Investing in real estate once meant high barriers to entry, hefty down payments, and complex legal paperwork. Today, technology has democratized property ownership, transforming it from a distant goal into an accessible strategy for wealth-building right from your smartphone. But this explosion of options brings a new challenge: navigating a crowded marketplace to find the platform that truly aligns with your financial goals, risk tolerance, and investment style. With dozens of apps all claiming to be the best, how do you distinguish genuine opportunities from clever marketing?

This guide is designed to be your definitive resource, cutting through the noise to provide a practical, hands-on analysis of the best real estate investment apps available. We go beyond surface-level descriptions to offer a comprehensive breakdown of platforms like Fundrise, Arrived, Roofstock, and others. For each app, you'll find a detailed review covering its core features, fee structures, minimum investment requirements, and liquidity options.

We will explore specific use cases to help you visualize how each platform works in practice. For instance, imagine a young professional, Sarah, who wants to start investing in real estate with just a few hundred dollars. An app like Arrived could allow her to buy fractional shares in a specific rental property in a growing market she's researched. This guide will provide that level of practical insight. Whether you're a beginner looking to invest your first $100 in fractional real estate or an accredited investor searching for institutional-quality commercial deals, this listicle provides the clarity you need. Inside, you'll find direct links, screenshots, and comparison tables to help you make a well-informed decision. Our goal is simple: to equip you with the insights necessary to confidently select the right app and start building your digital real estate portfolio today.

In This Guide

- 1 1. Fundrise

- 2 2. Arrived

- 3 3. Roofstock

- 4 4. CrowdStreet

- 5 5. RealtyMogul

- 6 6. Yieldstreet

- 7 7. Groundfloor

- 8 8. EquityMultiple

- 9 9. Streitwise

- 10 10. Cadre

- 11 11. AcreTrader

- 12 12. Doorvest

- 13 Top 12 Real Estate Investment Apps Comparison

- 14 Choosing Your App: Final Thoughts on Smart Real Estate Investing

- 15 Frequently Asked Questions (FAQ)

1. Fundrise

Fundrise stands out as one of the best real estate investment apps, particularly for those new to the space or seeking a hands-off approach. It pioneered the eREIT (electronic Real Estate Investment Trust) model, making high-quality private real estate deals accessible to everyday investors, not just accredited ones. Its core strength lies in its simplicity and diversification.

Instead of picking individual properties, you invest in a professionally managed portfolio tailored to your financial goals, such as long-term growth, balanced returns, or supplemental income. This model allows investors to gain exposure to a broad mix of residential and commercial properties across the U.S. with a single investment.

Real-Life Example: Imagine a new investor, Alex, who has $500 to start. He chooses Fundrise's "Long-Term Growth" plan. His investment is automatically spread across dozens of properties, such as a new apartment complex in Austin and a portfolio of single-family rentals in the Sun Belt. He doesn't need to analyze individual deals; Fundrise manages the portfolio, providing him with quarterly updates and dividend distributions.

Key Features and User Experience

- Investment Minimum: $10 (for the Starter Portfolio).

- Asset Classes: Diversified portfolios of private real estate, including apartment developments, single-family rentals, and commercial properties, plus private credit.

- Fee Structure: A straightforward 0.15% annual advisory fee and a 0.85% annual asset management fee.

- Liquidity: Offers a quarterly redemption program, though it may be subject to penalties and can be suspended during periods of economic stress.

The platform is designed for ease of use, automating the entire investment process from initial setup to ongoing dividend reinvestment. This hands-off nature makes it an excellent entry point for learning about real estate investing without the complexities of property management. If you're considering this asset class, it’s worth understanding why real estate can be a solid investment.

Website: https://fundrise.com

2. Arrived

Arrived brings a unique level of granularity to fractional real estate, making it one of the best real estate investment apps for those who want to build their own portfolio property by property. It allows investors to buy shares of individual single-family rentals and vacation homes, offering a more hands-on approach than fund-based platforms. This model empowers you to curate a portfolio based on specific markets, property types, and investment theses you believe in.

The platform is distinguished by its transparency and accessibility. Each property offering is SEC-qualified under Regulation A, with detailed financial models, inspection reports, and market analysis available for review.

Real-Life Example: Maria is interested in vacation rentals. She browses Arrived and finds a cabin in the Smoky Mountains with a projected annual rental yield of 8%. She reviews the property's financial documents, location details, and photos. Liking what she sees, she invests $250 for 2.5 shares. Now, she receives a portion of the monthly rental income and can track the property's estimated appreciation directly through her Arrived dashboard.

