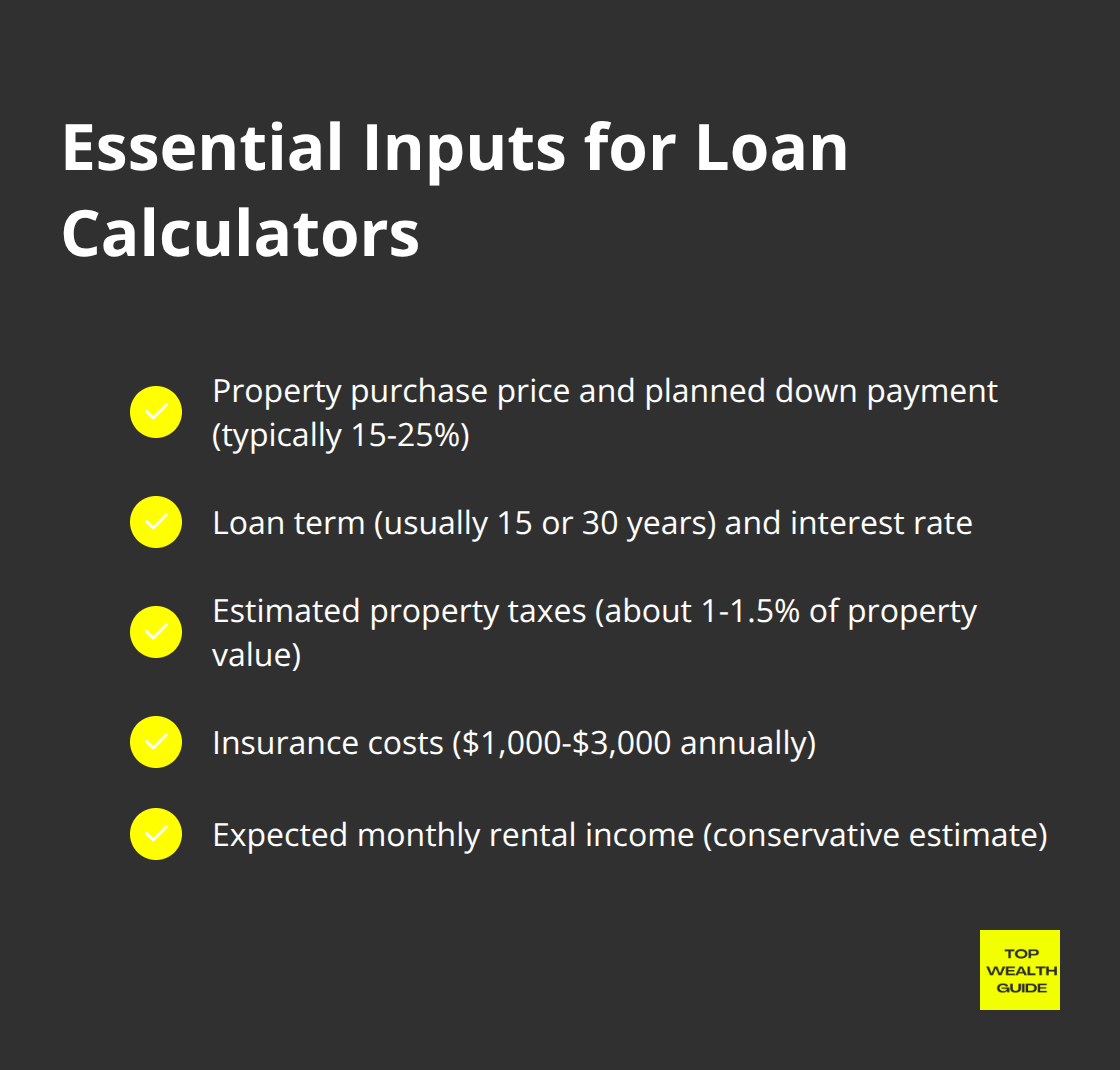

First thing’s first-you gotta feed these calculators the right intel. Punch in the property purchase price and your planned down payment. (Heads up: Most lenders play it safe, asking for a 15-25% down on investment digs.) Reality check-don’t aim for the moon, or you’ll end up orbiting the sun.

Then, it’s about the loan term-usually 15 or 30 years. Pro tip: Shorter term means you pay more each month but dodge that interest monster lurking in the shadows.

Ah, the dreaded interest rate. Hunt around, and when you stumble upon the golden egg-grab it (and use it).

Taxes and insurance-can’t skip ’em. They bounce around based on where you’re buying. Ballpark? About 1-1.5% of property value for taxes and $1,000-$3,000 for insurance.

Monthly rental income? Better be the humble hero-lowball it rather than dream big. Saves headaches later.

