Hard money loans are a different breed of financing. They're short-term loans from private outfits, and unlike your typical mortgage, they're secured by the real estate itself—the "hard asset"—not your credit score. Think of them as the express lane for real estate investors. When a golden opportunity pops up that requires a lightning-fast close, a hard money loan can get you the cash in days, not the months a bank would take.

In This Guide

- 1 Understanding Hard Money Loans and How They Work

- 2 How Hard Money Went from a Niche Player to a Mainstream Powerhouse

- 3 Hard Money Loans Vs. Traditional Mortgages: A Tale Of Two Loans

- 4 When Should You Actually Use a Hard Money Loan?

- 5 The Rise of Private Lending in Modern Real Estate

- 6 Securing a Hard Money Loan Step-by-Step

- 7 Your Hard Money Questions, Answered

- 7.1 1. What Are the Typical Interest Rates and Fees for Hard Money Loans?

- 7.2 2. How Quickly Can I Close on a Hard Money Loan?

- 7.3 3. Is Good Credit Required to Get a Hard Money Loan?

- 7.4 4. What Is an Exit Strategy and Why Is It So Important?

- 7.5 5. Can I Use a Hard Money Loan to Buy a Primary Residence?

- 7.6 6. What Are the Biggest Risks of Using a Hard Money Loan?

- 7.7 7. Do I Need Real Estate Experience to Qualify?

- 7.8 8. How Much of the Deal Will a Hard Money Lender Fund?

- 7.9 9. What Happens if I Default on the Loan?

- 7.10 10. How Is the Hard Money Lending Market Changing?

Understanding Hard Money Loans and How They Work

Let's paint a picture. You find a beat-up property with fantastic bones, but the seller is only accepting cash offers that can close in ten days. A traditional bank mortgage? No chance. Their underwriting process is a marathon, often taking 45 to 60 days. This is precisely where a hard money loan becomes your best friend, bridging the gap between a fleeting opportunity and conventional financing.

Instead of putting your FICO score and debt-to-income ratio under a microscope for weeks, a hard money lender gets straight to the point: the deal itself. They care about the property's value right now and, even more so, what it could be worth down the road.

The Asset-Centric Approach

The whole approval process revolves around the property, not the person. These lenders operate on a pretty simple premise: If you default on the loan, can they sell the property and get their money back? This asset-first mindset is their secret sauce for speed. It allows them to sidestep the rigid, federally regulated hoops that traditional banks have to jump through.

They zoom in on a few core components:

- Loan-to-Value (LTV): This is just the percentage of the property's current value they’re willing to lend. Hard money lenders play it safe, typically funding 65% to 75% of the property’s as-is value.

- After Repair Value (ARV): For any fix-and-flip investor, this is the holy grail. The ARV is what an appraiser thinks the property will sell for after you’ve finished all the renovations. A lender might cover a chunk of the purchase price and even 100% of the renovation budget, as long as the total loan stays under a certain threshold of the ARV (usually around 70%).

Real-Life Example: An investor spots a fixer-upper for $200,000. It needs $50,000 in work, and the estimated ARV is a solid $350,000. A hard money lender might offer 80% of the purchase price ($160,000) plus 100% of the renovation costs ($50,000). The total loan is $210,000, which is just 60% of the ARV. For the lender, that’s a very comfortable and secure deal. The investor only needs to bring $40,000 to the table to close.

The Role of Equity and Exit Strategy

Because the property is the collateral, lenders need to see you have some "skin in the game." This almost always means putting down a down payment, typically in the 20-30% range. Your cash contribution creates an immediate equity cushion that protects the lender. If you want to dive deeper into this foundational concept, our guide on what is equity in real estate is a great resource.

Finally, no hard money lender will sign off without seeing a clear, realistic exit strategy. Remember, these are short-term loans, usually with a lifespan of 6 to 24 months. You have to show them exactly how you plan to pay them back. The two most common exits are either selling the renovated property for a profit or refinancing with a traditional, long-term mortgage once the project is finished and the property is stabilized.

