The BRRRR strategy—ever heard of it? It’s shaking things up, flipping the usual script for real estate investors looking to stack up wealth. Think of it like a game of Monopoly… on steroids. You buy a property, rehab it, rent it out, refinance, and then—here’s the kicker—repeat. It’s like financial magic, recycling your capital into a whole collection of properties. Most folks trying this out get lost in the weeds of numbers and spreadsheets. It’s a maze—truly—a labyrinth of calculations just begging to trip you up.

But… fear not. Enter Top Wealth Guide, your GPS for this financial jungle. We’ve got the scoop on every figure you need to wrestle with your BRRRR method calculator. We’ve written the playbook—seriously—showing you how to dissect deals with laser focus, dodging those landmines of costly mistakes. You’re not just buying property; you’re buying confidence. And that’s the real deal.

In This Guide

How Does BRRRR Actually Work

Alright, here’s the deal-turning your hard-earned cash into a real estate empire, one flip at a time. The BRRRR method is all about recycling capital like a turbo-charged washing machine. You scoop up properties that have seen better days at bargain prices, slap on some much-needed renovations to pump up their value, rent them out for that sweet monthly cash flow, refinance to pull out your initial investment, and-yup, you guessed it-do it all over again. Each property transforms into a money machine while your original investment scuttles off to the next project.

