Financial freedom isn’t a luxury reserved for the wealthy. It’s a concrete goal you can reach by knowing exactly what you need and building a realistic financial independence timeline.

At Top Wealth Guide, we’ve helped thousands of people move from guessing about their future to having a clear, actionable plan. This guide walks you through calculating your personal number, building a strategy that works, and optimizing every dollar along the way.

In This Guide

What’s Your Real Financial Freedom Number

Your financial freedom number is the total wealth you need to stop relying on paychecks. This isn’t theoretical-it’s a concrete figure based on how much you actually spend and how long you want your money to last.

The 4% Rule: Your Foundation

The 4% rule suggests you can withdraw 4% of your portfolio annually without depleting it over 30 years or more. To find your number, multiply your estimated annual expenses by 25. If you spend $60,000 per year, your target is $1,500,000. This calculation assumes you’ll invest your wealth and live off the returns rather than touching the principal.

Some people prefer a more conservative 3% withdrawal rate, which multiplies expenses by 33 instead-a smart choice if you’re retiring before age 62 or want extra margin for error. The 4% rule comes from decades of market research, but it’s a guideline, not a guarantee. Your actual withdrawal rate depends on your tax situation, investment mix, and how markets perform in your early retirement years.

Calculate Your True Annual Expenses

Most people guess wrong about their spending. You need to track actual expenses for three months, then project them forward. Include housing costs, food, transportation, insurance, utilities, subscriptions, entertainment, travel, and medical expenses.

Be honest about what retirement looks like for you. If you plan to travel more or downsize your home, adjust accordingly. Fidelity research on retirement spending suggests people spend roughly 55% to 80% of their current income in retirement, depending on lifestyle changes. Once you have your annual figure, add a buffer for unexpected costs like a vehicle replacement or home repairs. If you currently spend $80,000 yearly and expect to spend $65,000 in retirement, that’s your baseline.

Account for Inflation and Time

Next, factor in inflation. Historical inflation averages around 3% annually. If you’re 20 years from retirement, your $65,000 annual expense becomes roughly $107,000 in today’s purchasing power. This adjustment matters significantly-ignoring inflation can leave you short when you actually retire.

Healthcare costs demand special attention. Medicare begins at 65, but if you’re retiring earlier, you’ll need to cover health insurance premiums until then. Plan for roughly $300 to $400 monthly per person for individual health insurance before Medicare eligibility. After age 65, Medicare coverage and costs vary based on your enrollment timing and plan selection. These expenses directly increase your required financial freedom number.

With your true expenses calculated and adjusted for inflation and healthcare, you now have the foundation to build your wealth-building strategy. The next step involves choosing the income sources and passive income opportunities that will actually get you to that number.

Building Income That Gets You There

Your financial freedom number is locked in. Now you need a realistic plan to actually reach it. This means being strategic about where your income comes from and ruthlessly honest about what will move the needle. Most people fail at financial independence not because their number is wrong, but because they underestimate how much they need to earn and save.

Choose Your Primary Income Source Strategically

Your primary income source-whether that’s your job, a business, or multiple streams-determines how fast you can accumulate wealth. If you’re earning $60,000 annually and need to save $20,000 per year to hit your target in 15 years, you’re looking at a 33% savings rate. That’s aggressive but doable. If you’re earning $100,000, the same $20,000 savings target drops to just 20% of your income, making it far more sustainable.

The hard truth: increasing your income often matters more than cutting expenses. A $10,000 raise is easier to achieve than cutting $10,000 from your annual spending. Fidelity research shows people who reach financial independence typically earn above-median incomes in their fields or have diversified their earnings. Negotiate your salary annually, switch jobs if it means a 15% to 25% bump, or develop a skill that commands higher pay. This single move can compress your timeline by years.

