The BRRRR method is a powerhouse strategy for real estate investors, and its name is a perfect acronym for the five stages involved: Buy, Rehab, Rent, Refinance, and Repeat.

Think of it as a repeatable system for building a portfolio of rental properties by recycling the same pot of money over and over again. It's a way to scale your investments much faster than the traditional method of saving up a new down payment for every single purchase. This guide offers an in-depth, comprehensive look at how to execute this strategy effectively, based on first-hand investor experience and detailed analysis.

In This Guide

- 1 What Is The BRRRR Method And How Does It Work

- 2 Breaking Down Each Stage of the BRRRR Method

- 3 Financing Your BRRRR Real Estate Deals

- 4 Putting The Numbers To Work: A Real-World BRRRR Example

- 5 Finding The Right Markets For BRRRR Success

- 6 Where BRRRR Can Go Wrong: A Reality Check

- 7 Frequently Asked Questions About the BRRRR Method

- 7.1 1. How much cash do I actually need to get started?

- 7.2 2. Is it really possible to do BRRRR with no money down?

- 7.3 3. What kind of credit score do I need for BRRRR?

- 7.4 4. What is the "70% Rule" and is it a strict rule?

- 7.5 5. What if the appraisal comes in lower than I expected?

- 7.6 6. How long does a full BRRRR cycle take?

- 7.7 7. Is the BRRRR method good for beginners?

- 7.8 8. How do rising interest rates impact the BRRRR method?

- 7.9 9. Can I use the BRRRR method on multi-family properties?

- 7.10 10. What are the tax implications of the BRRRR method?

What Is The BRRRR Method And How Does It Work

So, how do you turn one investment into a whole portfolio of cash-flowing rentals without constantly dipping into your savings? That's the magic of the BRRRR method. This isn't a passive, sit-back-and-wait kind of strategy; it’s a hands-on approach that requires diligence and a clear plan for each stage.

The entire strategy is built around a concept called forced appreciation. Instead of buying a perfect, move-in-ready house and hoping the market goes up, you specifically look for a property that needs some love. Through smart renovations, you manually increase its value. That newly created value is the secret sauce that lets you pull your original cash back out.

This strategy has become incredibly popular because it's a blueprint for scaling. The entire process hinges on finding properties you can buy for 20-40% below what they could be worth. As industry experts at Amerisave.com point out, a good deal on the front end is what makes the rest of the steps work.

