So, your emergency savings? Spoiler alert: probably not gonna cut it. Healthcare costs—oh boy—up 41% since 2020. And just when you thought your wallet could breathe, boom, home repairs and job chaos come knocking.

Recently, the brainiacs at Top Wealth Guide took a magnifying glass to emergency fund needs, and guess what? Americans are short by 40-60% on their rainy-day funds. The classic three-month buffer? Yeah… that ship’s sailed in this wild economic climate. You’re gonna need a bigger boat.

In This Guide

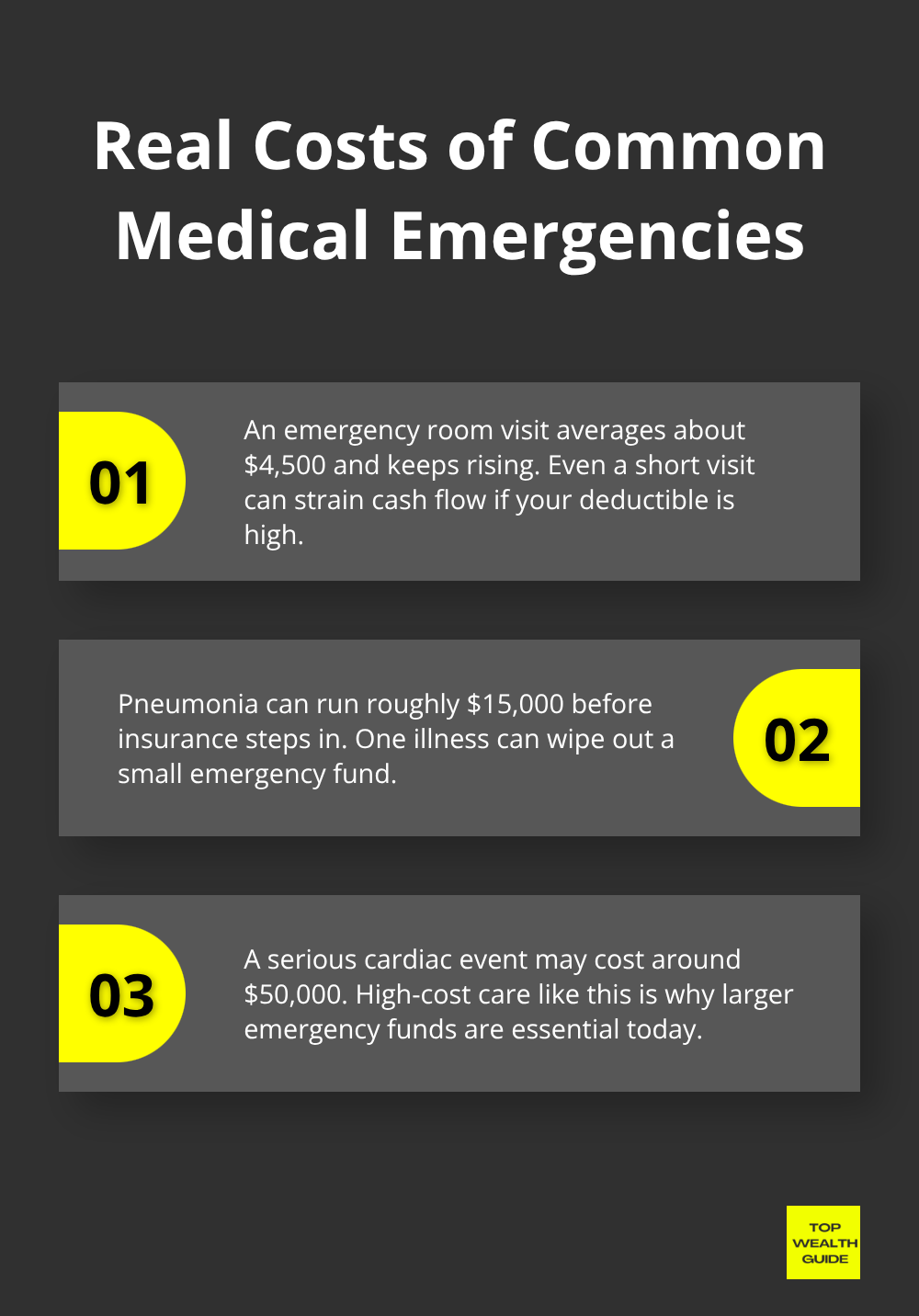

What Do Modern Emergencies Actually Cost

Alright, buckle up. Healthcare bills have gotten out of hand – we’re talking $4,500 on average just to walk through the emergency room doors. And you guessed it, they’re only climbing. Get hit with pneumonia and you’re looking at a $15,000 bill, even before insurance decides to intervene (if they do). But if the heart goes haywire? That’ll be $50,000, thank you very much.

The kicker? 100 million Americans are grappling with medical debt, as Neale Mahoney from Stanford points out, and people are now dipping into retirement funds simply to pay off these costs. Not because they want to, but because they have to.

Home Repairs Hit Different Now

Ever wonder what happened to home repairs? Well, they’re taking your wallet on a rollercoaster. Remember when replacing your HVAC set you back $8,000 in 2020? Now it’s $14,000. Need a roof fixed? Up from $7,500 to $12,000. And plumbing issues? Those emergencies cost about $1,400 now, no gold-plated faucets included. GOBankingRates discovered that 26.4% of folks are already turning to emergency savings for these home repairs, but here’s the twist – most are underestimating these costs by about half. Ouch.

