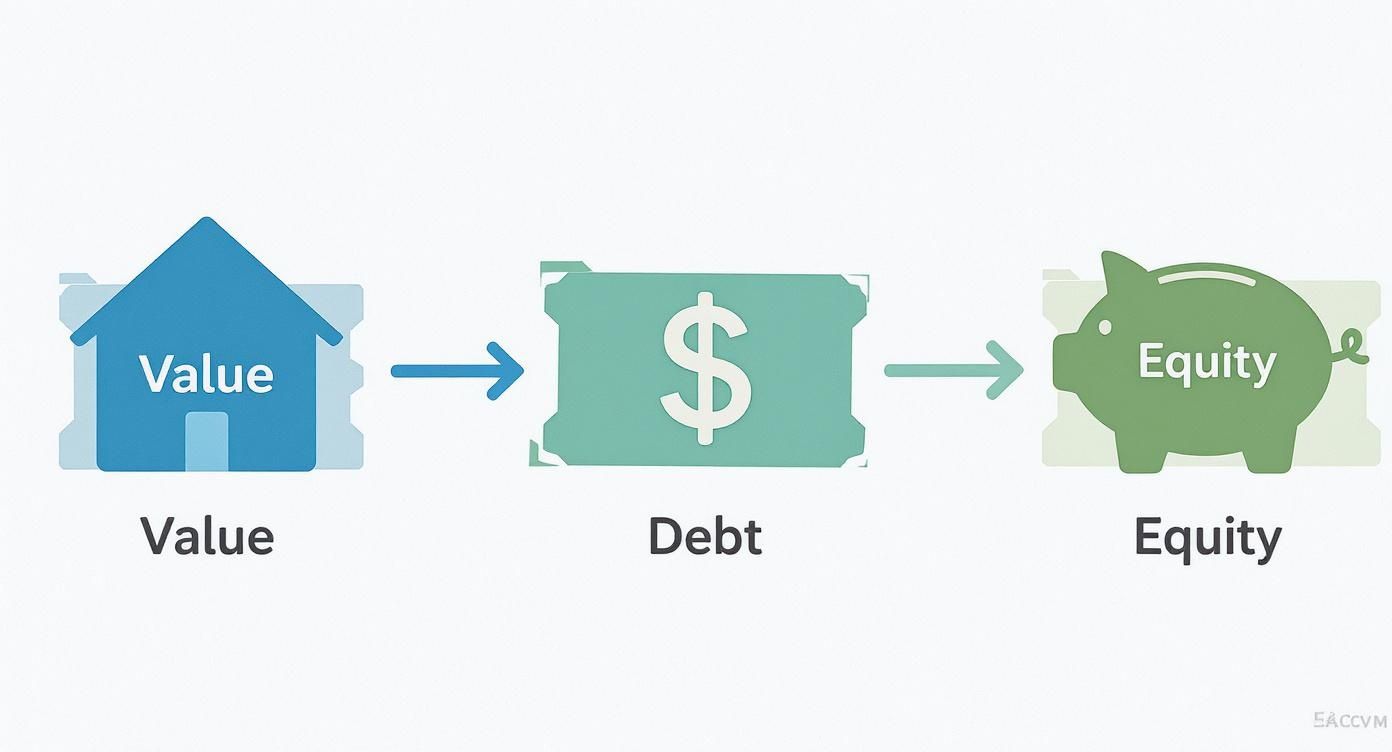

When you hear people talk about building wealth through real estate, what they’re really talking about is building equity. In the simplest terms, equity is the part of your home you actually own. It’s the difference between what your house is worth today and what you still owe the bank.

Think of it as your financial stake in the property—the portion that's truly yours, free and clear of the mortgage lender.

In This Guide

- 1 What is Real Estate Equity?

- 2 How to Calculate and Track Your Home Equity

- 3 The Two Primary Engines of Equity Growth

- 4 How to Unlock and Use Your Home Equity

- 5 Actionable Strategies to Build Equity Faster

- 6 Frequently Asked Questions About Home Equity

- 6.1 1. What’s the difference between equity and a down payment?

- 6.2 2. Is it possible to have negative equity?

- 6.3 3. How much equity do I need to get a home equity loan or HELOC?

- 6.4 4. What happens to my equity when I sell my home?

- 6.5 5. Are there tax implications for using my home equity?

- 6.6 6. Can my equity go down?

- 6.7 7. Does refinancing affect my equity?

- 6.8 8. How quickly can I build a significant amount of equity?

