Investing in real estate is all about buying property to make money, whether that's through collecting rent, watching its value grow over time, or a combination of both. It's a classic, time-tested way to build wealth because you're working with a tangible asset to create different streams of income.

Think of this guide as your roadmap, walking you through everything from getting your finances in order to eventually growing your collection of properties.

In This Guide

- 1 Why Real Estate Is Still a Smart Investment

- 2 Getting Your Finances Ready for Investment

- 3 Finding and Analyzing a Great Deal

- 4 Protecting Your Investment with Due Diligence

- 5 Managing Your Property and Scaling Your Portfolio

- 6 Frequently Asked Questions About Real Estate Investing

- 6.1 1. How much money do I realistically need to start?

- 6.2 2. Is it better to pay off a rental property quickly or use leverage?

- 6.3 3. What are the biggest risks for a new investor?

- 6.4 4. Should I form an LLC for my first property?

- 6.5 5. Can I invest in real estate with a full-time job?

- 6.6 6. What is the "1% Rule" and is it still relevant?

- 6.7 7. What's more important: cash flow or appreciation?

- 6.8 8. How do I find a good real estate agent for investing?

- 6.9 9. What is "house hacking"?

- 6.10 10. What's the biggest mistake new investors make?

Why Real Estate Is Still a Smart Investment

For generations, real estate has been a go-to for serious wealth-building, and there's a simple reason for that. Unlike a stock or a bond, you can actually see and touch a property. That physical presence provides a unique sense of security that you just don't get with purely digital assets.

At its heart, successful real estate investing boils down to two things: generating cash flow and building equity. Every month your tenants pay rent, they are essentially helping you pay down your mortgage. All the while, the property is (ideally) increasing in value, building your net worth in the background.

The Pillars of Real Estate Returns

So, where does the real power of this investment come from? It really stands on three key pillars:

- Consistent Cash Flow: Rental income is the lifeblood of your investment, providing a reliable revenue stream month after month. Once you’ve paid the mortgage, taxes, and other operational costs, what's left over is pure profit in your pocket.

- Long-Term Appreciation: History shows us that property values tend to climb. This isn't just random; it's driven by factors like inflation, growing demand in desirable areas, and local development. This slow, steady growth is how you build serious equity over the long haul.

- Significant Tax Advantages: This is a big one that many new investors overlook. You can deduct a whole host of expenses—think mortgage interest, property taxes, insurance, and repairs. Even better, you get to claim depreciation, which lets you write off a portion of your property's value each year, lowering your taxable income.

If you're wondering how these factors add up, check out our detailed analysis on whether real estate is still profitable in 2025.

Real estate investing offers a powerful combination of income, equity growth, and tax benefits that is difficult to find in other asset classes. It’s a strategy for building sustainable wealth, not just chasing quick profits.

Don't just take my word for it. Recent market data shows a strong comeback. The Emerging Trends in Real Estate® Global Outlook 2025 report revealed that global private real estate values have been on the rise for five straight quarters. This shows just how resilient property can be, even after a rocky economic patch. For a deeper dive, you can see the complete report from PwC.

Core Real Estate Investment Strategies at a Glance

Before you jump in, it helps to understand the main ways people invest in property. Each approach has its own demands and rewards. This table breaks down the most common strategies so you can see how they stack up.

| Strategy | Typical Capital | Return Profile | Management Level |

|---|---|---|---|

| Direct Ownership (Rentals) | High (Down Payment) | Cash Flow & Appreciation | High (or hire manager) |

| House Flipping | Medium-High | Quick, High Profit | Very High (hands-on) |

| REITs | Low (Price of a share) | Dividends & Stock Growth | Low (Passive) |

| Crowdfunding | Low-Medium | Varies (Debt or Equity) | Low (Passive) |

From being a hands-on landlord to a passive investor in a larger fund, there's a path for almost every budget and risk tolerance. The key is finding the strategy that aligns with your financial goals and the amount of time you're willing to commit.

Getting Your Finances Ready for Investment

Before you even think about scrolling through property listings, the real work begins at your own desk. I've seen countless promising deals fall apart because the investor's financial house wasn't in order. A successful real estate venture is built on a rock-solid financial foundation.

This isn't just about saving up some cash. It's about getting a crystal-clear, brutally honest picture of where you stand financially. Lenders will put your finances under a microscope, so you need to be prepared. This means knowing your debt-to-income (DTI) ratio inside and out, polishing your credit history, and having a realistic plan for the down payment and closing costs.

