Most people think building wealth requires constant stock-picking and market timing. At Top Wealth Guide, we know better-the right investment portfolio structure generates income automatically through dividends, bonds, and real estate investments.

This guide shows you exactly how to set up a portfolio that works while you sleep, with real historical data and step-by-step instructions you can implement today.

In This Guide

Understanding Passive Income Through Portfolio Building

What Passive Income Really Means

Passive income isn’t money that appears without effort-it’s earnings from investments that require minimal active work after you set them up. Warren Buffett famously said you need a way to make money while you sleep or you’ll be working for life, and that’s exactly what a well-structured portfolio delivers. The difference between passive and active income comes down to time: active income demands your constant attention (trading stocks daily, managing properties hands-on), while passive income works through automation and compounding. A dividend stock pays you quarterly whether you check your account or not. A bond ladder generates scheduled interest payments regardless of market noise. A REIT distributes rental income without requiring you to fix a leaky faucet. These aren’t get-rich-quick schemes-they’re wealth-building machines that operate in the background.

Why Portfolio-Based Passive Income Outperforms Active Trading

Active traders believe frequent buying and selling generates superior returns. The data says otherwise. Historically, dividends have played a significant role in total return, particularly when average annual equity returns were lower than 10% during a decade.

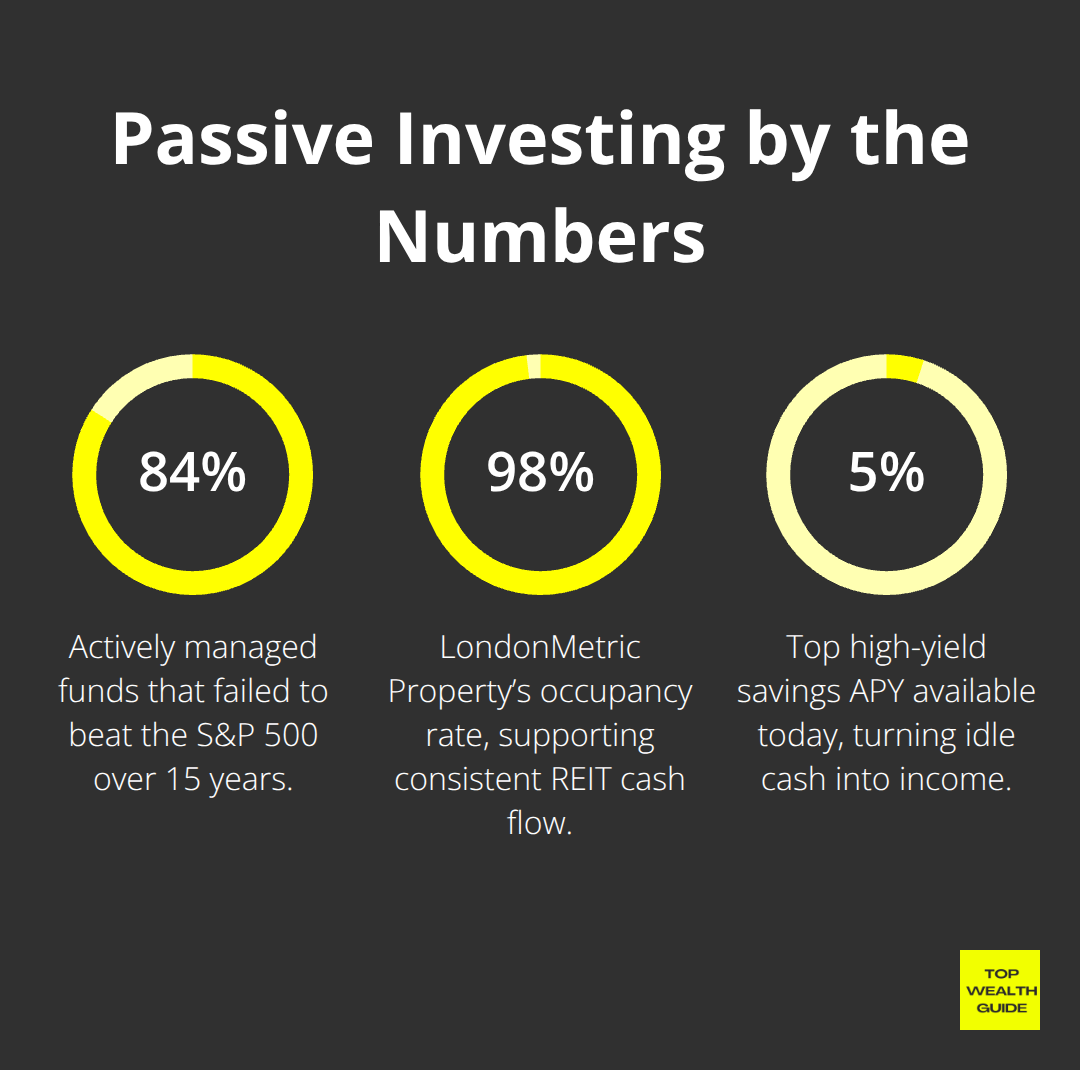