How Hard Money Went from a Niche Player to a Mainstream Powerhouse

To really get a handle on hard money loans, you have to understand they aren't some new fad. They're a battle-tested financial tool, born out of necessity and proven in the fires of economic turmoil. Looking back at their history shows a fascinating shift from a fringe, last-ditch option to a go-to funding source for sharp real estate investors.

This all started back in the Great Depression of the 1930s. The entire banking system was in shambles, and when banks failed, they shut off the lending spigot completely. This left property owners high and dry, with absolutely no way to get capital. Private lenders saw the gap and stepped in, offering loans secured by the property itself. This was the birth of hard money as we know it—an essential alternative when traditional money disappears. You can get a deeper look into this origin story and see how hard money lending has evolved over the years on yieldi.com.

A History of Stepping Up in a Crisis

This theme of private money filling the void left by big banks has played out time and again. Whenever a crisis hits and credit gets tight, hard money lending doesn't just hang on—it actually flourishes.

- The Savings and Loan Crisis (1980s-90s): When more than 1,000 savings and loan institutions went under, another credit vacuum appeared. Hard money lenders were there, providing the cash needed to keep real estate deals moving when conventional funding was nowhere to be found.

- The 2008 Financial Meltdown: After the subprime mortgage implosion, banks slammed the door shut with incredibly strict lending rules. Unsurprisingly, hard money lenders became a critical funding lifeline for investors, especially for those looking to buy up distressed properties on the cheap.

It all comes down to this: Hard money thrives by offering speed and asset-focused lending right when the rest of the financial world gets slow, bureaucratic, and scared of risk.

No Longer the Last Resort

For a long time, hard money loans had a reputation as the "lender of last resort"—the place you went when no one else would even talk to you. That perception has completely changed. The industry has grown up. What used to be a fragmented network of local guys is now a sophisticated market with large, national lending platforms offering more consistent terms and professional processes.

Today, investors don't use hard money loans because they have to; they use them because they want to. For a seasoned real estate pro, paying a bit more in interest is a tiny price for the power to close a deal in 7-10 days instead of waiting the 45-60 days a traditional bank requires. That speed is a massive competitive edge. It lets them jump on hot deals others miss, solidifying hard money's place as an indispensable tool in today's real estate world.

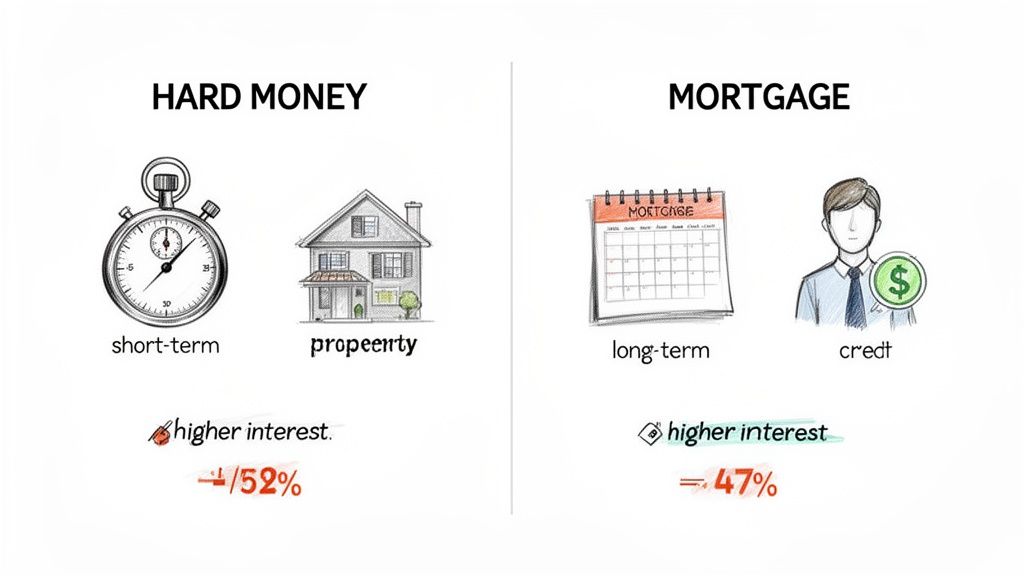

Hard Money Loans Vs. Traditional Mortgages: A Tale Of Two Loans

Picking the right financing can make or break your real estate deal. While both hard money loans and traditional mortgages get you the cash you need, they're fundamentally different tools for different jobs.

