Stock volatility… it’s the roller coaster of the financial world—taking you from dizzying highs to stomach-churning lows in what feels like the blink of an eye. Those top volatile stocks? They’ve got the moves like Jagger… swinging 20-50% within mere weeks. That’s not investing, folks… that’s a white-knuckle ride.

Here at Top Wealth Guide (a name that screams confidence, doesn’t it?), we’ve crunched today’s market numbers to spotlight the drama kings of Wall Street—the stocks with enough volatility to give you whiplash. The million-dollar question: Are the highs worth the hair-raising risks?

In This Guide

What Actually Drives Stock Volatility

Stock volatility-it’s not some Hogwarts mystery. It’s about real factors you can measure and, honestly, smart investors are paying attention. Company earnings surprises? They’re the fireworks here, making stocks dance 15-30% up or down based on how much they outperform or miss estimates, says FactSet’s numbers. Then you’ve got news events, analyst tweaks, and sector shuffle-all throwing fuel on the price swing bonfire. Small-cap stocks, worth under $2 billion, are like roller coasters with 40% higher volatility than their large-cap cousins. Why? Fewer shares trading, so, yup, even small transactions can swing the price pendulum wildly.

The Numbers That Matter Most

Beta coefficient-your compass in the stock market jungle. This measures a stock’s volatility against the big, broad market wave. A beta of 1.5 means brace yourself-this stock could move 50% more than the S&P 500 wave. So, if the market drops 10%, expect your stock’s not-so-gentle push down by 15%. Then there’s standard deviation-the yardstick for how far a stock wanders from its comfort price zone. Anything beyond 40% here screams high volatility. Free tools like Yahoo Finance let you track these babies. Quantum Computing Inc. with 126% volatility and Boxlight Corporation with 188%, they’re practically the poster children for volatility.

Market Fear Indicators

The VIX index acts as the market’s fear thermometer. This index uses S&P 500 options to take its pulse, spiking above 30 when the market gets jittery. Above 40? That’s panic mode, the sort that offers bargain hunting chances for those ready to pounce in the chaos.

