So, you're thinking about dipping your toes into the world of crypto. Great. At its heart, investing in crypto is really just about buying digital assets like Bitcoin or Ethereum, hoping they'll be worth more in the future.

Think of it like the stock market, but for the digital age. Instead of buying a piece of a company like Apple or Google, you're buying digital tokens. These tokens can represent ownership, a utility, or a stake in a decentralized network. The most important thing to remember is you’re investing in brand-new technology, not just a new kind of money.

In This Guide

- 1 Demystifying Crypto Investing for Beginners

- 2 Exploring the Main Types of Cryptocurrencies

- 3 How to Buy Your First Cryptocurrency Safely

- 4 Choosing the Right Crypto Wallet to Secure Your Assets

- 5 Developing a Smart Crypto Investment Strategy

- 6 Managing Risk and Staying Safe in the Crypto Space

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How much money do I need to start investing in crypto?

- 7.2 2. Is crypto investing safe for beginners?

- 7.3 3. What's the difference between investing and trading crypto?

- 7.4 4. Do I have to pay taxes on my crypto investments?

- 7.5 5. Can you explain blockchain in simple terms?

- 7.6 6. Should I only buy Bitcoin, or are other coins worth considering?

- 7.7 7. What happens if I lose my private keys or recovery phrase?

- 7.8 8. What does "Not your keys, not your coins" actually mean?

- 7.9 9. How do I properly research a new cryptocurrency?

- 7.10 10. What is Dollar-Cost Averaging (DCA) and why is it recommended?

Demystifying Crypto Investing for Beginners

When you get down to it, crypto investing is simply putting money into digital currencies with the hope of making a profit. But it’s fundamentally different from buying stocks. A stock gives you a slice of a corporation. A cryptocurrency, on the other hand, gives you a stake in a decentralized digital network.

These networks are all built on a fascinating piece of tech called blockchain.

Picture a digital notebook that’s shared with thousands of people all over the world. Every time a transaction happens, it’s added as a new page (or "block") to this notebook, and it’s permanently linked to the page before it. This creates a "chain." Because everyone has a copy and has to agree on new entries, it's incredibly difficult to cheat the system, making it super secure and transparent. If you want to go deeper down that rabbit hole, our guide on what cryptocurrency is and how it works is a great next step.

What Are You Actually Investing In?

When you buy a cryptocurrency, you're really placing a bet on the future success of its technology and the network it powers.

Let's break it down with a real-life example. Buying Bitcoin is a bit like buying digital gold. Its value comes from its scarcity—there will only ever be 21 million coins—making it a popular "store of value." Buying Ethereum, however, is more like investing in a global, decentralized supercomputer. Developers from all over the world can use it to build new applications, like the decentralized exchange Uniswap, and your investment helps power that ecosystem.

As more people start using a network and its token, demand often goes up, which can push the price higher. That’s the basic game plan.

A key concept to grasp is that you are not just buying a ticker symbol. You are investing in a project, a community, and a technological solution to a specific problem—whether it's decentralized finance, digital identity, or secure data transfer.

Understanding the Key Differences

Crypto is a different beast compared to traditional investing, and it's good to know what you're getting into. For one, the market never sleeps. It's open 24/7, which means prices can swing wildly while you're asleep, at work, or on vacation. This constant activity is a major reason for its famous volatility.

Here's a quick comparison to put it in perspective:

| Feature | Crypto Investing | Traditional Stock Investing |

|---|---|---|

| Market Hours | 24/7, 365 days a year | Fixed hours, Mon-Fri |

| Regulation | Evolving and less established | Heavily regulated (e.g., by the SEC) |

| Volatility | Extremely high; double-digit price swings in a day are common | Lower, though still present |

| Ownership | Direct ownership of a digital asset via private keys | Ownership of a share in a company |

This means there's huge potential for growth, but it also comes with much higher risks, from sharp price drops to security vulnerabilities. As a beginner, your best defense is a good offense: learn the fundamentals, make a plan, and stick to it. The goal is to make smart choices based on solid research, not just chase the latest hype.

