Saving your money is a fantastic first step, but if you want to build real, lasting wealth, you need to put that money to work. That’s what investing is all about: using your cash to buy assets—like shares in a company or a piece of a real estate fund—that have the potential to grow and earn you more money over time.

Think of it as turning your savings into a powerful engine for your financial future.

In This Guide

- 1 Why Investing Is Your Best Bet for Building Wealth

- 2 Defining Your Financial Goals and Investing Style

- 3 Choosing the Right Investment Accounts for Your Goals

- 4 How to Build Your First Investment Portfolio

- 5 Maintaining and Growing Your Investments for the Long Term

- 6 So, What’s Your Next Move?

- 7 Frequently Asked Questions (FAQ) for New Investors

- 7.1 1. How much money do I need to start investing?

- 7.2 2. Is investing the same as gambling?

- 7.3 3. What's the real difference between an ETF and a mutual fund?

- 7.4 4. How often should I check my investments?

- 7.5 5. Should I pay off all my debt before investing?

- 7.6 6. What are dividends?

- 7.7 7. What's the biggest mistake beginners make?

- 7.8 8. Do I need a financial advisor to start?

- 7.9 9. How are investment profits taxed?

- 7.10 10. What's the best way to keep learning without getting overwhelmed?

Why Investing Is Your Best Bet for Building Wealth

There’s a crucial difference between saving and investing. Saving is about keeping your money safe and accessible. Investing, on the other hand, is about growth. It’s the only reliable way to grow your money faster than inflation can eat away at its value.

The secret sauce that makes this possible is compound interest. This is where the returns you earn start earning their own returns, creating a snowball effect that can dramatically accelerate your wealth over the long haul. It's a concept so powerful, it's worth understanding deeply. You can learn all about it in our guide on the magic of compound interest.

The Power of Starting Early: A Real-Life Example

Let’s look at a classic real-world scenario. Imagine two friends, Sarah and Ben.

- Sarah starts investing $100 a month when she's 25.

- Ben waits until he's 35 but decides to invest double the amount, putting away $200 a month to catch up.

If we assume they both earn a pretty average 7% annual return, who comes out ahead by age 65?

You might be surprised. Sarah ends up with a portfolio worth over $239,000. Ben, despite investing more of his own money over the years, only accumulates about $187,000. That 10-year head start gave Sarah's money so much more time to compound, proving that when you start investing is often far more important than how much you start with.

This isn't just a fun hypothetical. The historical data is clear. According to the UBS Global Investment Returns Yearbook, global stocks have provided an average real return of about 5% after inflation for the last 125 years. This shows just how powerfully a modest investment can grow if you simply give it enough time.

Understanding Core Investment Types

Before you jump in, it helps to know the basic building blocks. Every investment portfolio is made up of different asset types, each with its own level of risk and potential for reward. For beginners, it's best to start with the essentials.

Here’s a quick rundown of the most common investment types to help you get your bearings.

Core Investment Types At A Glance

| Investment Type | What It Represents | Typical Risk Level | Best For |

|---|---|---|---|

| Stocks | Ownership in a company | High | Long-term growth |

| Bonds | A loan to a company or government | Low to Medium | Stable income and capital preservation |

| Funds (ETFs/Mutual Funds) | A collection of stocks or bonds | Varies (diversified) | Instant diversification and simplicity |

Most investors build their portfolios by combining these core assets. This mixing and matching allows you to create a diversified portfolio that aligns with your specific financial goals and how comfortable you are with risk.

Defining Your Financial Goals and Investing Style

Before you even think about putting your money into the market, you need a destination. Seriously, investing without a clear objective is like setting out on a road trip with no map and no idea where you're going. Your goals are the bedrock of your entire strategy, so let's get them sorted out first.

A great way to start is by breaking down your ambitions into different timelines. Think about what you're saving for.

- Short-term goals: Things you want to achieve in the next year or two, like saving for a big vacation or a new car.

