The stock market — it’s like a roller coaster for investors with a stomach for the ride. There’s a buffet of opportunities if you’re brave enough to handle the volatility. Right now, the economy’s doing its dance, and entire sectors are playing musical chairs… creating some big-time winners in various categories.

Over at Top Wealth Guide, we’ve cracked the code on the top stocks that deserve your attention, thanks to some hardcore fundamental analysis. This isn’t just your grandmother’s stock tip — we’re talking growth potential, dividend bicep curls, and some serious value plays. Buckle up.

In This Guide

What’s Moving Markets Right Now

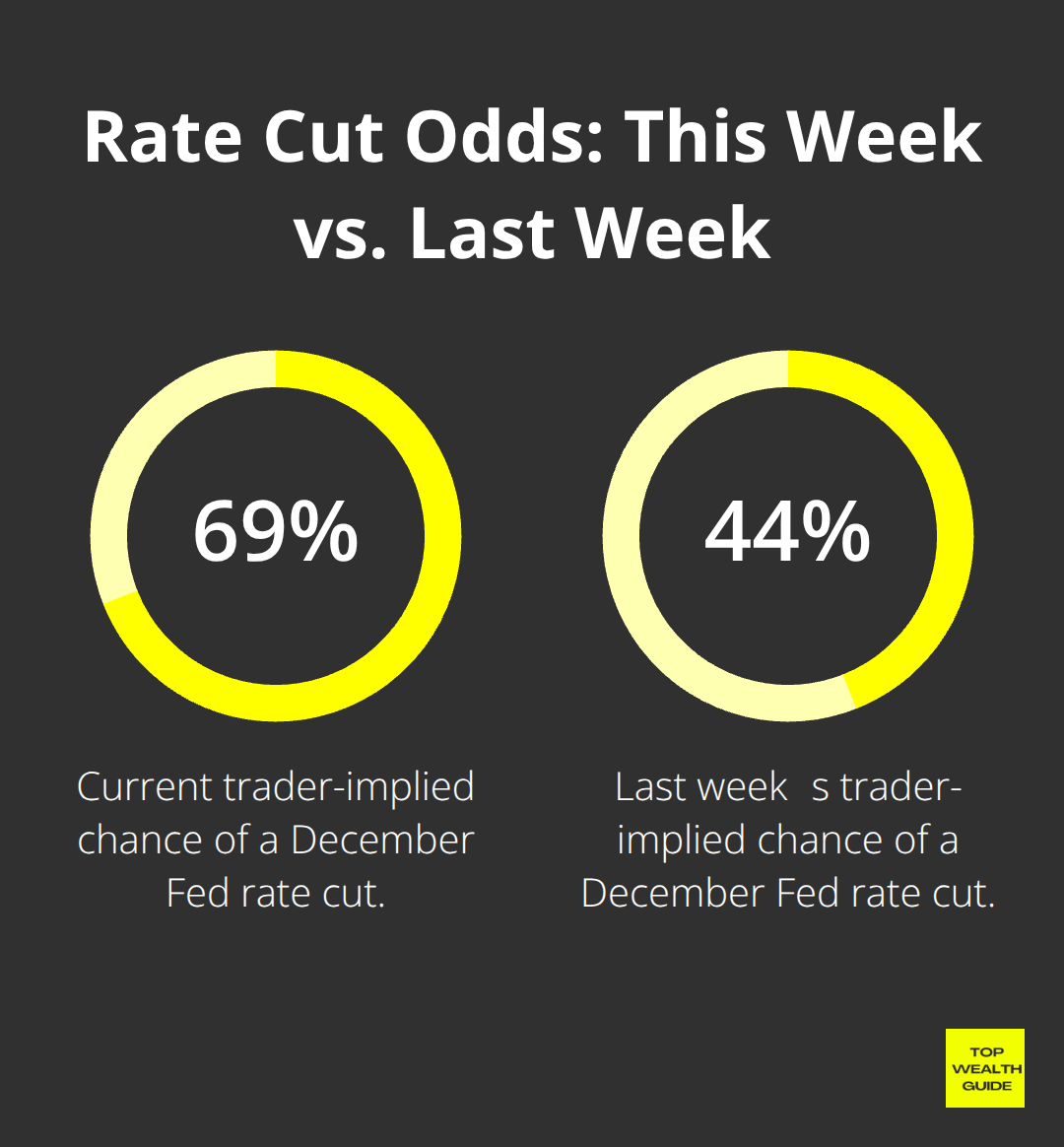

So, what’s the latest drama? The Fed-our beloved, market-moving puppet master-just hinted at a December rate cut. Suddenly, traders are thinking there’s a 69% chance it’ll happen, up from last week’s 44%… big jump, people. And what does that mean for you and your portfolio?

Opportunities knocking in rate-sensitive areas like real estate investment trusts and utilities. But beware-a storm’s coming for financial stocks that thrive on higher rates. The US500 index is hanging at 6,632 points, sprouting a nifty 10.77% gain year-over-year. Yet, Trading Economics analysts are throwing ice water on the optimism with a projection of a slip to 5,814.59 points in 12 months (translation: momentum chasers, caution).

