Market downturns—when everyone else is freaking out—create opportunities for those ready to pounce. Here’s the deal: while most investors hit the panic button during a correction, the savvy ones? They zig when everyone else zags.

At Top Wealth Guide, we’ve dug into strategies that rake in profits when stocks take a nosedive. We’re talking methods ranging from straightforward short-selling to clever tweaks in asset allocation that not only protect but actually grow your wealth when things get bumpy.

In This Guide

How to Profit When Markets Crash

Short Selling and Put Options for Maximum Gains

Buckle up and dive into short selling and put options – these are your golden tickets when markets decide to take a nosedive. Short selling? It’s basically borrowing shares, selling them right away, and buying them back at bargain-bin prices once the dust settles. And put options? They’re your sweet little contracts that say, “Hey, I can sell this stock at a set price,” which means cashing in when everyone else is watching their stock values drop like a brick. The Options Clearing Corporation saw a surge in action in 2024, as investors scrambled for safety nets.

Remember Warren Buffett in 2008? Yeah, $20 billion richer thanks to playing the market like a fiddle… and John Paulson grabbed roughly another $20 billion betting against iffy mortgages. So how do you mimic this? Grab put options a smidge below current prices with 30-90 days on the clock for a satisfying risk-reward cocktail. And for short selling-hone in on those overvalued tech or consumer stocks, the ones that tend to trip and fall during economic hiccups. Oh, and don’t skimp on stop-losses… set them at 10-15% above your entry, because, well, unpredictability happens.

