Building wealth through real estate isn’t just a saying; it’s a time-tested strategy that has worked for generations. At its core, it’s about owning a tangible asset that can generate income every month while its value quietly grows in the background. My own journey started over a decade ago with a single duplex, and I’ve experienced firsthand how this two-for-one approach can fundamentally change your financial future.

In This Guide

- 1 Why Real Estate Is a Proven Path to Wealth

- 2 Finding Your First Profitable Property

- 3 Smart Financing to Accelerate Your Growth

- 4 Managing Properties for True Passive Income

- 5 Scaling Your Portfolio for Generational Wealth

- 6 Common Questions About Real-Life Real Estate Investing

- 7 Frequently Asked Questions

- 7.1 1. What credit score do I need to buy an investment property?

- 7.2 2. Can I use my retirement account to invest in real estate?

- 7.3 3. How do I accurately estimate repair costs for a fix-and-flip?

- 7.4 4. What is the best way to find undervalued properties?

- 7.5 5. Are short-term rentals (like Airbnb) more profitable than long-term rentals?

- 7.6 6. How many properties do I need to own to achieve financial freedom?

- 7.7 7. What kind of insurance do I need for a rental property?

- 7.8 8. What’s the difference between cash flow and appreciation?

- 7.9 9. Should I pay off my rental properties quickly or keep them leveraged?

- 7.10 10. How do rising interest rates affect real estate investing?

Why Real Estate Is a Proven Path to Wealth

When you stack it up against stocks or bonds, real estate just plays in a different league. It’s not about crossing your fingers and hoping the market goes up. It’s a hands-on, strategic game where you use a physical asset to create wealth in several ways at once. The beautiful part? The concepts are surprisingly simple.

Seasoned investors know that success boils down to four powerful elements working in harmony:

- Steady Appreciation: History has shown us that over the long haul, property values climb. Things like inflation, growing communities, and new developments all push values upward, building your net worth while you sleep.

- Consistent Cash Flow: This is your bread and butter. The rent you collect each month is a dependable stream of income. Once you’ve paid the mortgage and other bills, the rest is pure profit you can pocket or reinvest.

- Powerful Tax Advantages: This is where the pros really win. The IRS allows you to deduct a whole host of expenses—mortgage interest, property taxes, insurance, repairs, you name it. Plus, depreciation is a fantastic “paper” expense that can slash your taxable income without costing you a dime out of pocket.

- Strategic Use of Leverage: You don’t need to be a millionaire to buy a valuable property. With a loan, you can control a large asset with a relatively small amount of your own money. This is huge because you get to profit from the appreciation of the entire property, not just the cash you put in.

Putting It All Together: A Real-World Example

Let’s make this real with a personal example. I bought a duplex for $400,000 early in my career. I put down 20%, which was $80,000.

I lived in one half and rented out the other for $1,800 a month. Right away, that rental income helped pay down my mortgage, dramatically cutting my own housing costs. This strategy, known as “house hacking,” allowed me to live nearly for free.

Fast forward ten years. My tenants have paid down a significant portion of my loan balance. The property’s value has increased to over $650,000 due to neighborhood improvements. And all along, I’ve been taking advantage of tax deductions. It’s a wealth-building machine, all powered by a single, smart investment.

Of course, a solid financial plan is never a one-trick pony. While property is a fantastic foundation, it’s wise to diversify. You can explore some of the best ways to build wealth to see how real estate fits into a bigger picture.

The confidence in this asset class isn’t just anecdotal; the numbers back it up. A recent global real estate market report showed that direct property transactions hit a staggering US$179 billion in just one quarter. That’s a 14% jump from the previous year, proving that investors around the world continue to pour capital into real estate as a trusted wealth-building tool.

Finding Your First Profitable Property

Before you even start scrolling through listings, you need to decide what kind of investor you want to be. Your strategy is your compass, and without it, you’re just wandering. The path you choose will shape everything from how you finance your deal to how much time you spend managing it.

For many, the classic long-term residential rental is the perfect entry point. It’s a proven model for generating consistent monthly income while the property appreciates in the background. If you’re more of a hands-on person looking for a bigger, faster payday, a fix-and-flip might be more your speed, but be prepared for the higher stakes and intense involvement it demands.

Then you have short-term vacation rentals, which can be cash cows in tourist hotspots but feel more like running a hotel than a passive investment. On the other end of the spectrum are commercial properties—think small office buildings or retail shops—that often come with longer leases and bigger returns, but also a much higher price tag to get in the game.

