Choosing the best decentralized crypto exchange (DEX) can feel overwhelming, with dozens of platforms competing for your attention. Unlike centralized exchanges, DEXs offer direct, peer-to-peer trading from your own wallet, giving you full control over your assets. This guide cuts through the noise to help you find the right platform for your specific trading needs, whether you're a beginner swapping your first tokens or an experienced investor hunting for optimal pricing.

We will provide a detailed breakdown of today's top DEXs and aggregators, including Uniswap, Jupiter, PancakeSwap, and Curve Finance. You'll get a clear, side-by-side look at their core features, fee structures, security measures, and ideal use cases. Each review is designed to be actionable, featuring screenshots to guide you through the interface and direct links so you can start trading immediately.

This article moves beyond surface-level descriptions to offer practical insights into which platform excels for specific tasks, such as finding the lowest slippage, earning yield, or accessing multi-chain assets. By the end, you'll have a clear understanding of each option's strengths and weaknesses, empowering you to navigate the decentralized finance landscape with confidence and select the best decentralized crypto exchange for your investment strategy.

In This Guide

- 1 1. Uniswap

- 2 2. 1inch

- 3 3. Jupiter

- 4 4. PancakeSwap

- 5 5. Curve Finance

- 6 6. CoW Swap (CoW Protocol)

- 7 7. Matcha (by 0x)

- 8 Quick Comparison of the Top Decentralized Exchanges

- 9 Your Next Step in Decentralized Trading

- 10 Frequently Asked Questions (FAQ)

- 10.1 1. What is the main difference between a decentralized exchange (DEX) and a centralized exchange (CEX)?

- 10.2 2. Are decentralized exchanges safe to use?

- 10.3 3. What is a DEX aggregator and why should I use one?

- 10.4 4. What are "gas fees" on a DEX?

- 10.5 5. Do I need to do KYC (Know Your Customer) on a DEX?

- 10.6 6. What is "slippage" and how can I minimize it?

- 10.7 7. Can I earn passive income on a decentralized exchange?

- 10.8 8. Which DEX is best for beginners?

- 10.9 9. Why would I use a specialized DEX like Curve?

- 10.10 10. What is MEV and how can I protect myself?

1. Uniswap

As the original pioneer of the Automated Market Maker (AMM) model, Uniswap remains a cornerstone of decentralized finance and arguably the best decentralized crypto exchange for users on Ethereum and its many Layer 2 scaling solutions. It provides a non-custodial trading experience, meaning you retain full control over your assets by connecting your own crypto wallet. Its interface is famously simple, making it accessible for beginners while its underlying architecture offers deep complexity for advanced users.

Uniswap’s primary function is to facilitate the swapping of ERC-20 tokens. Its massive liquidity pools, contributed by thousands of users globally, ensure that even large trades on popular pairs like ETH/USDC often experience minimal price slippage, rivaling the execution of centralized exchanges.

Key Features and User Experience

Uniswap’s standout feature is its concentrated liquidity model, introduced in Uniswap v3. This allows liquidity providers (LPs) to allocate their capital within specific price ranges, dramatically improving capital efficiency and leading to better prices for traders. For users, this translates directly into more favorable swap rates.

The platform supports a vast ecosystem of blockchains, including Ethereum, Polygon, Arbitrum, Optimism, Base, and Celo, making it a versatile hub for cross-chain DeFi activity. Recently, the launch of the first-party Uniswap Wallet for iOS has simplified the mobile experience, offering built-in MEV protection to shield users from front-running bots and ensure they receive the best possible price on their swaps.

Real-Life Example: A trader wants to swap 10 ETH for USDC. On a traditional AMM, their trade would be executed against the entire liquidity pool. On Uniswap v3, their trade is executed against the highly concentrated liquidity within the current price range, resulting in significantly lower price impact and receiving more USDC in return. This efficiency is why Uniswap remains a top choice for large swaps.

Pricing and Platform Suitability

| Feature | Uniswap Details |

|---|---|

| Trading Fees | 0.01%, 0.05%, 0.30%, or 1.00% (v3, pool-dependent) |

| Network Fees | User pays blockchain gas fees (variable) |

| Best For | Swapping major and long-tail ERC-20 tokens, providing liquidity |

| Access | Web app, mobile wallet (iOS) |

Pros:

- Extremely deep liquidity for major token pairs.

- Mature, battle-tested protocol with wide industry support.

- Concentrated liquidity offers superior price execution.

Cons:

- Gas fees on Ethereum mainnet can be prohibitively high.

- Faces ongoing regulatory scrutiny in the United States.

For a deeper dive into how this platform and others function, you can learn more about the core mechanics of a decentralized crypto exchange.