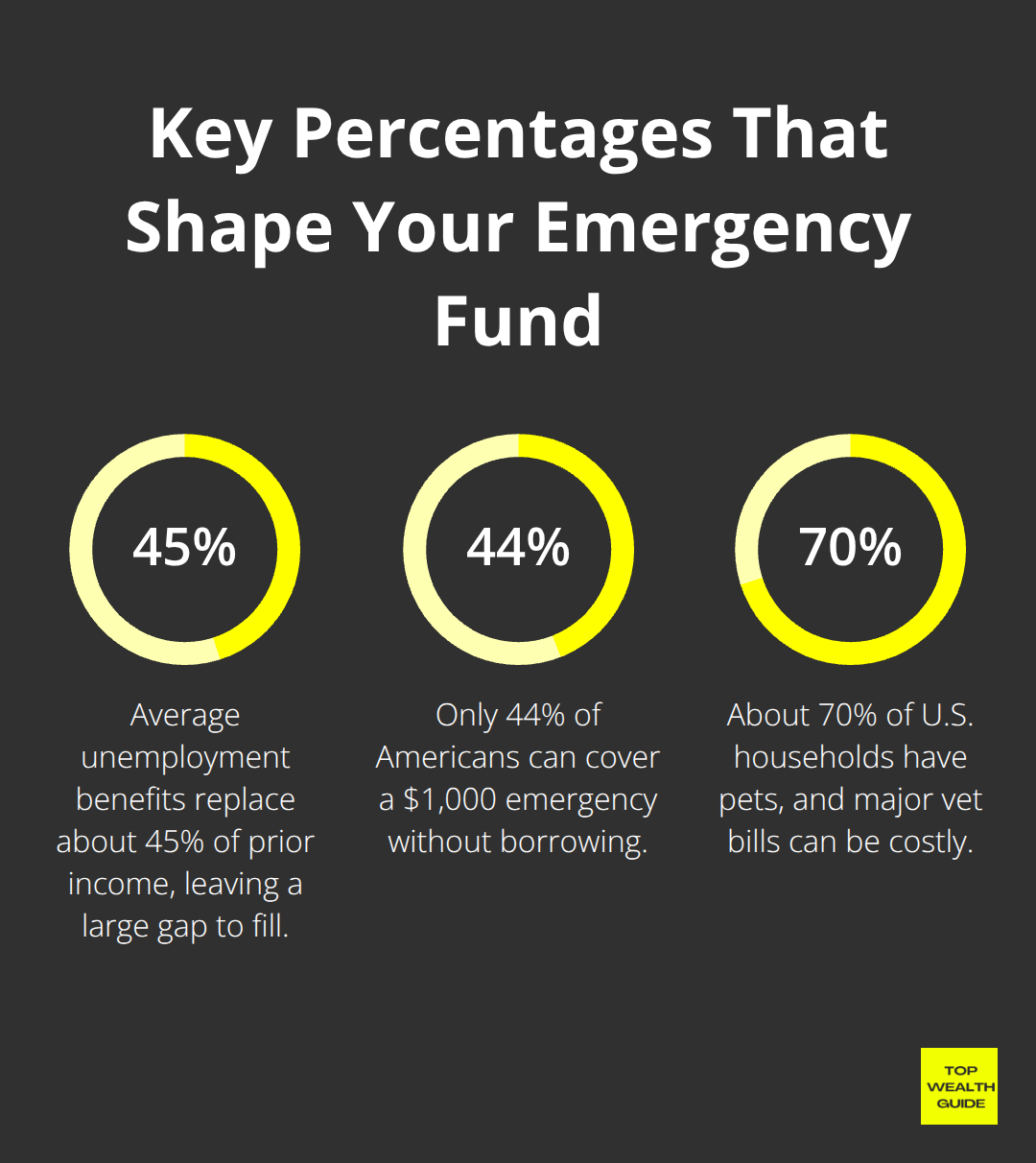

Job Loss Means Longer Recovery

Finding a job these days? Welcome to limbo. On average, job hunts take longer now, while unemployment benefits replace a measly 45% of your former paycheck. And if you’re in the gig economy, well, tough luck – no benefits for you. Tech layoffs? Even if you were pulling in the big bucks, be ready for an 8-12 month slog to find something similar. Your three-month rainy day fund? Yeah, it’s more of a drizzle cover, not enough for the actual downpour you’ll face, especially with competition tripling since 2022. Wild, right?

Pet Emergencies Drain Accounts Fast

Got a furry friend? Brace yourself. Pet health emergencies can sneak up and, bam, you’ve got bills that could make your head spin. With 70% of American households owning pets, it’s shocking how many don’t have pet insurance. If your pet hits a major health hurdle, you’re looking at expenses that can reach anywhere from $5,000 to $15,000 for something like emergency surgery. That’s not just a hit on your heart, but also a punch to your finances – making families choose between their beloved Fluffy and financial peace.

So, with these costs skyrocketing, it’s pretty clear why the old emergency fund advice doesn’t cut it anymore. The million-dollar question: just how much do you need to ride out these financial tempests? Crafting a solid emergency reserve is a critical step toward financial freedom in today’s rocky economic terrain.

How Much Should You Actually Save in 2025

