Real estate syndication offers passive investors a way to access premium properties and consistent returns without the burden of day-to-day management. Most syndication deals require $25,000 to $50,000 minimum investments, making institutional-quality real estate accessible to individual investors.

At Top Wealth Guide, we’ve created this guide to help you understand how syndications work, evaluate opportunities, and identify which deals align with your financial goals.

In This Guide

How Real Estate Syndication Works

The Sponsor-Investor Partnership

A real estate syndication is fundamentally a partnership where a sponsor (the general partner) sources a property, arranges financing, and manages day-to-day operations, while passive investors (limited partners) contribute capital in exchange for a share of profits and cash flow. The sponsor typically invests 5 to 20 percent of their own capital into the deal, which aligns their interests with yours and reduces the likelihood of reckless decisions. The structure takes the form of an LLC or partnership, and this choice matters because it determines your liability exposure, tax treatment, and control rights.

Accreditation Requirements and Investor Eligibility

Most syndications require [accredited investor status](https://www.investopedia.com/terms/a/accreditedinvestor.asp], defined by the SEC as a net worth exceeding $1 million excluding your primary residence. Some deals under Regulation D Rule 506(b) accept sophisticated investors without accreditation if they have a substantive relationship with the sponsor, but this remains the exception rather than the rule. You receive a pro-rata share of profits based on your capital contribution, and the sponsor compensates themselves through acquisition fees (typically 2 to 3 percent), asset management fees (around 1.5 percent annually), and a share of profits after investors receive their preferred return or initial capital back.