Website: https://app.uniswap.org

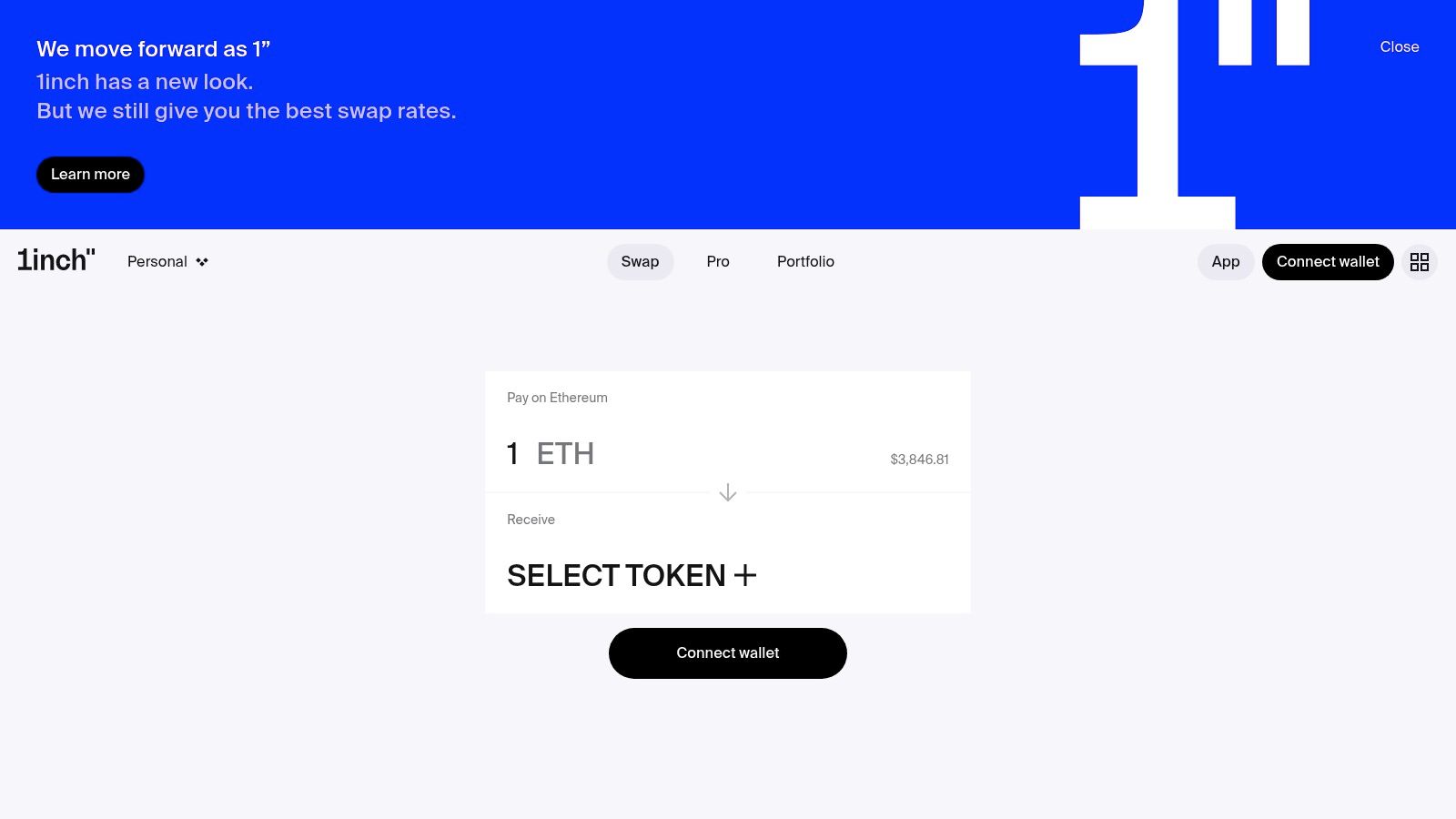

2. 1inch

As a premier DEX aggregator, 1inch offers a powerful solution for traders seeking optimal price execution without manually comparing different exchanges. It functions as a smart routing protocol that scans over a hundred liquidity sources across multiple blockchains to find the most efficient swap path. This makes it a contender for the best decentralized crypto exchange for users who prioritize getting the best possible rate on every trade, as it automatically splits orders and routes them through various DEXs to minimize slippage and maximize returns.

1inch provides a non-custodial gateway to the DeFi ecosystem, allowing you to trade directly from your crypto wallet with full control over your funds. Its core value is abstracting away the complexity of finding the best prices in a fragmented liquidity landscape.

Key Features and User Experience

The standout feature of 1inch is its Pathfinder routing algorithm. This technology analyzes countless potential trade routes in real-time, factoring in fees, slippage, and gas costs to present the user with the most cost-effective swap. The platform also offers advanced order types, including a limit order protocol that allows users to set specific buy or sell prices without incurring a protocol fee.

Another powerful feature is Fusion+, a system designed to facilitate gasless swaps by having authorized "resolvers" pay the transaction fees on the user's behalf. While this adds a slight delay, it protects users from failed transactions and potential MEV attacks. The platform supports a wide array of networks, including Ethereum, BNB Chain, Polygon, and Arbitrum, making it a highly versatile tool for multi-chain traders.

Real-Life Example: Imagine swapping $50,000 worth of Wrapped Bitcoin (WBTC) for DAI. A single DEX might not have enough liquidity, causing significant price slippage. 1inch's Pathfinder could split the order, routing 60% through Uniswap, 30% through SushiSwap, and 10% through Curve, all in a single transaction. This multi-path execution results in the user receiving thousands of dollars more in DAI compared to using a single platform.

Pricing and Platform Suitability

| Feature | 1inch Details |

|---|---|

| Trading Fees | No aggregator fee on standard swaps. User pays the fees of the underlying DEXs in the swap route. |

| Network Fees | User pays blockchain gas fees (variable). Gasless options available via Fusion+. |

| Best For | Optimizing trade execution, executing large swaps, and placing limit orders. |

| Access | Web app, mobile wallet (iOS & Android) |

Pros:

- Typically achieves better net price execution versus using a single DEX.

- No extra aggregator fee on standard swaps.

- Supports advanced order types like gasless limit orders.

Cons:

- The user interface and array of features can be complex for newcomers.

- Total transaction costs can be harder topredict due to complex routing.

To better understand how aggregators fit into the broader ecosystem, you can find more information in this complete DEX guide.

