The artificial intelligence boom has moved beyond abstract concepts and into the core of global economic growth, creating a tangible and potentially lucrative investment frontier. For investors, the challenge isn't recognizing AI's importance; it's discerning which companies are genuinely capitalizing on this seismic shift versus those merely riding the wave of market enthusiasm. Simply chasing headlines can lead to overvalued positions and unnecessary risk. The real opportunity lies in identifying the foundational pillars and innovative disruptors that will define the next decade of technological advancement.

This article cuts through the noise to provide a clear, actionable guide to the best AI stocks to buy. We move past surface-level analysis, offering a comprehensive breakdown of each company’s strategic position within the AI ecosystem. You will gain a clear understanding of not just who is leading, but why they are positioned for sustained growth.

Inside, you will find a curated list of top-tier AI investments, from the semiconductor giants powering the revolution to the software titans integrating AI into everyday life. For each stock, we will explore:

- A concise investment thesis: The core reason to consider the investment.

- Key growth drivers and specific risks: What could propel the stock forward and what potential headwinds to monitor.

- Valuation context: A brief look at its financial standing and market perception.

- Strategic portfolio role: How each company might fit into a diversified investment strategy.

Our goal is to equip you with the detailed insights needed to make informed decisions, helping you navigate the complexities of AI investing and build a resilient, forward-looking portfolio.

In This Guide

- 1 1. Nvidia (NVDA): The Undisputed King of AI Infrastructure

- 2 2. Microsoft Corporation (MSFT): The Enterprise AI Powerhouse

- 3 3. Alphabet Inc. / Google (GOOGL, GOOG): The AI-Powered Search and Cloud Giant

- 4 4. Amazon (AMZN): The Cloud AI and Commerce Powerhouse

- 5 5. Meta Platforms Inc. (META): The Social Media Giant's AI Pivot

- 6 6. Tesla Inc. (TSLA): The Real-World AI Data Juggernaut

- 7 7. Broadcom Inc. (AVGO): The Essential Networker for AI Supercomputers

- 8 8. Advanced Micro Devices Inc. (AMD): The Primary Challenger in AI Acceleration

- 9 9. Mobileye / Intel (INTC, MBLY): Paving the Road for Autonomous Driving

- 10 10. Palantir Technologies (PLTR): The AI Operating System for Institutions

- 11 Top AI Stocks at a Glance: A Comparative Overview

- 12 Building a Future-Proof Portfolio with Artificial Intelligence

- 13 Frequently Asked Questions (FAQ) about AI Stocks

- 13.1 1. What is the best AI stock to buy right now?

- 13.2 2. How can I invest in AI with little money?

- 13.3 3. Are AI stocks overvalued?

- 13.4 4. What are the biggest risks of investing in AI stocks?

- 13.5 5. Should I invest in AI hardware or AI software companies?

- 13.6 6. Is it better to buy individual AI stocks or an AI ETF?

- 13.7 7. Which company is the true leader in AI?

- 13.8 8. How will AI impact other sectors beyond tech?

- 13.9 9. What is the difference between AI training and AI inference?

- 13.10 10. How long should my investment horizon be for AI stocks?

1. Nvidia (NVDA): The Undisputed King of AI Infrastructure

Nvidia has cemented its position as the foundational pillar of the artificial intelligence revolution. The company designs the high-performance graphics processing units (GPUs) that function as the "brains" behind complex AI models, from large language models like ChatGPT to advanced recommendation algorithms. This dominance makes it one of the most compelling and direct ways for investors to gain exposure to the AI sector.

The Investment Thesis: Why Nvidia Leads

The core of Nvidia's investment appeal lies in its near-monopolistic control over the AI accelerator market. Its CUDA (Compute Unified Device Architecture) software platform creates a powerful and sticky ecosystem. Developers learn to build AI applications on CUDA, making it incredibly difficult for competitors to displace Nvidia's hardware. This integrated hardware-software advantage forms a deep competitive moat.

The company's growth is propelled by explosive demand from its Data Center segment, which now accounts for the vast majority of its revenue. Every major cloud provider (Amazon AWS, Microsoft Azure, Google Cloud) and countless AI startups are racing to build out their computing capacity using Nvidia's latest chips, such as the H100 and the newer Blackwell architecture GPUs.

Real-Life Example: When OpenAI needed unprecedented computing power to train its GPT-4 model, it relied on a massive cluster of tens of thousands of Nvidia's A100 GPUs. This real-world application demonstrates how cutting-edge AI development is directly dependent on Nvidia's hardware, driving immense demand.