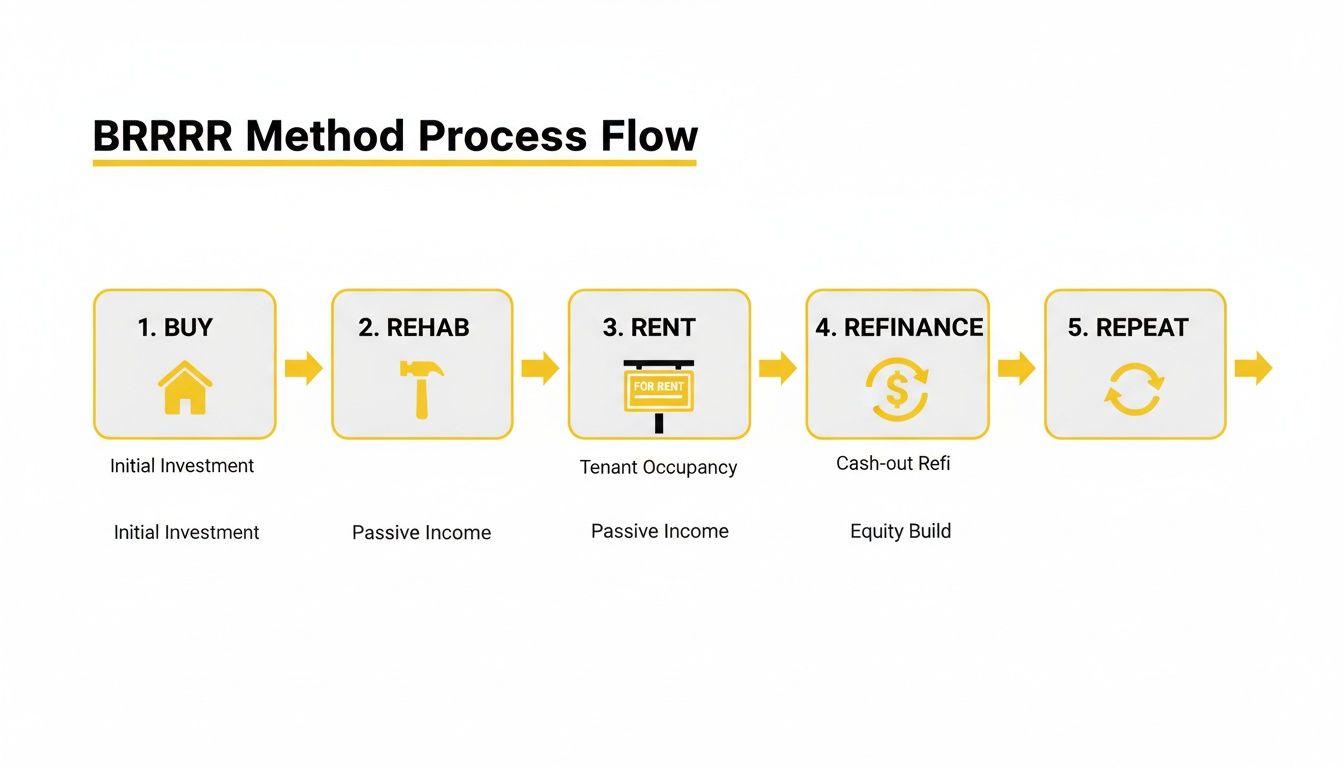

To give you a clearer picture, here's a quick breakdown of how each step flows into the next.

The 5 Stages Of The BRRRR Method At A Glance

This table provides a high-level overview of the entire process, showing how each stage sets up the next.

| Stage | Objective | Key Action |

|---|---|---|

| Buy | Acquire an undervalued property. | Find a distressed or outdated property and purchase it below market value. |

| Rehab | Force appreciation through renovations. | Renovate the property to increase its value and rental appeal. |

| Rent | Stabilize the asset and generate cash flow. | Place a qualified tenant in the property with a signed lease. |

| Refinance | Pull your initial investment capital out. | Secure a new, larger loan based on the property's After Repair Value (ARV). |

| Repeat | Scale your portfolio. | Use the cash from the refinance to fund the purchase of the next property. |

This cyclical nature is what makes the BRRRR method such an effective engine for building wealth.

The Cyclical Engine of Wealth Creation

Here’s where it gets interesting. Instead of flipping the property for a quick profit, you keep it as a long-term rental. Once it's renovated and you have a paying tenant, you go to a bank for a cash-out refinance. This new loan isn't based on what you paid for the property, but on its new, much higher appraised value.

Ideally, the new loan is large enough to do three things:

- Pay off the original loan you used to buy and fix up the place.

- Give you back most—or even all—of the cash you put in.

- Leave you with a rental property that’s putting money in your pocket every month.

That cash you just pulled out? It becomes the down payment for your next BRRRR deal, and the whole cycle starts over. You’ve basically turned your initial investment into a revolving fund for buying more properties.

The equity you build is the fuel for this engine. By forcing appreciation, you are literally manufacturing your next down payment instead of waiting years to save it up. You can learn more about what is equity in real estate and how it works in our detailed guide.

Breaking Down Each Stage of the BRRRR Method

Knowing the BRRRR method theory is a great start, but making it work in the real world is a whole different ball game. Success comes down to nailing each of the five stages—Buy, Rehab, Rent, Refinance, and Repeat—with a solid, well-thought-out plan. It’s like a relay race; a sloppy handoff in one leg can ruin the entire race.

This flowchart shows you exactly how the cycle works, turning one smart purchase into a wealth-building machine.

As you can see, each step flows directly into the next, creating a repeatable system that can fuel your portfolio's growth.

Stage 1: Buy Smart

This is it—the most critical step. Get the "Buy" wrong, and the rest of the project is an uphill battle. Your entire strategy rests on finding an undervalued property. Remember the old real estate saying: you make your money when you buy, not when you sell (or in this case, refinance).

