Picking the top stocks to buy now… ever feel like trying to find a needle in a haystack while the haystack is on fire? Yeah, same here. Today’s market landscape? It’s like nailing Jell-O to a wall. Over at Top Wealth Guide, we get it — we totally do. The investor struggle is real when you’re trying to piece together a profitable portfolio.

So — what do you do? Enter: this guide. It’s like your financial GPS. We’re gonna take you on a journey through the essential steps for finding those elusive promising stocks that vibe with your investment goals and risk comfort. We’ll dig deep into the key factors you need to consider, dish out some effective strategies, and drop practical tips that’ll empower you to make those oh-so-important informed decisions… in this crazy, current market environment. Buckle up.

In This Guide

Understanding Market Conditions and Your Investment Goals

The Stock Market: A Living Entity

Let’s face it – the stock market is like a living, breathing beast. It twists, turns, and never ceases to evolve. Right now, it’s in rally mode, with powerhouses like Tesla and Nvidia leading the charge. But, spoiler alert – being on top today means zilch for tomorrow. This rollercoaster reminds us that understanding the economic climate is priority numero uno before you dive into stock picking.

Economic Indicators: Your Financial Compass

Consider macroeconomic factors like your financial GPS – they guide where your portfolio’s headed. GDP, inflation, employment rates, retail sales… these aren’t just buzzwords. They’re your go-to indicators for making those sound investment decisions.

Hang tight on the inflation talk – you’ve got to keep tabs on GDP growth, unemployment, consumer spending, too. They’re like the Avengers of economic health. When GDP is on the up and unemployment’s low, that’s usually the green light you’re waiting for in the stock world.

Self-Assessment: Your Financial Profile

Time for some introspection. Define your investment goals. What’s your endgame? Retire in style, save for that white picket fence dream, or build a nice nest egg? These goals? They’re your strategy’s backbone.

Young guns with years ahead might dance with risk for bigger returns. Those nearing retirement might lean towards the stability and income side of things. Bottom line? There’s no one-size-fits-all. Your approach should be as unique as you are.

Time Horizon: A Critical Factor

Your time horizon? Oh, it’s a game-changer. Short-timers, like day traders, are in the thick of market chaos. They scout for stocks that swing 2-5% daily – excitement much?

Long-term folks, you’re different. You ride out short-term bumps, focusing on solid fundamentals and consistent growth. You measure success with Return on Equity – it’s like your profitability compass.

Yes, the stock market? Historically, it’s like a stubborn tide – always pushing upwards in the long run. If you’re in it to win it for the long game, ignore the noisy neighbors (aka daily market chatter).

Financial Capacity: Know Your Limits

Finally, let’s talk numbers – your financial capacity. Figure out what you can invest without wrecking your financial peace. Build that safety net first – 3-6 months’ expenses – before diving into stocks.