Key Features and User Experience

- Investment Minimum: $100 for most individual property offerings.

- Asset Classes: Single-family rentals, vacation rentals, a diversified Single Family Residential Fund, and a Private Credit Fund.

- Fee Structure: Fees vary by product, but typically include a one-time sourcing fee and ongoing asset management fees detailed in each offering circular.

- Liquidity: Shares are intended for multi-year hold periods (typically 5-7 years). A secondary marketplace is available for some properties, but liquidity is not guaranteed.

The web-based platform is clean and intuitive, making it easy to browse properties, review documentation, and make investments in just a few clicks. Its strength lies in giving investors the feeling of direct property ownership, complete with rental income and potential appreciation, but without any of the landlord responsibilities.

Website: https://arrived.com

3. Roofstock

Roofstock takes a more direct approach compared to fractional ownership platforms by operating as an online marketplace for buying and selling single-family rental (SFR) properties. It is one of the best real estate investment apps for those who want to own entire, income-producing properties without the traditional legwork of finding and vetting them. The platform specializes in tenant-occupied homes, meaning many listings are already generating cash flow from day one.

Its core value lies in the data and support it provides, making remote investing more accessible and transparent. Each property listing includes detailed inspection reports, property valuations, tenant lease information, and neighborhood ratings.

Real-Life Example: David, living in California, wants to invest in a more affordable market. He uses Roofstock to find a tenant-occupied single-family home in Indianapolis for $200,000. He analyzes the provided inspection report, lease details, and cash flow projections. After securing financing, he purchases the property entirely through the platform and hires a Roofstock-certified property manager, becoming a remote landlord without ever visiting the property.

Key Features and User Experience

- Investment Minimum: The full purchase price of a property (typically requires a down payment of 20% or more).

- Asset Classes: Single-family rental homes, small multi-family properties, and rental property portfolios.

- Fee Structure: A marketplace fee of 0.5% or $500 (whichever is greater) for buyers, and a 3.0% or $2,500 fee for sellers.

- Liquidity: Low; liquidity is tied to selling an entire physical property on the open market or through Roofstock's platform.

The platform is engineered for active investors who want control over their assets. While requiring more capital, Roofstock offers a powerful way to accelerate building wealth with real estate through tangible assets.

Website: https://www.roofstock.com

4. CrowdStreet

CrowdStreet carves out its niche as one of the best real estate investment apps for accredited investors seeking direct access to institutional-quality commercial deals. It operates as a marketplace, connecting sophisticated investors with experienced real estate developers and sponsors across the country. Unlike portfolio-based platforms, CrowdStreet allows you to take a more active role by handpicking individual properties or investing in curated funds.

Real-Life Example: Dr. Chen, an accredited investor, wants to diversify into commercial real estate. On CrowdStreet, she finds a "build-to-rent" community development project in a high-growth suburb of Phoenix. She attends a live webinar with the developer (sponsor), reviews their 20-year track record, and examines the financial pro forma. Confident in the deal, she invests $50,000 for an equity stake, targeting a 1.8x multiple on her investment over a 5-year hold period.

Key Features and User Experience

- Investment Minimum: Typically starts at $25,000 but varies by deal.

- Asset Classes: Direct investments in commercial real estate (CRE) including multifamily, industrial, retail, office, and managed portfolios.

- Fee Structure: Varies by deal sponsor; CrowdStreet does not charge investors platform fees, but sponsors pay fees that are disclosed in offering documents.

- Liquidity: Highly illiquid, with investment hold periods typically ranging from 3 to 10 years, reflecting the long-term nature of private CRE.

The platform is geared toward experienced investors who are comfortable performing their own due diligence. While it requires a significant capital commitment and is restricted to accredited investors, it offers unparalleled access to a caliber of deals that were once reserved for institutional players.

Website: https://www.crowdstreet.com

5. RealtyMogul

RealtyMogul establishes itself as one of the best real estate investment apps by offering a versatile, hybrid platform that caters to both non-accredited and accredited investors. It uniquely bridges the gap between simplified REIT investing and more complex individual property deals. This approach allows beginners to start with diversified, professionally managed portfolios while giving seasoned investors access to private placements and specialized opportunities like 1031 exchanges.

The platform is recognized for its extensive due diligence process and transparent deal presentations, providing detailed information to help investors make informed decisions.

Real-Life Example: A small business owner, Frank, has $10,000 to invest. He's not accredited but wants more than a generic fund. He chooses RealtyMogul’s Apartment Growth REIT. His investment gives him a piece of a diversified portfolio of apartment buildings across several U.S. markets, and he starts receiving quarterly distributions. This allows him to benefit from the multifamily sector without needing the capital or expertise to buy an entire building.