Comparing Real Estate Investment Strategies

To really get a feel for where you fit, it helps to see these strategies laid out side-by-side. This table breaks down the key differences to help you match your goals, capital, and available time with the right approach.

| Strategy | Best For | Capital Needed | Time Commitment | Risk Level |

|---|---|---|---|---|

| Long-Term Rentals | Investors seeking steady cash flow and appreciation over time. | Medium | Low to Medium | Low |

| Fix-and-Flips | Hands-on investors aiming for quick, large profits. | Medium to High | High | High |

| Short-Term Rentals | Investors in high-demand areas who can manage frequent turnover. | Medium | High | Medium |

| Commercial Property | Investors with significant capital looking for long-term tenants. | High | Low to Medium | Medium |

As you can see, there’s no magic bullet. The “best” strategy is the one that aligns with your personal finances, your schedule, and what keeps you up at night—or better yet, what doesn’t.

How to Analyze a Potential Deal

Once you have a strategy in mind, it’s time to hunt for a property. This is where the real work begins. Experienced investors don’t fall in love with houses; they fall in love with numbers. Relying on a “gut feeling” is one of the fastest ways to lose money.

You need to get comfortable with a couple of key metrics that will tell you the real story of a property’s potential:

- Capitalization Rate (Cap Rate): This is your quick-and-dirty way to gauge a property’s profitability before financing even enters the picture. You calculate it by dividing the Net Operating Income (NOI) by the purchase price.

- Cash-on-Cash Return: This is the one that really hits home. It tells you the return you’re making on the actual money you pulled out of your pocket. To find it, divide your annual pre-tax cash flow by your total cash invested (down payment, closing costs, renovation budget, etc.).

Pro Tip: You can run the numbers all day, but a bad location will sink a great property. Look for areas with real signs of growth—things like new companies moving in, city infrastructure projects, and a growing population. These are the tell-tale signs of future demand.

Running the numbers isn’t optional; it’s fundamental. To make sure you’re getting it right, our comprehensive real estate investment calculator can help you analyze deals with precision and confidence.

A Real-World Example of Finding Value

Let’s look at a real-life scenario. An investor, we’ll call her Sarah, was hunting for a multi-family home in a competitive city. Everything seemed overpriced. Instead of getting into bidding wars, she started digging into local economic data.

She spotted a neighborhood right next to a planned expansion for a major tech campus. At the time, it was still considered an “up-and-coming” area, but the hiring projections were huge. Sarah found a duplex that looked dated but was structurally solid and, most importantly, undervalued.

After running the numbers, she saw that with a few cosmetic upgrades, the property would generate a 12% cash-on-cash return, which blew the city average out of the water. Fast forward a year: the tech campus opened, new employees flooded the area, and rental demand skyrocketed. Property values in her neighborhood jumped by 15%, and Sarah was left with a cash-flowing asset that was appreciating fast.

Her success came from combining smart analysis with a forward-looking perspective. It’s a similar mindset used by large-scale commercial investors, who are often looking for stability and diversification. In fact, the S&P Global Property Index recently delivered a one-year total return of 14.1%, and 75% of market leaders plan to increase their real estate holdings to hedge against inflation and diversify their portfolios. The principle is the same: find where the growth is headed and get there first.

Smart Financing to Accelerate Your Growth

Leverage is the rocket fuel for building wealth in real estate. It’s what lets you control a valuable, income-producing asset with just a fraction of its total cost coming out of your own pocket. But smart financing isn’t just about getting any loan; it’s about structuring your debt to supercharge returns while shielding you from unnecessary risk.

Getting the right loan is your first big hurdle. Most new investors naturally gravitate toward traditional mortgages, which offer competitive rates and long-term stability. That’s a great starting point, but don’t stop there—other powerful options are on the table, especially early in your journey.

Finding the Right Loan for Your Strategy

- FHA Loans: These government-backed loans are a game-changer for first-time buyers. Requiring as little as 3.5% down, they open a lot of doors. The best part? You can use an FHA loan to buy a multi-unit property (up to four units), live in one, and have the rent from the others cover your mortgage. This classic “house hacking” strategy can get your portfolio started with minimal cash.

- Conventional Investment Loans: Once you’re buying properties you don’t plan to live in, you’ll likely turn to these. They typically demand a 20-25% down payment, so the barrier to entry is higher. In return, you often get more favorable terms and fewer restrictions.