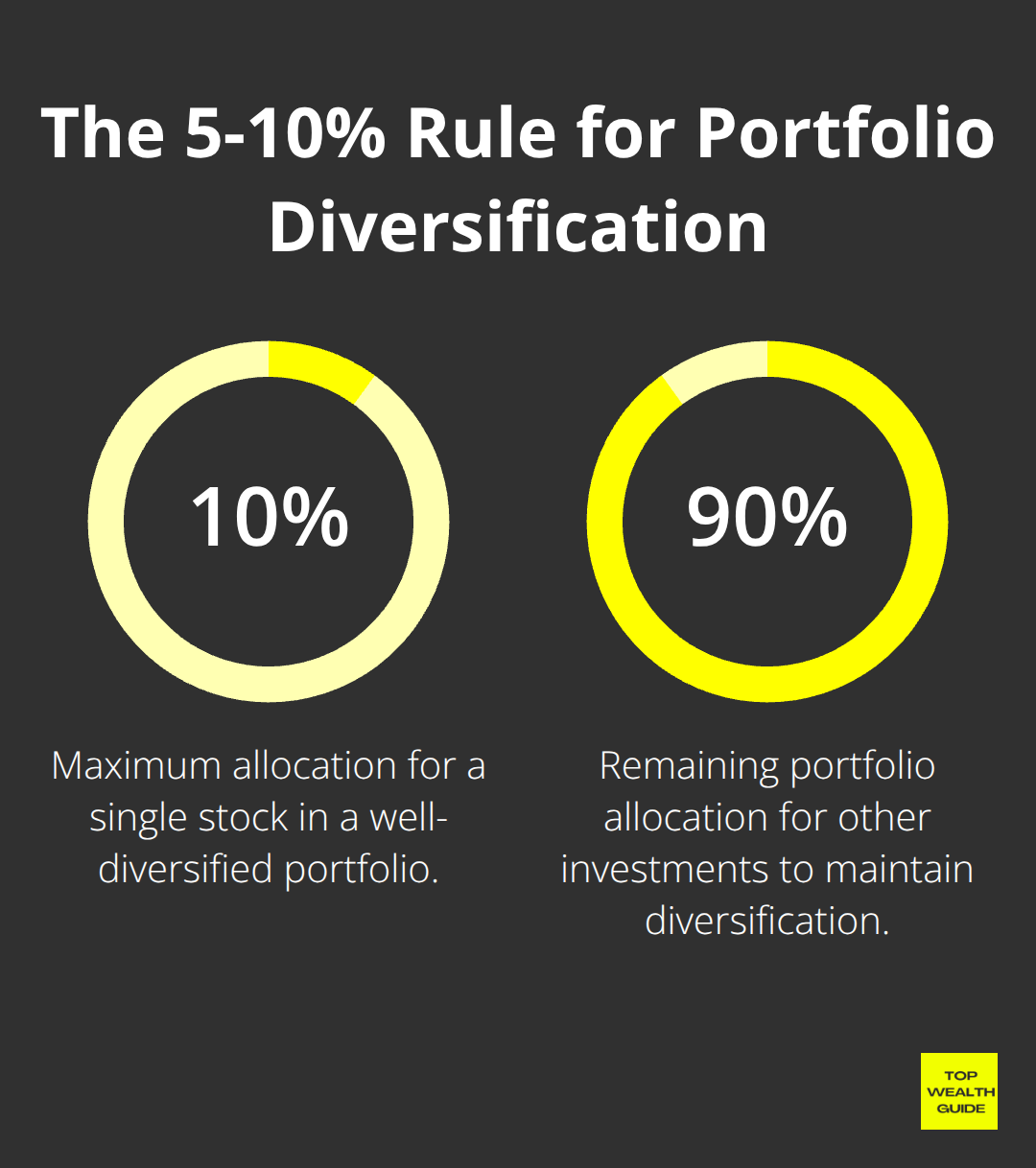

Consider the 5-10% rule. Simply put, don’t let any single stock hog more than 5-10% of your portfolio. It’s an easy way to keep your eggs spread across baskets and dodge unwanted risks.

Buckle up, because next, we’ll delve into the nitty-gritty of stock selection. These insights will arm you with the confidence to navigate the intricate world of stock picking with style and swagger.