- 6.9 9. What's a good amount of equity to have?

- 6.10 10. What is the fastest way to build equity?

- 7 Your Home Equity Is a Path to Financial Freedom

What is Real Estate Equity?

Let's use a simple analogy. Imagine your home is a pie. The whole pie represents its current market value. The slice you've promised to the bank is your mortgage balance. Your equity is the slice you get to keep. As you pay down your loan or as the pie gets bigger (your home's value increases), your slice grows.

This concept is the bedrock of homeownership. If your home is currently valued at $500,000 and you have a remaining mortgage of $300,000, your equity is $200,000. That $200,000 is your asset. For a deeper dive into market trends that can affect your home's value, the National Association of REALTORS® is an excellent resource.

This straightforward calculation is the first step in understanding your financial footing as a property owner.

Key Takeaway: Equity isn't just an abstract number. It’s a real, tangible asset that you build over time through two main forces: paying down your mortgage and the appreciation of your property's value. It’s your ownership footprint.

The Basic Equity Formula

Calculating your equity is surprisingly simple. You only need two numbers.

Current Market Value – Outstanding Mortgage Debt = Your Home Equity

This is the formula. It's the starting point for everything else. As you make your monthly payments and as the market shifts, this number will change, hopefully for the better.

To really nail this down, it helps to see the components broken out. The table below gives a quick summary of the moving parts involved in your home equity calculation.

Key Components of Real Estate Equity

| Component | Definition | Example |

|---|---|---|

| Market Value | The estimated price your property would fetch if you sold it today. This is based on current market conditions, not what you originally paid. | You bought your house for $400,000, but a recent appraisal shows it's now worth $480,000 thanks to a hot market. |

| Mortgage Debt | The total principal balance you still owe your lender. This is the amount left on your loan, not including future interest. | Your original mortgage was for $320,000. After five years of payments, your remaining balance is now $285,000. |

| Home Equity | The portion of your home's value that you own outright. It’s the gap between what it's worth and what you owe. | With a market value of $480,000 and a mortgage debt of $285,000, your current home equity is $195,000. |

Understanding these three pieces is fundamental. Once you have a handle on them, you can start tracking your equity and planning how to use it to your advantage.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

How to Calculate and Track Your Home Equity

Alright, let's move past the theory and get down to the numbers. Figuring out your home equity is where you start to see your real wealth take shape, and thankfully, it's not complicated. You just need two key figures.

Once you have them, you can keep a running tab on your financial standing as a homeowner. First, you need your home’s current market value—what it would sell for today, not what you originally paid. Second, you need your outstanding mortgage balance, which is simply what you still owe the bank.

Finding Your Home's Current Market Value

Your property's value isn't static; it moves with the market, so getting a fresh estimate is key. Here are a few reliable ways to pin down that number:

- Professional Appraisal: This is the gold standard. A licensed appraiser will come out, do a thorough inspection, and compare your home to similar properties that have sold recently. It's the most accurate method you'll find.

- Comparative Market Analysis (CMA): A good real estate agent can put one of these together for you. They’ll dig into MLS data to analyze "comps" (comparable properties) and give you a solid estimate of your home's current worth.

- Online Estimators: Quick and easy, sites like Zillow or Redfin have automated tools that can give you a ballpark figure in seconds. Just remember, they’re estimates and can sometimes be off—they haven't actually seen your home.

Once you have a solid handle on your home's market value, you're halfway there. Now for the easy part.

Determining Your Outstanding Mortgage Balance

Finding out what you still owe the lender is a piece of cake. They make this information readily available.

- Monthly Mortgage Statement: Take a look at your latest bill. It will clearly state the remaining principal balance.

- Online Lender Portal: Just log in to your lender’s website or app. Your current loan details are usually right there on the dashboard.

- Annual Statement: Once a year, your lender sends a summary that includes your remaining loan balance.

With those two numbers in hand, you're ready to do the math.

As you can see, it's a straightforward formula: subtract what you owe from what your home is worth. What's left is the part you truly own.

Real-Life Example: Tracking Equity Growth

Let's walk through a real-world scenario with a homeowner named Alex.

Alex buys a home for $400,000 with a 20% down payment ($80,000), taking out a $320,000 mortgage.

Year 1 Equity:

Market Value: $400,000

Mortgage Balance: $315,000

Alex's Equity: $85,000

Now, let's fast-forward five years. The neighborhood has really taken off, and Alex has been faithfully making those monthly mortgage payments.