Risks and Valuation Context

Despite its strengths, investors should be mindful of potential risks. The primary concern is its high valuation, which prices in significant future growth. Any slowdown in AI spending or the emergence of a viable competitor could negatively impact the stock price. Furthermore, geopolitical tensions, particularly regarding semiconductor manufacturing and sales to China, remain a persistent risk factor.

Given its premium valuation, NVDA stock is best suited for growth-oriented investors with a longer time horizon who can withstand potential volatility. For those seeking to learn more about the landscape of top artificial intelligence stocks to watch, understanding Nvidia's central role is the perfect starting point.

2. Microsoft Corporation (MSFT): The Enterprise AI Powerhouse

Microsoft has strategically repositioned itself as a dominant force in artificial intelligence by integrating AI across its entire product stack. From its foundational cloud platform, Azure, to its ubiquitous Office and Windows software, the company is embedding AI to enhance productivity and create new revenue streams. Its cornerstone partnership with OpenAI gives it access to cutting-edge models, making it a comprehensive AI investment.

The Investment Thesis: Why Microsoft Leads

Microsoft’s primary advantage is its unparalleled distribution network. The company is monetizing AI by upselling its massive existing enterprise and consumer customer base with AI-powered tools like Copilot for Microsoft 365. Unlike pure-play AI companies that need to find customers, Microsoft is bringing AI directly to where work already happens, creating a sticky and lucrative ecosystem.

The growth engine is twofold. First, Azure's cloud infrastructure is capturing immense demand from businesses building and deploying their own AI applications, with Azure OpenAI Service being a key driver. Second, the direct monetization of AI through subscriptions, such as Copilot Pro for consumers and premium enterprise tiers, is creating entirely new, high-margin revenue streams. This ability to capture value from infrastructure to application makes it one of the best AI stocks to buy for diversified exposure.

Real-Life Example: A major consulting firm can subscribe to Microsoft 365 Copilot for its thousands of employees. The AI assistant can then instantly summarize long email chains in Outlook, draft proposals in Word based on data in Excel, and create presentations in PowerPoint, leading to measurable productivity gains and justifying the premium subscription cost.

Risks and Valuation Context

A key risk for Microsoft is the immense capital expenditure required to build out the necessary AI infrastructure, which could pressure margins. Additionally, the company faces intense competition in the cloud space from Amazon's AWS and Google Cloud, both of which are investing heavily in their own AI capabilities. Regulatory scrutiny over its partnership with OpenAI and its market position also remains a potential headwind.

Microsoft's valuation reflects high expectations for its AI-driven growth. The stock is suitable for long-term investors who believe in the company's ability to successfully monetize AI across its software and cloud empire. For a deeper look into how companies like Microsoft Corporation (MSFT) are shaping the future of technology, understanding its multi-layered strategy is crucial.

3. Alphabet Inc. / Google (GOOGL, GOOG): The AI-Powered Search and Cloud Giant

Alphabet, the parent company of Google, is an entrenched AI powerhouse integrating advanced artificial intelligence across its vast ecosystem. From revolutionizing its core Search and advertising businesses to empowering enterprises through Google Cloud, the company is leveraging decades of research from DeepMind and Google Brain. This deep integration makes it one of the most comprehensive and durable AI stocks to buy for long-term growth.

The Investment Thesis: Why Alphabet Is a Core AI Holding

The investment thesis for Alphabet rests on its unparalleled ability to monetize AI at a global scale. The company’s core search and advertising engine, which generates over $200 billion in annual revenue, is being supercharged by its Gemini large language models. This enhances user experience and ad targeting, protecting and expanding its primary profit center.

Simultaneously, Google Cloud is emerging as a formidable competitor in the enterprise AI space. Its Vertex AI platform offers businesses the tools to build, deploy, and scale their own machine learning models, creating a significant new growth vector. This dual strategy of reinforcing its existing dominance while capturing new enterprise markets provides a powerful, diversified approach to AI investment.

Real-Life Example: When a user searches "best family vacation ideas for summer," Google's AI can now provide a comprehensive, conversational summary (AI Overview) that synthesizes information from multiple websites, saving the user time and providing a richer answer, while still offering links for deeper exploration. This improves the core product and keeps users within Google's ecosystem.

