Investing often seems like a complicated world reserved for Wall Street pros, but the core idea is surprisingly simple: making your money work for you. Think of it less like gambling and more like planting a seed. You put in a little capital (the seed), and with time and patience, it can grow into something much larger.

This guide is designed to cut through the noise and give you a straightforward, actionable plan to get started.

In This Guide

- 1 Why You Can't Afford Not to Invest

- 2 Understanding Your Core Investment Options

- 3 Setting Smart Goals for Your Investments

- 4 How to Balance Investment Risk and Reward

- 5 Your Step-by-Step Plan to Make Your First Investment

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. How much money do I actually need to start investing?

- 6.2 2. What's the single best investment for a beginner?

- 6.3 3. What happens to my money if the market crashes?

- 6.4 4. What's the difference between a Roth IRA and a traditional brokerage account?

- 6.5 5. What are the most important fees to watch out for?

- 6.6 6. Should I try to pick individual stocks like Apple or Tesla?

- 6.7 7. How often should I check my investments?

- 6.8 8. Is it better to invest a lump sum or invest small amounts over time?

- 6.9 9. How do investment taxes work?

- 6.10 10. Can I lose more money than I invest?

Why You Can't Afford Not to Invest

It’s a common myth that you need a ton of money or a finance degree to be an investor. The truth? Investing is one of the most practical tools available to anyone who wants to build a secure financial future.

It's the only reliable way to grow your money faster than inflation—that sneaky force that makes your cash worth a little less each year. If your money is just sitting in a standard savings account, it's actually losing its purchasing power over time. Investing gives it a fighting chance to grow.

The Power of Starting Small

As a new investor, your greatest asset isn't a huge pile of cash. It's time. When you start early, even with small, regular contributions, you unlock the incredible power of compounding.

This is the secret sauce of wealth-building. It's where the returns your investments earn start earning returns of their own, creating a snowball effect that can transform a modest portfolio into a serious nest egg down the road.

If you really want to grasp how this works, check out our deep dive into the magic of compound interest explained. Understanding this one concept is a game-changer.

Forget trying to time the market perfectly. The real key is time in the market. The longer your money is invested, the more powerful the growth potential becomes, bringing your biggest financial goals within reach.

The best part? You don't need a fortune to get in the game. With modern apps and platforms, you can literally start with as little as $5.

Our mission here is to arm you with the confidence and know-how to take that first step. We're going to break down investing into a few core ideas to help you build a solid foundation for your future. Think of it as building toward:

- Financial Freedom: Creating a future where your life isn't dictated by a 9-to-5 paycheck.

- Reaching Your Goals: Funding major life milestones, whether it's a down payment on a house, a dream vacation, or a comfortable retirement.

- Building Real Wealth: Growing your net worth in a way that saving alone could never achieve.