Vanguard research shows that over a 15-year period, approximately 84% of actively managed funds failed to beat the S&P 500 index. The cost of active trading compounds against you: a 1% annual fee might seem small, but over 30 years it can reduce your final portfolio value by 25% or more. Portfolio-based passive income avoids this trap entirely. You buy quality dividend stocks like Procter & Gamble or Johnson & Johnson, set dividend reinvestment to automatic, and let compounding work. You rebalance quarterly, not daily. You hold for decades, not days. This approach generates steady cash flow while minimizing taxes and trading costs, making it mathematically superior for building wealth.

Real Returns: Historical Data on Long-Term Investment Performance

Consider a concrete example: a $20,000 portfolio using a five-stock calendar dividend approach with stocks like Shell, HSBC, Legal & General, LondonMetric Property, and British American Tobacco generates approximately £1,160 annually in passive income based on a 5.8% forecast portfolio yield. That’s income deposited into your account without touching a single position. Over 10 years, if dividends are reinvested and the portfolio appreciates modestly, that £1,160 compounds into significantly more wealth. Real estate offers similar proof: LondonMetric Property, a REIT with a 98.1% occupancy rate and blue-chip tenants like Primark and Travelodge, delivers reliable rental income without tenant management responsibility. Broad-market index funds like the S&P 500 tracker provide diversification across 500+ companies (including Apple, Microsoft, and Amazon), generating dividends that compound automatically when reinvested. High-yield savings accounts yield up to 5.00% APY-far above the traditional savings rate of 0.42% APY-turning cash itself into a productive asset. These aren’t theoretical projections; they’re real returns from real portfolios that operate while you sleep. Now that you understand how passive income works and why it outperforms active trading, the next step is building the actual system that automates your wealth creation.