Risks and Valuation Context

Alphabet's primary risks include heightened regulatory scrutiny across the globe, which could impact its search dominance and advertising practices. Intense competition in the cloud and AI space from rivals like Microsoft and Amazon also poses a significant challenge. The successful monetization of generative AI features within Search without cannibalizing its lucrative ad-click model remains a critical execution risk to monitor.

Compared to other pure-play AI names, Alphabet's valuation often appears more reasonable, reflecting its mature business segments. This makes GOOGL an attractive option for investors seeking exposure to the best AI stocks to buy with a blend of growth and value, and who believe in the company’s ability to navigate competitive and regulatory pressures.

4. Amazon (AMZN): The Cloud AI and Commerce Powerhouse

While often seen as an e-commerce giant, Amazon is a formidable AI player primarily through its cloud computing division, Amazon Web Services (AWS). AWS provides the essential cloud infrastructure that powers a vast number of AI applications, making it a critical, picks-and-shovels investment in the artificial intelligence ecosystem. Beyond infrastructure, Amazon is deeply integrating AI to enhance its retail operations, advertising, and consumer services.

The Investment Thesis: Why Amazon Leads

Amazon’s investment case is a powerful two-pronged AI strategy. First, AWS is the undisputed market leader in cloud computing, a position it's leveraging to capture a massive share of enterprise AI spending. Services like Amazon SageMaker (for building and training models) and Amazon Bedrock (offering access to leading foundation models) make it easy for businesses to deploy AI without building their own infrastructure. The company’s major investment in AI startup Anthropic further solidifies its position in the generative AI race.

Second, Amazon is a prime beneficiary of its own AI technology. It uses machine learning for everything from optimizing warehouse logistics with robotics to personalizing product recommendations and powering its highly profitable advertising business. This internal application of AI creates a virtuous cycle, improving operational efficiency and enhancing the customer experience, which in turn drives growth across its diverse business segments. This makes AMZN one of the most comprehensive and best AI stocks to buy for broad exposure.

Real-Life Example: Inside an Amazon fulfillment center, AI-powered robots identify the most efficient path to retrieve items for an order, while AI systems predict regional demand for products to optimize inventory placement. This reduces shipping times and operational costs, directly boosting the company's bottom line.

Risks and Valuation Context

A primary risk for Amazon is the intense competition in the cloud computing space from Microsoft Azure and Google Cloud, both of which are aggressively pursuing AI market share. Any significant slowdown in AWS's growth rate could impact investor sentiment. Additionally, the company faces ongoing regulatory scrutiny globally regarding its market dominance in e-commerce and cloud, which could lead to unfavorable rulings or fines.

Amazon's valuation reflects its status as a diversified tech leader, but its AI growth story is a key component. The stock is suitable for long-term growth investors who believe in the continued dominance of AWS and the company’s ability to successfully integrate AI to drive efficiency and innovation across its entire business. Monitoring AWS revenue growth and the adoption of its custom AI chips like Trainium and Inferentia are key metrics to watch.

5. Meta Platforms Inc. (META): The Social Media Giant's AI Pivot

Meta Platforms is aggressively integrating artificial intelligence across its entire "Family of Apps" ecosystem, transforming its core business and positioning itself as a major force in the AI landscape. The company leverages AI for everything from hyper-targeting advertisements and enhancing user engagement on platforms like Instagram and Facebook to developing its own open-source large language models (LLMs) with the Llama series. This makes it a unique and multifaceted play among the best AI stocks to buy.

The Investment Thesis: Why Meta is a Core AI Player

Meta's investment case is built on using AI to directly boost its primary revenue driver: advertising. By employing sophisticated AI algorithms, such as the one powering the Reels recommendation engine, Meta increases user engagement, which in turn creates more valuable ad inventory. This AI also improves ad targeting and measurement, delivering a higher return on investment for advertisers and making the platform more sticky.

Beyond advertising, Meta is pursuing a vertical integration strategy with its own custom AI chips, the Meta Training and Inference Accelerator (MTIA). This initiative aims to reduce its long-term reliance on external chip suppliers and lower the massive costs associated with running AI models at scale. Furthermore, its open-source Llama models foster a broad developer ecosystem, accelerating AI innovation that Meta can then harness for its own products.

Real-Life Example: An Instagram user who watches a few short videos about hiking will quickly see their Reels feed populated with more content about hiking trails, gear, and travel destinations. This AI-driven recommendation engine keeps the user engaged on the platform for longer, creating more opportunities for Meta to serve targeted ads from outdoor brands.

