Traditional portfolios — think just stocks and bonds — are hitting a wall in today’s rollercoaster economy. One bad day in the market can erase years of progress, and don’t even get me started on inflation … it’s like a slow leak in your wallet.

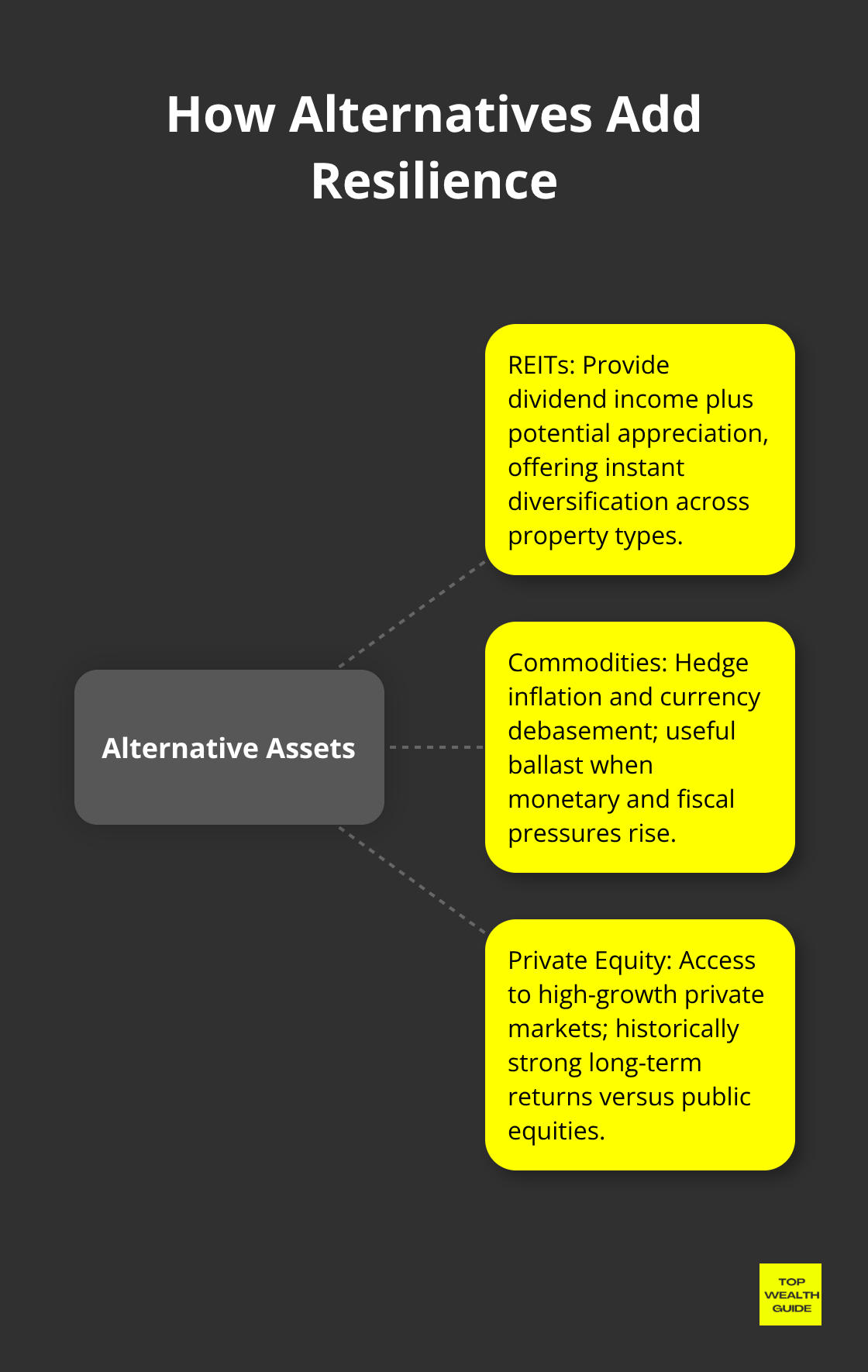

At Top Wealth Guide, we’re convinced savvy investors need to break out of the usual mold. Time to zoom out a bit, folks. Alternative investments — that’s real estate, commodities, private equity — can offer a shield and a growth potential that old-school assets just can’t compete with.