Year 5 Equity:

New Market Value: $475,000

New Mortgage Balance: $285,000

Alex's Equity: $190,000

In just five years, Alex's equity more than doubled, jumping from $85,000 to a whopping $190,000. That growth came from two places: $30,000 from paying down the mortgage and an impressive $75,000 from market appreciation.

If you want to run your own numbers and see how different scenarios could play out, using a good real estate investment calculator can give you a much clearer picture. By simply keeping these two numbers updated, you can watch your financial progress and make smarter decisions about your biggest asset.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

The Two Primary Engines of Equity Growth

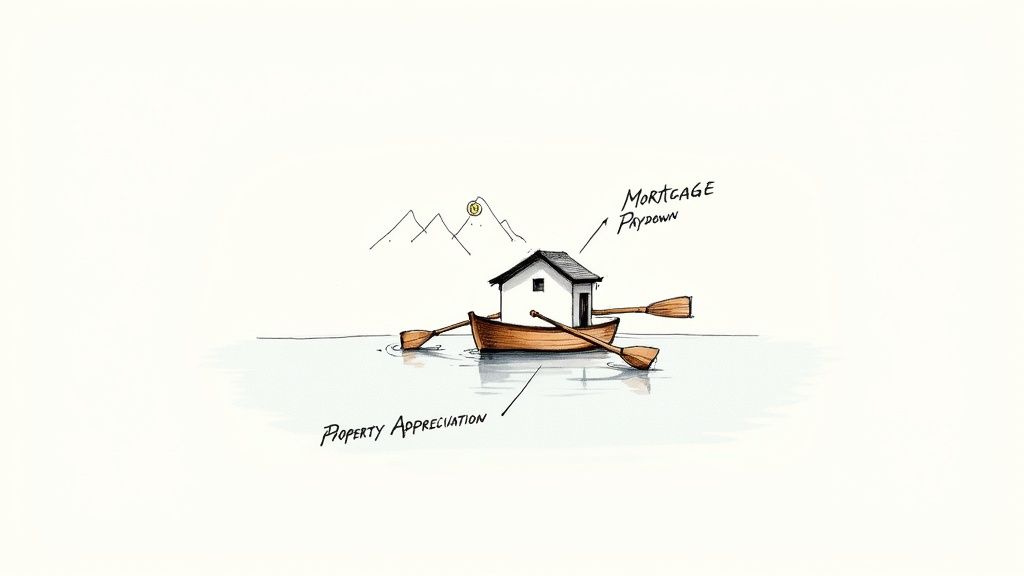

Knowing what real estate equity is is the first step. Watching it grow is where the real magic happens.

Think of it like rowing a boat with two oars. One oar is your consistent effort—paying down your mortgage month after month. The other oar is the market's current pushing you forward, which we call property appreciation. You move toward your financial goals a lot faster when both are working in sync.

Let's break down these two forces—one you control, and one you don't—that are the core drivers of your wealth as a homeowner.

Engine 1: Mortgage Paydown (Your Deliberate Effort)

Every time you make a mortgage payment, you're building equity. It's the most direct and reliable way to increase your ownership stake. This process is called amortization, a fancy term for paying off debt with regular, fixed payments. It's the slow-and-steady engine that you are completely in charge of.

When your loan is new, most of your payment goes straight to interest. Only a small fraction chips away at the principal (the actual loan balance). But with every single payment, that balance shifts. A little more goes to the principal, and a little less to interest. This happens month after month, year after year.

The Power of Amortization: Over the life of a 30-year mortgage, this shift becomes dramatic. In the final years of your loan, nearly your entire payment is dedicated to paying down the principal. That's a direct conversion of your payment into pure equity.

This methodical debt reduction guarantees you're increasing your ownership in the property, regardless of what the housing market is doing.

Engine 2: Property Appreciation (The Market's Contribution)

The second engine, and often the more powerful one, is property appreciation. This is simply the increase in your home's market value over time. Unlike paying down your mortgage, appreciation is largely a passive gain influenced by factors outside your direct control.

So, what makes a property's value go up? A few key things:

- Market Demand: It boils down to supply and demand. If more people want to live in your area than there are homes for sale, prices naturally climb.

- Economic Growth: A healthy local economy with new jobs attracts more people, which in turn boosts the demand for housing.

- Neighborhood Development: Things like new schools, trendy shops, parks, or better public transit can make a neighborhood more desirable and lift property values for everyone.