Understanding Your Core Investment Options

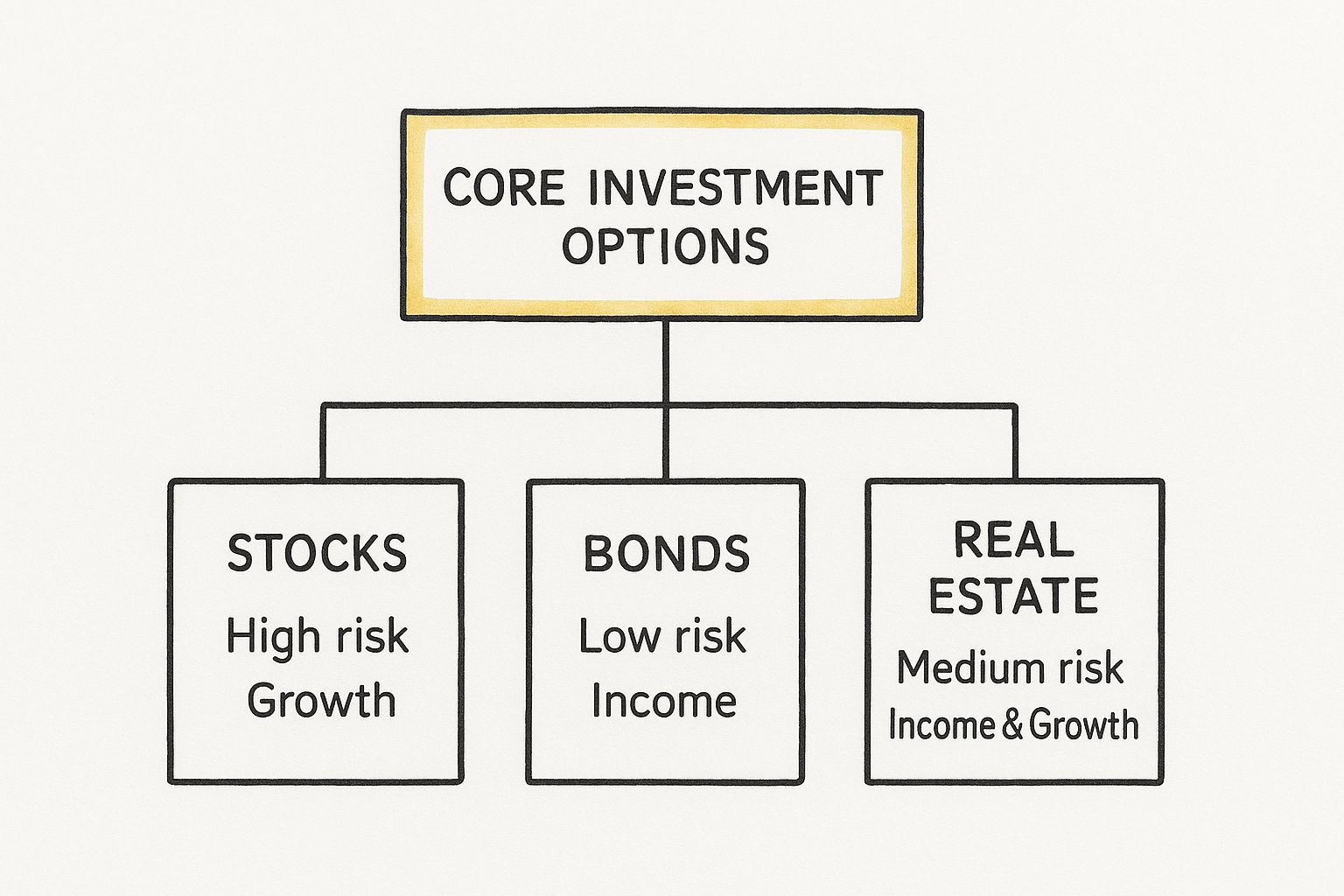

Before you can even think about building an investment portfolio, you need to know what you're working with. Think of it like a chef learning their ingredients—you can't create a masterpiece without knowing the difference between salt and sugar. Investing works the same way.

Let's break down the most common ingredients you'll use to build your financial future.

This gives you a quick visual snapshot of how different investments balance risk and reward. Some are built for speed, others for stability.

Stocks: The Growth Engine

When you buy a stock, you're not just buying a piece of paper or a digital symbol. You are purchasing a tiny slice of ownership in a real, living, breathing company. If you buy a share of Apple, you officially become a part-owner.

The whole point of owning stocks is growth. As the company you've invested in finds success—launching new products, growing its profits, and expanding its reach—the value of your ownership slice should climb right along with it. Of course, this potential for big gains comes with higher risk. A company’s fortunes can change quickly.

Key Takeaway: Stocks are the engine of your portfolio, designed for long-term growth. They offer the highest potential returns over many years but expect a bumpy ride along the way.

For instance, the buzz around AI and cloud computing continues to fuel demand for tech stocks. At the same time, governments and major investors are pouring billions into infrastructure projects like updating energy grids and communication networks, creating another major area of opportunity. This isn't just a local trend; you can find these opportunities in major markets all over the globe.

Bonds: The Stabilizer

If stocks are about owning, bonds are about loaning. It's that simple. When you purchase a bond, you're lending your money to a big organization, usually a government or a massive corporation.

What's in it for you? The borrower promises to pay you regular interest over a set period. Then, at the end of that term, they give you your original investment back. Think of it like loaning your city money to build a new park; they pay you a little something every year for the favor and then return your initial loan once the term is up.

Bonds are generally much safer than stocks, which makes them perfect for protecting your capital and generating a predictable stream of income.

Real Estate: The Tangible Asset

This is the one you can actually see and touch. Real estate investing means buying physical property, whether it’s a house to rent out, an apartment complex, or a commercial storefront.

Real estate is interesting because it can pull double duty. First, it can generate a steady income stream through rental payments. Second, the property itself can appreciate in value over time, giving you a shot at long-term growth.

The trade-off? Real estate isn't "liquid"—you can't sell it in five minutes like you can with a stock. It also demands a lot more upfront cash and hands-on management.