- Mid-term goals: Objectives that are a bit further out, maybe 3-10 years away, such as a down payment on a house.

- Long-term goals: The big ones, like retirement, which could be decades down the road.

The timeline for each goal completely changes how you should approach investing for it. You can really dial in your strategy by setting SMART financial goals for a prosperous future—it gives you a much clearer plan of attack.

What Is Your Investing Style?

Okay, goal timelines are set. Now it’s time for a little self-reflection. You need to figure out your personal risk tolerance, which is just a fancy way of asking, "How much market volatility can you stomach without panicking?"

Are you the type who would lose sleep if your portfolio dropped 10% in a month? Or do you see those dips as buying opportunities, comfortable with the bumps in the road in exchange for potentially bigger gains?

Generally, investors fall into one of three buckets:

- Conservative: Your top priority is protecting the money you put in. You'd rather have slow, steady growth than risk losing any of your initial investment.

- Moderate: You're looking for a happy medium. You want your money to grow, and you're willing to accept some calculated risks to make that happen.

- Aggressive: You're all about maximizing growth. You understand that the market can be a rollercoaster, and you're comfortable with big swings for the chance at the highest possible returns.

Think about it this way: a 25-year-old saving for retirement has decades to recover from market downturns, so they can afford to be more aggressive. But if you're saving for a wedding that's only 18 months away, you need that money to be safe and ready. A conservative approach is the only one that makes sense. Knowing your style from the get-go is your best defense against making emotional, reactive decisions down the line.

