You set ambitious financial goals, but somewhere between January and March, they fall apart. At Top Wealth Guide, we’ve seen this pattern repeat with thousands of people who have the right intentions but lack the right approach.

The gap between wanting financial success and achieving it isn’t about willpower-it’s about flawed financial goal setting and broken systems. This post shows you exactly where your goals derail and how to rebuild them so they actually work.

In This Guide

Why Your Financial Goals Stay Vague

Most people fail at financial goals because they never write them down with actual numbers attached. Thousands of failed financial plans follow the same pattern: people say things like save more, invest better, or cut spending without specifying what that means. Save more could mean $50 or $500 per month. Cut spending could mean eliminating one coffee or canceling three subscriptions. Without concrete targets, your brain has no specific instruction to follow, so it defaults to doing nothing.

Research shows that people who write down specific goals with measurable outcomes achieve them at higher rates than those who keep goals in their head. The difference between success and failure often comes down to one simple act: writing the number down. Instead of saying you want to build an emergency fund, specify that you want $5,000 by December 2026. Instead of saying you want to invest more, commit to putting $300 into a brokerage account every month starting February 15. This specificity forces you to confront reality and builds a roadmap your brain can actually follow.

Where Most People Stumble with Numbers

People underestimate how much they actually spend and overestimate how much they can save. According to the U.S. Bureau of Labor Statistics, average annual expenditures for all consumer units in 2024 were $78,535. When you set a savings goal without accounting for rent, groceries, utilities, and insurance first, you create a plan that crashes within weeks.

