A decentralized exchange is a peer-to-peer crypto marketplace where traders transact directly with each other without a middleman. Unlike centralized exchanges that hold your funds, a DEX allows you to maintain full control by trading straight from your personal wallet, a core principle of self-custody.

In This Guide

- 1 What Is a Decentralized Crypto Exchange?

- 2 How Decentralized Exchanges Actually Work

- 3 Key Benefits of Using a DEX for Crypto Trades

- 4 Diving Into the Risks and Challenges of DEXs

- 5 Comparing the Top Decentralized Exchanges

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. Are DEXs completely safe to use?

- 6.2 2. Why do I have to pay "gas fees" on a DEX?

- 6.3 3. Can I trade Bitcoin (BTC) on an Ethereum DEX like Uniswap?

- 6.4 4. What is "slippage" and how can I avoid it?

- 6.5 5. What happens if I lose my wallet's private keys or seed phrase?

- 6.6 6. How do DEXs make money?

- 6.7 7. Do I have to pay taxes on DEX trades?

- 6.8 8. What is a "rug pull" on a DEX?

- 6.9 9. What is the difference between an AMM and an Order Book DEX?

- 6.10 10. Which wallet is best for using a DEX?

What Is a Decentralized Crypto Exchange?

Imagine a farmers' market. You walk up to a farmer and swap your cash for their vegetables, right then and there. There's no store manager watching over, holding the money, or telling the farmer what they can or can't sell. A decentralized exchange (DEX) applies that exact same peer-to-peer concept to the world of crypto.

You don't deposit your assets into an account run by a company like Coinbase or Binance. Instead, you connect your personal crypto wallet to the DEX. The trades themselves are executed by smart contracts—self-executing code on a blockchain—to ensure the swap happens as agreed, removing the need to trust a third party.

The Core Principles of a DEX

The entire concept of a DEX is built on a few powerful principles that distinguish it from the traditional financial world. Understanding these is key to grasping why DEXs are a cornerstone of decentralized finance (DeFi). If you're new to the space, you can learn more about what is cryptocurrency and how does it work in our beginner's guide.

Here are the main ideas that drive a DEX:

- Self-Custody: This is the most crucial principle. With a DEX, you never surrender your private keys. You've likely heard the crypto mantra, "not your keys, not your coins," and this is its practical application. Your assets remain in your wallet until the moment a trade is executed.

- Permissionless Access: If you have a crypto wallet and an internet connection, you can trade. There are no sign-up forms, no identity verification (KYC/AML), and no geographic restrictions imposed by a central authority.

- Censorship Resistance: Since no single entity is in charge, no one can freeze your account, block a transaction, or delist an asset at will. The platform operates strictly according to the rules coded into its smart contracts.

A decentralized exchange isn't an "exchange" in the traditional sense. It's better understood as a suite of smart contracts that enables users to swap crypto directly, eliminating the need for a trusted intermediary to hold funds or match orders.

This model grants you complete control, but it also means you bear full responsibility for your own security.

Decentralized vs. Centralized Exchanges: A Direct Comparison

To truly highlight the difference, let’s place a DEX and a centralized exchange (CEX) side-by-side. The contrast in their philosophies and operations becomes stark when examining how they handle fundamental aspects like security, privacy, and control.

| Feature | Decentralized Exchange (DEX) | Centralized Exchange (CEX) |

|---|---|---|

| Asset Custody | You control your private keys and funds. | The exchange holds your funds in its wallets. |

| User Privacy | Anonymous; no personal information required. | Requires KYC/AML identity verification. |

| Asset Listings | Permissionless; anyone can create a trading pair. | Curated; the exchange decides which assets to list. |

| Security Risk | Smart contract bugs and vulnerabilities. | Hacking of the exchange's centralized servers. |

| User Support | Community-driven (e.g., forums, Discord). | Dedicated customer support teams. |

| Primary Weakness | User experience can be complex for beginners. | Single point of failure; regulatory risk. |

Ultimately, the choice between them involves a trade-off: CEXs offer convenience and user support, while DEXs provide autonomy and privacy at the cost of personal responsibility.