Exploring the Main Types of Cryptocurrencies

Stepping into the world of crypto can feel like visiting a new country where everyone speaks a different language. At first, it's a lot to take in. But once you understand the basic categories, you can navigate the space with much more confidence. The key is realizing that not all cryptocurrencies are created equal—they’re designed for very different purposes.

This graphic gives a great bird's-eye view of how the whole system works, from the foundational technology to the assets you can actually invest in.

As you can see, blockchain is the bedrock that makes everything else—the digital assets themselves—possible.

The Original Titans: Bitcoin and Ethereum

In this new digital world, two names stand above the rest: Bitcoin (BTC) and Ethereum (ETH). Think of them as the foundational pillars holding up the entire crypto economy. They’re the first ones everyone learns about for a good reason.

Bitcoin (BTC) was the trailblazer, the very first cryptocurrency. It's often called “digital gold” because its main job is to act as a store of value, independent of any government or bank. Its most powerful feature is its scarcity—there will only ever be 21 million coins. This built-in limit is what draws people looking for an asset that can't be devalued by printing more of it.

Ethereum (ETH) came next and changed the game entirely. It’s less like digital gold and more like a global, programmable computer that anyone can use. Ethereum introduced smart contracts, which are basically agreements that automatically execute themselves when certain conditions are met, all written in code. This single innovation opened the floodgates for things like decentralized applications (dApps), NFTs, and the entire world of decentralized finance (DeFi).

The Expansive World of Altcoins

So, what about everything else? Any cryptocurrency that isn't Bitcoin is generally called an altcoin, which is just short for "alternative coin." This is where things get wild. There are thousands of different altcoins, and the category is incredibly diverse.

Some altcoins are designed for lightning-fast transactions, others prioritize user privacy, and some focus on connecting blockchains to real-world information. Figuring out which might be the best cryptocurrency to invest in right now means digging into what problem each one is trying to solve.

Here are a couple of real-life examples to show you what I mean:

- Solana (SOL): This one is known for being incredibly fast and cheap to use. It was built to compete directly with Ethereum by offering a more scalable platform for developers to build their apps on. For example, the popular "move-to-earn" app STEPN was built on Solana to handle its millions of daily micro-transactions.

- Chainlink (LINK): Think of this project as a translator or a bridge. It allows smart contracts on the blockchain to securely use real-world data, like stock prices or weather reports. For instance, a decentralized insurance application might use Chainlink to verify a flight was delayed before automatically paying out a claim.

Understanding the purpose behind a cryptocurrency is crucial. An investment in Bitcoin is a bet on its future as a store of value, while an investment in Chainlink is a bet on the need for reliable, decentralized data.

Comparing Major Cryptocurrency Categories

To make this all a bit clearer, let's break down the main crypto categories in a simple table. This can help you quickly grasp the core function and relative risk of each type as you start your crypto journey.

| Category | Primary Use Case | Key Examples | Typical Risk Level for Beginners |

|---|---|---|---|

| Store of Value | Acts as a digital equivalent to gold; resistant to inflation due to a fixed supply. | Bitcoin (BTC) | Lower |

| Smart Contracts | Powers decentralized applications (dApps), NFTs, and the DeFi ecosystem. | Ethereum (ETH), Solana (SOL) | Moderate |

| Utility Tokens | Provides access to a specific product or service on a network. | Chainlink (LINK), Filecoin (FIL) | Higher |

This table shows why, for most people just starting, Bitcoin remains the cornerstone. Its purpose is straightforward and it has the longest track record.

Because of this, a common starter portfolio might allocate 50–70% to Bitcoin, 20–30% to Ethereum, and a small percentage to a few carefully chosen altcoins. This approach balances the relative stability of the market leaders with the high-growth (and high-risk) potential of newer projects.

How to Buy Your First Cryptocurrency Safely

Alright, you've got the basics down. Now for the fun part—actually buying your first bit of crypto. It might sound complicated, but it's gotten a lot easier over the years. The most important thing to focus on right now is doing it safely. And that all starts with picking the right cryptocurrency exchange.

Think of an exchange as a digital marketplace, kind of like an online stock brokerage, but for crypto. It’s the place you go to trade your regular money (like U.S. dollars) for digital currencies like Bitcoin or Ethereum. As a newcomer, you’ll want to prioritize an exchange that’s secure, easy to navigate, and upfront about its fees.