Assess Your True Financial Position

First things first, you need to know your numbers—and I mean exactly. No guesswork. Pull together your income statements, monthly debt payments (think car loans, student loans, credit cards), and your regular household expenses.

- Calculate Your DTI: Lenders generally look for a DTI of 43% or less. This ratio shows them how much of your monthly income is already spoken for by debt.

- Polish Your Credit Score: A great credit score is your golden ticket to better interest rates. You should be aiming for 740 or higher to get the best possible loan terms. Pay your bills on time, keep credit card balances low, and definitely don't open new lines of credit right before you apply for a mortgage.

- Save Like You Mean It: You'll need a down payment, which for investment properties is typically 20-25%. On top of that, budget another 2-5% of the purchase price for closing costs. And don't forget a cash reserve for those inevitable surprise repairs.

This initial number-crunching phase does more than just prepare you for a lender; it helps you figure out what kind of investor you can be right now.

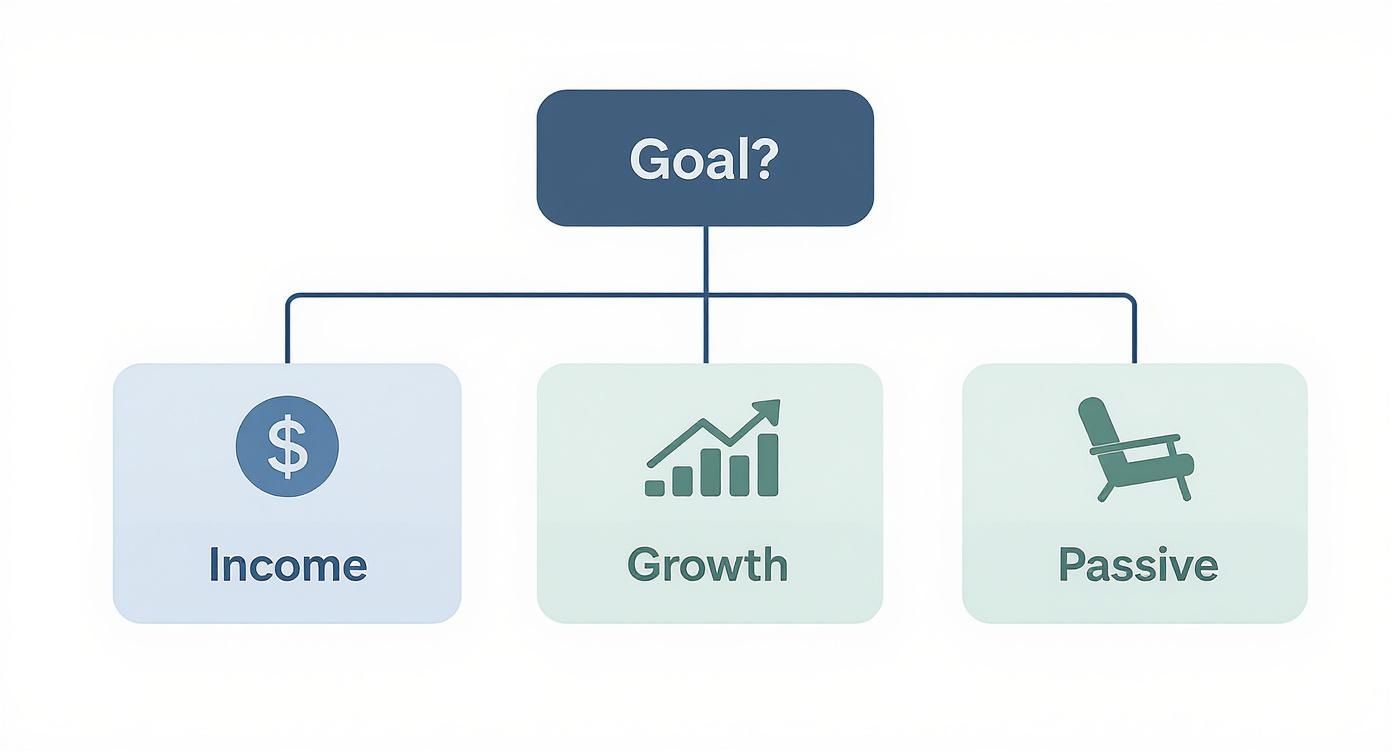

As the infographic lays out, whether your goal is quick cash flow, long-term appreciation, or a more hands-off investment, your financial starting point really dictates your path forward.