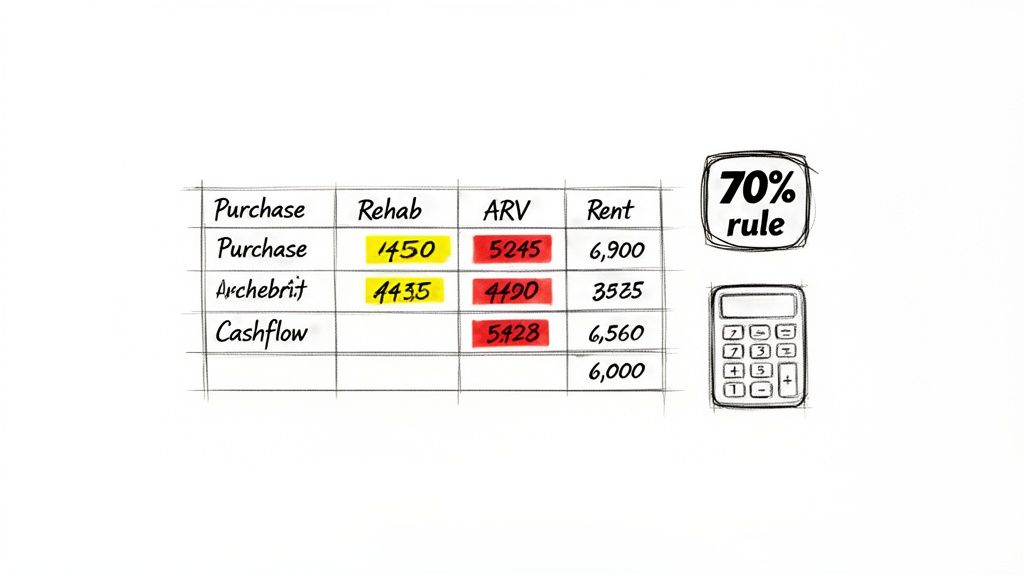

A fantastic rule of thumb that seasoned investors live by is the 70% Rule. It’s a simple formula that keeps you from overpaying. The idea is that you should never pay more than 70% of the After Repair Value (ARV), minus what you expect to spend on renovations.

Formula: (ARV x 0.70) – Rehab Costs = Maximum Allowable Offer (MAO)

Let's walk through an example. Say you find a place with an ARV of $300,000, and you estimate it needs $40,000 in repairs. Your top offer should be $170,000. Here's the math: $300,000 x 0.70 = $210,000, and $210,000 – $40,000 = $170,000. Sticking to this rule gives you a healthy equity cushion for unexpected problems and helps you meet the lender’s requirements down the line. A good place to start hunting is to learn how to find and buy distressed properties for your BRRRR deals, since these are often perfect candidates.

Stage 2: Rehab for Value

The "Rehab" phase is your chance to actively force appreciation. This isn't just about making things look pretty; it's about smart, strategic upgrades that add more value than they cost. You have to focus on the renovations that give you the biggest bang for your buck.

High-Impact Renovation Priorities:

- Kitchens and Bathrooms: These rooms sell houses and rent apartments. Modernizing fixtures, countertops, and appliances is almost always a winning investment that boosts both value and tenant appeal.

- Curb Appeal: You never get a second chance to make a first impression. A little landscaping, fresh exterior paint, and a new front door can dramatically change how people perceive the property.

- Flooring and Paint: Nothing transforms a tired, dated space faster than a fresh coat of neutral paint and some durable, modern flooring. It's a relatively low-cost update with a massive impact.

Before a single hammer swings, you absolutely need a detailed scope of work (SOW). This document is your project's bible, outlining every task, material, and cost. It’s what you’ll use to get accurate bids from contractors and, more importantly, to keep the project from going off the rails financially.

Stage 3: Rent for Stability

With the dust settled from the renovation, your focus pivots to stabilizing the property. That means finding a great tenant. The "Rent" phase is what turns your vacant property into an asset a lender will be excited about. A signed lease and a steady stream of rental income are non-negotiable for the refinance.

Here are your main goals at this stage:

- Price Competitively: Research the local market and set a rent that’s fair for a freshly renovated unit. This will help you attract a wider pool of qualified applicants, fast.