Risks and Valuation Context

The primary risks for Meta include intense competition in the social media space and the high capital expenditures required to build out its AI infrastructure. The company is spending billions on data centers and custom silicon, and the return on these investments is not guaranteed. Additionally, Meta faces ongoing regulatory scrutiny worldwide concerning data privacy, content moderation, and antitrust issues, which could lead to significant fines or operational restrictions.

Despite these challenges, Meta's valuation often appears more reasonable compared to other pure-play AI hardware companies. The stock is suitable for investors looking for exposure to AI's practical application layer within a highly profitable, established business. Investors should closely monitor user engagement metrics, growth in average revenue per user (ARPU), and progress reports on the MTIA chip's performance and cost-saving impact.

6. Tesla Inc. (TSLA): The Real-World AI Data Juggernaut

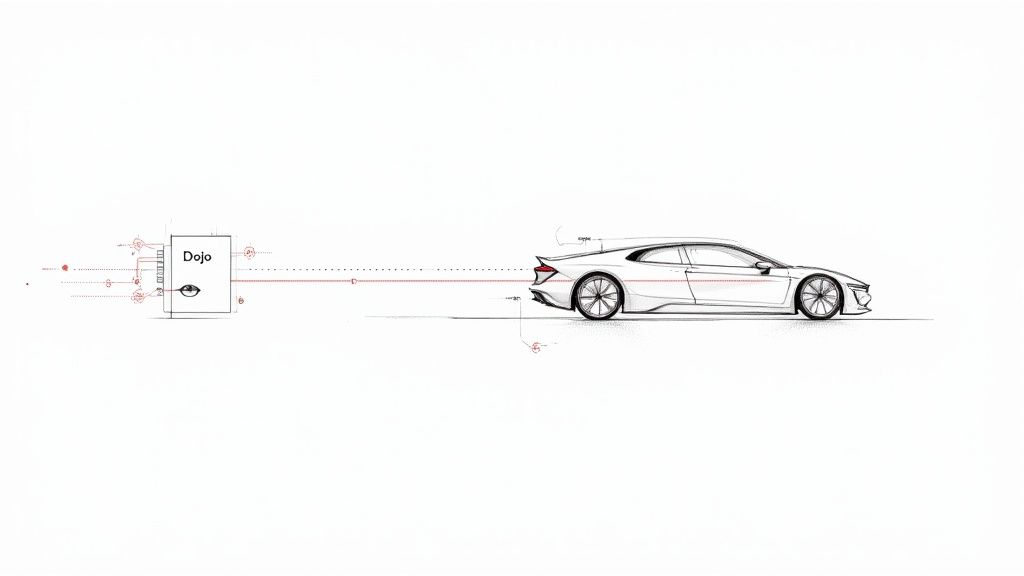

While known as an electric vehicle manufacturer, Tesla is fundamentally an artificial intelligence and robotics company. Its core investment thesis has shifted from simply selling cars to monetizing a vast ecosystem of AI-driven technologies, with autonomous driving at its heart. The company is leveraging AI not just for its ambitious Full Self-Driving (FSD) project but also for optimizing manufacturing, managing energy grids, and developing humanoid robots.

The Investment Thesis: Why Tesla is an AI Play

Tesla's competitive advantage in AI stems from its massive fleet of sensor-equipped vehicles, which collect billions of miles of real-world driving data. This data is the lifeblood for training its neural networks, creating a flywheel effect that competitors struggle to replicate. The company's vision-only approach to autonomy and its custom-designed Dojo supercomputer are key differentiators aimed at solving the complex challenge of autonomous driving at scale.

Beyond FSD, Tesla applies AI to boost efficiency in its gigafactories and manage its distributed network of Powerwall batteries. The potential for a fully autonomous ride-hailing network represents a transformative, multi-trillion-dollar opportunity that could redefine the company's business model entirely, moving it from a hardware seller to a high-margin software and services provider. This makes it a unique and high-potential candidate among the best AI stocks to buy.

Real-Life Example: A Tesla vehicle encounters an unusual construction zone with complex lane markings. The car's cameras capture this "edge case" data and upload it to Tesla's servers. This data is then used to retrain the FSD neural network, improving the software for the entire fleet via an over-the-air update, making every Tesla vehicle collectively smarter.

Risks and Valuation Context

Tesla's stock carries significant risk and a forward-looking valuation. The timeline for achieving true Level 5 autonomy is uncertain, and regulatory hurdles remain a major obstacle. Intense competition in the EV market could continue to pressure margins, and production targets have not always been met. The stock's price is highly sensitive to progress updates on FSD and announcements from CEO Elon Musk.