Exploring Your Financing Options

Many new investors assume a conventional mortgage is their only option, but that’s far from the truth. There are several different loan types out there, each designed for different situations. Understanding these can open doors you might have thought were locked. For a much more detailed look, our complete guide on how to finance an investment property is a great resource.

To get you started, let's compare some of the most common financing methods new investors turn to.

Comparing Real Estate Financing Options

The right loan can make or break your deal. This table breaks down the key differences between the most popular financing routes to help you see what might be the best fit for your situation.

| Financing Type | Down Payment | Credit Score | Ideal For |

|---|---|---|---|

| Conventional Loan | 20-25% | 620+ (740+ preferred) | Investors with strong credit and significant savings for a down payment. |

| FHA Loan | As low as 3.5% | 580+ | First-time buyers using the 'house hacking' strategy on a multi-unit property. |

| VA Loan | 0% | Varies by lender | Eligible veterans and service members, also great for 'house hacking' multi-unit homes. |

| Hard Money Loan | 10-25% | Flexible | Short-term financing for fix-and-flip investors who need to close a deal quickly. |

Each of these options serves a different purpose. While a conventional loan is the go-to for established investors, government-backed loans like FHA and VA can be incredible tools for getting your foot in the door with less cash upfront.

Real-World Example: A First-Time House Hack

Meet Sarah, a 28-year-old marketing manager. She was eager to get into real estate but didn't have the 20% down payment for a traditional investment loan. Instead of waiting, she got creative. She used an FHA loan to buy a duplex for $350,000.

Because she planned to live in one unit, she only needed a 3.5% down payment—just $12,250. The best part? The rent from the second unit covered 70% of her mortgage, which dramatically lowered her own living costs. Within a year, she had saved enough to start hunting for her next property, all while her first investment was building equity and practically paying for itself. It's a perfect example of how smart, creative financing can launch your investing journey.

Finding and Analyzing a Great Deal

The difference between a high-performing asset and a costly headache often comes down to one thing: finding the right property in the right market. This isn't about getting lucky. It's a skill you build by knowing what to look for and how to run the numbers, which makes great deals start popping up on your radar.

Seasoned investors have a knack for spotting potential in neighborhoods that haven't quite peaked yet. They're looking for subtle but powerful signs of growth—things like a sudden jump in new business permits, city-funded projects like parks or transit lines, and solid job growth. These are the clues that an area is on an upward trajectory.

Combining Digital Search with On-the-Ground Intel

Of course, your search will probably start online. Tools like Zillow and Realtor.com are fantastic for getting a lay of the land, letting you filter properties by price, size, and type to quickly gauge the inventory in a target area.

But here’s a rookie mistake: relying only on those online listings. Pictures and property data never tell the whole story. You absolutely have to get out there and see the neighborhood for yourself.

Visiting a potential neighborhood in person is non-negotiable. Drive through at different times—a weekday morning, a weeknight, and a weekend afternoon—to understand its true character, noise levels, and the types of activity it attracts.

This boots-on-the-ground approach reveals what a screen can't. Is the area clean and well-kept? Are people out walking their dogs or are kids playing in the parks? These qualitative details are just as critical as any spreadsheet. For a deeper dive, our guide on how to find great investment properties offers more of these actionable strategies.

This is a great time to be looking, too. After a period of decline, global real estate prices are stabilizing, creating new windows of opportunity. A 2025 outlook from Columbia Threadneedle highlighted that after some interest rate-driven drops, the global property price index actually saw a 1.2% year-over-year increase in 2024. Some markets, like Madrid, even hit 7.5% annual price growth, proving that strong local performance is out there if you know where to look.

Running the Numbers to Make Smart Decisions

Once you've zeroed in on a promising property, it's time to let the numbers do the talking. Leave emotion at the door; every investment decision has to be backed by cold, hard data. Two of the most important metrics you'll need are the capitalization rate (cap rate) and your cash-on-cash return.

- Capitalization Rate (Cap Rate): Think of this as a way to compare the potential return of different properties. You calculate it by dividing the property's Net Operating Income (NOI) by its purchase price. Generally, a higher cap rate suggests a higher potential return (and, often, more risk).