Key Features and User Experience

- Investment Minimum: $5,000 for REITs; higher for private placements (often $25,000+).

- Asset Classes: Non-traded REITs (Income and Apartment Growth), individual commercial properties, and 1031 exchange-eligible properties.

- Fee Structure: Varies by investment; REITs have management fees around 1-1.25%, while private placements have their own specific fee structures.

- Liquidity: Limited; a share buyback program is available for REITs after one year, but it is not guaranteed and may have limitations.

The user experience is professional and data-rich. Using a real estate investment calculator can help you project potential returns on these higher-value investments.

Website: https://www.realtymogul.com

6. Yieldstreet

Yieldstreet expands the concept of real estate investing by positioning it within a broader universe of alternative assets. While it offers robust real estate opportunities, its true strength lies in providing access to a diverse private market that includes art, private credit, legal finance, and venture capital alongside real estate debt and equity funds. This makes it one of the best real estate investment apps for investors looking to build a diversified portfolio of non-traditional assets under a single, unified platform.

The platform caters to a range of investor preferences by offering both individual deals for self-directed investors and managed portfolios like the Yieldstreet 360 Portfolios.

Real-Life Example: An experienced investor, Chloe, already has significant stock and bond exposure. She uses Yieldstreet to diversify. She allocates $15,000 to a real estate debt fund targeting an 11% yield and another $10,000 to an art equity fund. Yieldstreet allows her to manage these uncorrelated assets on one platform, helping her build a more resilient and diversified portfolio beyond public markets.

Key Features and User Experience

- Investment Minimum: Varies significantly by offering, typically starting from $5,000–$10,000 or higher.

- Asset Classes: Real estate debt, real estate funds, and a wide array of other alternative assets like private credit, art finance, and venture capital.

- Fee Structure: Fees are deal-specific and can include annual management fees (often 1-2.5%) and other charges detailed in each offering’s documentation.

- Liquidity: Most investments are illiquid with defined lock-up periods. A secondary marketplace offers a potential, but not guaranteed, path to early liquidity.

Yieldstreet’s platform is designed to be intuitive, presenting complex private market deals in a digestible format. The ability to fund investments through an IRA is a major advantage for those seeking tax-advantaged growth.

Website: https://www.yieldstreet.com

7. Groundfloor

Groundfloor offers a unique angle within the real estate investment app landscape by focusing exclusively on high-yield, short-term debt. Instead of buying equity in properties, investors act as the lender for fix-and-flip projects, funding loans originated by the platform. This model opens up the lucrative world of real estate debt to non-accredited investors, a space traditionally reserved for banks and private lenders.

Its core appeal lies in the ability to hand-pick individual loans or automate investments across a portfolio, giving users control over their risk and diversification. Each loan is graded for risk (from A to G) with a corresponding interest rate, providing exceptional transparency.

Real-Life Example: Ben wants to generate passive income with a low starting capital. He deposits $1,000 into Groundfloor and invests $100 into ten different short-term loans, each with a term of 9-12 months and varying risk grades (e.g., three Grade B loans at 8% and seven Grade D loans at 12.5%). As the borrowers repay their loans, Ben receives his principal and interest, which he can then reinvest into new loans, creating a compounding effect.

Key Features and User Experience

- Investment Minimum: $10 for individual loans (LROs); $1,000 for Groundfloor Notes.

- Asset Classes: Fractionalized debt investments in residential fix-and-flip loans (Limited Recourse Obligations) and Groundfloor Notes for portfolio exposure.

- Fee Structure: No fees are charged to investors; Groundfloor earns its revenue from fees paid by the borrowers.

- Liquidity: Most loans have short terms, typically 6-12 months. However, once invested, your capital is tied up until the loan is repaid.

The platform is built for active and passive investors alike. The granular control combined with low entry points makes it one of the best real estate investment apps for those who want to understand the mechanics of real estate lending.

Website: https://groundfloor.com

8. EquityMultiple

EquityMultiple caters specifically to accredited investors seeking direct access to professionally vetted commercial real estate deals. It stands out by offering investments across the entire capital stack, including senior debt, preferred equity, and common equity. This structure allows sophisticated investors to choose opportunities that align with their specific risk tolerance and return objectives.

The platform’s strength lies in its rigorous due diligence process, where only a small fraction of submitted deals are approved.