Here’s the deal-the old 3-6 month emergency fund rule? Extinct. Vanished, like stability in the job market and predictability in costs. Medical care prices jumped 3.3% in 2024-ouch. Home repair prices? Doubled. So, brace yourself: You need to stash away 8-12 months of expenses, minimum. That’s twice what the financial gurus used to preach. Sure, the Federal Reserve says three months is fine, but that’s based on a calm economy-remember those good ol’ days? Yeah, me neither.

Calculate Your Personal Risk Factor

Crunch time: take your monthly spending and multiply by your risk factor. Got a single income? You need 12 months. Dual income with rock-solid jobs? Maybe 8 months will do. Freelancers, gig workers-you’re in a different league. Better aim for 15 months because income flows like a roller coaster.

Oh, and if you own a home, add an extra $10k (big repairs ain’t cheap). Pet parents? Toss in another $5,000 for those inevitable vet surprises.

Just 44% of Americans could handle a $1,000 hiccup, which is why medical debt skyrockets past $140 billion.

Account for Inflation Impact

Your lifeline must match today’s bloated prices-not 2020’s whispers. Food? Up by 25% since 2022. Gasoline? Dizzying ups and downs. Childcare? Brace yourself for $15,000 per kid annually. If you’re shelling out $4,000 a month now, pencil in $4,500 by year-end, thanks to Mr. Inflation.

Inflation’s the pesky rascal that clips 3-4% off your buying power yearly. High-yield savings accounts offer 4-5% APY, just enough to keep you treading water. Here’s some mental gymnastics for you: take today’s monthly costs, add 15% for inflation, and then multiply by your personal risk factor in months.