Building Your Automated Income Streams

Three Pillars of Sleep-Mode Income

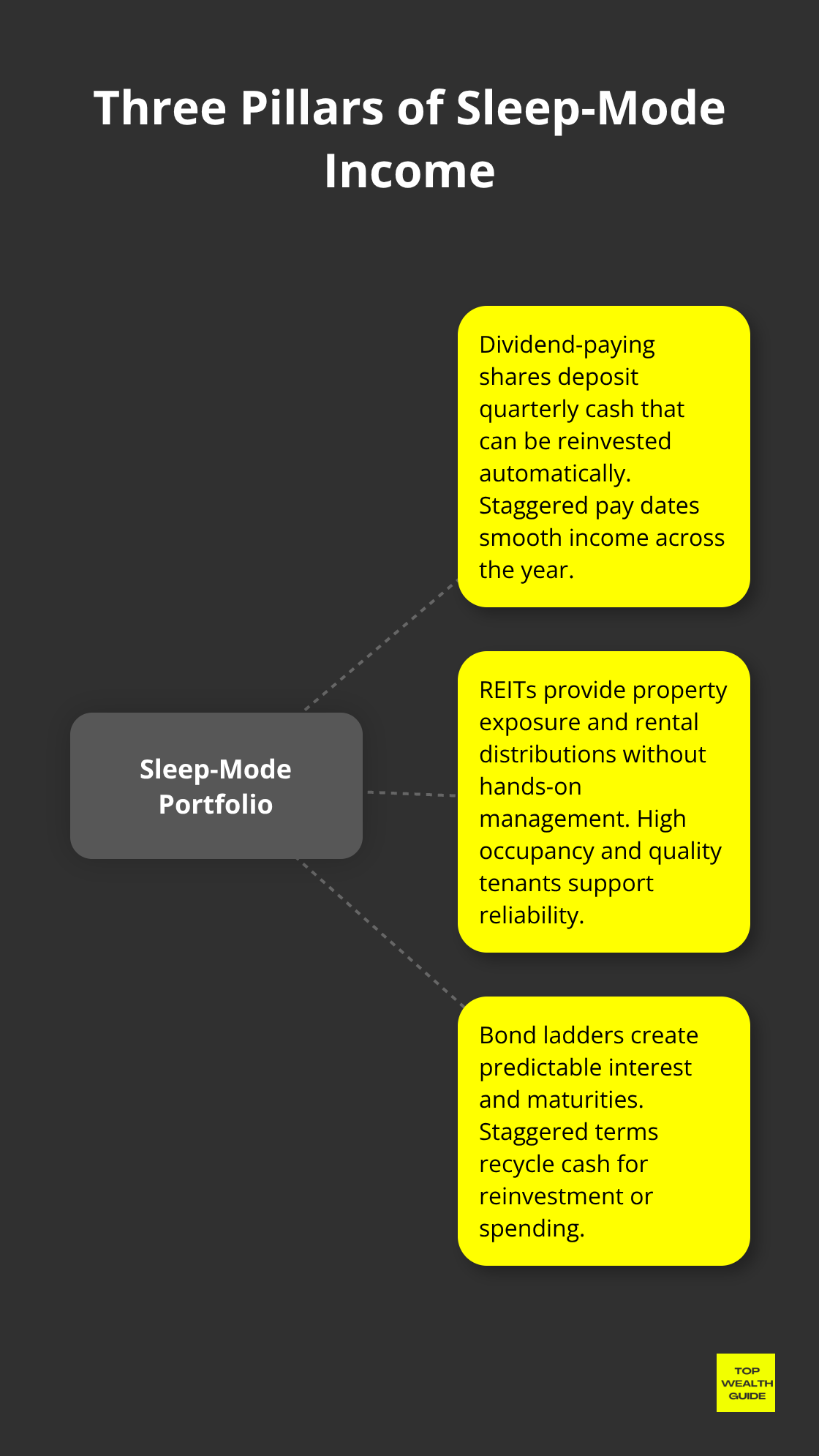

The foundation of a sleep-mode portfolio rests on three income-generating pillars: dividend-paying securities, real estate exposure through REITs, and fixed-income bonds. Each operates independently, yet together they create a diversified cash-flow engine that requires minimal intervention. Dividend stocks generate quarterly payments directly into your account-Shell pays in March, June, September, and December, while British American Tobacco distributes in February, May, August, and November. This staggered approach means income arrives throughout the year rather than in lump sums.

A five-stock calendar dividend strategy using Shell, HSBC, Legal & General, LondonMetric Property, and British American Tobacco produces approximately £1,160 annually on a £20,000 investment at a 5.8% blended yield. REITs eliminate property management entirely: LondonMetric Property maintains a 98.1% occupancy rate with tenants like Primark and Travelodge, generating reliable rental distributions without you managing leases or repairs. Bond ladders work differently-you purchase bonds maturing at staggered intervals (one-year, three-year, five-year, and ten-year Treasury bonds, for example), creating predictable interest payments that mature into cash you can reinvest or spend.

Automating Compounding Growth

The power emerges when you automate dividend reinvestment, allowing compounding to accelerate growth without manual intervention. A £1,160 annual dividend reinvested at 5.8% yield grows exponentially: after ten years of reinvestment and modest portfolio appreciation, that initial income stream nearly doubles in earning capacity. Most major platforms-Interactive Brokers, IG, and similar UK-based brokers-offer dividend reinvestment programs at no additional cost, meaning your quarterly payments automatically purchase fractional shares of the same holdings. This eliminates the temptation to spend the money and removes timing friction.

Building Your Core and Satellite Structure

Start with your core: a low-cost S&P 500 index fund or Schwab U.S. Dividend Equity ETF provides broad diversification across hundreds of stocks, reducing single-company risk while capturing dividend growth automatically. Then add satellite positions-individual dividend stocks and REITs-that concentrate your income in sectors you understand. Rebalancing quarterly takes thirty minutes: review whether each holding still represents your target allocation, and if drift exceeds 5%, sell overweight positions to purchase underweight ones. This discipline prevents concentration risk and forces you to sell winners and purchase dips, which mathematically outperforms emotional decision-making.