Comparing Common Asset Classes for Beginners

To help you see how these pieces fit together, here's a simple comparison of the most common investment types. This table breaks down their core characteristics, risk levels, and what they're typically used for.

| Asset Class | Simple Analogy | Primary Goal | Typical Risk Level | Liquidity | Best For |

|---|---|---|---|---|---|

| Stocks | Owning a piece of a business. | Long-term growth | High | High (Easy to sell) | Building wealth over 10+ years. |

| Bonds | Loaning money for interest. | Steady income & stability | Low | High | Preserving capital for short-term goals. |

| Real Estate | Owning a physical property. | Income & growth | Medium | Low (Hard to sell) | Generating rental income & long-term appreciation. |

| Index Funds | Owning a small piece of everything. | Diversified growth | Medium-High | High | Beginners seeking instant diversification. |

Each of these plays a unique role, and a smart portfolio often includes a mix. Many beginners start their journey by combining stocks and bonds through simple, low-cost funds. You can learn more about that strategy in our guide explaining if index funds are the key to long-term wealth building.

Setting Smart Goals for Your Investments

Here’s the thing about successful investing: it’s not really about chasing the latest hot stock or reacting to every bit of market news. At its core, investing is just about building a bridge between the money you have today and the life you want to live tomorrow. But to build that bridge, you need to know exactly where you're going.

Without a clear destination, your investment plan has no direction. It’s like setting off on a road trip with no map. This is where a simple, powerful framework can make all the difference.

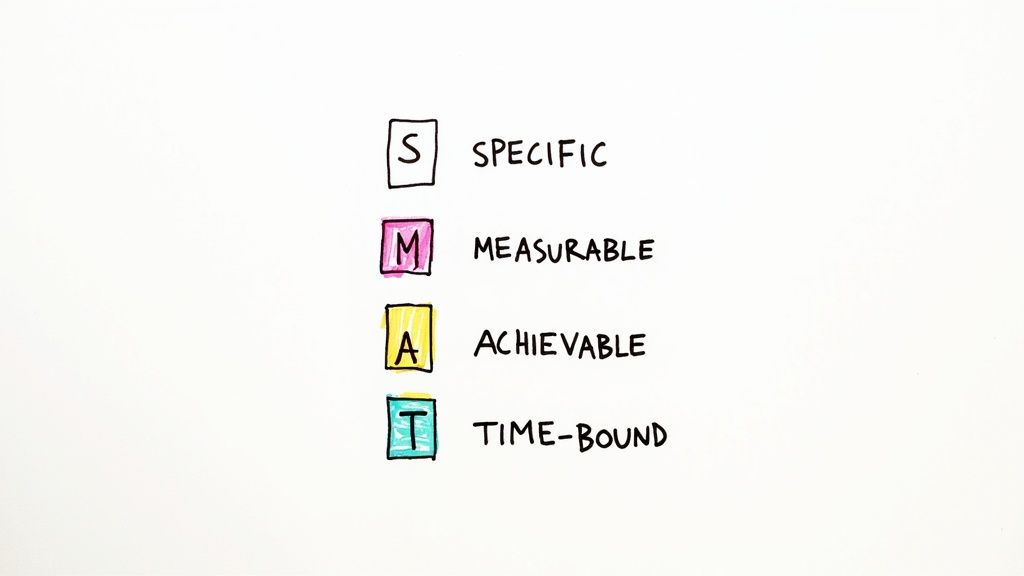

Adopting the S.M.A.R.T. Framework

The S.M.A.R.T. framework is a tool that turns vague financial wishes into a concrete, actionable roadmap. It’s the difference between saying, "I want to save for retirement," and actually having a plan to get there.

Let's break down what each letter means for you as a new investor.

- Specific: Nail down exactly what you want to achieve. Instead of "buy a house," a specific goal sounds like this: "save for a $40,000 down payment on a house in my target neighborhood."

- Measurable: Put a number on it. How will you know when you’ve won? "I will invest $500 per month" is a measurable goal; "I will invest more" is just a nice thought.

- Achievable: Be honest with yourself. Your goal should stretch you a bit, but it shouldn't be so out there that you lose motivation and give up.

- Relevant: Make sure the goal actually lines up with what you want out of life. Does hitting this target truly matter to you?

- Time-bound: Give yourself a deadline. Saying "I will reach my $40,000 goal in five years" creates a sense of urgency and a clear timeline to work with.

Putting this framework into action is one of the most important first steps you can take. If you want to dive deeper, we have a whole guide on setting S.M.A.R.T. financial goals for a prosperous future.