Build Your 2025 Target Number

Time to get real with modern-day math. A household dropping $5,000 monthly with moderate risk needs a cool $50,000 saved (10 months × $5,000). Add in home ownership surprises and furry friend emergencies, and you’re looking at a hefty $65,000.

But here’s the kicker-most people lowball their cushion by a staggering 40-60%. Median emergency funds sit at just $10,000, whereas actual sticky situations now run between $15,000 and $50,000. No wonder 60% of folks hit common financial roadblocks last year but couldn’t tackle them adequately.

So you’ve got your target number. Now for the million-dollar question: how do you save 100k without it taking eons?

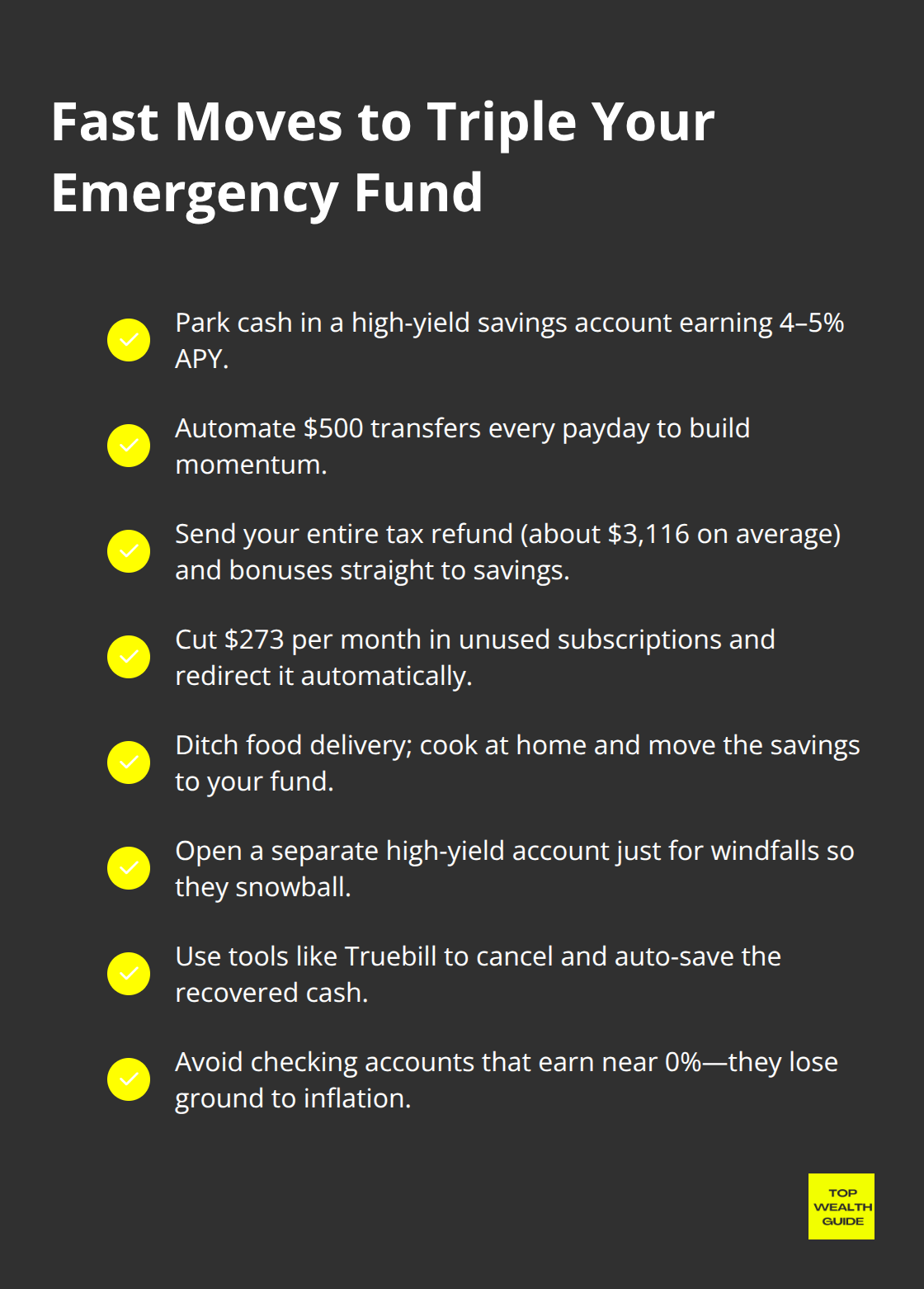

How to Triple Your Emergency Fund in 12 Months

Let’s talk high-yield savings accounts (4-5% APY) – that’s where your emergency fund should chill. Marcus by Goldman Sachs and Ally Bank are the usual suspects offering these rates. Now, imagine your $20K emergency stash growing to $21K just by sitting there… curious yet? Set up those automatic $500 transfers every payday – boom, that’s $13K a year. Most folks stash their rainy-day cash in checking accounts earning diddly-squat, which is financial madness when inflation’s eating up 3-4% annually.

Digital banks like Capital One 360 and Discover Online Banking have an edge because they skip those fancy branches. Here’s the cold, hard math: A $50,000 emergency fund in a regular savings account? It bleeds $1,500 in purchasing power every year.

High-yield accounts? At least they let you keep up with inflation.

Turn Tax Refunds and Windfalls Into Emergency Cash

Average tax refund? $3,116 per household, says the IRS. How do Americans usually spend this sweet windfall? Vacation splurge or retail therapy. Instead, funnel 100% of it into your emergency piggy bank-it’s like skipping the line to financial security. Same goes for that work bonus or a surprise check from Grandma. Think emergency fund, not extra guac on your burrito.

People automating these windfalls into savings-according to the Consumer Financial Protection Bureau-build emergency funds three times faster. Set up a solo high-yield account just for these surprise bucks and let it snowball. Tiny windfalls matter too; that unexpected $200 insurance refund or the $150 utility rebate? It adds up. Pro tip: Transform unexpected cash into emergency cash, not extra gear.