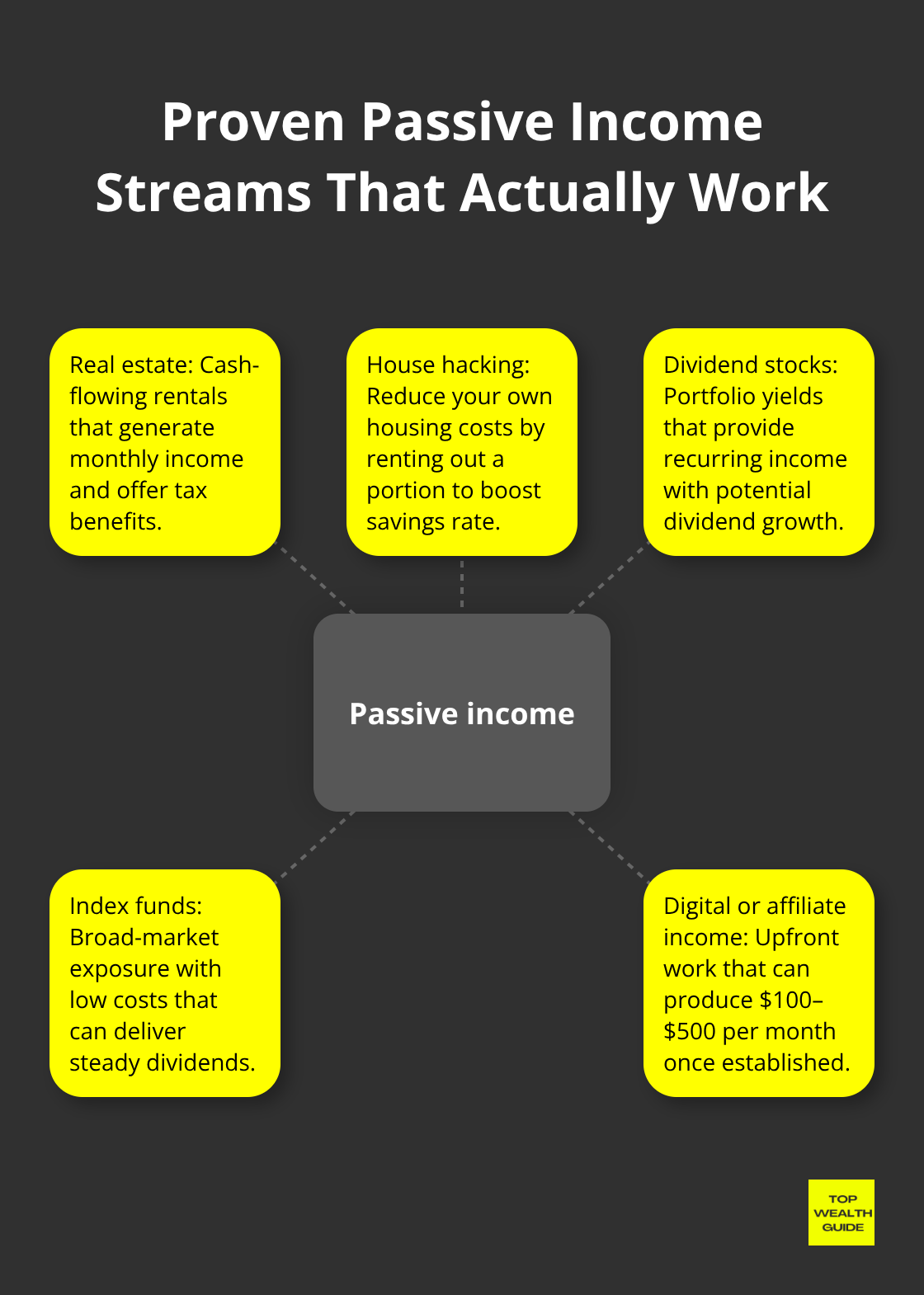

Build Passive Income That Actually Works

Passive income accelerates your path dramatically, but most passive income requires active work upfront. Real estate stands as the most proven method. If you purchase a rental property that generates $500 monthly in cash flow after all expenses, that’s $6,000 per year working for you without additional effort. Over 10 years, that amounts to $60,000 in passive cash flow. Real estate also provides tax deductions on mortgage interest and depreciation, which further improves your after-tax returns.

House hacking can reduce your personal housing costs by lowering your required financial freedom number and increasing your savings capacity. Dividend-paying stocks and index funds provide passive income too, though at lower yields. A $500,000 portfolio yielding 2% to 3% generates $10,000 to $15,000 annually. Online courses, digital products, or affiliate income require significant upfront work but can generate $100 to $500 monthly once established.

Match Your Passive Income Strategy to Your Timeline

The key involves choosing passive income aligned with your timeline. If you’re five years from your target, real estate takes too long. Digital products or affiliate income are better bets. If you have 15 years, real estate builds serious wealth. The timing of your financial freedom goal shapes which income streams make sense for your situation.

Track Progress Quarterly to Stay on Course

Track your progress quarterly, not annually. Calculate your net worth every three months and compare it against your target trajectory. If you’re $50,000 behind where you should be after six months, you need to adjust immediately-either increase income, cut expenses, or both. Most people wait until year-end to check progress, which wastes months of potential correction.

Set specific milestones: reach $100,000 in investments by month 12, $250,000 by year three, $500,000 by year five. These checkpoints keep you accountable and reveal whether your strategy is actually working or just feels good on paper. With your income sources identified and your tracking system in place, the next step focuses on optimizing how you invest and manage your cash flow to maximize every dollar’s impact.