Volume and Technical Signals

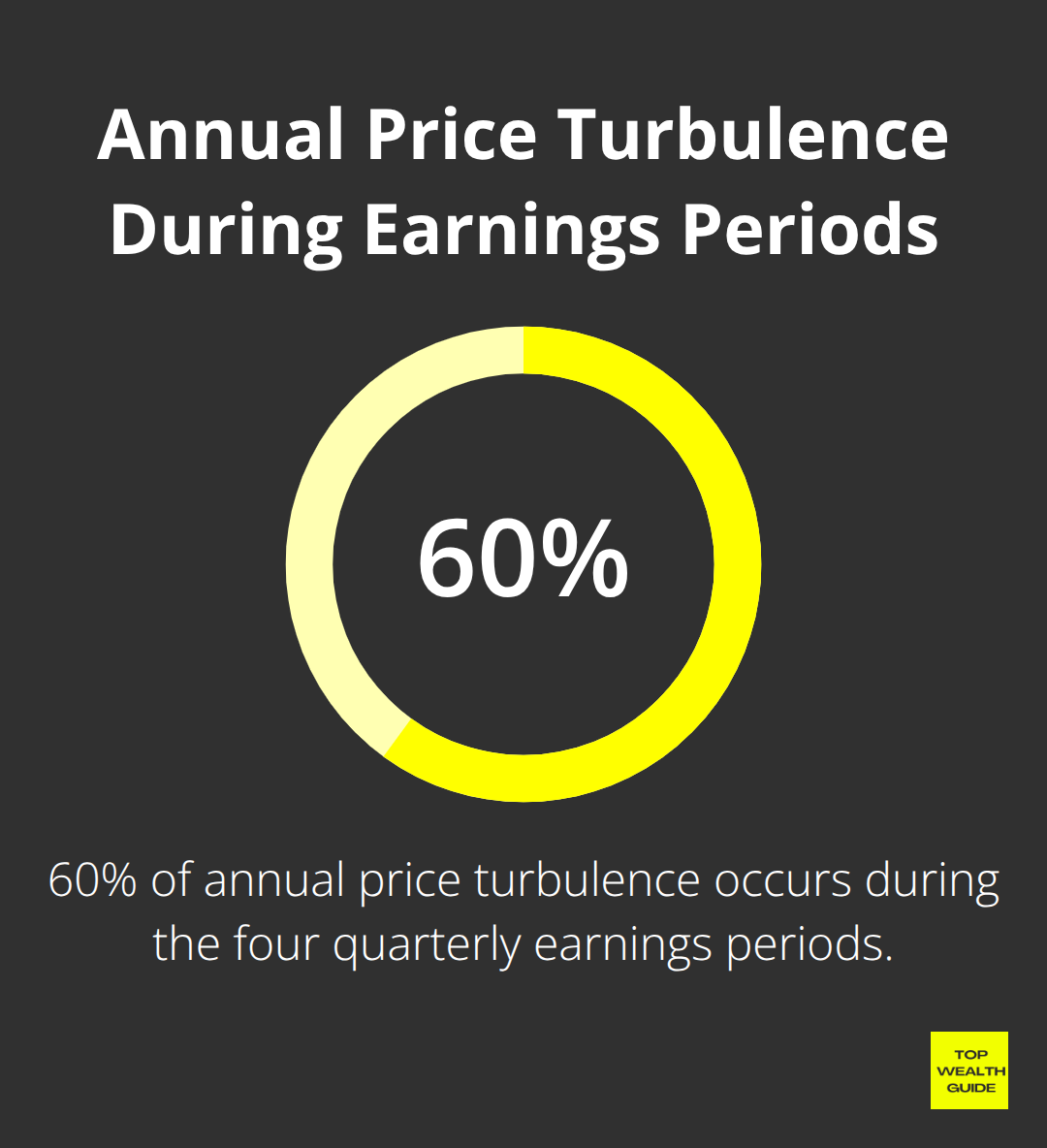

When you see volume spikes-2-3 times the daily norm-it’s like a giant neon sign warning of major price moves. Technical indicators like Average True Range set price movement expectations, with ATR above $5 raising the high-volatility flag. Bollinger Bands? They open up when things get shaky and close ranks when calming down. Pay close attention to earnings calendars-a staggering 60% of annual price turbulence hits during those four quarterly earnings periods.

These factors build the roadmap to spotting which stocks and sectors are currently skating the thin ice of high risk and reward. In that arena, savvy risk management isn’t just a strategy-it’s the ticket to building generational wealth.