In This Guide

Why Traditional Portfolios Fail in Crisis

When Markets Tank, Stocks and Bonds Tank Together

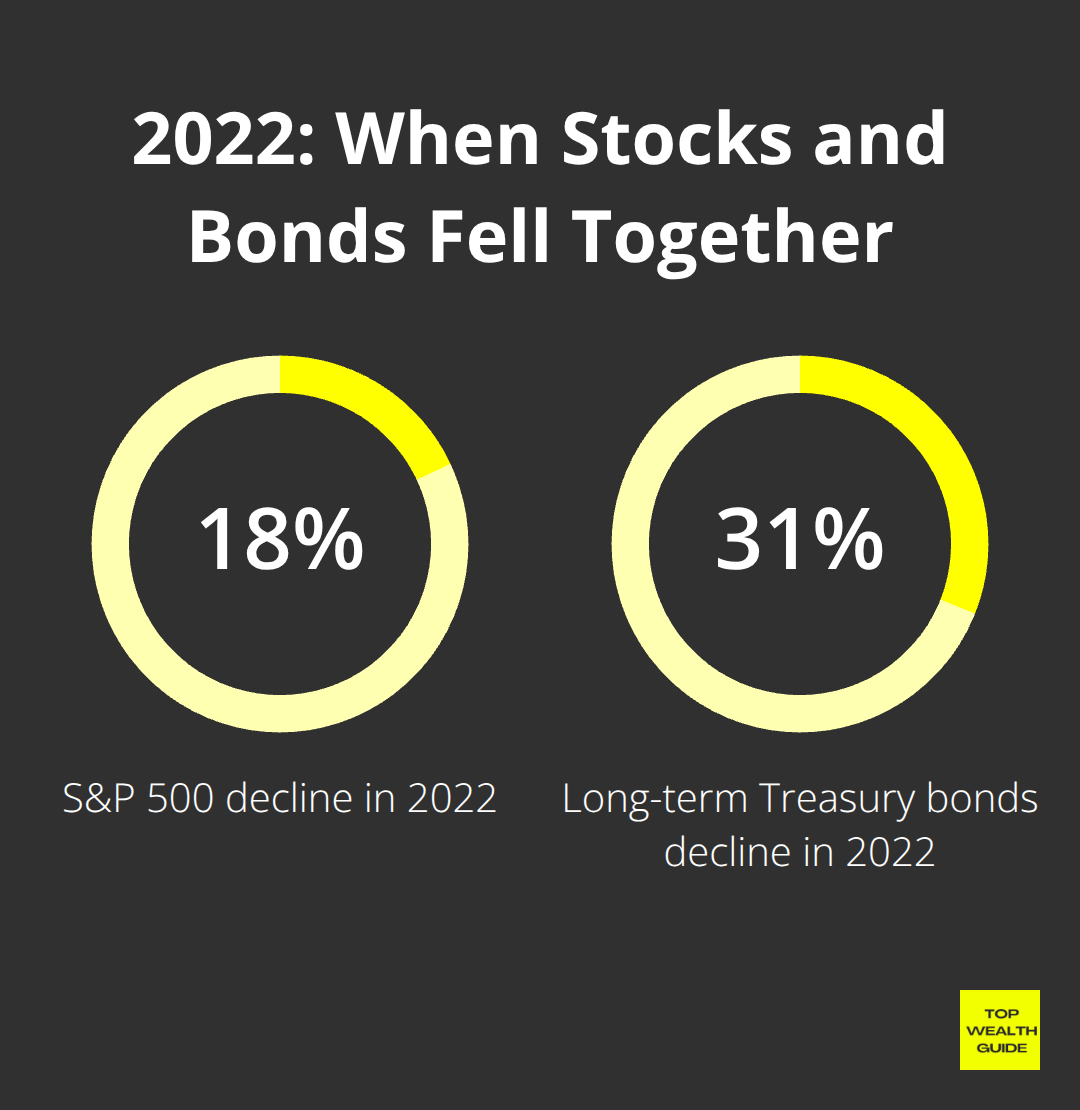

The 60/40 portfolio model? It imploded in 2022 – yeah, stocks and bonds went south at the same time. Picture this: The S&P 500 down 18% and long-term Treasury bonds off by 31%. The bedrock belief that bonds are your safety net when stocks dive? Gone. Blown to bits.

Investors – nowhere to hide.

Remember the Nasdaq crash from 2000 to 2002 – a 78% nosedive? Single asset class exposure – that’s wealth carnage 101. When stress hits the fan across multiple sectors, you’re looking at massive wealth erosion. A pattern, my friends, on repeat.

Inflation Devours Your Real Returns

US federal debt interest costs – more than defense spending by 2024 (yep, per the Congressional Budget Office). What does that scream? Fiscal strain. Countries with debt-to-GDP ratios over 100% – fiscal nightmares that devalue currencies and stoke inflation, cutting your purchasing power at the knees.

Your traditional portfolio doesn’t just lose – it gets clobbered twice. First, the nominal losses. Then? Inflation gnaws away further. A $100,000 portfolio losing 10% in a market slump and facing 6% inflation? It’s actually a brutal 15.4% real value punch-down in a year.

Market Cycles Expose Your Vulnerability

From 2000 to 2009, the S&P 500 slumbers – flat returns while emerging markets? They soar, outpacing US stocks by almost 10% a year. That’s a whole decade of growth opportunity – traditional portfolios just hit the snooze button. Economic cycles slam different asset classes at different times, but stock-and-bond portfolios? Stuck, tied down to domestic market performance.

The Fed? Their hands – tied in the high debt circus. Adjusting rates independently? Not happening. So, expect prolonged market turbulence. This is where alternative investments step in – they diversify, stabilize returns, and guard against inflation when traditional markets hit a rough patch.