Website: https://app.1inch.io

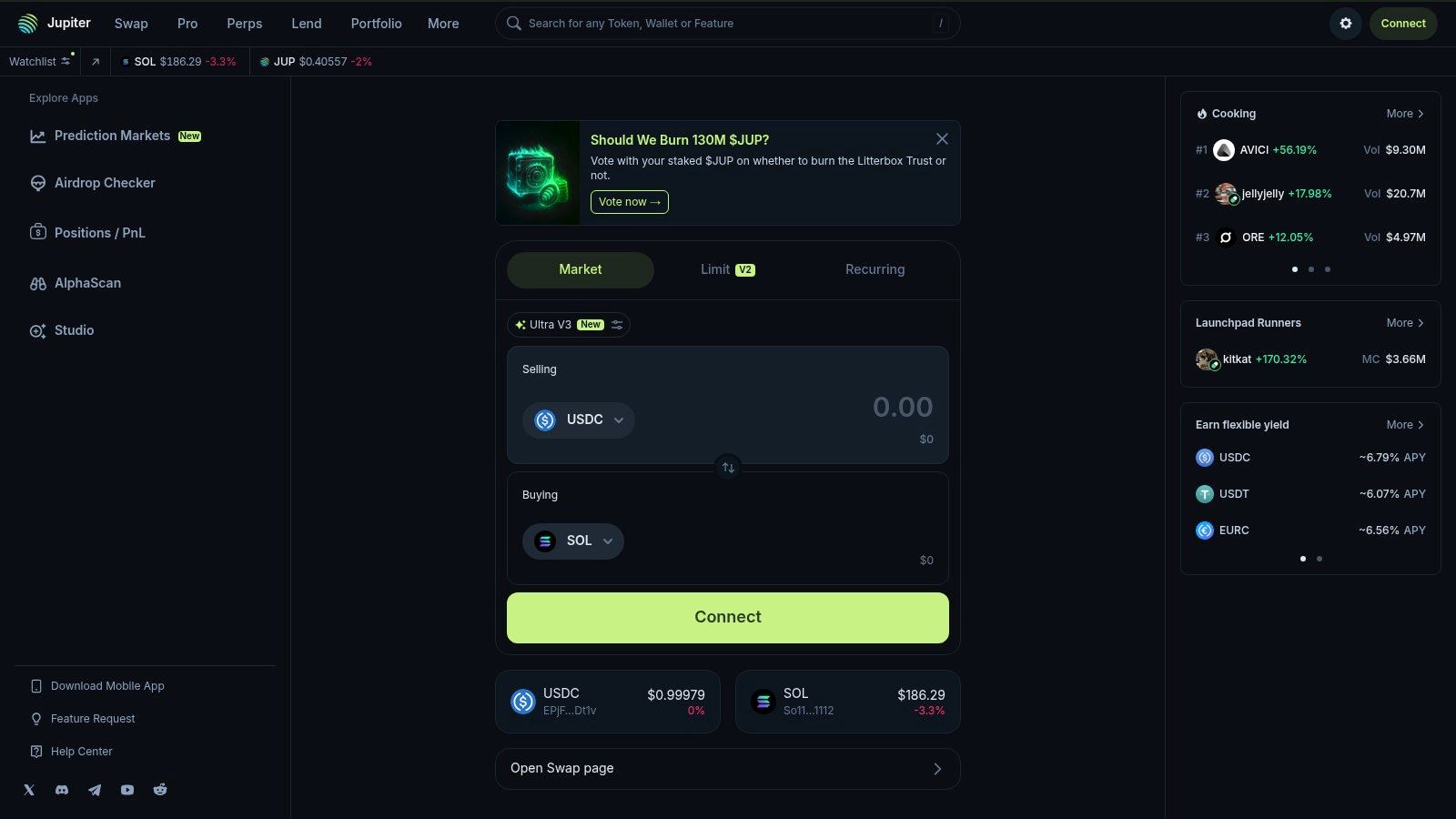

3. Jupiter

As the dominant DEX aggregator on the Solana blockchain, Jupiter has established itself as the go-to platform for high-speed, low-cost token swaps within its ecosystem. It stands out by routing orders across multiple underlying liquidity sources, like Orca and Raydium, to find the single best trade route for its users. This makes it a strong contender for the best decentralized crypto exchange for those focused on the Solana network, offering a non-custodial experience where you always control your funds via a connected Solana wallet.

Jupiter’s core function is to provide the most efficient trading path, minimizing price impact and maximizing the tokens you receive. Its powerful routing algorithm and the inherent speed of the Solana blockchain combine to deliver an experience that feels remarkably close to a centralized exchange, but with the benefits of self-custody.

Key Features and User Experience

Jupiter’s standout feature is its powerful trade aggregation engine. Instead of being limited to one liquidity pool, it scans the entire Solana DeFi landscape to execute your trade at the best possible price, a crucial advantage for both small and large traders. Beyond simple swaps, it offers a suite of advanced tools typically reserved for more complex platforms.

Users can access limit orders, set up Dollar-Cost Averaging (DCA) for automated, recurring buys, and even trade perpetual futures. This comprehensive toolset is presented in a clean, intuitive interface that makes navigating advanced trading strategies straightforward. The platform’s integration with wallets like Phantom and Solflare ensures a seamless and secure connection for managing your assets.

Real-Life Example: An investor wants to buy $100 worth of a new Solana-based token every week. Instead of manually making the purchase, they use Jupiter's DCA feature. They can set it to automatically swap 100 USDC for the desired token every Monday at 9 AM for the next six months. This "set and forget" approach automates their investment strategy, taking advantage of Solana's low fees.

Pricing and Platform Suitability

| Feature | Jupiter Details |

|---|---|

| Trading Fees | No protocol fee for standard swaps; explicit fees on advanced products (e.g., 0.1% for DCA) |

| Network Fees | User pays Solana network fees (typically < $0.01) |

| Best For | High-frequency trading, swapping Solana-based assets, automated investing |

| Access | Web app, integrated within various Solana wallets |

Pros:

- Extremely low network costs and near-instantaneous transaction speeds.

- Feature-rich platform with limit orders, DCA, and perpetuals.

- Aggregator model ensures optimal pricing across the Solana ecosystem.

Cons:

- Solana network congestion can occasionally cause transaction delays or failures.

- The asset selection is limited to the Solana ecosystem, differing from EVM chains.

For those new to the space, understanding these platform differences is a key part of learning how to invest in cryptocurrency.