Real-Life Example: An accredited investor, Rachel, is nearing retirement and wants to shift her portfolio toward income generation. She uses EquityMultiple to invest $20,000 into a preferred equity deal for a stabilized industrial warehouse. This position gives her a fixed 10% annual preferred return, paid monthly, placing her ahead of common equity holders in the payment waterfall. It provides a balance of higher yield than public debt with more security than a common equity position.

Key Features and User Experience

- Investment Minimum: Typically starts around $5,000, varying by offering.

- Asset Classes: Direct equity, preferred equity, and senior debt in commercial real estate, including multifamily, office, industrial, and retail properties.

- Fee Structure: Varies by deal but often includes a 0.5% to 1.5% annual asset management fee, plus a share of profits on equity deals.

- Liquidity: Highly illiquid, with investment terms typically ranging from one to ten years.

For those looking to add institutional-quality assets to their portfolio, EquityMultiple is one of the best real estate investment apps available, providing tools for building generational wealth through strategic asset allocation.

Website: https://equitymultiple.com

9. Streitwise

Streitwise carves out a niche in the crowded real estate investment app space by focusing on a singular, income-driven strategy. It offers a publicly available, non-traded REIT that primarily invests in a portfolio of stabilized, institutional-quality commercial properties. This approach is designed to generate consistent quarterly dividends for investors, making it an attractive option for those prioritizing cash flow.

Unlike platforms that offer a wide array of funds, Streitwise provides a simple, one-stop investment accessible to both accredited and non-accredited investors.

Real-Life Example: Tom, a retiree, wants to supplement his social security income. He invests $15,000 into the Streitwise REIT. The REIT owns a portfolio of commercial properties with long-term leases to creditworthy tenants. Tom begins receiving quarterly dividend checks, which have historically yielded over 8% annually, providing him with a reliable passive income stream.

Key Features and User Experience

- Investment Minimum: Approximately $5,000 (based on a minimum of 500 shares).

- Asset Classes: Focused portfolio of income-producing commercial real estate, such as office parks and retail centers.

- Fee Structure: A 2% annual asset management fee, which is aligned with the sponsor's performance.

- Liquidity: A share redemption program is available after a one-year lock-up period, though it is subject to certain restrictions and potential discounts.

The user experience is clean and direct, reflecting the platform's simple investment thesis. It's a great "set it and forget it" option for generating passive income.

Website: https://streitwise.com

10. Cadre

Cadre provides a gateway to institutional-quality commercial real estate for accredited investors, setting it apart from platforms geared toward beginners. Its strength lies in its rigorous, data-driven approach to sourcing and underwriting deals, offering access to high-potential commercial properties like office buildings, multifamily complexes, and industrial assets.

This model is designed for sophisticated investors who want more control and transparency. Cadre's tech-forward platform includes a proprietary marketplace that provides a unique, albeit limited, secondary market, offering potential liquidity.

Real-Life Example: A finance professional, Sam, invests $100,000 in a Cadre-managed fund focused on industrial properties in the Midwest. Two years into the five-year hold, Sam needs liquidity for another opportunity. During one of Cadre's quarterly secondary market windows, he is able to list his shares and successfully sells his position to another investor on the platform, realizing a gain without having to wait for the full fund lifecycle.

Key Features and User Experience

- Investment Minimum: Typically starts at $25,000, though this can vary by deal.

- Asset Classes: Direct investments in institutional-grade commercial real estate (office, multifamily, industrial, hotel) and diversified funds.

- Fee Structure: Multiple layers, often including an upfront commitment fee, an annual asset management fee, and a percentage of profits.

- Liquidity: A unique secondary market offers periodic windows for selling shares, though this is not guaranteed and is subject to platform conditions.

The platform is built for serious investors who understand the complexities of commercial real estate, delivering a level of access and sophistication that few other platforms can match.