- Cash-on-Cash Return: This metric tells you exactly what you're earning on the actual money you put into the deal. Just divide the annual pre-tax cash flow by your total cash invested (down payment, closing costs, renovation budget). It’s one of the truest measures of a deal's immediate performance.

Let's see how this works in a real-world scenario.

Case Study: Prioritizing Future Growth Over Current Rents

An investor was looking at two similar duplexes. Duplex A had great current rents, offering a 7% cash-on-cash return. Duplex B’s rents were a little lower, yielding only a 5.5% return. On paper, Duplex A seemed like the clear winner.

But the investor did their homework. Duplex B was located just two blocks from a site where a major tech company was building a new campus, set to bring 3,000 jobs to the area in two years. They chose Duplex B, betting that the influx of high-earning professionals would send rental demand and property values soaring.

Sure enough, two years later, they were able to raise rents by 30%, blowing past the returns of Duplex A. It’s a perfect example of looking beyond today's numbers to see a property's true long-term potential.

Protecting Your Investment with Due Diligence

So, you've found a property that looks great on paper. The numbers seem to work, and you're getting excited. Hold on. The most important phase—the part that separates successful investors from those who get burned—is just beginning. This is your due diligence period.

Think of it as your one and only chance to pop the hood and have a serious look at what you’re really buying. It's where you verify every single claim the seller has made and hunt for the hidden problems that could turn a promising asset into a nightmare.

Cutting corners here is one of the fastest ways to lose a lot of money in real estate. The goal isn't just to check boxes; it's to walk away from this process with complete confidence in your purchase.

The Professional Inspection and Beyond

Your first move is always to hire a fantastic, independent home inspector. Their job is to give you an unbiased, top-to-bottom look at the property's physical health, from the foundation right up to the roof.

But here’s where seasoned investors think differently: a standard inspection is a great start, but it’s a general overview. Inspectors are skilled at spotting visible issues, but they aren't experts in every single component of a house.

Once you have that initial report, you'll likely need to call in some specialists for a deeper dive, especially with older properties or ones that look a bit tired.

- HVAC Specialist: If that furnace or AC unit is over 15 years old, you need to know exactly how much life it has left.

- Roofing Contractor: An inspector sees damaged shingles. A roofer can tell you if you have two years left or ten—a crucial difference for your budget.

- Sewer Scope Inspection: I consider this non-negotiable. A small camera is run down the main sewer line to find cracks, invading tree roots, or blockages. This can uncover a $5,000 to $25,000 problem that is completely invisible from the surface.

- Foundation Expert: If the inspector mentions any unsettling cracks or signs of shifting, get a structural engineer in there immediately. Don't guess.

Spending a few hundred dollars on these extra checks feels painful in the moment, but it can literally save you tens of thousands down the road.

Investor Anecdote: The Plumbing Problem That Saved $15,000

A colleague of mine, Mark, was buying a four-unit building that looked perfect. The numbers worked, and the general inspection was mostly clean. But he has a hard-and-fast rule: always scope the sewer on any property built before 1980. The camera revealed the original cast iron pipes under the slab were shot—corroded and on the verge of total collapse. It was a $20,000 bombshell. Armed with the video and a plumber's estimate, Mark went back to the seller and renegotiated the price down by $15,000, turning a deal-killing disaster into a manageable repair.

Verifying the Books and the Title

When you buy a rental, you're not just buying a building—you're buying a small business. That means you absolutely have to verify the income and expenses the seller has presented. A deal can look incredible with inflated numbers but quickly become a money-loser once you're holding the keys.

At the same time, you've got to make sure the property is legally clean. A title search is essential to uncover any hidden claims or liens. This is how you confirm the seller actually has the right to sell you the property, free and clear of anyone else's mess.

Here's a quick rundown of what you need to be looking at:

| Category | Key Items to Verify | Why It Matters |

|---|---|---|

| Financial Records | Demand to see tax returns (Schedule E), bank statements showing rent deposits, and actual utility bills. | This is the only way to confirm the seller's claimed Net Operating Income (NOI). Don't ever trust their pro-forma spreadsheet alone. |

| Lease Agreements | Read every single lease, word for word. Check rental rates, lease end dates, and any strange clauses. | You need to know the exact agreements you're inheriting. Do the rents on the leases match what the seller told you? |

| Title Search | Your title company will dig for liens, easements, or ownership disputes. | This uncovers nasty surprises like unpaid contractor bills or rules that could stop you from using the property how you want. |

| Zoning & Permits | Call the local planning department. Confirm the property is properly zoned for your intended use (e.g., multi-family rental). | This ensures you're operating legally and won't be hit with fines or forced to make expensive changes down the line. |

Getting a clear picture of all the potential costs during due diligence is critical for your financial planning. This process directly informs your budget and helps you maximize every advantage. To learn more, check out our guide on property investment tax deductions. Properly documenting the expenses you uncover now is the first step toward a profitable investment.