Technology Sector Dominance Continues

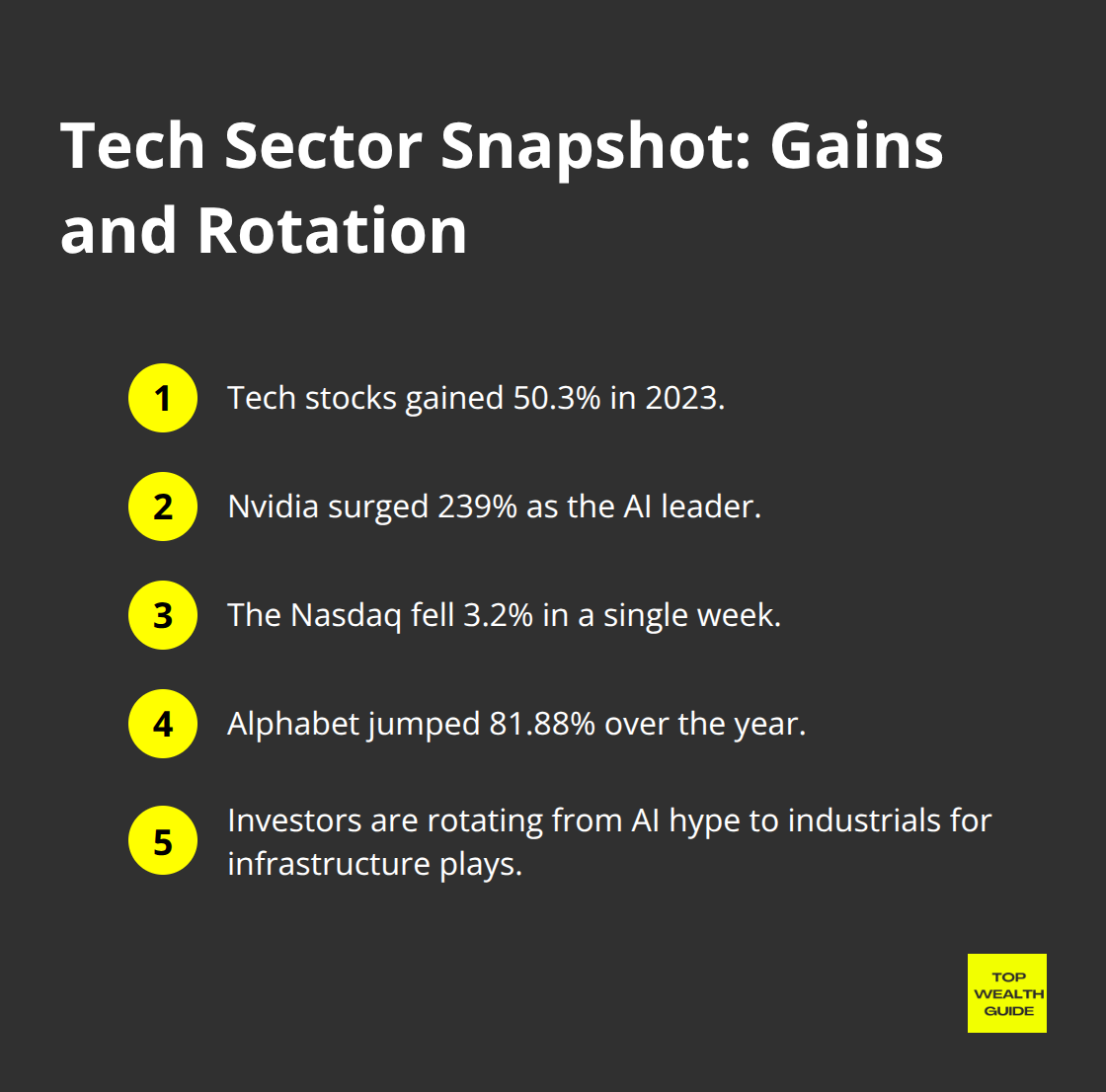

Tech stocks-oh boy, what a year. 50.3% gain in 2023. Nvidia, the AI darling, skyrocketed 239%.

But hold your horses-recent volatility yanked the Nasdaq down 3.2% in just a week. Looks like some folks are cashing out after the rush. Alphabet-yeah, that giant-soared 81.88% over the year. Meanwhile, Broadcom and Oracle didn’t have it so rosy, as investors second-guess AI valuations. So, what’s the play here? Smart money’s sliding away from AI hype and hitching onto industrials geared up for AI infrastructure. That’s where the under-the-radar action is.

Inflation and Consumer Behavior Shifts

Alright, let’s talk job jitters. September 2025 saw unemployment tick up, stirring a cocktail of Fed worries about growth and price stability. Consumers? They’re feeling the pinch-sentiment’s in the dumps despite forecasts of a trillion-dollar shopping bonanza. This disconnect? It hints at picky spending-discount stores like TJX get the love while old-school department stores… not so much. Meanwhile, the travel bug’s alive and well, fueling companies like Carnival Corporation to impressive 130% gains in 2023-post-pandemic honeymoon is full steam ahead.

Interest Rate Impact on Sector Rotation