Website: https://cadre.com

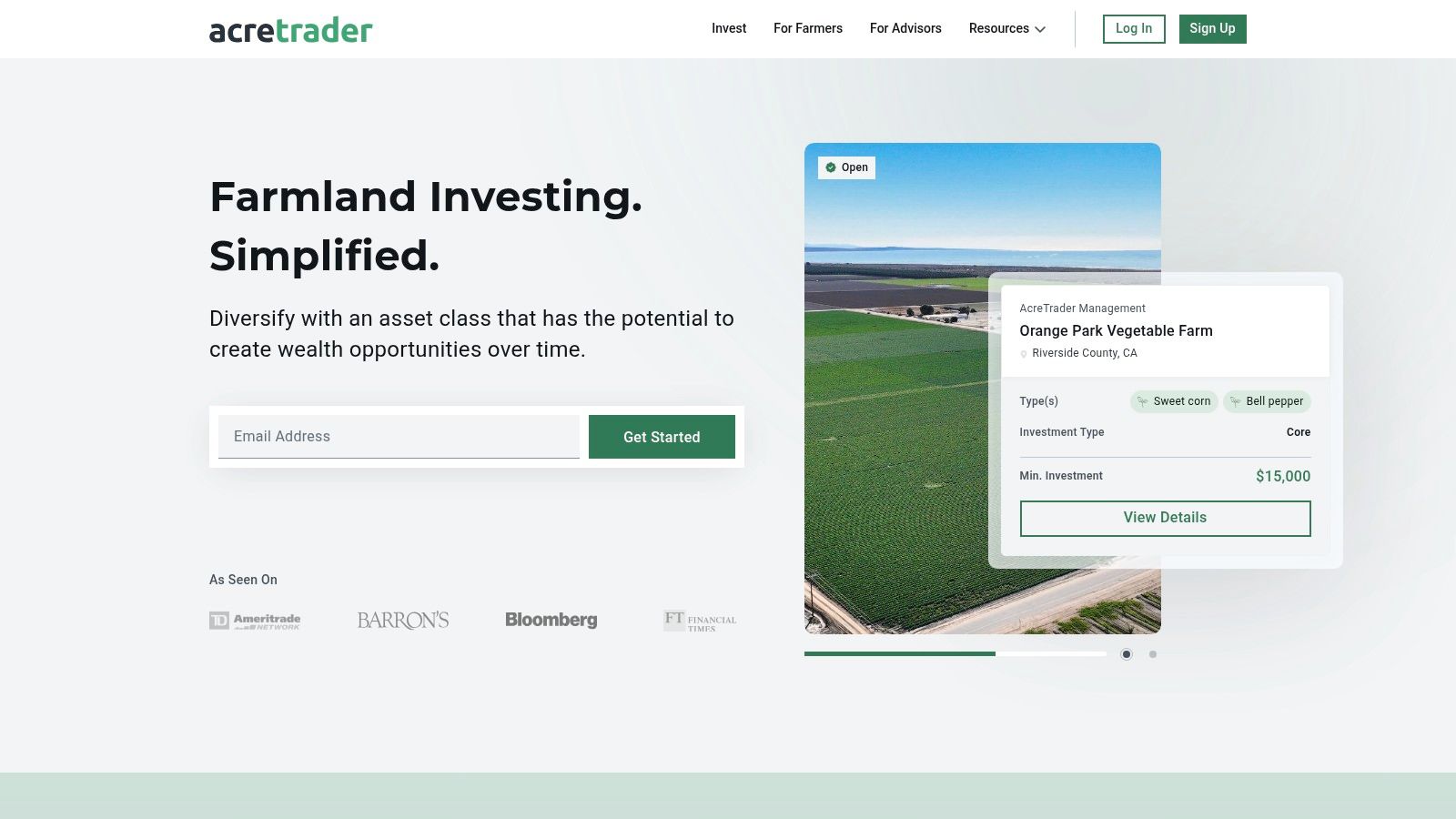

11. AcreTrader

AcreTrader offers a unique and specialized niche within the real estate investment app landscape by focusing exclusively on U.S. farmland. This platform provides accredited investors with direct access to an asset class that has historically shown low correlation to the stock market and traditional real estate sectors. By offering shares in individual farms, AcreTrader allows investors to benefit from potential land appreciation and passive income from cash rent paid by farmer tenants.

The platform’s strength lies in its rigorous due diligence process, where its team of specialists vets each property for soil quality, water rights, and tenant history before listing it.

Real-Life Example: An investor named Laura wants to add a tangible, inflation-resistant asset to her portfolio. She uses AcreTrader to invest $20,000 in a 100-acre corn and soybean farm in Illinois. AcreTrader manages the lease with the local farmer, and Laura receives an annual dividend from the cash rent (approx. 3-5% yield). Her primary return is expected from the long-term appreciation of the farmland itself.

Key Features and User Experience

- Investment Minimum: Typically ranges from $10,000 to $25,000 per offering.

- Asset Classes: Direct equity ownership in U.S. farmland, including row crops (corn, soybeans) and permanent crops (almonds, citrus).

- Fee Structure: An annual asset management fee, typically around 0.75% of the property value, is paid to Acretrader Management, LLC by the farm-owning LLC.

- Liquidity: Highly illiquid with expected hold periods of 5-10 years. A secondary market exists on the platform, but there is no guarantee of a buyer.