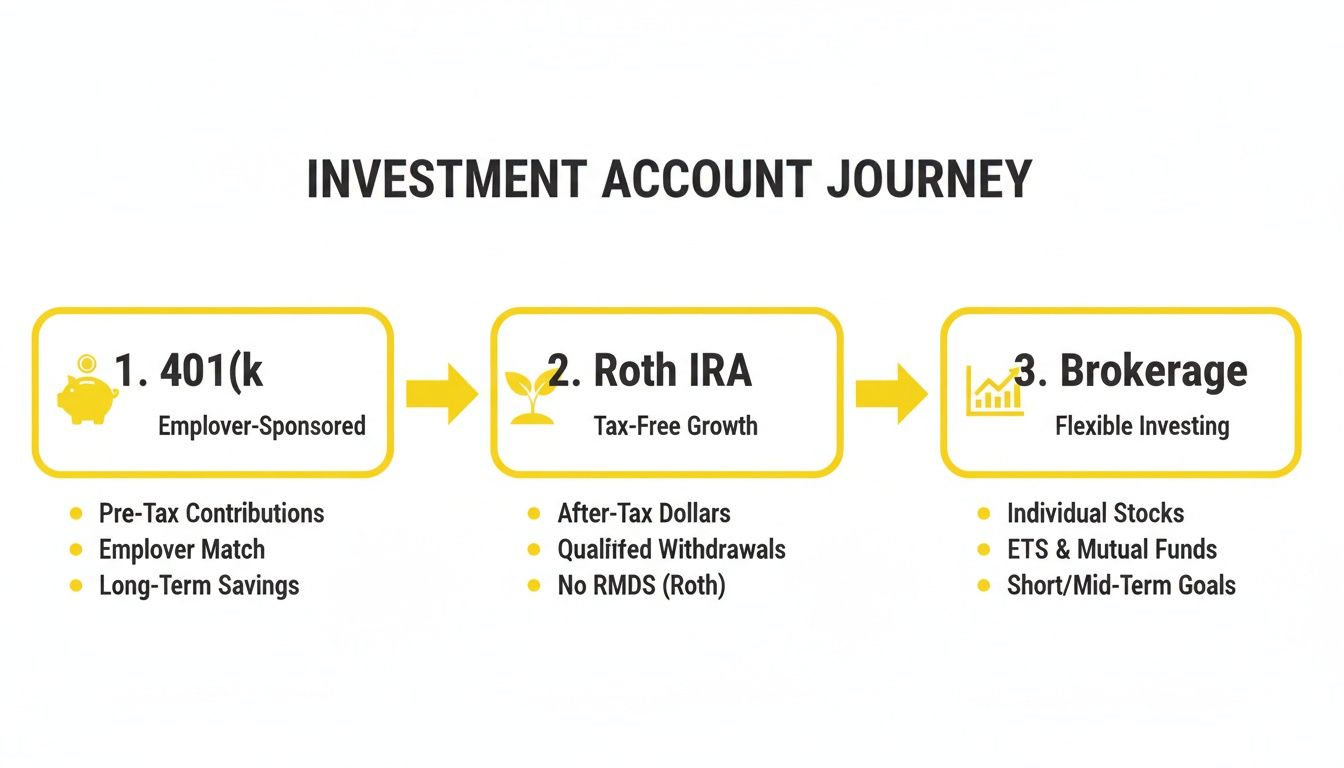

Choosing the Right Investment Accounts for Your Goals

Figuring out what to invest in is only half the battle. Where you hold those investments matters just as much. The right account acts as a powerful booster for your money, offering incredible tax advantages. The wrong one could leave you with a surprise tax bill down the road.

Think of the account as the "house" your investments live in. Some houses, like retirement accounts, have special rules but come with huge perks from the government. Others, like standard brokerage accounts, are more flexible.

For anyone just starting out, this is a crucial first decision.

Retirement vs. Brokerage Accounts

A tax-advantaged retirement account is exactly what it sounds like—an account designed to help you save for your golden years. Things like a 401(k) or a Roth IRA come with powerful tax breaks to incentivize you to save long-term. This could mean getting a tax deduction on your contributions now or pulling your money out completely tax-free when you retire.

On the other hand, a standard brokerage account is all about flexibility. You can put money in and take it out whenever you want, with no age limits or penalties. This makes it perfect for goals outside of retirement, like saving for a down payment or your next big vacation. The trade-off? You don't get those special tax benefits. You'll generally owe capital gains tax on any profits you make. For a deeper dive, check out our complete overview of what an investment account is.

Here's a practical example: Imagine you're 25 and just starting your career. A Roth IRA is an absolute game-changer. You contribute with money you've already paid taxes on, but every penny of growth and all your withdrawals in retirement are 100% tax-free. We're talking decades of compound growth that the taxman can never touch.

If your employer offers a 401(k) with a match, that should almost always be your first stop. An employer match is free money, plain and simple. It's an instant 100% return on your contribution, and you won't find that anywhere else.

Investment Account Comparison For Beginners

Choosing an account can feel overwhelming, so I've put together this simple table to break down the most common options. It compares their main features to help you match the right account to what you're trying to achieve financially.

| Account Type | Key Tax Benefit | Ideal For | Primary Consideration |

|---|---|---|---|

| 401(k) | Pre-tax contributions lower your current taxable income; employer match potential. | Long-term retirement savings, especially with an employer match. | You pay income tax on withdrawals in retirement. |

| Roth IRA | Post-tax contributions allow for completely tax-free growth and withdrawals. | Young investors in lower tax brackets; long-term tax-free growth. | Contribution limits are relatively low. |

| Brokerage Account | No contribution limits or withdrawal restrictions. | Short-to-mid-term goals; investing beyond retirement account limits. | Investment gains are subject to capital gains tax. |

Ultimately, you don't have to pick just one. Many successful investors use a combination of these accounts to build wealth for different life goals, both near and far.

How to Build Your First Investment Portfolio

Okay, you've set your goals and picked your accounts. Now for the exciting part: actually building your portfolio.

If you're just starting out, my best advice is to keep it simple. Seriously. You don't need to get bogged down trying to pick the next big stock. The smartest move is to focus on broad diversification, which you can get instantly with low-cost index funds and exchange-traded funds (ETFs). Think of these as pre-packaged bundles that hold hundreds, sometimes thousands, of different stocks or bonds in a single investment.