- Screen Thoroughly: Don't skip this. A rigorous screening process—including credit checks, background checks, income verification, and calls to previous landlords—is your best defense against future headaches.

- Secure a Lease: Get an ironclad lease agreement signed. This legal document formalizes everything and protects your investment.

Once a tenant is in place, you've officially proven to the bank that this property is a performing, income-generating asset. That’s the green light you need for the refinance.

Stage 4: Refinance to Recoup

This is the payoff. In the "Refinance" stage, you apply for a new, long-term loan based on the property’s new, much higher appraised value (the ARV). The goal of this cash-out refinance is simple: pay off the initial short-term financing and pull all of your original investment cash back out.

Be aware that most lenders have a seasoning period—a minimum amount of time you must own the property before they'll consider a refinance. This is often around six months. When the appraiser comes, hand them a detailed list of every single upgrade you made, complete with costs. You want to make sure they see every dollar of value you’ve added.

Stage 5: Repeat to Scale

The final "R"—Repeat—is the secret sauce that turns this from a one-off project into a scalable business. With the cash you just pulled out of the refinance, you’re ready to go hunting for your next undervalued property.

You can now start the entire BRRRR cycle all over again, but this time, you're not saving up for a new down payment from scratch. This is how savvy investors use the same pot of money over and over to build a cash-flowing real estate empire.

Financing Your BRRRR Real Estate Deals

Let's be clear: the BRRRR method is as much about money management as it is about real estate. The real “magic” of recycling your capital all comes down to how you structure the financing. It’s a two-act play, and you need to nail both parts.

First, you need to fund the initial purchase and the messy rehab work. Then comes the main event: the cash-out refinance that lets you pull your money back out. Getting this sequence right is everything.

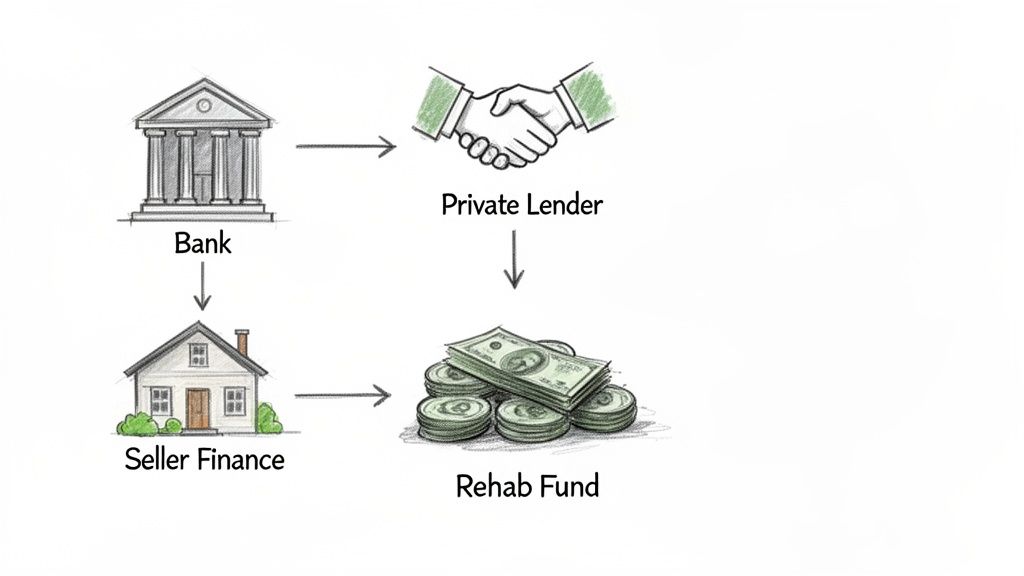

Funding The Initial Purchase And Rehab

Forget about walking into your local bank for a 30-year fixed mortgage on a beat-up property. Most traditional lenders won't touch a house that needs a gut job. This is where the world of short-term, creative financing comes into play. You need a loan that closes fast and covers both the house and the fix-up costs.

Here are the three most common paths investors take:

- Hard Money Loans: Think of these as loans from specialized private companies that care more about the deal's potential—the After Repair Value (ARV)—than your personal credit score. They're built for speed and are a go-to for BRRRR investors.