Matching Your Goals to Your Timeline

Your investment timeline—how soon you need the money—is probably the single most important factor shaping your strategy. We usually bucket goals into three categories: short-term, medium-term, and long-term. Each one requires a completely different playbook.

A shorter timeline demands a more conservative strategy to protect your capital, while a longer timeline allows you to take on more risk for potentially greater rewards.

Think of it this way: you wouldn't take a speedboat through a stormy sea to deliver a package that's due tomorrow. You also wouldn't try to row a tiny boat across the ocean if your destination is 30 years away. The vehicle has to match the journey.

Real-Life Example: Meet Alex

Let's bring this to life with a fictional beginner, Alex. He's 28 and ready to map out his financial future.

Alex's Short-Term Goal (1-3 years):

- Goal: Save for a trip to Japan.

- S.M.A.R.T. Application: "I will save $4,000 for a trip to Japan by investing $150 per month for the next two years."

- Strategy: Alex needs this cash relatively soon and can't risk losing it. A high-yield savings account or a short-term bond fund is a great low-risk choice here. The goal is preservation, not aggressive growth.

Alex's Long-Term Goal (10+ years):

- Goal: Build a retirement fund.

- S.M.A.R.T. Application: "I will build a $1 million retirement fund by age 60 by investing $600 per month into a diversified portfolio of stocks and bonds."

- Strategy: With more than 30 years on the clock, Alex can afford to weather the market's ups and downs to chase higher growth. A portfolio weighted heavily toward low-cost index funds that track the stock market makes a lot of sense.

By separating his goals by timeline, Alex creates a clear, logical plan where each dollar has a specific job to do. That’s how you build an effective investment strategy from the ground up.

How to Balance Investment Risk and Reward

When it comes to investing, there’s one fundamental truth you can’t escape: the relationship between risk and reward. It’s the engine that drives every financial market on the planet.

Put simply, if you want a shot at higher returns, you almost always have to take on more risk. It’s a trade-off, plain and simple.

Think about it like planning a cross-country trip. You could take the slow, scenic route, enjoying a smooth and predictable drive. That’s your low-risk, conservative portfolio. It’s safe and steady, but you won’t get to your destination overnight.

Or, you could hop on a plane. It's way faster, but you might hit some serious turbulence. That's your aggressive, high-risk portfolio. One isn't automatically "better" than the other—it all comes down to where you're going (your financial goals) and how you feel about the bumps along the way.

Diversification: The Smartest Way to Manage Risk

So, if risk is part of the deal, how do we handle it without losing sleep? The most powerful tool in any investor's kit is diversification. You’ve heard the old saying: "Don't put all your eggs in one basket." That’s really all it is.

By spreading your money across different asset classes (like stocks and real estate) and into different industries, you cushion the blow if one of your investments takes a nosedive. When one part of your portfolio is down, another might be up, smoothing out the overall ride.

This is more important now than ever. In our interconnected world, global events can send ripples through the market. For instance, in the first quarter of 2025, the U.S. net international investment position was a staggering –$24.61 trillion. That massive number, detailed on the U.S. Bureau of Economic Analysis website, reflects the constant flow of money across borders and highlights why betting on a single market is a risky game.

Real-Life Example: Two Beginner Portfolios

Let's make this real. Imagine a new investor named Sarah. She wants to grow her money, but her strategy depends entirely on what she’s saving for.

Portfolio A: The Aggressive Growth Plan

- Goal: Maximize growth for retirement in 30 years.

- Allocation: 80% Stocks (in a broad market index fund) and 20% Bonds.

- The Logic: When the market is booming, this portfolio will likely deliver impressive gains. During a downturn, it could drop significantly—but Sarah isn't worried. With decades until retirement, she has plenty of time to recover from any temporary dips.

Portfolio B: The Stable Income Plan

- Goal: Protect her savings and earn a little income for a house down payment in 5 years.

- Allocation: 30% Stocks and 70% Bonds (and other low-risk assets).

- The Logic: This portfolio won't see the huge highs of the aggressive plan, but it's also built to withstand a market storm. Its job is to provide stability and modest growth, making sure her money is there when she needs it in the near future.

The big lesson here? Your portfolio should be a direct reflection of your goals and your timeline. A well-built portfolio is one that lets you sleep at night because you know it's designed for your life.