Website: https://jup.ag

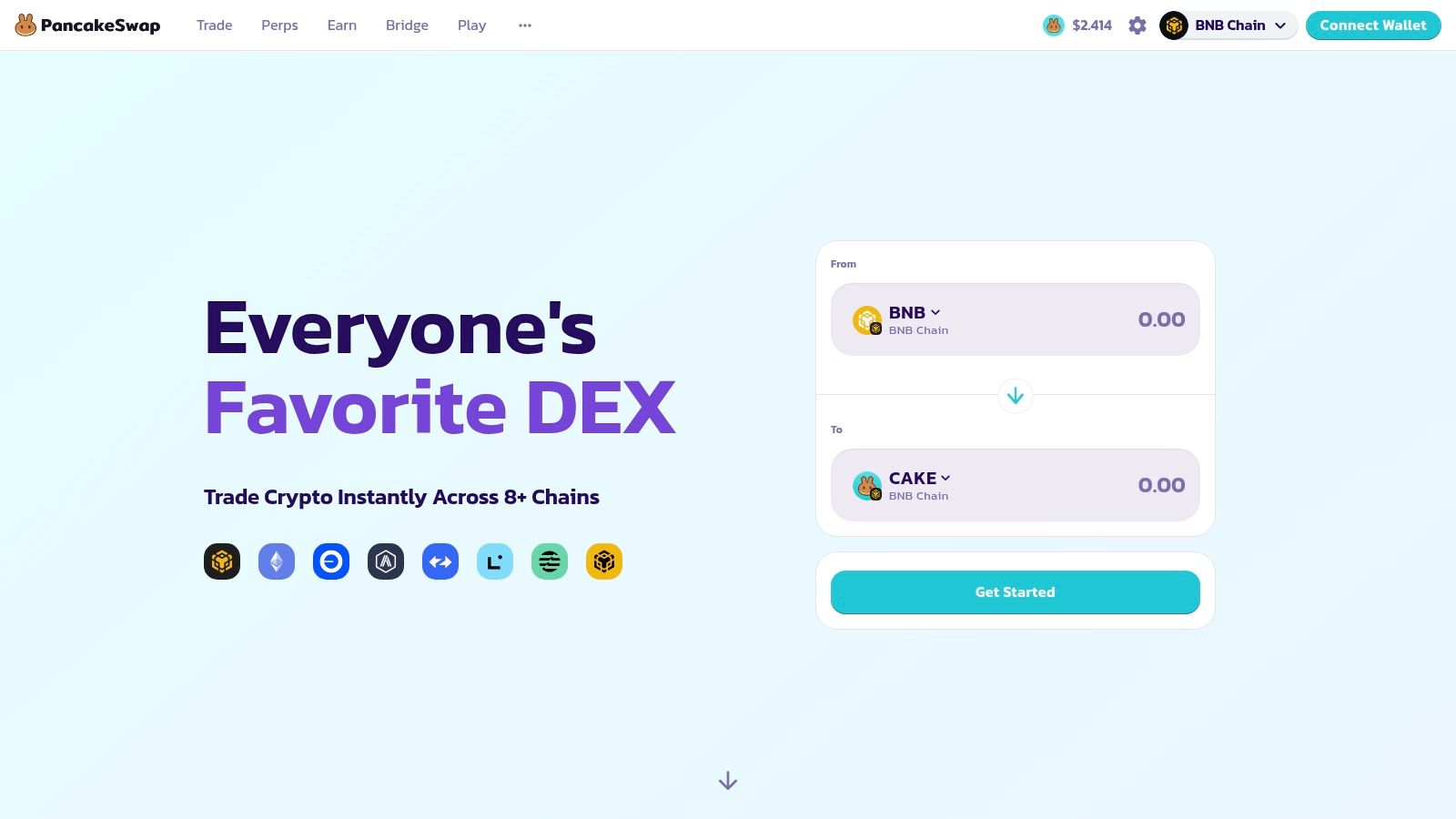

4. PancakeSwap

As the dominant force on the BNB Chain, PancakeSwap has evolved into a multi-chain powerhouse, making a strong case as the best decentralized crypto exchange for users seeking low-cost trades and a massive variety of tokens. It operates as a non-custodial Automated Market Maker (AMM), allowing you to trade directly from your crypto wallet with full control over your private keys. Its friendly and gamified interface makes it inviting for newcomers, while its advanced features provide depth for seasoned DeFi users.

Initially famed for popularizing DeFi on the BNB Chain, PancakeSwap's core function is facilitating lightning-fast, low-cost token swaps. Its deep liquidity and enormous trading volume, particularly on BNB Chain pairs, ensure trades execute with minimal slippage, offering an experience that is often cheaper and faster than its Ethereum-based counterparts.

Key Features and User Experience

Like other modern DEXs, PancakeSwap has adopted a v3 concentrated liquidity model. This feature empowers liquidity providers to allocate their capital to specific price ranges, which increases capital efficiency and results in better prices and lower slippage for traders. The platform offers a wide range of fee tiers, starting as low as 0.01% for stablecoin pairs.

PancakeSwap supports an impressive array of blockchains, including BNB Chain, Ethereum, Polygon zkEVM, zkSync Era, Arbitrum One, Linea, and Base. Beyond simple swaps, it offers a rich ecosystem of DeFi products like yield farming, staking pools (Syrup Pools), and an IFO (Initial Farm Offering) platform for new projects. This makes it a comprehensive hub for earning passive income on your crypto assets. For those just starting, you can learn more about PancakeSwap and other platforms for cryptocurrency beginners.

Real-Life Example: A user holds a significant amount of CAKE tokens. Instead of letting them sit idle, they stake their CAKE in a Syrup Pool on PancakeSwap to earn a new, up-and-coming token for free. This allows them to generate passive income and gain exposure to new projects within the ecosystem, all from one platform.