How Decentralized Exchanges Actually Work

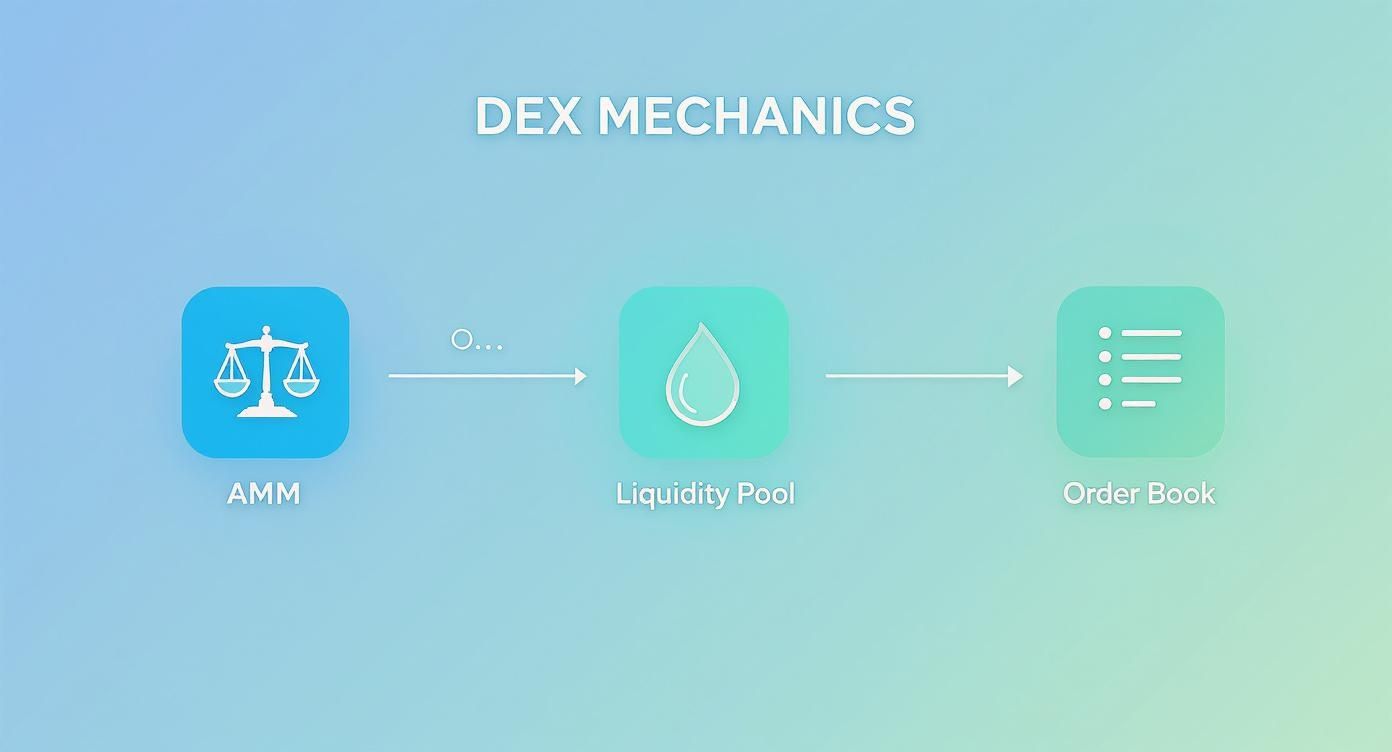

To understand what makes a decentralized exchange function, you have to look under the hood. Unlike a traditional exchange that maintains a central order book to match buyers and sellers, a DEX operates on automated code. This code typically follows one of two primary models: Automated Market Makers (AMMs) or Order Books.

Don't be intimidated by the technical terms; the concepts are quite intuitive. One acts like a self-balancing pool of crypto, while the other is essentially the New York Stock Exchange rebuilt on a blockchain. Understanding these two systems is key to appreciating the mechanics of instant, direct crypto trading.

The Automated Market Maker (AMM) Model

The engine powering most modern DEXs is the Automated Market Maker, or AMM. Instead of matching individual buyers with sellers, an AMM utilizes large reserves of crypto called liquidity pools to execute trades instantly.

Picture a liquidity pool as a large pot of money co-owned by the community. This pot holds a pair of tokens, for example, Ether (ETH) and USDC. When you want to swap your ETH for USDC, you add your ETH to the pot and withdraw an equivalent value of USDC. The price isn't determined by a list of offers; it's calculated by a mathematical formula based on the ratio of the two tokens in the pool at that moment.

So, who provides the funds for this pot? Users known as Liquidity Providers (LPs). These are individuals who deposit an equal value of both assets into the pool. In return for providing this service—which is what makes trading possible—LPs earn a small fee from every swap that uses their pool.