- Creative Financing: Sometimes a great deal doesn’t fit into a neat conventional box. That’s where creative options like seller financing (the owner acts as the bank) or hard money loans (short-term, asset-based loans) come in. They’re perfect for properties needing significant work, like a major fix-and-flip, that traditional lenders might shy away from.

If you want to dig deeper into these options, our full guide on how to finance an investment property really breaks down the pros and cons of each.

Nailing Your Loan Application

Lenders are looking for a borrower who is organized, reliable, and has a solid plan. Before you even think about talking to a loan officer, get your financial house in order. That means gathering your recent tax returns, pay stubs, bank statements, and a clear list of all your assets and liabilities.

Your credit score is absolutely critical here. Aim for a score of 740 or higher to unlock the best interest rates and terms. A great score can literally save you tens of thousands of dollars over the life of the loan. It’s non-negotiable.

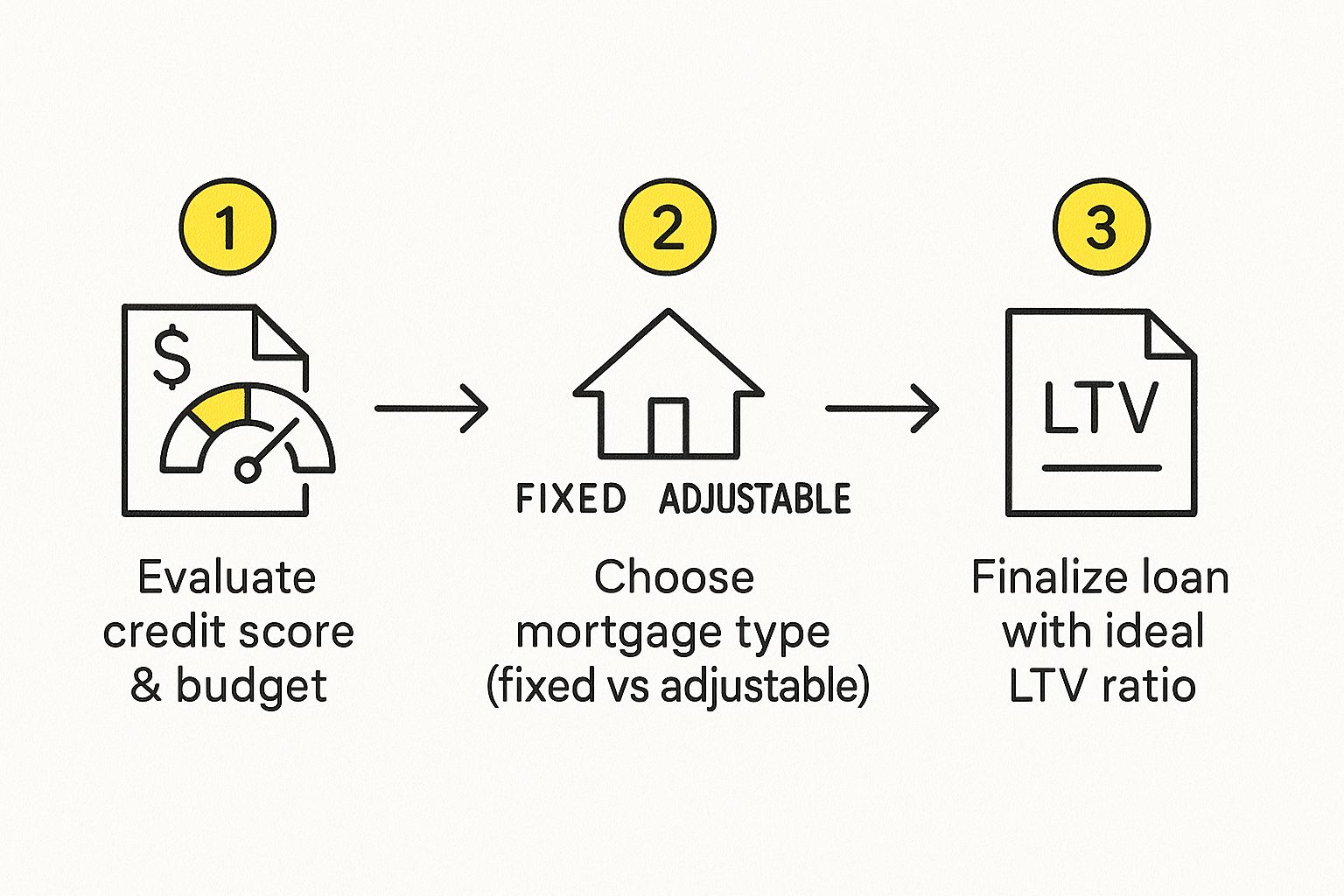

This visual breaks down the key steps to line up your financing the right way.