The user experience is educational and transparent. Understanding how to finance an investment property can provide helpful context, even for unique assets like farmland.

Website: https://acretrader.com

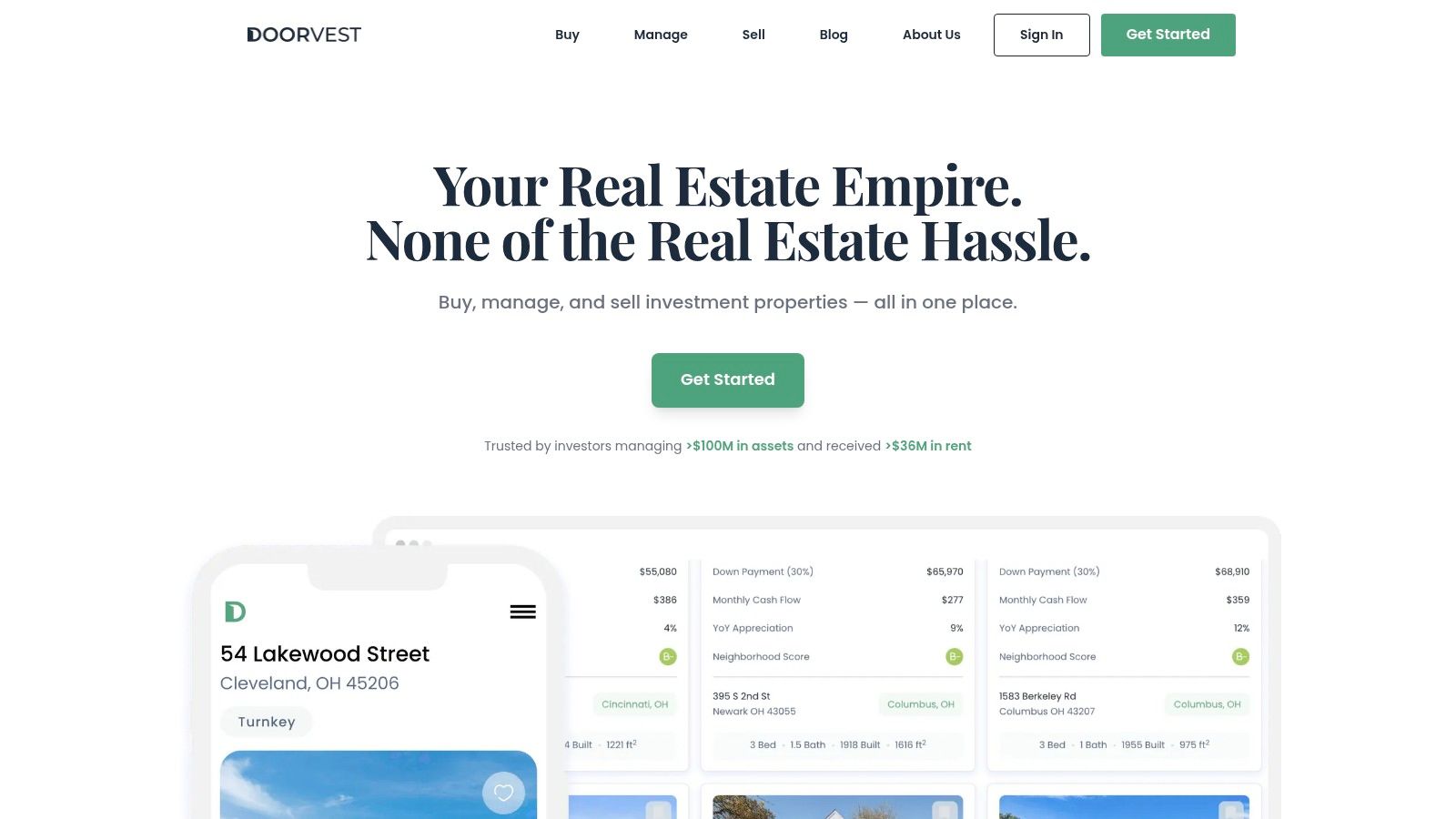

12. Doorvest

Doorvest offers a unique, end-to-end solution for those looking to own single-family rental properties without the typical landlord headaches. It stands apart by handling the entire process, from property acquisition and renovation to tenant placement and ongoing management. This turnkey model is specifically designed for passive investors who want the benefits of direct property ownership, such as appreciation and tax advantages, but lack the time or expertise.

The platform identifies promising investment properties, oversees a complete renovation, and places a qualified tenant before the investor even closes on the home.