Step-by-Step Guide to Using the Calculator

Here’s how to tango with these calculators:

- Start with property price and down payment.

- Punch in loan term and interest rate.

- Toss in your estimated property taxes and insurance.

- Factor in any HOA fees or the sneaky costs lurking in the dark.

- Wrap it up with expected monthly rental income.

With data inputted, hit “calculate” and voila-a breakdown of your monthly mortgage payment, cash flow, and all those juicy metrics.

Interpreting the Results

Now, brace yourself-the calculator churns out important numbers. Your monthly mortgage? An open book. The cash flow? (Rental income minus expenses, folks.) You want it flowing and positively so. How much matters on your playbook.

Dig into that cash-on-cash return. It’s your annual return on the dough you’ve invested, calculated as that sweet ratio between pre-tax cash flow and invested equity.

Oh, and your cap rate-it’s like checking out your property’s fitness level, financing aside. And as of Q1 2025, we’re looking at cap rates from about 4.84% for shiny Class A properties to 6.71% for the grit of Class C.

Keep an eye on your break-even point-how many ticks on the clock till you claw back your initial cash? Less is more here.

And hey, some calculators even throw in the long game, showing how your asset might appreciate (or not) and the mortgage paydown over time.

Knowing these calculators makes you the savant of property investing. More than just some arithmetic abacus, these are your crystal balls for profitable prophecies. Now that you’re a calculator wizard, let’s dive into the next chapter: evaluating investment property loans like a pro.

What Drives Investment Property Loan Costs?

The Down Payment Dilemma

Here’s the deal – lenders want a chunky 15-25% down payment for your investment properties. Why? Simple math – investment properties carry more risk than your cozy primary digs. Forking over a heftier down payment lowers your monthly pain and can score you better interest rates. But, it hogs a bigger chunk of your capital.

Thinking about a $300,000 place? You’re looking at coughing up $45,000 to $75,000 right out of the gate. That’s a boatload of cash that could sprout elsewhere in property TLC or portfolio spread. Sure, a beefier down payment might shift you into positive cash flow territory faster. The eternal tug-of-war – upfront pinch or that slow, sweet victory.

The Interest Rate Game

Brace yourself – interest rates for investment property clock in at 0.5% to 1% higher compared to your main home sweet home. Fast forward to September 2025, brace for sticker shock at around 7.5% or higher. A small step for rates, a giant leap… in tens of thousands over the loan’s sprawling lifetime.

Picture it: on a $250,000 loan at 7.5% over 30 years, you’re dishing out about $1,748 monthly. Nudge that rate up to 8%, and – boom – $1,834 (that’s a cool extra $1,032 per year or a whopping $30,960 over the loan’s life). Shopping around and haggling? Non-negotiable. Shave even a quarter-point off and – your wallet celebrates!

Loan Terms: Short vs. Long Game

Loan terms – the puppet masters of monthly payments and total interest bleeding. Opt for a 15-year and you’re hit with steeper monthly payouts but snag lower total interest compared to its 30-year sibling.

Crunching numbers for a $200,000 loan at 7.5%:

- 30-year term: $1,398 monthly, $303,280 total interest

- 15-year term: $1,854 monthly, $133,720 total interest

That 15-year loan? $238 more each month but saves you a clean $34,790 compared to its older sibling. Your cash flow balancing act and long-term vision? Your North Star.

Hidden Costs That Bite

Don’t turn a blind eye to property taxes, insurance, and maintenance. Silent but deadly – these can sneak in an extra 1-4% every year. High-tax zones? Property taxes alone could gobble up over 2% of the property’s value every year.

Rental property insurance? Expect to fork out 15-20% more than regular homeowner’s insurance. Budget wisely – roughly $1,200 to $2,500 annually for a standard single-family rental.

Maintenance – the Pandora’s box. The 50 percent rule whispers to stash half your annual property rent for those surprise expenses. For a $300,000 property, you’re looking at $3,000 a year. Got an older property or one in Mother Nature’s crosshairs? Jack it up.