Quarterly Reviews and Cash Buffers

The quarterly review also lets you spot deteriorating dividend safety-if a company cuts its payout, you catch it during rebalancing rather than discovering it months later. High-yield savings accounts serve as your portfolio’s cash buffer, holding three to six months of expenses while earning meaningful returns. This three-tier structure (index funds for growth and diversification, individual dividend stocks and REITs for concentrated income, and cash for stability) creates a system that generates increasing income annually without requiring you to add capital or make new investment decisions. With your automated income streams now operational, the next critical step involves monitoring this system strategically-not obsessively-to maintain performance and catch problems before they compound.

Setting Up Your Sleep-Mode Portfolio

Open Your Account and Automate Contributions

Opening a brokerage account takes fifteen minutes online, yet most people delay this step indefinitely. Choose a platform offering zero-commission trading, low account minimums, and integrated dividend reinvestment: Interactive Brokers charges 0.02% annually on cash balances under £100,000, while IG and AJ Bell offer flat-fee structures starting at £5 per month. Once your account opens, set up automatic monthly contributions-even £200 monthly compounds into meaningful wealth over decades. Vanguard research confirms that investors who automate contributions outperform those who try to time the market, simply because automation removes emotion and ensures consistent purchasing regardless of market conditions.

Build Your Core Index Fund Foundation

Your first purchase should be a core holding: the Vanguard S&P 500 UCITS ETF or iShares Core S&P 500 UCITS ETF provides instant diversification across 500+ companies at expense ratios below 0.04%, meaning you keep 99.96% of your returns rather than paying fund managers. Set this purchase to occur automatically on the same day each month-the 1st or 15th works best, aligning with payday. Next, enable dividend reinvestment within your brokerage settings; this checkbox-level action compounds returns without requiring you to manually repurchase shares. Most platforms complete this setup in under two minutes.

Add Satellite Positions Strategically

Your satellite positions (individual dividend stocks and REITs) should be added only after your core index fund reaches £5,000, ensuring your foundation is solid before concentrating capital. Build positions in high-quality dividend payers: Shell, HSBC, Procter & Gamble, and Johnson & Johnson have each increased dividends for 25+ consecutive years, reducing the risk of cuts. Add LondonMetric Property as your REIT exposure-its 98.1% occupancy rate and blue-chip tenants like Primark and Travelodge deliver reliable distributions without property management headaches.