Following this flow helps you understand your financial position first, then choose the right mortgage, and finally close the deal with a healthy loan-to-value (LTV) ratio. It sets a rock-solid foundation for your investment.

The Power of the BRRRR Method

One of the most effective strategies I’ve seen for scaling a portfolio quickly is the BRRRR method: Buy, Rehab, Rent, Refinance, Repeat. It’s a powerful cycle that lets you pull your initial capital back out of a deal to use on the next one.

Here is a real-world example from an investor in my network, whom we’ll call Alex.

Alex found a distressed single-family home and bought it for $150,000 using a hard money loan. She put $30,000 into renovations, bringing her total cash into the deal to $180,000. After the rehab, the property was now worth $250,000.

Next, Alex found a great long-term tenant, securing consistent rental income. With the property stabilized and cash-flowing, she went to a traditional bank for a cash-out refinance. The bank agreed to lend her 75% of the new appraised value, which comes to $187,500.

This new loan paid off her entire $180,000 investment, and she even walked away with $7,500 in her pocket. She now owns a cash-flowing rental with zero of her own money left in the deal, and she has her original capital back to hunt for the next property. This is how you build a portfolio from scratch.

Key Takeaway: The success of the BRRRR method lives or dies on two things: buying below market value and accurately estimating your renovation costs. Get either one wrong, and you risk trapping your capital and stalling your growth.

Even when the market fluctuates, the income-generating nature of real estate continues to attract smart money. In fact, over the last five quarters, global private real estate values have seen consistent growth, anchored by reliable rental income. This stability has made the real estate debt sector particularly attractive, proving that well-structured financing is a cornerstone of sound investing. You can discover more insights about these real estate trends and see how experts view the current market.

Managing Properties for True Passive Income

Finding a great property is only half the battle. The real work—and where the real money is made or lost—happens in the day-to-day management. This is the critical junction where your investment either becomes a source of genuine passive income or turns into a stressful, all-consuming second job.

Your first big decision is a fundamental one: are you going to manage it yourself, or hire a professional?

There’s no one-size-fits-all answer here. The right choice depends on your proximity to the property, what skills you bring to the table, and frankly, how much you value your own time. This single decision will shape your entire experience as a real estate investor.

Self-Management vs. Professional Property Manager

To make the right call, you need a clear-eyed view of what each path truly involves. The DIY approach gives you maximum control and keeps more money in your pocket each month, while hiring a pro buys you expertise and, most importantly, your freedom back.

Here’s a side-by-side comparison to help you decide the best management approach for your rental property.

| Factor | Self-Management | Hiring a Professional |

|---|---|---|

| Cost | No direct management fees, maximizing your monthly cash flow. | Typically 8-12% of the monthly rent, plus potential leasing fees. |

| Time Commitment | High. You’re on the hook for every call, repair, and marketing effort. | Low. This frees you up to focus on finding your next deal. |

| Tenant Screening | You’re responsible for background checks, credit reports, and interviews. | Handled by experts who know fair housing laws and can spot red flags. |

| Maintenance | You have to find, vet, and coordinate all contractors for every repair. | They have a network of trusted, often pre-vetted, vendors on call. |

| Legal Knowledge | You must stay current on landlord-tenant laws and eviction rules. | Professionals are fluent in legal compliance, reducing your personal liability. |

Ultimately, the table highlights a classic trade-off: money versus time. Which is more valuable to you right now?

The DIY Landlord Playbook

If you decide to go the self-management route, your success will come down to one thing: systems. Don’t even think about winging it. Your goal should be to automate and streamline everything you can to protect both your time and your asset.

First things first, create a rock-solid tenant screening process. This is your number one defense against late rent, property damage, and eviction headaches.

- Run a comprehensive background and credit check on every single applicant.

- Verify their income. A good rule of thumb is to require gross income of at least 3x the rent.

- Always, always call their previous landlords. You’ll learn more from a 5-minute phone call than you will from any application form.