Real-Life Example: A busy doctor in New York, Emily, wants to own rental property but has no time for management. She uses Doorvest and puts down a $2,000 deposit. Doorvest identifies a home in Houston, renovates it, and finds a tenant. Emily secures a mortgage for the property and closes. Doorvest’s property management arm handles everything—rent collection, maintenance—while Emily tracks her investment's performance and receives monthly net income through her online dashboard.

Key Features and User Experience

- Investment Minimum: The cost of a down payment on a single-family home (typically 20-25% of the property value), requiring substantial capital.

- Asset Classes: Direct ownership of fully renovated single-family rental homes in select U.S. markets.

- Fee Structure: Includes a property management fee (a percentage of monthly rent) and an asset management fee. Renovation costs are built into the final home price.

- Liquidity: Low. As with any direct property ownership, selling the asset is a lengthy process. Doorvest offers assistance with resale.

Doorvest's platform provides a streamlined dashboard to track property performance, view renovation progress, and manage financials. The experience is designed to be completely remote and hands-off, with guarantees on both the initial renovation quality and rental income for the first year.

Website: https://doorvest.com

Top 12 Real Estate Investment Apps Comparison

To help you visualize the differences, this table breaks down the key attributes of each platform:

| Platform | Best For | Minimum Investment | Investor Type | Core Asset Type | Liquidity |

|---|---|---|---|---|---|

| Fundrise | Hands-off beginners | $10 | Open to All | Diversified eREITs | Low (Quarterly Redemptions) |

| Arrived | Picking specific rental properties | $100 | Open to All | Fractional Rental Homes | Very Low (5-7 year hold) |

| Roofstock | Buying whole rental properties | ~20% Down Payment | Open to All | Single-Family Rentals | Very Low (Property Sale) |

| CrowdStreet | High-net-worth deal selection | ~$25,000 | Accredited Only | Commercial Real Estate | Very Low (3-10 year hold) |

| RealtyMogul | Hybrid REITs & private deals | $5,000 | Open & Accredited | REITs & Commercial RE | Low (Limited Redemptions) |

| Yieldstreet | Alternative asset diversification | ~$5,000-$10,000 | Primarily Accredited | Real Estate & Other Alts | Low (Secondary Market) |

| Groundfloor | Short-term debt investing | $10 | Open to All | Real Estate Debt (LROs) | Medium (6-12 month terms) |

| EquityMultiple | Capital stack investing | ~$5,000 | Accredited Only | CRE Debt & Equity | Very Low (1-10 year hold) |

| Streitwise | Simple, income-focused REITs | ~$5,000 | Open to All | Commercial RE REIT | Low (1-Year Lockup) |

| Cadre | Institutional-grade deals | ~$25,000 | Accredited Only | Institutional CRE | Low (Secondary Market) |

| AcreTrader | Niche farmland investing | ~$10,000 | Accredited Only | Farmland | Very Low (5-10 year hold) |

| Doorvest | Turnkey rental home ownership | ~20% Down Payment | Open to All | Single-Family Rentals | Very Low (Property Sale) |

Choosing Your App: Final Thoughts on Smart Real Estate Investing

Navigating the expansive landscape of modern real estate investing has never been more accessible. The journey from traditional, high-barrier property ownership to fractional, app-based investing represents a significant shift in wealth-building. Throughout this guide, we've dissected a dozen of the best real estate investment apps, each offering a unique pathway into the market.

We’ve seen how platforms like Fundrise and Arrived have democratized the industry, allowing beginners to start with as little as $10 or $100. Conversely, platforms such as CrowdStreet and Cadre cater to the accredited investor, providing access to institutional-grade commercial projects. The key takeaway is that there is no single "best" app for everyone. The ideal choice is deeply personal and hinges on your individual financial circumstances and investment philosophy.

Matching the App to Your Investor Profile

To crystallize your decision, consider which of these investor profiles best describes you:

- The Passive Diversifier: If your goal is broad market exposure with minimal effort, platforms like Fundrise or Streitwise are excellent choices. Their eREIT models automatically spread your capital across numerous properties.

- The Hands-On Deal Selector: For investors who want to actively choose their properties, Roofstock (for single-family rentals) and Arrived (for fractional shares) offer direct control. Accredited investors can take this even further with CrowdStreet or EquityMultiple.

- The Income-Focused Investor: If generating consistent cash flow is your priority, look toward debt investments. Groundfloor’s LROs offer short-term, high-yield opportunities, while platforms like RealtyMogul and Yieldstreet provide a mix of debt and equity options.