The AMM was a groundbreaking innovation that made decentralized trading accessible to the masses. It eliminated the need for a buyer and seller to be online at the same time, creating a market that is always liquid and available 24/7.

The On-Chain Order Book Model

The other, more traditional approach is the on-chain order book. This model functions almost identically to a classic stock exchange or a centralized crypto platform like Binance. It maintains a real-time list of all open buy orders (bids) and sell orders (asks) for a specific crypto asset.

When you place an order to sell 1 ETH for $3,000, for instance, the exchange’s smart contract searches the order book for a corresponding buy order at that price. If a match is found, the trade is executed.

The advantage here is price precision. The major drawback, however, is that operating this entire system on a blockchain can be slow and expensive. Every single action—placing an order, canceling an order—must be recorded as a transaction on the network, which can lead to significant gas fees. For a deeper dive into the technology that underpins this, explore our articles on blockchain basics.

AMM vs. On-Chain Order Book: A Quick Comparison

To make the distinction clear, here’s a quick rundown of how the two DEX models compare.

| Feature | Automated Market Maker (AMM) | On-Chain Order Book |

|---|---|---|

| Price Determination | Algorithmic, based on token ratio in a pool. | Matches specific buy and sell orders. |

| Liquidity Source | Sourced from community liquidity providers. | Depends on active buyers and sellers placing orders. |

| User Experience | Simple and instant swaps. | More complex; requires setting specific prices. |

| Best For | Quick, simple trades of common tokens. | Precise trading by experienced users. |

| Key Challenge | Impermanent loss for liquidity providers. | High gas fees and slower performance. |

A Real-Life Example: Swapping on an AMM DEX

Let's walk through a practical example. Imagine you want to swap 1 ETH for USDC on an AMM-based DEX like Uniswap. Here’s how it would play out step-by-step:

- Connect Your Wallet: You visit the Uniswap website and connect your personal crypto wallet (e.g., MetaMask). Your funds never leave your custody.

- Select Tokens: You specify that you want to trade from ETH and receive USDC.

- Enter Amount: You input that you are selling 1 ETH. The AMM's algorithm instantly calculates and displays the exact amount of USDC you will receive based on the pool's current balance.

- Confirm the Swap: You review a final summary, including the network fee (gas). If everything looks correct, you click "Swap" and provide a final approval in your wallet.

- Transaction Execution: The smart contract automatically sends your 1 ETH into the liquidity pool and simultaneously transfers the corresponding amount of USDC directly back to your wallet.

The entire process is completed in seconds, with no intermediaries. This kind of direct, efficient access is what has fueled DeFi's incredible growth. The total value locked (TVL) in DeFi protocols recently surged to $123.6 billion, a 41% increase in just one year. On a typical day, DEXs now handle around $4.93 billion in trading volume. You can explore more statistics about the rise of decentralized exchanges on CoinLaw.io.

Key Benefits of Using a DEX for Crypto Trades

The rising popularity of decentralized crypto exchanges is not a passing trend. It's a fundamental shift driven by the inherent limitations of traditional, centralized platforms. Traders are moving to DEXs for a few core reasons: greater control, enhanced privacy, and access to a much broader universe of digital assets.

At the top of that list is self-custody. When you use a centralized exchange like Coinbase or Binance, you are entrusting your crypto to their wallet. You are trusting them to safeguard it. A DEX completely inverts this model. Your funds remain in your personal wallet right up until a trade is finalized.

This means you, and only you, hold the private keys. That simple fact eliminates the single biggest risk of centralized exchanges—the danger of the entire platform being hacked or going bankrupt, taking customer funds with it. With a DEX, you are in charge of your own security.

Unparalleled Access and Privacy

Beyond asset security, DEXs democratize finance. They are built on public blockchains, governed by code, and are not beholden to any single company or country. All you need is a crypto wallet and an internet connection to participate.

This is a significant advantage for individuals in regions with unstable financial systems, offering them a direct and uncensorable link to global markets. Furthermore, most DEXs do not require Know Your Customer (KYC) verification.

- No Personal Data: You won't be asked to upload your passport, driver's license, or proof of address. This drastically reduces the risk of your sensitive information being compromised in a data breach.

- Enhanced Anonymity: Your trading activity is linked to your public wallet address, not your personal identity. This provides a powerful layer of privacy that centralized platforms cannot match.