Pricing and Platform Suitability

| Feature | PancakeSwap Details |

|---|---|

| Trading Fees | 0.01%, 0.05%, 0.25%, or 1.00% (v3, pool-dependent) |

| Network Fees | User pays blockchain gas fees (variable, very low on BNB Chain) |

| Best For | Low-cost trading, accessing a vast range of altcoins, yield farming |

| Access | Web app |

Pros:

- Extremely low trading fees, especially on stablecoin and major pairs.

- Massive token selection and high on-chain liquidity on BNB Chain.

- Extensive yield farming and staking opportunities.

Cons:

- The large number of new listings increases the risk of encountering scams.

- Navigating multi-chain features and fee tiers can be complex for new LPs.

Website: https://pancakeswap.finance

5. Curve Finance

As a veteran of decentralized finance, Curve Finance has carved out an indispensable niche as the best decentralized crypto exchange for stablecoins and other tightly correlated assets like staked ETH derivatives (e.g., stETH/ETH). Its unique pricing algorithm is specifically engineered to minimize slippage, allowing for massive swaps between pegged assets with an efficiency that often surpasses both centralized exchanges and other AMMs. This focus makes it a foundational building block for countless DeFi strategies.

Curve provides a non-custodial trading environment, allowing you to swap directly from your crypto wallet. While its interface might appear more data-driven than some competitors, its specialization provides unparalleled performance for its target use cases, making it a critical tool for serious DeFi users, arbitrage bots, and other protocols.

Key Features and User Experience

Curve's core innovation is its Stableswap invariant, a specialized AMM bonding curve designed for assets that should trade at or near a 1:1 ratio. This model concentrates the vast majority of liquidity around the peg, resulting in extremely low slippage for swaps between assets like USDC, DAI, and USDT. For traders, this means you can exchange millions of dollars worth of stablecoins with minimal price impact.

The platform is deployed across numerous blockchains, including Ethereum, Arbitrum, Polygon, and Avalanche, with its parameters and new pool deployments governed by the CurveDAO. This makes it a multi-chain hub for stable asset liquidity. Its deep integration across the DeFi ecosystem means that many other protocols and aggregators route their stablecoin swaps through Curve to find the best prices.

Real-Life Example: A DeFi protocol's treasury needs to rebalance by swapping $5 million USDT for USDC. Using a standard DEX would result in substantial slippage, costing them thousands. By using Curve, the swap is executed with near-zero price impact, perhaps only a few hundred dollars in slippage and fees. This ultra-high efficiency for stablecoins is why Curve is a fundamental building block of DeFi.

Pricing and Platform Suitability

| Feature | Curve Finance Details |

|---|---|

| Trading Fees | Varies by pool, often around 0.04% for stablecoins |

| Network Fees | User pays blockchain gas fees (variable) |

| Best For | Large-volume stablecoin swaps, trading pegged assets (stETH, wBTC) |

| Access | Web app |

Pros:

- Excellent execution for stablecoin and pegged-asset swaps, even at larger sizes.

- Mature, widely integrated DeFi building block used by many protocols.

- Offers yield opportunities for stablecoin holders through liquidity provision.

Cons:

- Not ideal for highly volatile or illiquid tokens.

- Interface can feel advanced compared with swap-only DEXs.

Its role as a cornerstone for stable asset liquidity is a key part of many advanced DeFi strategies. You can explore how it fits into broader portfolio management by learning more about different cryptocurrency investment strategies.