Which Stocks Are Moving the Most Right Now

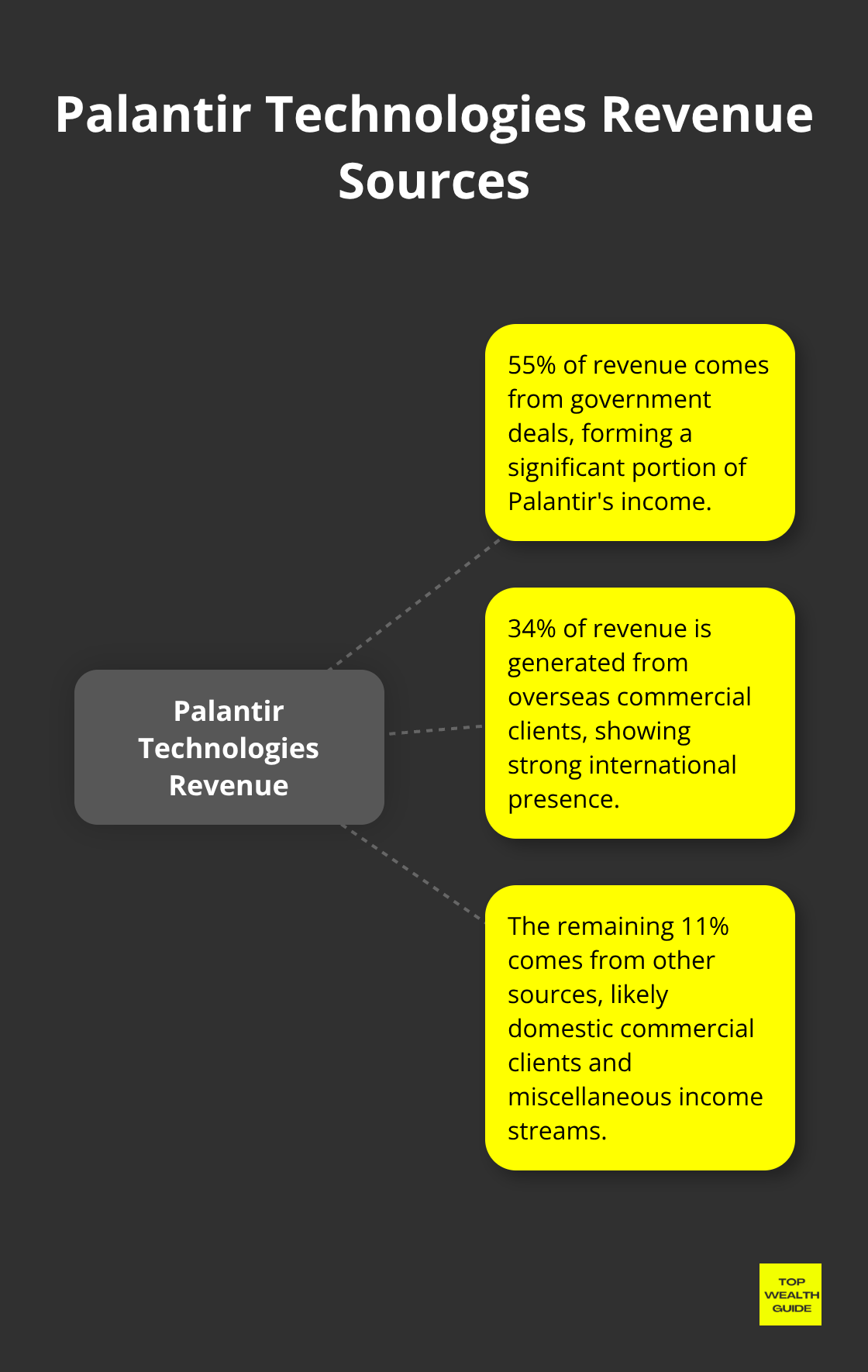

Tech stocks-front and center in today’s volatility circus. The narrative unfolds… check out Palantir Technologies-they’re pulling 55% of their revenue from government deals, and the rest? Commercial clients, with a juicy 34% coming from overseas. Tesla-doing its Tesla thing-riding a wild 70% year-to-date surge, playing pinball between $212 and $488 per share. That’s a $276 playground for day traders who just can’t resist the thrill. Meanwhile, AST SpaceMobile shot up 400% on satellite tech advances, and Quantum Computing Inc. hit a mind-boggling 3,000%-before the inevitable reality check came knocking. These kinds of explosive runs sift the winners from the wannabes in mere weeks-not years.

Biotech’s Binary Outcomes

Enter biotech-where drama meets bottom lines. Companies like Qualigen Therapeutics, in the therapeutic trenches-battling cancer in both grown-ups and kids. It’s all about those binary outcomes-drug approval equals cash bonanza, but rejection? Yep, bloodbath on aisle three. Small-cap biotechs-those below $500 million in market cap-experience roller-coaster rides, skyrocketing 50-200% on good news or diving just as fast on bad. Look at Big Pharma, like Pfizer-they’ve got more cushioning, but still, an 18% annual dip when blockbuster drugs leave the patent nest.

Crypto Proxies Amplify Digital Asset Moves

MicroStrategy-now rebranded as Strategy Inc.-jumping into Bitcoin with both feet, climbing 140% as cryptocurrency adoption picks up pace. These types of stocks? They’re like crypto on steroids-when Bitcoin’s up 10%, they often leap by 20-30%. Mining operations and blockchain outfits mirror this pattern-volumes swell during crypto bull runs. It’s a wild ride, offering turbocharged exposure to digital asset shenanigans minus actual crypto ownership.