This infographic illustrates how DEXs facilitate direct, user-to-user trades without a middleman.

As you can see, whether through an AMM’s liquidity pool or a traditional order book, the objective is the same: to enable you to swap assets directly with another person.

The Gateway to New Opportunities

For traders seeking the next big thing, DEXs are the primary destination. New crypto projects almost always list their tokens on a decentralized exchange first. The reason is simple: getting listed on a major centralized exchange is a slow, bureaucratic, and extremely expensive process.

On a DEX, anyone can create a new trading pair and provide liquidity for a brand-new token in minutes. This permissionless nature makes DEXs the number one venue for discovering new and under-the-radar assets before they reach the mainstream.

This gives savvy investors a significant advantage. You might discover a promising new project and acquire its token on a DEX weeks or even months before it is considered for listing on a major CEX. Incorporating this kind of early-stage discovery into your broader cryptocurrency investment strategies can be transformative. While it carries higher risk, the potential rewards are what attract so many to the DEX ecosystem.

Diving Into the Risks and Challenges of DEXs

While DEXs offer compelling benefits, they are not without significant risks. The same self-custody that gives you complete control also places all responsibility squarely on your shoulders. It’s a very different world from centralized exchanges, with its own unique set of traps for the unwary.

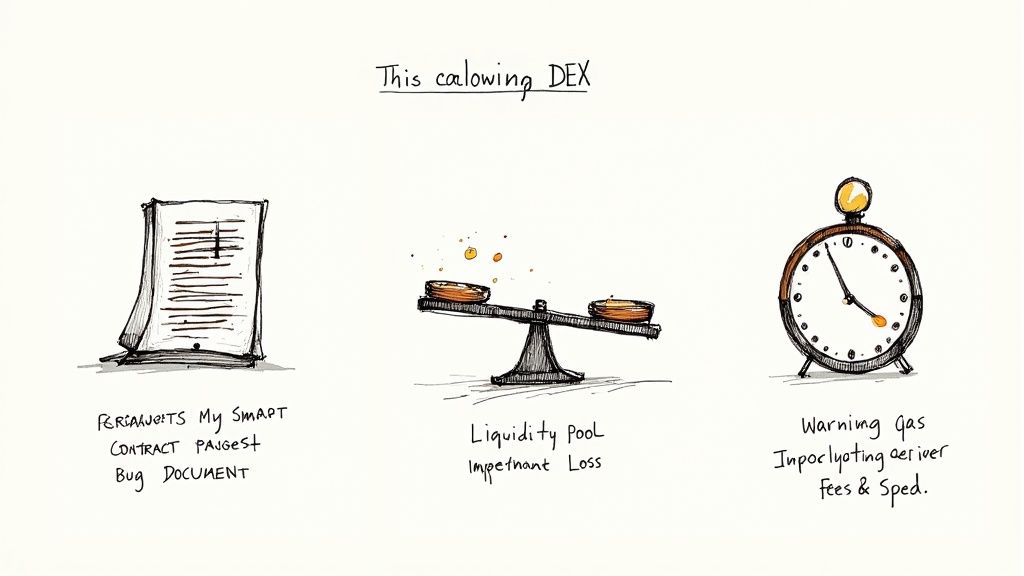

The most significant risk is smart contract vulnerability. These platforms are built on code, and even a minor bug can create an opening for a hacker. We’ve seen it happen repeatedly—DeFi projects losing millions of dollars overnight to exploits in code that was believed to be secure.

When funds are stolen from a smart contract, they are typically gone forever. There is no fraud department to call or FDIC insurance to cover your losses. This is why it's absolutely critical to use DEXs that have been battle-tested and audited by multiple reputable security firms.

Getting Your Head Around Impermanent Loss

If you are considering providing liquidity to earn trading fees, you must understand a concept known as impermanent loss. It's not a direct "loss" in the traditional sense, but rather an opportunity cost. It occurs when the price of a token you’ve deposited into a pool changes relative to the other token.

Let's illustrate with a real-life example:

- Initial Deposit: You provide liquidity to an ETH/USDC pool by depositing 1 ETH (valued at $3,000) and 3,000 USDC. Your total initial stake is $6,000.

- Market Movement: A week later, the price of ETH doubles to $6,000. To maintain the pool's balance, arbitrage traders buy the "cheaper" ETH from the pool, adding USDC in the process.