The Deal Timeline and Cash Flow Mechanics

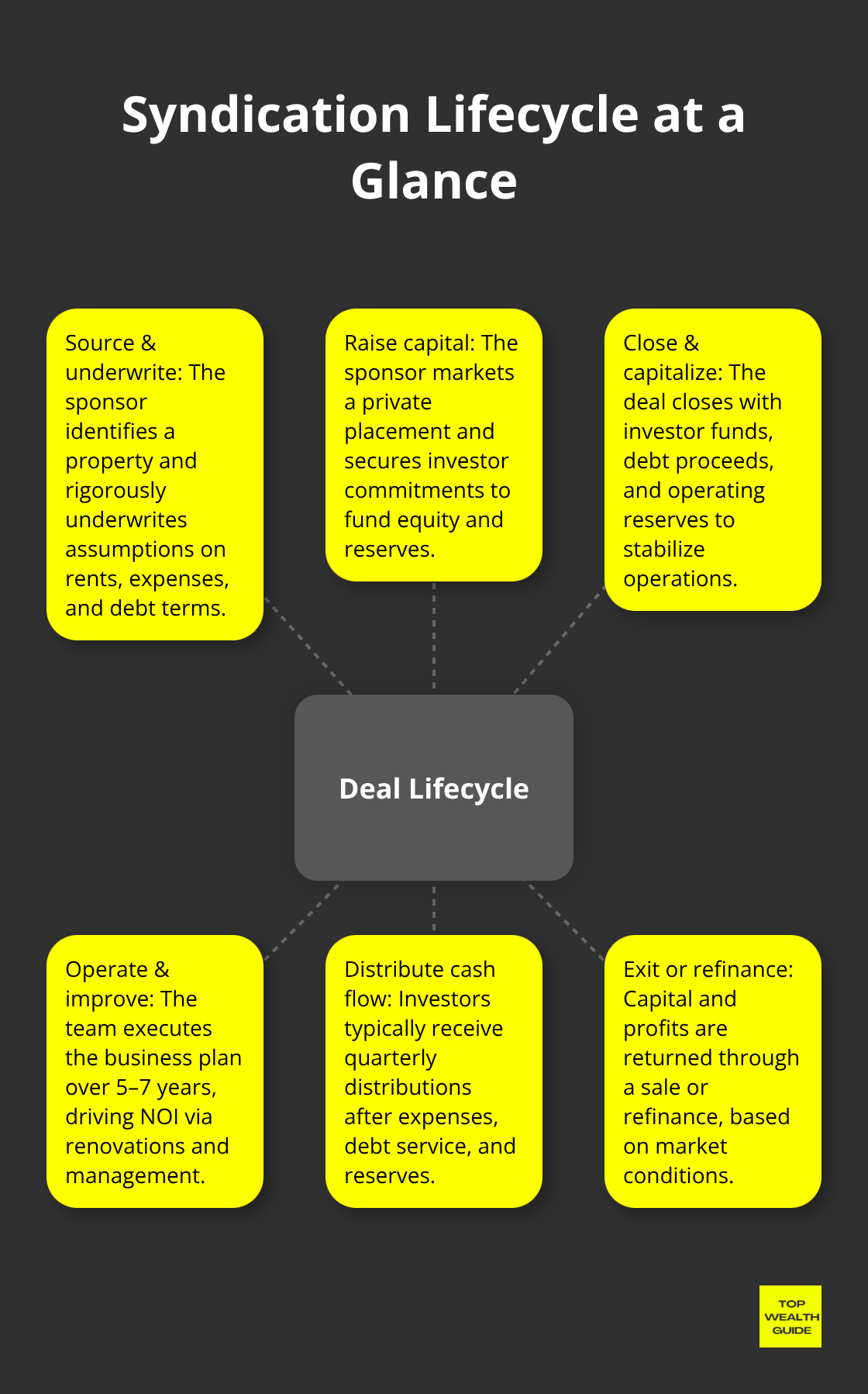

The sponsor identifies a property, conducts underwriting, raises capital through a private placement, closes the deal with investor funds as down payment and reserves, then executes the business plan over a 5 to 7 year hold period before selling or refinancing to return capital and profits. During the hold, you receive quarterly distributions from rental income after expenses, debt service, and reserves are paid.

Multifamily properties dominate syndications because they generate reliable cash flow and historically performed better than single-family homes during downturns. Self-storage, mobile home parks, and light industrial properties also attract syndication capital due to their resilience and cash flow characteristics.

Key Documents and Your Rights as an Investor

The Private Placement Memorandum outlines the property, team, expected returns, and risks, while the subscription agreement confirms your investment amount and ownership stake. You gain limited rights to inspect the property and review financial reports, though operational decisions rest entirely with the sponsor. This passive structure appeals to investors who want real estate exposure without becoming landlords, but it requires upfront diligence on the sponsor’s track record, the market fundamentals, and the deal’s underwriting assumptions before capital is deployed.

Understanding these mechanics positions you to evaluate whether a specific syndication aligns with your investment timeline and risk tolerance-a critical step before moving forward with any opportunity.

Why Passive Real Estate Investing Beats Active Landlording

Operational Freedom and Superior Downside Protection

Syndications eliminate the operational headaches that plague traditional rental property ownership. When you own a single rental property, you handle tenant screening, maintenance emergencies at 2 a.m., evictions, and property management coordination. A syndication sponsor absorbs all of this. You receive quarterly distributions without managing anything. Multifamily properties in syndications historically delivered better downside protection than single-family rentals.

During the 2008 financial crisis, multifamily loan delinquencies showed resilience compared to single-family mortgages. This resilience stems from multifamily’s superior cash flow diversification across dozens or hundreds of units. A single vacant apartment doesn’t tank your returns. A single vacant single-family home eliminates your entire cash flow that month.

Institutional-Quality Assets and Professional Management

Most syndications target 7 to 9 percent cash-on-cash returns upon stabilization, with growth potential as value-add improvements raise rental income and property value. You access institutional-quality assets with professional teams handling acquisition, financing, renovations, and tenant management. A $5 million multifamily property or a $10 million self-storage facility becomes accessible at a $50,000 investment minimum. These deals require expertise in market selection, underwriting, construction management, and tenant relations that individual investors rarely possess. The sponsor’s team typically includes dedicated property managers, experienced lenders, cost segregation specialists, and seasoned operators who’ve navigated multiple market cycles.