- Inflation: As the general cost of living rises over time, so does the cost of real estate. This contributes to long-term appreciation.

Of course, the market has its cycles. During periods of rising interest rates, like the cycle that began in 2022, property values can cool off or even dip. But markets often recover. A Q2 2025 outlook noted that in the UK, property capital values increased by 2.1% in the 12 months to February 2025, reversing earlier declines. This rebound shows how market shifts can help homeowners rebuild equity. You can find more details in this global real estate market outlook.

Comparing the Two Engines

Both mortgage paydown and appreciation are crucial, but they play very different roles in building your wealth. The table below lays out the key differences.

| Feature | Mortgage Paydown (Amortization) | Property Appreciation |

|---|---|---|

| Control | High: Directly controlled by your consistent payments. | Low: Influenced by market forces and economic trends. |

| Pace | Slow & Steady: A gradual, predictable increase over years. | Variable: Can be rapid in hot markets or stagnant in downturns. |

| Risk | Low: Your equity gain is guaranteed as long as you pay. | Moderate: Market values can fluctuate and even decline. |

| Source | Your Actions: Comes from your own capital contributions. | Market Forces: Comes from external economic factors. |

By understanding how both of these engines work, you get a much clearer picture of how your financial position improves through both your own discipline and the broader economic environment. This two-pronged approach is fundamental to successfully building wealth with real estate over the long haul.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

How to Unlock and Use Your Home Equity

Think of your home equity as more than just a number on a statement—it's a powerful financial tool you've been building for years. Every mortgage payment you make and every bump in your home's market value adds to this hidden savings account. When you need a significant amount of cash, this is where you can find it.

Tapping into your equity is essentially borrowing against the value you own in your home. It can be a smart way to fund major life expenses like a much-needed renovation, consolidating high-interest credit card debt, or covering tuition costs.

It’s an increasingly common strategy for American homeowners. Recent data shows the average home equity per owner has climbed to an impressive $220,000. This growing wealth has enabled many to access funds, pushing total HELOC balances in the U.S. over $500 billion. For a deeper dive into market trends, you can explore this global private markets report.

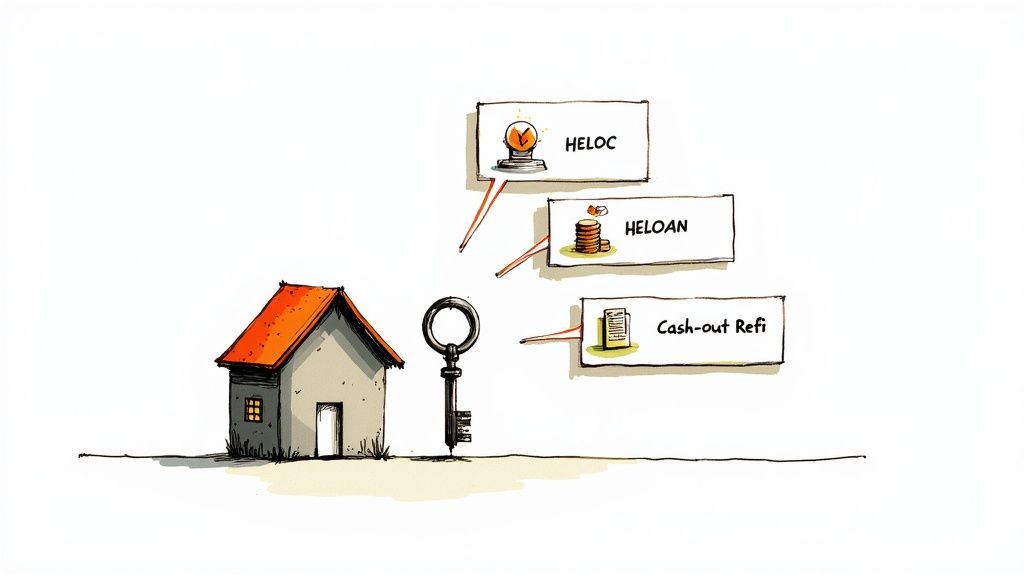

So, how do you turn that equity into cash you can actually use? There are three main paths you can take.

Home Equity Loan (HELOAN)

A home equity loan, often called a "second mortgage," gives you a lump sum of cash right upfront. You then pay it back with fixed monthly payments over a set term, usually somewhere between 5 to 15 years.