The rate cut talk? It’s shaking up the sector landscape. Banks and financials-brace yourselves for rough seas as margins take a hit. But, utilities and REITs… they’re gearing up to ride the wave of lower borrowing costs. Tech firms? Especially those high-fliers with chunky growth promises but slim current profits-they’re in for a revival as future cash flows shine brighter under lower rates (making them the belles of the ball post-selloff). All these macro moves? They’re setting up specific stock opportunities across the board. Ready to play?

Which Stocks Should You Buy Right Now

Tech Stocks with Real Momentum

Nvidia? It’s the big dog right now, even with all the market ripples-shares sitting at $140 and that forward P/E clocking in at 28.5. This beast owns a hefty 70% to 95% of the AI chip arena, and their Q3 revenue… a jaw-dropping $60.9 billion. That’s a whopping 94% uptick from last year. Meanwhile, Advanced Micro Devices? They’re hustling as the go-to rival in data center AI, eyeing Morningstar’s $125 fair value like a hungry wolf.

Meta Platforms, though-yeah, they’re not snoozing. A 194.1% upsurge in 2023 and nearly 3 billion active users in the bag. Plus, they’re pouring cash into AI like it’s going out of style. These heavyweights ain’t just talk; they’re raking in serious growth to back up their stocks.

Dividend Champions That Deliver

Dividend aristocrats-they’re the tortoise to your tech stock hares. Johnson & Johnson? A juicy 3.1% yield, chugging along with 61 years straight of dividend hikes. Coca-Cola gives you 3.0%, leaning on a stellar 62-year spree. And Home Depot’s rolling with a 2.4% yield, propping up the Dow’s 1.15% rally on November 21.