Due to its high-risk, high-reward profile, TSLA is suitable for investors with a very long-term horizon and a high tolerance for volatility. Monitoring FSD disengagement rates and vehicle delivery growth is crucial for tracking the company's progress.

7. Broadcom Inc. (AVGO): The Essential Networker for AI Supercomputers

While GPUs get the spotlight, Broadcom Inc. provides the critical, high-speed networking technology that allows thousands of those GPUs to function as a single, cohesive AI supercomputer. The company designs and manufactures custom and standard networking silicon, switches, and other connectivity solutions that form the digital backbone of modern AI data centers. This "picks and shovels" role makes it a powerful, and perhaps less obvious, way to invest in the AI infrastructure buildout.

The Investment Thesis: Why Broadcom Is Critical

Broadcom's investment case is built on its dominance in high-performance networking solutions essential for AI. As AI models grow larger and more complex, the need for faster and more efficient communication between thousands of GPUs becomes a primary bottleneck. Broadcom's Tomahawk and Jericho switch chips, along with its custom silicon solutions for hyperscalers like Google and Meta, directly address this challenge by enabling massive data throughput with low latency.

The company's strategic focus on custom AI accelerators and its strong relationships with cloud giants provide a clear path for growth. As these companies invest billions in building proprietary AI hardware, Broadcom is a key partner in developing the specialized networking fabric required to connect these systems. This creates a highly profitable and resilient revenue stream tied directly to hyperscaler AI capital expenditures.

Real-Life Example: A large cloud provider is building a new AI data center with 30,000 GPUs. To ensure all these processors can communicate with each other instantly to train a single massive language model, the provider uses Broadcom's high-speed Ethernet switches and custom silicon to create the networking fabric, preventing data bottlenecks and maximizing the efficiency of their multi-billion dollar GPU investment.

Risks and Valuation Context

Broadcom's primary risks include its significant exposure to the cyclical nature of the semiconductor industry and intense competition in the networking space. Any slowdown in data center spending by major cloud providers could directly impact its revenue growth. Furthermore, the company's valuation often reflects its established position, meaning significant upside requires continued execution and innovation in the AI networking sector.

Given its strong cash flow and dividend, AVGO may appeal to both growth and dividend-growth investors. For those looking to understand its financial standing, learning how to value stocks provides a framework for assessing whether its current price aligns with its long-term AI-driven growth prospects.

8. Advanced Micro Devices Inc. (AMD): The Primary Challenger in AI Acceleration

While Nvidia dominates the headlines, Advanced Micro Devices is strategically positioning itself as the most credible and powerful alternative in the high-stakes AI hardware market. The company is directly challenging the incumbent with its Instinct MI300 series of accelerators, which offer competitive performance for training and inferencing complex AI models. This strong second-player status makes AMD one of the best AI stocks to buy for investors seeking growth beyond the market leader.

The Investment Thesis: Why AMD is a Contender

AMD's investment case is built on its improving competitive position and the market's urgent need for supplier diversification. Hyperscalers like Microsoft Azure, Google Cloud, and Meta are actively seeking viable alternatives to Nvidia to mitigate supply chain risks and reduce costs. AMD's MI300X GPU is a direct answer to this demand, providing a powerful, cost-effective solution for data center AI workloads.

The company's success is not just in GPUs; its EPYC CPUs are also integral for AI-related data processing and management. The synergy between its CPU and GPU offerings allows AMD to provide comprehensive solutions. As its ROCm software ecosystem matures and gains broader developer adoption, the friction of switching from Nvidia's CUDA platform will decrease, potentially accelerating market share gains for AMD.

Real-Life Example: A large cloud company, wanting to avoid being solely dependent on Nvidia, decides to build out a new AI cluster using thousands of AMD's MI300X GPUs. By doing so, they can negotiate better pricing with both suppliers and ensure they have a resilient supply chain for critical AI hardware, making AMD an essential part of the broader ecosystem.

Risks and Valuation Context

The primary risk for AMD is the immense challenge of competing with Nvidia's deeply entrenched CUDA software moat. While ROCm is improving, it still lags behind in developer support and ecosystem maturity. The company's ability to execute on its product roadmap and rapidly scale production of its MI-series GPUs is critical. Any delays or performance gaps could cede ground back to the competition.

