So, you're eyeing a new motorcycle, ATV, or UTV and need a way to pay for it. That's where Freedom Road Financial comes in. They are a specialized lender that focuses exclusively on financing powersports vehicles, making them a key player for enthusiasts.

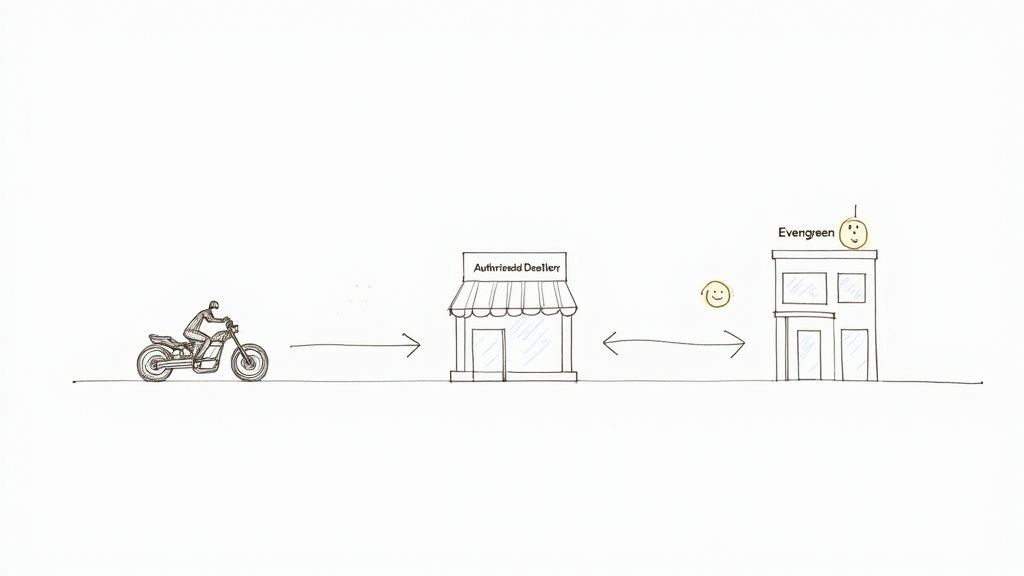

But here’s the twist: they aren't your typical bank. Freedom Road Financial is the national powersports lending division of Evergreen Bank Group, and they work directly through a network of authorized dealerships. Think of them as the in-house financing partner that makes it possible to get your loan and your keys in the same place.

In This Guide

Understanding Freedom Road Financial

We've all been there. You find the perfect bike, the one you've been dreaming of, only to hit a wall when it's time to figure out the financing. Do you go to your bank? A credit union? The process can feel disconnected and clunky.

Freedom Road Financial was built to solve that exact problem. By embedding their loan process right inside the dealership, they eliminate that extra step. You don't go to their website to apply; instead, you work with the finance team at the powersports dealer to get everything handled right on the spot. It’s all about making the purchase as seamless as possible.

How Their Dealer-Centric Model Works

The entire system is built on exclusive partnerships with powersports dealerships. This setup is designed to create a straightforward buying experience, merging the vehicle hunt and the financing approval into one fluid transaction. It's a very different approach compared to broader financial services, which you can explore in our overview of Freedom Financial.

So what does this mean for you as a buyer?

- One-Stop Shopping: You get to pick out your ride, fill out the loan application, and sign the final papers all in one go at the dealership.

- Specialized Focus: These guys live and breathe powersports. They understand the market and the real value of these vehicles, which can be a big advantage.

- No Direct Applications: Remember, you can't get pre-approved or apply online with them directly. Your journey starts and ends at one of their partner dealers.

Ultimately, this model is designed to get enthusiasts from the showroom floor to the open road with minimal fuss.

Diving Into Your Loan Options

Freedom Road Financial keeps things simple and focused. They stick to what they know best: offering retail installment loans specifically for powersports vehicles. This isn't your average, one-size-fits-all loan. It's built from the ground up for people buying motorcycles, ATVs, and UTVs through their approved dealer network.

That sharp focus allows them to offer some really appealing features for enthusiasts. One of the biggest draws is the flexibility in loan terms, which can go all the way up to 84 months. Spreading payments out over seven years can seriously lower your monthly bill, making that dream bike feel much more attainable.