Cut Subscriptions and Redirect Every Dollar

Let’s face it, Americans fritter away $273 monthly on ghost subscriptions, says recent surveys. The axe needs to fall on Netflix, Disney+, and that forgotten gym membership. Redirect those bucks into emergency savings. Food delivery apps? They’re like that secret monster under your financial bed, gobbling up $200+ monthly. Swap UberEats for a home-cooked meal and funnel that cash automatically to your fund.

The average household blows $1,200 yearly on subscriptions that gather dust. Go full cold-blooded accountant on your bank statements-those sneaky $9.99 charges for apps you barely remember downloading? Cut them. Even hacking $100 monthly from subscriptions adds a neat $1,200 to your emergency stash annually. Get help from apps like Truebill to spot the culprits and automate savings for every penny once wasted.

Final Thoughts

The math … doesn’t lie, folks. Americans are in a financial pickle-falling short on emergency savings by a staggering 40-60%. The consequences? They smack you in the face. Here’s the score: The typical emergency nest egg is about $10,000, but real-life emergencies? They’re running you $15,000 to $50,000. Look at healthcare-it’s $4,500 just for an emergency room visit. Got a busted HVAC? That’s $14,000. And if you’ve been on the job hunt … it’s taking you 8-12 months to land something.

So, what’s your play? Make it today. Automate $500 monthly into high-yield accounts with a nice 4-5% APY. That $273 you’re tossing away on needless subscriptions? Redirect it straight into your emergency fund (and for heaven’s sake, turn those tax refunds and sudden windfalls into a security blanket instead of blowing them on the latest extravagance).

This 8-12 month emergency fund isn’t just some financial guru’s babble-it’s your lifeline. With 60% of Americans getting blindsided by surprise expenses each year and only 44% able to tackle a $1,000 crisis, what separates the financially savvy from the shattered is having those reserves. We at Top Wealth Guide offer the practical tools and strategies you need to systematically build your wealth estate.

![Why Your Emergency Savings Account Isn’t Big Enough [2025] Why Your Emergency Savings Account Isn't Big Enough [2025]](https://topwealthguide.com/wp-content/uploads/emplibot/emergency-savings-hero-1761527337-1024x585.jpeg)