Here's a quick breakdown of how these two approaches stack up.

| Portfolio Feature | Portfolio A (Aggressive) | Portfolio B (Conservative) |

|---|---|---|

| Primary Goal | High Growth | Capital Preservation & Income |

| Best For | Long-term goals (10+ years) | Short-term goals (1-5 years) |

| Risk Level | High | Low |

| Potential Return | High | Low to Moderate |

Getting comfortable with how different asset mixes behave is the first step toward building a strategy that truly fits you. To get a clearer picture of what kind of numbers you might see, check out our guide on how to calculate the average rate of return on your investments.

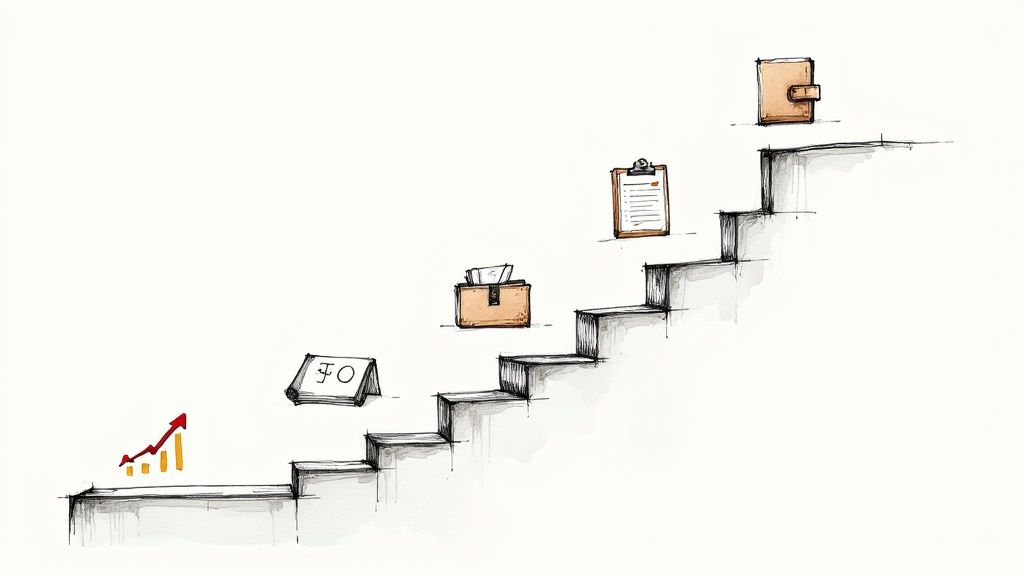

Your Step-by-Step Plan to Make Your First Investment

Alright, this is where the rubber meets the road. You’ve learned the what and the why—assets, goals, risk—and now it's time to put that knowledge into practice. Making your first investment can feel like a massive, intimidating leap, but I promise you it's just a series of small, totally manageable steps.

Let's walk through this process together. The goal here is to demystify everything and show you how simple it can be to go from having zero investments to officially owning a piece of the market. This five-step plan is the practical heart of this guide.

Step 1: Figure Out How Much You Can Invest

Before you can put any money to work, you need to know what you can comfortably set aside. This isn't about finding a giant pile of cash to get started. It's about figuring out a sustainable amount you can contribute regularly without making your daily life stressful.

A great way to start is by taking an honest look at your monthly income and expenses. After the rent, groceries, and other essentials are covered, see what’s left. Even $25 or $50 a month is a fantastic start. The real magic is in consistency, not the initial amount.

Step 2: Choose the Right Investment Account

Think of an investment account as the "container" that will hold all your assets. Different containers are built for different jobs, so picking the right one is key to matching your investments with your life goals. For most beginners, it boils down to two main options.

Here’s a simple breakdown to help you decide which path makes sense for you.

| Account Type | Primary Purpose | Key Benefit | Best For |

|---|---|---|---|

| Brokerage Account | General investing | Flexibility—No rules on how much you can put in or when you can take it out. | Shorter-term goals, like saving for a down payment or a new car. |

| Roth IRA | Retirement savings | Tax-Free Growth—Your money grows and can be withdrawn in retirement completely tax-free. | The long game, specifically building that retirement nest egg. |

For many people just starting out, a Roth IRA is a brilliant first choice because of its incredible tax benefits down the road. But if you think you'll need access to that money before retirement, a standard brokerage account gives you that freedom.

Step 3: Open and Fund Your Account

Getting an account set up is surprisingly easy these days. Most modern platforms have you up and running in about 15 minutes, all online. You'll just need some basic info handy, like your Social Security number and a driver's license.

Pick a platform known for being beginner-friendly, with low fees and a clean interface. Once your account is approved, all you have to do is link your bank account and transfer your starting funds.