- Your Pool Share Changes: Due to this rebalancing, your share of the pool is now approximately 0.707 ETH and 4,242 USDC. The total value is now $8,484 (0.707 ETH * $6,000 + 4,242 USDC). You've made a profit.

- The "Loss" Revealed: Here's the catch. If you had simply held your original assets, you'd have 1 ETH (now worth $6,000) and 3,000 USDC. Your total holdings would be $9,000. The $516 difference ($9,000 – $8,484) is your impermanent loss.

The trading fees you earn can often offset this loss, but it is a fundamental risk that every liquidity provider must accept.

The Not-So-User-Friendly Side of Things

Beyond the technical dangers, the user experience on a DEX can be challenging, especially for newcomers. There is no customer support chat to guide you. If a transaction gets stuck or you accidentally send funds to the wrong blockchain address, you are on your own.

You are also subject to the whims of the blockchain network itself, which can introduce its own frustrations:

- Volatile Gas Fees: The transaction fee, known as a gas fee, can fluctuate wildly. During peak network congestion, a simple swap on Ethereum could cost an exorbitant amount.

- Failed Transactions: If you set your gas fee too low during a busy period, your transaction may fail. The most frustrating part? You still lose the gas fee you paid for the attempt.

- Scams and Rug Pulls: Since anyone can create and list a token on a DEX for minimal cost, the space is fertile ground for scams. A "rug pull" is a common tactic where developers promote a new token, attract liquidity, and then suddenly withdraw all the valuable assets, leaving investors with a worthless token.

Key Takeaway: Using a DEX means embracing total self-reliance. Your wallet's security, the research you do, and the transactions you sign are 100% your responsibility.

Your best defense is diligent research. Before swapping for any new token, investigate the project, verify the team's credibility, and gauge community sentiment. Mastering this due diligence is a fundamental part of learning how to invest in cryptocurrency responsibly.

Comparing the Top Decentralized Exchanges

https://www.youtube.com/embed/2tTVJL4bpTU

With hundreds of decentralized exchanges available, choosing the right one can be daunting. While they all share core principles, a few heavyweights define the landscape.

Understanding these key players offers a window into how different blockchains and design philosophies shape the trading experience. Let’s examine the platforms that set the standard: Uniswap, PancakeSwap, and Curve Finance. Each has carved out a niche, from all-purpose token swapping to hyper-efficient stablecoin trades.

The Big Three DEX Platforms

Uniswap is the original AMM powerhouse on Ethereum. It is the go-to destination for trading the widest possible range of ERC-20 tokens. If a project exists on Ethereum, new or established, you will likely find it on Uniswap. Its deep liquidity pools mean you can execute large trades without significant price impact (slippage).

PancakeSwap effectively cloned the Uniswap model and deployed it on the BNB Smart Chain. It offers a very similar user experience but with a crucial advantage: significantly lower transaction fees. This makes it a favorite for traders conducting smaller, more frequent swaps where Ethereum’s gas fees would be prohibitive.

Curve Finance is a highly specialized DEX. Its entire system is engineered to facilitate swaps between stablecoins and other assets designed to trade at a 1:1 ratio (like different versions of wrapped Bitcoin). Curve’s unique algorithm minimizes slippage to near-zero levels, making it the preferred platform for traders moving large volumes of stable assets.

Top Decentralized Exchange Platforms Compared

This table provides a head-to-head comparison to help you decide which platform best suits your needs. Your choice will likely depend on your preferred blockchain and the types of tokens you intend to trade.

If you’re just starting, our guide on the 12 best cryptocurrency exchanges for beginners offers a broader look at both centralized and decentralized options.

| Feature | Uniswap | PancakeSwap | Curve Finance |

|---|---|---|---|

| Primary Chain | Ethereum | BNB Smart Chain | Multi-chain (Ethereum, Polygon, etc.) |

| Best For | Widest variety of ERC-20 tokens | Low-cost, frequent trading | Large stablecoin swaps |

| Key Advantage | Deepest liquidity on Ethereum | Very low transaction fees | Extremely low slippage for like-assets |

| Primary Risk | High gas fees during network congestion | Centralization concerns of BNB Chain | Complex tokenomics (veCRV) for new users |

So, what does this mean in practice?

Real-World Example: Let's say you hear about a hot new ERC-20 token. Uniswap is almost certainly where you'll find it first. But if all you want to do is swap a large bag of USDT for USDC, Curve will get you the best possible rate. And for a simple, cheap trade of BNB for another popular token on that chain, PancakeSwap is the fastest and most affordable way to go.