This approach lets you own a piece of the entire market without the headache of managing individual companies.

As the diagram shows, a common path is to first max out any tax-advantaged accounts you have, like a 401(k) or a Roth IRA. These accounts offer powerful tax breaks that can supercharge your long-term growth.

Finding Your Perfect Mix: Asset Allocation for Beginners

Asset allocation sounds technical, but it’s just the fancy term for how you split your money between different types of investments—mostly stocks and bonds. This mix is everything. It should directly reflect the risk tolerance you figured out earlier.

A great way to get started is with a simple two-fund portfolio. If you want to dive deeper into this topic, our guide on how to build a stock portfolio from scratch is a fantastic resource.

Here are a few classic models you can build using just two common ETFs:

- Conservative (Low Risk): 40% Stocks (like Vanguard's VTI) and 60% Bonds (like Vanguard's BND). This mix is designed for stability and is a good fit if you're nervous about big market swings.

- Moderate (Medium Risk): 60% Stocks (VTI) and 40% Bonds (BND). This is the quintessential balanced portfolio, offering a solid blend of growth potential and safety. It's a popular choice for many long-term investors.

- Aggressive (High Risk): 80% Stocks (VTI) and 20% Bonds (BND). With this allocation, you're aiming for maximum growth. It's best suited for those with a long time horizon who can ride out market volatility.

Pro Tip: Embrace Dollar-Cost Averaging

One of the most powerful habits you can build as an investor is dollar-cost averaging. It simply means investing a set amount of money on a regular schedule—say, $200 every month—no matter what the market is doing. When prices are low, your fixed amount buys more shares. When prices are high, it buys fewer. This smooths out your purchase price over time and, crucially, removes the temptation to "time the market," which is a game even the pros rarely win.

Maintaining and Growing Your Investments for the Long Term

Getting your first portfolio built is a huge first step, but the real journey to growing your wealth is a marathon, not a sprint. The secret to successful investing isn't frantic, daily activity; it's patience and discipline over the long haul. That means you have to resist the powerful urge to check your account balance every single day.

Honestly, a quick check-in once or twice a year is plenty. The main reason for this review is to see if your investments have drifted away from your original plan and if it's time to rebalance.

Keeping Your Portfolio on Track with Rebalancing

Think of rebalancing as a simple course correction. It’s just the act of selling a bit of what’s done well and buying more of what hasn’t to bring your portfolio back to its target mix. Over time, some of your investments will naturally grow faster than others, which can quietly throw your entire strategy out of balance.

Let's say you started with a classic 60/40 portfolio (60% stocks, 40% bonds). If the stock market has a fantastic year, you might look at your account and see it's now become 70% stocks and only 30% bonds. Without realizing it, you're now taking on more risk than you originally signed up for.

Rebalancing is the disciplined way to live by the old investing wisdom: "buy low and sell high." You're systematically selling some of the high-flying stocks to lock in profits and buying more of the lagging bonds, resetting your portfolio to your comfort zone.

You can dive deeper into the different ways to do this by exploring various portfolio rebalancing strategies to find the method that works best for you.

Mastering the Psychology of Investing

As an investor, your biggest opponent often isn't a volatile market—it's your own emotions. Fear and greed are the two forces that cause the most damage, leading people to panic-sell during a dip or chase a hot stock right at its peak.

Staying disciplined when the market gets choppy is absolutely critical. Always go back to why you started investing and trust the plan you put in place. Market history has shown time and again that downturns are temporary, and the investors who stick it out are the ones who are rewarded.

So, What’s Your Next Move?

You’ve got the basics down, which is a huge first step. Honestly, understanding the fundamentals puts you ahead of the game. But the real test, and where the magic happens, is turning that knowledge into action. Forget about making some huge, dramatic move; building wealth is all about taking that first, intentional step.