Website: https://curve.fi

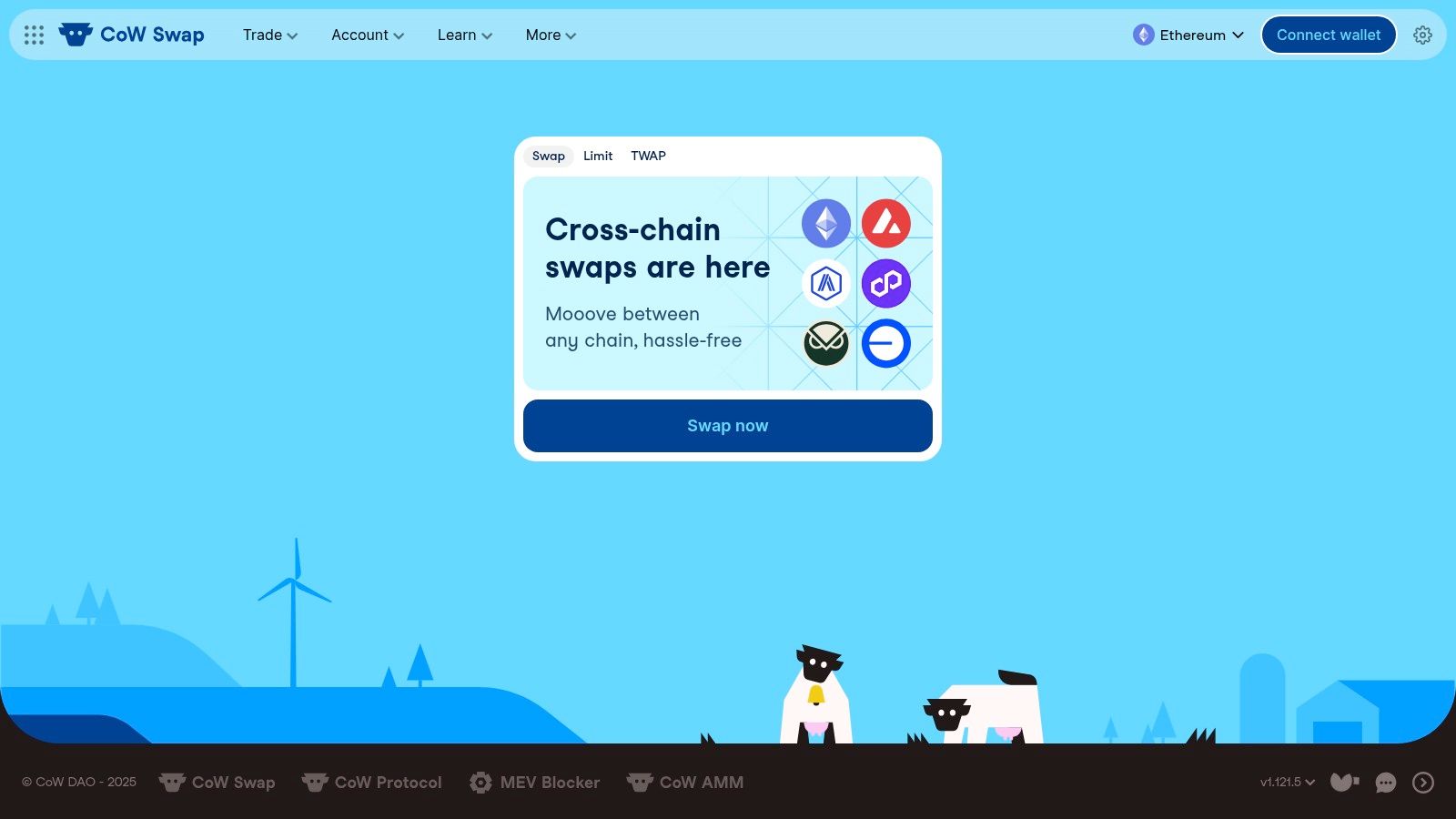

6. CoW Swap (CoW Protocol)

CoW Swap introduces a novel, intent-based approach to decentralized trading that sets it apart from traditional Automated Market Makers. Instead of executing swaps directly against a liquidity pool, it uses a mechanism called batch auctions. This design protects users from Maximal Extractable Value (MEV) attacks, making it a contender for the best decentralized crypto exchange for traders executing large orders or those highly sensitive to price slippage and front-running.

The protocol works by collecting user intents (e.g., "I want to trade 10 ETH for USDC") and matching them against each other off-chain in batches. Professional "solvers" then compete to find the best possible execution path for any remaining unmatched orders, either through peer-to-peer matches or by routing them through on-chain AMMs. This entire process is designed to find the best price while minimizing the transaction's exposure to the public mempool where MEV bots operate.

Key Features and User Experience

CoW Swap’s signature feature is its built-in MEV protection. By settling trades through batch auctions, it prevents common attacks like "sandwiching," where bots front-run and back-run a user's trade to extract value. Users submit a signature to express their trade intent, and solvers handle the complex execution, paying the gas fees on the user's behalf.

The platform also offers a "gasless" trading experience. While network fees are still paid, they are incorporated into the final settlement price of the trade, so users do not need to hold the native network token (like ETH) just for gas. The interface is clean and straightforward, clearly displaying the potential price improvement and MEV protection benefits for each trade.

Real-Life Example: A trader places a large order to buy a token on a standard DEX. An MEV bot sees this in the public mempool, buys the token right before them to drive the price up, and then sells immediately after the trader's purchase for a profit. This "sandwich attack" costs the trader money. By using CoW Swap, the trade is shielded from these bots. It's settled in a batch, preventing the bot from exploiting the transaction and ensuring the trader gets a fairer price.

Pricing and Platform Suitability

| Feature | CoW Swap Details |

|---|---|

| Trading Fees | Protocol and solver fees are included in the final price quote |

| Network Fees | User pays gas via the final token output (no native token needed) |

| Best For | Large trades, MEV-sensitive users, gasless swaps |

| Access | Web app |

Pros:

- Superior protection against sandwich attacks and front-running.

- Potential for price improvements from peer-to-peer "coincidences of wants."

- Gasless trading experience simplifies the user workflow.

Cons:

- The batch auction model can feel slower than instant AMM swaps.

- The execution model is less transparent and can be a learning curve for new users.