Managing Your Property and Scaling Your Portfolio

Getting the keys to your first investment property is a fantastic feeling, but it’s the starting line, not the finish. Now the real work begins: managing that asset so it performs well and paves the way for your next purchase. You're officially in the real estate business.

One of the first big questions you'll face is whether to manage the property yourself or hand it over to a professional. There's no single right answer here—it really boils down to your specific situation, skills, and goals.

DIY Landlord vs. Professional Management

Deciding how your property will be looked after is a crucial first step. Let's break down what goes into this choice.

| Decision Factor | DIY Management | Professional Manager |

|---|---|---|

| Time Commitment | High; you're the one taking calls, scheduling repairs, and showing the unit. | Low; the manager handles all the day-to-day headaches. |

| Cost | Lower upfront costs, but don't forget your time has value. | Typically 8-12% of the monthly rent, plus potential leasing fees. |

| Proximity | Best if you live within a 30-minute drive. | A must-have for out-of-state or distant investors. |

| Skills & Knowledge | You'll need to know landlord-tenant laws and have some basic maintenance know-how. | They are experts in legal compliance, tenant screening, and have a network of contractors. |

Real-World Scenario: A new investor, Alex, bought a duplex one town over. With a flexible job, he decided to manage it himself to learn the ropes. He saved about 10% in management fees each month, which he socked away for his next down payment. Meanwhile, another investor, Maria, bought a great property three hours from her home. She hired a manager immediately, realizing that the savings from DIY would be wiped out by gas money and lost time driving back and forth for every little issue.

Building Your Management System

If you decide to go the DIY route, you need to run it like a business from day one. Winging it is not a strategy.

- Tenant Screening: This is your first and best line of defense. Always run a full credit check, background check, and actually call to verify employment and past rental history. Don't skip this.

- A Rock-Solid Lease: Don’t just grab a generic template online. Use a state-specific lease that spells everything out—rent due dates, late fees, maintenance responsibilities, pet policies, you name it.

- A Go-To Maintenance Crew: You need a list of trusted plumbers, electricians, and handymen before something breaks. The last thing you want is to be scrambling for help when a pipe bursts at 2 AM.

Getting a firm grip on the numbers is just as important. For a deep dive, check out our guide on how to calculate your rental property cash flow.

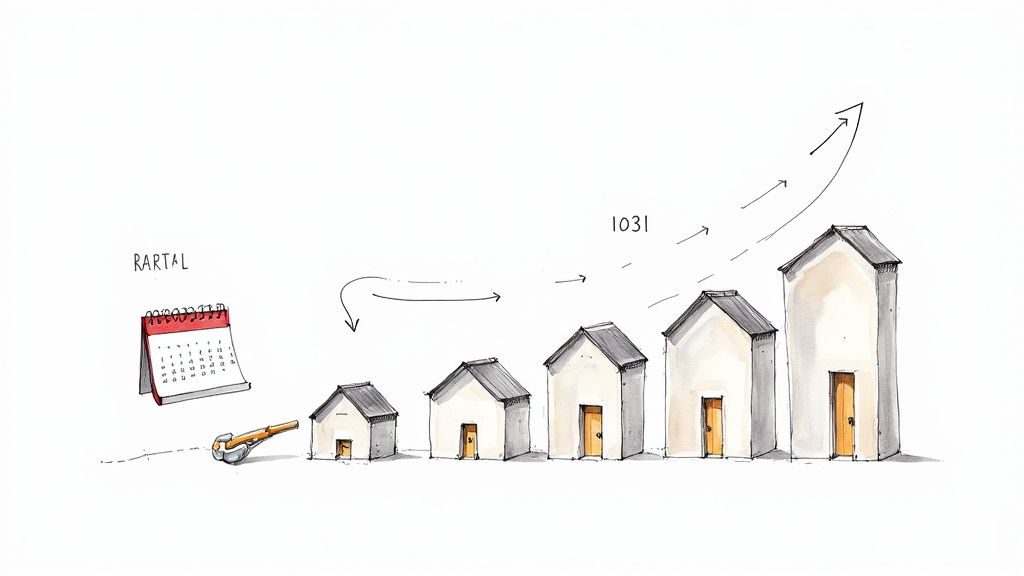

Scaling From One Property to a Portfolio

Once your first property is humming along and generating consistent income, it's time to think bigger. Smart investors use that first asset as a launchpad.