Key Factors to Consider When Selecting Stocks

The Power of Financial Fundamentals

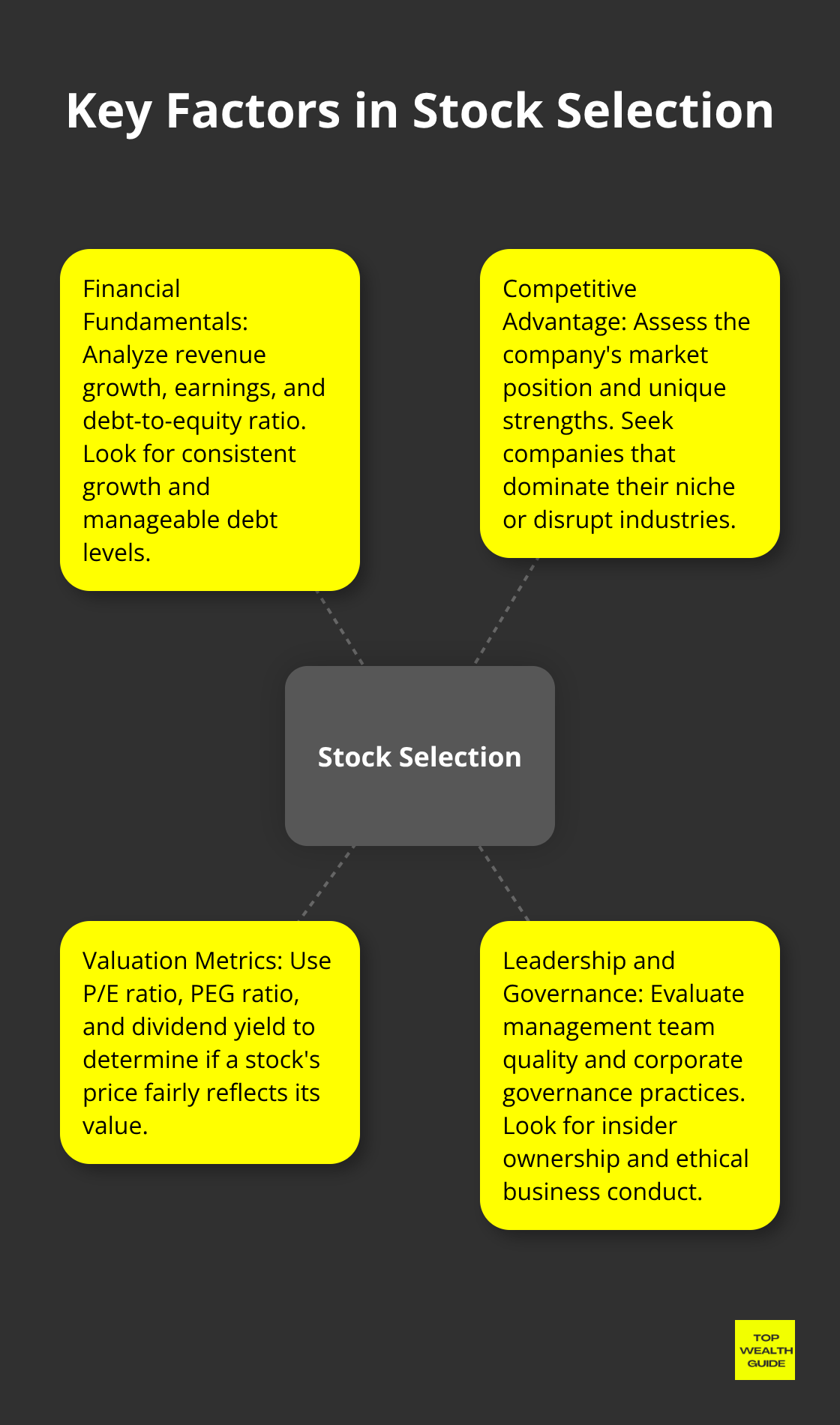

Listen, picking stocks isn’t about chasing the next shiny object or jumping on the tech rollercoaster. Nope, it’s all about getting into the nitty-gritty of financial fundamentals. Yep, financial statements – they don’t lie. Those numbers tell the real story about a company’s worth. Revenue growth? That’s your North Star. You want to see it ticking up consistently. And earnings? They’re the heartbeat. A growing bottom line? That shows the company’s not messing around.

Debt – it’s not always the bad guy, but if it piles up, your company could crash and burn quicker than you can say “Chapter 11.” Generally, a debt-to-equity ratio under 2 is your safety blanket, though it swings depending on the industry. Tech giants might juggle more debt than utility firms, just how it rolls.

Competitive Advantage: The Market Differentiator

Industry vibes and the competitive scene? They’re a big deal. Are we talking about a powerhouse in a niche or a teeny fish in the ocean? You want companies that either rule their domain or shake it up entirely.

Take Arista Networks (ANET). They’re out front in the computer networks game. They’re not just surfers; they’re wave makers. That kind of advantage? Turns a good stock into a great one.

Valuation Metrics: Pricing Potential

Let’s talk valuation metrics – they’re your magnifying glass. Is a stock’s price a fair reflection of its value? The Price-to-Earnings (P/E) ratio is your go-to. It’s like the stock market’s version of speed dating, lining up a stock’s market value with its earnings. The PEG ratio? It makes things three-dimensional, bringing expected earnings growth into the mix.

For the income-focused investors, dividend yield is your friend – but keep your eyes peeled. Ultra-high yields over 6%? That’ll have you asking if there’s trouble brewing.

Leadership and Governance: The Human Element

Never underestimate the folks pulling the strings. A standout management team? They can turn an average Joe of a company into a market rockstar. Executives with plenty of stock in their own firm? That’s a sign they’re betting on their own victory lap.

And corporate governance? It’s not just boardroom lingo – it shows how a company plays ball with shareholders, staff, everyone. Scandals and lawsuits? They’re alarm bells. Clear dialogue and ethics? That marks a company you might wanna cozy up to.