Dollar-Cost Averaging into Quality Assets

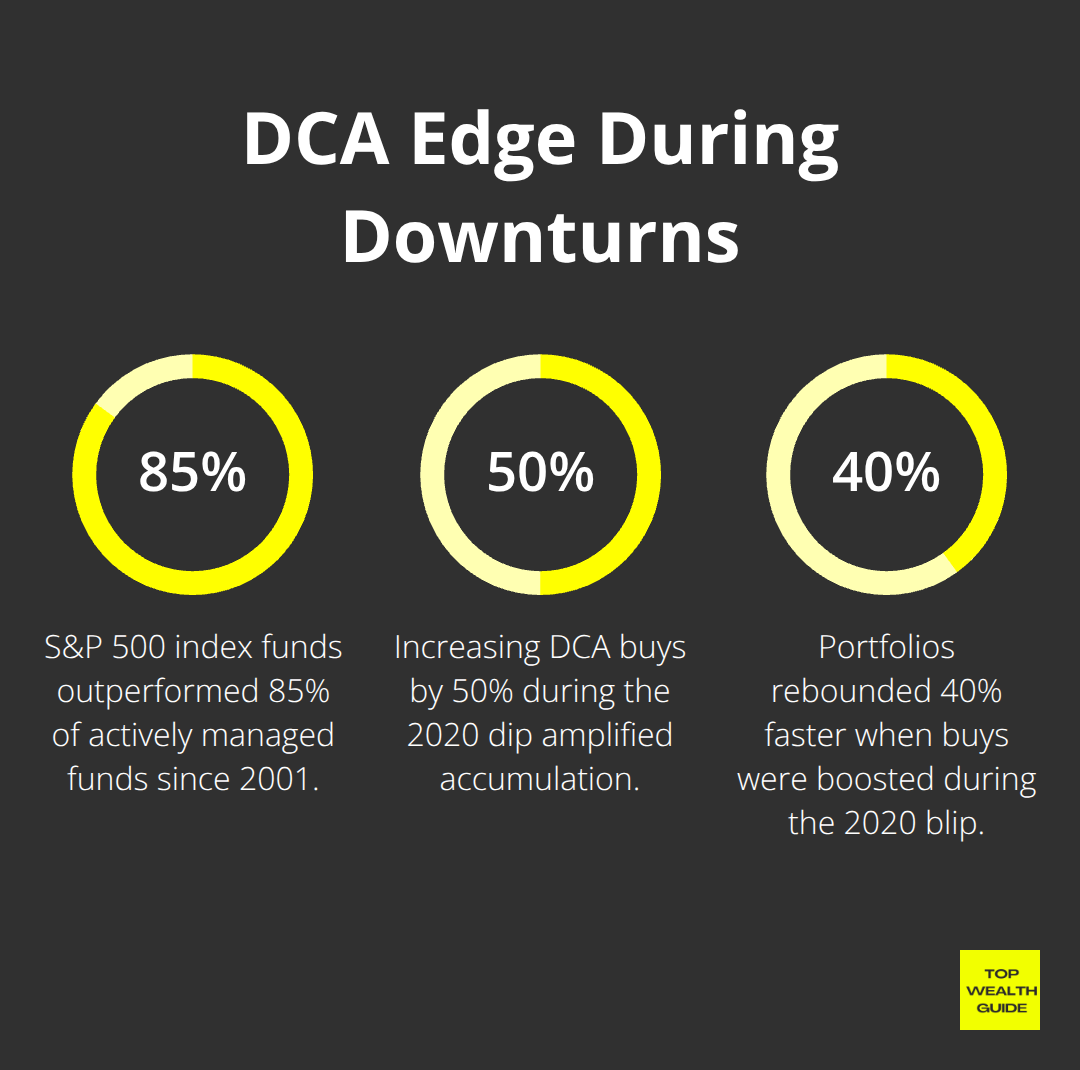

Turn stock market chaos into your best friend with dollar-cost averaging… where regular stock or ETF buying becomes your magic wand against volatility. It’s all about setting a steady purchase schedule, shrugging off the ups and downs. Data from the 2007-2009 plunge says it all: the steadfast buyers? They walked away with better long-term returns than those twiddling thumbs for the perfect timing.

Zoom in on S&P 500 index funds-they’ve outmatched 85% of actively managed competitors since 2001. Those savvy folks who upped their buys by 50% during the 2020 blip saw quicker portfolio rebounds… 40% faster, in fact. Ditch monthly buys for weekly or bi-weekly to snag more price whispers and cut the emotional clutter during the storm.

Defensive Stocks and Dividend Aristocrats

Meet your financial bomb shelter – Dividend Aristocrats-the stocks that rain dividends for 25+ years, even when the market’s throwing tantrums. Think Coca-Cola, Johnson & Johnson, Procter & Gamble… these legends kept the cash flowing through every rough patch since the 70s, offering you steady income when your portfolio’s appreciation is playing hide-and-seek.

Hunt down utility, consumer staple, and healthcare stalwarts… these recession warriors boast stability when things get wobbly. In 2024, utility stocks delivered a comforting 4.2% yield, braving 30% less market jerkiness compared to tech stocks. Aim for a meaty 30-40% investment in defensive positions, looking at companies with cozy debt ratios under 0.5 and flexing free cash flow yields above 6%.

These strategies-when mixed well with protective tactics-keep your portfolio from nosedives while holding onto that precious upside potential.

What Alternative Assets Work During Market Crashes

Gold Delivers Protection When Stocks Collapse

Gold-when everything else seems like it’s headed for the last round-keeps punching. Back in the 2008 financial mess, buying gold at roughly $924 an ounce? Today, you’re looking at it being around $3,359. The Federal Reserve’s data basically screams that gold holds up during those inflation spikes, making it a solid defense against your buck losing value.

Now, you’re not putting half your chips here, but a good 5-10% of your portfolio in physical gold or gold ETFs like SPDR Gold Shares. Actual gold coins from trustworthy mints give you the most control (and who doesn’t love control?), while ETFs let you slide in and out without the storage drama. Best times to buy? When that gold-to-silver ratio hits around 80:1 or higher. That’s the sweet spot.