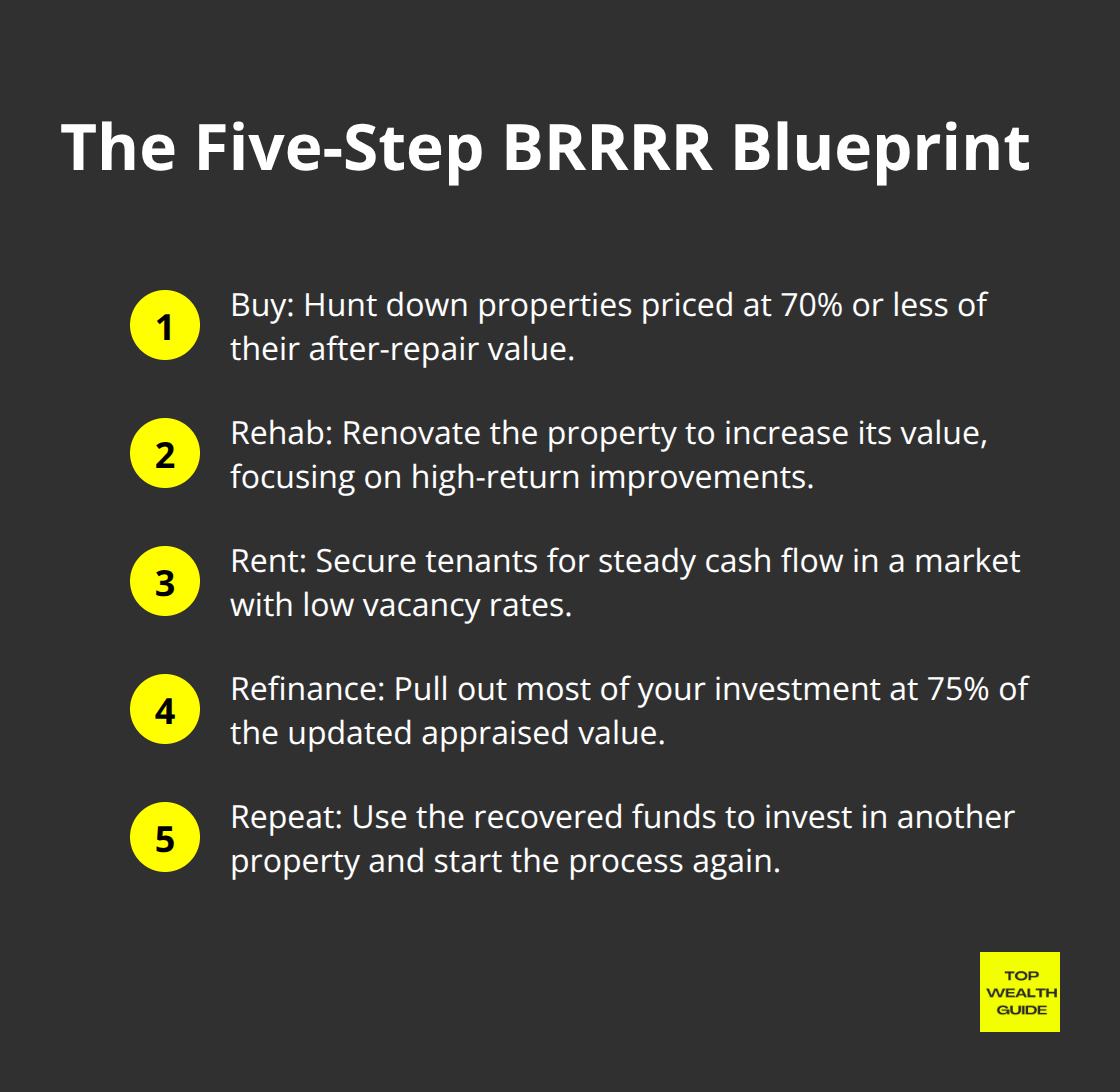

The Five-Step BRRRR Blueprint

Start by hunting down properties priced at a meager 70% (or less!) of their spruced-up value. According to Remodeling Magazine, flipping that ancient HVAC system could recoup a whopping 103.5% of costs, and even swapping out garage doors sees a 102.7% return. Once renovated, the game plan is to rent these properties for some steady cash flow. Considering vacancy rates are at rock-bottom levels, it’s definitely a landlord’s market. Then, refinance at a cool 75% of the updated appraised value, getting most of your dough back to roll into another purchase.

Why BRRRR Beats Traditional Methods

Here’s the kicker-BRRRR investors can rake in 25% cash-on-cash returns with the right setup, leaving the typical 8-12% rental profits in the dust. Old-school buy-and-hold folks? They’re locking up their entire down payment in one, lonely property. Meanwhile, BRRRR investors shuffle that same $50,000 initial payment across several properties in a year and a half. And if you’re eyeing the Sunbelt region, well, you’re in luck-properties there are appreciating like nobody’s business, making them perfect BRRRR candidates.

The Financial Mechanics That Drive Success

Hard money loans land you with interest rates between 9.5% and 11.99%-perfect for those early purchases. But here’s where the magic happens: refinance into those comfy 30-year mortgages with lower rates to boost your cash flow. This method sings for investors who can juggle renovations and tenant placement with ease. Sure, there’s some operational finesse required, but the wealth-building potential is sky-high when you pull off these deals with precision.

The numbers are crucial, yes, but understanding them-now that’s the art. You have to crunch them right to make savvy calls on each deal.

What Numbers Actually Matter in BRRRR Analysis

The 70% rule is your North Star in the land of BRRRR deals. It’s like the golden snitch for savvy investors-your total spend (purchase price plus those sneaky rehab costs) should dance around, never above, 70% of the property’s after repair value. It’s your shield against market tempests and the ticket to some nice, juicy profit. Big-shot BiggerPockets data tells us the folks hitting this mark are living the dream, while those wandering into the 75% danger zone often find themselves trying to refinance in a hailstorm. Here’s your magic formula for the max purchase price: (ARV × 70%) – rehab costs = your cap. So, if you’re eyeing something that’ll be worth $200,000 all fixed up and you’ve got $30,000 in reno costs, don’t even consider offering more than $110,000.

Rehab Cost Precision Separates Winners from Losers

Here’s the real battleground-nail the rehab estimates, or prepare to weep into your renovation budget. Think $15-25 per square foot for prettying up, $40-75 when you’re gutting the place. Kitchens, the money pits, run $75 to $250 per square foot; gotta love those materials and appliances. Oh, and always, always-tack on an extra 20% to whatever your contractor dreams up, because, surprise! Plumbing or electrical ghosts will haunt your project. Snap every angle with photos and lock in three written bids for the big stuff.