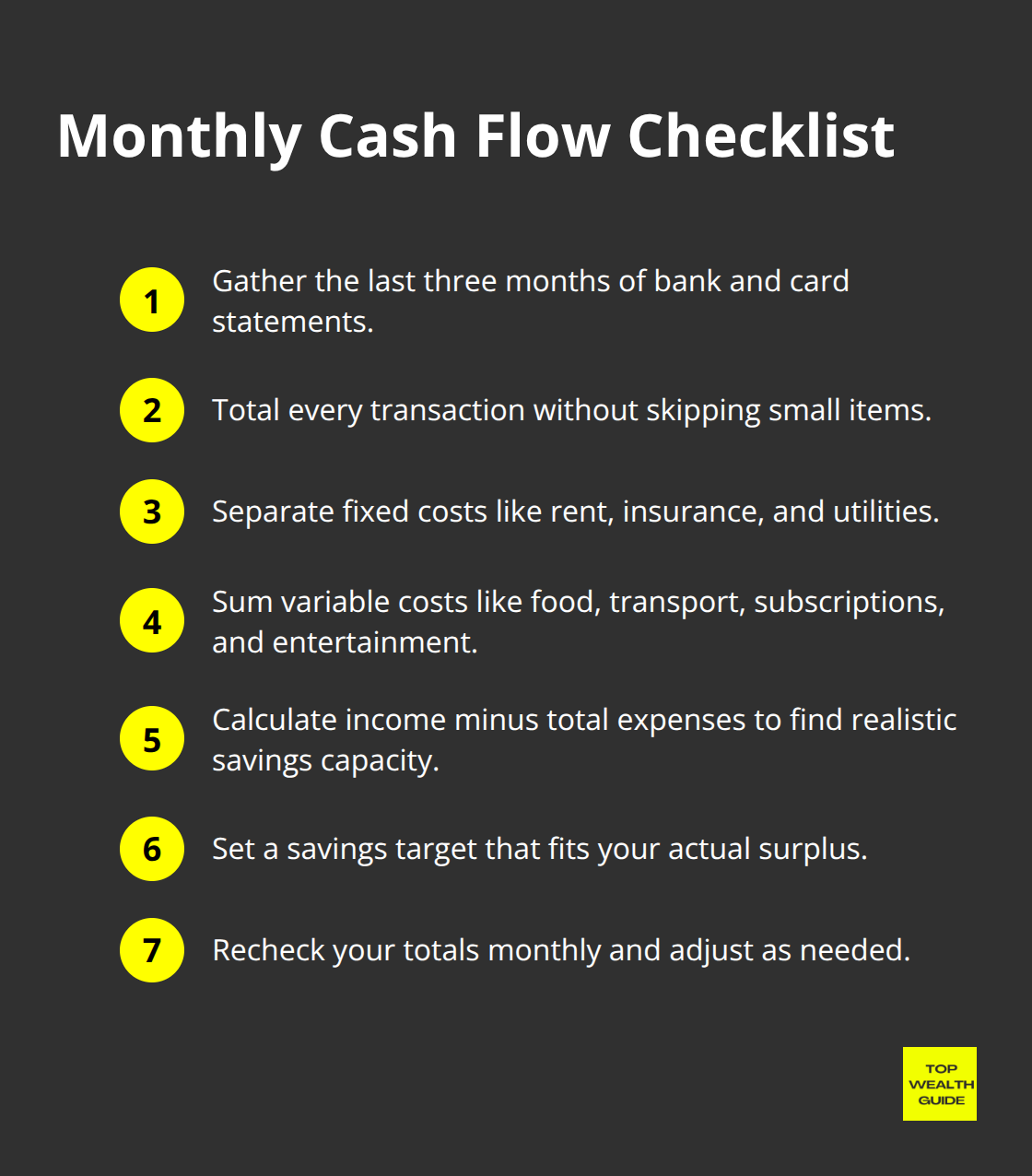

You need to know your actual monthly cash flow before you commit to any savings target. Sit down with your bank statements from the last three months and total every single transaction. Add up rent or mortgage, insurance, food, transportation, subscriptions, and entertainment.

Only after you know this number can you realistically determine how much you can save. If your monthly expenses are $5,000 and your income is $5,500, you cannot commit to saving $800 per month. You can realistically save $500. A flawed plan that ignores your real situation will fail every single time.

The Accountability Problem Nobody Talks About

Having a goal sitting in a notebook accomplishes nothing if you never check on it. Most people set goals in January and never look at them again until December when they feel disappointed. Without a tracking system, you lose momentum within the first month.

Set up a simple spreadsheet or use a free app to track your progress weekly. If your goal is to save $300 monthly, mark down every deposit you make. If your goal is to reduce spending, log your expenses daily. The act of tracking creates visibility, and visibility creates accountability. People who tracked their progress achieved their goals at nearly double the rate of those who did not track.

You also need another person to know about your goal. Tell a friend, family member, or financial advisor your specific target and check in with them monthly. This external accountability prevents you from quietly abandoning your goal when motivation dips. Without tracking and without another person holding you responsible, your goal becomes a wish, not a plan. The next section reveals how psychological barriers actually sabotage your financial decisions, even when your numbers look solid on paper.

Why Your Brain Sabotages Your Financial Plans

Your financial goals fail because your brain operates on emotion and habit, not logic. Even when you write down specific numbers and create a solid plan, psychological forces work against you every single day.

Time Blindness Destroys Your Timeline

Most people drastically underestimate how long it takes to build wealth and how much money they actually need. If your goal is to save $50,000 for a down payment and you earn $4,000 monthly after taxes, you need roughly 12 to 13 months of saving every dollar beyond expenses. But most people imagine they can accumulate this in 6 to 8 months because they underestimate their spending and overestimate their discipline. When month 9 arrives and you still have $35,000 to go, motivation collapses.