- The Niche Specialist: For those interested in unique asset classes, AcreTrader opens the door to farmland investing, while Doorvest provides a turnkey solution for owning entire rental properties remotely.

Actionable Steps to Get Started

Before you commit your capital, it’s crucial to take a few final steps. First, perform your own rigorous due diligence. Read the offering circulars, understand the fee structures, and explore user reviews for any platform you're seriously considering.

Second, start small. Many of these apps have low minimum investment requirements for a reason. Making a small initial investment allows you to experience the platform’s user interface, communication, and reporting firsthand without significant risk.

Finally, remember that these apps are tools, not magic wands. Real estate investing, even through a simplified app, carries inherent risks. Market fluctuations, liquidity constraints, and deal-specific issues are all part of the equation. A successful strategy involves a long-term perspective and an understanding that your portfolio will evolve.

The digital revolution has brought unprecedented opportunities to the world of real estate. By carefully aligning one of these powerful apps with your personal financial goals, you can take a confident and strategic step forward on your wealth-building journey.

Frequently Asked Questions (FAQ)

1. Can I really start investing in real estate with just $10?

Yes. Platforms like Fundrise allow you to invest in their Starter Portfolio with a minimum of $10. This gives you fractional ownership in a diversified portfolio of real estate projects, making it one of the most accessible entry points into the market.

2. What is the difference between an eREIT and a traditional REIT?

A traditional REIT (Real Estate Investment Trust) is typically publicly traded on a stock exchange, like a stock, offering high liquidity. An eREIT, pioneered by platforms like Fundrise, is a private, non-traded REIT sold directly to investors online. They are generally less liquid but offer access to private real estate deals that aren't available on public markets.

3. Do I have to be an accredited investor to use these apps?

Not for all of them. Apps like Fundrise, Arrived, Groundfloor, and Streitwise are open to all U.S. investors. However, platforms offering more complex or direct commercial deals, such as CrowdStreet, Cadre, and EquityMultiple, are generally restricted to accredited investors due to SEC regulations.

4. What are the main risks of using real estate investment apps?

The primary risks include:

- Liquidity Risk: Most private real estate investments are illiquid, meaning your money is tied up for several years.

- Market Risk: Real estate values and rental income can decline due to economic downturns or local market changes.

- Platform Risk: The success of your investment relies on the platform's ability to source and manage good deals.

5. How do these apps make money?

Their revenue models vary. Some charge an annual asset management fee (e.g., Fundrise, 1%). Others charge sourcing fees on new properties (e.g., Arrived). Platforms like Roofstock charge marketplace fees to buyers and sellers. Debt platforms like Groundfloor make money from fees paid by the borrowers, not the investors.

6. Can I lose my entire investment?

Yes. Like any investment, real estate carries risk, and it is possible to lose money, including your entire principal. Debt investments are secured by the property, offering some protection, while equity investments carry higher risk and higher potential reward.

7. Are the dividends or rental income I receive taxed?

Yes, income received from these investments is generally taxable. Dividend income is often taxed as ordinary income, though some may qualify for lower rates. You will typically receive a Form 1099 or a Schedule K-1 from the platform for tax reporting purposes. It's best to consult with a tax professional.

8. What's the difference between investing in debt and equity?

Investing in equity means you own a piece of the property (e.g., through Fundrise or Arrived). Your return comes from rental income and appreciation when the property is sold. It has higher potential returns but also higher risk. Investing in debt means you are acting as a lender (e.g., through Groundfloor). Your return is the fixed interest paid on the loan. It's generally lower risk but has a capped return.

9. Can I invest through my IRA?

Some platforms, like Yieldstreet and others via partnerships, allow you to invest through a Self-Directed IRA (SDIRA). This can offer significant tax advantages by allowing your real estate investments to grow tax-deferred or tax-free. Check with each platform for their specific IRA options.

10. How do I choose the right app for me?

Consider three factors:

- Your Capital: How much can you invest? (e.g., $100 vs. $25,000).

- Your Goal: Are you seeking passive income, long-term growth, or diversification?

- Your Involvement: Do you want a completely hands-off fund or do you want to pick individual properties?

Matching your answers to the platform features in our comparison table is the best way to start.

Ready to take your financial knowledge to the next level? The world of investing extends far beyond apps, and the Top Wealth Guide is your comprehensive resource for mastering diverse wealth-building strategies. Visit Top Wealth Guide to access expert insights, in-depth guides, and tools designed to help you make smarter financial decisions.

1 Comment

Pingback: How to Find Investment Properties That Actually Work