Execute Quarterly Rebalancing Reviews

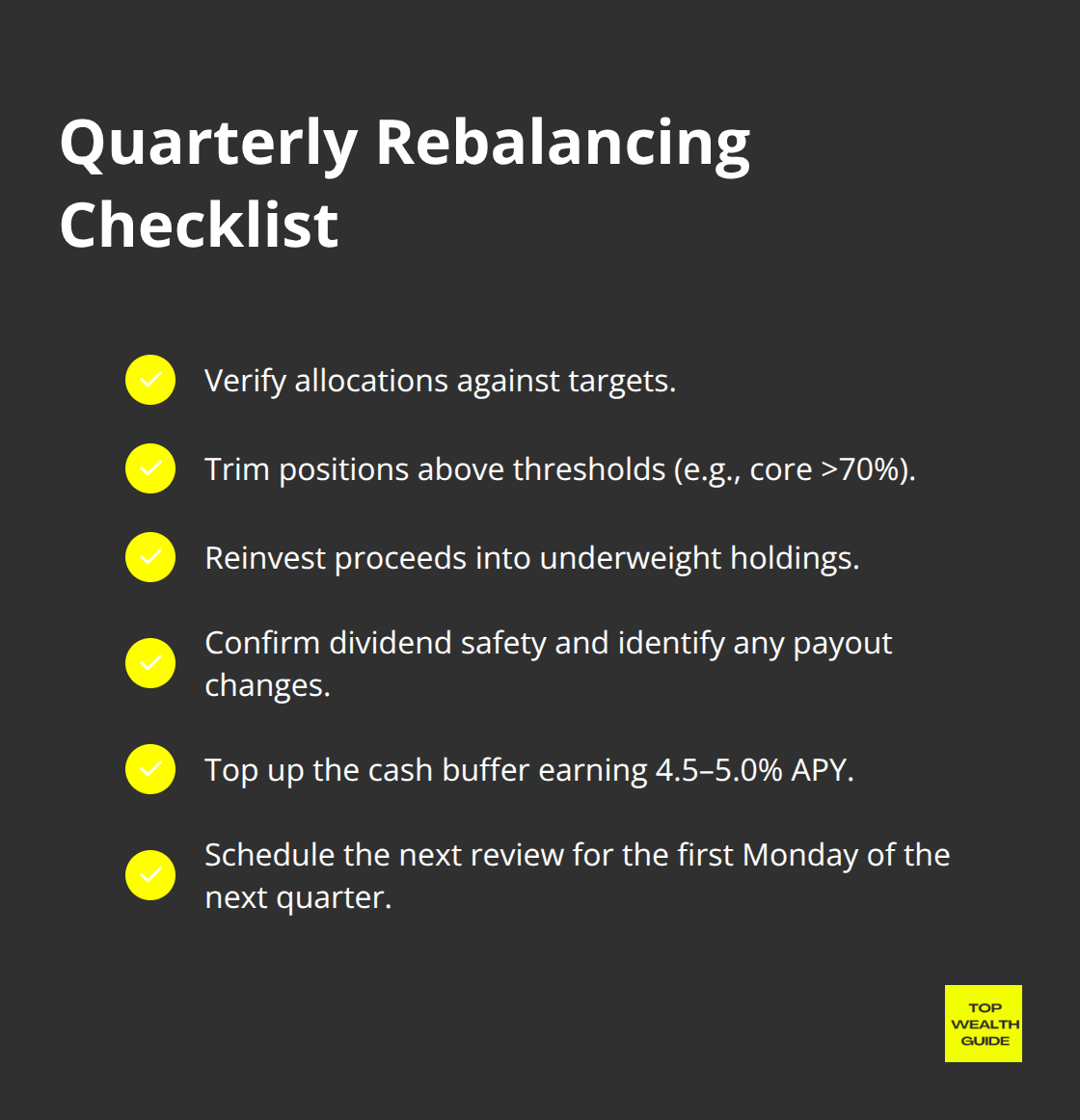

Set a calendar reminder for the first Monday of each quarter (January, April, July, October) to conduct your rebalancing review; this thirty-minute session prevents drift and catches deteriorating holdings before they damage returns. During rebalancing, check whether each position still represents your target allocation-if your core index fund has drifted above 70% of total portfolio value, sell enough dividend stocks to restore balance. This forced discipline mathematically outperforms emotional holding, as you automatically sell winners and purchase underperformers.

High-yield savings accounts earning 4.5-5.0% APY should hold three to six months of living expenses; this cash buffer prevents forced selling during market downturns.

Ignore Market Noise and Let Your System Work

Beyond quarterly reviews, ignore daily market movements entirely. Your portfolio generates income automatically, compounds through reinvestment, and requires no active trading. Market noise-headline inflation fears, rate hikes, geopolitical events-tempts people to abandon solid systems at exactly the wrong moments. The data proves otherwise: investors who check their portfolios more than monthly underperform those who check quarterly, because frequent monitoring triggers panic selling and poor timing decisions. Your system now operates independently, generating increasing passive income annually without requiring new decisions or capital additions beyond your automatic monthly contribution.

Final Thoughts

Your investment portfolio structure now rests on three proven pillars: dividend-paying stocks that generate quarterly income, REITs that provide real estate exposure without management burden, and bonds that deliver predictable cash flow. The data proves that investors who automate contributions, reinvest dividends, and rebalance quarterly outperform those who chase daily market movements. A £20,000 portfolio using dividend stocks like Shell, HSBC, and LondonMetric Property produces approximately £1,160 annually at a 5.8% blended yield, compounding into significantly larger income streams over time without requiring new decisions or active trading.

Open a brokerage account this week-the fifteen-minute process removes the largest barrier between intention and wealth building. Set up automatic monthly contributions starting at £200, direct funds into a core S&P 500 index fund first, then add satellite dividend positions once your foundation reaches £5,000. Enable dividend reinvestment in your account settings, schedule quarterly rebalancing reviews on your calendar, and maintain a cash buffer in a high-yield savings account earning 4.5–5.0% APY.

Ignore market noise between reviews and let your system operate independently. Top Wealth Guide provides the frameworks and step-by-step strategies to support your wealth-building journey. Start now, stay consistent, and let compounding work while you sleep.