Choosing and Setting Up Your Exchange Account

A good, reputable exchange is your foundation for investing in crypto safely. For most beginners, platforms like Coinbase or Kraken are excellent starting points. They’re built for people who aren't crypto wizards and have strong security in place.

When you're comparing your options, keep an eye on these things:

- Security Features: Does it offer Two-Factor Authentication (2FA)? Has it ever been hacked? A solid security track record is non-negotiable.

- User Experience: The website or app should be clean and simple. You don't want to get lost in a sea of confusing charts on day one.

- Fees: Every exchange charges fees. Make sure you understand how much you'll pay to buy, sell, or move your crypto. They should be clearly listed.

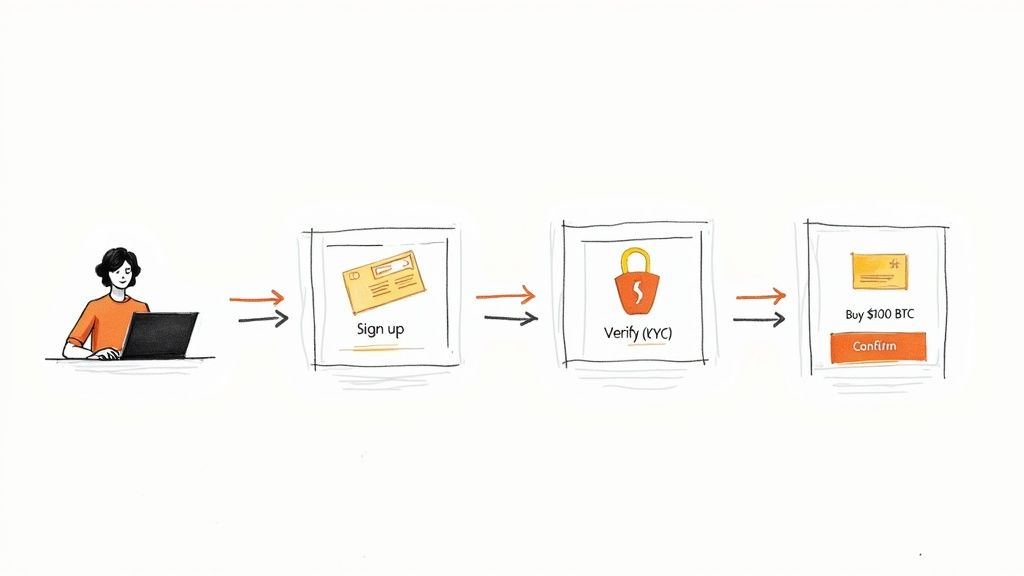

Once you’ve picked an exchange, signing up is pretty standard. You'll create an account and go through an identity check called Know Your Customer (KYC). This is a normal regulatory step that involves uploading a photo of your ID to prevent fraud. After that, you'll link a payment method, usually a bank account or debit card.

Crucial First Step: Don't do anything else until you've enabled Two-Factor Authentication (2FA). This is a vital security layer that requires you to approve logins from your phone, making it much harder for someone to access your account without your permission.

If you want a deeper dive into which platform might be right for you, check out our guide on the best cryptocurrency exchanges for beginners.

A Practical Example: Buying $100 of Bitcoin

Let's make this real. Say you've got your account set up on Coinbase and you're ready to jump in by buying $100 worth of Bitcoin (BTC). Here's what that actually looks like.

- Find the "Buy/Sell" Button: Log into your account. There will be a big, obvious button somewhere that says "Buy," "Trade," or something similar.

- Pick Your Crypto: A list of available coins will pop up. Find and select Bitcoin (BTC).

- Enter the Amount: You can type in that you want to spend $100. The exchange will automatically show you how much BTC that gets you at the current market price.

- Review Everything: Before you finalize it, a summary screen will appear. It'll show you the exact amount of Bitcoin you're getting, the price per BTC, and the fee for the transaction. Double-check it.

- Confirm the Purchase: If it all looks good, hit the "Confirm Buy" button. And that’s it!