The Impact of Credit Score

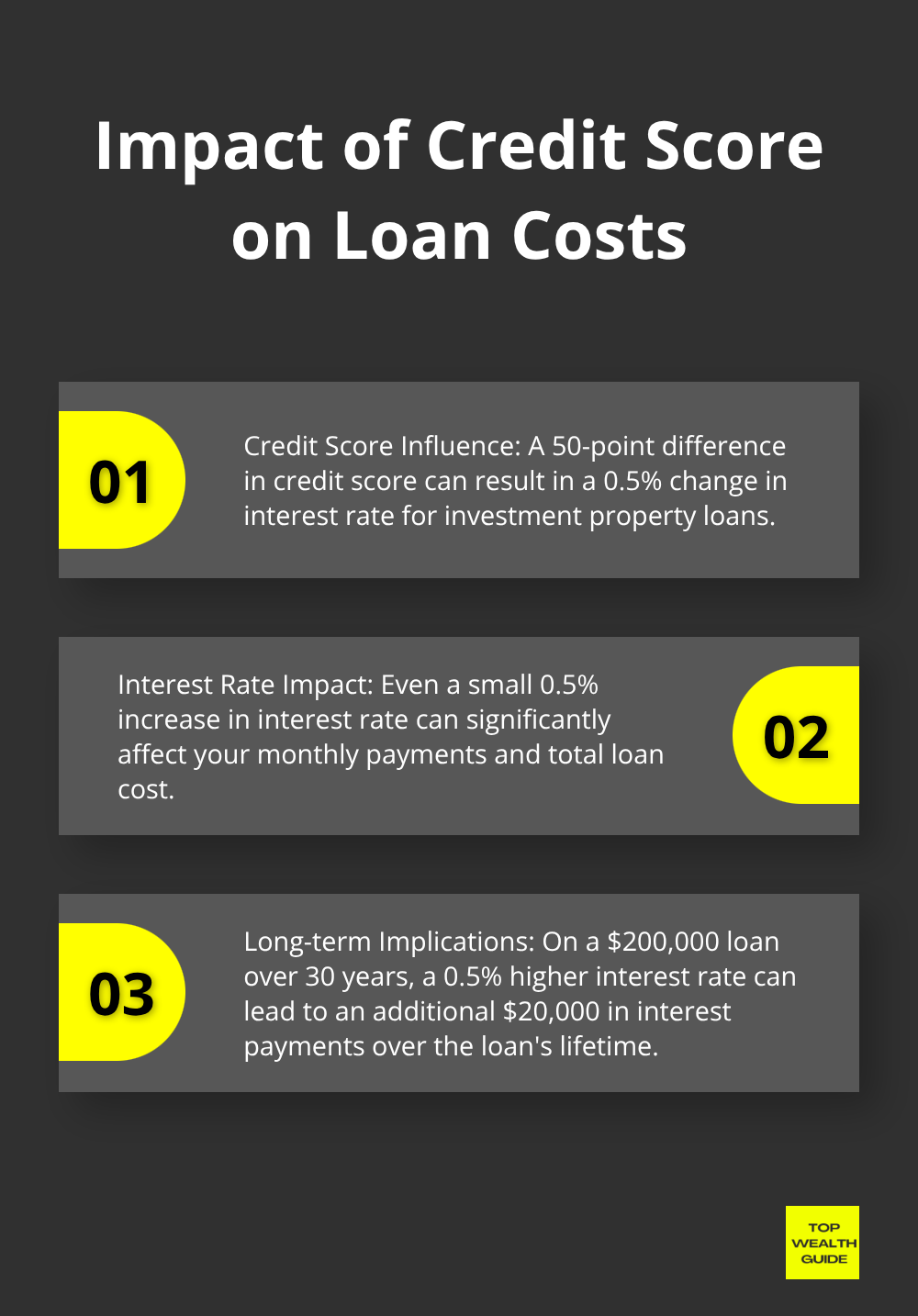

Think your GPA days are over? Guess again – your credit score’s the maestro behind your loan terms. Hit over 740 – you’re likely cruising with the best rates. Dip below 620? Securing an investment property loan gets tougher (and if you snag one, your wallet winces).

For example, slide 50 points in your credit score and you could see a shift of 0.5% in interest rate. Take a $200,000 loan over 30 years… this ‘tiny’ rate dance spells $20,000 more in interest payments. Not small change, friends.

Final Thoughts

So, a loan calculator for investment property-basically, it’s your crystal ball. This bad boy lets you punch in all sorts of scenarios and really see what’s cooking with your potential returns. You’ll get to pit loan terms, interest rates, and down payments against each other to sniff out the most profitable mix for your real estate hustle.

And hey, Top Wealth Guide. They’re not just standing around; they’re loaded with resources to help you tackle the wild jungle of property investing. They dish out articles on financing strategies and rentals that might just crank your income dial up a notch. Let’s be honest: every investor’s roadmap is a little different. That’s why they sprinkle their insights tailored to diverse experience levels and financial pinnacles.

Before you dive headfirst into your next property gig, whip out that loan calculator. Run those numbers like a pro. That tiny move? It could be the ticket to big-time gains on your wealth journey. Top Wealth Guide is right there in your corner, cheering you on as you stride toward financial freedom through savvy real estate plays.

2 Comments

Pingback: How to Finance Investment Property: Your Complete Guide

Pingback: Maximize ROI: Investment Property Calculator Guide - Top Wealth Guide - TWG