Investing can feel like a complex puzzle reserved for financial experts, but the truth is much simpler. Building wealth is accessible to anyone willing to take the first step, and starting early is one of the most powerful advantages you have. The goal isn't to get rich overnight; it's to make your money work for you consistently over time, leveraging the power of compounding to grow your initial capital into a significant nest egg. This process is more about discipline and strategy than timing the market or picking a single winning stock.

This guide is designed to demystify the process by breaking down the best investments for beginners. We will explore twelve straightforward, effective options that can serve as the foundation of a strong financial future. For each investment vehicle, we’ll provide a clear overview, detail the specific pros and cons, offer actionable steps on how to get started today, and share a real-life example to illustrate how it works in practice. From the stability of high-yield savings accounts and government bonds to the growth potential of index funds and Roth IRAs, you'll gain the practical knowledge needed to choose the right path for your financial goals. Consider this your roadmap to making informed, confident investment decisions.

In This Guide

- 1 1. High-Yield Savings Accounts

- 2 2. Index Funds

- 3 3. Target-Date Retirement Funds

- 4 4. Roth IRA

- 5 5. Employer-Sponsored 401(k) Plans

- 6 6. Dividend Stocks and Dividend ETFs

- 7 7. Real Estate Investment Trusts (REITs)

- 8 8. Robo-Advisors

- 9 9. Treasury Securities (I-Bonds and T-Bills)

- 10 10. Fractional Shares and Micro-Investing Apps

- 11 11. Peer-to-Peer (P2P) Lending

- 12 Top 11 Beginner Investment Options Comparison

- 13 Your Journey to Wealth Starts Now

- 14 Frequently Asked Questions

1. High-Yield Savings Accounts

When you're starting your investment journey, the first step isn't always about chasing high returns; it's about building a solid, safe foundation. A high-yield savings account (HYSA) is arguably the best investment for beginners because it combines safety, accessibility, and a better-than-average return with virtually zero risk. Unlike a traditional savings account that might offer a meager 0.01% APY, an HYSA provides a significantly higher interest rate, often between 4-5% APY or more.

These accounts are offered by banks, especially online banks, which have lower overhead costs and can pass those savings on to you. Your money is FDIC-insured up to $250,000 per depositor, per institution, meaning your principal is completely protected. This makes HYSAs the perfect vehicle for stashing your emergency fund or saving for a short-term goal like a down payment or vacation.

Real-Life Example

Samantha, a 28-year-old graphic designer, started funding her HYSA with $200 per month. After two years, she built a $5,000 emergency fund earning 4.5% APY—enough to cover three months of rent without touching her investments.

Why It’s a Great Starting Point

An HYSA is the ideal place to park the 3-6 months of living expenses that financial experts, like Dave Ramsey, recommend for an emergency fund. Before you invest in stocks or other assets with market risk, you need a liquid cash reserve. This prevents you from having to sell investments at a loss during an unexpected financial crisis.

How to Get Started

- Compare Top Accounts: Look at online banks like Ally Bank, Marcus by Goldman Sachs, or Capital One 360. They consistently offer competitive rates and often have no monthly maintenance fees or minimum balance requirements.

- Open an Account: The application process is typically done online in minutes. You'll need your personal information and a way to fund the account, like linking an existing checking account.

- Automate Your Savings: Set up recurring automatic transfers from your primary checking account. Even a small, consistent contribution can grow substantially over time thanks to compound interest.