AMD's valuation reflects high expectations for its Data Center segment's growth. The stock's performance is closely tied to its ability to meet and exceed revenue forecasts for its AI accelerators. For investors looking to deepen their understanding of market dynamics, exploring more about how to identify top-performing stocks in the market provides valuable context. AMD is a compelling choice for growth-focused investors who believe in the long-term trend of AI proliferation and the inevitable need for strong competition in the hardware space.

9. Mobileye / Intel (INTC, MBLY): Paving the Road for Autonomous Driving

While much of the AI focus is on data centers, Mobileye, majority-owned by Intel, is the dominant force applying artificial intelligence to the automotive world. The company develops the advanced driver-assistance systems (ADAS) and autonomous driving technologies that are rapidly becoming standard in new vehicles. Mobileye's cutting-edge computer vision and sensor fusion technology make it a critical enabler for the future of transportation, positioning it as one of the best AI stocks to buy for exposure to this specialized, high-growth vertical.

The Investment Thesis: Why Mobileye Commands the Road

Mobileye's investment case is built on its deep, long-standing relationships with over 300 automakers worldwide, creating a significant barrier to entry. Its technology, from basic collision avoidance to its sophisticated "SuperVision" hands-free driving platform, is already embedded in millions of vehicles. This creates a recurring revenue stream as auto manufacturers like BMW and General Motors integrate its systems across their model lineups.

The company's growth is driven by the increasing adoption of higher-level ADAS features and the eventual transition to fully autonomous vehicles. As its systems collect more road data from its global fleet, its machine learning models become smarter and more capable, reinforcing its technological lead. This creates a powerful data network effect that competitors find difficult to replicate.

Real-Life Example: A car manufacturer like Volkswagen signs a long-term deal to integrate Mobileye's "SuperVision" system into millions of its future vehicles. This provides VW with a competitive hands-free driving feature without the massive R&D cost of developing it in-house, while locking in a predictable, high-margin revenue stream for Mobileye for years to come.

Risks and Valuation Context

The primary risk for Mobileye is the long and uncertain timeline for widespread adoption of full Level 4/5 autonomy. Delays in technology, regulation, or consumer acceptance could temper growth expectations. The company also faces growing competition from other chipmakers and automotive OEMs developing their own in-house solutions. As a subsidiary of Intel, its strategic direction and stock performance can also be influenced by its parent company's broader objectives.

Given the developmental stage of the autonomous vehicle market, MBLY stock is best suited for long-term investors with a high tolerance for risk. Success hinges on its ability to maintain its technological leadership and successfully monetize its vast trove of driving data through future services like robotaxi networks.

10. Palantir Technologies (PLTR): The AI Operating System for Institutions

Palantir Technologies has built a formidable reputation by providing sophisticated data analytics and artificial intelligence platforms to government and large-scale commercial enterprises. The company's software, like Foundry and Apollo, acts as a central operating system, enabling organizations to integrate vast, disparate datasets and make AI-driven decisions. This positions Palantir as a critical infrastructure player for entities seeking to harness the power of their own data.

The Investment Thesis: Why Palantir Stands Out

The investment thesis for Palantir is built on its deep entrenchment within government agencies and its aggressive expansion into the commercial sector. Its platforms are notoriously "sticky," meaning that once an organization like the U.S. military integrates Palantir into its core operations, the high switching costs and deep integration make it an indispensable partner. This creates a reliable, long-term revenue stream from government contracts.

Now, Palantir is replicating this success in the commercial world with its Artificial Intelligence Platform (AIP). The company is helping major corporations in sectors like finance, healthcare, and manufacturing deploy AI models to optimize supply chains, analyze risk, and improve efficiency. As more enterprises seek to build their own AI capabilities, Palantir offers them a powerful, ready-made foundation, driving significant customer growth and higher average contract values.

Real-Life Example: A large manufacturing company uses Palantir's AIP to connect data from its supply chain, factory floor sensors, and sales forecasts. The platform's AI identifies a potential production bottleneck three weeks in advance, allowing managers to reroute materials and adjust schedules, saving millions in potential lost revenue.

Risks and Valuation Context

Palantir's primary risks include its historical reliance on a small number of very large government contracts and its premium valuation. The stock often trades at a high multiple, reflecting strong investor optimism about its AI-driven commercial growth. Any slowdown in acquiring new commercial customers or a failure to renew a major government contract could lead to significant stock price volatility.

The company's success is also closely tied to its leadership, including CEO Alex Karp, which can be seen as both a strength and a risk. For those interested in the broader applications of artificial intelligence in finance, understanding how Palantir's platforms are used can provide valuable context for innovative strategies; you can explore more on how to use AI for stock trading to see related concepts in action.