Think of it this way: a traditional mortgage is like a reliable family sedan. It’s built for the long haul, steady and predictable. A hard money loan? That’s more like a rugged 4×4, designed to move fast over rough, uncertain ground.

The biggest difference comes down to what the lender cares about most. A bank is focused almost entirely on you, the borrower. They’ll pore over your credit score, income stubs, and employment history. A hard money lender, on the other hand, is all about the deal. They’re laser-focused on the property's value and your plan to make a profit.

The Real Difference: Speed and Underwriting

This is where the rubber really meets the road. A traditional mortgage crawls through a complex approval maze that can easily take 30 to 60 days, sometimes longer. In a hot market, that kind of delay can mean losing out on a great property.

Hard money loans are built for speed. Because they aren't bogged down by the same red tape as banks, a hard money loan can often get approved and funded in just 7 to 14 days. That’s a huge advantage, letting you make aggressive offers that sellers love.

This speed is a direct byproduct of a completely different underwriting mindset.

- Traditional Lenders: Their job is to minimize risk related to the borrower. They do this with tons of paperwork and deep dives into your financial history.

- Hard Money Lenders: Their job is to minimize risk related to the asset. They do this by scrutinizing the property's current value and, most importantly, its After Repair Value (ARV). A fantastic deal can get funded even if your personal credit isn't spotless.

Hard Money Loans Vs. Traditional Mortgages At A Glance

To really see the contrast, it helps to put them side-by-side. The table below breaks down the key differences and shows why each loan has its own distinct purpose.

| Feature | Hard Money Loan | Traditional Mortgage |

|---|---|---|

| Approval Time | Fast: Typically 7-14 Days | Slow: 30-60+ Days |

| Loan Basis | The Property's Value (ARV) | Borrower's Credit & Income |

| Loan Term | Short-Term: 6-24 months | Long-Term: 15-30 years |

| Interest Rates | Higher: 8% – 15% | Lower (Varies with market) |

| Down Payment | Higher: Usually 20% – 30% | Lower: Can be 3.5% – 20% |

| Underwriting Focus | The Property & Exit Strategy | The Borrower's Financials |

| Best For | Fix-and-flips, bridge loans, quick acquisitions | Primary residences, long-term rentals |

As you can see, they are worlds apart. One isn't inherently "better"—they are simply different tools engineered for very different financial goals.

It’s A Classic Case Of Cost Vs. Opportunity

Yes, the interest rates and points on a hard money loan look high at first glance. But experienced investors don't see it as a cost; they see it as paying for an opportunity. The ability to snap up a profitable property that you’d otherwise lose while waiting for a bank often makes the higher financing cost well worth it.

Remember, the goal isn't to live with this loan for 30 years. It’s to get in, execute your plan, and get out—fast.

Of course, these aren't your only two options. For investors looking for other ways to tap into capital, you can learn more about using a HELOC for investment property in our detailed guide. Ultimately, the choice between hard money and a traditional loan boils down to what you need most right now: speed and agility or long-term stability and a lower cost of capital.

When Should You Actually Use a Hard Money Loan?

Knowing what a hard money loan is gets you in the door. Knowing exactly when to use one is what really separates the seasoned pros from everyone else. This isn't your everyday mortgage; it's a specialized tool. In the right situations, it gives you a powerful advantage that traditional financing just can't touch.

So, let's break down the three main scenarios where hard money loans aren't just an option—they're often the best move you can make.

The Classic Fix-and-Flip

This is the bread and butter of hard money lending. If you're an investor who buys distressed properties, renovates them, and sells for a profit (the classic "flip"), your entire business model depends on speed and reliable access to capital. Waiting on a bank is a deal-killer.