Just like that, you're officially a Bitcoin owner. The BTC will show up in your account’s wallet on the exchange. Congratulations—you’ve just taken your first real step into the world of crypto.

Choosing the Right Crypto Wallet to Secure Your Assets

So, you’ve bought your first bit of crypto. Right now, it’s probably sitting in the account you set up on the exchange. While that’s simple enough, think of it like leaving cash at a friend’s house—you trust them, but you’re not really in control.

To take true ownership of your digital assets, you need your own crypto wallet. This is a fundamental step for any serious investor and puts you, and only you, in the driver's seat.

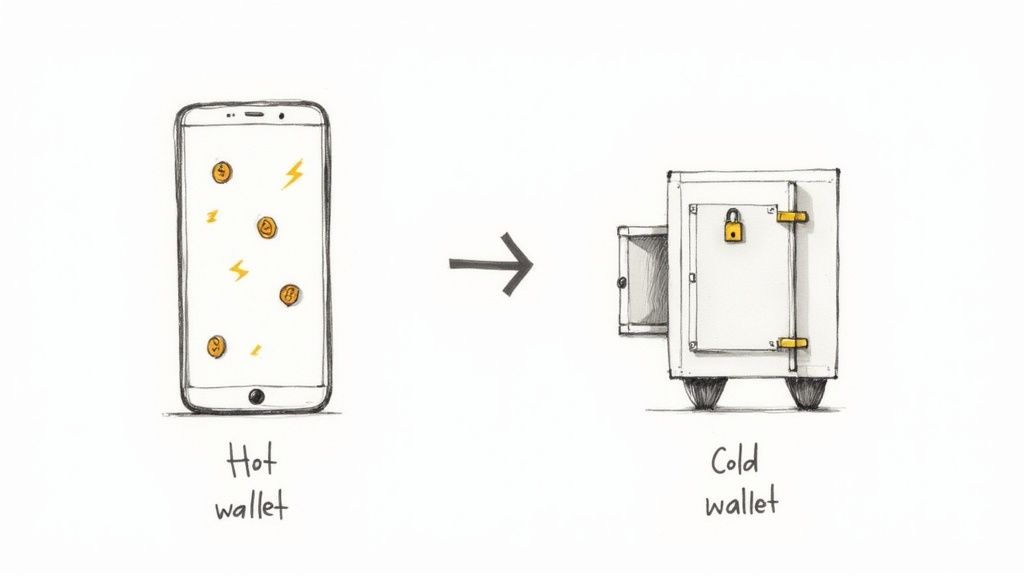

You’ll hear a common phrase in the crypto world: "Not your keys, not your coins." It’s a crucial concept. When your crypto lives on an exchange, you're relying on their security. When it’s in your own wallet, you hold the "private keys"—a secret, super-long password that proves the funds are yours. This distinction is everything when it comes to long-term security.

Hot Wallets: Your Digital Checking Account

A hot wallet is basically a software program or mobile app that stays connected to the internet. The best way to think of it is like your everyday checking account. It’s perfect for keeping a small amount of crypto handy for quick trades or interacting with decentralized apps (dApps).

The trade-off for all that convenience? Their constant internet connection makes them a bigger target for hackers and phishing scams.

A couple of popular hot wallets to know:

- MetaMask: This is the undisputed champion for anyone exploring the Ethereum ecosystem. It works as a browser extension and a mobile app, acting as your gateway to thousands of dApps.

- Exodus: Known for its slick, user-friendly design, this desktop and mobile wallet is a great starting point for beginners and supports a huge range of different cryptocurrencies.

Cold Wallets: Your Secure Bank Vault

On the other end of the spectrum, we have cold wallets. These are physical hardware devices—think of them as a high-tech USB drive built for one purpose: keeping your crypto keys offline. This is the digital equivalent of a fortified bank vault.

A hardware wallet is the gold standard for securing any significant crypto investment. It physically isolates your private keys from your internet-connected computer, making it nearly impossible for hackers to steal your funds remotely.

Because they aren't connected to the internet, cold wallets offer the highest level of security against online threats. This makes them the go-to choice for storing large amounts of crypto you plan to hold for the long haul. Brands like Ledger and Trezor are the most trusted names in the space.