Website: https://swap.cow.fi

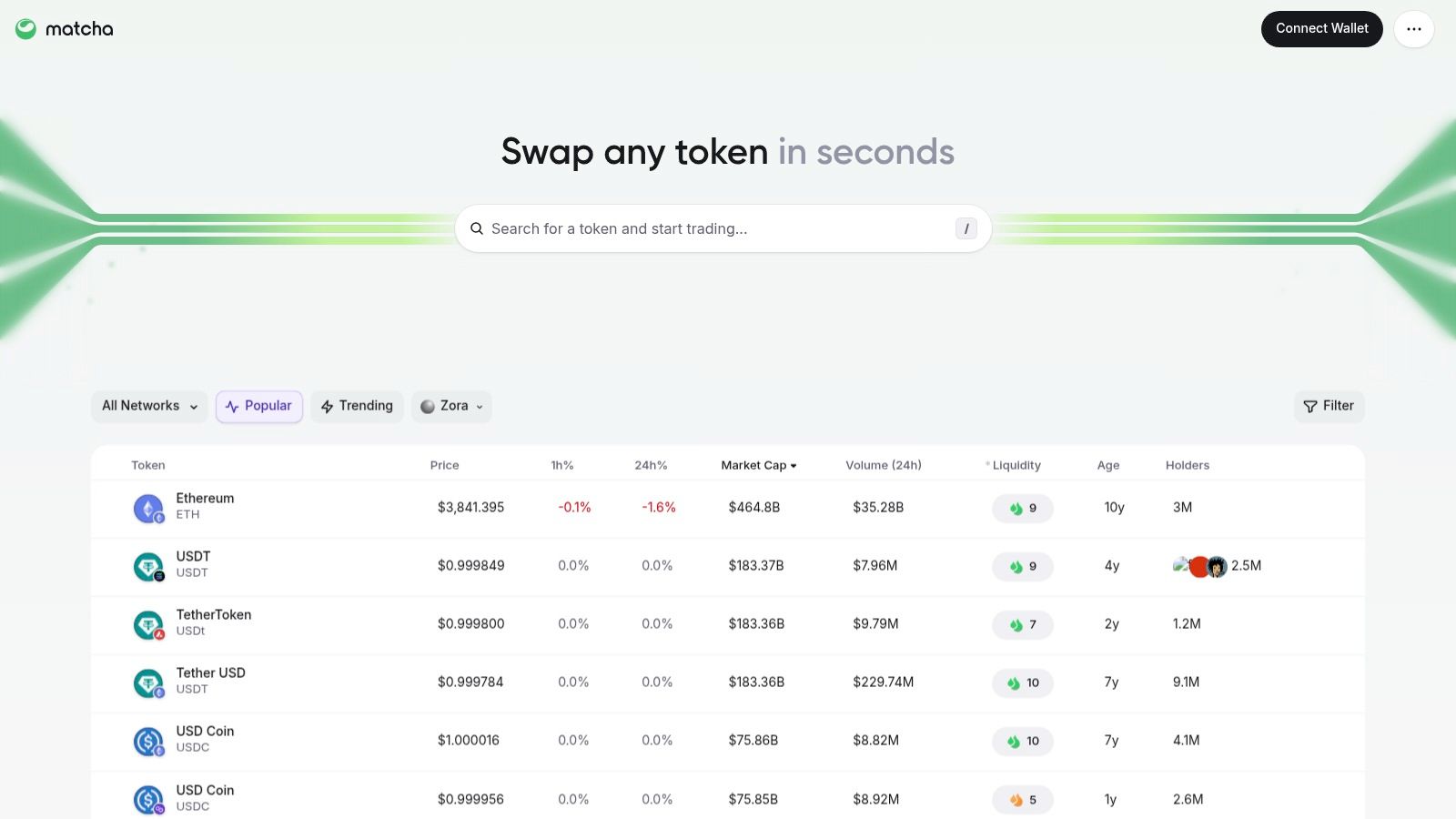

7. Matcha (by 0x)

For traders who value simplicity and clarity, Matcha stands out as a leading DEX aggregator powered by the 0x protocol. It is designed to find the most competitive prices by searching over 100 liquidity sources across multiple blockchains. As a non-custodial platform, Matcha ensures you always maintain control of your funds by connecting your own crypto wallet, offering a secure and streamlined trading experience.

Matcha’s core mission is to abstract away the complexity of DeFi, presenting users with a clean interface and transparent pricing. Instead of showing users confusing routing paths, it simply presents the final, competitive rate, making it an excellent candidate for the best decentralized crypto exchange for newcomers and those who prioritize ease of use.

Key Features and User Experience

The platform's primary strength is its powerful aggregation engine, which intelligently splits trades across various DEXs like Uniswap, Curve, and Balancer to minimize slippage and maximize returns for the user. A key differentiator is Matcha's commitment to cost transparency; it clearly displays all associated costs before a trade is executed, with no hidden aggregator fees.

Matcha supports a wide array of networks, including Ethereum, Polygon, Arbitrum, Base, and Avalanche, making it a versatile tool for multichain users. It also offers advanced order types not found on many basic AMMs, such as gasless limit orders powered by the 0x protocol. This feature allows users to set a specific price at which they want to buy or sell, which is executed automatically without them needing to monitor the market constantly.

Real-Life Example: A beginner to DeFi wants to swap some Polygon (MATIC) for another token but is intimidated by complex interfaces and charts. They navigate to Matcha, connect their wallet, and see a simple "you pay" and "you receive" interface. Matcha automatically finds the best price in the background and presents one clear number. This user-friendly experience allows them to trade confidently without needing to understand the underlying mechanics of liquidity routing.

Pricing and Platform Suitability

| Feature | Matcha (by 0x) Details |

|---|---|

| Trading Fees | No platform fees; sources liquidity from DEXs with their own fees |

| Network Fees | User pays blockchain gas fees (variable) |

| Best For | Beginners, finding the best price across multiple DEXs, setting limit orders |

| Access | Web app |

Pros:

- Extremely straightforward, beginner-friendly user interface.

- Transparent costs and competitive execution via 0x routing.

- Multichain support with powerful gasless limit-order capability.

Cons:

- Feature depth is lighter than platforms built for power users.

- Execution quality is dependent on the underlying liquidity of sourced DEXs.

To better understand how aggregators like Matcha operate, you can learn more about the core mechanics of a decentralized crypto exchange.

Website: https://matcha.xyz

Quick Comparison of the Top Decentralized Exchanges

This table provides a high-level overview to help you compare the key strengths and ideal user profiles for each DEX at a glance.

| Platform | Type | Best For | Key Advantage | Supported Chains (Examples) |

|---|---|---|---|---|

| Uniswap | AMM DEX | High-liquidity ERC-20 token swaps | Deep liquidity & concentrated liquidity model | Ethereum, Polygon, Arbitrum, Optimism |

| 1inch | DEX Aggregator | Finding the best price for large/complex trades | Smart routing across hundreds of liquidity sources | Ethereum, BNB Chain, Polygon, Avalanche |

| Jupiter | DEX Aggregator | Solana ecosystem trading and automation | Ultra-low fees, high speed, and advanced tools like DCA | Solana |

| PancakeSwap | AMM DEX | Low-cost trading & yield farming | Massive token selection on BNB Chain & low fees | BNB Chain, Ethereum, Base, Arbitrum |

| Curve Finance | AMM DEX | Large stablecoin & pegged-asset swaps | Minimal slippage for like-kind assets | Ethereum, Polygon, Arbitrum, Avalanche |

| CoW Swap | DEX Aggregator | MEV protection & large trades | Batch auctions prevent front-running & sandwich attacks | Ethereum, Gnosis Chain |

| Matcha (0x) | DEX Aggregator | Beginners & user-friendly multichain swaps | Simple interface with transparent pricing & limit orders | Ethereum, Polygon, Base, Arbitrum |

Your Next Step in Decentralized Trading

Navigating the world of decentralized finance can feel like exploring a new frontier. We've journeyed through some of the most innovative and powerful platforms available, from the pioneering AMM of Uniswap to the multi-chain aggregation prowess of 1inch and the Solana-native efficiency of Jupiter. Each platform presents a unique approach to solving the core challenge of decentralized trading: providing deep liquidity, minimal slippage, and user-centric control.