2. Index Funds

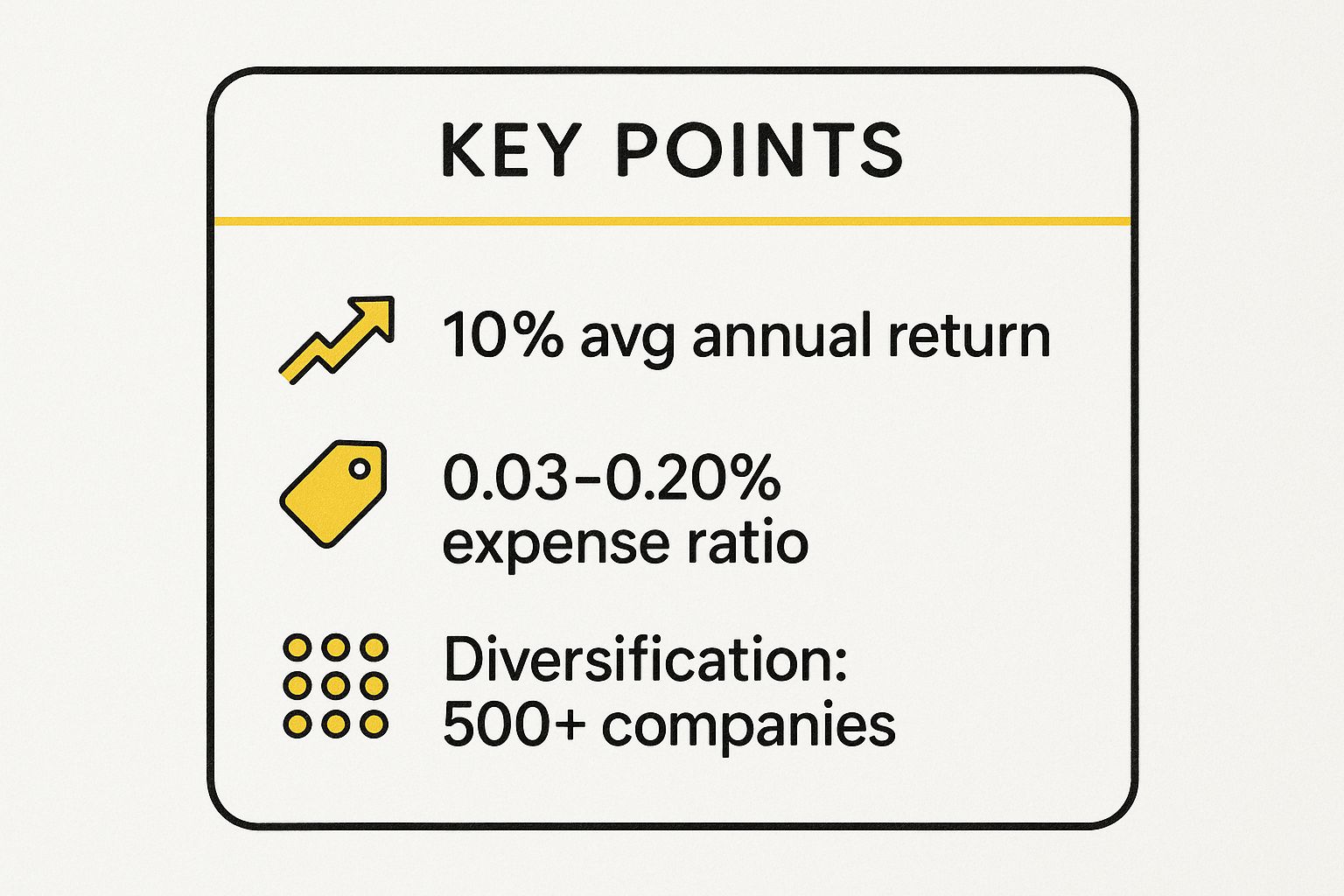

Once you have a solid emergency fund, the next step is putting your money to work for long-term growth. Index funds are one of the best investments for beginners because they offer a simple, powerful, and low-cost way to own a piece of the entire stock market. Championed by investing legends like Warren Buffett and Vanguard founder John Bogle, these funds don't try to beat the market; they aim to be the market by tracking a major index like the S&P 500.

An index fund is a type of mutual fund or ETF that holds all the stocks in a specific index, providing instant diversification across hundreds or even thousands of companies. Instead of picking individual stocks, you own a small slice of every company in the index. This passive approach has historically delivered consistent returns, averaging around 10% annually over the long term, and minimizes the high fees that actively managed funds often charge.

Real-Life Example

Carlos began investing $300 monthly into the Vanguard S&P 500 Index Fund in 2015. By 2024, he saw his contributions grow to over $40,000, demonstrating the power of dollar-cost averaging and long-term compounding.