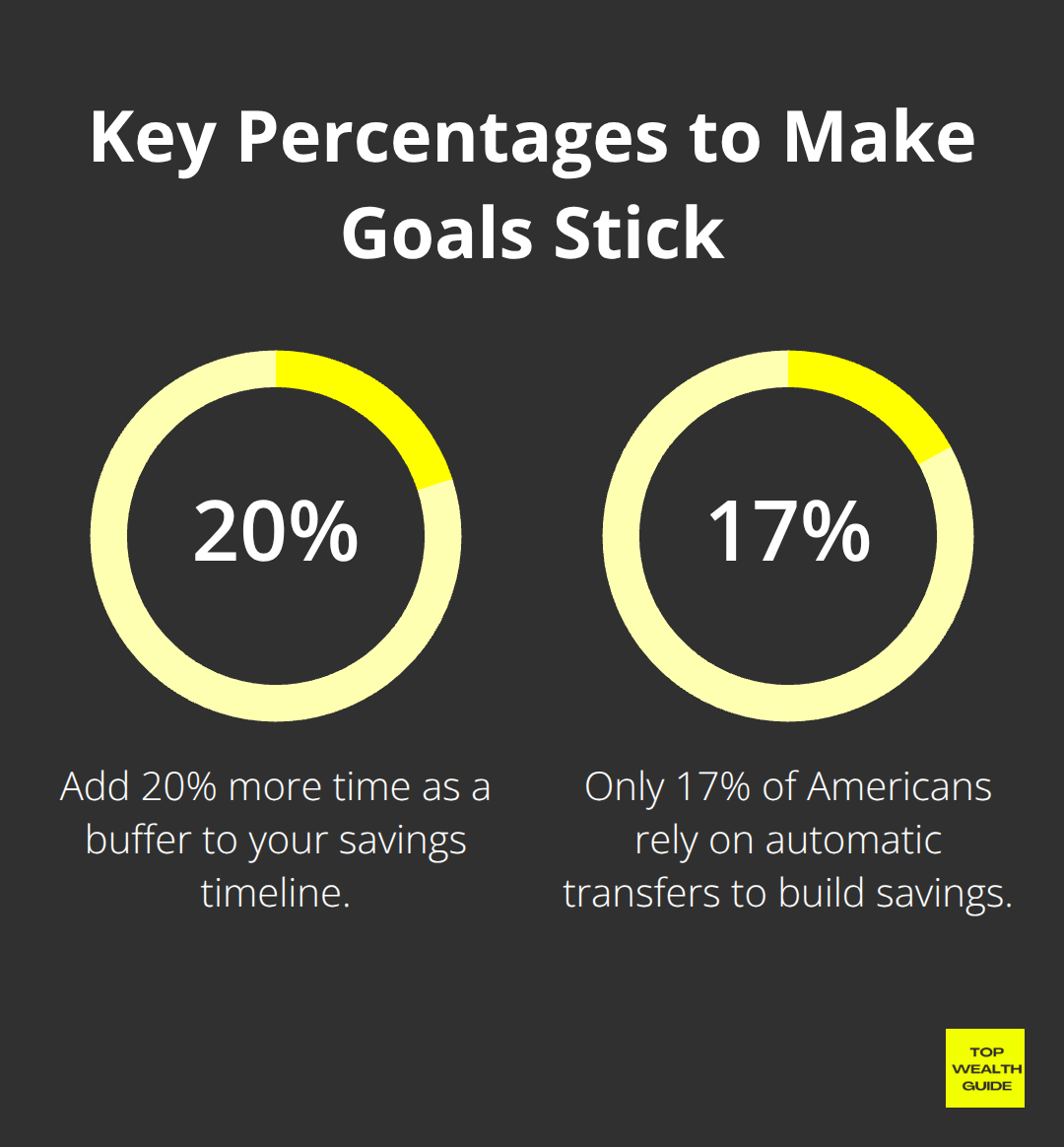

The fix is brutal honesty. Calculate your exact timeline by dividing your goal by what you can realistically save each month, then add 20 percent more time as a buffer. If you can save $300 monthly toward a $5,000 emergency fund, expect 17 months, not 12.

Post this number somewhere visible. Knowing the real timeline prevents the shock that kills most goals mid-year.

Emotional Spending Compounds Into Thousands

Emotional spending accounts for far more failed goals than poor planning. Research from the American Psychological Association shows that half of adults in the U.S. reported feelings of emotional disconnection. You hit a rough day at work, so you spend $60 on dinner instead of cooking. Your friend cancels plans, so you purchase something online to feel better. These impulse decisions feel small, but they compound into hundreds of dollars monthly that derail your savings target.

The solution isn’t willpower-it’s friction. When you feel the urge to spend emotionally, wait 48 hours before making the purchase. During that time, write down why you want to buy it. Most impulses fade within two days. For recurring emotional spending triggers (stress eating, shopping when bored, entertainment when lonely), identify the emotion first, then create an alternative action. If stress triggers spending, try a 20-minute walk instead. If boredom triggers shopping, call a friend or work on a hobby. You interrupt the automatic pattern and protect your savings.

Competing Priorities Force You to Adapt

You commit to saving $400 monthly, but then your car needs repairs, your kid’s school asks for activity fees, or you get reduced hours at work. Life doesn’t stop for your financial goals. Instead of abandoning your goal entirely when life happens, build flexibility into your plan from the start. Reduce your monthly savings target to $250 instead of $400, so you can absorb unexpected costs without derailing completely.