Small-Cap Volatility Champions

Look at Boxlight Corporation-posting a head-spinning 188% volatility and a 205% price change. Then you’ve got Better Home, strolling through mortgage finance territory with a $523.58 million market cap. Smaller fish, bigger swings-fewer shares mean even modest trades can spark massive price tremors. AgriFORCE Systems-exhibit A with 129% volatility, 137% in price hikes-small-cap stocks are today’s high-stakes game, ripe with both risk and reward.

Winning in this volatile space? It takes more than just sticking around-you need wealth building strategies that go beyond the old-school buy-and-hold playbook.

How to Trade Volatile Stocks Without Losing Your Shirt

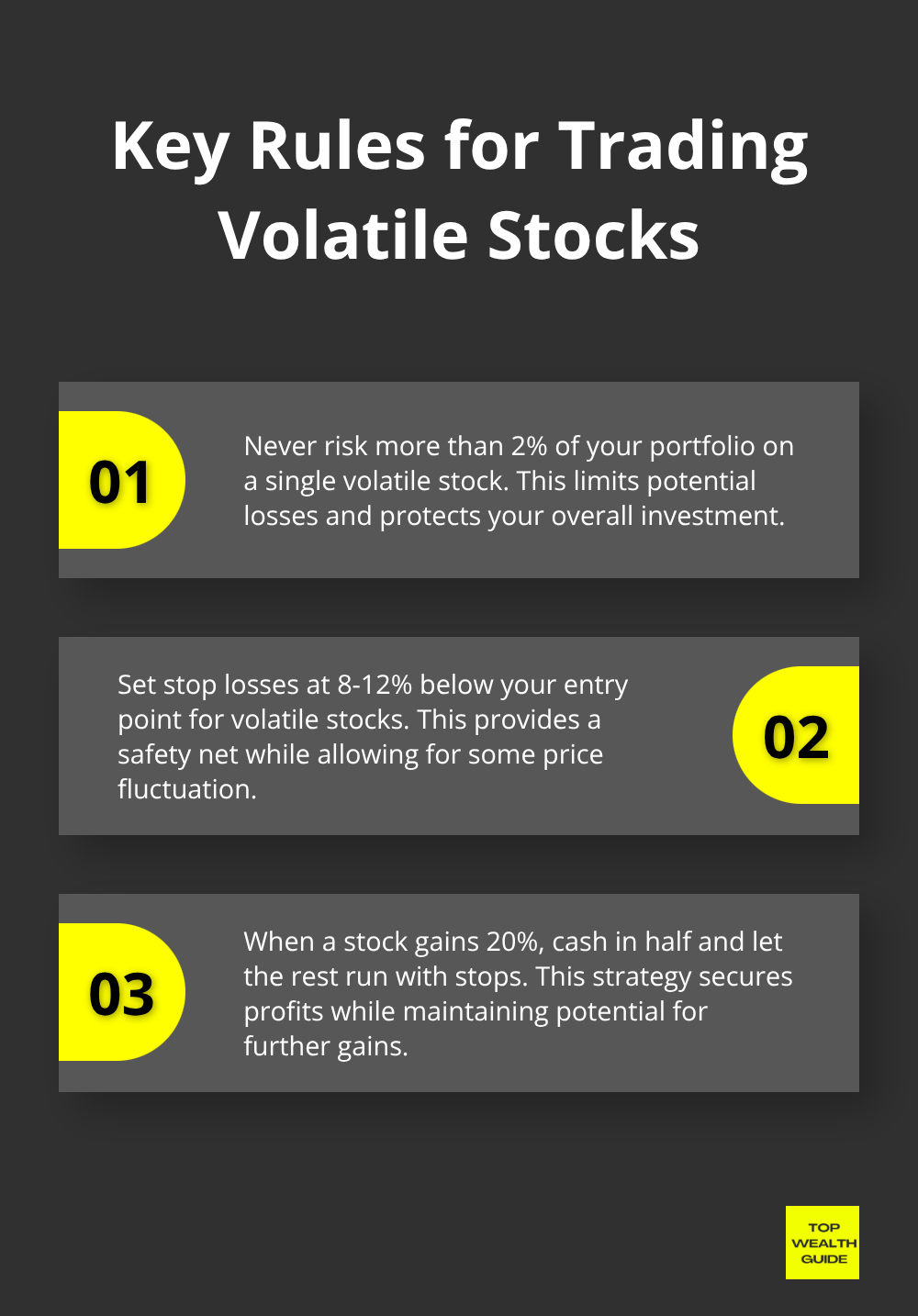

So, here’s the deal: professional traders preach the gospel of never risking more than 2% of their portfolio on a single volatile stock. Have $50,000 to play with? Keep trades at $1,000 max. Prop firms are like strict parents with a 1% rule – and volatile stocks? They’re a different beast. Enter the Kelly Criterion. This tool tells you exactly how much of your cash to risk, factoring in your ‘edge.’ But, when you’re dealing with stocks that swing 40%+ (think roller coaster), slash your position size in half. Quantum Computing’s 126% volatility is the Wall Street version of walking through a minefield.

Position Size Calculations That Work

Plan your loss before hitting buy. Grab your account size, multiply by 0.02, then divide by your stop-loss percentage. A $100,000 account with a 10% stop loss translates to a $20,000 position max ($100,000 × 0.02 ÷ 0.10). Oh, and volatile stocks? They love to drop 15-20% overnight just for fun-plan for gaps. Small-cap biotechs? They can tank 30% on failed drug trials-get your position sizing right, or it’s game over.

Stop Loss Strategies That Actually Protect Capital

For volatile stocks, your stop loss should be a safety net 8-12% below your entry-wider than the cozy 5-7% for the safe and steady ones. When you’re dealing with something like Tesla sitting around $276, a $25-35 stop loss cushion is reasonable. Trailing stops? They’re your best friend-ride the winners up, never adjust them down. Check Palantir: it jumped 55%, and a trailing stop 15% below its peak would’ve saved your bacon. Mental stops are what you use when you want to lose-fear and greed hijack every time. Stick to automated stop-loss orders with your broker or Yahoo Finance-no drama, just execution.

Smart Entry and Exit Techniques