REITs Provide Income When Stocks Stumble

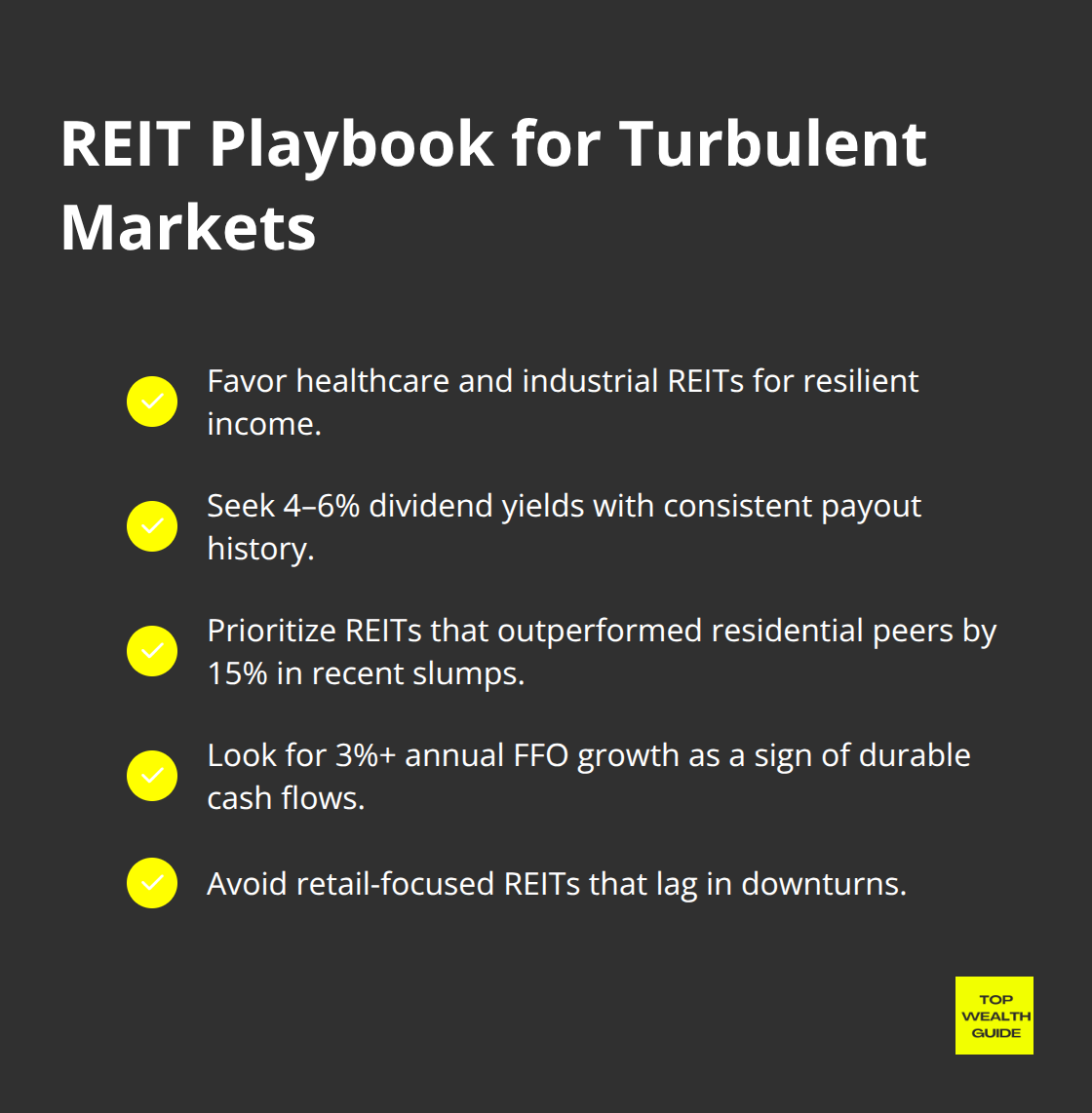

Real estate investment trusts, or REITs, they hand you the steady income stream even when the stock markets are in free fall. Take healthcare REITs like Welltower and Ventas-these guys kept payouts going through 2020’s pandemonium, offering nice 4-6% yields when bonds were basically snoozing at zero. And let’s not forget industrial REITs-data centers, warehouses-these outperformed the residential stuff by a clean 15% during recent slumps.