If you want to dive deeper, our guides on various crypto wallets can walk you through more specific options.

Hot Wallets vs. Cold Wallets: A Security Comparison

So, which one is right for you? The answer isn't "one or the other." Most savvy investors actually use both. They keep a small, active balance in a hot wallet for convenience and lock away the bulk of their holdings in a cold wallet for maximum security.

This simple table breaks down the core differences at a glance.

| Feature | Hot Wallet (e.g., MetaMask) | Cold Wallet (e.g., Ledger) |

|---|---|---|

| Connectivity | Always online | Completely offline |

| Security Level | Good, but vulnerable to online threats | Highest level of security |

| Convenience | Excellent for frequent, fast transactions | Less convenient for daily use |

| Best For | Small amounts, active trading, dApp use | Large amounts, long-term holding (HODLing) |

| Cost | Usually free | Typically $60 – $150+ |

Ultimately, this balanced strategy gives you the best of both worlds. You get the flexibility to engage with the exciting parts of the crypto ecosystem without ever putting your main investment at risk.

Developing a Smart Crypto Investment Strategy

Jumping into crypto without a strategy is a bit like sailing without a map—you might get lucky, but you're far more likely to get lost. The wild price swings in this market can easily lead to emotional decisions, causing newcomers to buy high on a wave of hype and sell low in a fit of panic. A solid, disciplined strategy is what separates you from the emotional rollercoaster.

Forget about trying to perfectly time the market. Seriously, even the pros struggle with that. A structured approach is much more reliable, letting you build your position over time. Let's walk through two of the most proven and beginner-friendly methods that prioritize long-term growth over short-term gambles.

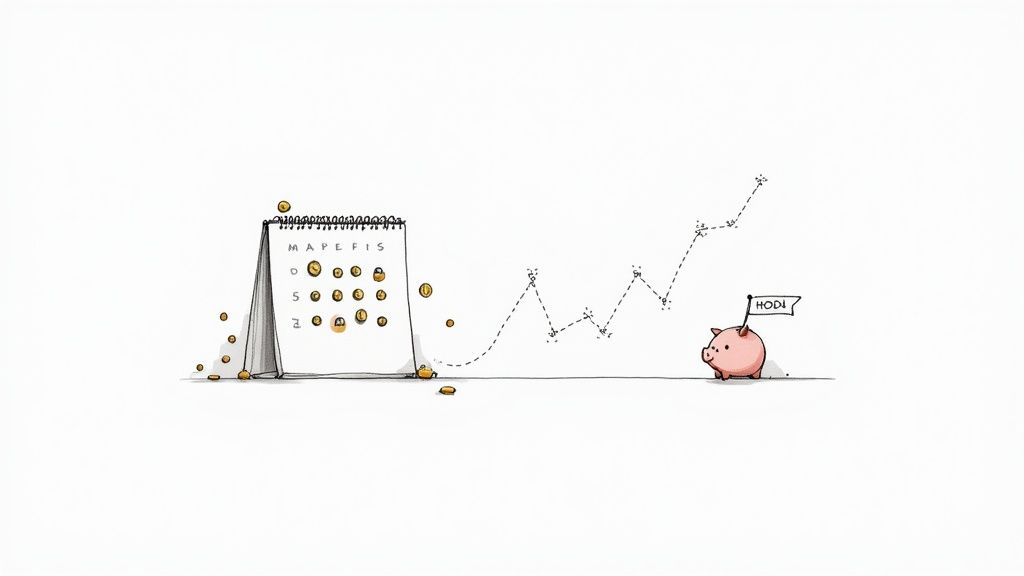

Embrace Consistency with Dollar-Cost Averaging

One of the most effective tools in any investor's kit, especially for beginners in crypto, is Dollar-Cost Averaging (DCA). It's simple: you invest a fixed amount of money at regular intervals—say, $50 every Friday—no matter what the price is doing. When prices are high, your $50 buys a little less. When they dip, it buys you more.

This simple but powerful technique automatically averages out your purchase price over time, smoothing out the bumps from market volatility. Someone investing $100 a month in Bitcoin, for example, can completely sidestep the stress of trying to find that "perfect" moment to buy. It’s a fantastic way to take emotion out of the equation and build your portfolio steadily. You can read more about how DCA fits into the bigger picture over at TokenMetrics.