Why It’s a Great Starting Point

Index funds remove the guesswork and high risk associated with trying to pick winning stocks. By automatically diversifying your investment across an entire market segment, you reduce the impact of any single company performing poorly. Their simplicity and proven track record make them an ideal core holding for any long-term portfolio, especially for those who want a "set it and forget it" strategy. You can learn more about how to incorporate them as you start your journey to start investing money on topwealthguide.com.

How to Get Started

- Choose a Brokerage: Open an account with a low-cost brokerage firm like Vanguard, Fidelity, or Charles Schwab. These firms are known for their wide selection of excellent, low-fee index funds.

- Select Your Fund: Start with a broad market index fund. Popular choices include the Vanguard S&P 500 Index Fund (VFIAX), Fidelity ZERO Total Market Index Fund (FZROX), or an ETF like the iShares Core S&P 500 ETF (IVV).

- Invest Consistently: Set up automatic investments to buy shares regularly, a strategy known as dollar-cost averaging. This ensures you are consistently investing regardless of market fluctuations and helps build wealth steadily over time.

3. Target-Date Retirement Funds

For beginners who want a "set it and forget it" approach to long-term investing, target-date retirement funds are a game-changer. These are all-in-one mutual funds that contain a diversified mix of stocks and bonds. Their key feature is a built-in "glide path" that automatically adjusts this mix over time, becoming more conservative as you approach your planned retirement date. This automated rebalancing makes them one of the best investments for beginners focused on retirement.

Initially, the fund holds more stocks for aggressive growth. As the target year (e.g., 2055) nears, it gradually shifts more assets into safer investments like bonds to protect your accumulated wealth. This strategy removes the guesswork and emotion from managing your own portfolio allocation. They are incredibly common and often the default option in employer-sponsored retirement plans like 401(k)s.

Real-Life Example

When David started his first job at age 25, he selected a “Target 2055” fund in his 401(k). Nine years later, he’s seen an 8% average return without ever logging into his account to pick individual investments.

Why It’s a Great Starting Point

Target-date funds offer instant diversification and professional management in a single, low-cost investment. You don't need to spend time researching individual stocks or rebalancing your portfolio; the fund manager handles it all. This simplicity allows you to start investing for retirement immediately, even with minimal knowledge, and is a key component when you learn more about managing wealth for long-term growth.

How to Get Started

- Choose Your Target Date: Select a fund with a year that most closely matches when you expect to retire. For example, if you plan to retire around 2055, you would choose a "Target 2055" fund.

- Compare Fund Providers: Look at options from low-cost providers like Vanguard (VFIFX), Fidelity (FDEWX), or Schwab (SWYMX). Pay close attention to the expense ratio, as lower fees mean more of your money stays invested.

- Invest Consistently: These funds are ideal for retirement accounts like a 401(k) or an IRA. Set up automatic contributions from each paycheck to take full advantage of dollar-cost averaging and compound growth over time.

4. Roth IRA

A Roth IRA is a tax-advantaged individual retirement account and one of the most powerful tools among the best investments for beginners. Unlike a traditional 401(k) or IRA, your contributions are made with after-tax money. This means that when you retire, all qualified withdrawals, including decades of investment growth, are completely tax-free.

This tax-free growth is a massive advantage, especially for young investors in a lower tax bracket today than they expect to be in the future. Personal finance experts like Suze Orman and The Money Guy Show frequently recommend prioritizing a Roth IRA for its long-term tax benefits. By starting early, you give your money the maximum time to compound in a tax-sheltered environment.

Real-Life Example

Emily funded her Roth IRA with $5,000 annually from age 22. By age 40, despite market dips, she expects to withdraw tax-free income of nearly $200,000 over the next decade.

Why It’s a Great Starting Point

A Roth IRA provides a flexible and powerful way to save for retirement. You can invest your contributions in a wide range of assets, from low-cost index funds to individual stocks. Because your future withdrawals are tax-free, you gain certainty about your retirement income without worrying about future tax rate hikes.

How to Get Started

- Choose a Brokerage: Select a reputable, low-cost brokerage. Top choices include Vanguard, Fidelity, or Charles Schwab, which all offer excellent Roth IRA options with a wide selection of no-fee index funds and ETFs.