Cash Flow and Return Calculations That Count

Cash flow is like the blood that keeps your BRRRR heart beating-gross rent minus every expense you can think of (mortgage, insurance, taxes, you name it). Aim for a modest, yet satisfying, $200-400 in positive cash flow per property at the very least. Cash-on-cash return? It’s the annual cash flow divided by your total out-of-pocket adventure-down payment, rehab costs included. Set your sights on decent returns depending on market climates. ROI mixes appreciation and paying down the principal-compute total return divided by your initial plunge. Places like Phoenix and Austin? Magnets for impressive returns if you’re a sharp BRRRR operator learning the game and hitting those numbers from the jump.

Master these numbers to build the foundation, but real transformation? That’s when these digits leap off the spreadsheet into real-world action with a methodical analysis process.

How Do You Actually Analyze a BRRRR Deal

Start with the neighborhood reconnaissance mission. Seriously, lace up your sneakers and hit the pavement-morning, afternoon, evening. Absorb the vibe-foot traffic, noise levels, the works. Dive into local crime stats on police websites and break down school ratings on GreatSchools.org (kids and families, they’re rental gold). Pull up comparable sales within half a mile over the past six months. The 1% rule? More like magic-properties should rent for at least 1% of their after-repair value each month. Anything at 1.2%… that’s top shelf.