Hard money lenders are perfect partners here because they get the flipping model. They’ll often fund a big chunk of the purchase price and, crucially, 100% of the renovation budget. This is typically handled through a draw schedule, where the lender releases funds as you hit specific construction milestones. It’s a smart system that keeps everyone protected and the project moving.

Real-Life Example: The Outdated Ranch House

An investor spots a dated but solid ranch house for $250,000. It needs a $60,000 overhaul for the kitchen, baths, and floors to bring it up to modern standards. The After Repair Value (ARV) is estimated at a healthy $420,000. A hard money lender steps in to fund 80% of the purchase ($200,000) and 100% of the rehab budget ($60,000). The investor just needs to bring their $50,000 down payment plus closing costs. The loan is set for 12 months with interest-only payments, keeping carrying costs low. Six months later, the work is done, and the house sells for $415,000. After paying back the $260,000 loan and covering other expenses, the investor pockets a nice profit. That whole deal was only possible because hard money moved fast. This approach is also vital for investors aiming to scale, a concept we explore in our guide on how to finance your BRRRR method real estate deals.

Bridge Financing When You're in a Bind

Ever find the perfect investment property while your cash is still locked up in another one you're trying to sell? It’s a classic real estate Catch-22. The seller of the new place has other offers and isn't going to wait around.

This timing gap is precisely what a bridge loan was designed for. As a type of hard money loan, it gives you short-term financing to "bridge" the gap between buying the new asset and selling your old one. It lets you make a powerful, near-cash offer and lock down the new property without being at the mercy of your current sale's timeline.

New Construction Projects

For small-to-midsize builders, getting a construction loan from a bank can feel like navigating a maze of red tape. Banks are notoriously slow and risk-averse with ground-up construction, especially if you don't have a decades-long track record.

Hard money lenders, on the other hand, are often more nimble. They're more interested in the project's potential—the location, the plans, and the finished value. Their ability to make quick decisions and fund in stages (draws) is a much better fit for the dynamic timeline of a construction project.

Construction vs. Fix-and-Flip Loans at a Glance

| Feature | Fix-and-Flip Loan | New Construction Loan |

|---|---|---|

| Property Status | Existing building that needs a facelift | Empty lot or a teardown |

| Primary Risk | Going over the renovation budget or missing the ARV | Permit delays and soaring material costs |

| Lender Focus | After Repair Value (ARV) is king | Loan-to-Cost (LTC) and the projected final value |

| Loan Structure | Usually purchase price + rehab funds | Funds released in stages as the build progresses |

Across all these situations, the common threads are speed, flexibility, and opportunity. Hard money loans give investors the power to pounce on a great deal the moment it appears—seizing opportunities that would be long gone by the time a traditional lender even got through the paperwork.