Top AI Stocks at a Glance: A Comparative Overview

To help you better understand the strategic positioning of these AI leaders, this table compares them across key operational dimensions.

| Company | Ticker | Primary AI Role | Key Strength | Main Risk Factor | Investor Profile |

|---|---|---|---|---|---|

| Nvidia | NVDA | Hardware (GPUs) | Market Dominance & CUDA Ecosystem | High Valuation & Competition | Growth / Aggressive Growth |

| Microsoft | MSFT | Software & Cloud | Enterprise Distribution & Integration | High Capex & Cloud Competition | Core Holding / Growth |

| Alphabet (Google) | GOOGL | Search, Ads & Cloud | Data Scale & AI Research (DeepMind) | Regulatory Scrutiny & Ad Model Risk | Growth at a Reasonable Price (GARP) |

| Amazon | AMZN | Cloud (AWS) & E-commerce | #1 Cloud Provider & Internal AI Use | Intense Cloud Competition | Core Holding / Long-Term Growth |

| Meta Platforms | META | Social Media & Ads | Massive User Data & Engagement AI | High R&D Spend & Regulation | GARP / Value |

| Tesla | TSLA | Automotive & Autonomy | Real-World Data Advantage | FSD Execution & High Volatility | Speculative Growth / High Risk |

| Broadcom | AVGO | Hardware (Networking) | Essential "Picks & Shovels" Role | Semiconductor Cyclicality | Growth & Income (Dividend) |

| AMD | AMD | Hardware (GPUs/CPUs) | #2 Player & Supplier Diversification | Competing with CUDA's Moat | Aggressive Growth |

| Mobileye | MBLY | Automotive (ADAS) | OEM Relationships & Market Share | Long Autonomy Timeline | Long-Term / Speculative Growth |

| Palantir | PLTR | Enterprise Software | "Sticky" Platforms & Gov't Contracts | High Valuation & Sales Cycles | Aggressive Growth / High Risk |

Building a Future-Proof Portfolio with Artificial Intelligence

Navigating the dynamic landscape of artificial intelligence investing can seem daunting, but as we've explored, a structured approach can demystify the process and unlock significant opportunities. We've dissected ten of the most compelling AI-centric companies, from the undisputed hardware leader Nvidia (NVDA) to the cloud and software titans Microsoft (MSFT) and Alphabet (GOOGL). Each represents a unique angle on the AI revolution.

The core takeaway is that "investing in AI" is not a monolithic strategy. It requires diversification across different layers of the AI value stack. Your portfolio might blend foundational semiconductor giants like Broadcom (AVGO) and AMD (AMD) with application-focused innovators like Palantir (PLTR) or industry-specific disruptors such as Tesla (TSLA). The key is to understand that the AI ecosystem is vast, encompassing everything from the silicon chips that power models to the consumer-facing applications that are changing our daily lives.

Key Insight: A robust AI investment strategy isn't about picking one winner. It’s about building a diversified basket of companies that lead in different, critical segments of the AI ecosystem, from infrastructure and platforms to applications and data.

From Analysis to Action: Your Next Steps

Armed with this information, the path forward involves transforming knowledge into a concrete investment plan. It's time to move beyond the watchlist and into strategic portfolio construction.

Here are your actionable next steps:

- Assess Your Current Portfolio: Before you buy any of the best AI stocks, analyze your existing holdings. Do you already have significant exposure to tech? Are you overweight in any single name? Understanding your starting point is crucial for balanced allocation.

- Define Your AI Allocation Strategy: Decide what percentage of your portfolio you want to dedicate to AI. Within that allocation, determine your preferred mix. For instance, a conservative approach might be 60% established leaders (like MSFT, GOOGL), 30% core infrastructure (like NVDA, AVGO), and 10% speculative high-growth players (like PLTR).

- Initiate Positions Strategically: Avoid going "all in" at once. Consider using dollar-cost averaging (DCA) to build your positions over time. This approach can help mitigate the risk of buying at a market peak, especially with volatile tech stocks. For example, you could decide to invest a set amount into your chosen AI ETF or a basket of 2-3 stocks every month for the next six months.

- Set Review Triggers: The AI sector evolves rapidly. Establish a schedule, perhaps quarterly, to review your AI holdings. This isn't about frequent trading; it's about reassessing the investment thesis. Has a company lost its competitive edge? Has a new, more promising player emerged? Staying informed is your best defense against market shifts.