This is the perfect tool for big, one-time expenses where you know exactly how much you need. Think a complete kitchen gut-renovation or a down payment on a vacation property. The predictability of a fixed interest rate and a consistent monthly payment makes it incredibly easy to budget for.

Home Equity Line of Credit (HELOC)

A HELOC works more like a credit card than a traditional loan. Instead of a single lump sum, you’re approved for a revolving line of credit you can draw from whenever you need it, up to your approved limit. The best part? You only pay interest on the amount you actually borrow.

HELOCs are typically structured in two phases. First is the "draw period," often 10 years, where you can borrow money. That's followed by a "repayment period," often 20 years, where you focus on paying back the principal and interest. With their flexibility and variable interest rates, they’re ideal for ongoing projects with fuzzy costs or as a ready-to-go emergency fund.

Key Insight: Choosing between a HELOAN and a HELOC comes down to your needs. A HELOAN offers stability for a known expense, while a HELOC provides flexibility for variable or recurring costs.

Cash-Out Refinance

A cash-out refinance is a different animal altogether. Here, you replace your existing mortgage with a completely new, larger one. The difference between the two loan amounts is what you get back in cash.

Let’s say your home is worth $500,000 and you still owe $250,000 on your mortgage. You could get a new loan for $350,000. The first $250,000 pays off your old mortgage, and you pocket the remaining $100,000 in cash. This is a fantastic option if you can also lock in a lower interest rate on your new, primary mortgage. The funds can be a great way to learn how to finance an investment property.

Choosing the Right Option for You

Deciding which route to take depends entirely on your financial goals and what you feel comfortable with. Each option has its own pros and cons when it comes to getting the funds, paying interest, and managing repayment.

To make it easier, here’s a straightforward comparison to help you decide which product might be the best fit.

| Feature | Home Equity Loan (HELOAN) | HELOC | Cash-Out Refinance |

|---|---|---|---|

| How You Get Funds | Single lump-sum payment. | Revolving line of credit. | Single lump-sum payment. |

| Interest Rate | Typically fixed. | Usually variable. | Can be fixed or variable. |

| Loan Type | A separate, second mortgage. | A separate line of credit. | Replaces your primary mortgage. |

| Best For | Large, one-time expenses. | Ongoing or unexpected costs. | Large expenses + a lower mortgage rate. |

| Repayment | Fixed monthly payments. | Interest-only, then P&I. | A single, new mortgage payment. |

Understanding these differences is the key to turning your dormant home equity into an active asset. It empowers you to pick the tool that truly aligns with your financial strategy and helps you reach your goals faster.

Actionable Strategies to Build Equity Faster

https://www.youtube.com/embed/kgwQuhX4Rqw

Sure, watching your equity grow slowly over time is nice. But what if you could put your foot on the gas? You absolutely can. Taking a more hands-on approach can shave years off your loan and supercharge your wealth-building journey.

The good news is there are several practical ways to make this happen. These strategies put you firmly in the driver's seat, letting you control the pace of your financial growth.

Accelerate Your Mortgage Paydown

The most straightforward way to build equity is to simply pay your mortgage down faster. Every extra dollar you send to the bank that goes toward your principal is another dollar of equity in your pocket—instantly. As a bonus, you also cut down on the total interest you’ll pay over the long haul.

Here are a few popular ways to do it:

- Make Bi-Weekly Payments: This is a classic for a reason. Instead of making one monthly payment, you pay half of it every two weeks. Since there are 26 two-week periods in a year, you naturally end up making one full extra payment annually without really feeling the squeeze.

- Round Up Your Monthly Payment: This one is almost effortless. If your mortgage payment is, say, $1,825, just round it up to an even $1,900 or even $2,000. That little extra bit goes straight to the principal, and trust me, those small amounts add up to a huge difference over the years.

- Make Occasional Lump-Sum Payments: Get a bonus from work? A tax refund? Instead of blowing it all, consider throwing a chunk of that cash directly at your mortgage principal. A single lump-sum payment can knock out a surprising amount of your loan balance.

Real-World Impact: Consider a homeowner with a $400,000, 30-year mortgage at a 6% interest rate. By paying just an extra $200 per month, they could pay off their loan nearly 5 years sooner and save over $80,000 in interest.

Increase Your Property Value with Strategic Improvements

While we can't control the real estate market, we can directly influence our home's value through smart renovations. This is what we call "forced appreciation"—when your own investment of time and money creates a real, measurable bump in what your property is worth.