By committing to a regular investment schedule, you shift your focus from short-term price charts to long-term accumulation. This discipline is often the dividing line between successful investors and those who get burned by market volatility.

Let's look at a quick example to see how this plays out.

DCA in Action: A Hypothetical Example

Imagine you decide to invest $100 into Ethereum (ETH) on the first of every month for four months. The price is all over the place during this time.

| Month | Your Investment | Price of 1 ETH | ETH Purchased |

|---|---|---|---|

| Month 1 | $100 | $2,000 | 0.050 ETH |

| Month 2 | $100 | $1,500 | 0.067 ETH |

| Month 3 | $100 | $1,800 | 0.056 ETH |

| Month 4 | $100 | $2,200 | 0.045 ETH |

| Total | $400 | – | 0.218 ETH |

After four months, you've put in a total of $400 and now hold 0.218 ETH. Your average cost for one ETH works out to about $1,835 ($400 divided by 0.218 ETH), even though the price swung from a low of $1,500 to a high of $2,200. You automatically bought more when it was cheaper and less when it was expensive—all without losing any sleep.

Adopt a Long-Term Mindset with HODLing

Another cornerstone strategy, especially popular for major assets like Bitcoin, is HODLing. The term actually came from a typo for "holding" on an old Bitcoin forum and has since evolved into a full-blown investment philosophy.

HODLing is just what it sounds like: you buy a cryptocurrency and hold on for the long haul—often for years—ignoring the short-term market drama. The core belief here is that despite temporary price drops, the fundamental value and growing adoption of a solid project will eventually lead to major gains.

This approach demands patience and real conviction in the assets you pick. It’s the perfect mindset if you view something like Bitcoin as "digital gold"—a long-term store of value. When you pair HODLing with a DCA strategy, you get an incredibly powerful combination for building wealth slowly and deliberately. For a deeper look, check out our complete guide on cryptocurrency investment strategies.

Managing Risk and Staying Safe in the Crypto Space

The crypto world is full of incredible opportunities, but it’s also a bit like the Wild West. You have to know how to protect yourself. High volatility, murky regulations, and a constant barrage of scams mean that being informed isn't just a good idea—it's your best defense. For anyone just starting out, a smart approach to crypto investing for beginners puts safety first, last, and always.

One of the first things you'll learn is how to handle the wild price swings. It’s absolutely critical to invest only what you can afford to lose. This isn't just a cliche; it’s the golden rule that will keep you from making panicked, emotional decisions when the market inevitably takes a nosedive.

Smart Allocation and Setting Goals

A huge part of managing risk is figuring out how much of your total investment portfolio should even be in crypto. Given how unpredictable it is, most financial experts will tell you to start small.

Because of the high risk, it's common for beginners to be advised to keep their crypto allocation fairly conservative. Some analyses suggest putting about 4% to 7.5% of your total investable assets into crypto. This strategy lets you get some exposure to potential growth without risking the farm.

For perspective, if you had a $1,000 portfolio, that would mean investing just $40 to $75 in cryptocurrencies. You can always learn more about building a disciplined allocation framework to find a balance that feels right for you.

Beyond just how much to invest, you need to know why you're investing. Are you playing the long game, aiming for growth over the next five years? Or are you trying to hit a shorter-term goal? Defining your objective gives you a North Star, helping you stick to a plan and ignore the daily noise.

Spotting and Avoiding Common Crypto Scams

Where there’s money, there are scammers. The crypto space is no different, but a little knowledge goes a long way in keeping your funds safe. Scammers love to play on people’s fear of missing out (FOMO) and dangle the promise of impossibly high returns.

Keep an eye out for these classic red flags:

- "Guaranteed" Profits: Real investing doesn't come with guarantees. If someone promises you surefire returns, run the other way.

- Impersonation Giveaways: You’ll see fake social media accounts pretending to be Elon Musk or a popular crypto project, promising to double any crypto you send them. It’s a trick. Never send your coins to a "giveaway."