Next, get a state-specific, attorney-reviewed lease agreement. A generic template you find online is a recipe for disaster and can leave you completely exposed. Your lease needs to clearly spell out all the rules, rent payment procedures, and the exact consequences for breaking the rules.

Finally, build your “A-team” of contractors—a reliable plumber, a good electrician, and a go-to handyman—before you actually need them. When a pipe bursts at 2 a.m., the last thing you want is to be frantically searching online for someone with decent reviews.

Choosing the Right Property Manager

Decided your time is better spent finding the next deal? Smart move. But be warned: not all property management companies are created equal. You’re handing over the keys to a six-figure asset, so you absolutely must do your homework.

When you’re interviewing potential managers, skip the fluffy sales pitch and ask direct, pointed questions:

- What’s your average vacancy rate? A low number tells you they’re good at marketing and keeping good tenants happy.

- Walk me through your process for late rent payments. You want to hear a firm, fair, and systematic approach, not a vague “we’ll handle it.”

- How often do you conduct routine inspections? Proactive managers catch small issues before they become five-figure problems.

- Can you show me a sample owner statement? You need absolute transparency on how maintenance funds are handled and how your money is being spent.

Red Flag Warning: Run, don’t walk, from managers who compete on price alone. Exceptionally low fees are almost always a sign of hidden costs, terrible service, or a business that’s struggling. When it comes to protecting your investment, the cheapest option is rarely the best one.

Don’t forget that smart management is also about optimizing your finances. The fees you pay a property manager are a deductible expense, which helps take the sting out of the cost. To make sure you’re taking full advantage, explore our guide to property investment tax deductions and stop leaving money on the table.

Scaling Your Portfolio for Generational Wealth

Going from one rental property to an entire portfolio is the real turning point. This is where you graduate from simply being a landlord to becoming a true asset manager, building serious, long-term wealth.

Your focus shifts. It’s no longer just about the monthly cash flow from a single door; it’s about building a powerful financial engine. You start making your money work for you, strategically growing your holdings so your net worth compounds faster than you thought possible. It’s all about creating a self-sustaining cycle of growth.

Leveraging Equity for Rapid Growth

Once you’ve owned a property for a few years and it’s appreciated, you’re sitting on a powerful tool: equity. Instead of just letting that value sit there, you can put it to work to buy your next property, often without having to save up a huge down payment all over again.

A cash-out refinance is one of the most common ways to do this. You simply replace your existing mortgage with a new, larger loan and pocket the difference in cash.

Let’s say your property is now worth $500,000 and you only owe $250,000. A lender might let you borrow up to 80% of its value ($400,000). After paying off your original $250,000 loan, you’d walk away with $150,000 in cash—plenty for a down payment on one or even two more properties.

This is a fantastic strategy, but you have to be smart about it. The new properties you buy absolutely must generate enough income to cover the higher mortgage payment on your original property, plus all their own expenses. Run the numbers carefully.

The Power of the 1031 Exchange

As your properties gain value, capital gains tax becomes a major roadblock to growth. Selling a winner can mean handing a huge chunk of your profit to the IRS, leaving you with less capital for your next deal. This is where the 1031 exchange becomes an investor’s best friend.

Section 1031 of the IRS code lets you sell an investment property and defer paying any capital gains tax, as long as you roll all the proceeds into a similar “like-kind” property of equal or greater value. You have to follow strict timelines, but it allows you to keep 100% of your money working for you.

Here’s a quick comparison. Imagine you bought a property for $300,000 and are selling it for $500,000, with a $200,000 gain.

| Strategy | Selling and Paying Taxes | Using a 1031 Exchange |

|---|---|---|

| Sale Proceeds | $500,000 | $500,000 |

| Capital Gains Tax (est.) | -$40,000 | $0 (Deferred) |

| Capital for Next Purchase | $460,000 | $500,000 |

| Purchasing Power | Reduced | Maximized |

That $40,000 difference is huge. The 1031 exchange gives you significantly more buying power, letting you level up to a bigger or better-performing asset and accelerate your portfolio’s growth dramatically.

Portfolio Optimization and Exit Strategies

A great portfolio isn’t something you just set and forget. It needs regular check-ups. At least once a year, you should be asking tough questions about every single property you own.

- Is the cash flow still hitting my goals?

- Has the neighborhood peaked, or is there still room for growth?

- Could the equity tied up in this property be working harder for me somewhere else?