Of course, a longer term means you'll likely pay more in interest over the life of the loan. It's a trade-off. You can play around with the numbers and see this in action using a compound interest calculator to understand how the total cost changes with the loan's length.

Key Loan Features at a Glance

For riders with a strong credit history, another standout feature is the chance to get a loan with zero down payment. This is a huge deal, as it removes one of the most common hurdles to buying a new vehicle. It’s a big part of how they’ve built their reputation since starting back in 2007, working exclusively with authorized partners like KTM and Triumph. You can find more details on FreedomRoad Financial's market position on zoominfo.com.

Let's break down what this looks like in the real world.

Real-Life Example: Zero-Down Financing

Alex, a weekend trail rider, has their eye on a new UTV that costs $15,000. Because Alex has a great credit score (750+), the dealership's finance manager, working with Freedom Road Financial, approves them for the full amount with $0 down on an 84-month term. Suddenly, that big purchase becomes a series of manageable monthly payments, and Alex gets on the trail without touching their savings account.

It’s this mix of a specialized product, long-term financing, and potential for no money down that makes their loans a go-to option for so many riders.

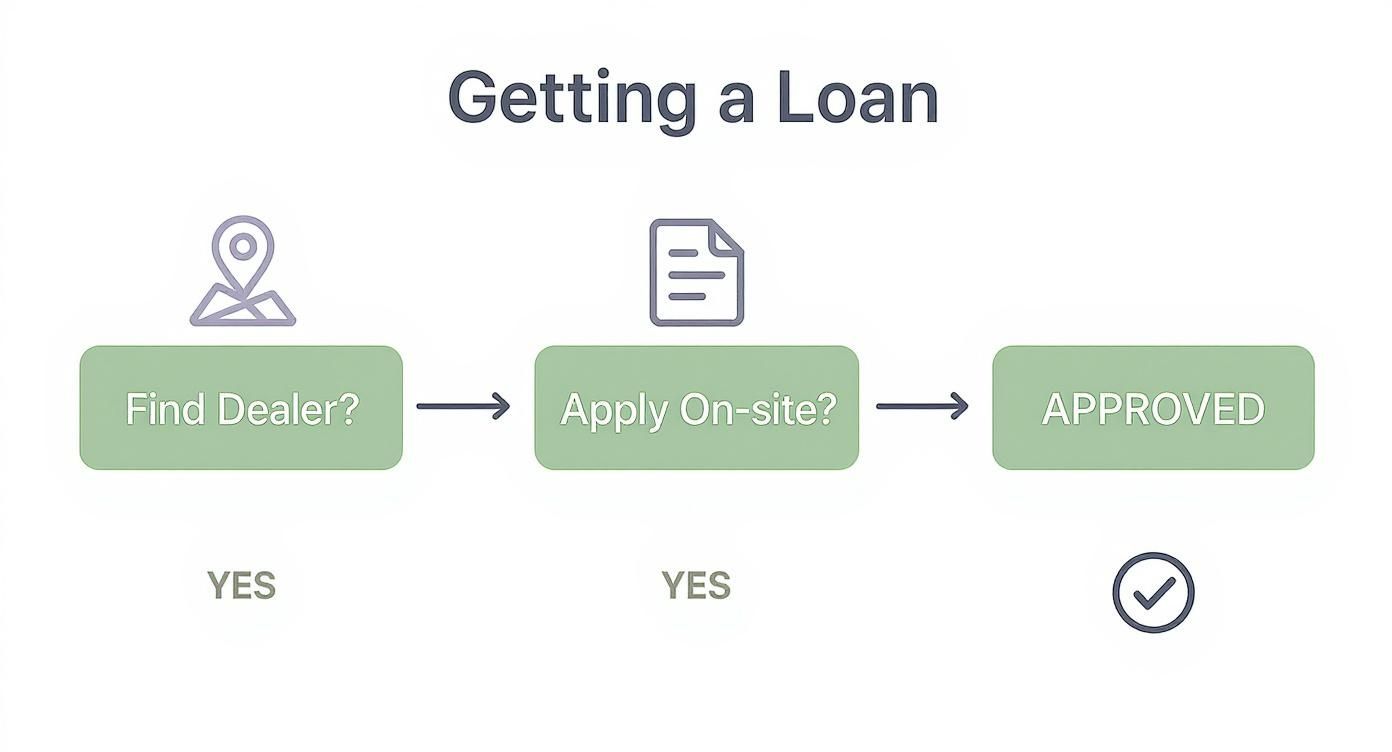

Getting Your Application on the Road

Unlike a traditional bank loan where you might fill out a form online, getting financed with Freedom Road Financial starts right on the showroom floor. You won't find an "Apply Now" button on their website—the whole process is built to happen at the dealership when you've found the ride you want.