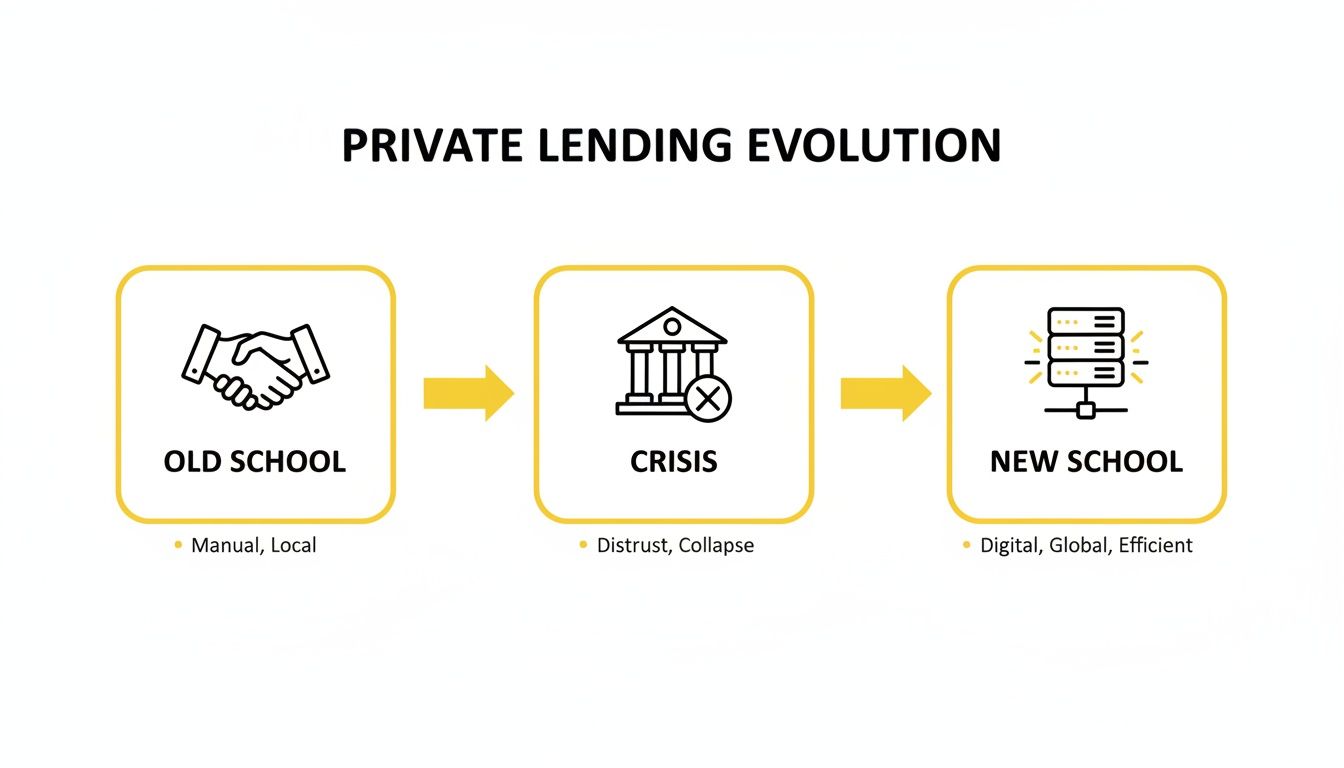

The Rise of Private Lending in Modern Real Estate

If you’ve been in the real estate game for a while, you know the private lending world has completely transformed, especially since the 2008 financial crisis. What was once a niche corner of the market is now a mature, scalable industry that’s absolutely central to how deals get done today.

This shift wasn’t random. It was a direct response to a massive change in how traditional banks operate. After 2008, banks got incredibly risk-averse. They tightened their lending standards and essentially walked away from anything that looked even slightly speculative, like fix-and-flips or ground-up construction. This left a huge funding gap, and private capital stepped in to fill it.

From Local Players to National Platforms

Go back a couple of decades, and "hard money" usually meant a wealthy local doctor or lawyer funding a deal in their own backyard. It worked, but it wasn't exactly scalable or consistent. Fast forward to today, and the industry is dominated by sophisticated national lending platforms, many of which are backed by serious institutional money from Wall Street.

This flood of big-league capital has changed everything:

- More Competitive Rates: With more money chasing deals, competition has naturally driven down interest rates and fees.

- Standardized Processes: The big national players have brought uniform application and underwriting systems, making the whole process much more predictable.

- Greater Accessibility: It doesn't matter if you're in Des Moines or Los Angeles; you can now tap into a huge variety of lenders and loan products online.

The 2010s were really the renaissance for private lending. In the wake of the 2008 crash, private lending volumes more than doubled, with U.S. private debt rocketing past $700 billion. The boom got another jolt when corporate buyers swept in, buying up thousands of foreclosed homes and creating even more demand for quick financing. This is when lenders like Kiavi and Anchor Loans really took off, shifting the industry from a network of small local operators to a landscape of national powerhouses. You can discover more insights about this historical shift on thinkrealty.com.

This professionalization means that for many investors, a hard money loan is no longer a "lender of last resort" but a strategic first choice for acquiring and repositioning assets quickly.