The Long-Term Vision for AI Investing

Ultimately, investing in the best AI stocks is a long-term commitment to participating in one of the most profound technological transformations in human history. The companies highlighted in this guide are not just riding a temporary wave; they are actively building the infrastructure and intelligence that will define the next decade of economic growth.

By thoughtfully constructing a diversified portfolio of AI leaders, you are not merely speculating on stock prices. You are investing in the future of automation, data analysis, scientific discovery, and human productivity. The journey requires diligence, patience, and a commitment to continuous learning, but the potential to build a truly future-proof portfolio makes the effort exceptionally worthwhile. The revolution is here, and a well-positioned portfolio can place you on the right side of history.

Frequently Asked Questions (FAQ) about AI Stocks

1. What is the best AI stock to buy right now?

There is no single "best" AI stock, as the ideal choice depends on your investment goals, risk tolerance, and portfolio composition. A company like Microsoft (MSFT) might be suitable for a more conservative growth investor, while a stock like Nvidia (NVDA) or Palantir (PLTR) might appeal to those seeking higher growth with more volatility. Diversifying across different types of AI companies is often the most prudent strategy.

2. How can I invest in AI with little money?

You can start investing in AI stocks with little money by using a brokerage that offers fractional shares. This allows you to buy a small piece of a high-priced stock like Nvidia or Amazon for as little as a few dollars. Alternatively, you can invest in an AI-focused Exchange Traded Fund (ETF), which provides diversified exposure to many AI companies in a single investment.

3. Are AI stocks overvalued?

Valuations for many top AI stocks are high, reflecting significant optimism about future growth. This means they carry risk if that growth doesn't materialize as expected. However, if these companies successfully execute their strategies and capitalize on the multi-trillion-dollar AI opportunity, their current valuations may be justified in the long term. It's crucial to assess each company's fundamentals rather than looking at the sector as a whole.

4. What are the biggest risks of investing in AI stocks?

The primary risks include high valuations, intense competition, rapid technological change that could make current leaders obsolete, regulatory scrutiny, and high capital expenditures needed to stay competitive. Geopolitical risks, especially related to semiconductor supply chains, are also a major factor.

5. Should I invest in AI hardware or AI software companies?

A balanced portfolio often includes both. Hardware companies like Nvidia and AMD are the "picks and shovels" of the AI gold rush, providing the essential infrastructure. Software and platform companies like Microsoft and Palantir monetize AI through applications and services. Investing in both layers of the stack provides diversification within the AI theme.

6. Is it better to buy individual AI stocks or an AI ETF?

Individual stocks offer the potential for higher returns if you pick a winner, but they also carry higher risk. An AI ETF provides instant diversification across dozens of companies, reducing single-stock risk, but your returns will be an average of the fund's holdings. Beginners or those who prefer a hands-off approach may find ETFs to be a better starting point.

7. Which company is the true leader in AI?

Several companies can claim leadership in different areas. Nvidia leads in AI hardware (GPUs). Alphabet (Google) is a leader in foundational AI research (DeepMind). Microsoft is a leader in enterprise AI software deployment. Amazon (AWS) leads in cloud infrastructure for AI. The "true leader" depends on which part of the AI ecosystem you are evaluating.

8. How will AI impact other sectors beyond tech?

AI is a general-purpose technology that will impact nearly every sector, including healthcare (drug discovery, diagnostics), finance (fraud detection, algorithmic trading), manufacturing (robotics, supply chain optimization), and transportation (autonomous vehicles). Investing in companies that are effectively using AI, not just creating it, is another valid investment strategy.

9. What is the difference between AI training and AI inference?

AI training is the computationally intensive process of teaching a model by feeding it massive amounts of data, which primarily uses high-end GPUs like Nvidia's H100. AI inference is the process of using the trained model to make predictions or generate content, which is less intensive and happens much more frequently. Companies like Broadcom and AMD are targeting both training and the growing inference market.

10. How long should my investment horizon be for AI stocks?

Given the transformative but still-developing nature of artificial intelligence, a long-term investment horizon of at least 5-10 years is recommended. The sector is prone to short-term volatility, hype cycles, and corrections. A long-term perspective allows you to ride out these fluctuations and potentially benefit from the fundamental, long-term growth trend of AI adoption.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

For investors seeking to deepen their understanding of wealth creation strategies beyond just stock picking, Top Wealth Guide offers comprehensive resources and expert insights. Explore our guides and tools to build a holistic financial future at Top Wealth Guide.