In the financial world, '000' is industry shorthand for thousands. When you see this on a financial statement, it’s a heads-up that the numbers have been abbreviated for simplicity. To get the real figure, you just add three zeros to the end or multiply the number by 1,000. This simple convention is crucial for accurately reading financial reports and making informed investment decisions.

In This Guide

Decoding the Three Zeros in Financial Reports

Ever looked at a corporate earnings report and seen a revenue figure like '$50,000' with a tiny note that says '(in 000s)'? It can throw you for a loop. But this little notation is a workhorse of financial reporting, designed to make massive, complex data sets cleaner and easier to read.

Think of it like a menu at a nice restaurant listing the steak for '45.' You just know it means $45.00, not 45 cents. Financial reports use the same kind of contextual shorthand, just on a much grander scale. By chopping off the last three zeros, companies can turn a huge number like $50,000,000 into a much more digestible $50,000.

The Rule of Three Zeros

The principle here is dead simple: see the number, then tack three zeros onto the end. This convention pops up everywhere in financial documents, saving precious space and preventing our eyes from glazing over.

Here’s how it works in practice:

- Real-Life Example: You're analyzing Microsoft's Q4 2023 earnings report. You see a line for "Net Income" showing $20,081. A quick look at the top of the table reveals "(in millions)". So, you multiply $20,081 by 1,000,000 to get the actual net income of $20.081 billion. The same principle applies to '(in 000s)'.

- A reported profit of $1,200 with a '(000s)' note is actually $1,200,000.

- Company assets listed as $850,000 really mean $850,000,000.

- Sales figures of $750 translate to a true value of $750,000.

This isn't some secret code meant to trick you; it's a standard practice for readability. The trick is to train yourself to always look for the fine print—it's usually tucked away in a column header, a footnote, or at the top of the page, saying something like '(in thousands)' or '(in 000s)'.

Quick Reference: Abbreviation vs. Actual Value

| Reported Figure (with 'in 000s' note) | Calculation | Actual Value |

|---|---|---|

| $2,500 | $2,500 x 1,000 | $2,500,000 (2.5 Million) |

| $450 | $450 x 1,000 | $450,000 (Four hundred fifty thousand) |

| $120,000 | $120,000 x 1,000 | $120,000,000 (120 Million) |

Think of this table as your cheat sheet. Spot the shorthand, do the quick math, and you've got the true scale of the company's finances.

Getting this one concept down is a huge first step for any investor. If you're ready to see how this fits into the bigger picture, you can learn more about how to analyze financial statements in our complete guide. Once you internalize this shorthand, you can assess a company's performance accurately and avoid making a very costly decimal point mistake.

Why Do We Even Use Financial Shorthand?

Ever wonder why financial reports are full of abbreviations like '000'? It’s not just to save ink. This practice is a direct result of a mathematical breakthrough that changed the world: the concept of zero. Without it, financial documents would be an intimidating, unreadable mess of digits.

Picture a company's annual report where every single number is written out in full. Revenue, expenses, profits—billions and millions sprawling across page after page. You'd go cross-eyed trying to scan it, let alone compare figures or spot a trend. Shorthand like '000' cuts right through that clutter, making enormous sums of money digestible in a single glance.

This whole system is built on a long history of mathematical innovation. The story really kicks off in ancient India around the 5th century CE, when mathematicians first treated zero as a number in its own right, not just an empty space. By 628 CE, the scholar Brahmagupta had laid out the rules for using it. That idea eventually traveled the globe, fueling huge leaps in science and commerce. If you're curious, you can read more about the amazing story of zero on thethinkacademy.com.

From Ancient Concept to Modern Practice

That ancient breakthrough is the direct ancestor of the financial notation we see today. Think about it: zero is what allows us to tell the difference between 1, 10, and 100. In the same way, '000' helps our brains instantly distinguish between $50,000 and $50,000,000 without having to count a string of zeros.

This isn't just a quirky habit; it's a fundamental part of global commerce for a few very practical reasons:

- Clarity and Readability: It cleans up dense tables, making them far less overwhelming.

- Error Prevention: Fewer digits to type or read means fewer chances for a costly mistake.

- Standardization: It creates a consistent, universal language for presenting large numbers across different industries and reports.

The use of '000' isn't some arbitrary rule. It's a practical tool born from centuries of mathematical evolution, allowing us to communicate massive numbers efficiently.