You want to scout REITs with debt-to-equity ratios between 1.0 to over 8.0 and see a 3%+ annual growth in funds from operations. And retail REITs? They’re just dead weight. Drop ’em.

Cryptocurrency Needs Strategic Approach

Bitcoin-it’s not the digital gold you might think during panic time; it mirrors growth stocks. The 2022 crypto crash? Bitcoin slipped 65%, moving in sync with tech stocks. But hey, thanks to Bitcoin ETFs and growing institutional interest, there’s a shift happening in the demand landscape.

Keep your crypto play small-2-5% tops, and zero in on Bitcoin and Ethereum. Those altcoins? They get wrecked when the real storm hits. Go with a dollar-cost averaging strategy during extended bear markets, specifically when Bitcoin’s under its 200-week average-it helps dodge the timing missteps. Stablecoins like USDC also make for a cozy cash spot with 4-5% returns via DeFi.

And remember, these alternative assets-they play best as part of a bigger plan that includes smart risk management techniques to keep your core portfolio intact.

How Do You Shield Your Portfolio From Total Destruction

Stop-Loss Orders and Position Sizing

Stop-loss orders-think of them as the financial airbags-are crucial when markets nosedive. Park them at 10-15% below your purchase price for those rollercoaster growth stocks. The secret sauce? Let your stops follow the price up… bank the gains, protect the downside.

Size up your positions like a pro-it’s more of a game-changer than stock picking. Risk only 1-2% of your total portfolio on any single move, and cap it at 5% on your big bets. The folks who trade for a living swear by this strategy-it’s why their returns stay steady even when the market’s throwing a tantrum.