- Phishing Attempts: Be on the lookout for fake emails or messages that look like they’re from your exchange or wallet provider. They'll ask for your login info or private keys. Always double-check the source and never click on a link you don't trust.

- Pump-and-Dump Schemes: This is where a group conspires to hype up a little-known coin, driving the price sky-high. They then sell all their holdings at the peak, and the price crashes, leaving everyone else holding a worthless token.

Your best defense is a healthy amount of skepticism and remembering the most important acronym in crypto: DYOR (Do Your Own Research). Always verify everything through official sources, and treat your private keys and recovery phrase like the keys to your financial kingdom—never share them with anyone.

By managing how much you invest, setting clear goals for yourself, and staying alert for scams, you can navigate the crypto world with confidence. This proactive mindset lets you focus on your strategy instead of reacting to fear or hype.

Frequently Asked Questions (FAQ)

It's totally normal to have a million questions spinning in your head when you're starting out. This last section is all about tackling the most common questions we hear from people just like you.

1. How much money do I need to start investing in crypto?

You can start with a small amount, often as little as $10 or $20. Most major exchanges allow you to buy fractional shares of cryptocurrencies like Bitcoin, so you don't need thousands of dollars to get started. The key principle is to only invest an amount you are comfortable losing.

2. Is crypto investing safe for beginners?

Crypto is inherently volatile and carries risks, including scams and market fluctuations. However, you can significantly increase your safety by using reputable exchanges, enabling Two-Factor Authentication (2FA), securing your assets in a personal wallet (especially a cold wallet for large amounts), and educating yourself on common scams. Starting small helps mitigate risk as you learn.

3. What's the difference between investing and trading crypto?

Investing is a long-term strategy where you buy and hold assets (HODL) for months or years, based on your belief in their fundamental value. Trading is a short-term strategy involving frequent buying and selling to profit from price swings. For beginners, an investing mindset is generally less stressful and often more successful.

4. Do I have to pay taxes on my crypto investments?

Yes. In most countries, including the U.S., cryptocurrencies are treated as property for tax purposes. This means you may owe capital gains tax when you sell, trade, or spend your crypto at a profit. Tax laws vary by location and can be complex, so consulting with a tax professional is highly recommended.

5. Can you explain blockchain in simple terms?

Imagine a digital public ledger, like a shared notebook, that is duplicated and spread across a network of computers. Each new transaction is a "block" that is permanently linked to the previous one, forming a "chain." Because this ledger is decentralized and cryptographically secured, it's incredibly difficult to alter, making it transparent and tamper-proof.

6. Should I only buy Bitcoin, or are other coins worth considering?

For beginners, it's often wise to start with the most established cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH). They have the longest track record and largest market capitalizations. Once you gain more experience, you might allocate a small portion of your portfolio to altcoins, but be aware they carry higher risk.

7. What happens if I lose my private keys or recovery phrase?

If you lose the private keys or recovery phrase to your personal crypto wallet, your funds are permanently lost. There is no central authority to help you recover them. This is why it is critical to write down your recovery phrase and store it in multiple secure, offline locations.

8. What does "Not your keys, not your coins" actually mean?

This is a core principle in crypto. It means that if you store your crypto on an exchange, you are trusting them with your assets. The exchange holds the private keys. When you move your crypto to a personal wallet where you control the private keys, you have true ownership and control. You become your own bank.

9. How do I properly research a new cryptocurrency?

Effective research goes beyond price charts. Start by reading the project's whitepaper to understand its purpose. Investigate the development team for experience and credibility. Assess the community engagement on platforms like Twitter and Discord. Finally, use data sites like CoinGecko or CoinMarketCap to analyze metrics like market cap and trading volume.

10. What is Dollar-Cost Averaging (DCA) and why is it recommended?

Dollar-Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset's price. For example, buying $50 of Bitcoin every Friday. This approach mitigates the risk of market timing, averages out your purchase price over time, and removes emotion from your investment decisions.

Ready to take your financial knowledge to the next level? At Top Wealth Guide, we provide exclusive insights and proven tactics to help you build and manage your wealth across stocks, real estate, and crypto. Subscribe today to enhance your investment portfolio and secure your financial future.