This approach is all about making it a one-stop shop. Your first move is to find a powersports dealership that works with Freedom Road Financial. You'll often see them partnered with big names like KTM, Triumph, and Husqvarna. Once you've picked out that perfect motorcycle or ATV, the dealer’s finance manager becomes your guide.

What to Bring to the Dealership

To keep things moving smoothly, you'll need to have some standard financial info on hand. Think of it like any other major purchase.

Here’s a quick checklist of what they’ll likely ask for:

- Proof of Identity: A valid driver's license or another government-issued photo ID.

- Proof of Residence: A recent utility bill or bank statement with your current address.

- Proof of Income: Your last couple of pay stubs or other proof of a steady income.

Of course, your credit history plays a huge role. The lender will look at your credit score, but they'll also pay close attention to your debt-to-income (DTI) ratio. This is just a simple comparison of how much you owe each month versus how much you earn. A lower DTI shows that you're not overextended, making you a less risky borrower.

If you're looking to improve your DTI, it's always a good idea to pay down existing debts. Many people find they can crush their debt fast with the debt snowball method to get their finances in great shape before a big purchase.

Walking into the dealership prepared makes the whole process faster and less stressful. With your documents in order, you can focus on the fun part—getting the keys and hitting the road.

Comparing Freedom Road Financial to Other Lenders

Alright, so you’ve got your eye on a new ride. Now for the big question: how are you going to pay for it? While Freedom Road Financial offers a pretty straightforward path through your dealership, it’s smart to look at the whole playing field. Every financing option has its own quirks, and what works for one person might not be the best fit for you.

Think of it like this: Freedom Road is the "in-house" specialist at the dealership. The process is designed to be seamless, getting you from browsing to riding as quickly as possible. This infographic breaks down that simple, dealer-focused journey.

As you can see, everything starts and ends right there at the store, which is a huge plus for convenience. But is convenience worth a potentially higher rate? Let's dig in.

Real-Life Example: Comparing Lender Options

Maria wants to buy a $10,000 motorcycle. She has good credit.

- Freedom Road Financial: The dealer offers her a loan at 8.9% APR over 72 months for maximum convenience. Her payment is around $180/month.

- Local Credit Union: She applies separately and gets pre-approved for a 6.5% APR loan over 60 months. Her payment is around $196/month, but she'll pay off the bike faster and save over $800 in total interest.

- Manufacturer Financing: It's a special promotion weekend, and the manufacturer offers 1.9% APR for 36 months. Her payment would be much higher at about $286/month, but her total interest cost would be minimal.

Maria chooses the credit union. While it took an extra day to secure the loan, the long-term savings were worth it for her. This highlights the trade-off between convenience and cost.

Powersports Financing Options Comparison Table

To make a smart decision, you need to compare apples to apples. The best choice really boils down to what you prioritize. Are you chasing the absolute lowest interest rate, or is getting the keys in your hand today the most important thing? Knowing your own financial standing is the first step. If you need a refresher, check out our guide on why financial literacy is the key to building wealth.

| Financing Option | Typical Interest Rates | Loan Terms | Best For | Potential Drawbacks |

|---|---|---|---|---|

| Freedom Road Financial | Moderate to High | Very flexible, up to 84 months | Convenience and one-stop shopping at the dealership. | Higher rates than credit unions; limited to partner dealers. |

| Manufacturer Financing | Often has promotional rates (0% APR) | Varies by promotion, can be shorter | Buyers with excellent credit who qualify for special deals. | Strict credit requirements; promotions are time-sensitive. |

| Credit Unions | Typically the lowest available | Standard, usually 36-72 months | Borrowers seeking the best possible interest rate. | Requires separate application and membership; slower process. |

| Traditional Banks | Moderate | Standard, usually 48-72 months | Individuals with an established banking relationship. | Less specialized in powersports; may have stricter collateral rules. |

Ultimately, there's no single "best" lender—only the one that’s right for your situation. Take a look at your credit score, how much you want to spend per month, and how quickly you need the financing to come through. That will point you in the right direction.