Step 4: Select Your First Investment

Okay, your account has money in it—now for the exciting part. For your very first purchase, the smartest thing you can do is keep it simple and diversified. Forget about trying to find the next big stock. Instead, focus on low-cost funds that do all the heavy lifting for you.

Your first investment doesn't need to be some complicated, home-run swing. A single, low-cost index fund or ETF gives you instant ownership in hundreds—or even thousands—of companies. It's the perfect foundation.

Here are two fantastic starting options to consider:

- S&P 500 Index Fund: This fund basically buys you a tiny slice of the 500 largest and most influential companies in the U.S. It's a straightforward way to bet on the growth of the American economy as a whole.

- Total Stock Market ETF: An Exchange-Traded Fund (ETF) that tracks the entire market is even broader. It offers maximum diversification in one simple package.

Real-Life Example: Maria Makes Her First Investment

Let’s see how this plays out in the real world with Maria, a 25-year-old who is ready to get started.

- Determine Amount: Maria looks at her budget and realizes she can comfortably invest $100 every month.

- Choose Account: Her main goal is saving for retirement, so she opens a Roth IRA to get that sweet tax-free growth.

- Open & Fund: She picks a well-known, low-fee brokerage and opens her Roth IRA online. She links her bank and transfers her first $100.

- Select Investment: After a little reading, she puts her entire $100 into an S&P 500 index fund.

And just like that, Maria is officially an investor. She now owns a tiny piece of Apple, Microsoft, Amazon, and hundreds of other huge companies. To make it effortless, she sets up an automatic monthly transfer of $100, so her portfolio can grow without her even thinking about it.

For a more detailed look, you can read our full guide on how to start investing money from the very beginning.

Frequently Asked Questions (FAQ)

Jumping into the world of investing is exciting, but it’s totally normal to have a few questions swirling around. Let's tackle some of the most common ones I hear from new investors.

1. How much money do I actually need to start investing?

A lot less than you think. Forget the myth that you need thousands of dollars. With modern brokerage apps, you can start with as little as $5 or $10. The key is not the initial amount, but the habit of investing consistently over time.

2. What's the single best investment for a beginner?

For most beginners, a low-cost S&P 500 index fund or ETF is an excellent starting point. It provides instant diversification by spreading your money across 500 of the largest U.S. companies, minimizing risk while capturing broad market growth.

3. What happens to my money if the market crashes?

Market downturns are a normal part of investing. When the market "crashes," the value of your assets temporarily drops on paper. You only realize a loss if you panic and sell. For long-term investors, a crash can be an opportunity to buy assets at a lower price. The key is to stay calm and stick to your plan.

4. What's the difference between a Roth IRA and a traditional brokerage account?

A Roth IRA is a retirement account offering tax-free growth and withdrawals in retirement. A traditional brokerage account is a general-purpose investment account with no tax advantages but greater flexibility, as you can withdraw money anytime without penalty.

5. What are the most important fees to watch out for?

The most critical fee for beginners is the expense ratio on funds like ETFs and mutual funds. This is the annual cost of running the fund. Aim for funds with an expense ratio of 0.10% or less to ensure more of your money stays invested and working for you.

6. Should I try to pick individual stocks like Apple or Tesla?

While you can, it's generally not recommended for beginners. Picking individual stocks is risky and requires extensive research. Starting with a diversified index fund is a much safer and more reliable way to build a solid foundation.

7. How often should I check my investments?

For a long-term investor, checking your portfolio once a quarter is more than enough. Checking daily or weekly can lead to emotional decisions based on normal market volatility. Trust your long-term plan and let it work.

8. Is it better to invest a lump sum or invest small amounts over time?

This is known as lump-sum investing vs. dollar-cost averaging (DCA). For most beginners, DCA (investing a fixed amount regularly) is the best approach. It builds a consistent habit and reduces the risk of investing all your money right before a market downturn.

9. How do investment taxes work?

In a standard brokerage account, you pay capital gains tax when you sell an investment for a profit. The tax rate is lower if you hold the asset for over a year (long-term capital gains). In a Roth IRA, your qualified withdrawals in retirement are completely tax-free.

10. Can I lose more money than I invest?

No. When investing in common assets like stocks, bonds, or ETFs, the maximum you can lose is the amount you initially invested. Your account value cannot go below zero.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. From stocks to real estate, our expert guides are designed to help you navigate the markets with confidence.

Start your journey to financial empowerment with Top Wealth Guide today!