Make your move during the stock market’s espresso hour-the first or last hour when volume and price discovery hit their stride. Earnings announcements? They cause more yearly volatility than a caffeine junkie with an energy drink-position yourself 2-3 days prior. When your stock scores a 20% gain, cash in half-and let the rest run with stops. You’re hedging your bets-locking in green while chasing blue skies.

Volume and Technical Indicators

Keep an eye on the VIX-a 25 rating signals spicy volatility ahead. High-volume breakouts above resistance levels scream “great entry.” The Average True Range indicator? Measure your stop distances-2-3 times the ATR value is the magic number for volatile darlings. When volume suddenly spikes 200-300% above average, it’s your heads-up for potential market moves. Consider it your crystal ball for breakouts or breakdowns, minus the woo-woo.

Final Thoughts

Alright, let’s break this down. Volatile stocks are like a high-stakes poker game, balancing the thrill of potential 200-400% jackpots against stomach-churning 50-80% losses. The patterns? They’re as clear as a summer sky – slicing through sectors and market caps like a hot knife through butter. You’ve got Quantum Computing shooting up 3,000% only to come crashing back down, a roller coaster that proves volatility is a double-edged sword. And then there’s Tesla, dancing around a $276 range like a stock market ballerina, flipping fortunes in a blink.

Now, the big boys – smart money – they swear by three golden rules when playing in the high-risk sandbox. Rule one: don’t put more than 2% of your chips on any one play. Rule two: slap on those stop losses 8-12% below where you bought in, especially with those wild high-beta stocks. Rule three: cash in those 20% gains while letting the winners run with a safety net of trailing stops. Take Palantir, for instance; it’s got this 55% government revenue lifeline – volatility on a silver platter every time a contract’s up for grabs. Meanwhile, biotech’s the wild, wild west of binary outcomes – a drug gets the nod and bam! You’re looking at a 100-200% lift overnight.

But forget gambling – success here is about prepping like a top chef before a big service. You’ve got to calculate your position sizes before diving in, automate those stop losses with your broker, and keep a weather eye on the VIX index – you see it climb above 30, time to get cautious. We at Top Wealth Guide stand by the idea that volatile stocks can play a role in your portfolio, but only if you’ve got your risk management game tight and your exit strategies as clear as day.