A plan that survives real life beats a perfect plan that shatters on first contact with reality. The people who succeed at financial goals don’t have fewer emergencies or stronger willpower. They build plans that bend but don’t break when circumstances change. This flexibility becomes your greatest asset when unexpected events arrive (and they always do). The next section shows you exactly how to construct a plan that handles these psychological obstacles and actually moves you forward.

How to Build Financial Goals That Actually Stick

Write Your Goal Down With Real Numbers

The gap between wanting a financial goal and achieving it closes the moment you stop thinking about it and start documenting it. Most people carry their entire financial plan as a mental note, which means it disappears the instant life gets busy or motivation dips. You need a physical plan that lives somewhere you can access it weekly. Open a Google Doc, create a spreadsheet, or use a dedicated app like YNAB or Mint. Write your goal down with real numbers, your target amount, your deadline, and the exact monthly savings required to reach it.

If your goal is to save $8,000 for a vacation by August 2026 and you have six months, you need to save approximately $1,333 monthly. That number becomes your north star. Post it on your bathroom mirror, set it as your phone wallpaper, or print it and tape it to your desk. The goal must be visible, not buried in a file you never open. People who write down their financial goals with specific numbers and deadlines achieve them at higher rates than those who keep goals vague and mental.

Your written plan also forces you to confront whether your goal is actually realistic given your income and expenses. If you earn $4,500 monthly and your expenses total $4,000, claiming you will save $1,500 monthly is fantasy. The written plan exposes these delusions immediately, which is exactly what you need.

Create Quarterly Milestones to Track Progress

Break your main goal into quarterly milestones so progress feels tangible. If you want to save $10,000 in one year, your quarterly targets are $2,500, $5,000, $7,500, and $10,000. When you hit the first quarter marker, you have proof that your plan works. This momentum carries you through the harder months when motivation naturally fades. Without milestones, you are just grinding toward a distant finish line with no evidence that you are making progress.

Automate Your Savings Before You Spend

Automation transforms your financial goals from something you have to remember into something that happens without you. Set up an automatic transfer from your checking account to a separate savings account on the same day you receive your paycheck. If you get paid on the 15th and the 30th, schedule transfers for those exact dates. Move the full amount you committed to saving before you have a chance to spend it. This removes the willpower component entirely. You cannot spend money that is no longer in your checking account.

Only 17% of people rely on automatic transfers to build their savings. Your brain never adjusts to having that money available, so you do not miss it. For long-term goals like retirement or investment accounts, automate contributions to your 401k through payroll deduction or set up automatic monthly investments into a brokerage account. If you target $300 monthly into an index fund, that money leaves your account automatically every month without requiring you to log in, decide, and execute. This consistency compounds into significant wealth over years.