Sometimes, the smartest move is to sell an underperformer to free up capital for a better opportunity. Don’t get emotionally attached. Pruning your portfolio is a healthy and necessary part of maximizing your long-term returns.

Finally, you need to think about your endgame. What’s the ultimate goal here? Your exit strategy will depend entirely on your vision.

- Hold for Cash Flow: You might decide to just hold onto your properties, pay them off, and enjoy the passive income through retirement.

- Sell and Consolidate: Many investors use 1031 exchanges to trade up from several small properties into larger, more hands-off assets like apartment complexes or commercial buildings.

- Estate Planning: This is about creating a legacy. You’ll want to work with professionals to ensure your portfolio can be passed smoothly to your heirs. Our guide explains more about how to create generational wealth through this kind of forward-thinking.

Whatever your path, the key is to begin with the end in mind. Let that long-term vision shape the decisions you make about scaling your portfolio today.

Common Questions About Real-Life Real Estate Investing

Even with the best roadmap, you’re going to have questions. That’s a good thing—it means you’re taking this seriously. Let’s tackle some of the most common hurdles and concerns that come up for new investors. These are the questions I hear all the time, and getting clear on the answers will give you the confidence to move forward.

How Much Money Do I Really Need to Start?

This is always the first question, and the answer is almost always less than people assume. The classic 20% down payment is a great goal, but it’s not the only way to get in the game. Don’t let that big number stop you before you even start.

In reality, there are several powerful strategies to lower your out-of-pocket costs:

- FHA Loans: For owner-occupied properties (including multi-family up to four units), these government-backed loans let you get in the door with as little as 3.5% down. This is the foundation of the “house hacking” strategy—live in one unit, rent out the others, and let your tenants pay your mortgage.

- VA Loans: If you’re a veteran or an eligible service member, this is a massive advantage. VA loans often require 0% down, which is an absolute game-changer.

- Partnerships: Teaming up is one of the most underrated ways to start. By pooling your money with a trusted partner, you split the down payment, the closing costs, and the risk. It makes that first deal feel a whole lot more achievable.

Is This Actually Passive Income?

Let’s be real: real estate income is more accurately described as semi-passive. The fantasy of just cashing checks without ever thinking about the property is just that—a fantasy. But you absolutely can build systems to make it as passive as possible.

Once you hire a great property manager, your role changes dramatically. The late-night tenant calls, the leaky faucets, the minor repairs—that’s all off your plate. You’re no longer the landlord; you become the asset manager. Your job shifts to the big picture: reviewing monthly statements, approving major expenses, and making the strategic calls for your portfolio.

What Are the Biggest Risks I Should Be Ready For?

Every investment has a downside, and real estate is no exception. Knowing the risks ahead of time is the key to managing them instead of being blindsided by them.

These are the big three you need to plan for:

- Sudden Vacancy: An empty unit is a liability, not an asset. Every month it sits empty, you’re paying the mortgage out of your own pocket.

- Big-Ticket Repairs: It’s not a matter of if a roof will need replacing, but when. A new HVAC system or foundation work can run into the thousands, and you need to be ready for it.

- Market Swings: Property values don’t only go up. The best way to protect yourself is to buy for long-term cash flow, not just for short-term appreciation. Cash flow can carry you through a down market.

A healthy cash reserve isn’t just a suggestion; it’s non-negotiable. I tell every investor to have at least 3-6 months of total expenses—PITI (principal, interest, taxes, insurance) plus utilities—stashed away for each property.

Should I Buy a Property Myself or Just Invest in a REIT?

This really comes down to what you’re trying to achieve and how involved you want to be. Owning a property directly and owning shares in a Real Estate Investment Trust (REIT) are two completely different ballgames.

| Feature | Direct Property Ownership | Real Estate Investment Trust (REIT) |

|---|---|---|

| Control | Total control. You call all the shots. | Zero control. You’re just a shareholder. |

| Leverage | You can use a mortgage to control a large asset. | Not applicable on a personal level. |

| Tax Benefits | Huge advantages like depreciation and deductions. | Limited; pays dividends taxed as ordinary income. |

| Liquidity | Low. Selling takes time, money, and effort. | High. You can sell your shares in seconds. |

| Effort | Requires your active (or semi-passive) attention. | Completely passive. |

You don’t have to choose just one. Many sophisticated investors build a core portfolio of physical properties and then add REITs for easy diversification and liquidity.

What’s the One Percent Rule and Does It Still Work?