Optimize Your Investments and Cash Flow

Allocate Assets Based on Your Timeline

Your investment allocation determines whether you reach financial freedom in 10 years or 30 years. Most people treat this decision casually, which is a mistake. The difference between a 60/40 stock-bond portfolio and an 80/20 allocation compounds into hundreds of thousands of dollars over time. Asset allocation based on timeline is crucial because the amount of time you have before retiring is a major factor in determining effective strategies. If you have 15 years until your target retirement date, you should be weighted heavily toward stocks because you have time to recover from market downturns. A 25-year-old aiming for financial freedom at 50 needs roughly 85 to 90 percent stocks, with only 10 to 15 percent bonds for stability. A 50-year-old targeting 60 should shift to 70 percent stocks and 30 percent bonds. The math is straightforward: stocks historically return around 7 percent annually while bonds return roughly 2 percent. That 5 percent difference compounds aggressively over decades. Your timeline is your biggest advantage, so use it.

Automate Your Contributions and Capture Employer Matches

Set up automatic transfers from your checking account to your brokerage on payday, before you see the money. This removes the temptation to spend it. If your employer offers a 401(k) match, that’s free money-contribute enough to capture the full match immediately, even if it means delaying other investments. A 5 percent employer match on an $80,000 salary equals $4,000 per year you’re leaving on the table if you skip it.

Eliminate Waste Without Sacrificing Quality

Most people think cutting expenses means deprivation, but the opposite is true. Smart expense reduction means eliminating waste while keeping what actually brings satisfaction. Track your spending for one month in detail. Look for subscriptions you forgot about-the average person has 9.6 active subscriptions and forgets about 3 of them. Cancel those immediately. Review your insurance: shop your car insurance annually and your homeowners insurance every two to three years. Most people save $500 to $1,200 per year just from new quotes.

Meal planning reduces food costs by 20 to 30 percent compared to eating out or buying convenience foods. If your food budget is $800 monthly, planning meals can save $160 to $240. That’s $1,920 to $2,880 per year with zero lifestyle sacrifice-you eat better and save more. Housing is typically the largest expense. If your mortgage or rent exceeds 30 percent of your income, consider downsizing. A move from a $400,000 home to a $300,000 home saves roughly $400 to $600 monthly depending on rates, plus lower property taxes and insurance. Over 15 years, that’s $72,000 to $108,000 redirected toward your financial freedom goal. This single decision often cuts five years off your timeline.

Reinvest Gains to Accelerate Your Path

Once you’ve optimized your investments and trimmed waste, reinvest every gain instead of lifestyle creeping. When you get a $5,000 raise, don’t spend it-direct 80 percent toward your investments and keep 20 percent for quality-of-life improvements. When your rental property generates $600 monthly in cash flow, reinvest it into another property or dividend stocks rather than treating it as spending money. This compounding effect is where financial freedom actually accelerates.

A person earning $70,000 annually who saves $15,000 per year at a 6 percent average return reaches $1 million in roughly 27 years. That same person who increases their savings to $18,000 per year reaches $1 million in 24 years. The extra $3,000 saved annually compressed their timeline by three years. Now multiply that across multiple years of raises and income growth. Someone who captures half of each raise and reinvests it could compress their timeline by 7 to 10 years compared to someone who spends every additional dollar. Your investment allocation, expense discipline, and reinvestment habit form the actual engine of financial freedom. Get these three elements right and your path becomes inevitable rather than aspirational.

Final Thoughts

Your financial independence timeline depends entirely on three factors you control: how much you earn, how much you spend, and how you invest the difference. A person earning $80,000 who saves $20,000 annually at a 6% return reaches $1 million in roughly 25 years, while someone who increases income to $100,000 and maintains the same savings rate reaches the goal in 20 years. Small changes in any of these three areas compound into years of freedom.

Start your personal plan this week by writing down your actual annual expenses, calculating your financial freedom number using the 4% rule, and identifying your target retirement age. Then pick one income source you can develop and one expense category you can optimize. These aren’t theoretical exercises-they form the foundation of your actual path forward. Monitor your progress quarterly by checking your net worth every three months and comparing it against where you should be.

Markets will fluctuate, income will vary, and unexpected expenses will arise, but what matters is whether your overall trajectory points toward financial freedom or away from it. We at Top Wealth Guide offer practical tools and strategies specifically designed to help you track progress and refine your approach as circumstances change. Your financial independence timeline reflects your choices, your discipline, and your commitment to building wealth intentionally.