Ultimately, getting comfortable with this notation is a huge step in your financial literacy journey. To keep building on this, you might want to check out our guides on other accounting basics to sharpen your skills. Once you understand the why behind the shorthand, you can start reading financial data with much more confidence and accuracy.

Spotting '000' in Real-World Scenarios

Knowing what '000' means in theory is one thing, but spotting it in the wild is where the real skill lies. Once you start looking for it, you’ll see this shorthand pop up everywhere, from dense corporate filings to quick market summaries. It's a fundamental part of the language of finance.

You'll most frequently bump into this in corporate earnings reports. These documents are crammed with numbers, and analysts rely on this kind of abbreviation to keep things readable.

In Corporate Earnings Reports

Let's say you're digging into Tesla's (TSLA) Q4 2023 Update. You find the income statement, run your finger down to the revenue line, and see $25,167. For a company like Tesla, that number looks disastrously small.

But then you glance up at the column header. You see the key phrase: (in millions). While not '000', the principle is identical.

That little note changes everything. The actual revenue isn't $25,167; you have to do the math:

- Reported Figure: $25,167

- Multiplier: 1,000,000

- Actual Revenue: $25,167,000,000 (Twenty-five billion, one hundred sixty-seven million dollars)

Just like that, a tiny number transforms into a massive sum. Missing that context would mean undervaluing the company's performance by a factor of a million. This is a perfect example of why learning how to read stock charts and financial statements is all about understanding the context, not just the numbers themselves.

Across Different Markets

This isn't just a stock market quirk, either. You’ll find the '000' shorthand used in any field dealing with big numbers.

In a real estate market report, for instance, you might see the median home price for a city listed as '450' in a column labeled '(in 000s)'. That doesn't mean you can buy a house for the price of a used TV. It means the actual median price is $450,000. Financial data platforms do the same thing, abbreviating market caps and trading volumes to squeeze more information onto your screen.

No matter the asset class, the principle is the same: always check the headers, footnotes, and legends. Making this a habit is what separates a novice from an experienced analyst.

Actively looking for these contextual clues is your best defense against one of the most common—and potentially costly—rookie mistakes. After all, the difference between $75,200 and $75.2 million could be the difference between a bad trade and a brilliant one.