- Open Your Roth IRA: The online application process is straightforward and takes only a few minutes. You'll need to provide your Social Security number and other personal details.

- Fund the Account and Invest: Link your bank account to contribute money. Remember, just funding the account isn't enough; you must invest the cash into assets like an S&P 500 index fund to make it grow. Aim to contribute consistently and work toward the annual maximum.

5. Employer-Sponsored 401(k) Plans

For many, an employer-sponsored 401(k) is the single most powerful tool for building wealth and one of the best investments for beginners. This retirement plan allows you to invest a portion of your pre-tax paycheck automatically, reducing your current taxable income. The true magic, however, lies in the employer match. Many companies offer to match your contributions up to a certain percentage of your salary, which is essentially a 100% return on your investment instantly.

This "free money" is an unmatched benefit that you should prioritize above nearly all other investments. For example, if your employer matches 100% of your contributions up to 5% of your salary, you double your money on that portion before it even has a chance to grow in the market. Neglecting this is like turning down a pay raise. Over decades, these matched contributions, combined with compound growth, can dramatically accelerate your retirement savings.

Real-Life Example

Mark started contributing 6% to his 401(k) right out of college, capturing the full employer match. Over 15 years, his account balance tripled, largely thanks to those matched contributions.

Why It’s a Great Starting Point

A 401(k) automates the entire investing process, making it effortless to build good habits from your very first paycheck. Financial experts like Dave Ramsey advocate for saving 15% for retirement, and a 401(k) makes this goal achievable. It forces discipline and leverages the power of long-term, tax-advantaged growth. Capturing the full employer match is the most crucial first step in any beginner’s investment strategy.

How to Get Started

- Enroll Immediately: During your new-hire orientation, sign up for your company's 401(k) plan. Don't put it off.

- Contribute for the Match: At a bare minimum, contribute enough from each paycheck to receive the full employer match. For instance, if your company matches up to 6% of your salary, you should contribute at least 6%.

- Choose Your Investments: Most plans offer a simple, diversified option like a target-date fund, which automatically adjusts its risk level as you near retirement. Low-cost index funds, often from providers like Vanguard or Fidelity, are also excellent choices.

6. Dividend Stocks and Dividend ETFs

For beginners looking to build wealth over time, dividend stocks offer a powerful two-in-one benefit: regular income and the potential for long-term growth. These are shares in established, profitable companies like Procter & Gamble or Coca-Cola that distribute a portion of their earnings back to shareholders as cash payments, called dividends. This creates a steady, passive income stream while your initial investment can also appreciate in value.

For those who want instant diversification, a dividend ETF (Exchange-Traded Fund) bundles dozens of these high-quality stocks into a single investment. This approach significantly reduces the risk associated with picking individual companies. Instead of betting on one horse, you are investing in the entire stable, which is a much safer strategy for newcomers. This makes dividend investing one of the best investments for beginners focused on compounding returns.

Real-Life Example

Laura invested $2,000 in the Schwab U.S. Dividend Equity ETF (SCHD) and activated DRIP. After three years, her quarterly payouts have doubled, allowing her to reinvest and accelerate her portfolio growth.

Why It’s a Great Starting Point

Dividend investing, popularized by luminaries like Benjamin Graham, encourages a long-term, patient mindset. The regular income can be reinvested to buy more shares, creating a snowball effect known as compounding. This strategy allows your wealth to grow exponentially over time with minimal effort. It is an excellent way to see tangible returns from your investments without having to sell your shares.

How to Get Started

- Choose Your Approach: Decide if you want to buy individual stocks or an ETF. For most beginners, ETFs like the Vanguard Dividend Appreciation ETF (VIG) or the Schwab U.S. Dividend Equity ETF (SCHD) are ideal for their built-in diversification.

- Open a Brokerage Account: You will need an account with a broker like Fidelity, Charles Schwab, or Vanguard to buy stocks and ETFs. The setup process is quick and can be done online.

- Set Up Dividend Reinvestment: Most brokerage platforms offer a Dividend Reinvestment Plan (DRIP). Activating this automatically uses your dividend payments to purchase more shares of the same stock or ETF, putting your compounding on autopilot. Explore our guide to learn more about the top dividend stocks for steady income.