- Private Money Lenders: This is just borrowing from other people. It could be friends, family, or fellow investors in your network. The terms can be incredibly flexible, but you absolutely need a rock-solid legal agreement to keep things professional.

- Seller Financing: Sometimes, the owner of the property is willing to act as the bank. If they own the house outright and are motivated to sell, they might "carry the note" for you. This can be a fantastic way to structure a deal with creative terms and fewer hoops to jump through.

Each option comes with its own set of pros and cons related to speed, cost, and the fine print. To get a much more detailed look, you can explore our full guide on how to finance your BRRRR method real estate deals.

BRRRR Financing Options Compared

Choosing how you'll fund the first two steps of BRRRR is a critical decision that directly impacts your budget and timeline. The table below breaks down the key differences to help you see which lane might be the best fit for your situation.

| Financing Type | Best For | Typical Interest Rate | Pros | Cons |

|---|---|---|---|---|

| Hard Money Loan | Investors needing to close quickly on distressed properties that won't qualify for conventional loans. | 10-15% | Fast closing (7-14 days), approval based on the deal's merit, rehab funds often included. | High interest rates and fees, short repayment terms (6-18 months). |

| Private Money Lender | Investors with a strong personal network who can negotiate flexible, relationship-based terms. | 6-12% | Highly flexible terms, potentially lower rates than hard money, builds valuable relationships. | Can be difficult to find, mixing business with personal relationships can be risky. |

| Seller Financing | Buyers who can negotiate directly with a motivated seller, often avoiding traditional bank underwriting. | 4-8% | Low closing costs, flexible down payment and terms, can be faster than bank loans. | Not widely available, depends entirely on the seller's willingness and financial position. |

Ultimately, the "right" choice depends on the deal itself, the relationships you've built, and how quickly you need to move. Many seasoned investors end up using a mix of these options across different projects.

The Critical Cash-Out Refinance

This is the step that makes the whole BRRRR engine turn over. Once the dust has settled from the renovation and you have a happy tenant paying rent, you go to a traditional lender (like a bank or credit union) for a brand-new, long-term mortgage.

Here’s the crucial part: this new loan isn't based on what you paid for the property. It's based on the property’s new, much higher After Repair Value (ARV).

Key Takeaway: The entire goal of the refinance is to get a loan big enough to pay back your initial short-term lender and reimburse yourself for every dollar you put into the deal. This is how you get your initial capital back to "Repeat" the process.

Most lenders will give you a loan for up to 75-80% of the property’s new appraised value. This is called the Loan-to-Value (LTV) ratio. If you bought and rehabbed correctly, that 75% should be more than enough to cover your total costs.

One thing to watch out for is the seasoning period. Many banks won’t let you refinance based on the new value until you've owned the property for a certain amount of time, usually six months. This is to prevent fraudulent flips. Finding and building relationships with investor-friendly banks who understand what you're doing is a huge advantage here—they know the process and can help you navigate these rules without a hitch.

Putting The Numbers To Work: A Real-World BRRRR Example

Theory is great, but real estate investing is a numbers game. Let's walk through a tangible, step-by-step example to see how the BRRRR method actually works in the wild—and how an investor can turn a neglected property into a cash-flowing machine while getting all their initial capital back.

Step 1: The Buy

Let's meet our investor, Sarah. She’s found a tired-looking duplex with good bones in a solid neighborhood. It’s a classic diamond in the rough. Through her market research, she knows that a fully updated duplex in this area has an After Repair Value (ARV) of around $400,000. She gets quotes and confidently estimates the renovation will cost $50,000.

To make sure the deal works, she runs the numbers using the 70% Rule to figure out her maximum offer:

- ($400,000 ARV x 0.70) – $50,000 Rehab Costs = $230,000 Maximum Allowable Offer

After a bit of back-and-forth, she gets the property under contract for $225,000. To fund the deal and the rehab, she uses a short-term hard money loan. Her total capital needed upfront is $275,000 ($225,000 purchase price + $50,000 for repairs).

Step 2: The Rehab and Rent

Sarah's rehab plan is smart and focused. She prioritizes updates that tenants love and that add real value: modern kitchens and bathrooms, durable LVP flooring throughout, and a fresh coat of paint. The project takes four months and she manages to stick to her $50,000 budget.