Which Alternative Assets Actually Build Wealth

Real estate. It’s the heavyweight champ of alternative investments – not just by a little bit, but by a landslide. Why? Well, REITs delivered returns that could give most portfolios performance anxiety during inflationary stretches. Real estate isn’t just your average player; it’s like getting rental income on the reg while your property values do a nice appreciation dance. Think of it as having a double-income faucet-something stocks can only dream about.

Real Estate Investment Trusts Offer Instant Diversification

Here’s the cheat code: REITs. You can dive into commercial real estate without the migraine of dealing with clogged drains and tenant drama. Take Realty Income Corporation – it’s been the reliable boomerang of the investment world, tossing dividends back to you for 54 years straight and upping the ante for 29 of those years. Then, you’ve got healthcare REITs like Welltower riding the age wave and data center REITs such as Digital Realty Trust catching the cloud computing train. For a sprinkle of everything? Broad-market REIT ETFs like VNQ are your one-stop shop for instant diversification.

Commodities Hedge Against Currency Debasement

Let’s talk gold. It shattered ceilings at over $2,400 an ounce in 2024 as central banks decided to beef up global reserves by a hefty 1,045 tonnes. What’s silver doing? Playing the underdog game – with an 80:1 trade ratio to gold when history suggests 16:1 makes more sense. Tap into commodities with ETFs like DJP for a taste of energy and metal magic without the hassle of a storage unit. And don’t roll your eyes at physical precious metals-5-10% of your portfolio is a smart bet against the less-than-perfect fiscal maneuverings of, well, most developed nations.