7. Real Estate Investment Trusts (REITs)

Dreaming of earning income from real estate without the hassle of being a landlord? Real Estate Investment Trusts (REITs) make that possible. REITs are companies that own, operate, or finance a portfolio of income-generating properties like apartment buildings, warehouses, shopping centers, or cell towers. They are a staple of the best investments for beginners because they offer exposure to the real estate market with the simplicity of buying a stock.

By law, REITs must pay out at least 90% of their taxable income to shareholders as dividends, which can result in attractive, consistent income streams. This unique structure allows you to earn passive income from a diversified pool of properties, blending the potential for property appreciation with regular dividend payments, often much higher than the broader stock market.

Real-Life Example

After reading about REITs, Kevin purchased $1,000 of Realty Income (O). Six months later, he’s already received $40 in dividends, which he reinvested into VNQ for broader exposure.

Why It’s a Great Starting Point

REITs provide instant diversification across dozens or even hundreds of properties with a single purchase, a feat impossible for most beginners to achieve with physical real estate. They are highly liquid, meaning you can buy and sell shares easily on a stock exchange, unlike physical property which can take months to sell. This combination of income, diversification, and liquidity makes them a powerful tool for building a well-rounded portfolio. To dig deeper into the pros and cons, you can learn more about real estate as an investment.

How to Get Started

- Choose Your Approach: You can buy shares in individual REITs like Realty Income (O) or Prologis (PLD), or you can opt for a diversified REIT ETF like the Vanguard Real Estate ETF (VNQ), which holds a broad basket of REITs.

- Open a Brokerage Account: You'll need an account with a brokerage like Fidelity, Charles Schwab, or Vanguard to purchase REITs or REIT ETFs. The process is quick and can be done online.

- Consider Tax Implications: REIT dividends are typically taxed as ordinary income. To maximize your returns, consider holding REITs in a tax-advantaged account like a Roth IRA or 401(k).

8. Robo-Advisors

If you like the idea of a diversified portfolio but feel overwhelmed by the thought of managing it yourself, a robo-advisor is one of the best investments for beginners. These automated platforms use sophisticated algorithms to build and manage a portfolio tailored to your financial goals, timeline, and risk tolerance. For a small fee, they handle everything from investment selection to rebalancing, making professional-grade money management accessible to everyone.

Robo-advisors typically invest your money in a diversified mix of low-cost ETFs. This approach offers a hands-off, set-it-and-forget-it solution that prevents you from making emotional decisions during market fluctuations. It’s an excellent way to start investing in the market without needing deep financial knowledge, all while keeping costs significantly lower than a traditional human advisor.

Real-Life Example

Anna signed up for Betterment with $500. After a year, the platform rebalanced and harvested tax losses automatically, boosting her net returns by 0.5%.

Why It’s a Great Starting Point

A robo-advisor removes the guesswork and emotion from investing. It automatically diversifies your investments across various asset classes, a strategy proven to reduce risk. Many platforms also offer features like tax-loss harvesting, which can help lower your tax bill. This makes them a powerful tool for building long-term wealth in both retirement and taxable investment accounts.

How to Get Started

- Choose a Platform: Compare leading robo-advisors like Betterment, Wealthfront, or Schwab Intelligent Portfolios. Look at their management fees, account minimums, and features. Many have low or no minimums, making them easy to start with.

- Complete the Questionnaire: You'll answer a series of questions about your income, investment goals, and comfort with risk. The platform uses this data to recommend a suitable portfolio allocation.

- Fund Your Account: Link your bank account and make your initial deposit. You can then set up recurring automatic contributions to consistently grow your portfolio without having to think about it.

9. Treasury Securities (I-Bonds and T-Bills)

For beginners seeking the ultimate in investment safety, nothing beats securities backed by the full faith and credit of the U.S. government. Treasury securities are debt instruments issued by the U.S. Department of the Treasury to fund government operations. They are considered one of the safest investments in the world because the risk of default is virtually zero. This makes them a cornerstone for conservative investors and an excellent component of a diversified portfolio.