The trick is to be smart about it. Not all home projects are created equal. You want to focus on the ones that deliver the best bang for your buck, or return on investment (ROI).

| Home Improvement Project | Average Cost | Resale Value Added | Return on Investment (ROI) |

|---|---|---|---|

| Kitchen Remodel (Minor) | $28,000 | $22,500 | ~80% |

| Bathroom Remodel (Midrange) | $25,000 | $17,500 | ~70% |

| New Garage Door | $4,000 | $3,900 | ~98% |

| Exterior Paint | $3,500 | $2,500 | ~71% |

Look at that table. Sometimes the most effective upgrades aren't the most expensive ones. A new garage door can have a massive ROI. The key is to focus on curb appeal and updating high-traffic areas like kitchens and bathrooms to get the most value. For investors wanting to take this to the next level, understanding what is the BRRRR method and how does it work offers a powerful system for buying, renovating, and building equity on a timeline you control.

When you combine consistent, extra mortgage payments with strategic, value-adding improvements, you've created a powerful one-two punch. This approach doesn't just build your equity faster; it strengthens your entire financial foundation for whatever comes next.

Frequently Asked Questions About Home Equity

1. What’s the difference between equity and a down payment?

Your down payment is the initial equity you have in a home. It's the cash you contribute upfront. Equity is the total value of your ownership, which includes your down payment plus any principal you've paid on your mortgage and any appreciation in the home's value. The down payment is the starting point; equity is the total stake you've built over time.

2. Is it possible to have negative equity?

Yes. This is often called being "underwater" or "upside down" on your mortgage. It occurs when your home's market value drops below the amount you still owe on your loan. For example, if your home is worth $280,000 but your mortgage balance is $300,000, you have $20,000 in negative equity.

3. How much equity do I need to get a home equity loan or HELOC?

Most lenders require you to retain at least 15-20% equity in your home after borrowing. This means they will typically lend up to a combined loan-to-value (CLTV) ratio of 80-85%. To calculate your potential borrowing amount, multiply your home's value by 0.85 and then subtract your current mortgage balance.

4. What happens to my equity when I sell my home?

When you sell, the proceeds from the sale are first used to pay off your outstanding mortgage balance and any closing costs. The remaining amount is your equity, which you receive as cash. This is often used as a down payment for a new home.

5. Are there tax implications for using my home equity?

Yes. According to IRS rules, the interest on a home equity loan or HELOC is only tax-deductible if the funds are used to "buy, build, or substantially improve" the home that secures the loan. If you use the money for other purposes, like consolidating debt, the interest is generally not deductible.

6. Can my equity go down?

Absolutely. Since a significant portion of your equity is tied to your property's market value, it can decrease if local home prices fall. Even if you continue to pay down your mortgage, a market downturn can reduce your overall equity.

7. Does refinancing affect my equity?

A standard "rate-and-term" refinance does not change your equity amount. However, a "cash-out" refinance directly reduces your equity because you are increasing your loan amount to pull cash out of your home.

8. How quickly can I build a significant amount of equity?

The speed of equity growth depends on your down payment, loan term (a 15-year mortgage builds equity faster than a 30-year), any extra payments you make, and local market appreciation. In a strong market, it's possible to build substantial equity within 5-7 years.

9. What's a good amount of equity to have?

Reaching 20% equity is a major milestone, as it typically allows you to eliminate Private Mortgage Insurance (PMI) on conventional loans, reducing your monthly payment. Beyond that, having more equity gives you greater financial flexibility and security.

10. What is the fastest way to build equity?

The fastest way is a combination of three strategies: 1) making a larger down payment upfront, 2) making extra principal payments on your mortgage regularly, and 3) increasing your home's value through strategic renovations (forced appreciation).

Your Home Equity Is a Path to Financial Freedom

At the end of the day, getting a handle on your home equity is about more than just numbers on a page. It's about recognizing you have a powerful tool at your disposal for building real, long-term wealth. Think of it as a tangible scorecard for your financial journey—a versatile asset you can tap into to create new opportunities down the road.

We've covered a lot of ground here, from the nuts and bolts of what equity actually is to the simple formulas you can use to track it. You now see how the two key drivers—paying down your mortgage and market appreciation—work together to build your stake in your property. You're officially armed with the knowledge to take control.

So, what's next? The ball is in your court.

Take what you've learned, run the numbers on your own home, and figure out where you stand today. Then, pick one single action you can take this week to start building your equity a little faster. As that number grows, remember you're doing more than just paying off a house. You're paving a clear path toward true financial freedom.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.