Your journey really just starts with a simple plan.

Putting Together Your Action Plan

First things first, figure out what you’re actually investing for. Is it a down payment on a house in five years? Or are you thinking about retirement, which might be 30 years down the road? The timeline and the goal itself will dictate your entire strategy, especially how comfortable you should be with risk.

Once you know your "why," you can pick the right tool for the job. This means choosing the right investment account.

- For long-term goals like retirement: A Roth IRA is a fantastic choice. Your money grows tax-free, which is a massive advantage over several decades.

- For more medium-term goals: A standard brokerage account offers flexibility. It's perfect for goals you want to reach before you hit retirement age.

Think of these accounts as different tools in your financial toolkit—each one is designed for a specific purpose.

The final piece of the puzzle is to put your plan on autopilot. Set up a recurring deposit from your checking account, even if it’s just a small amount to start. Then, have that money automatically invested into a simple, diversified ETF or index fund. This single action builds the habit of consistency without you even having to think about it.

Look, the investors who win in the long run aren't the genius stock pickers who time the market. They're the ones who show up, stay consistent, and let time do the heavy lifting. Your path to building real wealth starts right now, with this one manageable step.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. Learn more about our wealth-building resources at Top Wealth Guide.

Frequently Asked Questions (FAQ) for New Investors

1. How much money do I need to start investing?

You can start with as little as $1. Modern brokerage platforms offer commission-free trades and fractional shares, which means you can buy a small slice of a stock instead of a full share. The key is not the starting amount but building a consistent habit.

2. Is investing the same as gambling?

No. Gambling is a bet on a random outcome, usually with unfavorable odds. Investing is owning a piece of a real business that generates value. While all investments carry risk, it's a calculated risk based on a company's potential for long-term growth and profitability, not chance.

3. What's the real difference between an ETF and a mutual fund?

Both are baskets of investments, but they trade differently. ETFs (Exchange-Traded Funds) trade like stocks on an exchange, with prices changing throughout the day. Mutual funds are priced once per day after the market closes. ETFs often have lower fees and are generally more tax-efficient, making them a popular choice for beginners.

4. How often should I check my investments?

For long-term investors, less is more. Checking daily or weekly can trigger emotional decisions (like panic-selling during a dip). A review once or twice a year is usually sufficient to rebalance your portfolio and ensure it aligns with your goals.

5. Should I pay off all my debt before investing?

Prioritize paying off high-interest debt (like credit card balances >15% APR) first, as the interest cost is likely higher than any potential investment return. For low-interest debt (like a mortgage or some student loans), it often makes mathematical sense to invest simultaneously, as historical market returns have typically outpaced these lower interest rates.

6. What are dividends?

Dividends are a portion of a company's profits paid out to its shareholders, usually quarterly. It's a way for companies to share their success. You can take dividends as cash or, more powerfully, reinvest them automatically to buy more shares.

7. What's the biggest mistake beginners make?

The most common mistakes are trying to "time the market" (predicting highs and lows), letting fear or greed drive decisions, and failing to diversify. A simple, automated strategy using low-cost index funds is the best defense against these pitfalls.

8. Do I need a financial advisor to start?

Not necessarily. Tools like robo-advisors and simple, low-cost index fund strategies have made do-it-yourself investing very accessible for beginners. An advisor can be valuable for complex financial situations, but they are not a requirement to get started on your wealth-building journey.

9. How are investment profits taxed?

You are taxed on capital gains only when you sell an investment for a profit. If you hold the investment for more than one year, it's taxed at the lower long-term capital gains rate. If held for less than a year, it's taxed as ordinary income, which is usually a higher rate.

10. What's the best way to keep learning without getting overwhelmed?

Start small and stay consistent. Find a few reputable sources like established financial news websites, well-regarded podcasts, or books from trusted authors. Focus on understanding core concepts like diversification and compound interest rather than trying to follow every market trend.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.