With the work done, the duplex looks fantastic. She lists both units and quickly finds qualified tenants who are happy to pay $1,600 per month each. Just like that, the property is stabilized, bringing in a total gross income of $3,200 every month.

Step 3: The Refinance

Now for the magic. Sarah has owned the property for six months, satisfying her new lender's "seasoning period" requirement. She applies for a cash-out refinance.

The bank sends out an appraiser who sees the beautifully renovated property and confirms her initial estimate—the duplex is officially valued at $400,000. The lender agrees to give her a new, long-term loan based on 75% of this new value (Loan-to-Value or LTV).

Loan Amount Calculation: $400,000 (Appraised Value) x 0.75 (LTV) = $300,000

The bank is ready to write her a check for $300,000. This is more than enough to cover her entire initial investment.

Calculating The Payout: How Sarah Got Paid To Buy a Duplex

This is the part that gets every BRRRR investor excited. Sarah takes the proceeds from her new loan to settle her old debts and put her cash back in her pocket.

- Total Loan from Refinance: $300,000

- Pays off Hard Money Loan: -$275,000 ($225k purchase + $50k rehab)

- Cash Back in Sarah's Pocket: $25,000

Think about that for a second. Sarah not only got 100% of her initial investment back, but she also walked away from the closing table with an extra $25,000. She now owns a cash-flowing rental property with $100,000 in forced equity (the 25% difference between the value and the new loan) and has zero of her own money left in the deal.

If you want to run these kinds of numbers on your own potential deals, a good tool is indispensable. You can learn how to analyze your deals with our detailed BRRRR method calculator guide.

The Final Financial Picture

So, what does the duplex's performance look like as a long-term hold?

| Financial Metric | Monthly Amount | Annual Amount |

|---|---|---|

| Gross Rental Income | $3,200 | $38,400 |

| New Mortgage (P&I) | -$1,600 | -$19,200 |

| Property Taxes | -$250 | -$3,000 |

| Insurance | -$100 | -$1,200 |

| Vacancy (5%) | -$160 | -$1,920 |

| Repairs & Maintenance (5%) | -$160 | -$1,920 |

| Total Monthly Expenses | -$2,270 | -$27,240 |

| Net Monthly Cash Flow | $930 | $11,160 |

After all is said and done, Sarah has a high-quality rental property that puts $930 in her bank account every month. Because she pulled all of her cash out, her cash-on-cash return is technically infinite. She's free to take her original capital and the extra $25,000 and repeat the process all over again.

This is the power of the BRRRR method in action.

Finding The Right Markets For BRRRR Success

Trying to pull off a perfect BRRRR deal in a market that's flatlining or, even worse, declining is an uphill battle. You can have the best execution in the world, but if the economic environment is working against you, it’s tough to win. The long-term health of your portfolio really comes down to where you invest just as much as how you invest. Think of the market as the foundation—if it's not solid, everything you build on top of it is at risk.

A great BRRRR market is, at its core, a place with a healthy, growing economy. You have to put on your detective hat and look for areas with solid job growth across different industries. When good companies are hiring, people move in. That influx of people drives population growth and, critically for us, boosts demand for rental housing. It's a simple, powerful cycle that pushes both rent and property values in the right direction.

Key Indicators Of A Strong BRRRR Market

Beyond the big picture of jobs and population, a few other things make a market a sweet spot for this strategy. Landlord-friendly laws are a huge plus. You want a place with a clear, fair legal framework for managing your properties without jumping through a million hoops. Affordable property prices are also non-negotiable. If home prices are sky-high, it's almost impossible to find a deal with enough of a discount to make the whole strategy work.

As you're scouting locations, keep an eye out for these specific traits:

- Strong Population Growth: Is the city consistently attracting new residents?

- High Rental Demand: Low vacancy rates and steadily rising rents are the clearest signs of a healthy rental market.

- Favorable Rent-to-Price Ratio: You need to make sure the monthly rent is a good percentage of what you paid for the house. That's the key to solid cash flow.

- Landlord-Friendly Laws: Dig into the state and local rules on things like evictions, rent control, and security deposits.