Capital Efficiency Through Refinancing and Redeployment

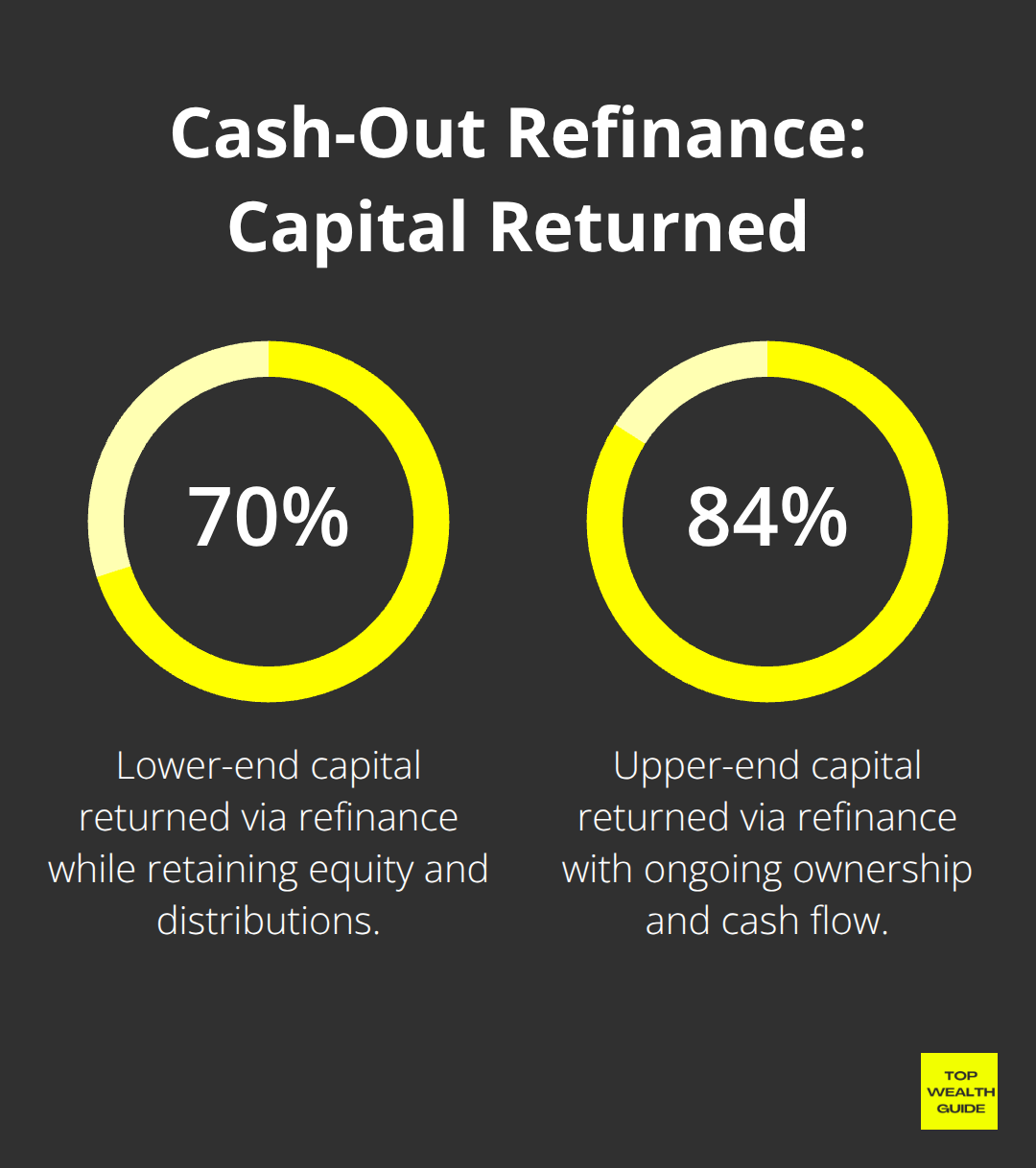

Capital efficiency matters significantly in real estate investing. Your $50,000 investment in a syndication controls a fractional share of a much larger asset generating consistent income. A cash-out refinance can return 70 to 84 percent of your initial capital while you retain ongoing equity ownership and continue receiving distributions. This capital-return mechanism enables investors to deploy the same dollars into multiple deals, compounding wealth faster than traditional buy-and-hold single-property ownership.

Risk Reduction Through Geographic and Asset Diversification

You spread risk across different markets, property types, and sponsor teams rather than concentrating capital in one property or one market. A multifamily deal in Memphis operates independently from a self-storage facility in Austin or a light industrial property in Denver. Market downturns affect different asset classes and geographies at different speeds. Geographic and asset diversification reduces sponsor-specific risk because no single operator controls your entire real estate portfolio. Geographic diversification matters because employment patterns, population growth, and supply-demand dynamics vary dramatically. A market with strong job growth and limited new construction typically supports stable rents and property appreciation. A market with declining employment and oversupply faces downward rent pressure. Syndications grant you exposure to multiple markets simultaneously without the capital requirements of owning properties outright in each location.

Understanding these advantages positions you to evaluate specific syndication opportunities and assess how they fit within your broader investment strategy. The next step involves learning how to identify quality sponsors and analyze deal structures to protect your capital.