Strategic Asset Allocation

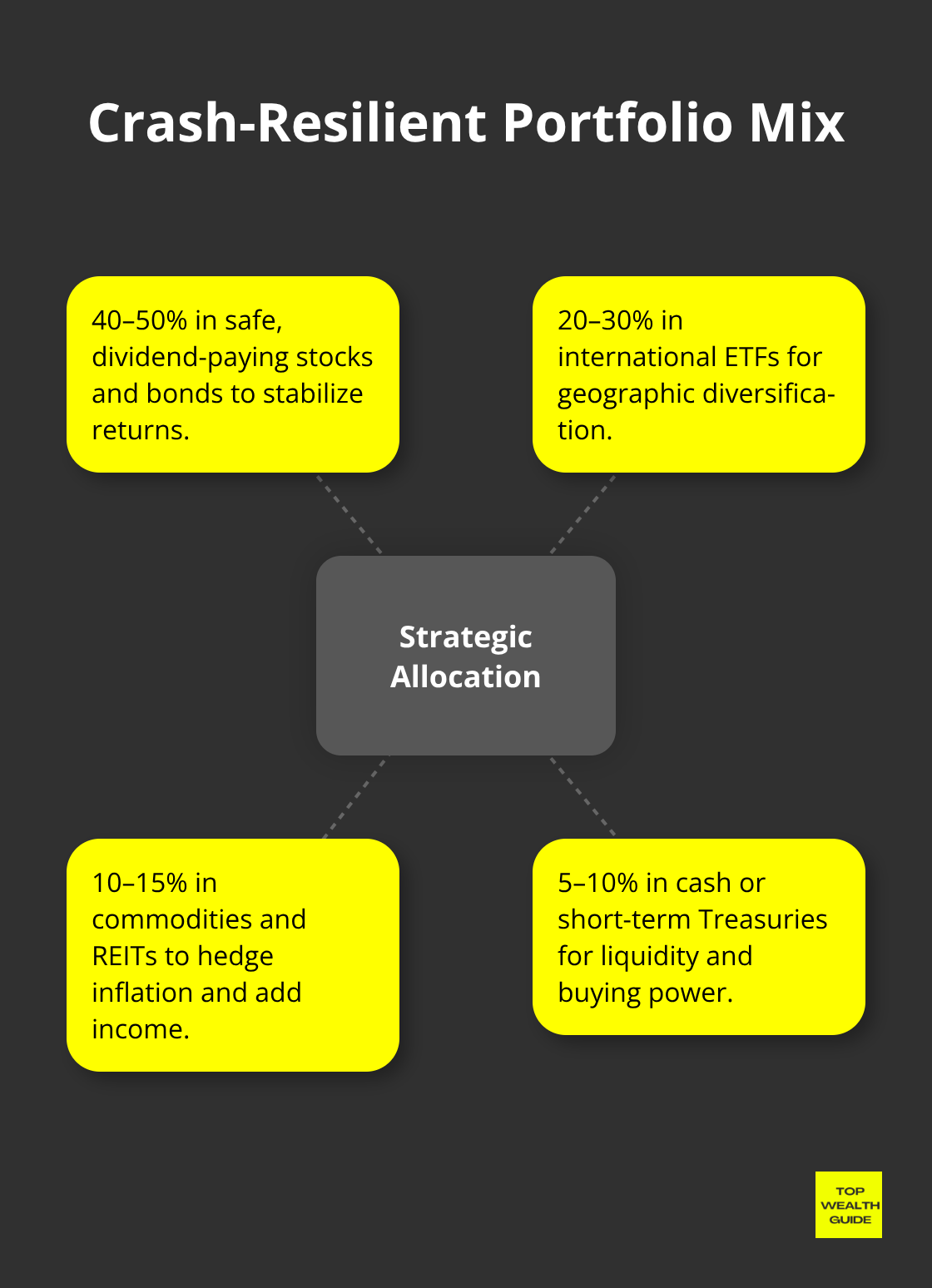

Diversification isn’t just about buying different kinds of tech stocks-it’s about spreading risk across assets that dance to their own beat. Remember the 2022 market meltdown? Tech, crypto, growth-all went down in flames together, and that’s the lesson.

Smart players slice their portfolios differently: Go 40-50% in safe, dividend-paying stocks and bonds, toss 20-30% into international waters via ETFs, 10-15% in commodities and REITs, and stash 5-10% in cash or short-term treasuries. This is your lifeline when everything else does the Titanic.

Cash Reserves Strategy

Cash-it’s not just for emergencies. Stack up 6-12 months’ worth in high-yield savings accounts and call it your “safety fund.” It keeps you from panic selling and gives you the firepower to pounce on deals when others run for the hills.

Back in the 2020 crash, the ones with extra cash to buy the dip watched their portfolios bounce back quicker than those who were fully locked into the market. That cash stash (often dubbed “dead money”) morphs into your ace in the hole when markets go into meltdown and bargains are everywhere you look.

Rolling out these wealth protection strategies isn’t a walk in the park-it takes guts and a plan. But they anchor any solid wealth management strategy, getting you through market mayhem like a champ.

Final Thoughts

Market downturns-nature’s way of testing your mettle. Smart investors aren’t the ones running for the hills. When the market does a nosedive, separate yourself from the herd; you can actually profit here. Think short selling, put options, and dollar-cost averaging into those quality dividend aristocrats. Take notes from the 2008 crisis-while most were losing their shirts, Warren Buffett and John Paulson were making it rain with billions.

Defense, folks-don’t leave home without it. Just as crucial as your offense. Stash away 5-10% in that shiny gold stuff, mix it up with REITs offering 4-6% yields, and keep cash ready for those golden buying moments. Set your safety nets-stop-losses, that is-10-15% below entry points and never, and I mean never, plunk down more than 2% of your portfolio on one position (this little gem saves your bacon when things hit the fan).

Kickstart these strategies before the next storm hits. Beef up your cash stash, earmark stocks ready for dollar-cost averaging, and dabble with paper trading for mastering options strategies. We at Top Wealth Guide are your wingmen for practical insights and killer strategies to build wealth through any market rollercoaster-swing by Top Wealth Guide for deeper dives into investing and wealth protection.

![How to Profit When Markets Tank [Investor Guide] How to Profit When Markets Tank [Investor Guide]](https://topwealthguide.com/wp-content/uploads/emplibot/market-correction-hero-1765847383-1024x585.jpeg)