Identifying Thriving BRRRR Cities

Some cities just consistently check all the right boxes for BRRRR investors. When you're making your short list, focus on areas with strong population growth—ideally 1.5% or higher each year—and intense rental demand. Indianapolis, for instance, has become a go-to market because it's affordable and the demand is always there. Kansas City and San Antonio are two other great examples that pop up on a lot of investors' radars.

The best markets often see strong annual rent growth of 3-5% and have vacancy rates below 5%. That's the sweet spot that helps ensure your properties will keep producing cash flow even after you refinance. You can discover more insights about top BRRRR cities on easystreetcap.com.

Expert Insight: Don't just chase the hottest, most expensive markets you see on the news. The best BRRRR deals are often found in stable, almost "boring" secondary markets that give you that perfect mix of affordability, steady demand, and predictable growth.

In the end, your goal is to find a place where the local economy acts like a tailwind, helping to lift your investment's value over time. Do your homework on the market first—that upfront research will pay off for years and make every step of the BRRRR process that much easier.

Where BRRRR Can Go Wrong: A Reality Check

Every great investment strategy has its weak points, and BRRRR is no different. The theory is beautiful, but the real world is messy. Understanding where the pitfalls are before you jump in is the single best way to protect your capital and keep your projects from going off the rails.

Let's be honest, the simple explanation of BRRRR is one thing. Actually pulling it off means juggling a lot of moving parts, any of which can derail a seemingly perfect deal. Here’s a look at the most common hurdles you'll face.

BRRRR Method vs. Traditional Rental Investing: A Comparison

To better understand the unique advantages and challenges of BRRRR, it's helpful to compare it to the traditional way of buying rental properties.

| Feature | BRRRR Method | Traditional Rental Investing |

|---|---|---|

| Capital Requirement | High upfront for purchase and rehab, but capital is recycled. | Requires a new 20-25% down payment for each property. |

| Scaling Speed | Fast. The same capital can be used to acquire multiple properties per year. | Slow. Scaling is limited by the ability to save for new down payments. |

| Equity Creation | Proactive. Equity is "forced" through renovation, not market appreciation. | Passive. Relies primarily on loan paydown and market appreciation over time. |

| Property Type | Distressed, undervalued properties requiring significant work. | Typically turn-key or lightly used properties ready for tenants. |

| Risk Level | Higher. Involves construction risk, appraisal risk, and financing risk. | Lower. Fewer moving parts and less reliance on short-term financing. |

| Investor Involvement | Very high. Requires hands-on project management and deal analysis. | Moderate. Primarily involves property management after purchase. |

The Budget Blowout: Underestimating Rehab Costs and Timelines

This is probably the number one deal-killer. It’s shockingly easy to misjudge the true cost of a renovation. You budget for paint and flooring, but once the drywall comes down, you find ancient knob-and-tube wiring or leaky plumbing that has to be replaced. That's how a simple cosmetic job balloons into a full-gut nightmare.

Time is the other silent killer. Delays are the rule, not the exception. Waiting on permits, dealing with a contractor who disappears for a week, or discovering that the windows you ordered are on backorder—all these things push back your timeline. Every single day of delay costs you money in taxes, insurance, and loan payments, directly eating into your profits.

How to Protect Yourself:

- Build a Real Contingency Fund: Don't even think about starting without a cushion. A good rule of thumb is to set aside an extra 15-20% of your estimated rehab costs. This isn't optional; it's your safety net.

- Never Trust a Single Bid: Get at least three detailed, itemized bids from contractors you’ve personally vetted. Do this before you close on the property.

- Expect the Unexpected: Add a buffer to your timeline from day one. If you think a project will take three months, plan for four. You'll be glad you did.

The Dreaded Appraisal Gap

The cash-out refinance is the heart of the BRRRR method. It's how you get your money back to do it all over again. But this hinges entirely on the property appraising for your target After Repair Value (ARV). If the appraiser's number comes in low, you're stuck. A low appraisal means you can't pull out all of your initial capital, effectively trapping it in the deal and stopping your momentum dead in its tracks.

A low appraisal is the roadblock that can stop a BRRRR investor cold. It freezes your capital, preventing you from scaling your portfolio and moving on to the next opportunity.