What Could Go Wrong With Your Syndication Investment

Illiquidity Traps Your Capital for Years

Your capital remains locked in a syndication for 5 to 7 years, sometimes longer. Illiquidity is not theoretical-it’s the defining constraint of the asset class. If you need funds for a medical emergency, job loss, or unexpected opportunity, you cannot simply sell your position like you would a stock or mutual fund. Some sponsors offer secondary markets where you can sell to other investors, but these transactions occur at steep discounts, typically 15 to 30 percent below fair value, because buyers demand compensation for the illiquidity they’re accepting.

The Private Placement Memorandum explicitly states this risk, and ignoring it has cost investors real money. Before committing capital, stress-test your personal finances. Do you have 12 months of emergency savings outside this investment? Can you afford to lose this money entirely without derailing your life plan? If the answer is no, syndications are premature for your situation.

Operator Risk Concentrates Your Exposure

The minimum investment threshold of $25,000 to $100,000 per deal means most passive investors cannot diversify across enough sponsors to mitigate operator risk. You might invest with three sponsors, but that’s still concentrated exposure compared to owning 50 different rental properties or 500 different stocks.

Syndicator quality determines outcome more than market conditions or property selection. A mediocre sponsor in a strong market underperforms. An excellent sponsor in a weak market often outperforms. This reality makes due diligence non-negotiable. Pull the sponsor’s track record directly-ask for references from prior investors, not just testimonials on their website. Contact three to five prior Limited Partners and ask specific questions: Did distributions arrive on schedule? Were capital calls made? Did the sponsor communicate transparently during downturns? How did the actual returns compare to projections?

A sponsor with 15 years managing multifamily properties across three market cycles carries less risk than one with two years of experience in a single market. Verify their team’s continuity. If the lead operator leaves, who replaces them? What happens if your primary point of contact departs? Sponsors with institutional depth weather disruptions better than one-person operations.

Market Downturns Hit Asset Classes Unevenly

Market downturns hit different property types and geographies at different intensities. During the 2020 pandemic, office properties suffered while multifamily remained relatively stable. Self-storage performed exceptionally. Industrial facilities thrived. Retail and hospitality collapsed. Your syndication’s resilience depends on asset class selection and market fundamentals.

A sponsor projecting 10 percent annual rent growth in a market with 2 percent historical growth and limited new construction is overestimating returns. Compare the sponsor’s assumptions to actual market data from CoStar, Real Capital Analytics, or Census Bureau employment trends. If projections deviate significantly from historical performance, question why. Sponsors sometimes use optimistic underwriting to close deals, and you pay the price when reality diverges from the pitch deck.

Debt Structure Amplifies Risk in Downturns

Debt structure matters enormously. A property financed with 70 percent loan-to-value performs differently than one financed at 80 percent LTV during a downturn. Higher leverage amplifies returns in good markets but accelerates losses in bad ones (think of a $100,000 investment controlling a $500,000 property versus a $1 million property-the same downturn hits harder on the smaller asset base).

Ask what happens if the sponsor cannot refinance at the projected timeline. What’s the backup plan? A sponsor with no contingency for refinancing risk is taking your money without adequate preparation. Sponsors who stress-test their deals against rising interest rates, extended hold periods, and lower exit cap rates demonstrate the rigor you should expect before deploying capital.

Final Thoughts

Assess your financial readiness before committing capital to real estate syndication. Confirm you meet accreditation requirements, maintain 12 months of emergency savings outside this investment, and can afford to lock capital away for 5 to 7 years without financial strain. These constraints separate investors who succeed from those who face forced exits at unfavorable terms.

Evaluate the sponsor with the same rigor you would apply to hiring a financial advisor to manage millions of dollars. Request their track record across multiple market cycles, contact three to five prior Limited Partners directly, and verify team continuity through economic downturns. Compare their rent growth assumptions to actual historical data from CoStar or Census employment trends, and ask for detailed CapEx budgets and stress-tested projections showing how the deal performs if interest rates rise or the exit timeline extends.

Start small with your first real estate syndication investment. Deploy capital into one or two deals with sponsors who demonstrate transparency, institutional depth, and meaningful personal capital in the deal. Visit Top Wealth Guide to explore frameworks for evaluating opportunities and constructing a diversified portfolio that balances real estate syndications with other wealth-building vehicles.