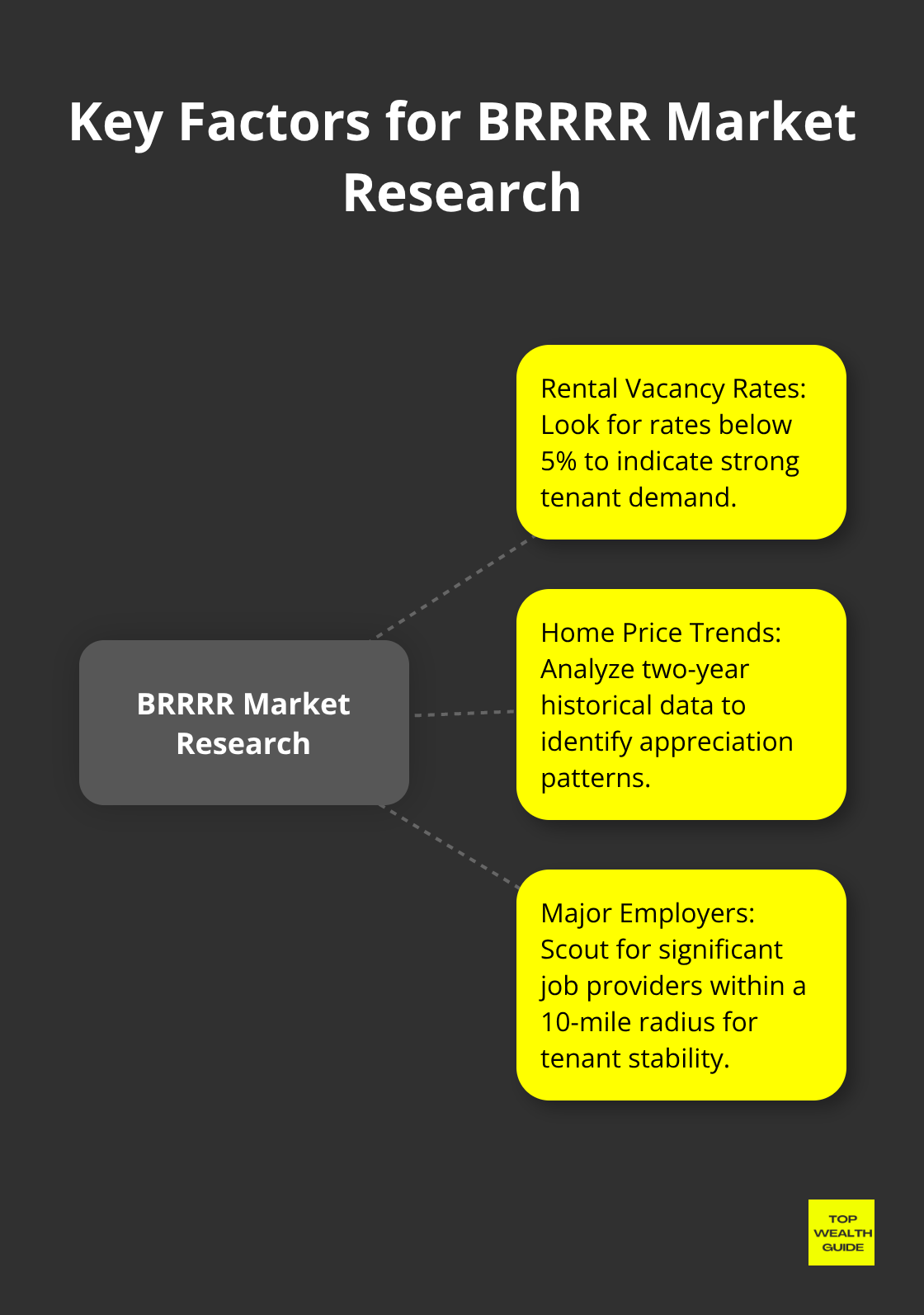

Market Research That Matters

Let’s focus on what truly predicts success-three data points. First, peep those rental vacancy rates-below 5% screams strong tenant demand. Next, home price trends-look back two years to catch appreciation waves. Lastly, scout for major employers within a 10-mile radius (job stability, it’s the rent payer’s BFF). Properties near those buzzing hospitals, universities, or hot tech hubs? They leave rural spots in the dirt.

Real Numbers Analysis

Here’s the juicy part: picture a distressed three-bedroom joint going for $85,000 in a spot where revamped places fetch $160,000. Contractor says $35,000 for the glow-up (think new floors, kitchen magic, bathroom sparkle). Use the 70% rule-all-in cost? $112,000 minus that $35,000 rehab hits $77,000 max purchase. Listed at $85,000? Time to wield those negotiation skills or bounce. Similar pads rent at $1,400 monthly-that’s $16,800 a year in rental loot.

Cash Flow Calculations That Count

So, you crunch the numbers-mortgage $580, insurance $125, taxes $200, plus $140 for maintenance. Net? $355 monthly cash flow. Pour in $42,000 total cash (down payment and rehab), and you’re looking at an 8.5% cash-on-cash return. Factor in vacancy allowances (5-8% annually) and property management fees if you outsource the hassle. Properties netting under $200 monthly? Not worth the sweat or risk.

Tools That Actually Work

BiggerPockets? It’s your BRRRR calculator hero, juggling complex stuff like hard money financing with ease. Plug in purchase price, rehab costs, rental guesses, and financing terms for instant cash flow magic. Spreadsheet warriors-craft those templates: track acquisition, renovation holding costs, rental income forecasts, and refinance scenarios. DealMachine dishes out property data and comps across a staggering 150M properties-market research? Streamlined. For financing finesse, tap an investment property loan calculator to play out different scenarios and nail your deal structure.

Final Thoughts

Ah, the BRRRR method calculator-think of it as your GPS navigating through real estate chaos. It distills that cryptic mess of property analysis into bite-sized decisions you can actually digest. So, know the 70% rule like the back of your hand and get those rehab estimates to within 20%-because who wants nasty surprises? And you’re shooting for a cool $200-400 in monthly cash flow, minimum, okay? Those are your basics-they’re what keep your wallet fat, not bleeding dry on bad investments.

Now, where do you kick off your first BRRRR adventure? Right here, with neighborhood recon and comparable sales intel. Arm yourself with BiggerPockets calculators for various scenarios, lock down hard money to snap up properties, and make friends with contractors who don’t flake. Markets with less than 5% vacancy and booming job growth within a stone’s throw-10 miles or so-are your playground (think hospitals, universities, and oh those tech hubs-rental demand goldmines).

Precision is king. I’m talking laser focus on acquisition cost, renovation bills, what you expect to rake in from rentals, and even the nitty-gritty on refinancing. You want properties hitting that sweet 1.2% monthly rent-to-value ratio in up-and-coming places like Phoenix? Yeah, that’s the stuff of dreams for eagle-eyed investors. Rinse-repeat this winning formula, and you’ve got yourself a blueprint for lasting wealth through sharp property buys. It’s all about rolling up your sleeves and diving deep into the grind.