Whether you're drawn to the BNB Chain ecosystem powerhouse PancakeSwap, the stablecoin-focused depth of Curve Finance, the MEV-resistant batch auctions of CoW Swap, or the user-friendly aggregation of Matcha, the key takeaway is that the "best" decentralized crypto exchange is not a one-size-fits-all answer. Your ideal platform is a direct reflection of your specific trading strategy, risk tolerance, and blockchain preferences.

How to Choose Your DEX

Making the right choice requires a clear understanding of your personal investment goals. Before you connect your wallet and execute your first trade, consider these critical factors:

- For the Yield Farmer & Liquidity Provider: If your primary goal is to earn passive income on your assets, platforms like Curve Finance (for stablecoins) and PancakeSwap (for a wide variety of token pairs on BNB Chain) offer robust and often lucrative liquidity pools and staking opportunities.

- For the High-Volume Trader: If you frequently trade large amounts or niche altcoins, a DEX aggregator is your best ally. 1inch and Jupiter excel at splitting your order across multiple liquidity sources to find the absolute best price and minimize costly slippage.

- For the Security-Conscious Investor: Concerns about front-running and MEV are valid. CoW Swap directly addresses this by using batch auctions, ensuring your trades are executed at a fair, uniform price without being exploited by bots.

- For the Multi-Chain Explorer: If your portfolio spans Ethereum, BNB Chain, Solana, and beyond, an aggregator with strong cross-chain support like 1inch or a platform with a seamless user interface like Matcha will simplify your trading experience significantly.

Your journey into decentralized trading is one of continuous learning and adaptation. The ideal DEX for you today might not be the same one you use next year as your strategies evolve and new innovations emerge. The crucial first step is to align your chosen platform's strengths with your immediate needs. By starting with a DEX that complements your trading style, you empower yourself to transact with greater confidence, security, and efficiency in the exciting and ever-evolving landscape of DeFi.

Frequently Asked Questions (FAQ)

1. What is the main difference between a decentralized exchange (DEX) and a centralized exchange (CEX)?

A centralized exchange (like Coinbase or Binance) is a company that holds your crypto assets for you in a custodial wallet. A decentralized exchange is a non-custodial protocol where you trade directly from your own self-custody wallet (like MetaMask or Phantom), meaning you always retain full control of your private keys and funds.

2. Are decentralized exchanges safe to use?

DEXs are generally considered safe from a custody perspective because you control your own funds. However, the risks shift to smart contract vulnerabilities. Always use well-established, audited platforms like the ones listed in this guide. Additionally, you are responsible for protecting your wallet's private keys and avoiding scams or malicious tokens.

3. What is a DEX aggregator and why should I use one?

A DEX aggregator (like 1inch or Jupiter) doesn't have its own liquidity. Instead, it scans multiple DEXs to find the best possible price for your trade. For large trades, it can split your order across several platforms to reduce slippage, often resulting in a better final price than using a single DEX.

4. What are "gas fees" on a DEX?

Gas fees are transaction fees paid to the blockchain network (e.g., Ethereum or Solana) to process and validate your trade. These fees are not paid to the DEX itself but to the network's validators or miners. They vary based on network congestion and are typically much lower on Layer 2 networks like Arbitrum or high-throughput chains like Solana.

5. Do I need to do KYC (Know Your Customer) on a DEX?

No, the vast majority of decentralized exchanges do not require KYC. Because you are trading from your own anonymous wallet and not creating an account with a central company, there is no need to provide personal identification documents.

6. What is "slippage" and how can I minimize it?

Slippage is the difference between the expected price of a trade and the price at which it is actually executed. It often occurs in volatile markets or when trading tokens with low liquidity. Using a DEX with deep liquidity (like Uniswap for major pairs) or a DEX aggregator (like 1inch) that can route your trade through multiple sources are the best ways to minimize slippage.

7. Can I earn passive income on a decentralized exchange?

Yes. Most AMM-based DEXs like Uniswap, PancakeSwap, and Curve allow users to become Liquidity Providers (LPs). By depositing a pair of tokens into a liquidity pool, you earn a share of the trading fees generated by that pool. This is a common way to earn yield in DeFi but comes with its own risks, such as impermanent loss.

8. Which DEX is best for beginners?

Matcha is an excellent choice for beginners due to its incredibly simple and user-friendly interface that hides complexity while still providing great pricing. PancakeSwap is also very accessible, particularly for those looking to explore the BNB Chain ecosystem.

9. Why would I use a specialized DEX like Curve?

Specialized DEXs are optimized for specific tasks. Curve Finance is the best choice for swapping large amounts of stablecoins (like USDT for USDC) or other like-kind assets because its unique algorithm ensures extremely low slippage, which is far more efficient than a general-purpose DEX for this use case.

10. What is MEV and how can I protect myself?

Maximal Extractable Value (MEV) refers to the profit blockchain validators or bots can make by reordering, inserting, or censoring transactions. A common form is a "sandwich attack," where a bot front-runs your trade to manipulate the price against you. Using a DEX with built-in MEV protection, like CoW Swap, is the most direct way to protect your trades.

Ready to deepen your understanding of digital assets and build a comprehensive investment strategy? The insights from Top Wealth Guide can help you navigate not just crypto, but the entire wealth-building ecosystem. Visit Top Wealth Guide to access expert analysis and guides that empower you to make smarter financial decisions.