Private Equity Opens Doors to High-Growth Opportunities

Private equity – think of it as the VIP room for investments. It’s all about snagging those high-growth companies before they make it to the stock market party. Yeah, there’s a price of admission (minimum commitments of $250K to a cool million), but those returns? So worth it. Private equity delivered a tidy 13.2% average annual return over the last decade, leaving the 11.9% of the public equities to catch some shade. Venture capital’s the extreme sport version here – early rounds in Uber or Airbnb made their early believers smile all the way to the bank with returns topping 1,000%.

The magic? Strategic allocation across these alternative asset classes so you’re not stuck in the old-school stocks and bonds echo chamber, but instead are striding into the future with a diverse, powerful portfolio.

How Do You Build a Portfolio That Actually Works?

Asset Allocation Models That Survive Market Chaos

Cue Ray Dalio’s All Weather Portfolio: the classic remix of asset allocation with a twist – 30% stocks, 40% long-term bonds, 15% intermediate-term bonds, 7.5% commodities, and 7.5% TIPS. That 60/40 model? Nice try, but it’s like a Jurassic Park dinosaur… doesn’t adapt when the meteor hits. All Weather? It’s about riding the wave instead of wiping out.

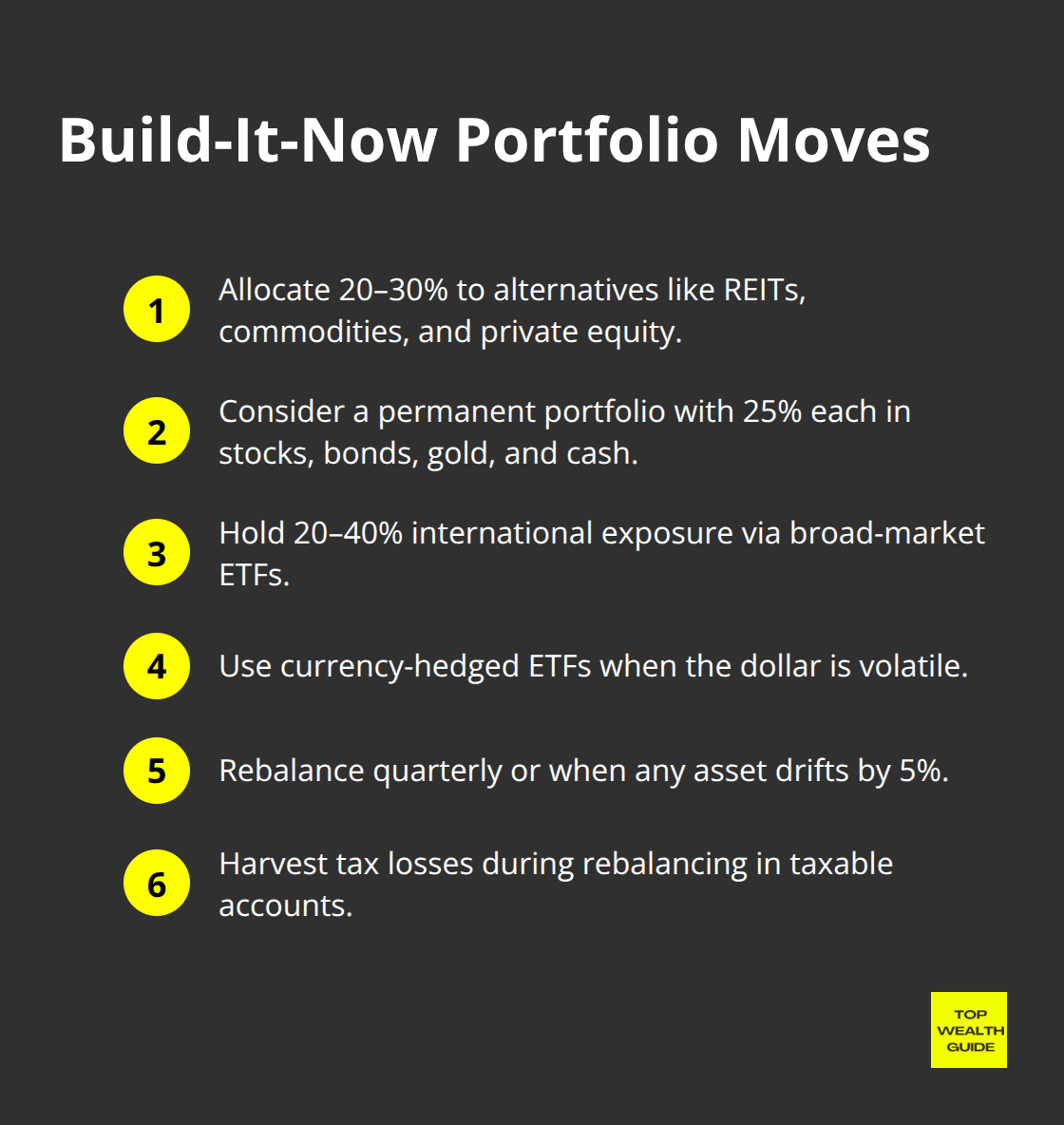

Need real diversification that won’t make you wake up in a cold sweat? Allocate 20-30% to the untouchable cool kids: REITs, commodities, and private equity. Then there’s the permanent portfolio – 25% each in stocks, bonds, gold, and cash. Survived everything thrown its way since 1970, posting a win in 35 of 45 years. That’s championship form.

Geographic Spread Protects Against Single-Country Risk

See, International markets are the surprise hit this year, while the US has been… hitting the snooze button. Proof that being geographically agnostic works wonders. Remember when emerging markets smoked the US stocks by 10% annually from 2000-2009, while the S&P 500 browsed Netflix?