When 000 Is Not a Number

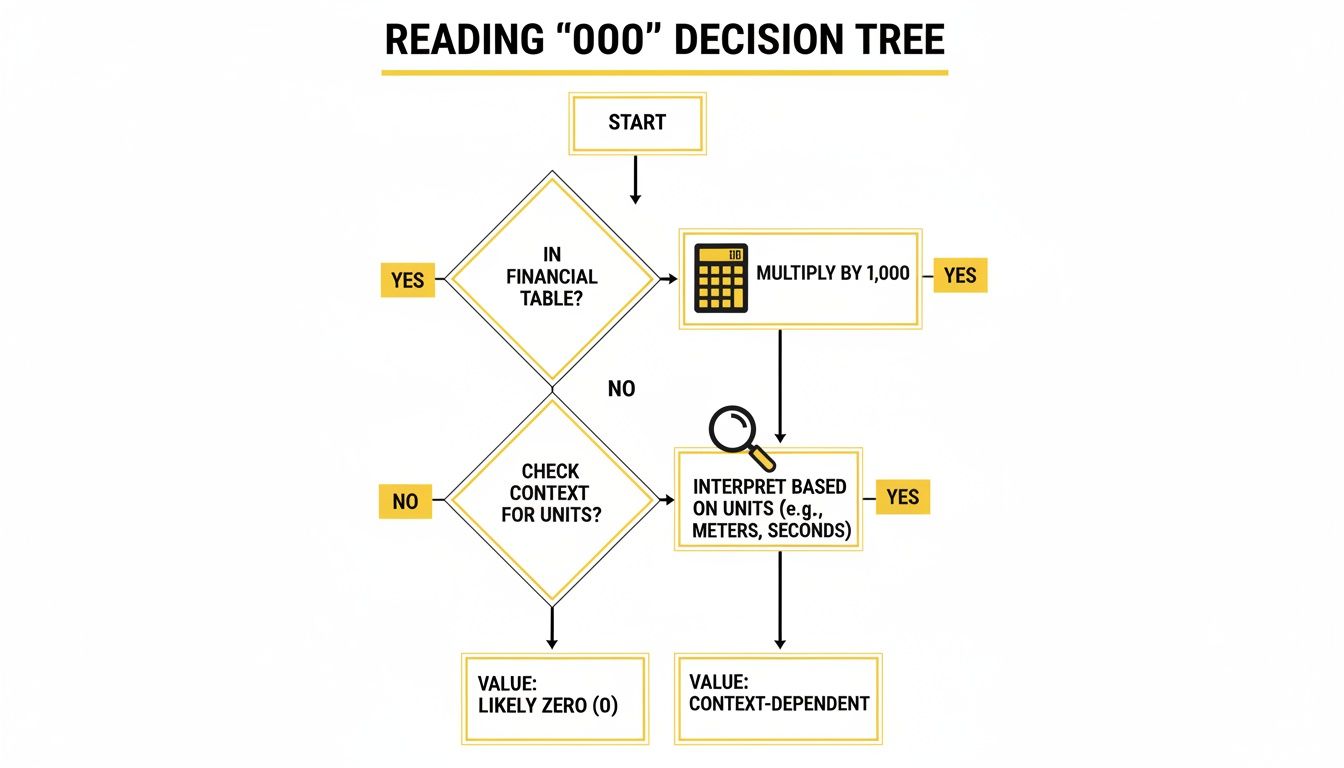

You've got the hang of spotting 000 as shorthand for thousands, but here's where things get tricky. Sometimes, those three zeros aren't a number at all. Confusing an identifier for a value is a classic rookie mistake, and it all comes down to context.

Think about where you're seeing it. If 000 pops up in the revenue column of a financial report, you can bet it means "multiply by a thousand." But if you see it in a field labeled "Ticker Symbol" or "CUSIP," it’s likely part of a unique code for a bond or a specific class of stock.

This simple decision tree can help you make the right call in seconds.

As you can see, if the 000 is sitting in a column of financial metrics, you do the math. If it’s anywhere else, it’s time to put on your detective hat and figure out what it's labeling.

Identifier vs. Numerical Value

Learning to tell these two apart is a fundamental skill for any investor. It’s a lot like a street address. Your house number might be '123,' but you wouldn't add that to your property value—it's just a label. The same exact logic applies to financial data. Honing this ability is a huge part of successful financial data interpretation.

To stay out of trouble, always ask yourself one simple question: “What is this column actually describing?” If it’s a quantifiable metric like sales or volume, then 000 is almost certainly numerical shorthand. If it’s an identifier, those zeros are just part of the name.

Comparison Table: Understanding Different Contexts for '000'

| Context | Common Meaning | Action to Take | Real-World Example |

|---|---|---|---|

| Financial Tables | Shorthand for thousands | Multiply the number by 1,000 | A revenue figure of '500' in a table marked '(in 000s)' becomes $500,000. |

| Bond Identifiers | Part of a unique code (CUSIP) | Do not perform calculations. | A Treasury bond CUSIP might be '912828C00' (the final digit varies). The '00' is part of the code, not a value. |

| Data Placeholders | Missing or null data | Ignore or investigate the data source. | A field showing '000' in a database export might indicate that data wasn't available for that period. |

| Brokerage Order Types | A specific trade instruction | Understand the order's specific function. | In some legacy systems, '000' could be part of a code for a specific type of trade or client account. |

Ultimately, a quick check of the column header or report key is your best defense against misinterpretation. Taking that extra second can save you from a major headache later.

Common Mistakes That Lead to Costly Errors

Misreading the ‘000’ shorthand is one of the fastest ways to make a major financial blunder. The most common pitfall is simply taking a number at face value, completely missing the footnote that multiplies its meaning by a thousand.

Real-Life Example: Imagine you're researching a small-cap biotech company. You pull up their latest quarterly filing and see "Net Income: $50". You might immediately write them off as a failing business. However, tucked away at the top of the income statement is the note "(in thousands of U.S. dollars)". That single line changes the story completely. The actual net income isn't $50; it's $50,000. While still small, it's a thousand times better than your initial assessment and could signal a company on the verge of profitability.

These are exactly the kinds of common financial mistakes that can cost you millions over time if you're not careful.

Beyond the Three Zeros: A Quick Comparison

Another classic mistake is thinking ‘000’ is the only abbreviation you need to watch out for. Financial reports use different shorthand all the time. Assuming every abbreviation means "thousands" is a recipe for disaster.

| Shorthand Notation | Means | Example (Reported as '$250') |

|---|---|---|

| in 000s or in thousands | Multiply by 1,000 | $250,000 |

| in millions | Multiply by 1,000,000 | $250,000,000 |

| in billions | Multiply by 1,000,000,000 | $250,000,000,000 |

The core principle of due diligence is to "trust, but verify." Never assume the unit of measurement. Always actively look for the key that unlocks the true value of the numbers you are analyzing.