A cash-out refinance is a classic move. After you've paid down the mortgage and the property has appreciated, you can refinance for a larger loan amount and pull the difference out in cash. That cash then becomes the down payment for your next property.

The 1031 exchange is another powerful tool for growth. This tax code provision allows you to sell an investment property and defer paying capital gains taxes, as long as you reinvest the proceeds into a new "like-kind" property. It’s an incredible way to trade up to larger or better-performing assets without a tax bill slowing your momentum.

As your portfolio grows, so do your options. You might start looking beyond single-family homes or small multi-family units. The 2025 Emerging Trends in Real Estate report highlights a major shift, with assets like data centers becoming a top prospect for investors globally. Fueled by the AI boom, global investment in data centers saw transaction volumes jump by over 20% in 2024. As you can see from the global outlook from ULI Europe, the world of real estate is vast, and your first property is just the beginning.

Frequently Asked Questions About Real Estate Investing

1. How much money do I realistically need to start?

The amount varies greatly. For a traditional rental property, you'll typically need a 20-25% down payment plus closing costs. However, strategies like "house hacking" with an FHA loan (3.5% down) or investing in Real Estate Investment Trusts (REITs) can lower the barrier to entry significantly.

2. Is it better to pay off a rental property quickly or use leverage?

This depends on your risk tolerance and goals. Paying off a mortgage increases cash flow and reduces risk. Using leverage (keeping a mortgage) allows you to control a larger asset with less cash, enabling you to acquire more properties and scale your portfolio faster. Many investors use leverage to grow and then pay down debt as they near retirement.

3. What are the biggest risks for a new investor?

The top risks include extended vacancies (no rental income), unexpected major repairs (like a new roof or HVAC), difficult tenants who cause damage or require eviction, and buying in a declining market. These risks can be mitigated with thorough due diligence, maintaining a healthy cash reserve, and implementing a strict tenant screening process.

4. Should I form an LLC for my first property?

While an LLC offers liability protection by separating your personal assets from your business assets, it's not always necessary for your first property. A good landlord insurance policy with high liability coverage can provide substantial protection. Consult with a real estate attorney and a CPA to determine the best structure for your situation.

5. Can I invest in real estate with a full-time job?

Absolutely. Most real estate investors start while working a full-time job. You can either hire a professional property manager to handle the day-to-day operations or create efficient systems to manage it yourself in a few hours per week.

6. What is the "1% Rule" and is it still relevant?

The 1% Rule is a guideline suggesting that the monthly rent should be at least 1% of the property's purchase price. For example, a $200,000 property should rent for at least $2,000/month. In many high-cost markets today, this rule is difficult to achieve. It’s better used as a quick initial screening tool rather than a strict requirement. Always perform a detailed cash flow analysis.

7. What's more important: cash flow or appreciation?

Both are crucial, but for a beginner, focusing on positive cash flow is often the safer strategy. Cash flow pays the bills and provides immediate returns, while appreciation is a long-term benefit that isn't guaranteed. A great investment offers a balance of both.

8. How do I find a good real estate agent for investing?

Look for an agent who is also an investor themselves. They will understand the unique needs of an investor, such as analyzing deals, understanding rental markets, and connecting you with investor-friendly lenders and contractors. Ask for referrals from local real estate investor groups.

9. What is "house hacking"?

House hacking is a strategy where you purchase a multi-unit property (e.g., a duplex, triplex, or fourplex), live in one unit, and rent out the others. The rental income from the other units can significantly offset or even cover your entire mortgage payment, allowing you to live for free or at a very low cost while building equity.

10. What's the biggest mistake new investors make?

The most common mistake is "analysis paralysis"—spending months or even years learning and analyzing potential deals but never taking action. While education is vital, real learning happens by doing. The second biggest mistake is skipping due diligence to save time or money, which often leads to costly surprises later on.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build lasting wealth through smart investing in real estate, stocks, and more. Explore our resources and start your journey today.