Point is: aim for 20-40% international exposure using ETFs like VTIAX for developed markets and VWO for emerging powerhouses. Hedge your currency bets through ETFs like HEDJ (dollar’s bowling with butter, fiscal pressure’s rising). Then there’s the eye candy: Japan and India – epic growth potential as they modernize and bloom middle classes like a Pixar animation.

Rebalancing Beats Market Timing Every Time

Clock in those calendar rebalancing dates quarterly or when any asset class does a 5% tango away from your target allocation. It’s like automatic market zen: sell high, buy low while sipping your coffee. Back in 2022’s rocky times, folks who rebalanced religiously into bonds and international stocks popped back faster than a jack-in-the-box versus those grab-and-hold-ers.

And if REITs want to be overachievers and hit 15% instead of your 10% aim, trim and sprinkle it onto the under-performing veggies on your plate. Oh, and tax-loss harvesting during rebalancing is no less than a hack: letting those strategic losses dance-off gains in taxable accounts. Legal and genius in equal measure.

Final Thoughts

Traditional stocks-and-bonds portfolios – they crumble when the market’s having a meltdown. But here’s the kicker – alternative assets? They’re like the secret sauce for savvy investors looking for both protection and growth. Seriously, the data backs this up. Diversified portfolios with REITs, commodities, and private equity? They crush it during turbulence and inflation. These alternatives dish out income streams and hedges that make the stock market look like an also-ran.

The clock’s ticking, folks. Don’t sit around waiting for the stars to align. Get 20-30% of your investments into alternatives – think REIT ETFs, commodity funds, and cast a wide international net (quarterly rebalances are your BFFs here). Going global shields you from single-country pitfalls while alternatives iron out the bumps across different economic storms.

Kick things off with broad-market REIT ETFs and commodity funds, then dive into the deep end with private equity. Remember, your financial future hinges on what you do now – not later. At Top Wealth Guide, we’re all about crafting portfolios that thrive in any market climate with tactics and insights you can actually use.