A Preventative Checklist for Investors

To build a solid habit of diligence and steer clear of these expensive errors, run through this simple checklist every time you're reviewing financial data:

- Read Footnotes First: Before you even look at the numbers, scan the top and bottom of the page. Hunt for critical notes like '(in thousands)' or '(unaudited)'.

- Verify Column Headers: Always check the unit specified at the top of a data column. Is it in 000s, millions, or something else entirely? This is often where the clarification lives.

- Cross-Reference Shocking Numbers: If a figure seems way too high or suspiciously low, that's your cue to investigate. Double-check it against a previous report or another credible source like the company's official filing on the SEC website to make sure everything lines up.

So, What's the Bottom Line?

At the end of the day, remember that ‘000’ is a tool for clarity, not confusion—but only if you know how to read it. It’s an incredibly common way to make huge numbers manageable on a financial statement, but it all falls apart if you're not in on the convention.

Your default setting should be to assume '000' means the numbers are in thousands. But—and this is the important part—you can't stop there. The very next thing you do, before you even think about analysis, is hunt for confirmation. Scan the column headers, check the footnotes, and look for a legend.

Think of it like this: trust that the shorthand is there to help, but always verify what it means. Never just assume.

This isn't just about ticking a box. It's a fundamental habit that separates a casual observer from someone who truly understands the numbers. Getting this right builds your confidence and precision as an investor.

By taking a moment to confirm this one small detail, you protect yourself from massive errors in valuation and ensure your decisions are based on what the data actually says. It’s a simple step, but your diligence here will pay for itself over and over again.

Frequently Asked Questions (FAQ)

1. Is '000' the same as 'k' for thousands?

Yes, conceptually they mean the same thing (thousands). However, 'k' (e.g., $500k) is informal shorthand used in articles or conversation, while '(000s)' is the formal, standardized notation used in official financial reports like 10-K filings to ensure clarity and consistency.

2. Why don't companies just write out the full numbers?

It comes down to readability and space. A financial statement with full numbers like $5,432,109,876.54 would be incredibly cluttered and difficult to scan. Abbreviating to $5,432 (in millions) makes the data cleaner, easier to compare across periods, and reduces the chance of transcription errors.

3. What other financial shorthands should I know?

Besides '000' for thousands, be on the lookout for 'M' or 'MM' for millions and 'B' or 'bn' for billions. Always check the document's key or legend, as 'MM' is often used to avoid confusion with 'M' which historically (from Roman numerals) could mean thousands.

4. Can I trust my financial software or spreadsheet to handle this automatically?

Often, but not always. When you export data from a PDF report into a spreadsheet, the contextual note '(in 000s)' at the top of a column can get lost. This can lead your spreadsheet to analyze $50,000 as fifty thousand instead of the correct fifty million. Always double-check your imported data against the original source document.

5. Does '000' ever just mean zero?

In a formal financial statement column for revenue or profit, almost never. It's a multiplier. However, in raw data exports or databases, '000' can sometimes be used as a placeholder to indicate that data is missing, not applicable, or is truly zero. Context is the ultimate guide.

6. Is using '000' a standard practice globally?

Yes, this is a globally recognized accounting and finance convention. Whether a company reports under U.S. GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), you will encounter this type of notation to simplify large numbers.

7. Where is the most common place to find the '(in 000s)' note?

You will most commonly find it in the header of a table or column in a financial statement (like an income statement or balance sheet). It can also be located in a footnote at the bottom of the page or in the introductory section of the financial report.

8. How does this apply to bond investing?

In the bond market, face values are typically quoted in units of $1,000. If a trader says they are buying "500 bonds," they mean they are purchasing bonds with a total face value of 500 x $1,000 = $500,000. Misunderstanding this could lead to a very expensive mistake.

9. What should I do if a report is unclear about the units?

If you cannot find a clear note explaining the units, do not guess. Your first step should be to find a previous financial report from the same company to see their standard reporting practice. If that fails, cross-reference the data with a reliable third-party source like Yahoo Finance or Bloomberg.

10. Could a simple mix-up with '000' really cause a significant loss?

Absolutely. It's one of the most fundamental and dangerous errors an investor can make. If you value a company based on a profit of $200,000 when its actual profit was $200 million, your entire investment thesis is flawed. Your calculation of price-to-earnings, valuation multiples, and growth potential would be completely wrong, potentially leading you to make a disastrous investment decision.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.