Two popular types for beginners are I-Bonds and Treasury Bills (T-Bills). I-Bonds are designed to protect your money from inflation, featuring an interest rate that combines a fixed rate with a variable rate that adjusts with the Consumer Price Index. T-Bills are short-term securities (from four weeks to one year) sold at a discount to their face value, with the difference being your interest earned at maturity. Both offer predictable returns and are a step up from a traditional savings account.

Real-Life Example

To hedge against inflation, Lisa bought $1,500 in I-Bonds in 2022 at a 7% composite rate. Her balance has grown to $1,650 within a year, protecting her purchasing power.

Why It’s a Great Starting Point

Treasury securities are one of the best investments for beginners because they remove market volatility from the equation. While stock market investments can fluctuate wildly, the return on a Treasury security is guaranteed if held to maturity. This stability makes them ideal for short-to-medium-term goals where capital preservation is more important than aggressive growth. During periods of high inflation, as seen in 2022-2023, I-Bonds became particularly popular, offering rates above 7%.

How to Get Started

- Open a TreasuryDirect Account: The primary way to buy new Treasury securities is directly from the source. Visit TreasuryDirect.gov to set up a free account. The process requires your personal and bank account information for transactions.

- Choose Your Security: Decide between I-Bonds (for inflation protection) and T-Bills (for short-term, fixed returns). T-Bills are sold via auction, where you can place a non-competitive bid to accept the auction's resulting interest rate.

- Fund and Purchase: Link your bank account and follow the on-screen instructions to purchase. Remember that I-Bonds have an annual purchase limit and must be held for at least one year. T-Bills can be set to automatically reinvest upon maturity.

Historically, buying a single share of a major company like Amazon or Google could cost thousands of dollars, creating a significant barrier for new investors. Fractional shares eliminate this obstacle by allowing you to invest by dollar amount rather than by share. This means you can own a small piece of an expensive stock or ETF for as little as $1, making it one of the best investments for beginners with limited capital.

This approach is popularized by micro-investing apps, which often automate the process through features like spare change round-ups or scheduled micro-deposits. By rounding up your daily purchases to the nearest dollar and investing the difference, these platforms help you build a diversified portfolio effortlessly. This method removes the psychological hurdle of investing large sums and helps build consistent saving habits.

Real-Life Example

Using Acorns, Michael rounds up each coffee purchase. Over a year, his spare-change investments totaled $250, which he allocated across a five-ETF portfolio, yielding 6% growth.

Why It’s a Great Starting Point

Fractional shares allow you to gain exposure to high-growth companies without needing a large initial investment. This is perfect for learning the ropes of stock market investing with real, albeit small, amounts of money. Micro-investing automates the process, turning small, everyday actions into long-term wealth-building habits, which is crucial for beginner success.

How to Get Started

- Choose a Platform: Apps like Acorns excel at "round-up" investing, while brokers like Robinhood, Fidelity, and M1 Finance offer commission-free fractional share trading. You can learn more about the best investment apps for beginners on topwealthguide.com to compare features.

- Link Your Bank Account: Connect your primary checking or debit card to fund your investments. If using a round-up feature, the app will track your purchases automatically.

- Automate and Diversify: Set up recurring weekly or monthly investments, even if it's just $5 or $10. Use fractional shares to build a diversified portfolio across several companies and ETFs rather than putting all your money into one stock.

11. Peer-to-Peer (P2P) Lending

Peer-to-peer (P2P) lending offers a modern twist on traditional lending, allowing you to act as the bank. Through online platforms, you can lend money directly to individuals or small businesses, earning interest on the loan. It's one of the best investments for beginners looking to diversify beyond stocks and bonds, as it provides a fixed-income stream and isn't directly tied to the stock market's daily fluctuations.

These platforms vet borrowers, assign risk ratings, and handle the collections process, making it accessible for investors. You can typically start with a small amount of capital, spreading it across dozens or even hundreds of different loans to minimize the impact of any single borrower defaulting. This diversification is key to managing risk in the P2P space.