This growth has also given birth to more specialized loan products. For investors who focus on building a rental portfolio, for instance, the invention of asset-based financing has been a total game-changer. You can learn more about these options by exploring our complete guide to DSCR loans. All this new capital and competition has cemented private credit’s place as an essential tool in any serious real estate investor's toolkit.

Securing a Hard Money Loan Step-by-Step

Getting a hard money loan is a whole different ballgame compared to dealing with a traditional bank. It's faster, more direct, and focused on one thing: the quality of your deal. If you can show a lender a solid property, a clear plan, and a path to profit, you’re already halfway there.

Let's walk through exactly how to package your project to get the "yes" you're looking for.

The world of private lending has changed dramatically over the years. What used to be a closed-off network of local money guys has opened up, largely thanks to technology.

This shift from old-school handshakes to modern digital platforms means faster approvals and more predictable processes for investors like us. It’s a good time to be in the game.

Step 1: Find the Right Lender

First things first, you need to find the right funding partner. Not all hard money lenders are the same. Some live and breathe fix-and-flips, while others prefer new construction or commercial bridge loans.

Your best bet is to look for a direct lender—someone funding the deal with their own cash. They have the final say, which means fewer hoops to jump through and a much faster timeline from application to closing.

Step 2: Prepare Your Deal Package

Once you’ve got a shortlist of lenders, it's time to put your deal package together. This is your business plan for the project, and it needs to be professional and buttoned-up. Remember, hard money lenders are betting on the asset first and you second. A clean, organized package screams competence.

Here’s what you absolutely must include:

- Executive Summary: A simple, one-page snapshot of the deal. Include the property address, what you're paying for it, your rehab budget, and your target After-Repair Value (ARV).

- Purchase Agreement: A copy of the signed contract you have on the property.

- Detailed Scope of Work: Don't just say "kitchen remodel." Break it down. A line-item budget showing what you're spending on cabinets, countertops, labor, etc., shows you've done your homework.

- Proof of Funds: You'll need to show you have the cash for your down payment and closing costs. Simple bank statements will do.

- Investor Experience: A quick summary of your track record. If you have past projects, list them out. Before-and-after photos are pure gold here.

Step 3: Underwriting and Approval

After you submit your package, the lender’s real work begins. They’ll start their due diligence, which always includes ordering a third-party appraisal. Their appraiser will verify both the property's current "as-is" value and, more importantly, your projected ARV. This appraisal is the linchpin of the entire deal.

To make sure you're not missing anything on your end, it’s worth reviewing a detailed real estate due diligence checklist. It's a great way to double-check that you've covered all the bases before the lender even starts their review.

Key Insight: The lender isn't just crunching numbers; they're stress-testing your plan. A well-supported ARV and a realistic renovation budget prove you're an investor they can trust, not a speculator.

Step 4: Closing and Funding

If the appraisal comes back in line with your projections and the lender is happy with your package, you’ll get a term sheet. This document lays out the final interest rate, points, and terms of the loan.

Once you sign off on it, the closing attorney prepares the final documents. Before you know it, you're at the closing table. The whole process can move incredibly fast, often wrapping up in just 7 to 10 days. The funds are wired, the keys are in your hand, and it's time to get to work.

Your Hard Money Questions, Answered

Jumping into the world of hard money lending can feel a little overwhelming. There are new terms, different rules, and a faster pace than you might be used to. To clear things up and help you move forward with confidence, let's tackle some of the most common questions investors have.

1. What Are the Typical Interest Rates and Fees for Hard Money Loans?

This is usually the first question on everyone's mind. You can expect hard money loan interest rates to fall somewhere between 8% and 15%. Yes, that’s higher than a conventional mortgage, but you're paying for speed and flexibility, not a 30-year term. The rate reflects the lender's risk and the short-term nature of the deal.

Beyond the interest rate, you'll also see origination points. This is an upfront fee lenders charge to put the loan together, typically ranging from 1 to 5 points. Just remember, one point is simply 1% of the total loan amount. So, on a $300,000 loan with 3 points, you'd have a $9,000 origination fee.