Weighing the Pros and Cons

Whenever you're choosing a lender, you have to look at the whole picture—the good, the bad, and everything in between. Freedom Road Financial has a specific way of doing things that’s a fantastic match for some riders but might not be the right fit for everyone.

Advantages of Freedom Road Financial

- Unmatched Convenience: The entire process happens at the dealership. You find your vehicle, apply for the loan, and sign the papers in one visit.

- Powersports Specialization: They understand the value of motorcycles, ATVs, and UTVs better than a general lender, which can lead to more favorable loan-to-value ratios.

- Flexible Terms: Loan terms up to 84 months can make monthly payments more affordable and accessible.

- Zero-Down Options: Qualified buyers can often finance 100% of the purchase price, reducing the upfront cash needed.

Potential Drawbacks to Consider

- No Pre-Approvals: You can't shop around with a pre-approved offer. This limits your ability to compare rates beforehand and may weaken your negotiating position.

- Potentially Higher Rates: The price of convenience can sometimes be a higher interest rate compared to what you might get from a credit union.

- Limited to Partner Dealers: Your choice of dealerships is restricted to those within their network. If you find a great deal elsewhere, you'll need another financing source.

The Bottom Line: Freedom Road Financial is built for one thing: a fast, simple, and totally integrated buying experience. If you value getting everything done at the dealership quickly, it's hard to beat.

This focused business model is a core part of their identity. They’ve been steadily growing by leaning into what they do best, recently bringing more of their services online to better serve customers across the country. Their strong alliances with major manufacturers show they are a serious player in the powersports world. You can read more about their strategic updates for an exciting 2024 on prnewswire.com.

Frequently Asked Questions (FAQ)

Here are answers to the 10 most common questions about financing with Freedom Road Financial.

1. What credit score do I need for a Freedom Road Financial loan?

There is no specific minimum credit score published. They work with a wide range of credit profiles, but as with any lender, a higher score (typically 670 and above) will give you access to the best rates and terms. The dealership's finance manager can provide the most accurate guidance based on your personal credit history.

2. Can I get pre-approved before going to the dealership?

No. Freedom Road Financial's model is entirely dealer-based. The application process begins at a partner dealership after you have selected a vehicle.

3. Are there penalties for paying off my loan early?

Typically, no. Their loans are simple interest installment loans, which means you can usually pay them off ahead of schedule without incurring any prepayment penalties. This allows you to save on interest over the life of the loan.

4. What types of vehicles does Freedom Road Financial finance?

They specialize in financing new and used powersports vehicles, including motorcycles, ATVs, UTVs, and side-by-sides from their partner manufacturers like KTM, Triumph, Husqvarna, and others.

5. Can I finance accessories and gear with my vehicle loan?

Yes. It is very common to bundle the cost of accessories, riding gear, extended warranties, and performance parts into the main vehicle loan. This can be arranged with the finance manager at the dealership.

6. How do I make my monthly payments?

Freedom Road Financial offers multiple payment options for convenience. You can typically pay online through their customer portal, by mail, or over the phone. You will receive detailed instructions after your loan is finalized.

7. How do I find a participating dealership?

The best method is to visit the official website of the powersports brand you're interested in (e.g., KTM, Triumph) and use their dealer locator tool. Authorized dealers for these brands are highly likely to be partners with Freedom Road Financial.

8. What happens after I pay off my loan?

Once your final payment is processed, Freedom Road Financial will release the lien on your vehicle's title. They will then send the title or the necessary lien-release documents directly to you or your state's DMV, according to local regulations.

9. Can I use a co-signer on my loan application?

Yes, in most cases, you can apply with a co-signer or co-applicant. This can be very helpful for applicants who are building their credit or whose income doesn't quite meet the requirements on its own.

10. Does Freedom Road Financial offer refinancing for existing loans?

No, this is not their primary business. They focus on providing purchase financing through their dealer network. If you are looking to refinance an existing powersports loan, you will need to explore options with other lenders like credit unions or traditional banks. For more information, you can read our Freedom Financial Road guide.

At Top Wealth Guide, our mission is to provide you with the clear, actionable financial insights you need to achieve your goals. Whether you're financing a new purchase or planning your long-term investment strategy, we're here to help you navigate the journey. Explore more resources and expert guidance at https://topwealthguide.com.