Real-Life Example

Jessica invested $1,000 on LendingClub across 20 loans with varying credit grades. Her blended return averaged 7% annually, outperforming many bonds.

Why It’s a Great Starting Point

P2P lending provides predictable returns through monthly interest payments, creating a consistent cash flow. Unlike stock dividends, these payments are structured and expected. This investment vehicle gives you a high degree of control, allowing you to choose the risk level of the loans you want to fund, from conservative to more aggressive.

How to Get Started

- Select a Platform: Research reputable P2P lending sites like Prosper or LendingClub. Compare their historical returns, fees, borrower standards, and minimum investment requirements.

- Create an Account: Sign up and fund your account. The process is straightforward, requiring basic personal and financial information.

- Build Your Portfolio: Use the platform's tools to filter loans based on criteria like credit score, loan purpose, and risk rating. Start small and reinvest your earnings to benefit from compounding returns.

Top 11 Beginner Investment Options Comparison

| Investment Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| High-Yield Savings Accounts | Low 🔄 | Low ⚡ (no/minimum deposits) | Moderate, stable returns (3-5% APY) 📊 | Emergency funds, short-term savings | FDIC insured, liquid, no market risk ⭐ |

| Index Funds | Low 🔄 | Medium ⚡ ($1,000+ minimum) | Long-term growth (~10% annual) 📊 | Wealth building, retirement investing | Low fees, diversification, proven returns ⭐ |

| Target-Date Retirement Funds | Low to Medium 🔄 | Medium ⚡ ($1,000+ minimum) | Adjusted risk, long-term growth 📊 | Retirement planning, hands-off investing | Auto-rebalancing, professional management ⭐ |

| Roth IRA | Medium 🔄 | Low to Medium ⚡ ($0-$7,000 annual limit) | Tax-free growth, retirement income 📊 | Long-term retirement savings | Tax-free withdrawals, flexible contributions ⭐ |

| Employer-Sponsored 401(k) Plans | Medium 🔄 | Medium to High ⚡ (paycheck percentage) | Tax-deferred growth, employer match 📊 | Workplace retirement investing | Employer match (free money), high limits ⭐ |

| Dividend Stocks & ETFs | Medium 🔄 | Medium ⚡ (cost of at least 1 share) | Income + capital appreciation 📊 | Passive income, portfolio diversification | Regular dividends, potential growth ⭐ |

| Real Estate Investment Trusts | Medium 🔄 | Medium ⚡ (cost of 1 share/unit) | Dividend income (3-5%) + appreciation 📊 | Real estate exposure without property hassles | High yields, liquidity, inflation hedge ⭐ |

| Robo-Advisors | Low 🔄 | Low to Medium ⚡ ($0-$5,000 minimum) | Customized portfolio growth 📊 | Beginners seeking automated investing | Automated management, tax-loss harvesting ⭐ |

| Treasury Securities (I-Bonds/T-Bills) | Low 🔄 | Low ⚡ ($25-$100 minimum) | Safe, low-volatility returns 📊 | Short-to-medium term, inflation protection | Government-backed, inflation-adjusted returns ⭐ |

| Fractional Shares & Micro-Investing Apps | Very Low 🔄 | Very Low ⚡ ($1-$5 minimum) | Variable, depends on assets chosen 📊 | Absolute beginners, small investors | Low entry barrier, commission-free trading ⭐ |

| Peer-to-Peer (P2P) Lending | Medium 🔄 | Low to Medium ⚡ ($25+ minimum) | Fixed income (5-12% annual) 📊 | Portfolio diversification, alternative income | Loan diversification, higher yields ⭐ |

Your Journey to Wealth Starts Now

Embarking on your investment journey can feel like standing at the base of a massive mountain. The peak, representing financial freedom, seems distant and intimidating. However, this guide has equipped you with a detailed map and the essential gear needed for the climb. We've explored a diverse landscape of the best investments for beginners, from the foundational safety of High-Yield Savings Accounts and Treasury Securities to the automated simplicity of Robo-Advisors and Target-Date Funds.