2. How Quickly Can I Close on a Hard Money Loan?

Speed is the name of the game here, and it's the biggest advantage hard money offers. While your traditional bank loan crawls through a 30- to 60-day underwriting process, a hard money lender can often get you funded in just 7 to 14 days.

I've even seen deals close in under a week when the borrower has all their ducks in a row. This kind of speed is what allows you to swoop in and make aggressive offers that other investors, waiting on slow bank approvals, simply can't compete with.

3. Is Good Credit Required to Get a Hard Money Loan?

Not in the way you might think. A hard money lender is definitely going to look at your credit report, but a less-than-perfect score won't automatically kill your deal. Their main concern isn't your FICO score; it's the quality of the property and the strength of your investment plan.

The deal itself is the star of the show. If you bring a project with a ton of built-in equity and a clear path to profit, many lenders will fund it even if your personal credit has seen better days. They're underwriting the asset first.

4. What Is an Exit Strategy and Why Is It So Important?

Think of your exit strategy as the final chapter of your investment story. It’s your concrete plan for paying back the hard money loan when its short term is up. Lenders don't just want to see this; they require it. It’s their proof that you know exactly how you’re going to return their capital.

There are two classic exit strategies:

- Sell the Property: This is the standard fix-and-flip model. You renovate the property, sell it for a profit, and use that cash to pay off the loan.

- Refinance: After you’ve fixed up the property and stabilized it (maybe by placing a tenant), you refinance into a long-term, traditional mortgage with a much lower interest rate.

5. Can I Use a Hard Money Loan to Buy a Primary Residence?

This is a common question, but the answer is almost always no. Hard money loans are designed as business-purpose loans for investment properties—meaning, places you don't plan to live in. Regulations like the Dodd-Frank Act place a lot of strict consumer protection rules on loans for primary residences, and most hard money lenders aren't set up to navigate that red tape.

6. What Are the Biggest Risks of Using a Hard Money Loan?

Let's be real: the biggest risks are the high cost and the ticking clock. If your renovation budget balloons or the project drags on longer than you planned, those high-interest payments can start chewing through your potential profits in a hurry. The absolute worst-case scenario is failing to execute your exit strategy before the loan is due. That puts you in danger of default and potentially losing the property to foreclosure.

7. Do I Need Real Estate Experience to Qualify?

It certainly helps. Lenders feel a lot more comfortable when they see you have a proven track record of successfully managing similar projects. But don't let that discourage you if you're new. A first-time investor can absolutely get approved, but you'll need to bring an undeniable "home-run" deal to the table, likely with a larger down payment to help ease the lender's concerns.

8. How Much of the Deal Will a Hard Money Lender Fund?

Lenders usually base their funding on two core metrics: Loan-to-Value (LTV) and Loan-to-Cost (LTC). For example, they might offer up to 75% of the property's current "as-is" value or up to 90% of your total project cost (which includes both the purchase price and your renovation budget). A lot of lenders will happily fund 100% of the renovation costs, but you should expect to bring your own cash for a down payment—at least 10-20% of the purchase price is standard.

9. What Happens if I Default on the Loan?

This is the serious part. Because the property itself is the collateral for the loan, defaulting gives the lender the legal right to foreclose on it to get their money back. It's a stark reminder of why a solid, realistic plan—and maybe even a backup plan—is so critical from day one.

10. How Is the Hard Money Lending Market Changing?

The private lending world is anything but static. We're seeing a huge surge in demand for hard money as traditional banks tighten their lending standards and interest rates remain high. This is pushing more real estate investors to look for flexible financing alternatives. On a global scale, private credit is booming. U.S. banks' exposure has climbed to nearly $300 billion, making up 10.4% of their total loans—a massive jump from just 3.6% a decade ago. Technology is also playing a bigger role, with online platforms making the application and underwriting process faster and more accessible than ever. Learn more about these hard money lending trends on thehardmoneyco.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. Whether you're navigating real estate, stocks, or crypto, our resources are designed to help you achieve your financial goals. Explore more expert guides and investment tools at Top Wealth Guide.