The numbers speak for themselves. Uniswap has reclaimed its position as the market leader, commanding nearly 36% of the market share with over $111 billion in monthly volume. Meanwhile, PancakeSwap has experienced its own explosive growth, reaching a record monthly trading volume of $325 billion. It’s clear these platforms are not just niche tools—they are massive financial hubs.

Frequently Asked Questions (FAQ)

1. Are DEXs completely safe to use?

DEXs are safer in some ways but not risk-free. The key safety feature is self-custody: you always control your private keys, so the exchange itself cannot be hacked to lose your funds. The primary risk lies in the smart contracts. A bug in the code could be exploited by hackers. To mitigate this, use well-established DEXs that have undergone multiple public security audits.

2. Why do I have to pay "gas fees" on a DEX?

Every action on a DEX (like swapping tokens) is a transaction that must be recorded on the blockchain. Gas fees are payments made to network validators or miners to process and confirm your transaction. This fee goes to the blockchain network (e.g., Ethereum), not the DEX itself. Fees fluctuate based on network demand—more traffic means higher fees.

3. Can I trade Bitcoin (BTC) on an Ethereum DEX like Uniswap?

Not directly. Bitcoin and Ethereum are separate blockchains that cannot communicate with each other. To trade the value of Bitcoin on Ethereum, you use Wrapped Bitcoin (WBTC), an ERC-20 token pegged 1:1 to the value of BTC. This allows Bitcoin's value to be represented and traded within the Ethereum DeFi ecosystem.

4. What is "slippage" and how can I avoid it?

Slippage is the difference between the expected price of a trade and the price at which it is actually executed. It happens due to rapid price changes or low liquidity. You can manage this by setting a slippage tolerance (e.g., 0.5% or 1%) in the DEX interface. This tells the smart contract to cancel the trade if the price moves against you by more than your set percentage.

5. What happens if I lose my wallet's private keys or seed phrase?

Your funds will be lost forever. This is the uncompromising reality of self-custody. There is no "forgot password" option or customer support to help you recover access. A DEX cannot help because it never had control of your keys. It is absolutely critical to write down your seed phrase and store it securely offline.

6. How do DEXs make money?

Most DEXs generate revenue by charging a small trading fee on each swap, typically between 0.05% and 0.3%. A significant portion of this fee is distributed to liquidity providers as a reward for funding the pools. The remainder may go to a project treasury, which is often governed by token holders to fund the platform's development and growth.

7. Do I have to pay taxes on DEX trades?

Yes, in most jurisdictions. In countries like the United States, swapping one cryptocurrency for another is a taxable event. You are considered to have "sold" the first asset, potentially triggering capital gains or losses. Since DEXs are pseudonymous and don't issue tax forms, you are responsible for tracking your own transaction history for tax reporting purposes.

8. What is a "rug pull" on a DEX?

A "rug pull" is a type of exit scam where developers create a new token, pair it with a legitimate one (like ETH) in a liquidity pool, and heavily promote it to drive up the price. Once enough investors have swapped their ETH for the new token, the developers withdraw all the ETH from the liquidity pool, causing the new token's value to crash to zero. Always be extremely cautious with new, unvetted projects.

9. What is the difference between an AMM and an Order Book DEX?

They are two different methods for matching trades. An Order Book DEX works like a traditional stock market, maintaining a list of buy and sell orders and matching them. An AMM (Automated Market Maker) uses liquidity pools and a mathematical formula to determine prices, allowing users to trade against the pool rather than directly with other traders. AMMs guarantee liquidity but can be subject to impermanent loss for providers.

10. Which wallet is best for using a DEX?

The "best" wallet depends on your needs. For desktop use on Ethereum and EVM-compatible chains, MetaMask is the industry standard. For a mobile-first experience, Trust Wallet is very popular. For specific ecosystems, you'll need a native wallet, like Phantom for Solana. For maximum security, using a hardware wallet from a trusted brand like Ledger or Trezor in conjunction with a software wallet is the gold standard.

At Top Wealth Guide, we're dedicated to helping you understand the financial landscape, from traditional stocks to the evolving world of crypto. Our goal is to provide the clear insights and actionable strategies you need to build your wealth with confidence. Explore more guides and resources at https://topwealthguide.com.