Stock selection – part science, part art. Use these factors like a toolkit to sketch a full picture of a company’s real value. Then, as you steer ahead, look into strategies to wield these insights skillfully in today’s market arena.

Winning Stock Strategies for Today’s Market

Growth Investing: Riding the Wave of Expansion

Alright, growth investing-it’s all about catching that wave, right? We’re talking companies ready to fly, with revenue growth that makes your eyes pop. Think about firms that consistently clock a 15.9% upswing over three years. Check out industries like tech, healthcare, and renewable energy-where the action really happens.

Nvidia (NVDA) is the star of this show-think AI chips and BOOM! A 61% revenue boost last year… it’s a textbook case of what happens when a company hits the sweet spot in growth stocks.

When you’re eyeing growth stocks, it’s all about EPS growth-earnings per share. If EPS is climbing, that means profits are too, not just the size of the business. Look for companies outpacing their industry norms on this one.

Value Investing: Unearthing Hidden Gems

Value investing? It’s like finding a diamond in the rough. You’re on the hunt for undervalued players with rock-solid fundamentals. Stark reality is these stocks often fly under the radar, priced lower than their true worth. What should you focus on? Well…

- Price-to-Earnings (P/E) Ratio: Seek out the ones below the industry bar.

- Price-to-Book (P/B) Ratio: A sweet spot? Between 1 and 3; that usually means fair play.

- Debt-to-Equity Ratio: Financially steady? Ratios under 0.5 tick that box.

Warren Buffett-the Yoda of value investing-he’s all about those companies with economic moats (unbeatable edges that keep the cash flowing long-term).

Dividend Investing: Steady Income in Uncertain Times

Dividend stocks-they’re like that comfy couch that pays you back for sitting on it. If you’re in for steady income, this is your jam. Look for those with a track record of paying out, and better yet, increasing dividends. The dividend aristocrats-that’s your starting lineup.

Here’s what to consider:

- Dividend Yield: Sweet spot ranges 2% to 6%. Go too high, and you might be looking at something unsustainable.

- Payout Ratio: Below 60% shows room to grow those dividends.

- Dividend Growth Rate: Companies beating inflation with their dividend hikes are where you wanna be.

Take Procter & Gamble (PG)-it’s on a 66-year roll of hiking dividends… that’s the fortress of stability dividend folks crave.

Momentum Investing: Riding Market Trends

Momentum investing-you’re betting the trend is your friend. This strategy banks on past winners continuing to lead the pack.

For momentum lovers, these are your telltale signs:

- Relative Strength Index (RSI): This is your measure of recent price chatter.

- Moving Averages: Stocks above their 50-day and 200-day lines… big momentum.

- Volume: A spike in trading? That confirms a strong price trend.

Think Tesla (TSLA)-it’s momentum in motion, driven by market whispers and high hopes.

Sector Rotation: Adapting to Economic Cycles

Sector rotation gets you playing the economic cycles like a maestro. It’s about knowing which sector shines in what phase of the economy.

Here’s the rundown:

- Economic expansion? Consumer discretionary and tech are your heroes.

- Recession lurking? Huddle up with utilities and consumer staples.

- Early recovery moments: Financials and industrials take the lead.

To nail sector rotation, you gotta be in tune with economic indicators and have the knack to time market shifts. It’s not for the faint-hearted but when done right-it’s magic.

Final Thoughts

Picking the top stocks now? It’s like a mental jigsaw puzzle that demands more than just a wild guess. We dove into those steps – understanding market moods, pinning down your investment goals, dissecting the nitty-gritty of what drives stock performance. There are myriad strategies, my friends, and each offers its own playbook for navigating today’s whirlwind market. First rule: Sync that strategy with your financial dreams and risk appetite.

Winning the investing game? It’s about assembling a portfolio that can not only handle a market tantrum but also jump on chances as they appear. Diversify, diversify, diversify – sprinkle some investments across sectors, company sizes, and styles to dodge unnecessary drama. Meanwhile, keep your research game strong and stay plugged into market buzz, economic vibes, and how companies are faring. That’s the secret sauce for nailing stock picking.

Yes, the stock market is like a treasure chest for those who sweat the preparation. Here at Top Wealth Guide, we’re dishing out the freshest insights and the practical tools you need to crush that investment quest. So, start laying the bricks on your path to financial glory. Why wait?