You can’t just cross your fingers and hope for a good appraisal. You need to build a case for your value. When the appraiser shows up, hand them a professional-looking binder. It should include a detailed list of every single upgrade (with costs), compelling before-and-after photos, and a list of strong comparable sales in the neighborhood that justify your valuation. Your homework here can make all the difference, and using a solid real estate due diligence checklist ensures you’ve covered all your bases from the start.

Shifting Sands: Financing and Market Risks

Remember, BRRRR relies heavily on the lending environment. If banks decide to tighten their lending standards, getting that cash-out refinance can become much harder, even if your property is a home run. Interest rates are another wild card. If rates jump up between when you buy the property and when you refinance, your new mortgage payment could be significantly higher than you planned, crushing your monthly cash flow.

And don't forget the local market itself. A sudden downturn could mean it takes longer to find a quality tenant, or you might not get the rent you projected. Managing the project is only half the battle; you also have to be ready for these outside forces you can't control.

Frequently Asked Questions About the BRRRR Method

Navigating your first BRRRR deal can bring up a lot of questions. Here are clear, concise answers to the top 10 questions we hear from investors.

1. How much cash do I actually need to get started?

You need enough capital to cover the down payment on your initial loan (often 10-25% with a hard money lender), all closing costs, and the entire renovation budget. While the goal is to get this money back, you cannot start with zero capital.

2. Is it really possible to do BRRRR with no money down?

A true zero-money-down deal is extremely rare and usually involves complex financing like combining seller financing with a private loan. For most investors, the realistic approach is "low money down," where a hard money loan covers the bulk of the purchase and rehab costs, minimizing your initial cash outlay.

3. What kind of credit score do I need for BRRRR?

For the initial purchase using a hard money loan, your credit score is less important than the quality of the deal itself; lenders focus on the After Repair Value (ARV). However, for the final cash-out refinance, you will need a good credit score (typically 680 or higher) to qualify for the best long-term mortgage rates.

4. What is the "70% Rule" and is it a strict rule?

The 70% Rule is a guideline stating you should pay no more than 70% of the ARV minus rehab costs. It's not a strict law but a crucial risk management tool. Experienced investors may adjust it (e.g., to 75% in a hot market), but beginners should stick to it closely to build in a protective cushion for unexpected costs.

5. What if the appraisal comes in lower than I expected?

A low appraisal is a major risk. If it happens, you won't be able to refinance out all your capital. Your options include: 1) challenging the appraisal with better comparable sales, 2) leaving some of your cash in the deal and trying to refinance again later, or 3) selling the property to recoup your capital if the numbers still work for a flip.

6. How long does a full BRRRR cycle take?

A typical cycle takes 6 to 12 months. This includes finding the property, closing, completing the rehab (2-4 months), renting it out, and then waiting out the lender's "seasoning period" (often 6 months from the date of purchase) before you can complete the cash-out refinance.

7. Is the BRRRR method good for beginners?

BRRRR is generally considered an intermediate strategy due to its many moving parts (managing contractors, securing two different loans, etc.). A beginner can succeed, but it's vital to have a strong team (mentor, agent, contractor) and start with a simple cosmetic rehab rather than a major gut job.

8. How do rising interest rates impact the BRRRR method?

Rising interest rates directly squeeze your profits. A higher rate on the final refinance loan means a larger monthly mortgage payment, which reduces your monthly cash flow. It's critical to "stress-test" your numbers by calculating your potential cash flow with interest rates that are 1-2% higher than current rates.

9. Can I use the BRRRR method on multi-family properties?

Absolutely. BRRRR works extremely well for small multi-family properties (2-4 units). The process is identical: buy an undervalued building, renovate the units, fill it with tenants, and refinance based on the new, higher value and rental income. This can be a powerful way to scale your door count faster.

10. What are the tax implications of the BRRRR method?

When you do a cash-out refinance, the cash you receive is loan proceeds, not income, so it is generally not a taxable event. As a landlord, you gain significant tax benefits, including the ability to deduct operating expenses and mortgage interest, and most importantly, depreciate the value of the building, which can substantially lower your taxable income.

At Top Wealth Guide, we provide the insights and tools you need to master investment strategies like the BRRRR method. To continue your wealth-building journey with expert guidance, visit us at Top Wealth Guide.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.