Charles Schwab isn’t sleeping, either-bounced back from lows, riding those high interest rate waves with their brokerage playbook. This stock’s like a life jacket in rising rate seas, buoying those margins.

Recovery Plays with Upside Potential

Now, SoFi Technologies-they’re zeroing in on those moneyed millennials, scoring a hefty 115.8% stock rise in 2023. Sure, it’s all about growth over dividends, but they cater to those underbanked high-earners traditional banks can’t bother with.

Carnival Corporation? Put ’em on the radar. The post-pandemic travel boom gave them a wind in the sails. Cruise stocks-they’re the poster kids for cyclical recovery, blending growth and future income vibes as industries roar back to life.

Each of these stock packs offers a different flavor of risk and reward. But real portfolio brilliance? It’s not just about snagging the winners-it’s about chess-playing your way through strategic allocation and risk management to shield your gains while hunting for that elusive growth.

How Do You Protect Your Stock Gains

Smart Portfolio Allocation Cuts Risk in Half

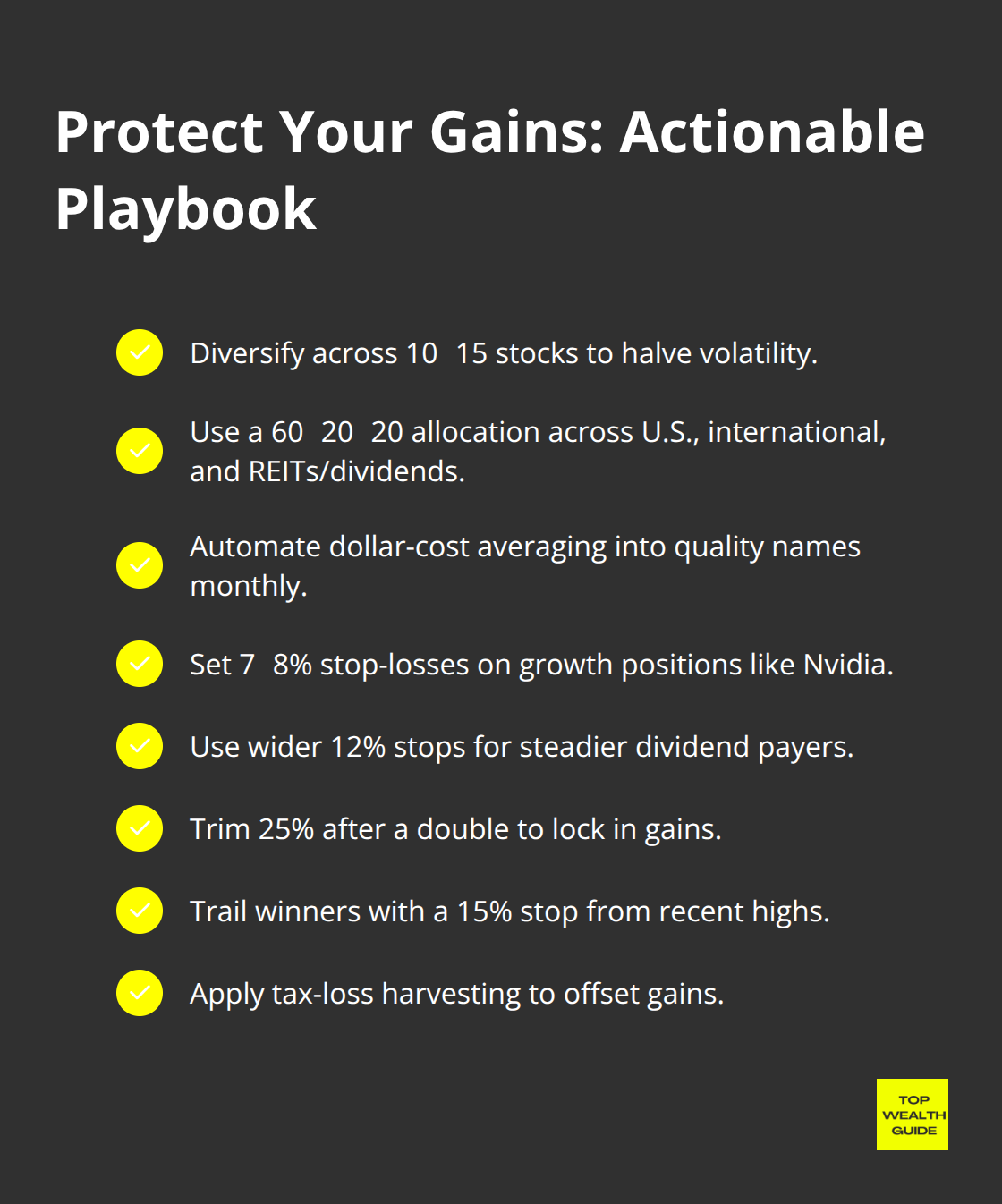

Look, building a solid stock portfolio isn’t about predicting the next big thing like Nvidia. It’s about diversifying – spreading your bets across sectors that don’t all dance to the same beat. Vanguard’s got the receipts: just 10-15 stocks across different sectors can cut your portfolio’s volatility in half. That’s right, 50%. Ditch the all-in tech gamble. Instead, try the 60-20-20 formula: 60% in large-cap stocks spread across sectors, 20% taking a stroll internationally, and 20% chilling in REITs or dividend stocks.

So when tech takes a 3.2% nosedive like Nasdaq did recently, your utilities and consumer staples are there with the safety net. Charles Schwab chimes in – portfolios following this blend beat those concentrated gambles by 2.3% annually over a decade.

Dollar-Cost Averaging Beats Market Timing Every Time

Listen up, stop obsessing over catching the market wave at just the right moment. Dollar-cost averaging is your compass here, guiding disciplined investment paths. Sure, it may not dazzle like lump-sum investing, but it works. Here’s the breakdown: pump $500 into the S&P 500 every month for ten years, and you turn $60,000 into $87,000. What’s the alternative? Sitting on the sidelines and watching gains pass you by. Automate it, buy Meta or Alphabet on autopilot every 15th. This approach? It smooths out the rollercoaster ride and kicks fear to the curb.