Each option we covered, whether it was harnessing the broad market power of Index Funds, building a passive income stream with Dividend ETFs and REITs, or taking advantage of powerful retirement accounts like a 401(k) or Roth IRA, represents a distinct path up that mountain. The key takeaway is that you don't need a Wall Street-level salary or an encyclopedic knowledge of market dynamics to get started. Modern tools like fractional shares and micro-investing apps have democratized access to the market, allowing you to begin building wealth with just a few dollars.

The Power of Starting Small and Staying Consistent

The single most important principle for a new investor is not picking the "perfect" stock or timing the market flawlessly. Instead, it is the simple, yet profound, act of starting. The magic of compound interest, where your earnings begin to generate their own earnings, is a force that rewards time in the market above all else. A small, consistent investment made today has far more growth potential than a larger investment made a decade from now.

Key Insight: Your greatest asset as a beginner investor is time. Consistent contributions, even small ones, combined with the power of compounding over many years, are the bedrock of sustainable wealth creation. Don't let the pursuit of perfection lead to paralysis; the best time to invest was yesterday, but the second-best time is right now.

Your Actionable Next Steps

Feeling empowered is one thing; taking action is what truly matters. Here is a simple, three-step plan to move from learning to doing:

- Define Your "Why": Before you invest a single dollar, clarify your goals. Are you saving for a down payment in five years? Planning for retirement in thirty? Your timeline and risk tolerance will immediately help you narrow down the options we discussed.

- Choose Your First Vehicle: Don't try to master everything at once. Select one or two investment types from this list that align with your goals and comfort level. A common and effective starting point for many is opening a Roth IRA and funding it with a low-cost S&P 500 index fund.

- Automate Your Contribution: The final step is to make your progress automatic. Set up a recurring transfer from your bank account to your investment account, even if it's just $50 a month. This "pay yourself first" strategy removes emotion from the equation and ensures you are consistently building your portfolio without having to think about it.

By following this path, you are not just investing money; you are investing in your future self. You are building a foundation of financial security that will provide you with options, freedom, and peace of mind for decades to come. The journey has just begun, and the most rewarding steps are right ahead of you.

Ready to take your financial education to the next level? The Top Wealth Guide offers advanced courses, personalized tools, and expert insights designed to accelerate your journey from beginner to confident investor. Visit Top Wealth Guide to discover the resources you need to build a smarter, more secure financial future.

Frequently Asked Questions

1. What is the best investment for beginners?

Most beginners start with a high-yield savings account for an emergency fund and a broad-market index fund for long-term growth. Your choice depends on your risk tolerance, timeline, and goals.

2. How much money do I need to start investing?

You can begin with as little as $1 using fractional share platforms or micro-investing apps. Traditional brokerage accounts may have minimums ranging from $0 to $1,000.

3. Are index funds safe?

Index funds carry market risk but are diversified across hundreds of companies. Over the long term, they have historically delivered consistent returns of about 10% annually.

4. What is dollar-cost averaging?

Dollar-cost averaging means investing a fixed amount regularly (e.g., monthly) regardless of market price. This strategy reduces timing risk and smooths out purchase prices over time.

5. Can I lose money investing in stocks?

Yes, stocks can decline in value, especially in the short term. Diversification through index funds and long-term investing can help mitigate that risk.

6. How do I choose the right brokerage?

Consider fees (commissions, expense ratios), account minimums, available investments (ETFs, mutual funds), research tools, and user experience on desktop or mobile.

7. What’s the difference between a Roth IRA and a Traditional IRA?

Contributions to a Roth IRA are made with after-tax dollars and grow tax-free, while Traditional IRA contributions may be tax-deductible but are taxed upon withdrawal.

8. How do I avoid high fees?

Opt for low-cost index funds, ETFs, or robo-advisors. Watch for management expense ratios (MERs) under 0.20% and avoid companies with hefty transaction or advisory fees.

9. Should I pay off debt before investing?

Priority often goes to paying high-interest debt (credit cards, personal loans) before investing. For lower-interest debts (mortgage, student loan), balancing debt paydown with investing can make sense.

10. How can I track and rebalance my portfolio?

Most brokerages offer dashboard tools to monitor performance. Aim to rebalance annually or when allocations drift by more than 5% from your target mix. Automated rebalancing is available with robo-advisors.