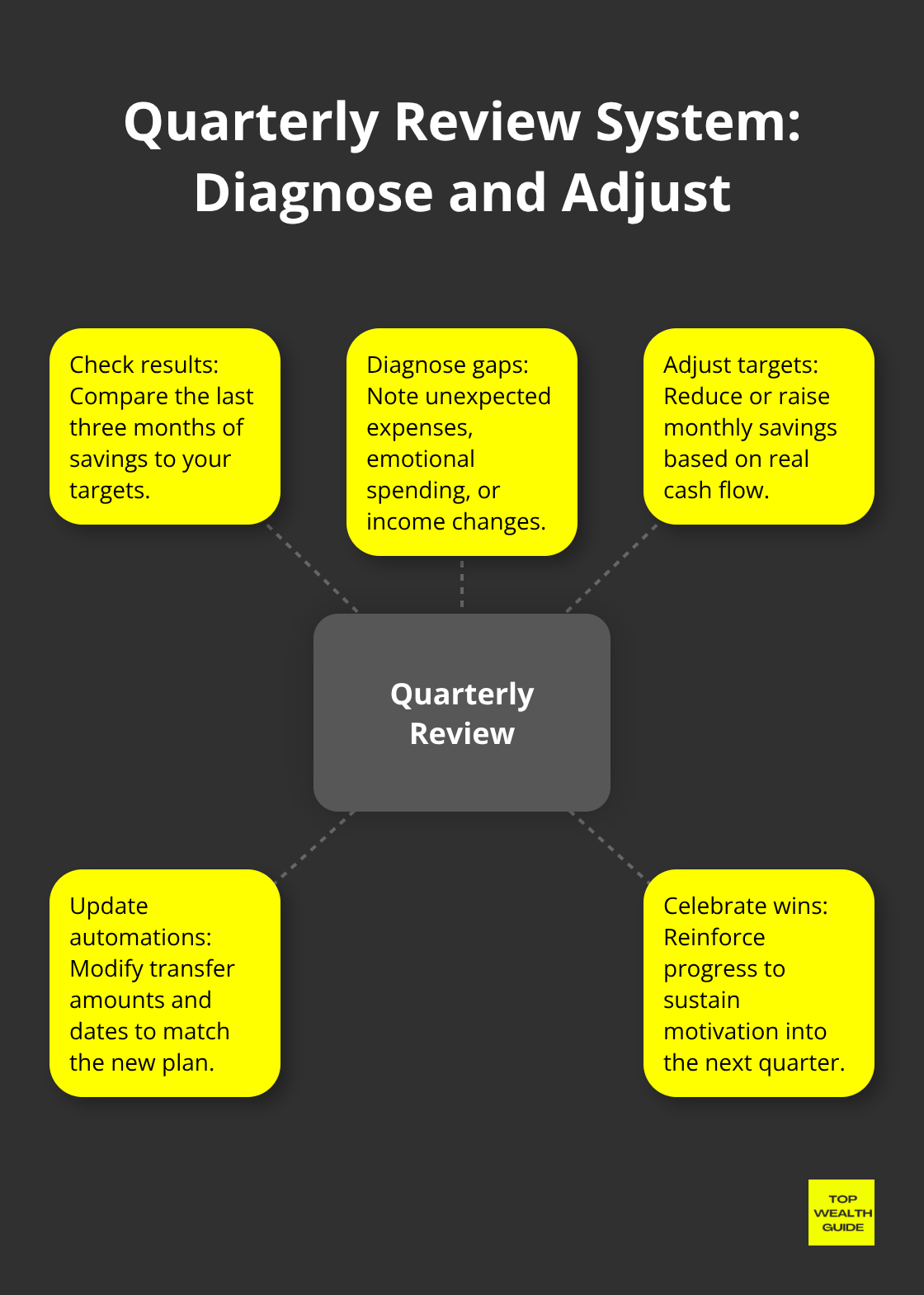

Review and Adjust Every Quarter

Set a recurring calendar reminder for quarterly reviews on the 15th of January, April, July, and October. On these dates, spend 30 minutes reviewing your written plan. Check whether you hit your savings targets for the past three months. If you saved your full amount, celebrate the win and look ahead to the next quarter. If you fell short, examine what happened.

Did unexpected expenses derail you, or did you overspend emotionally? Did your income drop, or did you simply lose focus? Adjust your plan based on reality, not shame.

If you consistently cannot save $1,500 monthly but you can save $1,000, change the plan. A plan you can actually execute beats a perfect plan you abandon. Life circumstances change constantly. Job loss, medical emergencies, or family changes mean your original plan may no longer fit your reality. The quarterly review catches these shifts before they become plan-killers. You make small adjustments every 90 days instead of letting your plan deteriorate for months until it collapses entirely. This approach keeps your financial goals alive and responsive to your actual life.

Final Thoughts

Your financial goals fail not because you lack discipline, but because you lack a system. The people who build real wealth do not have more willpower than you-they have better processes. They write down numbers instead of keeping goals in their heads, automate savings instead of relying on motivation, and review their progress quarterly instead of abandoning plans mid-year. Treat your financial goal setting as a living document that you revisit and adjust every 90 days, not a one-time event in January that you forget by February.

Life changes constantly, and your plan must adapt to these realities or it will break. Income fluctuates, unexpected expenses arrive, and circumstances shift in ways you cannot predict. Before you commit to any savings target, know exactly what you spend each month on fixed costs like rent, insurance, and food. Only then can you determine what remains available to save, and only then can you build a plan that actually survives contact with reality.

Start today with one concrete action: open a spreadsheet and write down one financial goal with the exact dollar amount and deadline. Calculate how much you need to save monthly to reach it, then set up an automatic transfer for that amount. That single action moves you from wishing to building, and Top Wealth Guide stands ready to help you move from financial confusion to financial clarity through practical strategies and step-by-step guidance.