Stop-Losses Save Your Portfolio From Disaster

The pros live and breathe the 8% rule, and so should you. Studies show cutting losses at 7-8% below your entry stops minor setbacks from ballooning into disasters. When Nvidia was at $140, savvy minds set stop-losses at $129. For steadier ships like Johnson & Johnson, go with a wider 12% net. Profits rolling in? Scale back 25% if a stock doubles, then ride the wave with a trailing stop at 15% below its crest – this method rode Tesla’s 400% surge while safeguarding gains against a sudden tide change. And hey, consider tax-loss harvesting – using strategic losses to balance your gains.

Final Thoughts

Stock selection-let’s break it down-rests on three fundamentals: rock-solid basics, a mix of exposure, and some good ol’ risk management. The top stocks on the radar? You’ve got your growth powerhouses like Nvidia dominating the AI chip scene with a 70–95% grip, the dividend stalwarts such as Johnson & Johnson, boasting 61 years of consecutive hikes-seriously, how’s that for stability?-and then there are the rebound kids like SoFi, tapping into those high-income millennials that traditional banks missed.

Keep an eye on those risk factors-Fed’s rate calls are the marionette strings for sector movements, inflation is the unwanted guest at the consumer spending party, and AI valuations are the yo-yo pulling the Nasdaq down 3.2%. Also, unemployment’s slight nudge to 4.4%-it’s like a not-so-friendly whisper of potential economic turbulence. Market waves bring both chances and pitfalls (so yeah, strategic positioning’s your best pal now).

So, what’s your game plan? Start with the 60-20-20 allocation, automate that dollar-cost averaging into quality picks, and let’s not forget-8% stop-losses like gospel. Building wealth-it’s a marathon, not a sprint. Forget timing the market; think strategy and patience. And hey, we’re at Top Wealth Guide, ready to equip you with the practical tools and market insights to navigate these waters like a pro.