The 1% Rule is a classic back-of-the-napkin test. It simply suggests that a property’s gross monthly rent should be at least 1% of its purchase price. So, a $200,000 house should ideally rent for $2,000/month or more.

Think of it as a quick screening tool to weed out properties that are obviously overpriced for their rental potential. It’s a first glance, nothing more.

In today’s market, especially in more expensive cities, hitting the 1% rule can be incredibly difficult, but that doesn’t mean those properties are bad investments. You still need to run the full numbers. Use the rule as a guideline, not a gospel.

Do I Need to Form an LLC for My Rentals?

Once you get serious about investing, the answer is almost always yes. A Limited Liability Company (LLC) is all about one thing: protection. It builds a legal wall between your business assets (your rental properties) and your personal assets.

If a major issue arises—say, a tenant sues you—an LLC helps ensure they can only go after the assets held within the business. Your personal home, car, and savings accounts are protected. Yes, there are some initial setup fees and minor annual paperwork, but that cost is nothing compared to the peace of mind you get, especially as you start to grow your portfolio.

Before you do anything, though, have a conversation with a real estate attorney and a CPA. They can advise you on the best legal and tax structure for your specific situation.

Frequently Asked Questions

1. What credit score do I need to buy an investment property?

For conventional investment property loans, lenders typically look for a credit score of 620 at a minimum, but a score of 740 or higher will secure you the best interest rates and terms. For government-backed loans like FHA, the requirements can be more lenient.

2. Can I use my retirement account to invest in real estate?

Yes, you can use a self-directed IRA (SDIRA) to purchase investment properties. This allows you to use your retirement funds for real estate, but there are strict IRS rules you must follow. It’s crucial to work with a custodian that specializes in SDIRAs.

3. How do I accurately estimate repair costs for a fix-and-flip?

Always get a detailed inspection from a qualified home inspector first. For major work (roof, HVAC, foundation), get multiple quotes from licensed contractors. For cosmetic updates, create a detailed spreadsheet of material costs and add a 15-20% contingency fund for unexpected issues. Never rely on a rough guess.

4. What is the best way to find undervalued properties?

Finding off-market deals is key. This can involve driving through target neighborhoods looking for distressed properties (“driving for dollars”), networking with local real estate agents and wholesalers, and using direct mail campaigns to homeowners in your desired area.

5. Are short-term rentals (like Airbnb) more profitable than long-term rentals?

They can be, but they are also significantly more work. Short-term rentals often have higher gross revenue, but also higher expenses (cleaning, utilities, supplies) and more active management. Profitability depends heavily on location, local regulations, and your ability to maintain a high occupancy rate.

6. How many properties do I need to own to achieve financial freedom?

There’s no magic number. It depends on your monthly income goal and the cash flow per property. For example, if your goal is $5,000 per month and each property cash flows $500, you would need 10 properties. The key is to focus on acquiring properties that produce reliable positive cash flow.

7. What kind of insurance do I need for a rental property?

You’ll need a landlord insurance policy, which is different from a standard homeowner’s policy. It typically covers property damage, liability protection in case a tenant is injured on the property, and loss of rental income if the property becomes uninhabitable due to a covered event.

8. What’s the difference between cash flow and appreciation?

Cash flow is the profit left over from your rental income after all expenses (mortgage, taxes, insurance, repairs) are paid each month. Appreciation is the increase in the property’s value over time. Smart investors look for properties that offer both.

9. Should I pay off my rental properties quickly or keep them leveraged?

This is a common debate. Paying them off provides security and maximizes cash flow. Keeping them leveraged (with mortgages) allows you to control more properties and potentially grow your net worth faster through appreciation and principal paydown on multiple assets. Your risk tolerance and financial goals will determine the right strategy for you.

10. How do rising interest rates affect real estate investing?

Rising rates increase the cost of borrowing, which can reduce your monthly cash flow and potentially cool down property price appreciation. However, they can also create buying opportunities by reducing competition. The fundamental principle remains the same: the deal must make sense with the current numbers.

At Top Wealth Guide, we are dedicated to providing you with the knowledge and tools you need to build lasting financial security. From real estate to the stock market, our expert insights are designed to help you make informed decisions and grow your wealth with confidence. Explore more strategies and guides on https://topwealthguide.com.

1 Comment

Pingback: Investment Mindset Shifts That Create Millionaires - Top Wealth Guide - TWG